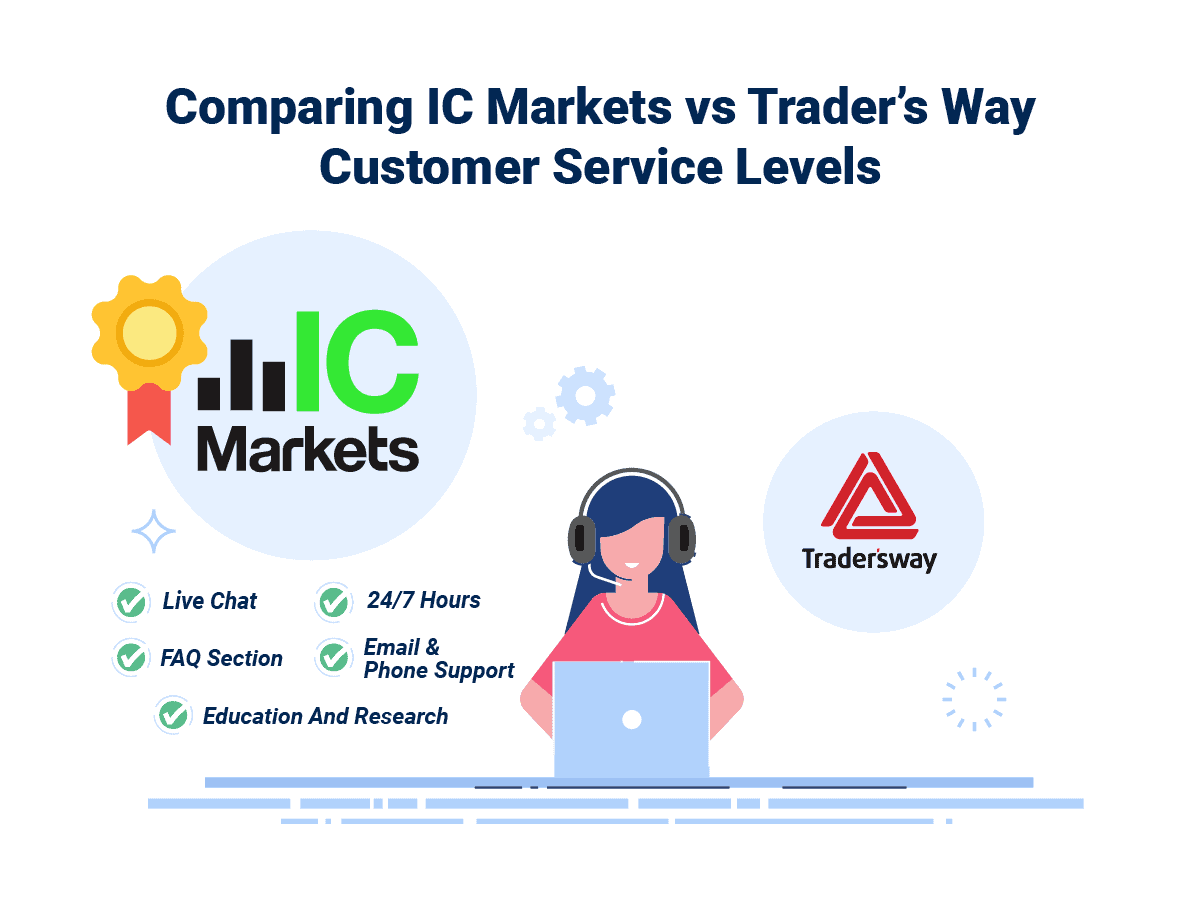

Tradersway vs IC Markets 2024

IC Markets is regulated by ASIC and CySEC, and Trader’s Way is unregulated. Our comprehensive comparison of Trader’s Way vs IC Markets dissects key areas like trading costs, Forex trading platforms, and regulations to help you choose the right Forex broker.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert