Tradersway Review Of 2026

Tradersway raises concerns with its lack of regulatory oversight and misleading portrayal as an ECN broker. The broker’s spreads are also less competitive than top brokers, making it a risky choice for security-conscious traders.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Tradersway Summary

| 🗺️ Regulation | Not Regulated |

| 💰 Trading Fees | Standard + Raw Accounts |

| 📊 Trading Platforms | MetaTrader 4, cTrader |

| 💰 Minimum Deposit | $50 |

| 💰 Withdrawal Fees | $25 |

| 🛍️ Instruments Offered | Forex, CFD, Crypto, Commodities |

| 💳 Credit Card Deposit | Yes |

Why Choose Tradersway

Our view of Tradersway is cautious since the broker is not regulated, for this reason we recommend you look at more reputable brokers. Still there are some reasons to consider Tradersway over some other brokers in particular for their crypto funding, fast deposit and withdrawal, 24/7 customer support and leverage of 1:1000.

Beyond these features, Tradersway lacks features that make them stand out. Spreads and commission are average and the platforms are MT4, MT5 and cTrader which most brokers have anyway. For this reason we don’t see a compelling reason to choose them over a properly regulated broker.

Tradersway Pros and Cons

- Low spreads

- Scalping and hedging are allowed

- Copy trading

- Unregulated

- No micro accounts

- No visible analytics

Open Demo AccountVisit Trader's Way

The overall rating is based on review by our experts

Trading Fees

To assess Tradersway’s market position in terms of spreads, we conducted an analysis of average spreads data from over 40 brokers.

1. Raw Account Spreads

In the Raw Spread Account, Tradersway’s ECN pricing is not as competitive as one might expect from a true ECN broker. Their raw spreads start from 0.5 pips for major pairs like EUR/USD, which is significantly wider than the spreads offered by top regulated brokers such as Pepperstone and IC Markets, averaging around 0.1 pips.

ECN Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.50 | 0.70 | 1.70 | 0.60 | 0.80 |

| 0.01 | 0.02 | 0.50 | 0.27 | 0.30 |

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| 0.14 | 0.31 | 0.62 | 0.39 | 0.75 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

| 0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

| 0.80 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

| 0.51 | 1.15 | 0.99 | 0.94 | 1.28 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

This discrepancy in spread competitiveness, coupled with Tradersway’s operation as a market maker despite promoting itself as an ECN broker with Straight Through Processing, raises questions about their trading environment’s transparency and fairness. Moreover, compared to the average broker, their spreads are higher in most currency pairs.

| Raw Account Spreads | Tradersway | Average Spread |

|---|---|---|

| Overall | 0.96 | 0.74 |

| EUR/USD | 0.5 | 0.21 |

| USD/JPY | 0.5 | 0.39 |

| GBP/USD | 0.5 | 0.48 |

| AUD/USD | 0.7 | 0.39 |

| USD/CAD | 0.8 | 0.53 |

| EUR/GBP | 0.6 | 0.55 |

| EUR/JPY | 0.8 | 0.74 |

| AUD/JPY | 1.7 | 1.07 |

| USD/SGD | 2.5 | 2.34 |

2. Raw Account Commission Rate

Tradersway charges a commission of USD 3 per side, per 100k traded for its CT.ECN, MT4.ECN and MT5.ECN accounts.

This rate is around the industry average, comparable to brokers like FP Markets, EightCap, IC Markets, and Pepperstone, who have similar commission structures.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Tradersway Commission Rate | $3.00 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

For the EUR/USD pair, Tradersway’s no commission spreads average at 1.4 pips, which is considerably higher compared to the market’s best, such as IC Markets, averaging around 0.62 pips.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Tradersway Average Spread | 1.4 | 1.6 | 2.1 | 2.5 | 2.6 | 2.5 | 2.6 | 4.9 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

The gap widens further with the AUD/USD pair, where Tradersway’s average of 2.50 pips is significantly greater, showing a difference of approximately 225% compared to IC Markets’ average of 0.77 pips.

4. Swap-Free Account Fees

Tradersway offers three account types with both no commission and commission pricing:

| Account Type | Spreads | Trading Platform | Islamic Account Option |

|---|---|---|---|

| MT4.VAR | No Commission | MetaTrader 4 | Yes |

| MT4.ECN | Commission | MetaTrader 4 | No |

| MT5.ECN | Commission | MetaTrader 5 | No |

| CT.ECN | Commission | cTrader | No |

The MT4.VAR account offered by the broker can be adapted to a swap-free pricing structure, catering to Islamic traders.

This swap-free account aligns with Islamic finance principles, which prohibit earning interest on trades. It ensures that traders adhering to Sharia law can participate in forex markets without compromising their religious beliefs.

5. Other Fees

There are no additional fees when it comes to deposits, withdrawals, and inactive accounts.

Verdict on Tradersway Fees

Tradersway’s higher-than-average spreads and industry-standard commission rates suggest a less competitive cost structure, especially for traders prioritising affordability and transparency.

Trading Platforms

Tradersway offers three popular trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform caters to different trading styles and preferences.

| Trading Platform | Available With Tradersway |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| TradingView | No |

| Proprietary Platform | No |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

- MetaTrader 4 (MT4): Ideal for beginners and forex-focused traders, MT4 is user-friendly with a clean interface, offering essential and advanced tools. It’s less resource-intensive and widely trusted.

- MetaTrader 5 (MT5): A more comprehensive platform suitable for trading multiple assets, MT5 is a step up from MT4 with additional features and 64-bit processing for faster execution.

- cTrader: Known for its modern design and advanced order options, cTrader is preferred by traders who prioritise fast order execution and custom trading software development.

MetaTrader 4

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for their user-friendliness, community support, and compatibility across various devices.

MT4, known for its straightforward approach, is highly effective for forex trading. It offers a range of technical analysis tools, including numerous charting options and indicators, making it a favorite among traders who rely on technical analysis.

Additionally, MT4’s automated trading capabilities, facilitated by Expert Advisors (EAs), allow traders to automate their strategies, enhancing efficiency and precision.

MetaTrader 5

MT5, an advanced iteration of MT4, expands on these features. It includes an increased number of technical indicators and timeframes, providing a more in-depth analysis for a broader range of CFDs. Its enhanced graphical tools and the economic calendar integrate seamlessly into the trading experience.

MT5 also supports automated trading with improved EAs and the ability to backtest strategies over multiple currencies and timeframes.

cTrader

cTrader, on the other hand, is recognised for its intuitive interface, state-of-the-art charting tools, and rapid order execution. It’s particularly suited for traders who prioritize technical analysis and custom trading solutions. cTrader’s charting capabilities are advanced, offering a wide range of technical indicators and drawing tools.

The platform also excels in automated trading with cAlgo, allowing traders to create custom cBots and indicators. This feature is particularly beneficial for algorithmic traders who require a platform that supports complex, customized trading strategies.

Below is a head-to-head comparison of the features of the platform:

Tradersway enhances its trading platforms with a range of trading tools:

- FxStat: A social and auto trading platform providing extensive statistical and financial analysis tools, allowing for in-depth evaluation of trading systems and performance.

- Myfxbook AutoTrade: This system enables direct copying of trades into MetaTrader accounts, featuring a extensive selection of systems and analytical tools. It focuses on filtering out low-performing signals, highlighting only the most successful ones.

- MT4 Trading Signals: Integrated within the MetaTrader platform, this feature allows for easy subscription to a wide range of signal providers, offering a diverse selection of trading styles and strategies within its large community.

Mobile Trading Apps

Both MetaTrader and cTrader platforms offer mobile app versions, ensuring traders can manage their accounts and trade on-the-go. These apps maintain the core functionalities of their desktop counterparts, providing convenience and continuous access to the markets.

Trade Experience

Tradersway portrays itself as an ECN broker offering Straight Through Processing (STP), yet their detailed terms reveal that they actually operate as a market maker.

This discrepancy is significant because, as an unregulated broker, Tradersway is not bound by the advertising and operational regulations set by top-tier regulators like ASIC (Australian Securities and Investments Commission) or FCA (Financial Conduct Authority). These regulators mandate a level of transparency in a broker’s pricing and liquidity structure, ensuring fair trading conditions for investors.

Verdict on Tradersway Trading Platforms

Tradersway offers a diverse range of trading platforms including MetaTrader 4, MetaTrader 5, and cTrader, each catering to different trading styles and preferences, with a focus on user-friendliness, technical analysis tools, and automated trading capabilities.

Is Tradersway Safe?

Tradersway is not considered a safe broker and has a low trust score of 24.

1. Regulation

Tradersway is not a regulated broker. Many traders would rightfully consider this to be concerning. The best brokers are licensed by tier-1 regulators (i.e. ASIC for Australia, FCA for the UK, BaFIN and CySEC for Europe, or MAS for Singapore).

| Trader's Way Safety | Regulator |

|---|---|

| Tier-1 | X |

| Tier-2 | X |

| Tier-3 | X |

Trading with an unregulated broker like Tradersway carries significant risks. The lack of regulation means your funds may not be secure, the broker could face insolvency without warning, and there’s no formal process for complaints or transparency in their financial dealings.

With Tradersway’s low trust score and high-risk jurisdiction, it’s prudent to consider regulated brokers with a stronger reputation such as Pepperstone or IC Markets for safety and reliability.

2. Reputation

Tradersway was established in 2008 and is headquartered in Dominica, which is considered a high-risk jurisdiction. This broker maintains a modest footprint in the online forex trading landscape. With approximately 8,100 monthly Google searches, it ranks as the 58th most popular forex broker based on our 2024 analysis of 65 brokers. Web traffic data from Similarweb in February 2024 tells a similar story, positioning Tradersway as the 60th most visited broker with 20,000 global visits.

| Country | 2025 Monthly Searches |

|---|---|

| United States | 1,300 |

| Australia | 390 |

| India | 320 |

| South Africa | 320 |

| France | 260 |

| Canada | 260 |

| United Kingdom | 170 |

| Pakistan | 90 |

| Kenya | 70 |

| Nigeria | 70 |

| Germany | 50 |

| Netherlands | 40 |

| Tanzania | 40 |

| Brazil | 30 |

| Bangladesh | 30 |

| Colombia | 30 |

| Mexico | 30 |

| Ethiopia | 30 |

| Italy | 20 |

| Philippines | 20 |

| Malaysia | 20 |

| Spain | 20 |

| Poland | 20 |

| United Arab Emirates | 20 |

| Turkey | 20 |

| Indonesia | 20 |

| Japan | 20 |

| Sweden | 20 |

| Egypt | 20 |

| Cyprus | 20 |

| Peru | 20 |

| Sri Lanka | 10 |

| Singapore | 10 |

| Thailand | 10 |

| Morocco | 10 |

| Vietnam | 10 |

| Hong Kong | 10 |

| Venezuela | 10 |

| Portugal | 10 |

| Switzerland | 10 |

| Saudi Arabia | 10 |

| Greece | 10 |

| Algeria | 10 |

| Austria | 10 |

| Ireland | 10 |

| Cambodia | 10 |

| Argentina | 10 |

| Uganda | 10 |

| Ghana | 10 |

| Chile | 10 |

| Dominican Republic | 10 |

| Taiwan | 10 |

| Botswana | 10 |

| Jordan | 10 |

| Uzbekistan | 10 |

| Mauritius | 10 |

| New Zealand | 10 |

| Ecuador | 10 |

| Bolivia | 10 |

| Costa Rica | 10 |

| Panama | 10 |

| Uruguay | 10 |

| Mongolia | 10 |

1,300 1st | |

390 2nd | |

320 3rd | |

320 4th | |

260 5th | |

260 6th | |

170 7th | |

90 8th | |

70 9th | |

70 10th |

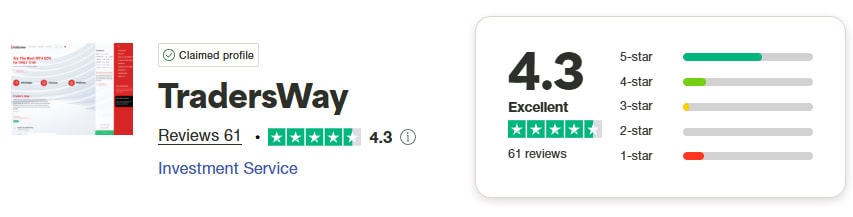

3. Reviews

The brokers TrustPilot score is 4.3 out of 5, yet there has only been 61 reviews.

Verdict on Tradersway Trustworthiness

Tradersway’s low trust score, lack of regulation, and high-risk jurisdiction position it as a potentially unsafe broker, making it advisable for traders to seek more regulated and reputable alternatives for enhanced security and reliability.

Deposit and Withdrawal

Tradersway requires a low minimum deposit and provides a range of payment methods for deposits and withdrawals.

What is the Minimum Deposit at Tradersway?

Tradersway requires a small initial minimum deposit of $10 for all trading accounts.

Account Base Currencies

Tradersway offers four base currencies for MT4 and MT5 accounts, being USD, EUR, CAD, X. If you are using cTrader, you are limited to the USD only.

| Account Type | Minimum Deposit | Base Currencies |

|---|---|---|

| MT4.VAR | USD 10 | USD, EUR, CAD, GBP |

| MT4.ECN | USD 10 | USD, EUR, CAD, GBP |

| MT5.ECN | USD 10 | USD, EUR, CAD, GBP |

| CT.ECN | USD 10 | USD |

Deposit/Withdrawal Options and Fees

Tradersway offers 14 payment methods in total including debit/credit cards, e-wallets, and cryptocurrency options.

| Debit Cards | USD Coin (USDC) |

| Credit Catds | Tether (USDT) |

| Bank Transfer (Abra) | TrueUSD (TUSD) |

| Bitcoin | Skrill |

| Ether | Neteller |

| Litecoin | Perfect Money |

| Ripple | FasaPay |

Verdict on Tradersway Payment Methods

Tradersway facilitates funding and withdrawals with a low minimum deposit of $10, offering a variety of payment methods including debit/credit cards, e-wallets, and cryptocurrencies, across multiple base currencies.

Product Range

Tradersway offers five asset classes to trade, being forex, precious metals, stock indices, energies, and cryptocurrencies.

- Forex: up to 40 currency pairs available on all platforms

- Metals: gold and silver (MT4 and MT5)

- Energies: gas and oil (MT4 and MT5)

- Cryptocurrencies: including popular cryptos like Bitcoin and Ethereum (MT4 and MT5)

- Stock Indices: i.e. ASX 200, Dow Jones, S&P 500 (MT4 only)

Overall Tradersway provides limited market access compared to top brokers like IG or IC Markets.

Verdict on Tradersway CFD Range

Tradersway’s offering of five asset classes including forex, metals, energies, cryptocurrencies, and stock indices is relatively limited when compared to the other top brokers.

Customer Service

Tradersway’s customer support team is available 24 hours a day, 5 days a week, offering assistance through live chat, phone, email, and social media. Enquiries are typically processed within 24 hours on business days.

However, it’s important to note that Tradersway does not have any physical office locations. This lack of a tangible presence can be a point of concern, especially considering that Tradersway is an unregulated broker. The absence of physical offices might add an extra layer of uncertainty for traders seeking more direct or personal customer service interactions.

Verdict on Tradersway Customer Support

Tradersway provides 24/5 customer support through various channels, but the absence of physical offices and its unregulated status may affect the reliability and directness of customer service interactions.

Research and Education

Tradersway offers a rather limited selection of research and educational materials for traders. While they do provide access to webinars and some market analysis, the resources are relatively basic. They also feature an economic calendar, which is a standard tool for traders to keep track of significant financial events.

However, Tradersway lacks more comprehensive educational content, such as in-depth trading guides or extensive courses, which are often crucial for both novice and experienced traders seeking to enhance their trading knowledge and skills.

This limited range of educational resources might not fully meet the needs of traders looking for a thorough understanding of forex trading and advanced strategies.

Verdict on Tradersway Research and Education

Tradersway’s educational offerings, comprising basic webinars, market analysis, and an economic calendar, fall short in providing comprehensive learning resources for traders seeking in-depth knowledge and advanced trading strategies.

Final Verdict On Tradersway

The final verdict on Tradersway highlights its mixed attributes: while offering benefits like high leverage and low minimum deposits, it is hampered by its unregulated status, less competitive spreads, and limited educational resources.

This combination of factors, along with concerns about its operational transparency as a market maker, suggests that Tradersway may not be the ideal choice for traders seeking a secure and transparent trading environment, especially when compared to more regulated and reputable brokers.

Tradersway FAQs

What is the Minimum Deposit at Tradersway?

The minimum deposit required at Tradersway is $10 for all trading accounts. This low initial deposit makes it accessible for a wide range of traders, from beginners to those looking to test the platform with minimal financial commitment.

However, it’s important to consider that Tradersway operates as an unregulated broker, which may raise concerns about fund security and overall trading safety.

What Leverage is Available with Tradersway?

Tradersway offers leverage up to 1:1000 for MetaTrader accounts and up to 1:500 for cTrader accounts, with a tiered leverage system that reduces the maximum leverage as trading volume increases.

What Demo Account Does Tradersway Offer?

Tradersway provides a free demo account on trading platforms like MetaTrader 4 and cTrader, allowing users to practice trading and strategy development without risk.

Is Tradersway a Safe Broker?

Tradersway is not considered a safe broker, as evidenced by its low trust score of 26. This assessment is based on its status as an unregulated offshore broker, which raises concerns about the security of funds and the integrity of its trading practices.

About the Review

Our review of Tradersway follows the comprehensive methodology established by CompareForexBrokers. This approach involves a detailed analysis of 40 brokers across eight key categories, ensuring a thorough and unbiased evaluation. Our expert team, backed by technical researchers, utilizes automation tools like Expert Advisors, Indicators, and Scripts for precise testing. The review process prioritises factors such as trading costs, experience, platform features, customer service, market range, education, and funding options.

We place significant emphasis on spreads, commissions, and other fees to assess trading costs accurately. Trust and reputation are evaluated based on regulatory compliance, operational history, and global presence. Our methodology also includes testing order execution speeds and account management processes to gauge the overall trading experience. This rigorous and multi-faceted approach ensures that our review of Tradersway is both reliable and relevant to traders’ needs.

Compare Trader’s Way Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to Tradersway Website

Visit Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

How does the TradersWay bonus work?

TradersWay has a 100% bonus on your deposit.This essentially means whatever you deposit, TradersWay will double this in trading credits.

Do TradersWay accept US clients?

No, TradersWay does not accept US clients.