AvaTrade Review Of 2026

AvaTrade offers several features that make us view them favourably. In addition to 55 Forex Pairs, our AvaTrade review found a typical EURUSD spread is 0.9 and they offer 42 forex options and good risk management.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

AvaTrade Summary

| 🗺️ Tier-1 Regulation | ASIC, CIRO, CySEC |

| 🗺️ Tier-2 Regulation | ADGM, ISA, JFSA, CBI, KNF |

| 💰 Trading Fees | No Commissions |

| 📊 Trading Platforms | MT4, MT5, AvaTradeGo, AvaOptions |

| 💰 Minimum Deposit | $100 |

| 🛍️ Instruments | Forex, CFDs, Crypto, Options, Bonds |

| 💰 Credit Cards | Yes |

Why Choose AvaTrade

We like that AvaTrade has a genuine point of difference. For starters, the broker is a market maker but allows automation, social trading and scalping. The broker even has specialist software for social trading. The other feature of note is availability of options trading, they even have an app just for this type trading. Lastly, we found the broker to have a decent range of market research and education resources.

Unfortunately, we found that their customer service team lacked knowledge of their own products. Inactivity fees and spreads for trading CFDs are on the higher end.

AvaTrade Pros and Cons

- No charge on funding

- Easy account opening

- Extensive research materials

- Inactivity fee

- Mediocre CFD fees

- Limited products

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

AvaTrade only offers a fixed spread account for retail traders, which means trading costs are included in the spread. As a result, spreads will be wider than ECN pricing, and standard accounts with floating spreads however offer greater spread stability.

Standard Account Spreads

Comparing AvaTrade’s ‘typical’ spreads with other brokers that offer fixed spreads and advertise them on their website, one can see that AvaTrade’s spreads are leaders in their niche.

AvaTrade Fixed Spreads Comparison | |||||

|---|---|---|---|---|---|

| 0.90 | 1.10 | 1.50 | 1.80 | 1.50 |

| 0.70 | 1.20 | 1.50 | 1.80 | 1.30 |

| 1.20 | 1.50 | 1.30 | 2.00 | 1.70 |

| 1.50 | 1.80 | 2.00 | 2.00 | 2.00 |

| 3.00 | 3.00 | 3.00 | 3.00 | 3.00 |

| 1.00 | 1.00 | 1.50 | 2.00 | 2.00 |

| 4.00 | 4.00 | 3.00 | 5.00 | 5.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Additionally, compared to the industry average spread, AvaTrade shows tighter spreads on most currency pairs.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| AvaTrade Average Spread | 0.8 | 1.3 | 1.2 | 0.9 | 1.8 | 1.2 | 1.8 | 1.9 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

AvaTrade Account Types

The majority of clients trading with AvaTrade will be limited to one account type. If you are a client in the UK or Europe then you have the “Retail” account available for your use. If you are a client from outside the UK and Europe, then you will have the “Standard” account. These accounts are the same in that they are a market maker/dealing desk type of account with no commissions.

The majority of clients trading with AvaTrade will be limited to one account type. If you are a client in the UK or Europe then you have the “Retail” account available for your use. If you are a client from outside the UK and Europe, then you will have the “Standard” account. These accounts are the same in that they are a market maker/dealing desk type of account with no commissions.

Standard Account (Australia, South Africa, Japan) / Retail Account (UK, Europe, UAE).

AvaTrade’s Standard and Retail Account are almost the same. The difference is who the account is available for and the level of leverage. The shows the nations each account is available for and the leverage.

AvaTrade’s Standard and Retail Account are almost the same. The difference is who the account is available for and the level of leverage. The shows the nations each account is available for and the leverage.

The reason there are different account AvaTrade needs to comply with ESMA MiFID requirements for its European clients and FSRA requirements set by the Abu Dhabi Global Market for UAE clients. These countries allow two types of trading conditions, one for retail traders and one for professional traders.

The Standard/Retail accounts allow commission-free trading. For this reason, you will find spreads are wider than STP or ECN style, with no dealing desk style brokers which have tighter spreads but added commission costs. To open a trading account, 100 base units (100 USD approx) will be needed.

Other Accounts

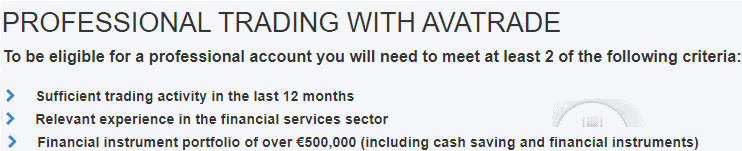

Professional Account (UK, Europe, UAE)

Traders in the UK, Europe and UAE) who work in the finance industry, manage a financial portfolio or make regular trades of significant size can apply for a professional account. With this account, you will be able to access leverage in line with the available traders with a Standard Account.

- Only for clients in the UK, Europe and the United Arab Emirates

- Maximum leverage of 1:400 (Abu Dhabi and South Africa branches only)

- Margin Call – 10% of your margin

Swap-Free Account Fees

A swap-free style account is available for Islamic traders that follow sharia law. With this account, there are no interests paid or received. In its place, the spread is widened by 1 pip for forex pairs when you open your position. If you keep your position open for 10 or more days, then you will lose Islamic privileges.

Islamic account features:

- Only for Islamic traders who can verify their eligibility

- No daily swap fees (or rolling / overnight fees)

- 1 pip (on top of normal spread) fee to open position

- Available for all CFDs except for cryptocurrency

- ZAR, TRY, RUB, MXN pairs not available for trade

Options Account

AvaTrade offers Vanilla Options or European style options for 42 forex pairs, along with spot gold and silver. With this broker, options trading gives you the right to buy (call) or sell (put) a specified amount for forex, gold or silver at a certain price at an agreed time in the future. Options are available for a day, week, one or more months and up to one year,

When trading options, a premium is paid for the right to the options. This is determined by the existing price of the instrument and the length of time in the future the option will expire.

Options account features:

- Trade Vanilla Options – Call and Put options

- 42 Forex pairs Options, Spot Gold, Spot Silver Options

- AvaOptions Trading Platform for Web and Mobile

Open a demo accountVisit Broker

*Your capital is at risk ‘66% of retail CFD accounts lose money’

Leverage

The margin requirements or leverage available with AvaTrade will vary depending on the type of trading account you are using and the subsidiary you are trading with.

Retail investor accounts signed up to the Australian or European branches will be restricted to leverage of 1:30 for forex, 1:10 for commodities, 1:5 for individual stocks and ETFs, 1:20 on indices. Under FCSA (South Africa) and ADGM (Abu Dhabi) regulation, retail traders can use leverage up to 400:1, while in Japan (JFSA) it is as low as 25:1.

If you want larger exposure, if you meet qualification requirements for a professional account, you’ll be able to trade with much higher leverage. Professional traders are considered to have the skills and access to capital to properly manage leverage and the high risk of losses, which is why increased leverage is available to them,

Crypto

Cryptocurrency leverage for cryptocurrency trading also will vary depending on the type of account you have access to. Leverage for cryptocurrencies is tighter (2:1 in Europe, the UK and Australia) than other financial products because of its highly volatile nature.

Options

Leverage for options is consistent with leverage available for spot forex, spot gold and spot silver.

AvaTrade Spread Betting

AvaTrade offers spread betting for UK and Irish traders. Like CFDs, spread betting lets you trade on rising and falling financial markets. Unlike CFDs, spread betting gives you the advantage of trading without capital gains tax and stamp duty. This decreases your costs and increases your profit potential.

Leveraged trading, AKA Margin Forex Trading, enables you to open larger trading positions than those available from your existing capital. And you can spread bet on the most of same financial instruments as you can when CFD trading.

You can only spread bet using MetaTrader 4. This limits you to 200 of AvaTrade’s range of financial instruments, which includes FX pairs, indices, equities & bonds.

What we like about MT4 is how flexible and customisable a platform it is, with a range of built-in indicators and analytical tools. You can also use expert advisors (EAs), either creating your own or importing from the MetaTrader Market, for automated trading. In addition, you can choose from 2000 Trading Signals to copy other traders’ strategies in real time. One unique feature we particularly like about AvaTrade’s MT4 spread betting offering is Guardian Angel, which provides feedback on your trading performance.

However, AvaTrade doesn’t let you integrate with TradingView or cTrader, which is a slight disappointment for us. TradingView offers the best user interface and impressive charts or analytical tools. You also can’t use AvaTradeGO or MT5 for spread betting, which limits the range of markets (like shares) and features you can use (like AvaProtect). For this reason with think spread betting with AvaTrade compared unfavourably with brokers like Pepperstone and IG who allow you to trade using a wider range of trading platforms.

Overall, we found AvaTrade’s MT4 spread betting platform to be a reliable and competitive option for spread betting. While it might not be the best option in the market, it’s certainly not a bad one either.

Other Fees

There are no charges for deposits and withdrawals.

For inactive accounts:

- $50 per quarter after 90 days

- $100 annual administration fee is inactive for 12 months

Verdict on AvaTrade Fees

AvaTrade’s trading fees are competitive, especially with its commission-free model and predictable fixed spreads. Although its spreads may be slightly higher than some competitors, its fee structure is simple and transparent for most traders.

Open a demo accountVisit Broker

*Your capital is at risk ‘66% of retail CFD accounts lose money’

Trading Platforms

One impressive aspect of AvaTrade offer is a large range of trading platforms.

| Trading Plaform | Available With AvaTrade |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

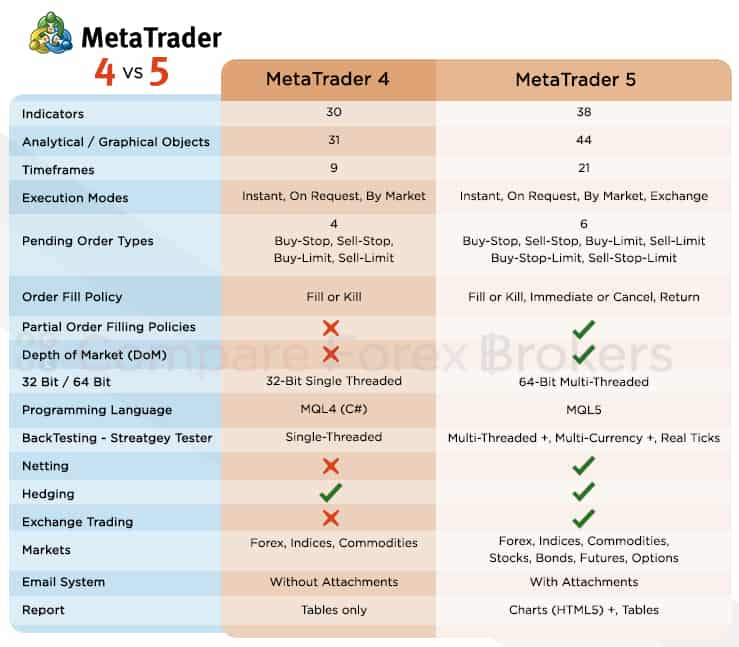

MetaTrader 4

The popular MetaTrader 4 (MT4) is available and still a leader when it comes to platforms for trading forex despite its age. This platform is used by more traders than any other so brings with a strong reputation and large community which can help for social trading, sharing ideas, buying and selling signal and advisors and finding skilled developers to write scripts.

MetaTrader 5

The successor MT4 is MetaTrader 5. While not yet as popular as MT4, it brings with it more powerful processing capability, a greater range of trading tools and the ability to trade exchange-traded derivatives such as stocks and ETFs. If you are new to trading and deciding between MT4 and MT5, then MT5 can be a smart choice as MT5 offer a longer-term solution as MT4 will phase out since MetaQuotes no longer offers new development for MT4.

Mobile Trading – AvaTrade Go

AvaTradeGo is not a “true” trading platform in the sense trades are not executed by the platform itself. Rather, AvaTradeGo is a mobile app that allows you to manage your MetaTrader 4 trading account with the ability to trade using the MetaTrader underlying platform.

Available via iOS and Android, the platform allows you to easily see your trades, create watch lists, analyse charts and obtain live feeds and prices in order to make trading decisions. The platform does have a few useful custom resources, such as:

- “Market Trends” With this feature, you can monitor social trends happening in the AvaTrade community

- AvaProtect™ (see risk management)

- Step-by-step guidance on opening trades

- Easy switching between demo account and live account for backtesting and practice before trading CFDs.

AvaTrade Options

AvaOption is AvaTrade’s solution for options trading. Like AvaTradeGO, it is built on the MetaTrader 4 platform but offers extra features essential for trading options. Trading of options can be complicated, so AvaTrade’s features that simplify the trading process offer helpful benefits.

Tools to simplify the trading process include:

- 14 in-built trading strategies for options which make the execution trades possible with one click.

- Graphical tools in the form of current and historical implied volatility curves to demonstrate the risks and potential rewards

- Special pages that summarise portfolio risks including Delta, Theta and Vega

The default options trading strategies feature is very useful. With this tool, your order ticket will be populated with details related to the options contract, which you can then modify by changing the price and expiration date.

This feature is available for both mobile and web browsers.

Robo Trading

Robo Trading

In addition to expert advisers for trading automation via MetaTrader 4 and MetaTrader 5, AvaTrade offer DupliTrade (with MT4), ZuluTrade and MQL5 – Signal Service.

These are all social trading or copy trading tools that have features that allow you to automate the trading process by mirroring other traders’.

Open a demo accountVisit Broker

*Your capital is at risk ‘66% of retail CFD accounts lose money’

Risk Management

AvaTrade offers a range of risk management tools that take go beyond the standard tools many brokers offers. These include:

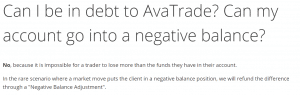

Negative Balance Protection for all clients

AvaTrade offers guaranteed negative balance protection to all clients. While most CFD brokers only offer it to retail clients in the UK and Europe to meet regulation requirements, AvaTrade offers Negative Balance Protection to all their retail clients.

Negative balance protection is an excellent feature for retail traders who are gaining trading experience and learning how CFDs work.

Margin Call (MC3) / Stop Out

AvaTrade will exit you from your trades when your equity falls below margin requirements.

AvaTrade has the following policies

- Retail Accounts 50% of the required margin

- Standard Account, Professional Account – 10% of the required margin

- AvaOptions – Net Liquidation Value drops below 25% of Required Margin

AvaProtect

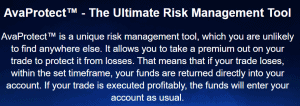

AvaTrade offers a unique feature on its AvaTradeGo mobile trading platform that is similar to easyMarkets dealCancellation. AvaProtect is an order type that protects you against any losses for a period of time for a small fee.

Introduced in Jan 2020, AvaProtect is an opt-in feature that allows you to buy guaranteed protection for a pre-determined timeframe. Should this trade prove to be a losing one during this defined period, you will be reimbursed in liquid cash for any of these trades losing trades. Protection of up to 1 million is available and can be used with retail, standard and professional accounts.

While this is a great tool, if you are using MetaTrader 4 or 5, you will not be able to access this tool as it’s only available with AvaTradeGO.

Open a demo accountVisit Broker

*Your capital is at risk ‘66% of retail CFD accounts lose money’

Is AvaTrade Safe?

AvaTrade has a trust score of 72, from the broker’s regulation, reputation, and reviews.

1. Regulation

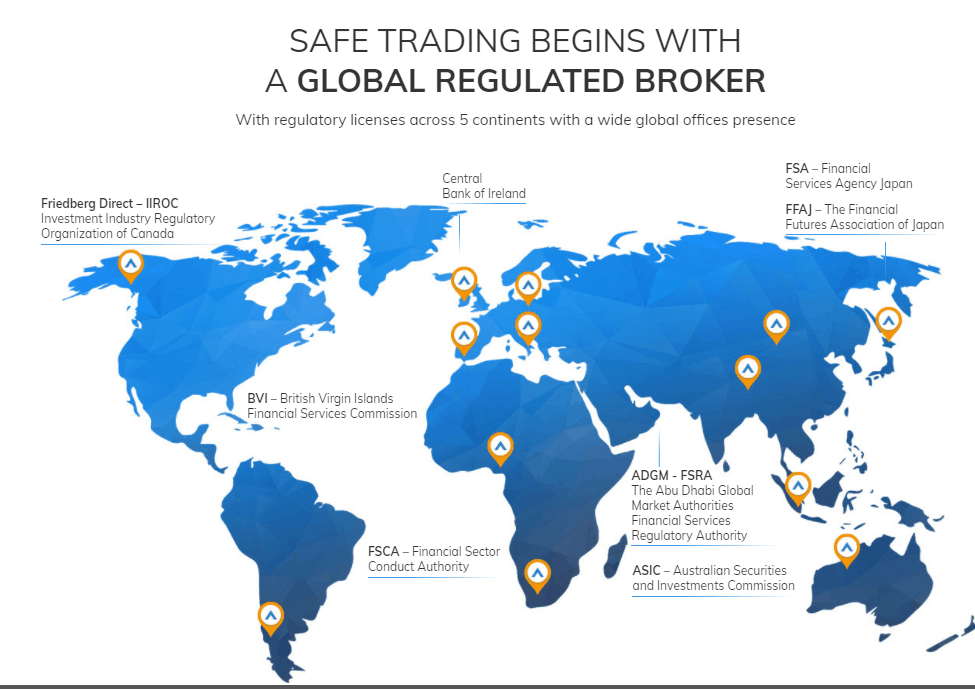

AvaTrade offers is a regulated broker with a number of tier-1 oversights. These include (entity followed by the regulator and licence number):

- AVA Trade EU Ltd – Europe, Central Bank of Ireland under license #C53877.

- AVA Trade EU Ltd – Poland, Polish Financial Supervision Authority (KNF)

- Ava Capital Markets Australia Pty Ltd – Australia, Australian Securities and Investments Commission (ASIC) under license #406684.

- Ava Trade Japan K.K – Japan, FSA under license #1662 and the FFA under license #1574.

- Ava Capital Markets Pty Ltd – Financial Sector Conduct Authority (FSCA) South Africa, FSB under license #45984.

- Ava Trade Ltd – International. British Virgin Islands Financial Services Commission (No. SIBA/L/13/1049)

- AvaTrade Middle East Ltd Abu Dhabi Global Market Financial Services Regulatory Authorities (ADGM FSRA) Category 31A licence (No. 190018)

| AvaTrade Safety | Regulator |

|---|---|

| Tier-1 | ASIC CIRO CySEC |

| Tier-2 | ADGM ISA JFSA CBI KNF |

| Tier-3 | FSC- BVI FSCA |

Regulation is important as it ensures your funds are safe and the broker is acting in a professional manner that is respectful to clients in terms of their business conducts, financial products and trading conditions.

AvaTrade will not accept clients from the following countries –

- Belgium

- Brazil

- Canada

- Iran

- New Zealand

- North Korea

- Singapore

- Turkey

- United States

2. Reputation

AvaTrade is part of the AVA Group of companies and was founded in Dublin, Ireland, 2006. They have 5 offices around the world including Ireland, Australia, Japan, Abu Dhabi and the British Virgin Islands.

Their popularity maintains a solid mid-tier position in the global forex brokerage industry. With approximately 90,500 monthly Google searches, it ranks as the 23rd most popular forex broker among the 65 brokers we analyzed. Similarweb data from February 2024 shows a consistent picture, positioning Avatrade as the 25th most visited broker with 713,000 global visits.

This broker has grown its presence to serve over 400,000 registered users who execute more than 3 million trades monthly. The broker processes an average monthly trading volume exceeding $80 billion, reflecting its established market position. Avatrade has expanded its regulatory footprint across multiple jurisdictions, contributing to its global reach across over 150 countries.

| Country | 2025 Monthly Searches |

|---|---|

| South Africa | 8,100 |

| Italy | 5,400 |

| India | 3,600 |

| France | 3,600 |

| United Arab Emirates | 2,900 |

| United States | 2,400 |

| Germany | 2,400 |

| Canada | 2,400 |

| Spain | 2,400 |

| United Kingdom | 1,900 |

| Colombia | 1,900 |

| Indonesia | 1,600 |

| Nigeria | 1,300 |

| Brazil | 1,300 |

| Mexico | 1,300 |

| Australia | 1,300 |

| Malaysia | 1,300 |

| Netherlands | 1,000 |

| Poland | 1,000 |

| Singapore | 1,000 |

| Mongolia | 1,000 |

| Turkey | 880 |

| Pakistan | 880 |

| Japan | 880 |

| Ireland | 590 |

| Egypt | 480 |

| Saudi Arabia | 480 |

| Venezuela | 480 |

| Sweden | 480 |

| Vietnam | 480 |

| Thailand | 480 |

| Morocco | 480 |

| Kenya | 480 |

| Argentina | 480 |

| Peru | 480 |

| Algeria | 480 |

| Switzerland | 480 |

| Portugal | 480 |

| Philippines | 390 |

| Cyprus | 320 |

| Hong Kong | 320 |

| Ecuador | 320 |

| Chile | 320 |

| Jordan | 260 |

| Bangladesh | 260 |

| Dominican Republic | 260 |

| Austria | 260 |

| Greece | 260 |

| Ghana | 260 |

| Taiwan | 210 |

| Sri Lanka | 210 |

| Tanzania | 210 |

| Uganda | 210 |

| Cambodia | 170 |

| Uzbekistan | 170 |

| Botswana | 140 |

| Bolivia | 140 |

| Mauritius | 140 |

| Uruguay | 110 |

| Panama | 110 |

| Costa Rica | 90 |

| Ethiopia | 90 |

| New Zealand | 70 |

8,100 1st | |

5,400 2nd | |

3,600 3rd | |

3,600 4th | |

2,900 5th | |

2,400 6th | |

2,400 7th | |

2,400 8th | |

2,400 9th | |

1,900 10th |

3. Reviews

AvaTrade has a TrustPilot score of 4.8 out of 5 from 10,386 reviews.

Deposit and Withdrawal

What is the minimum deposit at AvaTrade?

What is the minimum deposit at AvaTrade?

The minimum deposit to open an account and start trading with AvaTrade is $100.

Deposit Options and Fees

AvaTrade range of options for deposits is limited. While some brokers offer 5 to 20 options for deposits, AvaTrade stick only offers essential options. While this may not suit everyone, most traders should be fine with this.

Deposit options

- All Nations – Credit Card/ Debit Cards (Visa, MasterCard)

- Australia – POLi

- UK and Europe – Skrill / Neteller

- Asia – WebMoney

When making deposits, there is a minimum deposit requirement of 100 units (i.e. AUD/USD/EUR 100). If you are only planning to trade small amounts, then this may be an issue for you. Transfer times are as follows:

- Credit Card / Debit Card – instant transfer

- Bank Transfer / Wire Transfer – up to 7 days transfer

- e-Payment – transfer within 24 hours

Withdrawal Options and Fees

AvaTrade follows a strict Know Your Customer (KYC) process for withdrawal, this is to keep AvaTrade compliant with anti-money laundering processes.

Withdrawals will be returned to your account within 24-48 hour once KYC verification is complete. If you made your deposit with a credit or debit card, then 200% of the amount of your first deposit must be returned to the credit or debit card before you can withdraw to other accounts. If you made your deposit with other methods, then 100% must first be returned to that account.

Other Cost

AvaTrade has a quarterly inactivity fee of $25 admin fee when there is no trading activity on the account for 3 months.

Product Range

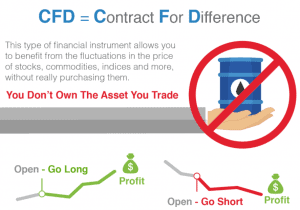

AvaTrade offers a solid range of financial derivatives for trading. AvaTrade contract for difference (CFD) range stands out because they offer bonds, treasuries, and options which are only available with a few brokers.

AvaTrade offers a solid range of financial derivatives for trading. AvaTrade contract for difference (CFD) range stands out because they offer bonds, treasuries, and options which are only available with a few brokers.

CFDs

While AvaTrade has a good collection of stocks compiled from NYSE, NASDAQ and London Stock Exchange along with Indices and ETFs covering the US, Europe and Asia, the absence of options from Australian markets is noticed. No share options from the ASX is available now ASX200 indices.

The table below shows the range of CFDs available for trade.

| Available | Notable Markets | Spread Range | |

|---|---|---|---|

| Forex | 55 | Majors, Minors, Exotics | |

| Stocks | 625 | US, Europe and Asian Markets | Most between 0.13% and 0.19% |

| Commodities | 30 | 8 x Oil (Brent, Crude, Heating) Gas, Gasoline 3 x Gold, 3 x Silver, Copper, Palladium, Platinum 7 x Soft Commodities | Gold - 0.34 Oils - 0.03 Heating Oil, Gasoline - $0.0015 over market Brent Oil, Gas -$0.02 over market Silver - 0.029 |

| Indices | 33 | 12x MSCI, 2x DOW Jones, 4x ProShares 4 x Direxion Daily 2 x S&P 500 | 0.25 to 3 over market |

| ETFs | 59 | 12x MSCI, 2x DOW Jones, 4x ProShares, 4x Direxion Daily, 2x S&P 500 | Most between 0.13% and 0.19% |

| Bonds | 2 | EURO-Bund, Japan Govt Bond | Euro-Bund - 0.03 Over Market Japan Govt Bond - 0.06 Over Market |

| Cryptocurrencies | 15 2 Crypto currency crosses 1 Crypto index | 0.5% to 2% over market | |

| Options | 42 - Forex Options 1 Gold, 1 Silver |

Cryptocurrencies

Cryptocurrencies

AvaTrade offers some 13 different types of cryptocurrency assets. Most interesting is the availability of crypto pairs to different currencies and a cryptocurrency index.

Please note: Due to changes in FCA regulation in the UK, AvaTrade’s UK based branch is no longer able to offer crypto trading to UK residents. If you are in the UK and want to trade cryptocurrency, you will need to sign up with the broker’s other subsidiaries that operate in Australia or Europe.

Available Cryptos:

| Cryptos | BitCoin Cryptos & Indices |

|---|---|

| Ripple | Bitcoin USD (BTCUSD) |

| Stellar | Bitcoin EUR (BTCEUR) |

| Dash | Bitcoin JPY (BTCJPY) |

| NEO | Bitcoin Cash |

| EOS | Bitcoin Gold |

| MIOTA | Crypto 10 Index |

| Litecoin | Dodgecoin |

| Uniswap | Chainlink |

Options

AvaTrade allows vanilla options trading for 42 currency pairs plus gold and silver via their AvaOptions platform. The options period can be set for up to one year will be cash-settled using the intrinsic value and closed when expired using intrinsic value.

Customer Service

AvaTrade customer support team are available via live chat, webmail (via contact us page) and phone 24/5. The support team is multilingual, with a local number for phone support available in 21 European countries, Australia, 2 African countries, 7 Asia countries, 4 South American nations, 2 Countries in the Middle East and Mexico in North America. There have no contacts in the USA and Canada.

Research and Education

AvaTrade offers an exceptional range of educational resources to help you develop your trading skills, regardless of what level of trader you may be.

![]() If you are new to trading, you will find the “Trading For Beginners” education very helpful. Here you will find 59 chapters or webpages explaining a wide range of trading concept. This content is a mix of written, AvaTrade produced YouTube video and even infographics. These 59 chapters are neatly divided into 3 sections:

If you are new to trading, you will find the “Trading For Beginners” education very helpful. Here you will find 59 chapters or webpages explaining a wide range of trading concept. This content is a mix of written, AvaTrade produced YouTube video and even infographics. These 59 chapters are neatly divided into 3 sections:

- What is – What is forex, what are options

- Banks – European Central Bank, Bank of England

- How to – How to trade stocks, how to trade online

![]() Once you have completed the above, you can move onto Professional Trading strategies. This follows the same format as Trading For Beginners but covers more advanced trading concepts. Here you can find 27 topics including chapters for just about every type of technical indicator you should know.

Once you have completed the above, you can move onto Professional Trading strategies. This follows the same format as Trading For Beginners but covers more advanced trading concepts. Here you can find 27 topics including chapters for just about every type of technical indicator you should know.

If you prefer something a little more structured and stored on your hard drive, a free ebook called “Forex First Steps” can be emailed to your inbox by completing the registration form.

AvaTrade also offers videos and webinars if you prefer to learn visually. Topics covered include:

- Beginner (9 videos)

- Assets and tools (12 videos)

- Trading strategies (10 videos)

- Advanced trading tools (14 videos)

- Trading platforms (7 videos)

- Trading safely (3 videos)

AvaTrade also has a section in their education suite explaining the order types available with MetaTrader and types of economic indicators.

Market Research and Analysis

AvaTrade’s range of in-house developed Market Analysis is limited however a blog is released each business day looking at market events that may concern your trades and an economic calendar is available.

The Sharp Trader

AvaTrader runs an online commercial trading academy for those wanting to learn to trade. While most people will need to pay to access this content, AvaTrade clients can access this content for free.

Here you will find trading academies for Beginners, Intermediate and Advanced traders plus a Trader’s Gateway including a TV channel and in-depth technical analysis and fundamental analysis content. If you want to take your trading to the next level. You will benefit from this content.

Final Verdict on AvaTrade

AvaTrade has a number of features that lead us to look at them favourably. The broker can be trusted as they are overseen by tier-1 regulators in 6 different countries and offer a diverse and interesting collection of CFD products including over 50 forex pairs, options for forex, bonds, and a large collection of cryptocurrencies in addition to shares, indices, and ETFs.

The other features the broker offers then increase their appeal include the availability of MetaTrader trading platforms, handy social trading tools, negative balance protection, AvaProtect for risk management (if you are using AvaTradeGo and a wealth of educational tools. As a market maker, the broker only has a commission-free trading account, which means you are after the tightest possible spreads then you may prefer a broker that uses an STP or ECN trading model. This would be its main weakness but keep in mind the spreads are fixed so targeted at a particular trading needs.

Open a demo accountVisit Broker

*Your capital is at risk ‘66% of retail CFD accounts lose money’

FAQs

What is the minimum deposit for AvaTrade?

The minimum deposit is $100 across all account types.

What trading platforms does AvaTrade offer?

AvaTrade supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaOptions, and AvaTradeGo.

Does AvaTrade offer negative balance protection?

Yes, all retail clients receive negative balance protection.

What account types are available with AvaTrade?

AvaTrade offers Standard and Professional accounts, depending on your trading experience and regulatory jurisdiction.

Compare AvaTrade Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to Avatrade Website

Visit Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

What other fixed spread brokers can I trade with?

There are not that many “fixed spread” brokers. Possible the main broker look into is EasyMarkets. This broker not only has fixed spreads but has a reputation for keeping the spreads fixed even when the market is at its most volatile and come with a unique range of risk management tools. FxPro has fixed spreads for selected currency pairs (most major fx pairs). Other brokers include NordFx (but don’t accept clients in the USA, Canada and Europe)

Can you day trade on Avatrade?

Yes, AvaTrade allow all types of trading such as day trading, scalping and automation.

Does AvaTrade use PayPal?

Yes you can use PayPal but only for selected countries. You will need to check with you individual region to see if they do.

How much leverage does AvaTrade give you?

This will depend on what country you join AvaTrade from but for retail traders in Australia, UAE, Europe and the UK it is 1:30 for major currency pairs and in other regions it is 1:400