ATC Brokers Review Of 2026

We would describe ATC Brokers as a generic provider offering standard trading platforms with average trading costs. The broker is popular primarily in the UK with the provider being FCA regulated.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

ATC Brokers Summary

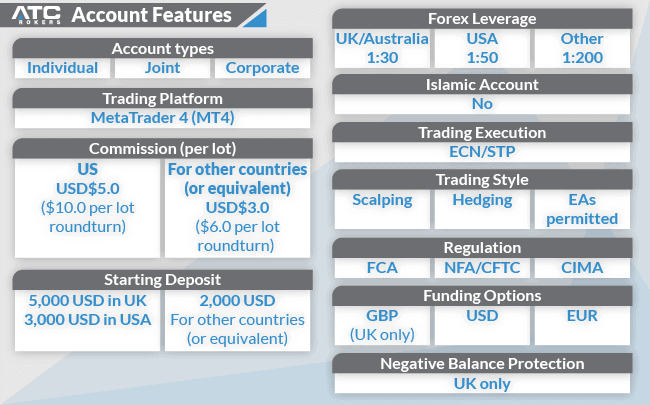

| 🗺️ Tier 1 Regulation | FCA |

| 🗺️ Tier 3 Regulation | CIMA |

| 💰 Trading Fees | Variable spread with no commission |

| 📊 Trading Platforms | MetaTrader 4 (MT4), MT Pro |

| 💰 Minimum Deposit | $2,000 |

| 💰 Withdrawal Fees | Yes |

| 🛍️ Instruments Offered | Forex, Metals, Energies, Indices, Crypto |

Why Choose ATC Brokers

ATC Brokers is among the few providers offering a RAW account with ECN-style spreads plus a commission, leading to lower trading costs. Their spreads and commissions are just below the average and it’s disappointing that no GBP commission rates are offered for UK traders (USD only).

The primary negative concern is they require a high minimum deposit of $2000.

ATC Brokers Pros and Cons

- Tight spreads

- Wide range of currency pairs

- FCA Regulation in the UK

- High minimum deposit

- Offers only MetaTrader4

- Inactivity fee

Open Demo AccountOpen Live Account

*Your capital is at risk ‘58.18% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Fees

ATC Brokers is a no-dealing desk broker, which means quotes are sourced from liquidity brokers such as major banks and financial institutions without intervention from the broker. This is known as a RAW account which is the gold standard for low trading fees. Below we compared their trading fees with other brokers offering RAW accounts.

1. Spreads

Every month, we gather the average spreads popular forex brokers list on their website for major currency 0.. The chart below shows the average spreads available for major forex pairs. As you can see, ATC Brokers fare poorly compared to other leading forex brokers with similar style accounts such as Pepperstone and Eightcap for major pairs such as EUR/USD.

RAW Account Spreads | |||||

|---|---|---|---|---|---|

| 0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.14 | 0.31 | 0.62 | 0.39 | 0.75 |

| 0.01 | 0.02 | 0.50 | 0.27 | 0.30 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

| 0.80 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

| 0.51 | 1.15 | 0.99 | 0.94 | 1.28 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

6 of the 9 most traded forex pairs have lower spreads for ATC Brokers compared to the average broker. Their average spread across all 9 is 0.62 vs 0.72 for the industry average.

| Raw Account Spreads | ATC Brokers | Average Spread |

|---|---|---|

| Overall | 0.62 | 0.74 |

| EUR/USD | 0.3 | 0.21 |

| USD/JPY | 0.3 | 0.39 |

| GBP/USD | 0.6 | 0.48 |

| AUD/USD | 0.4 | 0.39 |

| USD/CAD | 0.5 | 0.53 |

| EUR/GBP | 0.5 | 0.55 |

| EUR/JPY | 0.5 | 0.74 |

| AUD/JPY | 1 | 1.07 |

| USD/SGD | 1.5 | 2.34 |

2. Commission Rate

ATC Brokers only offer a USD commission rate which is surprising since most traders are based in the UK. The rate is $3.00 vs $3.44 for the industry average per side (100,000 units traded). While this is competitive the fact they don’t offer other base currency commission rates is surprising and can lead to additional currency conversion fees.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| ATC Commission Rate | $3.00 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Other Fees

ATC charges minimal fees for some transactions involving crypto, as well as an inactivity fee:

- Deposit Fee: 1% if using crypto

- Withdrawal Fee: $40 (0.20% if using crypto)

- Inactivity Fee: $50 per month after 6 months

Verdict

ATC Brokers has spreads slightly lower than the average of the broker we compared but only offer USD commission rates which can lead to additional fees for UK traders with a GBP base currency.

Trading Platforms

ATC Brokers offers its users one of the most popular trading platforms in the industry, MetaTrader4, also known as MT4. The MT4 platform is arguably the most used forex and CFD trading platform in the foreign exchange market. This is largely because of the wide array of features the software offers.

| Trading Plaform | Available With ATC |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | No |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

There are two versions of the MT4 platform: Desktop and Mobile. Let’s inspect each.

MetaTrader 4 (MT4) Desktop Trading Platform

The MT4 desktop platform is the gold standard in forex trading software. The platform is available for both Windows and MacOS (so long as you’re running Mojave (v. 10.14) or earlier), if you use later versions of MacOS, you’ll need to use an emulator or WINE.

New and experienced traders like the MT4 platform because it’s sleek and clean with a stylish interface. There’s not a lot of clutter or confusing information that often intimidates inexperienced traders. However, users can customise their dashboard, adding the tools and trading instruments they need for a pleasant online trading experience.

Traders can quickly and easily view their trading conditions and positions, so they have the information they need when they need it. Users can also automate their trading using EAs, also known as Expert Advisors. There is no shortage of features and trading tools available with the MT4 desktop platform.

Some of the more popular features include:

- User-friendly trading interface

- 2100 technical indicators and 1700 trading robots

- 2000 free indicators

- 70 paid indicators

- Various pending order types, including trailing stops and stop orders

- Trade forex online via MT4 Web Trader

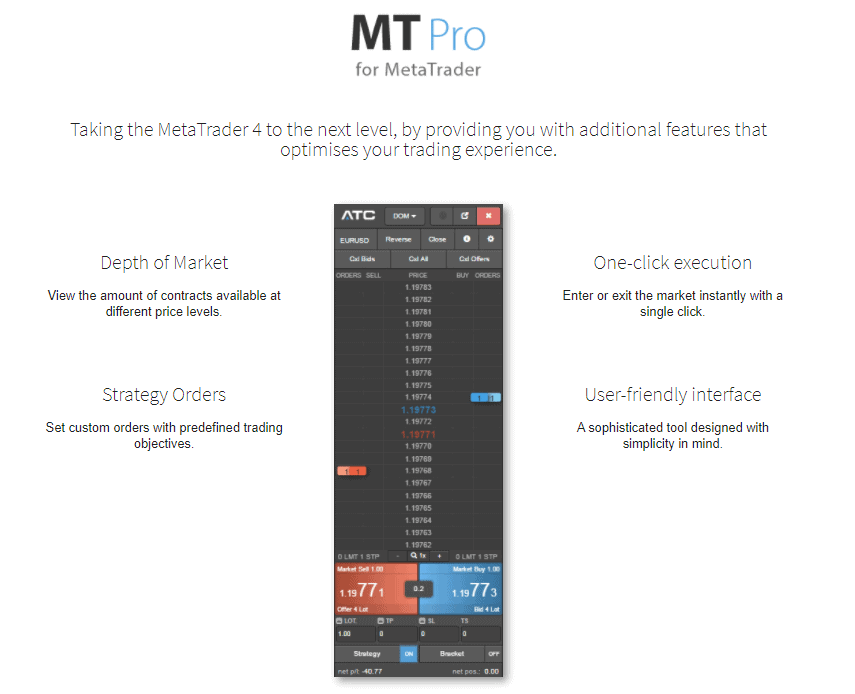

MT Pro

MT4 also offers an MT Pro version with various features designed to allow users to customise their trade settings while improving their trading experience. With MT Pro, you’ll use a platform that uses your account information to pull your trading data, creating useful and informative reports.

With MT Pro you’ll get features such as:

- The ability to close all open positions

- Cancel all pending orders

- View current market spreads

- Customise strategy orders

- Economic Calendar

Mobile App

If you like to know what’s going on with your forex trades while you’re on the go, the MT4 software is available on both iOS and Android devices. No matter where you are, you can view your trades and positions with the MT4 mobile app. It’s perfect for users who spend more time on their mobile devices than desktop computers.

When you use the MT4 mobile app, you’ll get plenty of features, including:

- Full execution types and modes

- Real-time access to financial markets

- 30 technical indicators

- 3 bar chart types – bars, broken lines, and Japanese candlesticks

- 9 timeframes, including M1, M5, M15, M30, H1, H4, D1, W1, and MN

Verdict

While MT4 is a widely used platform, we feel that offering just this single platform can be limiting for most traders.

Is ATC Brokers Safe?

ATC Brokers has a low trust score of 51 out of 100. Find out which categories they scored low (or high).

1. Regulation

ATC Brokers is regulated by one tier-1 regulator in the UK, and outside of the UK, it onboards clients under a tier-3 regulator. While the UK entity offers more broker protections, the second offers higher leverage and a wider range of markets that can be traded.

| ATC Brokers Safety | Regulator |

|---|---|

| Tier-1 | FCA (United Kingdom) - Financial Conduct Authority |

| Tier-2 | X |

| Tier-3 | CIMA (Cayman Islands) - Cayman Islands Monetary Authority |

2. Reputation

ATC Brokers has been around since 2005, with headquarters in Glendale, California. They show limited visibility in the online forex trading landscape. With approximately 18,100 monthly Google searches, it ranks as the 45th most popular forex broker among the 65 brokers analyzed. Web traffic data suggests even lower market penetration, with Similarweb reporting just 17,000 global visits in February 2024, positioning ATC Brokers as the 62nd most visited broker.

The broker focuses primarily on institutional and professional traders rather than the mass retail market. The company doesn’t publicly disclose its client numbers or trading volumes, but its specialized focus and limited online visibility metrics suggest a niche operator targeting a specific segment of sophisticated traders rather than pursuing broad market appeal.

| Country | 2025 Monthly Searches |

|---|---|

| Germany | 2,400 |

| United States | 110 |

| United Arab Emirates | 70 |

| Netherlands | 50 |

| United Kingdom | 40 |

| Poland | 40 |

| Greece | 40 |

| Italy | 20 |

| Canada | 20 |

| Japan | 20 |

| India | 20 |

| Spain | 20 |

| Austria | 20 |

| Taiwan | 10 |

| Australia | 10 |

| Malaysia | 10 |

| Thailand | 10 |

| Hong Kong | 10 |

| Indonesia | 10 |

| Vietnam | 10 |

| Singapore | 10 |

| Chile | 10 |

| Dominican Republic | 10 |

| France | 10 |

| Cyprus | 10 |

| New Zealand | 10 |

| Turkey | 10 |

| Cambodia | 10 |

| Brazil | 10 |

| Nigeria | 10 |

| Philippines | 10 |

| Pakistan | 10 |

| South Africa | 10 |

| Mexico | 10 |

| Switzerland | 10 |

| Colombia | 10 |

| Bangladesh | 10 |

| Morocco | 10 |

| Sweden | 10 |

| Argentina | 10 |

| Portugal | 10 |

| Kenya | 10 |

| Egypt | 10 |

| Saudi Arabia | 10 |

| Mauritius | 10 |

| Ireland | 10 |

| Peru | 10 |

| Ghana | 10 |

| Venezuela | 10 |

| Algeria | 10 |

| Uzbekistan | 10 |

| Sri Lanka | 10 |

| Uganda | 10 |

| Botswana | 10 |

| Bolivia | 10 |

| Ethiopia | 10 |

| Panama | 10 |

| Costa Rica | 10 |

| Jordan | 10 |

| Tanzania | 10 |

| Uruguay | 10 |

| Mongolia | 0 |

| Ecuador | 0 |

2,400 1st | |

110 2nd | |

70 3rd | |

50 4th | |

40 5th | |

40 6th | |

40 7th | |

20 8th | |

20 9th | |

20 10th |

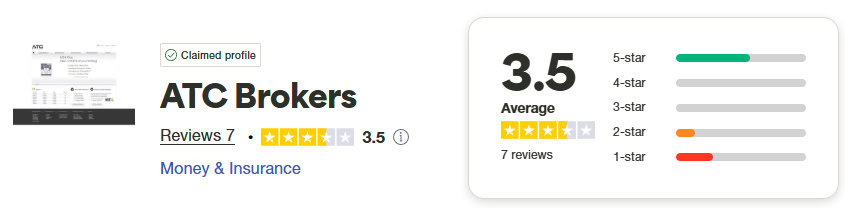

3. Reviews

ATC Brokers has only 7 reviews on TrustPilot compared to the thousands for other forex brokers. While the final score is 3.5/5, the lack of reviews has marked the provider down significantly compared to the more established brokers.

Verdict

While it’s reassuring that ATC Brokers has a ‘tier 1’ reguatlion (FCA), the lack of traders and review led to a low trust score.

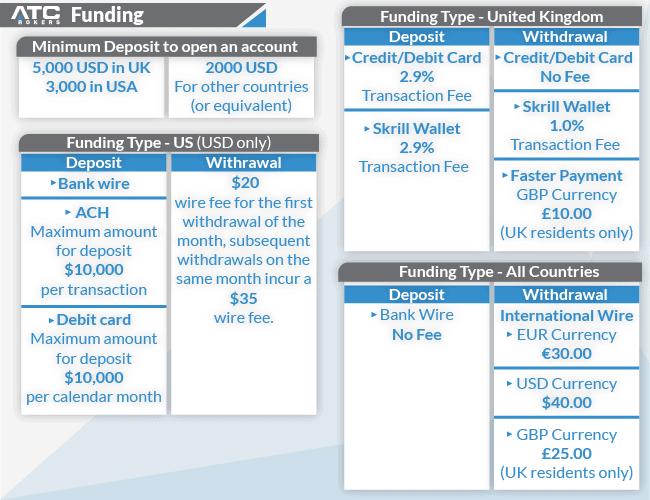

Deposit And Withdrawal

What is the minimum deposit at ATC Brokers?

The minimum deposit at ATC Brokers is USD $2,000 or equivalent for EUR or GBP.

Deposit Options and Fees

Users can currently only deposit funds in their accounts through either bank wire or UnionPay using either USD or EUR. Unfortunately, the brokerage firm does not accept popular payment methods such as PayPal, ChinaPay, Klarna, or Mastercard. You can’t even use a credit card if you are in the USA and some other countries. This limitation can be seen as a major weakness of the broker. The good news is that there are no fees for depositing funds into your ATC Brokers account.

Withdrawal Options and Fees

If you want to withdraw funds, go to your ATC Brokers account and select “Withdraw funds.” Remember that when you remove your funds, ATC charges a withdrawal fee. If you’re using USD, you’ll pay $40; if you’re using EUR, it will run you €30.00.

Verdict

ATC Brokers has a high deposit threshold which may exclude most traders looking to test the broker initially.

Product Range

ATC Brokers offers around 30+ products, which include forex trading, metals, CFDs, and Contract Specs. Here’s a closer peek at what is involved with each of these options.

| Product Type | Forex Pairs | Indices | Cryptocurrencies | Metals | Energies |

|---|---|---|---|---|---|

| Tradable Markets | 38 | 2 | 5 | 2 | 2 |

Forex

Few people know how much trading volume the forex market does daily. There are more than $6.5 trillion in trades every day. Plus, it’s a significant trading industry since it’s available to anyone in the world no matter where they live. It’s also available Monday-Friday, 24 hours a day.

You can trade 38 major, minor, and exotic currency pairs with ATC Brokers. These include AUD/USD, EUR/USD, EUR/JPY.

If you are trading with ATC Brokers from the United States, you should know that you will be trading spot Forex rather than CFD Forex. All other countries will trade CFDs.

Unfortunately, the range of trading pairs is limited compared to other popular forex trading platforms. Other sites offer nearly double the currency pairs ATC Brokers supports, with many more exotic options. If you need a lot of forex trading choices, you may want to look elsewhere.

Metals

Products on the platform include Gold and Silver, which you can trade against the USD. If you decide to trade in the metals market on the ATC Brokers platform, remember that while it is open from Sunday to Friday, it opens at 10 pm GMT on Sunday and closes at 9 pm GMT on Friday. You can trade metals on ATC brokers with leverage of 50:1 and spreads of 0.07 pips for gold and 0.16 pips for silver.

Something to keep in mind when trading metals on ATC Brokers is that the platform only offers two metals. Gold and Silver are your only options. Palladium, Copper, and Platinum – other very popular metals – are unavailable through ATC Brokers.

Note: Metals are not an option for US traders.

Energies

Like most of its product offerings, ATC Brokers only offers a few energy trading options. Energies are used to diversify portfolios without having actually to own the product itself.

Unfortunately, the only options available through ATC are WTI and Brent Crude oil. It would be nice if the platform offered additional fuel energies, or soft commodities like sugar, corn, or coffee that other brokers often offer.

Note: Energies are not an option for US traders.

Indices

If you’re new to forex trading and want to gain exposure to other countries’ stock markets, trading indices is a great place to start. Unfortunately, ATC Brokers does not offer a very robust lineup. There are no stocks or shares available. Otherwise, you can choose between DAX/EUR, STX/EUR, FTS/GBP, DOW/USD, SPX/USD, NDX/USD, and AUS/AUD.

Note: Indices are not an option for US traders.

Cryptocurrencies

Trading cryptocurrencies is only available for professional account types. Remember that trading crypto through ATC Brokers is not available during the weekend. The traditional crypto exchange is open 24/7, so you’ll lose out in a few days of trading.

However, if you use ATC for crypto trading, you can access popular digital coins like Bitcoin, Bitcoin Cash, Ethereum, Ripple, and Litecoin.

Note: Cryptocurrencies are not an option for US and UK traders.

Verdict

ATC Brokers has a limited number of products on offer compared to other brokers.

Customer Service

You can contact customer service through chat or email and learn more about trading through the site’s Learn section. ATC could probably do more for its users, but it’s a step in the right direction.

Customer service is an area where ATC Brokers could do better. When using the chat feature, you’re left feeling like your questions weren’t addressed. You’re often directed to a ticketing system that allows you to input your personal information, along with your problem or question.

While ATC does a good job of getting back to you in a timely manner – usually within a few hours – you might still feel like your questions aren’t answered. For example, when asking about the different accounts, the platform responded with leverage options and pushed to set up a call to review their options and features. While that makes things a little more personal, the question was never answered.

However, the site offers an extensive FAQ section, which answers many general questions, giving you plenty of information about the platform. This includes information about pricing, leverage, spreads, and more. If you can’t find the answer through the FAQ section, a form at the bottom of the page lets you send a message to the customer support team. If you prefer not to use the form, you can email the support team directly.

Verdict

ATC Brokers could improve communication by offering additional channels and more responsive service.

Research and Education

ATC Forex offers lessons in forex trading that apply to both experienced and novice traders. Topics in this section cover everything from how to get started trading to information about ECN broker services, trading platforms, and much more. Want to learn more about CFDs or Day Trading? ATC Brokers has you covered.

There’s plenty of information available in the ATC Learn section of the site, but it would be great to see them expand on what they offer. Most topics are just one long page broken up into smaller subsections about forex trading. While some people might learn this way, most people will not keep what they read.

It would be nice if topics were broken up into various levels so users know where to start. Some broker platforms provide more interactive methods for learning about forex trading.

Verdict

With all that said, at least ATC Brokers offers a learning module, which is more than other platforms do for their users.

Final Verdict on ATC Brokers

We would summarise ATC Brokers, offering as relatively generic, they offer the essential features needed for trading. This includes the most popular trading platform and a decent range of financial instruments for trading and regulation.

Traders wanting a richer trading experience will notice what they are missing. For example, the range of financial instruments for trading is quite limited, they only have 38 currency pairs, 9 indices, and no share trading. It would also be nice if they included copy or social trading tools, VPS, and a more extensive education library and market analysis tools.

ATC Brokers FAQs

What is the Minimum Deposit at ATC Brokers?

The minimum deposit at ATC Brokers is USD $2,000 or equivalent in Euro of British Pounds.

What Demo Account Does ATC Brokers Offer?

ATC Brokers is regulated by the Cayman Islands Monetary Authority (CIMA) and has been in operation since 2005. Despite a low trust score of 25 out of 100, it has a TrustPilot score of 4.3 out of 5 from 11 reviews, suggesting a level of reliability.

What Leverage Does ATC Brokers Offer?

Leverage varies by region:

- UK/Europe and Australia: 30:1 for major currency pairs, 20:1 for non-major pairs, indices, and gold, and 10:1 for silver and other commodities. Crypto trading is not available for UK traders, but European and Australian traders can use 20:1 leverage.

- Other Countries (via Cayman Islands subsidiary): Up to 200:1 for accounts below $100,000 USD, and 100:1 for accounts above $100,000 USD. Metals leverage is 50:1, indices 100:1, and cryptocurrencies 20:1.

Is ATC Brokers good for Australian Forex Traders?

ATC Brokers offers a range of services that could be appealing to Australian forex traders, including access to the MetaTrader 4 platform, a variety of financial instruments, and regulation by reputable authorities. However, there are specific considerations for Australian traders:

- Leverage for Australian Traders: Australian traders can expect leverage of up to 30:1 for major currency pairs and 20:1 for non-major pairs, indices, and gold, according to the regulatory standards applicable in Australia. This aligns with the leverage restrictions imposed by many regulatory bodies to promote responsible trading.

- Financial Instruments: ATC Brokers offers trading in forex, metals, energies, indices, and cryptocurrencies (though restrictions apply to crypto trading for certain traders). The range of products may meet the needs of many Australian traders looking to diversify their trading strategies.

- Minimum Deposit: The minimum deposit requirement might be higher than local options. Australian traders should consider this, especially if they prefer starting with a lower capital investment.

- Trading Platform: The exclusive use of MetaTrader 4 could be seen as a limitation or an advantage, depending on the trader’s preference. MT4 is widely regarded for its advanced trading tools, but some traders might prefer brokers that offer various platform options.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Can I open a demo account with ATC Brokers before trading live?

Yes, all brokers with MT4 or MT5 have demo accounts available for free to test with before signing up for a live account. Demo accounts are usually good for 90 days.