Eightcap vs Admirals: Which One Is Best?

Our assessment of both Eightcap and Admirals is quite enlightening. We can see the significant differences between the two and where each excels, which would be advantageous for both beginner and seasoned traders. Which one will you choose? The choice is yours.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison dives into the 10 most crucial trading factors to help you make an informed decision between Eightcap and Admirals.

- Admirals has superior average spreads starting from 0.5 pips.

- Eightcap and Admirals both recommend a minimum deposit of $100 in Australia.

- Admirals holds three top-tier regulatory licences, offering more extensive coverage.

- Eightcap excels in crypto offerings with over 250 options.

- Admirals is slightly more popular, receiving 966 thousand website visits.

1. Lowest Spreads And Fees – Admirals

In this review, we see that Admirals takes the lead with its competitive pricing when it comes to spreads and fees. The broker offers spreads starting from just 0.5 pips on major currency pairs, making it a cost-effective choice for traders.

Apparently, Admirals clearly outperforms Eightcap in the cost department. With low spreads starting at 0.5 pips on major pairs and no commission on standard accounts, it’s a cost-effective choice. This is especially beneficial for high-frequency traders, where every pip counts. Admirals’ competitive pricing structure makes it the ideal broker for those keen on minimizing trading costs.

- Admirals offers average spreads of 0.5 pips on EUR/USD.

- Eightcap’s spreads start at 1 pip for the same currency pair.

- Admirals charges no commission on its standard accounts.

- Eightcap charges a $3.5 commission per lot on its Raw account.

Bear in mind, that traders, beginners or seasoned, will benefit more from brokers with lower spreads and fees as it makes forex trading more accessible, and it allows traders to trade with smaller initial investment thus reducing financial risks.

Our Lowest Spreads and Fees Verdict

Admiral Markets clearly outperforms in this category due to having lowest spreads and fees.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

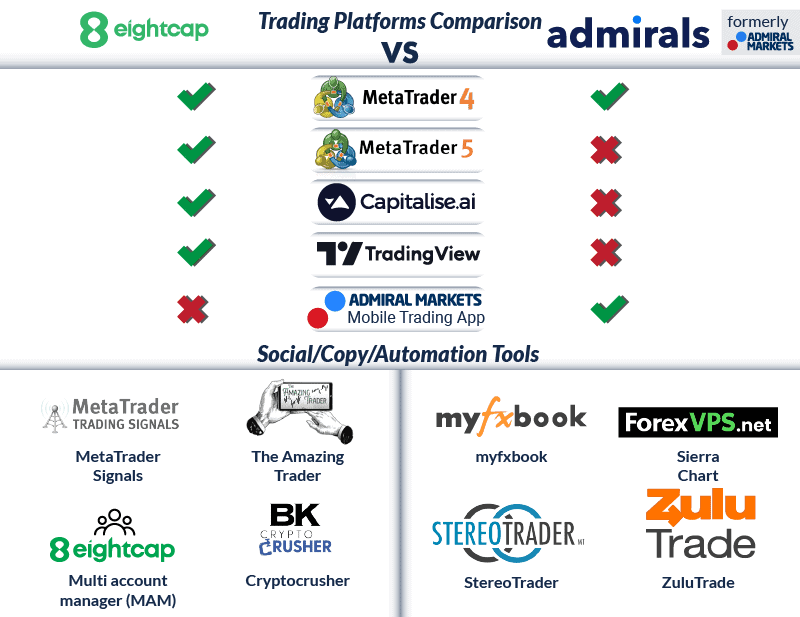

2. Better Trading Platform – Eightcap

With this part of the review, we explore the trading platforms offered by both Eightcap and Admirals, alongside the additional trading tools provided by the brokers.

| Trading Platform | Eightcap | Admirals |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

The most popular forex trading platforms are MetaTrader 4 and MetaTrader 5, or MT4/MT5 respectively.

Both Eightcap and Admirals give you access to the base offerings of the two platforms.

In terms of other CFD trading platforms, Admirals only offers you a proprietary mobile trading app (android/iOS), allowing you to trade CFDs on the go.

Trading tools offered by Admirals include StereoTrader, and ‘MetaTrader Supreme Edition’. In essence, these are information panels added onto the base MetaTrader platform, giving you tools like one-touch trading, indicator trackers, and sentiment analysis.

Eightcap has a wider range of extra CFD platforms. TradingView provides you with top-notch charting capability, and the Capitalise.ai platform allows you to utilise algorithmic trading bots completely code-free. This makes Eightcap a great choice if you are an avid chart trader or a beginner in the forex markets.

The tools offered by Eightcap include AmazingTrader and Cryptocrusher. AmazingTrader is a MetaTrader add-on that helps risk-manage your trades for you. Cryptocrusher on the other hand generates trading strategies for different cryptocurrencies for you and represents a great add-on to Eightcap’s strong crypto offering.

We can definitely say that Eightcap provides you with both a wider range of trading platforms and a stronger set of trading tools that will help you trade better. As a result, we determine that Eightcap is our platform winner.

Our Better Trading Platform Verdict

Eightcap aces high in this part owing to having better trading platform.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

3. Superior Accounts And Features – Admirals

When it comes to account features, Admirals offers a more comprehensive set, including a wider range of account types and more flexible leverage options.

- Admirals offers four types of accounts, including an Islamic account.

- Eightcap offers two main account types: Standard and Raw.

- Admirals provides leverage up to 1:500 for professional traders.

- Eightcap offers a maximum leverage of 1:30.

Account Features Table

| Eightcap | Admirals | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

Seemingly, Admirals is the superior choice when it comes to account features and flexibility. With a broader range of account types, including an Islamic account, and higher leverage options, it caters to a more diverse set of traders. This makes Admirals a more versatile and accommodating broker, especially for those who require specific account features or higher leverage.

Our Superior Accounts and Features Verdict

Admirals takes the lead due to having superior accounts and features.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Eightcap

When it comes to user experience, Eightcap is the go-to platform for traders who love variety and ease of use. The broker offers a plethora of platforms like TradingView and Capitalise.ai, making it a haven for both chart traders and those who fancy algorithmic trading.

- Eightcap’s AmazingTrader aids in risk management, a crucial aspect for any trader.

- Capitalise.ai on Eightcap allows for code-free algorithmic trading, a boon for beginners.

- TradingView on Eightcap offers top-notch charting capabilities, a must-have for technical traders.

- Admirals’ StereoTrader and MetaTrader Supreme Edition add layers of functionality to basic trading.

Admirals, on the other hand, focuses on enhancing the MetaTrader experience. Their MetaTrader Supreme Edition offers features like one-touch trading and sentiment analysis, which are valuable but not as diverse as Eightcap’s offerings.

Definitely, Eightcap is the clear winner when it comes to versatile and refined trading experience. The broker not only offers a variety of platforms, but also integrates features like code-free algorithmic trading and advanced charting. This makes it a one-stop-shop for traders of all styles and levels.

Our Best Trading Experience and Ease Verdict

Eightcap tops in this category in light of having the best trading experience and ease.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

5. Stronger Trust And Regulation -Admirals

We see here that Admirals scored 74 while Eightcap have a score of 85. You have to keep in mind that having a great trust score means these brokers ensure a secure and transparent trading environment, which builds more trader confidence.

Admiral Markets Trust Score

Eightcap Trust Score

Trust and regulation are vital in the trading industry. Admirals has the upper hand, being regulated by multiple top-tier authorities, which provides an extra layer of security for traders.

- Admirals is regulated by three top-tier authorities, bolstering its credibility.

- Eightcap is regulated by ASIC and also holds a license from the less reputable VFSC.

- Admirals has been in the industry since 2001, adding to its trustworthiness.

- Eightcap, founded in 2009, is relatively younger and less experienced.

Regulatory Table

| Admirals | Eightcap | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) | FCA (UK) CYSEC (Cyprus) ASIC (Australia) |

| Tier 2 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) | |

| Tier 3 Regulation | FSA-S (Seychelles) CMA (Kenya) JSC FSCA (South Africa) | SCB (Bahamas) |

Reviews

Eightcap holds a solid Trustpilot rating of 4.2 out of 5, based on over 3,100 reviews. Admiral Markets (also known as Admirals) has a slightly lower Trustpilot score of 4.0 out of 5, based on around 2,000 reviews.

Our Stronger Trust and Regulation Verdict

Admirals secures the top spot here thanks to their stronger trust and regulation.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

6. Most Popular Broker – Admiral Markets

Admiral Markets gets searched on Google more than Eightcap. On average, Admiral Markets sees around 220,000 branded searches each month, while Eightcap gets about 40,500 — that’s 81% fewer.

| Country | Eightcap | Admirals |

|---|---|---|

| Austria | 140 | 550,000 |

| United Kingdom | 1,600 | 450,000 |

| Italy | 590 | 60,500 |

| Greece | 90 | 60,500 |

| United States | 1,900 | 33,100 |

| Germany | 1,000 | 33,100 |

| India | 1,300 | 9,900 |

| Spain | 720 | 6,600 |

| Philippines | 210 | 5,400 |

| Japan | 140 | 4,400 |

| Canada | 2,400 | 3,600 |

| France | 720 | 3,600 |

| Poland | 260 | 2,900 |

| Brazil | 1,000 | 2,400 |

| Indonesia | 590 | 2,400 |

| Switzerland | 170 | 2,400 |

| Turkey | 110 | 2,400 |

| Australia | 2,400 | 1,900 |

| Netherlands | 480 | 1,900 |

| Malaysia | 880 | 1,600 |

| Ireland | 110 | 1,600 |

| Sweden | 320 | 1,300 |

| Thailand | 9,900 | 1,000 |

| Argentina | 590 | 1,000 |

| Nigeria | 390 | 1,000 |

| United Arab Emirates | 210 | 1,000 |

| Egypt | 90 | 1,000 |

| South Africa | 480 | 880 |

| Pakistan | 320 | 880 |

| Mexico | 320 | 880 |

| Taiwan | 140 | 880 |

| Chile | 140 | 880 |

| Saudi Arabia | 70 | 880 |

| Colombia | 720 | 720 |

| Singapore | 390 | 720 |

| Vietnam | 170 | 720 |

| Cyprus | 90 | 720 |

| Portugal | 210 | 590 |

| Hong Kong | 170 | 590 |

| Morocco | 210 | 480 |

| New Zealand | 210 | 480 |

| Bangladesh | 140 | 390 |

| Uzbekistan | 90 | 390 |

| Kenya | 170 | 320 |

| Peru | 140 | 320 |

| Algeria | 110 | 320 |

| Jordan | 30 | 260 |

| Ghana | 70 | 210 |

| Venezuela | 110 | 170 |

| Ecuador | 110 | 170 |

| Uganda | 70 | 170 |

| Bolivia | 30 | 170 |

| Dominican Republic | 320 | 140 |

| Sri Lanka | 50 | 140 |

| Cambodia | 90 | 90 |

| Costa Rica | 30 | 90 |

| Panama | 20 | 90 |

| Mongolia | 70 | 70 |

| Tanzania | 30 | 70 |

| Ethiopia | 30 | 70 |

| Mauritius | 20 | 50 |

| Botswana | 30 | 30 |

140 1st | |

550,000 2nd | |

1,600 3rd | |

450,000 4th | |

590 5th | |

60,500 6th | |

1,900 7th | |

33,100 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Admiral Markets receiving 595,437 visits vs. 259,000 for Eightcap.

Our Most Popular Broker Verdict

Admiral Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Eightcap

Both Eightcap and Admirals offer a wide array of trading products, but Eightcap takes the lead in diversity.

| CFDs | Eightcap | Admirals |

|---|---|---|

| Forex Pairs | 61 | 50 |

| Indices | 16 | 42 |

| Commodities | 8 Commodities Softs and Metals | 29 Commodities 7 Metals (3 x Gold) 4 Energies 7 Softs (11 Futures) |

| Cryptocurrencies | 95 Crypto | 37 |

| Shares CFDs | 586 | 300 |

| ETFs | No | 362 |

| Bonds | No | 2 |

| Futures | No | No |

| Treasuries | No | 2 |

| Investment | No | No |

Apparently, we can see that Eightcap outshines Admirals in terms of product diversity, particularly in the booming crypto sector. With over 250 crypto options and a broader range of other CFDs, Eightcap is the go-to broker for traders looking for a wide array of trading opportunities.

Our Top Product Range and CFD Markets Verdict

Eightcap outshines in this category as a result of having top product range and CFD markets.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

8. Superior Educational Resources – Admirals

Education is the cornerstone of successful trading and this is the philosophy of Admirals and Eightcap. While both brokers offer educational resources, clearly, Admirals has a more comprehensive suite.

- Eightcap offers basic educational articles but lacks depth.

- Admirals provides webinars and seminars for interactive learning.

- Eightcap lacks advanced educational tools like trading calculators.

- Admirals offers trading calculators and advanced charting tools.

- Eightcap doesn’t offer demo account tutorials, a missed opportunity for beginners.

- Admirals provides in-depth market analysis, a valuable resource for all traders.

As we finish off this portion, we can see that Admirals takes the lead in educational resources by offering a more comprehensive and interactive learning platform. From webinars and seminars to advanced trading calculators and in-depth market analysis, Admirals provides a holistic educational experience for traders at all levels.

Our Superior Educational Resources Verdict

Admirals stands out for having superior educational resources.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

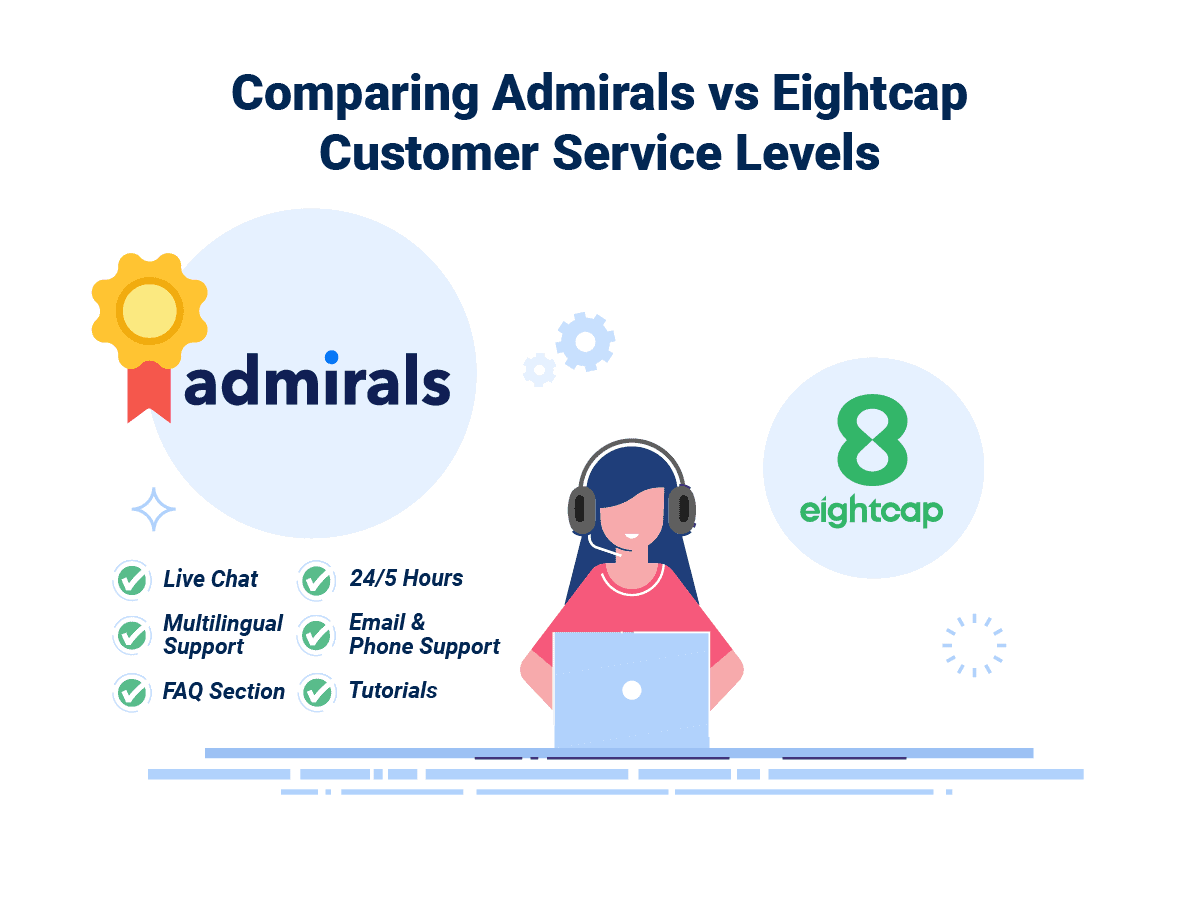

9. Superior Customer Service – Admirals

Customer service can make or break your trading experience. Both brokers offer decent support, but Admirals has a slight edge. Remember that customer service and support is important as it resolves technical issues as it provides a portal for guidance and education as well as emotional support for traders, beginners or seasoned.

- Eightcap offers 24/5 support but falls short of Admirals’ 24/7 availability.

| Feature | Eightcap | Admirals |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Evidently, we can see that Admirals takes the lead in the customer service race by offering 24/7 support and a broader range of features, including tutorials. This makes Admirals not just a broker but a reliable partner that stands by you round the clock, ensuring a seamless trading experience.

Our Superior Customer Service Verdict

Admirals ranks highest in this category because of their superior customer service.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

10. Better Funding Options – Eightcap

Funding your account should be hassle-free, and both brokers offer multiple options. However, Eightcap goes above and beyond by including cryptocurrencies.

| Funding Option | Eightcap | Admirals |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | Yes |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Undoubtedly, Eightcap stands out as the better choice for modern traders when it comes to funding options. The broker not only supports traditional funding methods but also embraces cryptocurrencies, offering a flexible and diverse range of options that cater to the needs of today’s traders.

Our Better Funding Options Verdict

Eightcap takes the stage in this category due to better funding options.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

Eightcap and Admirals have a $100 minimum deposit requirement. Admiral Markets has a uniform minimum deposit of $100, while Eightcap’s minimum deposit varies by location.

Always keep in mind that brokers with lower minimum deposits make forex trading more accessible, especially for new traders starting with smaller investments, as this reduces financial risks for traders.

Eightcap

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | N/A | $100 | €100 | N/A |

| Neteller | N/A | $100 | €100 | N/A |

Admiral Markets

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Skrill | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Neteller | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

Our Lower Minimum Deposit Verdict

It’s a deadlock for both Eightcap and Admiral Markets due to their lower minimum deposit.

So Is Admirals Or Eightcap The Best Broker?

Admiral Markets undoubtedly outshines because it offers a more comprehensive trading experience, from lower spreads to superior educational resources and customer service. The table below summarises the key information leading to this verdict.

| Criteria | Eightcap | Admirals |

|---|---|---|

| Lowest Spreads And Fees | ❌ | ✅ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ✅ |

Admiral Markets: Best For Beginner Traders

Admirals is the better choice for beginner traders, offering a robust educational platform.

Eightcap: Best For Experienced Traders

Eightcap is more suited for experienced traders, thanks to its diverse product range and advanced trading platforms.

FAQs Comparing Eightcap vs Admirals

Does Admirals or Eightcap Have Lower Costs?

Admirals has lower costs. They offer average spreads starting from 0.5 pips, which is quite competitive. For more information on low-cost brokers, check out our lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and Admirals offer MetaTrader 4, but Admirals enhances the experience with its MetaTrader Supreme Edition. For more details, visit our best MT4 brokers page.

Which Broker Offers Social Trading?

Neither Eightcap nor Admirals offer social or copy trading. However, there are other brokers that do, as listed on our best copy trading platforms page.

Does Either Broker Offer Spread Betting?

No, neither Eightcap nor Admirals offer spread betting. For brokers that do, you can visit our best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap is superior for Australian Forex traders. It’s ASIC-regulated and offers a wide range of products. For more details, check out our Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK traders, Admirals is the better choice. It’s FCA-regulated and offers a comprehensive trading experience. For more information, visit our best UK Forex brokers page.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert