Pepperstone vs Trader's Way 2025

Let’s conduct a comprehensive examination of the comparison between Pepperstone and Tradersway, covering every aspect from costs to platforms to features. We’ll uncover which broker emerges as the superior choice in this review. Dive deeper into the analysis, and remember, the final decision on which broker to trade with rests in your hands.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do Trader’s Way Vs Pepperstone Compare?

Our full comparison covers the 10 most essential trading factors between Pepperstone and Trader’s Way.

- Pepperstone is known for low-cost trading and advanced platforms.

- Pepperstone’s average spread on EUR/USD is 1.16 pips.

- Pepperstone charges a commission on its Razor account.

- Pepperstone is regulated by multiple top-tier bodies.

- TradersWay’s is 1.4 pips.

- TradersWay has no inactivity fees.

- TradersWay offers diverse account types and higher leverage.

- TradersWay is regulated by the FSA of Saint Vincent and the Grenadines.

1. Lowest Spreads And Fees – Pepperstone

In forex trading, costs significantly impact profitability, especially for active traders. Pepperstone and Tradersway offer some of the lowest spreads and fees, appealing to beginners and experienced traders alike. Lower spreads reduce transaction costs, benefiting scalpers and high-frequency traders. Competitive pricing boosts trading volume and client retention for brokers. This chapter will explore how these cost-effective conditions enhance profitability and the trading experience.

Spreads

In forex trading, tight spreads are a key factor in reducing trading costs and maximizing profitability, especially for high-frequency traders and scalpers. When comparing Pepperstone and Tradersway, the difference in spreads is evident across major currency pairs.

Pepperstone stands out in the forex market with an exceptional 0.1 pip spread for EUR/USD, far surpassing Tradersway’s 0.5 pips and significantly undercutting the industry average of 0.28 pips. This strategic advantage enables Pepperstone traders to minimize costs, which is especially crucial in fast-paced trading environments where every pip matters. In the case of AUD/USD, Pepperstone offers a 0.2 pip spread, compared to Tradersway’s 0.7 pips, which also exceeds the industry benchmark of 0.45 pips. As a result, Pepperstone emerges as the more economical choice for Australian dollar traders.

Evaluating overall average spreads, Pepperstone leads the pack with 0.47 pips, while Tradersway follows at 0.96 pips, in contrast to the industry average of 0.72 pips. This data underscores Pepperstone’s commitment to providing ultra-tight spreads, a vital consideration for traders seeking to enhance their cost efficiency. Although Tradersway offers competitive options, their wider spreads may hinder profitability over the long term, particularly for those who trade frequently.

For cost-conscious traders, Pepperstone stands out as a superior choice compared to Tradersway, consistently providing lower spreads on major currency pairs. These tighter spreads lead to lower transaction costs, enhanced profit potential, and more favorable trading conditions—essential components that can greatly impact long-term trading success.

| RAW Account | Pepperstone Spreads | Tradersway Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.47 | 0.96 | 0.72 |

| EUR/USD | 0.1 | 0.5 | 0.28 |

| USD/JPY | 0.3 | 0.5 | 0.44 |

| GBP/USD | 0.3 | 0.5 | 0.54 |

| AUD/USD | 0.2 | 0.7 | 0.45 |

| USD/CAD | 0.4 | 0.8 | 0.61 |

| EUR/GBP | 0.2 | 0.6 | 0.55 |

| EUR/JPY | 0.711 | 0.8 | 0.74 |

| AUD/JPY | 0.5 | 1.7 | 0.93 |

| USD/SGD | 1.5 | 2.5 | 1.97 |

Commission Levels

Our dedicated team has designed the exclusive fee calculator below, showcasing that, in most cases, Pepperstone provides the most competitive fees for RAW account types.

When attempting to trade, comprehending broker fee structures is essential for maximizing profits. Let’s conduct a thorough comparative analysis of Pepperstone and Tradersway, exploring their commission rates, deposit requirements, account features, and funding options.

Commission Rates: For traders using RAW accounts, Pepperstone charges a commission of $3.50 per lot on each side, resulting in a total cost of $7.00 for a round turn. In comparison, Tradersway presents a more attractive option with a lower commission of $3.00 per lot per side, bringing the round turn cost down to $6.00.

Deposit Requirements: Both brokers offer a $0 minimum deposit, enabling traders to begin with any investment amount. However, they recommend different initial deposit levels: Pepperstone advises a starting deposit of $200 to ensure sufficient margin coverage, while Tradersway suggests a more manageable $10, making it accessible for those with limited capital.

Account Features: Both Pepperstone and Tradersway cater to traders in search of SWAP-free accounts, aligning with Islamic trading principles.

Funding Methods: Pepperstone boasts an impressive selection of over 16 funding methods, including bank transfers, credit and debit cards, and a variety of e-wallets, granting traders exceptional flexibility. Tradersway, though slightly more restricted, still presents a strong offering with more than 14 funding options.

Additional Fees: One key difference between the two platforms is their policy on inactivity fees. Pepperstone imposes a monthly fee of $15 after three months of account inactivity, which could pose a burden for traders who do not trade frequently. In contrast, Tradersway stands out by not charging any inactivity fees, offering a significant benefit for those who trade less often.

Tradersway features a slightly lower commission rate and lacks inactivity fees, whereas Pepperstone boasts a wider array of funding options and suggests a higher initial deposit to facilitate trading endeavors. It is essential for traders to consider these elements in light of their trading strategies and levels of activity in order to make an informed decision between the two brokers.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| Tradersway | $3.00 | N/A | N/A | N/A |

Our dedicated team has designed the exclusive fee calculator below, showcasing that, in most cases, Pepperstone provides the most competitive fees for RAW account types.

Standard Account Fees

In forex trading, grasping the fee structures of brokers is essential for maximizing returns. We will conduct a comparative analysis of Pepperstone and Tradersway, examining their commission rates, deposit requirements, account features, and funding options.

Commission Rates: For traders using RAW accounts, Pepperstone charges a commission of $3.50 per lot per side, resulting in a total of $7.00 for a round trip. In comparison, Tradersway offers a more competitive commission rate of $3.00 per lot per side, bringing the total round turn cost to $6.00.

Deposit Requirements: Both brokers offer a $0 minimum deposit, enabling traders to begin with any amount they choose. However, their suggested initial deposit amounts vary significantly: Pepperstone advises starting with $200 to ensure sufficient margin coverage, while Tradersway offers a more accessible recommendation of just $10, making it ideal for traders with limited funds.

Account Features: Both Pepperstone and Tradersway offer SWAP-free accounts, catering to traders who wish to follow Islamic trading principles.

Funding Methods: Pepperstone offers traders an impressive selection of over 16 funding methods, including bank transfers, credit and debit cards, and a variety of e-wallets, ensuring maximum flexibility. In comparison, Tradersway provides a solid choice with more than 14 funding methods, albeit slightly less extensive.

Additional Fees: A significant difference between the two brokers is their approach to inactivity fees. Pepperstone imposes a monthly charge of $15 for accounts that have been dormant for three months, which can be detrimental for traders who engage infrequently. In contrast, Tradersway offers a considerable advantage for less active traders by not enforcing any inactivity fees whatsoever.

Tradersway stands out with its slightly lower commission rates and absence of inactivity fees. However, Pepperstone excels by offering a more extensive array of funding options and a higher recommended deposit to facilitate trading. It is crucial for traders to evaluate these elements according to their specific trading strategies and activity levels, enabling them to make a well-informed decision between the two brokers.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.10 | 1.20 | 1.20 | 1.20 |

|

1.40 | 2.50 | 2.50 | 2.10 | 1.60 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Our Lowest Spreads and Fees Verdict

Evidently, Pepperstone dominates this section due to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

In the complicated and busy industry of forex trading, having a state-of-the-art trading platform is crucial for achieving success. The finest platforms offer sophisticated charting tools, real-time market data, and lightning-fast execution speeds, enabling traders to respond promptly to market fluctuations. A user-friendly interface, customizable features, and strong security protocols further refine the trading experience, making it suitable for both novices and experienced traders alike. Moreover, the inclusion of automated trading, social trading options, and an extensive variety of financial instruments empowers traders to carry out their strategies with accuracy. In this chapter, we will delve into a comparison of Pepperstone and Tradersway, evaluating how each broker excels in providing a superior trading experience and identifying which one holds the competitive advantage.

| Trading Platform | Pepperstone | Trader's Way |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

Our expert team created a software questionnaire with six questions to recommend the best trading platform for your style.

Metatrader

Pepperstone and Tradersway both offer MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. MT4 is popular for its user-friendly design and advanced charting, ideal for forex and CFD trading. MT5 enhances MT4 with more features like additional timeframes and improved order management, suitable for multi-asset trading. Both platforms allow customization, automated trading, and access to trading tools, helping traders optimize their strategies. Users benefit from technology-driven trading environments at both brokers.

Advanced Platforms

A robust trading platform significantly enhances a trader’s capacity to analyze markets, automate strategies, and leverage community insights for improved decision-making. A standout feature is social and copy trading, which empowers traders to replicate the moves of seasoned professionals. Pepperstone excels in this area, providing access to MyFxBook and ZuluTrade, allowing users to effortlessly follow and adopt successful trading strategies. In contrast, Tradersway lacks social and copy trading options, which may limit traders who thrive in a collaborative environment.

For those embracing automated trading, both Pepperstone and Tradersway provide VPS (Virtual Private Server) hosting, ensuring smooth execution of trading strategies with minimal latency. However, Pepperstone goes a step further with advanced tools like Autochartist, delivering real-time market analysis and pattern recognition, alongside API trading that enables the development and implementation of custom trading algorithms. These cutting-edge features give Pepperstone a technological advantage, positioning it as the preferred choice for traders in search of an advanced, automation-friendly trading environment.

Copy Trading

While MetaTrader 4 (MT4) and MetaTrader 5 (MT5) remain popular among traders, there is a growing demand for platforms that offer enhanced features, user-friendly interfaces, and advanced trading tools. Pepperstone stands out in this regard by providing access to cTrader, a cutting-edge platform renowned for its sleek design, rapid order execution, and sophisticated charting options. This platform is especially advantageous for algorithmic traders and scalpers, thanks to features like Depth of Market (DOM) visibility, one-click trading, and seamless integration with cAlgo for automated strategies. These tools empower traders to execute their trades with unrivaled precision and efficiency.

In contrast, Tradersway limits its offerings to MT4 and MT5, which, while robust, may not cater to traders who desire more advanced execution tools. Moreover, both Pepperstone and Tradersway do not support TradingView—a platform celebrated for its comprehensive charting capabilities, social trading features, and excellent broker integration. This limitation may pose challenges for traders who value TradingView’s collaborative environment. However, Pepperstone’s inclusion of cTrader presents a compelling alternative for those seeking a more sophisticated trading experience, complete with improved execution speed and automation functionalities.

Our dedicated team surmises that Pepperstone offers a wider range of trading platforms and tools, making it the better choice for traders who value flexibility and advanced features. For more details, you can check out our best forex demo accounts page.

Our Better Trading Platform Verdict

Pepperstone excels in this niche, this is in light of their better trading platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

3. Superior Accounts And Features – Tradersway

A well-structured trading account can make all the difference in a trader’s success. Pepperstone and Tradersway present a wide array of account types tailored to various trading styles, ranging from low-spread, commission-based alternatives to swap-free accounts. These brokers equip traders with essential tools such as demo accounts for practice, sophisticated charting software, and a broad selection of financial instruments. Moreover, features like social trading, automated trading, and prompt customer support elevate the overall trading experience, promoting efficiency and trader satisfaction. In this chapter, we will delve into how these account offerings influence trading performance and empower traders to unlock their full potential.

The landscape of forex trading is always evolving, and in this case Pepperstone and Tradersway offers features and platforms that will help traders with their trading.

For Pepperstone, they provide two primary account types:

- Standard Account: Features no commissions with a 1 pip markup on raw spreads, appealing to traders who prefer simplicity.

- Razor Account: Offers raw spreads starting from 0.0 pips on major currency pairs, with a commission of approximately $7 per round turn, catering to traders seeking tighter spreads.

Conversely, Tradersway offers a diverse range of account types to accommodate various trading preferences:

- MT4.VAR. Account: Provides variable spreads with no additional commissions, suitable for traders favoring a standard account structure.

- MT4.ECN. Account: Delivers tight variable spreads starting from 0 pips, with a commission of $3 per 100,000 USD turnover, appealing to those seeking ECN trading conditions.

- MT5.ECN. Account: Offers similar ECN conditions on the MetaTrader 5 platform, with spreads from 0 pips and a minimum deposit of $10.

- CT.ECN. Account: Provides ECN trading via the cTrader platform, featuring tight spreads and a minimum commission starting from $3 per 100,000 USD turnover.

These varied account offerings from both brokers enable traders to select options that best align with their trading styles and objectives.

| Pepperstone | Trader's Way | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

TradersWay excels in this category due to their superior accounts and features.

4. Best Trading Experience And Ease – Pepperstone

A truly seamless trading experience is anchored in cutting-edge platforms, rapid execution speeds, competitive spreads, and dependable customer support. Brokers that emphasize these crucial elements empower traders to make informed decisions, execute trades with accuracy, and manage their accounts effectively. Furthermore, an intuitive interface, extensive educational resources, and robust trading tools significantly boost both accessibility and profitability. In this chapter, we will delve into how Pepperstone and Tradersway stack up against each other in providing an exceptional trading environment tailored to fulfill the needs of both novice and seasoned traders.

A broker’s trading environment can significantly impact a trader’s performance. This includes factors like execution speeds, slippage, and server stability.

In the busy world of forex trading, Pepperstone distinguishes itself with exceptional execution speeds. Recent data shows that Pepperstone boasts an impressive average execution time of around 30 milliseconds, placing it among the fastest brokers in the industry. This swift execution significantly reduces slippage, guaranteeing that traders receive optimal prices for their orders.

Although Tradersway did not undergo formal execution speed tests, user feedback indicates a level of performance that meets expectations. The availability of platforms such as cTrader represents a significant advantage, featuring a sleek interface and enhanced execution speeds that are particularly attractive to traders who specialize in scalping or high-frequency trading.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| Tradersway | 198ms | 29/36 | 214ms | 32/36 |

Our Superior Accounts and Features Verdict

Based on our tests, Pepperstone outperforms in this section owing to their superior accounts and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Pepperstone

A secure and transparent trading environment is paramount for fostering trader confidence and ensuring market integrity. Regulated brokers adhere to stringent oversight, guaranteeing compliance with financial standards that safeguard traders against fraud, malpractice, and unfavorable trading conditions. Robust regulatory frameworks build trust, motivating traders to engage more actively while drawing a broader client base. In this chapter, we will explore how Pepperstone and Tradersway measure up in terms of regulatory compliance, security protocols, and overall reliability, emphasizing their dedication to protecting traders and upholding ethical trading practices.

Pepperstone Trust Score

Tradersway Trust Score

Trust and regulation are crucial factors when choosing a forex broker. Both Pepperstone and TradersWay are regulated by reputable authorities, but there are differences in their regulatory coverage.

| Criteria | Pepperstone | TradersWay |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) |

When attempting to do business in forex trading, regulatory oversight is vital for ensuring a secure and transparent environment. Pepperstone stands out as a premier brokerage due to its authorization and regulation by several prestigious financial authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, the Dubai Financial Services Authority (DFSA), and the Securities Commission of the Bahamas (SCB). This comprehensive regulatory framework enforces strict standards, ensuring that traders receive robust protection against fraud and malpractice.

In contrast, TradersWay is subject to the oversight of the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. While this provides a certain level of regulation, it lacks the recognition and rigor of authorities such as ASIC or the FCA. Additionally, the Commodity Futures Trading Commission (CFTC) has placed TradersWay on its RED List, highlighting that the firm is soliciting and accepting funds from U.S. customers without the necessary registration, which raises significant concerns regarding its regulatory compliance.

Our Stronger Trust and Regulation Verdict

Pepperstone dominates this niche, this is due to their stonger trust and regulation

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than Trader’s Way. On average, Pepperstone sees around 110,000 branded searches each month, while Trader’s Way gets about 8,100 — that’s 92% fewer.

| Country | Pepperstone | Trader's Way |

|---|---|---|

| Australia | 8,100 | 390 |

| Brazil | 6,600 | 30 |

| United Kingdom | 5,400 | 260 |

| United States | 4,400 | 2,900 |

| Malaysia | 4,400 | 20 |

| Thailand | 4,400 | 20 |

| Kenya | 4,400 | 40 |

| Germany | 3,600 | 70 |

| Hong Kong | 3,600 | 10 |

| Mexico | 3,600 | 40 |

| Colombia | 3,600 | 70 |

| India | 2,900 | 1,000 |

| South Africa | 2,900 | 320 |

| Italy | 1,900 | 30 |

| Spain | 1,900 | 40 |

| Mongolia | 1,900 | 10 |

| Singapore | 1,600 | 10 |

| Turkey | 1,600 | 20 |

| Indonesia | 1,600 | 30 |

| Peru | 1,600 | 20 |

| Pakistan | 1,300 | 90 |

| Nigeria | 1,300 | 90 |

| Argentina | 1,300 | 20 |

| Bolivia | 1,300 | 10 |

| France | 1,000 | 390 |

| Taiwan | 1,000 | 10 |

| United Arab Emirates | 1,000 | 20 |

| Chile | 1,000 | 10 |

| Ecuador | 1,000 | 20 |

| Netherlands | 880 | 50 |

| Philippines | 880 | 20 |

| Dominican Republic | 880 | 10 |

| Canada | 720 | 320 |

| Vietnam | 720 | 10 |

| Morocco | 720 | 10 |

| Poland | 720 | 30 |

| Tanzania | 720 | 50 |

| Portugal | 480 | 20 |

| Japan | 480 | 20 |

| Cyprus | 480 | 20 |

| Costa Rica | 480 | 10 |

| Sweden | 390 | 10 |

| Algeria | 390 | 10 |

| Bangladesh | 390 | 40 |

| Egypt | 390 | 20 |

| Botswana | 390 | 20 |

| Uganda | 390 | 10 |

| Ethiopia | 390 | 10 |

| Venezuela | 390 | 10 |

| Austria | 320 | 10 |

| Switzerland | 320 | 20 |

| Sri Lanka | 320 | 10 |

| Cambodia | 320 | 10 |

| Panama | 320 | 10 |

| Saudi Arabia | 260 | 10 |

| Ireland | 260 | 10 |

| Ghana | 260 | 20 |

| Jordan | 260 | 10 |

| Greece | 210 | 10 |

| New Zealand | 170 | 10 |

| Uzbekistan | 140 | 10 |

| Mauritius | 110 | 10 |

2024 Monthly Searches For Each Brand

Pepperstone - Australia

Pepperstone - Australia

|

8,100

1st

|

Trader's Way - Australia

Trader's Way - Australia

|

390

2nd

|

Pepperstone - Brazil

Pepperstone - Brazil

|

6,600

3rd

|

Trader's Way - Brazil

Trader's Way - Brazil

|

30

4th

|

Pepperstone - US

Pepperstone - US

|

4,400

5th

|

Trader's Way - US

Trader's Way - US

|

2,900

6th

|

Pepperstone - Mexico

Pepperstone - Mexico

|

3,600

7th

|

Trader's Way - Mexico

Trader's Way - Mexico

|

40

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 20,000 for Trader’s Way.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

A vast and wide range of financial instruments is important for optimizing trading opportunities and adapting to continuously evolving market conditions. Brokers that provide a comprehensive range of CFDs—including forex pairs, commodities, indices, and cryptocurrencies—enable traders to diversify their portfolios and seize various market trends. This diversity not only enhances flexibility but also supports a range of trading strategies, from hedging to speculative approaches. In this chapter, we will examine the product offerings of Pepperstone and Tradersway, ensuring that traders are well-equipped to access the best market opportunities available.

When trading, always rememaber that the breadth of a broker’s product offerings significantly influences a trader’s ability to diversify and capitalize on various market conditions. Pepperstone stands out with an extensive array of financial instruments. Traders have access to over 90 currency pairs, encompassing major, minor, and exotic pairs, allowing for comprehensive forex market engagement. Beyond forex, Pepperstone offers more than 1,200 CFDs across diverse asset classes, including commodities, indices, cryptocurrencies, and shares. This extensive selection enables traders to implement varied strategies, from hedging to speculative trading, across multiple markets.

Conversely, Tradersway provides a more limited range of instruments. The broker offers 41 forex pairs, which, while covering essential currency pairs, may not satisfy traders seeking broader exposure. In terms of CFDs, Tradersway’s offerings are comparatively modest, with fewer options in commodities, indices, and cryptocurrencies. Notably, the absence of share CFDs and ETFs may limit diversification opportunities for traders interested in equity markets. This narrower product range could constrain the adaptability of trading strategies, especially for those aiming to leverage a wide spectrum of market opportunities.

In summary, while both brokers provide essential tools for forex and CFD trading, Pepperstone’s expansive product suite offers traders a more versatile platform to navigate and capitalize on global financial markets.

Comparison Table:

| CFDs | Pepperstone | Tradersway |

|---|---|---|

| Forex Pairs | 93 | 41 |

| Indices | 26 | 7 (MT4) |

| Commodities | 40 Commodities 15 Metals, 4 Energies, 16 Softs, 5 Hard | 2 Metals 2 Energies |

| Cryptocurrencies | 27 | 9 |

| Share CFDs | 1,200+ | 0 |

| ETFs | 108+ | 0 |

| Bonds | 0 | 0 |

| Futures | 42 | 0 |

| Treasuries | 0 | 0 |

| Investments | 0 | 0 |

From the table above, it’s evident that Pepperstone has a broader range of products and CFD markets compared to Trader’s Way. This extensive offering ensures that traders have a wide variety of options to choose from, catering to different trading preferences and strategies.

Our Top Product Range and CFD Markets Verdict

Pepperstone ranks highest in this specialty, thanks to their top product range and CFD markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

For new and seasoned traders, always remember that comprehensive educational resources are crucial for traders looking to refine their strategies and improve decision-making. Pepperstone and TradersWay both offer educational content for traders, yet their resources differ significantly in depth and accessibility. Pepperstone excels with a vast array of webinars, in-depth articles, market analysis, and video tutorials that cater to traders at all levels. It also features structured forex courses and guides covering a wide spectrum from fundamental analysis to advanced trading techniques. This comprehensive educational framework empowers traders to stay informed about the latest market trends and sharpen their trading skills.

In contrast, TradersWay presents a more limited selection of educational materials. While it does provide basic trading guides and articles, it notably lacks the extensive webinar series and structured courses that Pepperstone offers. For traders who thrive on continuous learning and valuable market insights to enhance their trading strategies, Pepperstone’s superior educational resources represent a distinct advantage. Moreover, access to real-time market analysis and expert insights enriches the learning experience, enabling traders to adapt to changing market conditions effectively.

In summary, although both brokers supply educational resources, Pepperstone delivers a more thorough and supportive educational experience for traders at every stage of their journey. For individuals who prioritize structured learning, advanced market insights, and interactive educational methods, Pepperstone emerges as the clear choice.

Pepperstone:

- Offers a comprehensive range of educational materials.

- Provides webinars, seminars, and trading guides.

- Features a dedicated section for beginner traders.

- Has an extensive FAQ section addressing common queries.

- Offers video tutorials on various trading topics.

- Collaborates with professional traders for expert insights.

Trader’s Way:

- Provides a basic set of educational resources.

- Features occasional webinars and seminars.

- Offers trading guides tailored for intermediate traders.

- Has a limited FAQ section.

- Lacks in-depth video tutorials.

- Does not collaborate with trading experts for insights.

Our Superior Educational Resources Verdict

Based on our team’s testing, Pepperstone takes the crown in skillset, this is in light to their superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

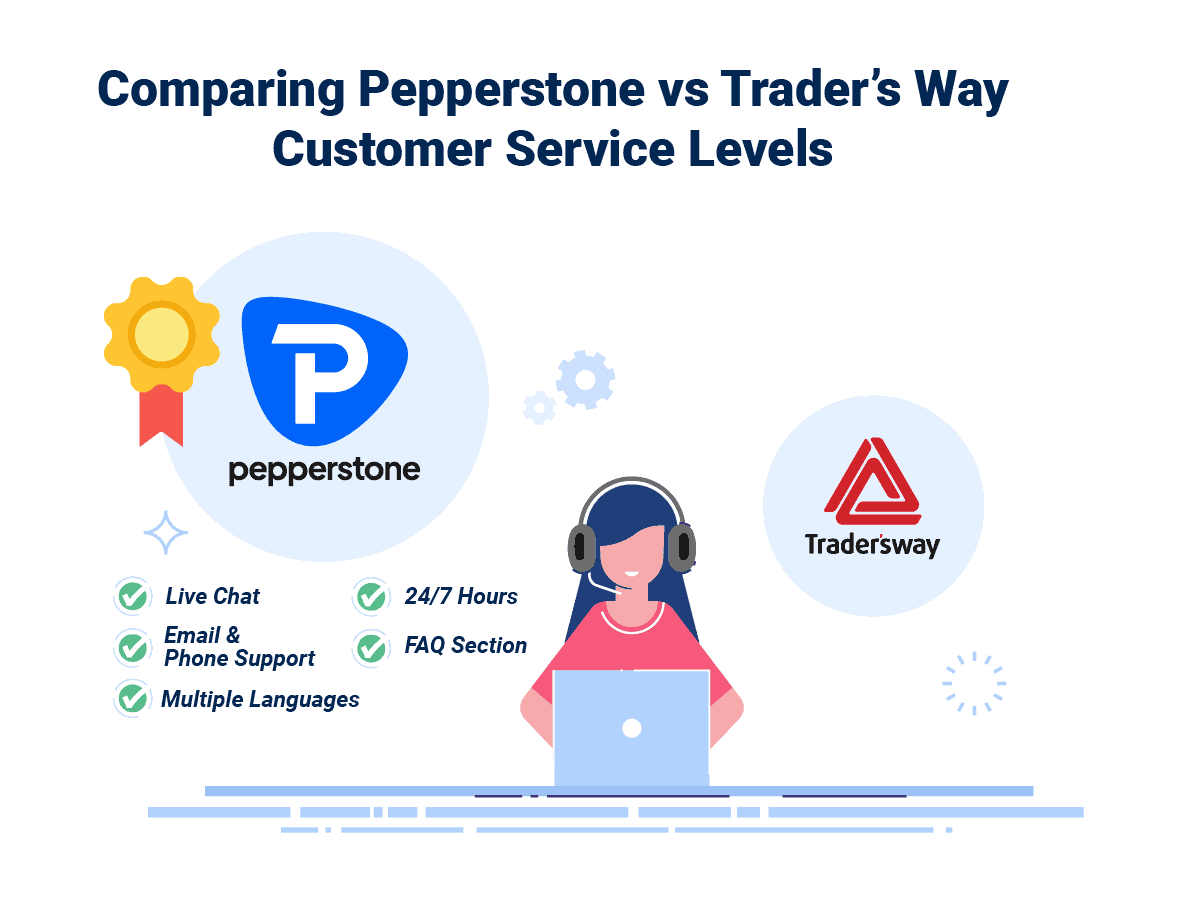

9. Superior Customer Service – Pepperstone

Before you do your trading in forex, please take note that superior customer support plays a crucial role in ensuring a seamless trading experience. Brokers offering 24/7 support via live chat, phone, and email help traders navigate markets confidently, minimizing disruptions. Quick assistance resolves issues in real time, reducing downtime and losses. Multilingual support enhances accessibility for global traders. Exceptional customer service fosters satisfaction, trust, and loyalty, giving brokers a competitive edge in the forex industry.

In forex trading, reliable customer support is essential for traders navigating fast-moving markets, technical challenges, and account management. Pepperstone and TradersWay both offer a variety of support channels, including live chat, email, and phone assistance, ensuring that traders can seek help whenever they require it. The notable distinction between the two lies in their availability: TradersWay provides 24/7 support, while Pepperstone operates customer service from Monday to Friday, aligning with major trading hours. This difference makes TradersWay a more convenient option for traders in diverse time zones who may need assistance over the weekends.

User feedback indicates that both brokers deliver responsive and effective support, yet Pepperstone consistently receives acclaim for its professionalism and extensive market knowledge. Their support team is recognized for offering well-informed responses, particularly regarding technical issues and trading queries. Such expertise is vital for traders looking for guidance on market dynamics, platform challenges, or advanced trading strategies. While TradersWay ensures continuous support, some traders have noted that response times can fluctuate based on the nature of the inquiry.

In the end, the caliber of customer support can greatly influence a trader’s experience and overall confidence in their broker. Although both brokers excel in this aspect, Pepperstone’s solid reputation for professionalism and expertise provides it with an advantage, making it the preferred choice for traders seeking knowledgeable and efficient service.

| Feature | Pepperstone | Tradersway |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

While both brokers offer good customer service, Pepperstone come up trumps in this forte, this is on account of their superioor customer service.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

In forex trading, seamless deposit and withdrawal options are essential for maintaining efficiency and liquidity. Brokers with diverse funding methods like bank transfers, credit/debit cards, e-wallets, and cryptocurrencies offer traders flexible account management. Fast processing and low fees enhance the experience, ensuring quick fund access. These options significantly impact traders, fostering trust and reliability in a competitive forex market.

Pepperstone and TradersWay both offer a variety of funding options such as bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. What sets Pepperstone apart is its inclusion of PayPal, a highly utilized and secure payment method that significantly enhances transaction flexibility for traders. Each broker is committed to ensuring quick deposits and withdrawals; however, Pepperstone does not impose any funding fees, while TradersWay’s fees may fluctuate based on the payment provider.

In addition to diverse funding choices, Pepperstone provides advanced features like social trading, automated trading, and a comprehensive educational section tailored for traders seeking strategic tools and market insights. In contrast, TradersWay appeals to those with a higher risk tolerance by offering increased leverage. While such leverage can magnify potential gains, it also heightens exposure to risk, underscoring the importance of careful risk management.

| Funding Option | Pepperstone | Tradersway |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

Clearly, Pepperstone steals the show in this niche as a result of their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

A low minimum deposit in forex trading removes financial barriers, allowing more traders—especially beginners—to enter the market with minimal risk. Brokers promote inclusivity by allowing smaller initial investments, encouraging participation from those with limited capital. This approach fosters skill development and strategy testing before larger commitments. Flexible deposit requirements attract diverse clients, enhancing the trading experience with robust tools and education, making forex trading more accessible and sustainable.

When it comes to minimum deposit requirements, both Pepperstone and TradersWay provide flexible options that cater to different types of traders. Pepperstone offers a unique advantage by allowing traders to open accounts without a mandatory minimum deposit, empowering them to manage their investment according to their personal budget and risk appetite. This flexibility is especially attractive to those who want full control over their initial capital while still benefiting from competitive trading conditions. Although Pepperstone suggests a recommended starting deposit of $200 to optimize the use of its sophisticated trading tools and features, the absence of a strict minimum deposit is a key selling point.

In contrast, TradersWay distinguishes itself with an exceptionally low minimum deposit requirement of just $10, positioning itself as one of the most accessible brokers for traders with limited financial resources. This minimal entry threshold is perfect for beginners eager to gain practical market experience without significant financial pressure. While both brokers offer leveraged trading and a variety of account options, TradersWay’s low deposit requirement is particularly appealing to high-risk traders who wish to test and refine their strategies on a smaller scale before increasing their investments.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| Tradersway | $0 | $10 |

Our Lower Minimum Deposit Verdict

Again, Pepperstone ranks highest in this niche, this is due to their lower minimum deposit.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: Trader’s Way or Pepperstone?

Pepperstone undoubtedly emerges victorious in this category as a result of consistently outperforms Trader’s Way in most of the key areas that traders value the most, such as spreads, trading platforms, educational resources, and regulation.

The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | Tradersway |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Best For Beginner Traders

Trader’s Way is better suited for beginner traders due to its low minimum deposit and higher leverage options.

Best For Experienced Traders

Pepperstone is the ideal choice for experienced traders owing to its advanced trading platforms, fast execution speeds, and competitive trading costs.

FAQs Comparing Pepperstone Vs Trader's Way

Does Trader's Way or Pepperstone Have Lower Costs?

Pepperstone generally has lower trading costs. For instance, Pepperstone’s average spread on the EUR/USD pair is 1.16 pips, while TradersWay’s is 1.4 pips. Pepperstone also offers competitive spreads on its standard account. For a more detailed comparison on costs, you can visit our lowest spread forex brokers.

Which Broker Is Better For MetaTrader 4?

Both Pepperstone and Trader’s Way offer MetaTrader 4, one of the most popular trading platforms in the forex industry. However, Pepperstone is often praised for its advanced features and seamless integration with MT4. For traders who prioritize using MT4, you can check out our comprehensive list of the best MT4 brokers.

Which Broker Offers Social Trading?

Pepperstone offers social and copy trading through platforms like MyFxBook and ZuluTrade. This allows traders to emulate the strategies of successful traders. Trader’s Way, on the other hand, does not offer social or copy trading. For those interested in social trading platforms, here’s a guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting for UK-based clients. This tax-efficient form of trading allows traders to speculate on price movements without owning the underlying asset. Trader’s Way, however, does not provide spread betting services. For those interested in exploring spread betting further, you can check out our guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is the superior choice for Australian forex traders. Founded in Melbourne, Pepperstone is ASIC-regulated, ensuring a high level of trust and security for its clients. Trader’s Way, on the other hand, is based overseas and lacks the local presence and reputation that Pepperstone has built in Australia. For a comprehensive list of top brokers in Australia, you can visit our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

From my perspective, Pepperstone stands out as the superior broker for UK forex traders. While both brokers offer services to UK clients, Pepperstone is FCA-regulated, ensuring robust protection and security measures for traders. Trader’s Way, being founded overseas, doesn’t have the same local reputation in the UK. For those looking to explore the Best Forex Brokers In UK, here’s our guide on the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert