KOT4x vs Hugo's Way 2026

Hugo’s Way and Kings of Transparency (KOT4X) are both ECN-like forex brokers, offering MetaTrader 4 trading accounts. However, despite their broad similarities, there are plenty of differences to be aware of with each brokerage. We compared the brokers based on spreads, forex trading platforms and trading features.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

CHF Pairs: 50:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do Hugo’s Way Vs KOT4X Compare?

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between KOT4X and Hugo’s Way:

- Both Hugo’s Way and KOT4X offer MetaTrader 4 platforms but lack underlying ‘tier 1’ regulation.

- Hugo’s Way charges a commission of $5 per trade, whereas KOT4X charges $3.50.

- The minimum deposit for KOT4X ranges from $10-$25, while Hugo’s Way requires a minimum deposit of $100.

- KOT4X offers 23+ cryptocurrency CFDs, while Hugo’s Way offers 38+.

- Hugo’s Way and KOT4X are both unregulated offshore brokers based in St Vincent and the Grenadines.

1. Lowest Spreads And Fees: Tie

All traders want to maximize their profitability when trading, so one of the first things to consider is the rates a platform charges. Overall, the rates on KOT4X and Hugo’s Way are decent. As discussed, they both use ECN-like pricing through the Straight Through Processing (STP) execution model to keep spreads low and as close to possible as what the initial liquidity prices offer.

But they’re certainly not the best in the industry. For better rates, you’d be better off opting for one of the better platforms out there. For more information, we recommend reading our Pepperstone Review, IC Markets Review, Markets.com Review, and FP Markets Reviews.

Spreads And Commission

It’s quick and easy to find out the latest spreads on Hugo’s Way — there’s a live spreads page on the website that covers FX majors and crosses, cryptos, indices, and commodities. However, beware that this advertises the minimum spreads rather than the average. Spreads start from 0 for foreign currency pairs, but they’re usually higher, hovering between 0.7 and 1.5 (although some go far higher).

Spreads Compared

Unfortunately, neither KOT4X nor Hugo’s Way provides their average spreads on their website. A good, reliable, transparent broker would be happy to provide their average spreads, so we think it is disappointing that these brokers do not provide these details.

Each month, we here at Compare Forex Brokers compile the average spreads of different brokers that have been published on the broker’s website. The module below gives a decent idea of spreads you should expect from some of the better brokers for low spreads and can also help show which brokers you should avoid.

| 0.90 | 1.30 | 3.60 | 3.00 | 1.70 |

| 1.10 | 1.10 | 1.30 | 2.10 | 1.40 |

| 0.70 | 2.20 | 1.10 | 1.60 | 1.60 |

| 1.90 | 2.00 | 2.40 | 2.30 | 2.50 |

| 1.40 | 2.50 | 2.50 | 2.60 | 2.60 |

| 1.40 | 1.60 | 1.40 | 2.10 | 1.90 |

| 1.40 | 1.90 | 1.30 | 1.90 | 1.70 |

| 0.70 | 0.80 | 1.30 | 2.40 | 1.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

However, Hugo’s Way also charges commission — a $5 fee and a $10 round-turn fee for trades. Once you account for these, the ECN-like pricing suddenly doesn’t sound so appealing. These spreads and fees are ok, but you could find them even lower elsewhere; one should not be paying more than $3.50/$7.00 (round turn) in commission costs.

| Commission | Side-ways (Standard lot) | Round-turn (Standard lot) |

|---|---|---|

| HugosWay | USD$5.00 | $10.00 |

| KOT4X | USD$3.50 | USD$7.00 |

| Pepperstone | USD or AUD$3.50 | USD or AUD$7.00 |

| IC Markets | USD or AUD$3.50 | USD or AUD$7.00 |

| Think Markets | USD or AUD$3.50 | USD or AUD$7.00 |

| Fusion Markets | AUD$2.25 | AUD$4.50 |

| AxiTrader | USD$3.50 | USD$7.00 |

| Go Markets | AUD$3.00/USD$2.50 | AUD$6.00/USD$5.00 |

As we’ve seen already, the fees you can expect on KOT4X will depend on the account type you choose.

The currency you’ll pay the fees depends on the dominant currency selected. If you open a USD account, you’ll pay 7 USD; if you open a EUR account, you’ll pay 7 EUR per lot round-turn. It’s hard to compare the two platforms directly since spreads are always changing, and the commission depends on a few factors. However, KOT4X has the edge, provided you open a VAR or PRO account.

Other Fees

Hugo’s Way charges an inactivity fee of $15 per month, which is quite sneaky if you ask us and definitely something to be aware of. There are no additional fees we know of on KOT4X — we’d expect no less, considering their commitment to transparency.

Our Lowest Spreads and Fees Verdict

The spreads with Hugo’s Way would need to be truly outstanding to make up for the additional commission costs. Given both brokers are ECN or STP-style brokers, we don’t think this is likely.

2. Better Trading Platform: Tie

Both Hugo’s Way and KOT4X only offer trading through the MetaTrader 4 platform. Some traders might find this slightly limiting since many brokers also support the MetaTrader 5 platform, which has added tools and functionality, and others may have cTrader too.

However, considering MT4 remains the most popular for most traders and has pretty much everything you need to trade, it’s certainly not a deal-breaker.

Because both platforms only offer MT4, which is quite generic no matter which broker is offering it, there aren’t many major differences here. But just to leave no doubts in your mind, let’s take a more in-depth look at what the trading platforms look like on both services and which features you can expect.

Trading Platforms Offered

Hugo’s Way only offers MT4 trading, which you can use on Windows, Mac, IOS, Android, or via the webtrader option. You can also use it via Play on Mac for Mac OS, but this isn’t officially supported.

We downloaded MT4 for Windows, and after installing it successfully, we were taken to the following screen to choose a server.

Here, you can see all the features available and start trading if you wish.

The process is almost exactly the same for KOT4X. You can download the MT4 software for Windows, Mac, Android, or IOS, and you can also use it through the web browser. After downloading it from the website (select the MT4 for Windows option), you’ll be prompted to choose one of the following trading servers.

Based on the MT4 software alone, it’s pretty hard to differentiate between both brokers!

Interface Comparison

As you can see from the screenshots above, the two interfaces are both very similar. They should be easy and pleasant to use if you’re familiar with ML4.

However, if you’re completely new to this kind of trading, then you might struggle — not least because there are no educational resources on either website to guide you through the process.

In contrast, many other brokers provide training materials and the latest news about investments to guide you through your trading journey.

Features

Since the brokers use an MT4 platform, you can access all the usual features, including technical analysis and algorithmic trading. They allow Best Brokers for Scalping, hedging, margin calls, and access to expert advisors (EAs) to automate your trading. See that big “AutoTrading” button on the screenshots?

However, overall we’d say that both platforms have weaker features than similar competitors. For instance, they don’t provide any educational resources, tools for market analysis (like news and blogs), social trading tools, or advanced risk management. These factors should make you consider opting for something else.

Experienced traders might want more options, while beginners might need more help. See the dilemma?

Our Better Trading Platform Verdict

Both brokers offer the same trading platform.

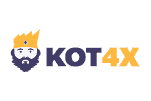

3. Superior Accounts And Features: KOT4X

Hugo’s Way and KOT4X have a range of different accounts for you to choose from, depending on your needs.

Let’s look at the account types offered on both trading platforms.

Hugo’s Way Account Types

Unlike most other brokers, Hugo’s Way doesn’t offer different account types or tiers. Every live account is ECN/STP to minimize price manipulation and give you the best spread provided by liquidity providers.

So, no need to worry about wasting time figuring out which account is right for you.

KOT4X Account Types

In contrast, there are four different live account types available on KOT4X; the one you choose dictates the type of pairs you can trade, the fee structure you’ll face, and how many lots you can trade. These are as follows:

- Standard: Trading with medium spreads and commissions.

- PRO: Trading with low spreads and paying commissions.

- VAR: Trading with no commission.

- MINI: For trading micro-lots (up to 1000).

The MINI account offers forex trading only, whereas the other three accounts also allow you to trade the full array of forex, indices, commodities, stocks, and cryptos. Also, on a MINI account, you’ll be restricted to 29 pairs of forex currency pairs, whereas the other accounts allow you to trade up to 55 pairs.

For most people, either the PRO or the VAR accounts make the most sense. The MINI account is too restrictive, and the commission you’ll have to pay on the Standard account makes it too prohibitive. Meanwhile, the low spreads from the PRO account and the lack of commission for the VAR account make these accounts more attractive, especially as there doesn’t appear to be a tradeoff compared to the Standard account.

As the name suggests, the PRO account is best for experienced traders, and the VAR account is for beginners (so they don’t have to grapple with commissions). Each one only offers to trade on MT4 since this is all the platform supports. Also, every account allows you to use the STP trading model, market execution, swaps, and trade between 0.01 and 1000 lots.

The other primary differences between the accounts are the minimum deposits and fees, but we’ll go into that later.

Demo Accounts

You can open a demo account on both platforms, which lets you trade in exactly the same way as you would on a standard account, with none of the repercussions. You can access the same amount of leverage and unlimited funds.

Islamic Accounts (Swap-Free Accounts)

Neither KOT4X nor Hugo’s Way have Swap Free Islamic Accounts. However, Hugo’s Way has shown that it may add this account type in the future. Watch this space!

Our Superior Accounts and Features Verdict

KOT4X offers a choice of multiple account types as opposed to the one account type from Hugo’s Way, so KOT4X wins.

4. Best Trading Experience And Ease: Hugo’s Way

When it comes to trading experience and ease, both KOT4X and Hugo’s Way have their strengths. We’ve spent countless hours on both platforms and here’s what we’ve found:

- Both platforms offer a user-friendly interface that’s easy to navigate.

- The charting tools and technical indicators available are comprehensive and cater to both beginners and advanced traders.

- Order execution is swift, ensuring that you get the best possible price.

- Customer support is responsive, which is crucial when you run into any trading hiccups.

From our own testing, we’ve noticed that while many brokers excel in specific areas, the overall experience is what truly matters. It’s not just about the platform’s look and feel but also about the range of tools available, the speed of execution, and the quality of customer support.

Our Best Trading Experience and Ease Verdict

Based on our comprehensive review and testing, Hugo’s Way offers a slightly better overall trading experience compared to KOT4X.

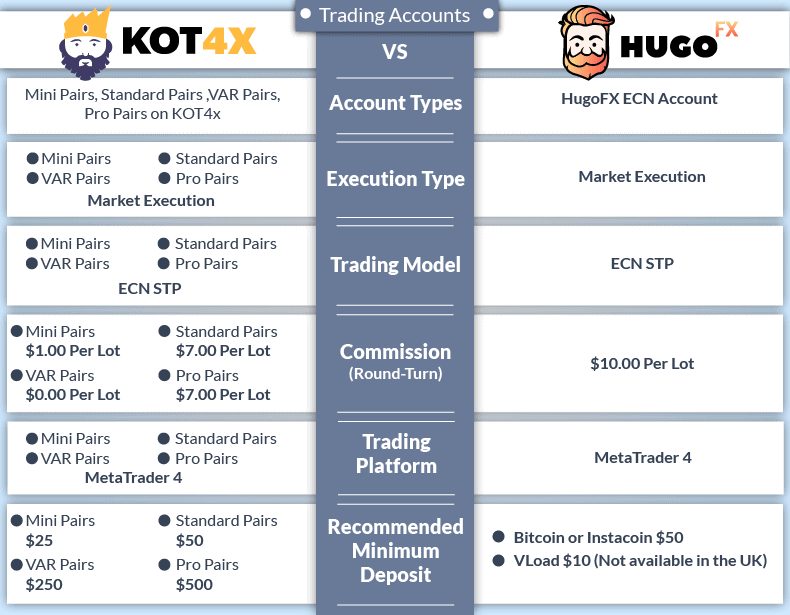

5. Stronger Trust And Regulation: Tie

In forex trading, establishing a secure and transparent environment relies heavily on strong trust and regulation.

KOT4x Trust Score

Hugo’s Way Trust Score

Regulations

For obvious reasons, security and regulation are major factors to consider when deciding which broker to choose. This one can be answered quickly, but unfortunately, it’s not good news. Both Hugo’s Way and KOT4X are offshore brokers (they’re in St Vincent and the Grenadines), and so neither are regulated brokers.

Most offshore brokers such as those with offices in the Bahamas, Seychelles, Belize and Vanuatu do have some level of regulation. We could call the level of regulation these brokers offer tier-3 since their regulatory standards are lower than top-level regulation jurisdictions like Australia, Europe and Singapore, and mid-tier regulators like the UAE or South Africa. Unlike above, St Vincent and Grenadines don’t provide any regulation. The only requirement is for the broker to be registered as a company in the country.

To ensure your money and data are protected, you’d be better off opting for another platform. For instance, notable brokers such as Pepperstone, IC Markets, Markets.com, FP Markets and OANDA are regulated by ASIC, Australia’s primary regulator for Australian clients. All these brokers also make use of European regulators, such as for European clients. Pepperstone, for example, is a regulated broker in the UK (FCA), BaFIN (Germany) and CySEC (Cyprus), making them a broker you can definitely trust with your funds. But if you want the full picture of both platforms’ security measures, keep reading.

At CompareForexBrokers, we never recommend unregulated brokers. While we are not suggesting these brokers are scams or untrustworthy, we don’t see why you would want to risk your valuable savings when you can use regulated brokers that have much the same trading conditions and superior financial services.

Restricted Countries

If you’re based in the UK, you’ll also want to remember Hugo’s Way classifies the nation as a restricted country. Somewhat confusingly, this doesn’t mean that you can’t use the trading platforms, but it means that you won’t be able to verify your account. A representative told us that “it is the responsibility of our clients to ensure that their activity is in line with their local regulations.”

As a result, if you decide to proceed and use Hugo’s Way with an unverified account, you’ll only be able to deposit and withdraw using Bitcoin or Instacoins.

However, you’ll still be able to use KOT4X with no issues.

Security Protocols

If it puts your mind at rest a little, just because the platforms aren’t regulated, it doesn’t mean that they’re completely insecure.

For instance, they both use two-factor authentication (2FA) as an extra security measure (although adding it is optional). For this to work, you need to pair your account with an authentication app by scanning a QR code. You’ll then need to enter the code the app generates every time you log into your account.

This is a pleasant feature that not every broker has the decency to offer.

They also both keep your money in segregated accounts from established institutions to ensure your funds don’t get used for anything else or mixed in with the money of KOT4X/Hugo’s Way themselves. However, the brokers don’t deserve too much credit for this — it’s the bare minimum they can do for their customers, and it’s partly meaningless without a regulator overseeing everything.

Hugo’s Way also uses Know-Your-Customer (KYC) to make sure none of their clients isn’t money laundering, which adds some extra credibility.

| KOT4x | Hugo's Way | |

|---|---|---|

| Tier 1 Regulation | ||

| Tier 2 Regulation | ||

| Tier 3 Regulation |

Reviews

KOT4X and Hugo’s Way both receive low ratings on Trustpilot. KOT4X holds a Trustpilot score of 1.4 out of 5, based on around 120 reviews. Hugo’s Way also scores poorly, with a 1.4 out of 5 from over 200 reviews. Both brokers face serious trust concerns from users, but KOT4X appears to attract even more criticism for alleged unethical practices. Neither platform inspires strong confidence based on Trustpilot feedback.

Our Stronger Trust and Regulation Verdict

We can’t recommend a broker that doesn’t have oversight from top regulators, so we won’t declare a winner for this one. That’s not to say you can’t choose a broker that is not regulated. If you prefer to fund your account using cryptocurrencies, you could look into such a broker, but make sure you do your research first and know your risks.

6. Most Popular Broker – KOT4X

KOT4X gets searched on Google more than Hugo’s Way. On average, KOT4X sees around 14,800 branded searches each month, while Hugo’s Way gets about 9,900 — that’s 33% fewer.

| Country | KOT4X | Hugo's Way |

|---|---|---|

| United States | 12,100 | 6,600 |

| Canada | 480 | 320 |

| France | 320 | 50 |

| United Kingdom | 320 | 260 |

| Nigeria | 210 | 170 |

| India | 170 | 40 |

| South Africa | 140 | 70 |

| Vietnam | 90 | 10 |

| Germany | 90 | 50 |

| Mexico | 70 | 70 |

| Australia | 70 | 50 |

| Dominican Republic | 70 | 20 |

| Colombia | 50 | 40 |

| Italy | 50 | 20 |

| Spain | 50 | 50 |

| Kenya | 50 | 20 |

| Netherlands | 50 | 40 |

| Morocco | 40 | 10 |

| Brazil | 40 | 40 |

| Turkey | 40 | 10 |

| Venezuela | 40 | 30 |

| Pakistan | 30 | 30 |

| Poland | 30 | 20 |

| Switzerland | 30 | 20 |

| Ghana | 30 | 10 |

| Sweden | 30 | 10 |

| Thailand | 20 | 10 |

| Japan | 20 | 10 |

| Indonesia | 20 | 10 |

| Philippines | 20 | 20 |

| Bangladesh | 20 | 10 |

| Peru | 20 | 10 |

| Ecuador | 20 | 10 |

| United Arab Emirates | 20 | 10 |

| Chile | 20 | 20 |

| Argentina | 20 | 30 |

| Portugal | 20 | 30 |

| Cyprus | 20 | 10 |

| Ethiopia | 20 | 10 |

| Ireland | 20 | 10 |

| Malaysia | 10 | 10 |

| Egypt | 10 | 10 |

| Uzbekistan | 10 | 10 |

| Algeria | 10 | 10 |

| Cambodia | 10 | 10 |

| Taiwan | 10 | 10 |

| Singapore | 10 | 10 |

| Saudi Arabia | 10 | 10 |

| Sri Lanka | 10 | 10 |

| Greece | 10 | 10 |

| Jordan | 10 | 10 |

| Austria | 10 | 10 |

| Botswana | 10 | 10 |

| Mongolia | 10 | 10 |

| Bolivia | 10 | 10 |

| Hong Kong | 10 | 10 |

| Uganda | 10 | 10 |

| Tanzania | 10 | 10 |

| Costa Rica | 10 | 10 |

| Panama | 10 | 10 |

| New Zealand | 10 | 20 |

| Mauritius | 10 | 10 |

12,100 1st | |

6,600 2nd | |

480 3rd | |

320 4th | |

320 5th | |

50 6th | |

320 7th | |

260 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with KOT4X receiving 136,000 visits vs. 47,000 for Hugo’s Way.

Our Most Popular Broker Verdict

KOT4X is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

7. Top Product Range And CFD Markets: Hugo’s Way

Hugo’s Way and KOT4X both specialise in forex trading, but that doesn’t mean they offer nothing else — quite the contrary. You can choose from a range of derivative options, including indices, stocks, cryptocurrencies and hard commodities. You can even trade futures.

One thing to note is that KOT4X say they have 104 stocks on their main page, but they only actually list 24 on the trading asset page.

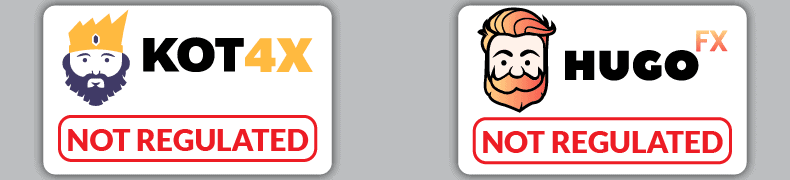

Forex

Both brokers give you a choice of 55 forex pairs to pick from. These comprise major and minor pairs, but there may be an exotic or two. The number of forex pairs is around the mark for what most brokers offer. However, some good brokers offer over 60 pairs.

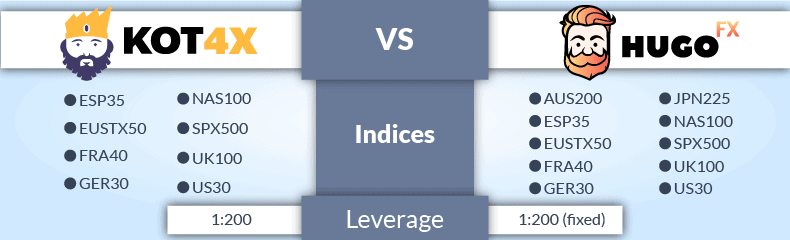

Indices

As a CFD broker, the indices offered by Hugo’s Way and KOT4X are broadly quite similar, but Hugo’s Way has the edge by offering a few more options. It has the Australian Securities Exchange 200, Nikkei 225, or the Hang Seng 50, which KOT4X lacks.

Hugo’s Way offers these indices:

- Australian Securities Exchange 200

- Spanish Exchange Index 35

- Euro Stoxx 50

- France CAC 40

- Germany 30

- Hang Seng 50

- Nikkei 225

- NASDAQ 100

- S&P 500

- UK FTSE 100

- Dow Jones 30

KOT4X offers these indices:

- Spanish Exchange Index 35

- Euro Stoxx 50

- France CAC 40

- Germany 30

- NASDAQ 100

- S&P 500

- UK FTSE 100

- Dow Jones 30

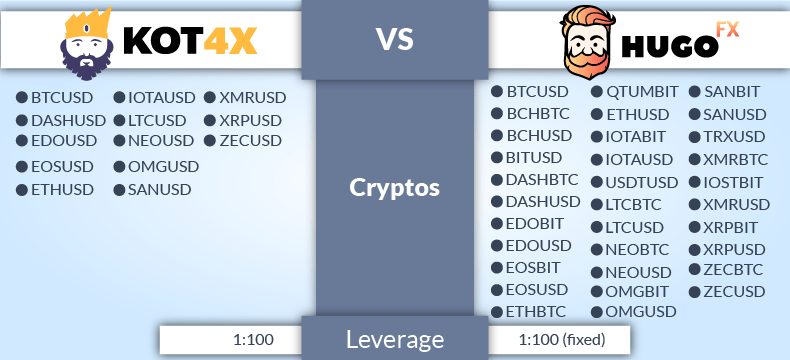

Cryptocurrencies

Once again, there’s a lot of overlap in the cryptocurrencies you can trade on both platforms, but KOT4X just about wins out. You can only trade Basic Attention Coin, Binance, Stellar, and Doge on KOT4X, but Hugo’s Way offers nothing that KOT4X doesn’t have.

In leverage, both have a maximum of 1:100 but leverage with HugosWay is fixed.

Hugo’s Way has 15 different cryptocurrencies available and 32 crypto cross-pairs. This offering is quite substantial and would make Hugo’s Way among the best of any broker. Below are the crypto-assets available:

- Bitcoin

- Bitcoin Cash

- Dash

- Eidoo

- EOS

- Ethereum

- Iota

- Litecoin

- Monero

- Neo

- OmiseGO

- Ripple

- Santiment

- Tron

- Zcash

Meanwhile, KOT4X offers 13 cryptocurrencies, but on their main page, they say they have 31 cryptos, so it’s likely there are cross pairs you can choose from that they don’t list on their trading products page.

- Basic Attention Coin

- Binance Coin

- Bitcoin

- Bitcoin Cash

- bitUSD

- Dash

- Eidoo

- EOS

- Ethereum

- Iota

- Litecoin

- Monero

- Neo

- OmiseGO

- Ripple

- Santiment

- Stellar

- Tron

- Zcash

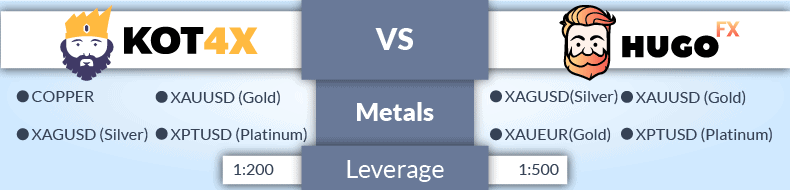

Metals

As for metals, you’ll have the following options on Hugo’s Way to trade against the USD or with Gold, the Euro:

- Gold

- Platinum

- Silver

And the following on KOT4X:

- Silver

- Gold

- Platinum

- Copper

Clearly, the two are broadly the same, but only Hugo’s Way will let you trade copper. Pretty niche, but good to know.

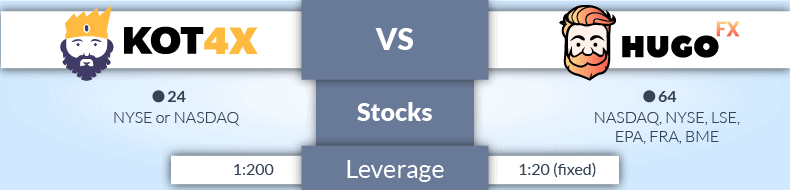

Stocks

There are more stocks available for trading on Hugo’s Way, which offers a very impressive range of most major companies, but KOT4X also offers a good mix to choose between. With Hugosway, some 64 stocks are available, and these are not just limited to the American stock exchanges like NASDAQ and NYSE.

When trading stocks, both brokers limit leverage to 1:20.

KOT4x allows you to choose from 2 stocks, and these all come from NASDAQ or NYSE.

Energy

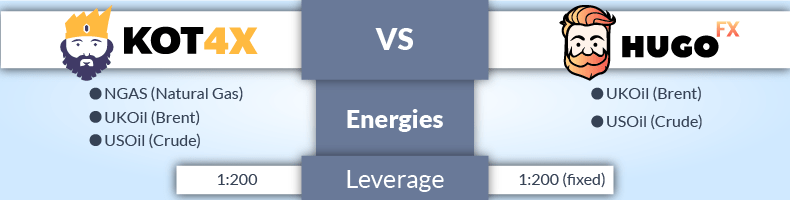

You can also buy Brent oil (UK) and crude oil (USA) with KOT4X and Hugo’s Way, but KOT4X lists Natural Gas as an option which Hugos do not.

Our Top Product Range and CFD Markets Verdict

Overall, the brokers have similar offerings, you are really splitting hairs, but Hugosway lists more products on their website we are giving the win to them.

8. Superior Educational Resources: Hugo’s Way

KOT4X:

- Offers a comprehensive Forex Education section for beginners.

- Provides detailed video tutorials on various trading topics.

- Webinars are frequently organized to educate traders.

- E-books on Forex trading are available for in-depth knowledge.

- Trading glossary helps new traders understand complex terms.

- Customer support is available to answer any educational queries.

Hugo’s Way:

- Features a Trading Academy for novice traders.

- Video lessons cover a wide range of trading strategies.

- Regularly conducts educational webinars for its users.

- Provides E-books on different aspects of trading.

- FAQ section addresses common queries related to trading.

- Dedicated support team assists in educational matters.

Our Superior Educational Resources Verdict

Based on our team’s testing, Hugo’s Way scores slightly higher in educational resources, making it the preferable choice for traders seeking comprehensive learning materials.

9. Superior Customer Service: Tie

With customer support, we’re sad to say that neither broker is particularly promising. Perhaps that shouldn’t be overly surprising, considering the lack of regulation.

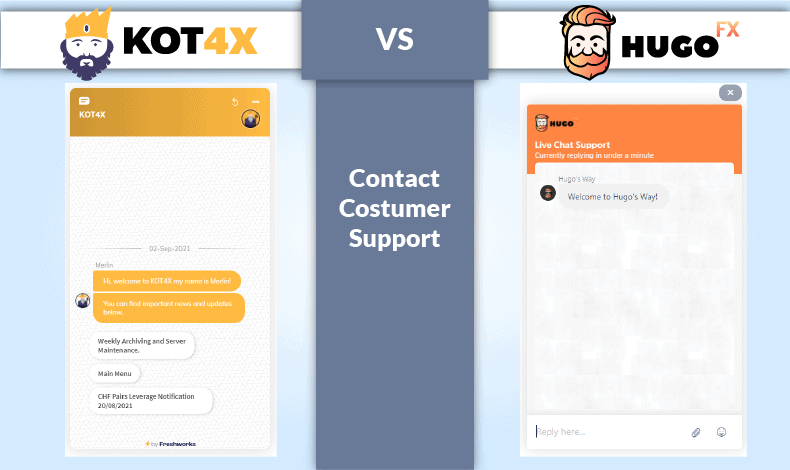

Contacting Customer Support

Hugo’s Way offers a 24/7 support team that gives you two principal methods to choose between: live chat or submitting a contact form. But like many live chat options, you’ll be speaking with a chatbot initially. Instead of directing you to a person, it will direct you to the support forum, so we recommend submitting a support form (even though it’s a slower option).

There is no phone number given on the website, but you can also request a callback if you’d prefer to speak to a human about your queries.

If you need support on KOT4X, your primary option is to submit a ticket and then wait for a response. You can choose whether you’d prefer to receive communications via email or phone.

Unfortunately, there’s no option to call a representative directly. There’s a live chat option on the website, but once again, this is a chatbot rather than a human representative. Still, with a little trial and error, you might be passed on to somebody more useful.

Quality Of Customer Service

Although Hugo’s Way seems promising on the surface for offering a few different ways to contact them, this doesn’t guarantee a great service overall. Hugo’s Way has poor reviews on Trustpilot and other review sites, which should certainly be a word of warning.

But KOT4X doesn’t fare any better — in fact, it’s even worse. The average score is the same, but there are fewer reviews, and the page hasn’t even been claimed. A bad sign? Perhaps.

Our Superior Customer Service Verdict

Both brokers have pretty poor customer service. Both have live chat, but don’t expect them to answer questions beyond the most basic.

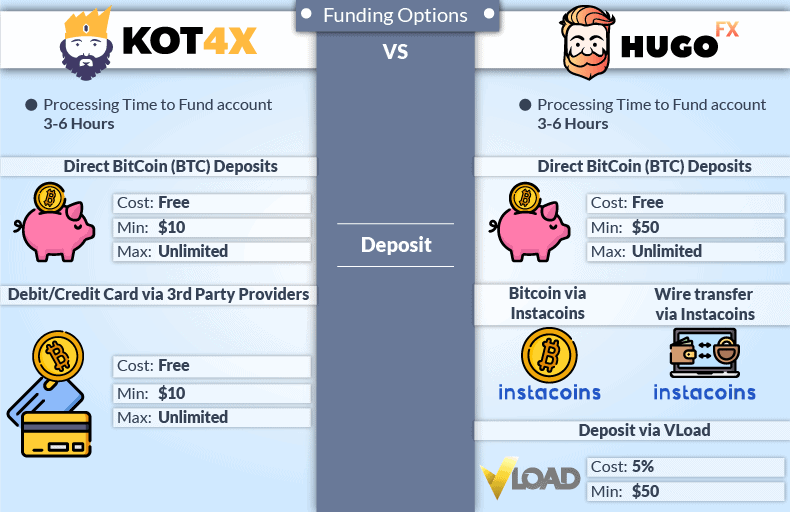

10. Better Funding Options: Hugo’s Way

Hugo’s Way fares well with its unique funding options and low minimum deposits, giving it an edge over more well-known and respected forex brokers. KOT4X doesn’t do so well, but it’s still worth considering.

Deposit And Withdrawal Costs

There are no withdrawal or deposit fees for wire transfers on KOT4X, but you may encounter network fees when withdrawing Bitcoin / BTC (though these come from the Blockchain network rather than KOT4X).

On Hugo’s Way, there’s a 5% charge for depositing if you use VLoad (we’ll explain what this is later), but there are no fees involved if you use Bitcoin or a credit or debit card. Whichever method you choose, there are no withdrawal fees.

Funding

Hugo’s Way stands out from many other brokers because of its unique funding options. Besides using a credit or debit card, you can fund your account with Bitcoin, VLoad, and a third-party platform called Ole.

What’s VLoad, you ask? It’s essentially a voucher system — you buy vouchers using a wider range of funding methods and then use the vouchers to fund your account, giving you greater flexibility without making you pay more.

You can also use bank wire, but this incurs a costly fee of $25 (which also applies to withdrawing money). Finally, you can use a Visa or MasterCard card to fund your account, but it is more expensive.

On KOT4X, you can fund your account through Bitcoin or your card (either via eCommerce or a third-party platform.

Unfortunately, the withdrawal and deposit process for Bitcoin is confusing on KOT4X.

Our Better Funding Options Verdict

Hugo’s Way gives you more funding options. This is important when you consider these brokers don’t offer conventional funding methods such as credit cards and PayPal.

11. Lower Minimum Deposit: Hugo’s Way

Many people make the mistake of only worrying about things like minimum deposits and funding options once they’ve already signed up for a broker and started using it. Don’t be like most people!

Minimum Deposit

On Hugo’s Way, the minimum deposit amount depends on the method you choose. For a credit or debit card and Bitcoin, the minimum is $50, but this goes down to just $10 if you use VLoad. This is a significant advantage for beginners who just want to test the water or those who want to start by trading micro-lots or mini-lots (a useful feature that Hugo’s Way offers).

The minimum deposit on KOT4x to open an account depends on the account type you select. They’re as follows:

- Standard: $50

- PRO: $500

- VAR: $250

- MINI: $25

Considering that the VAR and PRO accounts are the most attractive options for most people due to their lower fees and greater options, the higher minimum funding might seem off-putting.

Our Lower Minimum Deposit Verdict

Our Final Verdict On Which Broker Is The Best: Hugo’s Way or KOT4X?

Hugo’s Way is the winner because it consistently outperforms KOT4X in several key areas, including trading experience, product range, educational resources, funding options, and minimum deposit requirements. The table below summarises the key information leading to this verdict:

| Criteria | Hugo’s Way | Kot4x |

|---|---|---|

| Lowest Spreads And Fees | Yes | Yes |

| Better Trading Platforms | Yes | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| CFD Product Range And Financial Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Better Customer Service | Yes | Yes |

| More Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Best For Beginner Traders

Hugo’s Way is the preferred choice for beginner traders due to its comprehensive educational resources and user-friendly platform.

Best For Experienced Traders

For experienced traders, Hugo’s Way offers a wider product range and better trading experience, making it the top choice.

FAQs Comparing KOT4X Vs Hugo's Way

Does Hugosway or KOT4X Have Lower Costs?

Hugosway generally offers more competitive costs. Both brokers have their own fee structures, but when it comes to spreads, Hugosway tends to be more favourable. For a detailed comparison of brokers with low commissions, you can refer to this comprehensive guide on the lowest commission forex brokers.

Which Broker Is Better For MetaTrader 4?

Both Hugosway and KOT4X offer MetaTrader 4, making them suitable choices for traders familiar with this platform. MT4 is a popular choice among traders globally, and its features are well-utilised by both brokers. For a deeper dive into the best MT4 brokers, check out this list of best MT4 brokers.

Which Broker Offers Social Trading?

Hugosway offers social trading features, allowing traders to follow and copy the trades of professionals. Social trading is a great way for beginners to learn from experienced traders. If you’re interested in exploring more about social trading platforms, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Hugosway nor KOT4X offer spread betting. Spread betting is a unique form of trading popular in the UK and some other countries. If you’re interested in brokers that offer spread betting, you can check out this list of the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, neither Hugosway nor KOT4X are the top choices for Australian Forex traders. Both brokers are not ASIC-regulated, and they are founded overseas, not in Australia. It’s essential for Australian traders to choose brokers that are ASIC-regulated for better protection and security. For a comprehensive list of top brokers in Australia, you can refer to this guide on the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

Personally, I believe that neither Hugosway nor KOT4X are the best fit for UK Forex traders. Neither of the brokers are FCA regulated, and they are not founded in the UK. FCA regulation is crucial for UK traders as it ensures a high level of security and protection. If you’re looking for the Best Forex Brokers In UK, here’s a comprehensive guide on the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert