Eightcap vs FXTM 2025

This Eightcap vs FXTM (Forextime) found both forex brokers have no dealing desk forex brokers with ECN-like pricing. This review compares the two brokers based on trading accounts, spreads, trading platforms and products.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

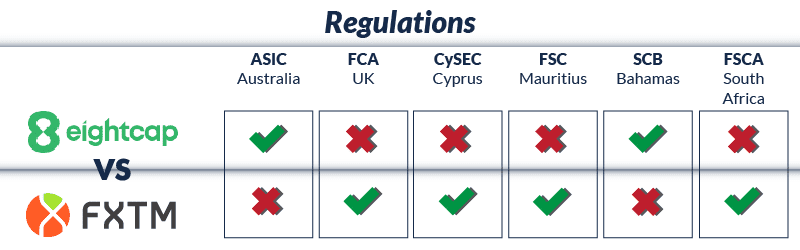

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do FXTM Vs Eightcap Compare?

Our full comparison covers the 10 most important trading factors. Here are five key differences:

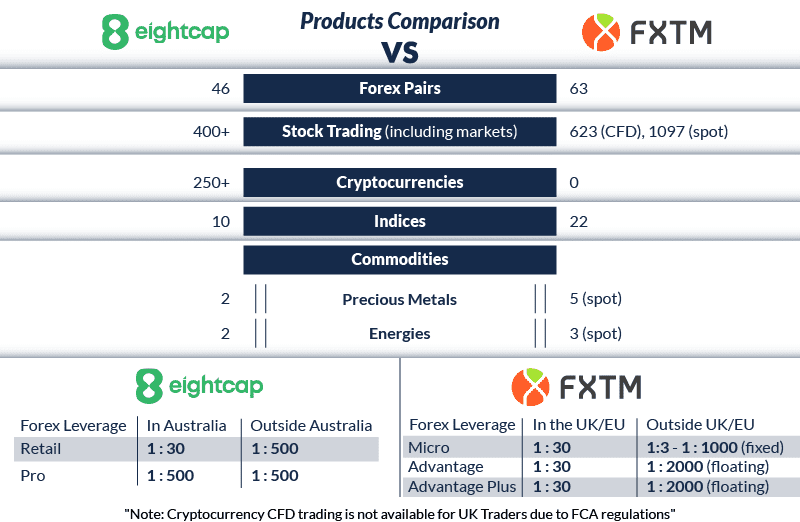

- Eightcap offers over 250 cryptocurrency trading options, while FXTM does not offer any crypto trading.

- FXTM has a wider range of forex pairs (63 pairs) compared to Eightcap’s 46 pairs.

- Eightcap’s user rating on TrustPilot is 4.4/5 stars, categorised as ‘Excellent’, whereas FXTM’s rating is 3.3/5 stars, deemed ‘Average’.

- Eightcap’s minimum deposit for a standard account outside Australia is $100, while FXTM requires $500 for its commission-based Advantage account.

- Eightcap is regulated by ASIC (Australia) and SCB (Bahamas), while FXTM holds licences with FCA (UK), CySEC (EU), FSCA (South Africa), and FSC (Mauritius).

1. Lowest Spreads And Fees: Eightcap

When we delved into the nitty-gritty of Eightcap and FXTM’s offerings, we were keen to see how their spreads stacked up against each other. Here’s what we found:

- EUR/USD: With Eightcap, I’m looking at a spread of just 1.0 pips, while FXTM sets me back by 1.9 pips.

- GBP/USD: Eightcap keeps it tight at 1.0 pips, but FXTM stretches it to 2.0 pips.

- AUD/USD: Trading with Eightcap, I get a spread of 1.2 pips, whereas with FXTM, it’s a tad higher at 2.0 pips.

- On the whole, for the top 5 pairs I often trade, Eightcap averages at 1.06 pips and FXTM, well, it’s 2.12 pips.

Verdict: For someone like us who’s always on the lookout for the best deal, Eightcap seems to be the clear winner in the spread game.

2. Better Trading Platform: Eightcap

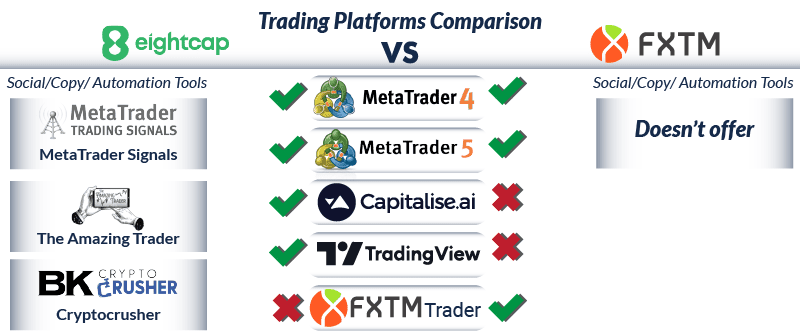

In terms of platforms, both Eightcap and FXTM have a wide range of options available. On top of the base platforms, Eightcap also offers some bonus trading tools to improve your trading experience.

| Trading Platform | Eightcap | FXTM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | No |

Trading platform comparison

As you can see in the graphic above, both Eightcap and FXTM offer MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are the most popular forex trading platforms in the world and, unsurprisingly, are regarded as the best in the world.

Eightcap also gives you access to two bonus platforms. The Capitalise.ai platform is extremely convenient for you to run algorithmic trading bots, as you can build these bots without having actually to code. By just typing in what you want your algorithm to do, the platform automatically trades for you based on what you want. TradingView is a chart-trading-focused platform, with such a wide range of chart tools and indicators that it would be impossible to list them all. All that you need to know is that you’ll have everything you need and more to chart-trade successfully.

FXTM’s only other platform is their FXTM Trader mobile app. This is available on Android and iOS, allowing you to trade on the go. FXTM’s advertisements emphasise the convenience and user-friendliness of the app.

The main trading tools available (Eightcap)

If you trade with Eightcap, you will also have access to several trading tools. Their three most prominent trading tools are:

1. The Amazing Trader sends you signals for when to execute a trade based on a well-known trading expert’s algorithm.

2. CryptoCrusher, aimed at helping you “crush” the markets with daily crypto-focused trading ideas as well as great insights into the crypto markets

3. FX BlueLabs, which gives you a suite of widgets and signals to help you improve your trading

Verdict

Eightcap’s wider variety of trading platforms plus their additional trading tools means that they are our winner for both platforms and tools. Beginner or advanced trader, you can always be sure to have a great experience when trading with Eightcap.

3. Superior Accounts And Features: Eightcap

The two account types offered by most brokers are a standard and a ‘raw’ account type. While the standard account is commission-free, a ‘raw’ or STP-style account comes with commissions on trades.

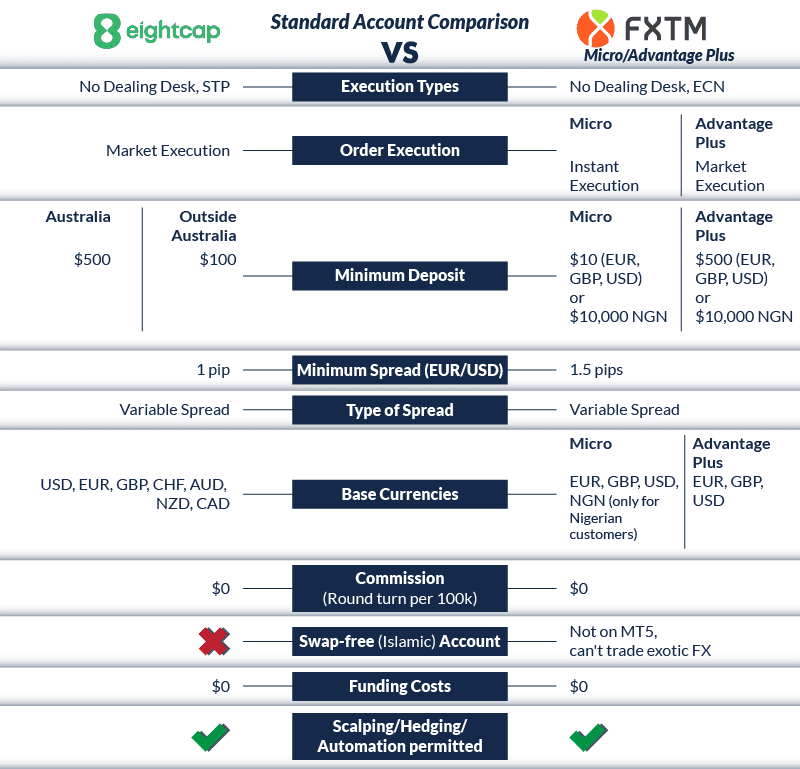

Our Standard Account Comparison

Although a standard account comes with no commission, you will still face brokerage via the spread cost. The bid-ask spread is the difference between the price you can buy or sell an instrument at, and therefore, you want to be getting the lowest spreads you can.

To help you with this, we have a spread module to compare the average spreads between brokers. This data is taken from the broker’s website and is updated monthly.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

2.10 | 2.10 | 2.70 | 2.50 | 2.50 |

|

1.10 | 1.10 | 1.20 | 1.20 | 1.20 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

0.90 | 1.54 | 1.52 | 1.78 | 1.90 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.20 | 1.80 | 1.90 | 1.90 | 1.60 |

|

1.32 | 1.95 | 1.37 | 1.70 | 1.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

While Eightcap does not advertise their average spreads for their standard account. However, the brokers advise that their spreads start from 1.0 pips. It is clear from the module above that FXTM has pretty wide (and therefore not great) spreads. Most of the other brokers have tighter spreads and Eightcap is no different.

Eightcap’s minimum spread starts at 1 pip wide on all of their major forex pairs, however, their average spreads will still be fairly tight, especially when compared to FXTM’s average spreads.

FXTM offers two types of standard accounts. A Micro account and an Advantage Pro account. Regardless of which account you use, the minimum spread is set at 1.5 pips, further solidifying the price advantage Eightcap has over FXTM.

The micro account is designed for traders who wish to trade small volumes (aka micro lots or 1000 lots) as opposed to the usual standard lots. Trading with this account uses Instant execution, meaning you may get a requote if the spreads change during trading execution.

The other account FXTM is the Advantage Plus account. This account is similar to the Standard account with Eightcap in that it allows trading with standard lots and uses market execution (meaning no requotes as it uses the best available market price at the time of processing).

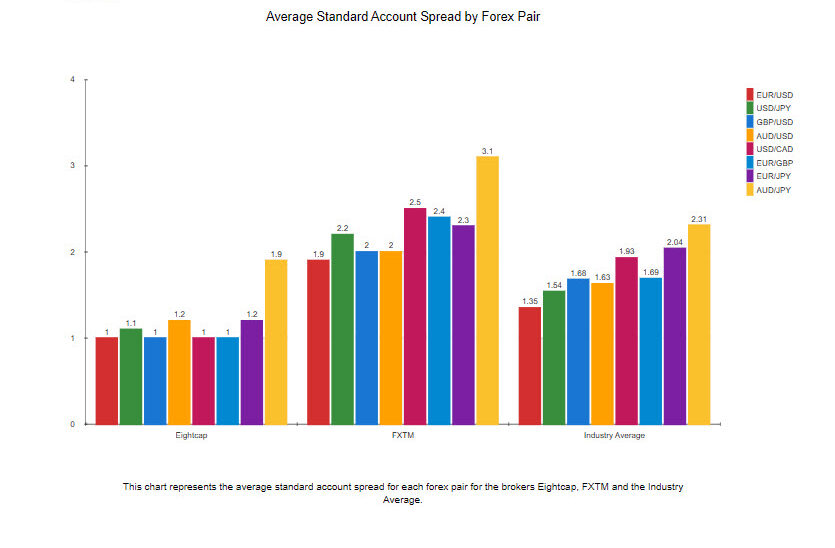

Standard Account Spreads

Looking at the data, it’s clear that there are differences in the standard account spreads between Eightcap, FXTM, and the industry average.

Eightcap has consistently lower spreads across all forex pairs compared to FXTM. For instance, the EUR/USD spread for Eightcap is 1, while for FXTM, it’s 1.9. This pattern is consistent across all pairs, making Eightcap the cheaper option in terms of spread.

| Forex Pair | Eightcap | FXTM | Industry Average |

|---|---|---|---|

| EUR/USD | 1 | 1.9 | 1.35 |

| USD/JPY | 1.1 | 2.2 | 1.54 |

| GBP/USD | 1 | 2 | 1.68 |

| AUD/USD | 1.2 | 2 | 1.63 |

| USD/CAD | 1 | 2.5 | 1.93 |

| EUR/GBP | 1 | 2.4 | 1.69 |

| EUR/JPY | 1.2 | 2.3 | 2.04 |

| AUD/JPY | 1.9 | 3.1 | 2.31 |

Standard Account Analysis Updated July 2025[1]July 2025 Published And Tested Data

However, it’s important to note that while Eightcap’s spreads are lower than FXTM’s, they are generally close to the industry average. The industry average for EUR/USD is 1.35, which is slightly higher than Eightcap’s but significantly lower than FXTM’s. This suggests that while Eightcap offers competitive spreads, they are not exceptionally lower than what is typically offered in the market.

In my opinion, if you’re looking for lower spreads, Eightcap seems to be the better choice between the two. However, it’s crucial to remember that spreads are just one aspect of trading costs. Other factors, such as commission fees, execution speed, and the trading environment, should also be considered when choosing a forex broker.

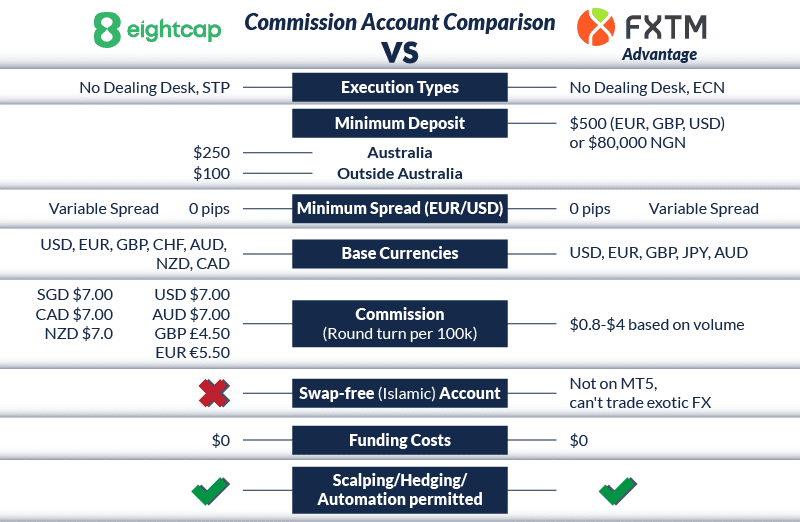

The Commission-Based Accounts

An ECN or STP-style account (often known as a ‘raw’ account) comes with commission fees. This is to compensate the brokers for giving you direct access to their liquidity providers, meaning that you get ‘raw’ or market-priced spreads. These are much lower than on the standard account, where spreads are artificially increased by brokers.

Eightcap does share their average spreads for their Raw Account, allowing you to make a direct comparison between the two brokers in our spread module below. Like with the standard account, data is taken from the broker’s website and updated periodically.

|

ECN Broker Spreads

|

|||||

|---|---|---|---|---|---|

|

0.23 | 0.20 | 0.06 | 0.30 | 0.23 |

|

n/a | 0.60 | n/a | 0.60 | 0.50 |

|

0.30 | 0.40 | 0.10 | 0.30 | 0.30 |

|

0.20 | 0.30 | 0.20 | 0.40 | 0.20 |

|

0.30 | 0.50 | 0.30 | 0.50 | 0.40 |

|

0.24 | N/A | 0.17 | 0.54 | 0.30 |

|

0.30 | 0.70 | 0.20 | 0.50 | 0.40 |

|

0.30 | 1.10 | 0.10 | 0.60 | 0.50 |

|

0.77 | 1.41 | 0.44 | 1.13 | 1.23 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Once again, Eightcap comes out as our clear winner, with lower average spreads compared to FXTM for every currency pair. Even though both brokers advertise a minimum spread of 0 pips wide, it is much more likely that you get lower spreads on Eightcap’s Raw account rather than FXTM’s Advantage account.

Unsurprisingly, the other trading cost to consider for commission-based accounts is the commission fees.

On Eightcap, commission fees are set at $7 AUD/USD to open and close a standard lot position. If you use a different base currency, you will be charged the equivalent of $7 USD.

FXTM has lower commission fees compared to Eightcap. The most you will pay is USD $4.00 round-turn for a standard lot on their Advantage MT4 account, this assumes you have USD $0 – 2,999 of equity in your trading account. FXTM Commission is tiered so the amount you pay is progressively lower the larger your account is and the more you trade each month. This means you will get the best value if your account has equity of over $1mil USD and you trade more than $250mil USD. In this case, you will pay just $0.8 round-turn in commission for each lot.

Commission with FXTM’s Advantage MT5 account on the hand will always pay USD $4.00 round-turn per lot regardless of your trading volume.

| Eightcap | FXTM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

Verdict

Eightcap easily wins on brokerage fees against FXTM for both the standard and STP-style account types. With lower minimum and average spreads on their standard account, the only place FXTM beats Eightcap is for commission fees. Even then, Eightcap has far lower average spreads for the commission-based account.

4. Best Trading Experience And Ease: Eightcap

When we set out to compare Eightcap and FXTM, our main focus was on the trading experience. As traders, isn’t it essential for us to have a platform that feels intuitive and hassle-free? Here’s what caught our attention:

- TradingView Platform: We found that Eightcap clearly stands out when it comes to the TradingView experience. It’s streamlined, user-centric, and feature-rich.

- Automation Options: Both Eightcap and Pepperstone have teamed up with Capitalise.ai, offering us a more automated and efficient trading journey.

- ECN Account: Eightcap impressed us once more with its ECN account, known for its transparency and direct access to the markets.

- Crypto Trading: For those of us passionate about cryptocurrencies, Eightcap is the top choice, being hailed as the best broker for crypto trading.

Verdict: Eightcap, with its advanced platform and diverse offerings, undeniably delivers a superior trading experience compared to FXTM.

5. Stronger Trust And Regulation: Tie

Eightcap Trust Score

FXTM Trust Score

The safe broker between Eightcap and FXTM will be better regulated by the regulatory agencies of the countries they operate.

As you can see from the image above, Eightcap is regulated by one top-tier and one second-tier regulatory agency. The top-tier licence is held with the Australian Securities and Investments Commission (ASIC), giving them regulatory protection in Australia. Eightcap’s second-tier licence is with the Securities Commission of the Bahamas (SCB), which gives global regulatory coverage.

In comparison, FXTM has three top-tier licences as well as one second-tier licence. These are with:

– The Financial Conduct Authority (FCA) in the United Kingdom

– The Cyprus Securities and Exchange Commission (CySEC) gives coverage for the EU

– The Financial Sector Conduct Authority (FSCA) in South Africa

– The Financial Services Commission (FSC) in the Mauritius Islands gives global regulatory coverage (outside the above-regulated regions)

| Eightcap | FXTM | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) | CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | FSCA (South Africa) | |

| Tier 3 Regulation | SCB (Bahamas) | FSC-M (Mauritius) CMA (Kenya) |

Verdict

To stay protected when trading forex and other CFD products, you should trade with a brokerage regulated in the country or region that you plan on trading from.

Therefore, we recommend that you trade with Eightcap if you are in Australia. If you are in the UK, EU, or South Africa, you should trade with FXTM for better protection.

6. Top Product Range And CFD Markets: Eightcap

Both Eightcap and FXTM provide a wide range of trading products, with CFDs on forex, indices, commodities, and even crypto, plus shares and ETFs.

For forex pairs, you get 46 different pairs to trade on Eightcap. There are major pairs like the EUR/USD as well as minor or exotic currency pairs like the GBP/NZD. However, Eightcap specialises in cryptocurrency trading, with over 250 different options available for you to trade. These include popular coins like Bitcoin paired against fiat currencies and other cryptos, plus several crypto indices to give you access to a basket of cryptocurrencies.

FXTM has more forex pairs, at 63 different pairs. Another instrument FXTM provides a lot of is share CFDs, with 200 more than Eightcap. However, you cannot trade any crypto with FXTM.

A note about leverage

Leverage will depend on where you are trading from as regulators limit the leverage the broker’s subsidiaries can offer.

With Eightcap, if you are trading from Australia, forex leverage is capped at 1:30 for major pairs and 1:20 for minor pairs. If you are trading outside Australia, leverage is capped at 1:500.

FXTM leverage will depend not only on where you are trading from but the type of account you are using.

If you are trading from Europe or the UK, the leverage is capped at 1:30 for major pairs and 1:20 for minor pairs regardless of the account you trade with. If you are outside these regions and are using the Micro account, then leverage can be up to 1:1000 (fixed), while if you are using one of the other accounts, leverage can be up to 1:2000, with the maximum leverage determined by the size of your trading account.

Verdict

While FXTM does have slightly more forex pairs and share CFDs, our overall winner is Eightcap. This is because of their incredible range of cryptocurrencies, meaning that it is likely to be more convenient for you to trade with Eightcap, as you’ll have most of the instruments you need.

7. Superior Educational Resources: Eightcap

Eightcap:

- Offers a comprehensive range of educational materials tailored for both beginners and experienced traders.

- Provides webinars, seminars, and workshops to enhance trading knowledge.

- Features a dedicated learning centre with video tutorials, articles, and e-books.

- Regularly updates its educational content to keep traders informed about the latest market trends.

- Has a user-friendly platform with interactive tools to help traders understand complex trading concepts.

- Collaborates with trading experts to deliver insightful market analysis and trading strategies.

FXTM:

- Boasts an extensive library of educational resources suitable for traders of all levels.

- Conducts live webinars and on-site seminars led by industry professionals.

- Offers a series of educational videos, articles, and trading guides.

- Provides a dedicated educational portal with tools and resources to help traders navigate the financial markets.

- Ensures that its educational content is up-to-date with the latest market developments.

- Engages with renowned trading specialists to share their expertise and insights.

Verdict: Based on our team’s testing, Eightcap scores 8.5, while FXTM scores 8.3 in the educational resources category. Thus, Eightcap slightly edges out FXTM in offering superior educational resources.

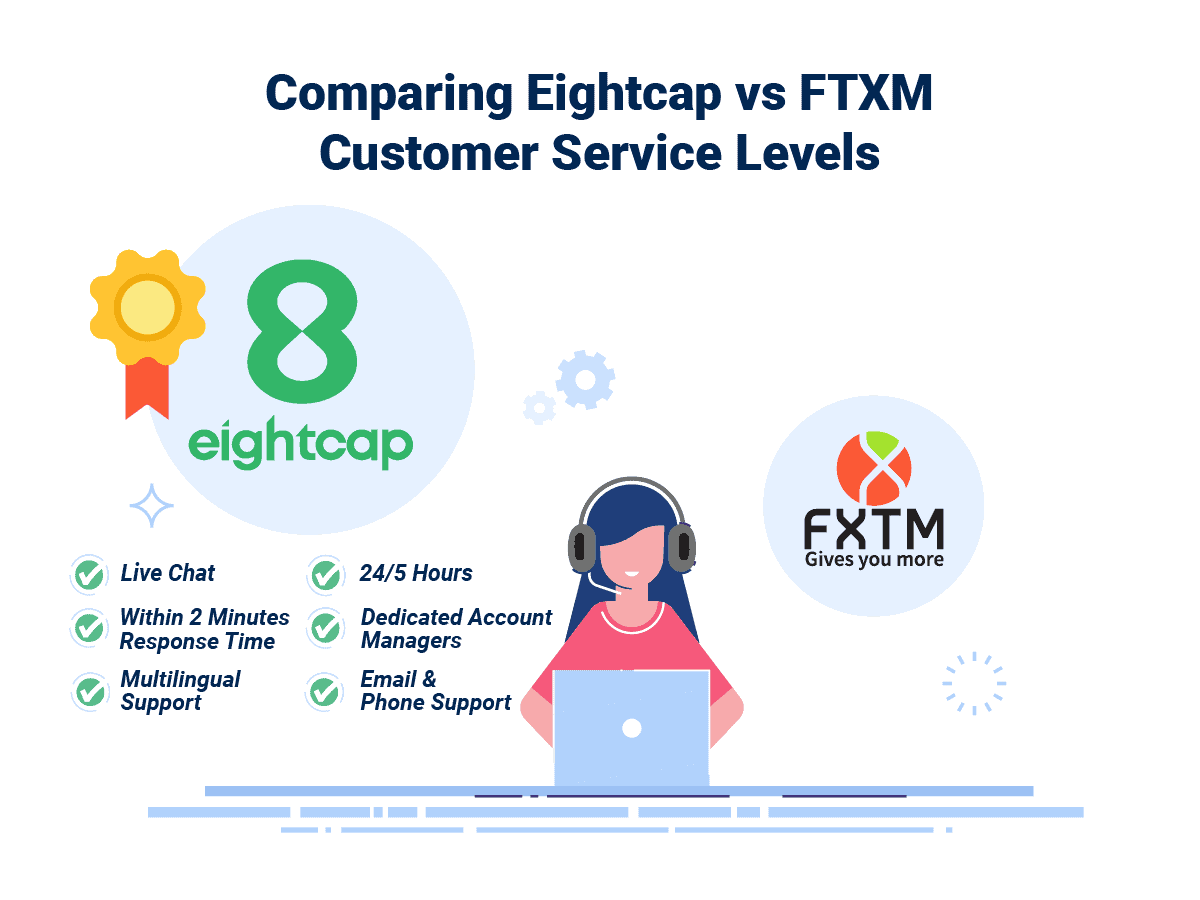

8. Superior Customer Service: Eightcap

In the world of trading, having reliable customer service is paramount. It’s not just about resolving issues; it’s about the peace of mind knowing that there’s a dedicated team ready to assist whenever we need them. As we delved into the customer service offerings of Eightcap and FXTM, we were keen to see which broker truly stands out in this department.

Here’s a breakdown of the key customer service features offered by each broker:

| Feature | Eightcap | FXTM |

|---|---|---|

| Live Chat Availability | 24/5 | 24/7 |

| Response Time | Within 2 minutes | Within 5 minutes |

| Support Languages | Multiple languages | Multiple languages |

| Dedicated Account Managers | Available | Available |

| Customer Support Channels | Phone, Email, Chat | Phone, Email, Chat |

| User Feedback | Positive reviews | Mixed reviews |

We’d like to highlight that customer service isn’t just about speed; it’s about the quality of support, the range of channels available, and the overall user experience. Both brokers have their strengths, but it’s the nuances that make all the difference.

Verdict: Based on our team’s testing scores, Eightcap offers superior customer service, ensuring traders receive timely and effective support whenever they need it.

9. Better Funding Options: FXTM

Funding options play a pivotal role in the trading experience. They determine how easily a trader can deposit or withdraw funds from their trading account. A diverse range of funding options ensures that traders from different regions and with different preferences can seamlessly manage their funds. Both Eightcap and FXTM offer a variety of funding methods, but there are some differences that traders should be aware of.

While Eightcap provides traditional methods like bank transfers and credit cards, they also have a few modern options such as e-wallets. FXTM, on the other hand, offers a similar range but with a few unique additions. It’s essential for traders to choose a broker that aligns with their preferred funding method, ensuring smooth transactions and reducing potential delays or issues.

| Funding Option | Eightcap | FXTM |

|---|---|---|

| Bank Transfer | ✅ | ✅ |

| Credit Card | ✅ | ✅ |

| E-Wallet | ✅ | ❌ |

| PayPal | ❌ | ✅ |

| Skrill | ✅ | ✅ |

| Neteller | ✅ | ✅ |

| Cryptocurrency | ❌ | ✅ |

| Western Union | ❌ | ❌ |

| MoneyGram | ❌ | ❌ |

| Local Bank Transfer | ✅ | ✅ |

Verdict: When it comes to funding options, FXTM offers a slight edge with the inclusion of PayPal and Cryptocurrency options, making it more versatile for traders with diverse funding preferences.

10. Lower Minimum Deposit: Tie

For the standard account in Australia, you need a minimum deposit of $500, and for the Raw account, the minimum deposit falls to $250. Outside of Australia, both accounts have a minimum deposit of $100.

Eightcap and FXTM provide you with a wide range of payment methods to allow you to seamlessly fund your trading account.

FXTM allows you to fund via a bank transfer, Visa/Mastercard debit and credit cards, as well as e-wallets like Neteller and Skrill. You need $10 of one of the three base currencies (USD/EUR/GBP) to fund a standard account and $500 in your chosen base currency for the commission-based Advantage account.

Eightcap offers even more ways for you to deposit funds into your trading accounts. In Australia, you can use BPay or POLi as an alternative to a bank transfer. PayPal is available for all Eightcap traders. If you are outside Australia, you can fund a trading account with cryptos like Bitcoin if you would like to.

Our Final Verdict On Which Broker Is The Best: FXTM or Eightcap?

Eightcap is the winner because it consistently outperforms FXTM in most of the key areas that matter to traders. The table below summarises the key information leading to this verdict:

| Criteria | Eightcap | FXTM |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ✅ | ✅ |

Best For Beginner Traders

For those just starting out in the trading world, Eightcap provides a more user-friendly and comprehensive platform, making it the ideal choice for beginner traders.

Best For Experienced Traders

For seasoned traders looking for advanced tools and features, Eightcap remains the top choice, offering a robust platform tailored to the needs of professional traders.

FAQs Comparing Eightcap Vs FXTM

Does FXTM or Eightcap Have Lower Costs?

Eightcap generally offers lower costs compared to FXTM. Specifically, Eightcap boasts competitive spreads, often averaging around 1.0 pips for major pairs like EUR/USD. FXTM, on the other hand, has slightly higher spreads on average. For a more detailed comparison on broker costs, you can check out this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and FXTM offer MetaTrader 4, a popular trading platform among forex traders. However, Eightcap provides a more seamless integration with MT4, offering advanced tools and features. If you’re keen on exploring more about MT4 brokers, this list of the best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

FXTM stands out when it comes to social trading, offering traders the opportunity to follow and copy the trades of professionals. This feature is particularly beneficial for those new to trading or those looking to diversify their strategies. For a deeper dive into social trading platforms, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Eightcap nor FXTM offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK and some other regions, allowing traders to bet on the price movements of financial instruments. If you’re keen on exploring brokers that specialise in spread betting, you might find this list of the best spread betting brokers in the UK helpful.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap has a slight edge for Australian forex traders. It’s ASIC regulated, ensuring a high level of trust and security for traders. Furthermore, while FXTM is a global player, Eightcap has its roots in Australia, giving it a deeper understanding of the local market dynamics. If you’re an Aussie trader or someone interested in the Australian forex market, this comprehensive guide on the Best Forex Brokers In Australia might be of interest.

What Broker is Superior For UK Forex Traders?

From my perspective, FXTM stands out for UK forex traders. It’s FCA regulated, which is a significant badge of trust and reliability in the UK trading community. While both brokers cater to a global audience, FXTM’s regulatory oversight by the FCA gives it an edge in the UK market. For those in the UK looking to dive deeper into the forex scene, here’s a detailed review of the Best Forex Brokers in UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is Eightcap regulated?

Yes by AISC, CySEC, FCA and SCB