easyMarkets Review Of 2025

Originally EasyForex, easyMarkets is an ASIC and CySEC-regulated forex broker with 200+ CFD instruments and 64 currency pairs. They have exclusive risk management tools, strong customer support, and the choice of several trading platforms.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

easyMarkets Summary

| 🗺️ Regulation Country | Australia (ASIC), Europe (CySEC) |

| 💰 Trading Fees | Fixed Spreads with no commission |

| 📊 Trading Platforms | easyMarkets Trading Platform |

| 💰 Minimum Deposit | $200 |

| 💰 Withdrawal Fees | $50 |

| 🛍️ Instruments Offered | Forex, Shares, Crypto, Metals, Commodities, Indices |

| 💳 Credit Card Deposit | Yes |

Why Choose easyMarkets

easyMarkets distinguishes itself with a clear and simple pricing model , setting it apart from many rivals that have more complicated fee structures. Over time, it has broadened its market to include commodities, indices, and cryptocurrencies, while being regulated in both Australia and Europe.

Catering to a global market, the broker attracts a wide range of users thanks to its user-friendly platform, extensive educational materials, and support in multiple languages. However, its heavy emphasis on CFDs and absence of traditional stock trading might not be ideal for every trader.

easyMarkets Pros and Cons

- Wide product range

- Easy account opening

- Several trading platforms

- Limited support

- No copytrading

- Complex spread variables

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

Spreads

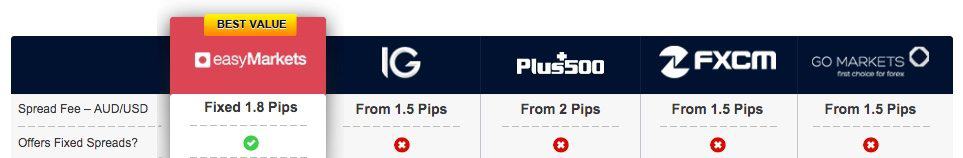

easyMarkets charges no commissions on any trades. It also offers fixed spreads which are relatively unique in the online broker market. Looking at the table below, their spreads are a tad higher than the industry average for most currency pairs.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| easyMarkets Average Spread | 0.8 | 1.5 | 1.3 | 1.5 | 2.3 | 2 | 2.2 | 3 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

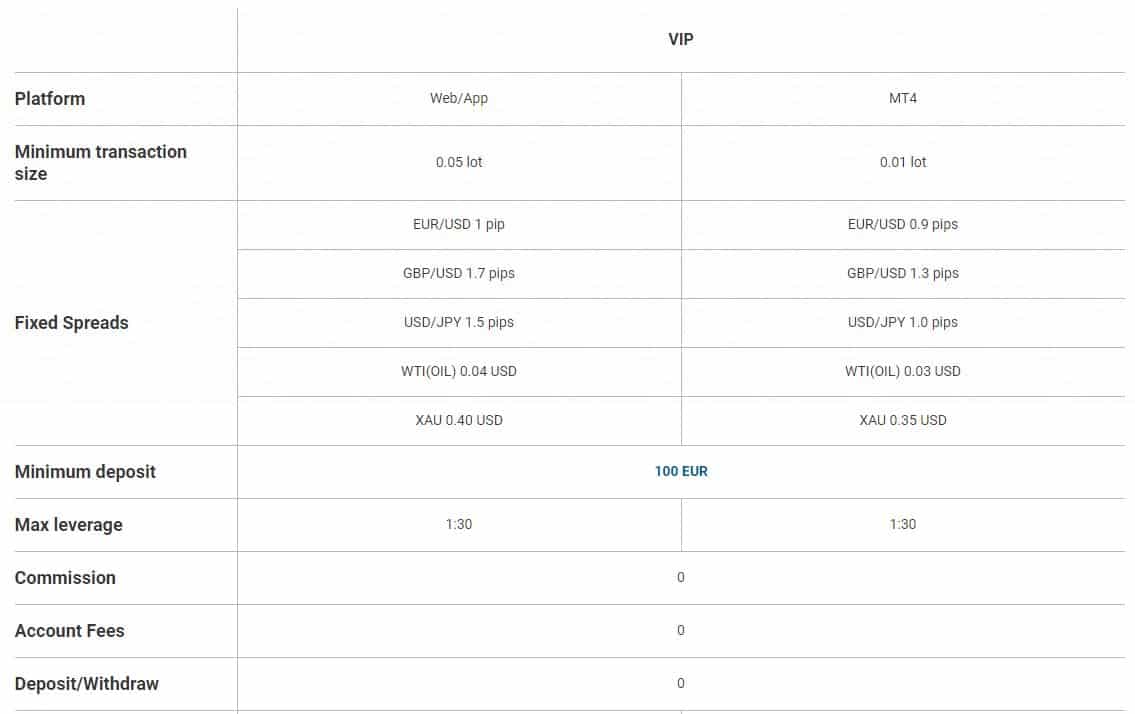

The fixed spreads are based on the type of account chosen which is determined by the deposit:

Clients in the UK and Europe:

Clients Outside the UK and Europe:

- $200 Deposit = Standard Account

- $3,000 Deposit = Premium

- $10,000 Deposit = VIP

Leverage

It’s worth noting that leverage is the difference the broker offers varies by the regulator that applies to the relevant territory.

If you are in the UK or Europe, then you be able to access leverage of 30:1 for major currency pairs and 20:1 for minor currency pairs. This is because easyMarkets are regulated by the Cyprus Securities Exchange Commission (CySEC) for this region.

CySEC has low leverage because they want to protect retail clients as leverage can increase the risk of losing money. Low leverage means less money will be lost if forex movements are unfavourable. The flip side is, leverage be very profitable if currency movement goes in your favour.

Clients from anywhere else in the world will have a leverage of 200:1 if using the easyMarkets platform and 400:1 if using the MetaTrader 4 platform. This is because easyMarkets must conform to the regulation set by the Australian Securities and Investments Commission (ASIC).

What do fixed spreads mean?

Spreads are the difference between a buy and sell rate on any trade. It’s similar to the situation at the airport when you try to exchange your currency with a forex provider who advertises one rate they will buy the currency off you and at another rate they will sell it to you. The difference between these rates is one of the ways that when forex trading the brokers make money. easyMarkets are market makers, like with the example of an exchange at the airport with the provider who sets their own rates, easyMarkets are your counterparty with each trade. This means you are buying and selling with their liquidity.

Fixed spreads mean that you will always know what the difference is between the buy and sell rates for currency pairings (eg AUD/USD). It provides certainty that you know the fees of every transaction, unlike most other brokers whose fees will vary depending on the market. Variable spreads such as those offered by Pepperstone, IC Markets, and Axi can be lower than easyMarkets as the spreads are raw. This means the liquidity pool determines the spread without intervention as No Dealing Desk Brokers.

Other Fees

Many brokers add hidden fees on top of spreads and commissions, but easyMarkets does not charge any hidden fees. Here are the main areas where easyMarkets doesn’t impose a fee:

- $0 Deposit Fee

- $0 Withdrawal Fee

- $0 Inactivity Fee

Verdict on easyMarkets Fees

easyMarkets offers a transparent fee structure with fixed spreads . While their spreads are generally wider compared to brokers with variable spreads, this is due to its risk management tools such as guaranteed stop-loss orders and negative balance protection.

Trading Platforms

This easyMarkets review focused on their own trading platform. easyMarkets also offer MetaTrader 4 (the most popular forex trading platform), MetaTrader 5 and TradingView but features unique to this forex broker are not offered.

| Trading Plaform | Available With easyMarkets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

Only with the easyMarkets platform a trader can:

- Activate dealCancellation

- Avoid Slippage

- Freeze Rate

- Easy Trade

- Guaranteed Stop-Orders / Take Profit

- Trade all FX and CFD products

- Trade forward deals

MT4 and MT5 have some great features such as Expert Advisors (EAs) which utilise automation and but if you are interested in this platform then another forex broker is recommended. These include the Best Forex Trading Apps.

Overall, the easyMarkets platform is easy to use, doesn’t require a download and is ideal for new to currency trading.

Is easyMarkets Safe?

easyMarkets are the only forex broker to offer Guaranteed stops and Guaranteed negative balance protection for all trades. (to have guaranteed stops you must be using the easyMarkets trading platform, it is not available with MT4 or MT5)

i) Guaranteed Stops

When forex trading, one type of ‘safety mechanism’ is guaranteed stop-loss. This risk management feature is recommended to those new to forex and CFDs trading. This is a major reason during our easyMarkets vs Plus500 we recommended the broker for new & intermediate traders.

A guaranteed stop means that you can set the maximum amount you are willing to lose in a single trade and the broker will ‘guarantee’ you will not lose more than this amount.

Guaranteed stops provide a ‘safety net’ in extreme situations when currency movements can be dramatic. While all brokers offer ‘stop-loss’ orders, most are not guaranteed. No guarantee means you may experience slippage. The broker will try to exit you at your stop loss, but if they can’t exit you, you bear the loss.

As leverage exposes all traders to high risk when forex trading, a ‘guaranteed stop’ at least provides peace of mind in that you will know the maximum you can lose on a trade. Easy Forex (now easyMarkets broker) is of the few forex brokers offering this feature.

ii) Guaranteed Negative Balance Protection

easyMarkets (formally Easy Forex) includes guaranteed Negative Balance Protection for all their clients. This risk management feature means your account balance will not go negative. If your account goes below the brokers’ margin requirements, then they will seek to exit you from trades, if they cannot exit you before your account goes below zero, the broker will reset your account back to zero and bear the cost.

Guaranteed negative balance provides peace of mind as volatile economic events are known to lead to large losses for traders without protection.

Regulation

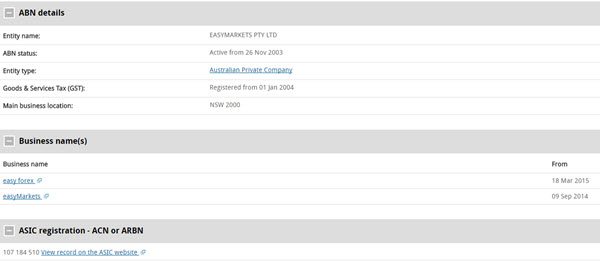

easyMarkets is regulated by Tier 1 regulatory bodies such as the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities Exchange Commission (CySEC).

| easyMarkets Safety | Regulator |

|---|---|

| Tier-1 | ASIC CySEC |

| Tier-2 | X |

| Tier-3 | FSC-BVI FSA-S |

Reputation

In 2001, easyMarkets was formed in Cyprus. Despite their years in the market, their popularity seems low with only 6,600 monthly Google hits.

Reviews

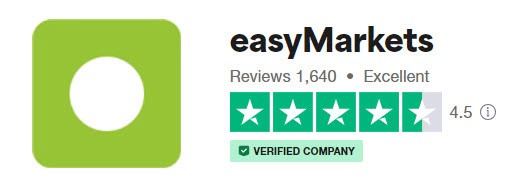

While comparing easyMarkets reviews from several trading-related websites, we found that people generally regard their easyMarkets experience as positive. The easyMarkets review analysis found that most forex trading Australia individuals praised the adoption of fixed spreads as they are competitive and affordable. People also like the MT4 trading platform and its ease of use for new traders. Trading accounts can be set up for as little as $200, which comparatively is extremely affordable. Customers also are quite fond of the multitude of payment options and fast payouts, citing very few issues or difficulties.

It’s also worth pointing out that we made this easyMarkets review because, like other brokers compared on this site including IG Markets, they have an AFSL. This means that deposits are segregated into a separate account, and there are training standards and requirements for external auditing. It’s strongly recommended that all Forex Trading Australia be done through an Australian-regulated broker to avoid Forex scams that occur internationally. Forex scams are attributed to non-regulated forex brokers.

DealCancellation – Cancel Trades In 1 to 6 Hours

![]() dealCancellation (sometimes called Deal Cancellation) is a feature unique to easyMarkets.

dealCancellation (sometimes called Deal Cancellation) is a feature unique to easyMarkets.

The feature allows a trader to cancel a trade to avoid a trading cost within:

- 1 hour

- 3 Hours

- 6 Hours

To access this feature you need to be using the easyMarkets platform, not the MetaTrader 4 platform which easyMarkets also offers. When taking your position, you must activate dealCancellation as shown on the screenshot below. When you do this, a small premium in the form of a slightly wider spread will be charged.

Once a trade is made, a countdown clock shows how much time is left for the trade to be cancelled without realising a loss using this feature. If a stop-loss is also reached within the period and dealCancellation is active, no trading loss will be realised.

Overall, the process for dealCancellation is:

- Opt for dealCancellation on a trade

- Cancel the trade within the period set if it’s making a loss

- Have your original funds returned minus fees

The feature is perfect for those new to forex trading, those who like to trade during turbulent periods (eg rate decisions) or those looking to manage the risks of currency trading.

How Popular Is EasyMarkets?

EasyMarkets demonstrates a mid-tier presence in the online forex trading space. With approximately 49,500 monthly Google searches, it ranks as the 28th most popular forex broker among the 65 brokers analyzed. Web traffic metrics position it slightly lower, with Similarweb reporting 296,000 global visits in February 2024, placing EasyMarkets as the 40th most visited broker.

| Country | 2024 Monthly Searches |

|---|---|

| Italy | 18,100 |

| Brazil | 3,600 |

| Australia | 2,400 |

| United States | 1,900 |

| India | 1,600 |

| Japan | 1,000 |

| France | 1,000 |

| Malaysia | 880 |

| South Africa | 720 |

| Germany | 590 |

| Vietnam | 590 |

| Egypt | 590 |

| Cyprus | 590 |

| Indonesia | 480 |

| Pakistan | 480 |

| Philippines | 480 |

| United Kingdom | 390 |

| Nigeria | 390 |

| Spain | 390 |

| Greece | 390 |

| Uzbekistan | 390 |

| Poland | 320 |

| Colombia | 320 |

| Mexico | 320 |

| Kenya | 260 |

| Bangladesh | 260 |

| Singapore | 210 |

| Canada | 210 |

| United Arab Emirates | 210 |

| Algeria | 210 |

| Netherlands | 170 |

| Hong Kong | 170 |

| Saudi Arabia | 170 |

| Morocco | 170 |

| Argentina | 170 |

| Turkey | 140 |

| Thailand | 140 |

| Peru | 140 |

| Cambodia | 140 |

| New Zealand | 140 |

| Sweden | 110 |

| Switzerland | 110 |

| Austria | 110 |

| Taiwan | 90 |

| Sri Lanka | 90 |

| Chile | 90 |

| Costa Rica | 90 |

| Portugal | 70 |

| Ghana | 70 |

| Dominican Republic | 70 |

| Panama | 70 |

| Ireland | 50 |

| Tanzania | 50 |

| Ecuador | 50 |

| Botswana | 50 |

| Jordan | 50 |

| Uganda | 40 |

| Venezuela | 40 |

| Ethiopia | 30 |

| Bolivia | 20 |

| Mauritius | 10 |

| Mongolia | 10 |

2024 Average Monthly Branded Searches By Country

Italy

Italy

|

18,100

1st

|

Brazil

Brazil

|

3,600

2nd

|

Australia

Australia

|

2,400

3rd

|

United States

United States

|

1,900

4th

|

India

India

|

1,600

5th

|

Japan

Japan

|

1,000

6th

|

France

France

|

1,000

7th

|

Malaysia

Malaysia

|

880

8th

|

South Africa

South Africa

|

720

9th

|

Germany

Germany

|

590

10th

|

Deposits And Withdrawal

easyMarkets holds all funds in a segregated bank account ‘Bankwest’. This is owned by the CBA (Commonwealth Bank of Australia) providing stability to the bank account and allowing for fast transfers.

What is the minimum deposit at easyMarkets?

The easyMarkets minimum deposit varies by the account chosen. The lowest minimum amount relates to the standard account, which is $200AUD. The largest minimum amount relates to the super VIP, which is $50,000. The incentive to choose an account with a higher minimum deposit is lower fixed spreads and a personal account manager.

The easyMarkets minimum withdrawal account is $50USD to bank accounts. Other withdrawal methods to eWallets or credit/debit cards have no minimum withdrawal amounts. There are no easyMarkets fees on any deposits and withdrawals, although some vendors may charge their own fees, which are worth investigating.

Deposit Options and Fees

Another positive aspect found when completing the easyMarkets review was that there are no charges or any fees on withdrawal requests. easyMarkets also accommodates many payment options including most major credit cards, EFT and Skrill.

As the table shows, there are a number of deposit and withdrawal methods including:

- Credit Cards

- Debit Cards

- Online Banking

- eWallets

Withdrawal Options and Fees

With no fees applicable to any of these funding methods, the key factors of which method comes down to convenience for the forex trader and the deposit processing times that vary considerably.

Product Range

Leverage is a critical element for any forex trader, particularly experienced traders, due to small movements in currency markets over time. Based on this, leverage is critical, and easyMarkets offers one of the higher levels in Australia at 400:1.

It should be noted that the broker (easyMarkets) previously offered different leverage options, so it’s worth closely monitoring the leverage available at any one time. Leverage will amplify any movements within currency markets which are generally modest. This means that small movements can lead to big gains or losses. Risk, therefore, is the central outcome of leverage, so understanding your level of forex trading knowledge and risk appetite is critical when factoring in this variable.

Why Does Forex Leverage Matter?

Leverage allows Australian forex trading with a multiple of their deposit. So at the maximum 400:1 level, you can trade 400x your deposit or the amount you’re willing to trade on a currency pairing. An example of a $1,000 deposit at 400:1 means the forex trader is effectively trading $400,000 on currency markets. If during a forex trading Australia session a pairing then moves 0.1% a profit or loss of $400 will be recorded. This may not sound significant, but it’s in fact 40% of the initial amount traded. This means that leverage will increase the profits of smart trading, but also increase the risks and ability to lose large sums. Due to this increase in risk profile, traders should understand the risks and consider risk reduction strategies that some forex brokers offer, such as guaranteed stops discussed next.

Customer Service

Our easyMarkets review found that customer service and training were the two key strengths of the forex broker. When it comes to customer support, three of the four accounts offer a personal account manager. It is advised that a premium account be considered if you want regular customer service to assist with your day-to-day forex trading.

As the table above highlighted, two of the most popular contact methods are phone and live chat. Live chat is not offered by all the forex brokers and is ideal for short questions relating to traders.

As the table above highlighted, two of the most popular contact methods are phone and live chat. Live chat is not offered by all the forex brokers and is ideal for short questions relating to traders.

Live chat is complemented by Viber and even Facebook messenger. The key is that these communication channels including live chat are available to all forex accounts offered by easyMarkets.

Based on this, it’s strongly recommended to open a premium account as it ensures you receive lower spreads and better customer service and only requires a larger minimum deposit (which you don’t actually have to trade).

Research and Education

When it comes to online training, there is a plethora of options including:

- An online community

- eBooks

- Seminars

- Articles & News

- Online Simulators

Final Verdict on easyMarkets

easyMarkets is recommended for two types of traders only:

- Those new to forex trading

- Those looking to reduce their trading risks

If you’re an advanced or expert forex trader and looking for features such as Expert Advisors (EAs) then easyMarkets may not be suitable for your needs.

Background to easyMarkets Comparison

This forex broker comparison for easyMarkets was updated in 2025 by a panel of Forex trading Australia experts who have considerable experience with the Forex market. The easy markets review came from this forex comparison chart focusing on low fees which factored in pips and fixed vs variable models. All the information above and on our forex broker comparison tables are based on data found on the listed broker’s official website forex scams.

This information is compiled manually and if you happen to come across any type of inaccuracy or misinterpretation of information, please let us know; this is likely due to human error. From time to time brokers update information such as fees and bonuses. Our forex trading team aims to update these frequently, so we are always relevant to users. However, it is for this reason that the information included in our comparison tables be considered for indicative purposes only.

Compare easyMarkets Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to easyMarkets Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

I use eWallets more than online banking, when is the best time to withdraw from EasyMarkets?

It doesn’t matter when you withdrawal except best to do it during business hours not weekends.

Does easyMarkets allow hedging?

Yes, as long as it in good faith. That is, as long as you are not trying to ‘game’ the system.

What is the leverage on easyMarkets?

Leverage with EasyMarkets for most retail traders range from 30:1 for major pairs and 20:1 for minor and exotic currency pairs when trading Forex. Leverage for Professional clients ranges from 1:200 with easyMarkets WEB/App, 1:400 for MT4 and 1:500 for MT5.

What is the inactivity fee for easy markets?

easyMarkets does not have an inactivity fee