Best MT4 Brokers For UK Trading

Many forex brokers offer the MetaTrader 4 (MT4) forex trading platform in the UK. When choosing an MT4 broker, look for an FX broker that offers fast execution, a range of CFDs and currency pairs and low spreads.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Our top UK forex broker offering MetaTrader 4 list is:

- Pepperstone - Best MT4 Broker In UK

- XTB - Top MT4 Broker With Low Spreads

- ThinkMarkets - Good MT4 Broker For Zero Spreads

- FXCM - Best MT4 Broker For High Volume Traders

- City Index - Best No Commission MT4 Forex Broker

- FxPro - Great MT4 Fixed Spreads Forex Broker

- FOREX.com - MT4 Forex Broker With Good Research Tools

- AvaTrade - Best Day Trading Broker With MT4 Platform

- IG Group - MT4 Forex Broker With Top Range of Markets

What is the best MT4 broker in the UK?

Pepperstone offers lowest RAW spreads of 0.1 pips on EUR/USD, £2.25 commissions, 77ms limit order execution, and Smart Trader Tools package with additional indicators under FCA regulation. We tested MT4 performance and trading tools across multiple UK brokers.

1. Pepperstone - The Best MT4 Broker In UK

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We recommend Pepperstone because it offers one of the lowest RAW spreads of just 0.1 pips for the EUR/USD pair. This, combined with the low commission of £2.25 makes Pepperstone a very cost-effective forex broker with MetaTrader 4 as well as with the MetaTrader 5, cTrader and TradingView trading platforms.

In our tests done by Ross Collins on the broker’s performance with MT4, we discovered that Pepperstone has one of the fastest order execution speeds of just 77ms for limit orders.

Pepperstone also received a perfect 10/10 score in our customer service test thanks to its highly responsive and helpful support team that’s available 24/7.

Pros & Cons

- MT4, MT5, TradingView and cTrader Platforms

- Good 3rd party tools like DupliTrade Offers an interest-free Islamic account

- Supports 10 different base currencies

- Winner for fastest execution speed

- Lack of educational resources

- Lack of e-wallet funding options

- Demo account is limited to 90 days

Broker Details

Pepperstone Uses MT4’s Trading Tools And Features To Avail Of Low Spreads On The Wide Array Of Financial Products

Pepperstone is a MetaTrader 4 (MT4) broker that is regulated by top-tier financial authorities including the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC), the Dubai Financial Services Authority (DFSA), the Cyprus Securities and Exchange Commission (CySEC) as well as in Kenya (CMA), Germany (BaFin), and the Bahamas (SCB).

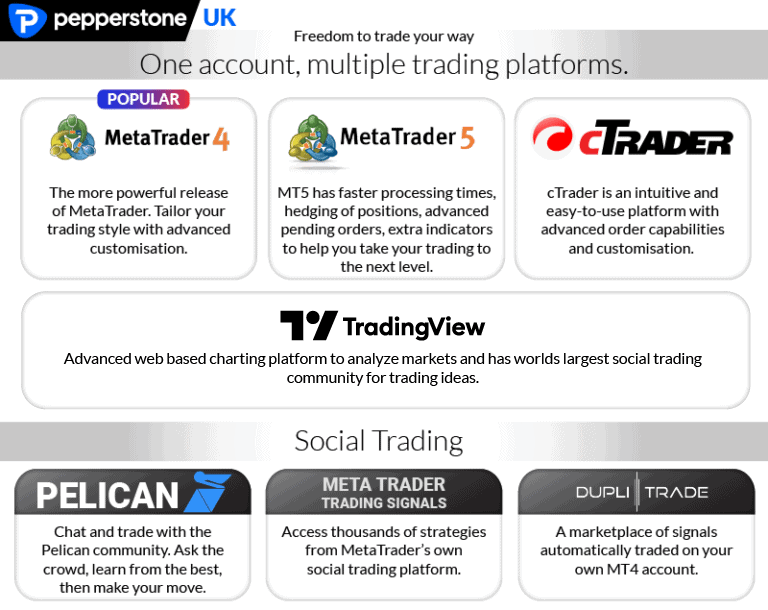

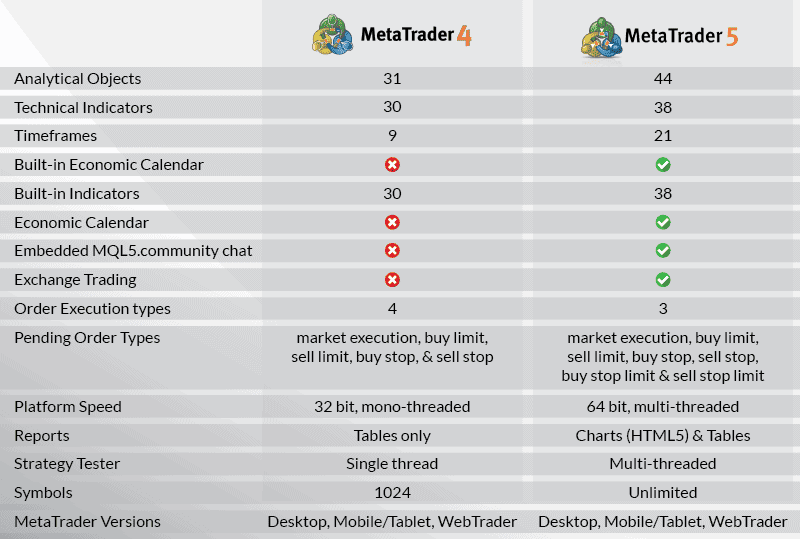

The broker also offers MetaTrader 5 (MT5) as a trading platform option along with cTrader – you can learn more about the difference between MetaTrader 4 vs MetaTrader 5 and cTrader vs MT4, but MetaTrader 4 (MT4) is generally the most popular choice due to its large forex community, professional-grade trading environment and sophisticated range of tools and features. Overall, Pepperstone is the best MT4 broker due to three key strengths:

- Low Forex Spreads

- Excellent Trading Conditions

- MetaTrader 4 Trading Tools

1. Tight ECN-Like Spreads

When trading with Pepperstone, customers can choose from two main trading accounts. The Standard Account is commission-free and has spreads from 1.0 pips, and the Razor Account, with tighter spreads starting from 0.0 pips, requires you to pay a flat rate commission fee of £4.59 round turn for each standard lot. Pepperstone recommends an initial minimum deposit of $200 for both account types.

Additional features available to both Standard and Razor trading accounts using MetaTrader 4 include:

- GBP, USD, EUR or CHF trading accounts base currency.

- Leverage up to 30:1 (retail accounts) and 500:1 (professional accounts) when trading major forex pairs

- Hedging and scalping

- Minimum trade size of 0.01 lots, maximum 100 lots.

- Account funding via Visa, Mastercard or bank transfer

Pepperstone’s Razor Account

The broker’s ECN-style account is suited to those executing scalping, day trading and Expert Advisor trading strategies or those wanting Pepperstone’s lowest trading costs. As spreads are ultra-tight, Razor account holders pay commission fees on top of the spread as compensation to Pepperstone for facilitating trading. Commission costs are £4.59 round turn per 100,000 traded.

Pepperstone offers the lowest spreads across all five major currency pairs compared to the best forex brokers. For instance, Pepperstone customers can trade average spreads of 0.13 pips for the USD/JPY FX pair, while those trading with the London Capital Group is offered at 0.40 pips.

With tight spreads and competitive commission fees, Razor account holders pay low trading costs. Overall, Pepperstone’s Razor Account is great for UK traders wanting access to an institutional-grade trading environment with ECN pricing.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Pepperstone’s Standard Account

Standard Account types are excellent for those new to trading who want easy entry into forex and CFD markets. With no commission fees, Standard account holders can avoid complex fee calculations and easily forecast trading costs. As Pepperstone’s compensation is included in the spread, Standard accounts trade with wider spreads than commission-based Razor accounts.

As shown below, Pepperstone’s commission-free spreads are significantly tighter than competing forex brokers. For the EUR/USD currency pair, brokers such as FXTM offer 2.00 pips, while Pepperstone clients can trade average spreads of 1.13 pips. Likewise, Pepperstone averages 1.33 pips for the USD/JPY FX pair, while XM offers 3.30 pips – nearly 2 full pips wider.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

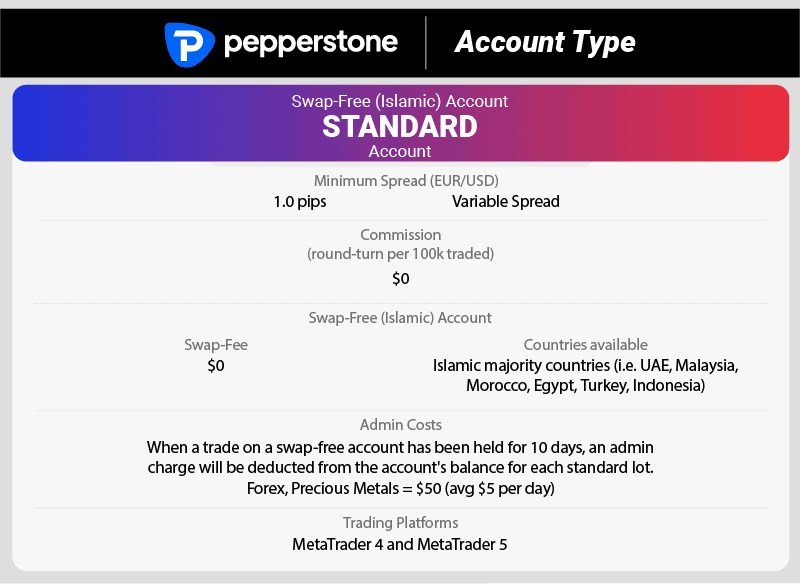

Swap Rates And Swap-Free Accounts

As with most forex brokers, Pepperstone charges overnight financing fees (swap rates) on positions held open for longer than one day. Swap rates are interest-based fees and credits calculated using the interest rate differentials of each currency involved in the trade.

For those following Islamic finance practises and unable to pay or receive interest-based payments, Pepperstone offers a Swap-free Account (similar to an Islamic trading account). Swap-free accounts follow the broker’s standard account structure, with minimum spreads of 1.0 pip and no commission fees. Although account holders do not incur interest-based swap charges, positions held longer than ten days will have an admin charge between 1-50 USD, depending on the currency pair held.

2. Trading Conditions And Execution

Pepperstone is a no dealing desk (NDD) broker that executes orders with straight-through-processing (STP). As an NDD and STP broker, Pepperstone fills clients’ orders using external liquidity providers such as top-tier banks and financial institutions. Using quality and external sources of liquidity enables the broker to offer institutional-grade pricing to retail investor accounts.

As well as ECN-style spreads, Pepperstone partnered with the Equinix Data Centre to ensure ultra-fast order execution on the MT4 platform. Equinix hosts Pepperstone’s servers in New York’s financial district, with low latency reducing slippage and increasing execution speeds.

Pepperstone execution infrastructure uses the best fibre optic cable to achieve average execution speeds of 30ms. Fast execution reduces the likelihood of slippage, which means you will likely get the buy and sell price quoted by the provider.

3. MetaTrader 4 Trading Tools And Features

One feature that makes MetaTrader 4 (MT4) so popular is the automated trading features and advanced analysis tools. Depending on your preferred trading device, MT4 is available as a desktop platform, mobile app, or WebTrader platform online.

- MT4 desktop trading platform: Mac and PCs.

- MT4 WebTrader: Accessible from any browser.

- MT4 mobile apps: iOS trading apps for iPhones and iPads can be downloaded from Apple’s app store. The Android app is available on Google Play Store.

As a Pepperstone client using MT4, you gain access to most financial products the broker offers. Apart from Share CFDs, Pepperstone’s entire product range includes forex, indices, and commodity CFDs. Due to recent changes to FCA forex trading rules, retail traders can no longer trade cryptocurrencies in the UK. Crypto trading with products such as Bitcoin or Bitcoin Cash is restricted to professional traders only.

Automated Trading Strategies

MT4 users can develop and run Expert Advisors (trading robots/algorithms) or use MT4 or third-party social-copy trading services to automate trading. Both algorithmic and social-copy trading can significantly reduce the time spent conducting technical analysis and researching financial markets. As well as saving time, automated trading removes the emotion from trading, which may benefit beginner traders about to start.

Expert Advisors

To execute algorithmic trading strategies using Expert Advisors (EAs), Pepperstone’s MT4 customers can write and develop their own using the MQL4 programming language or download free or paid EAs from MetaTrader’s Marketplace online.

To optimise Expert Advisors, the MT4 platform offers backtesting features where traders can test EAs against historical data. MT4’s backtesting is single-threaded, and only one currency pair can be tested simultaneously.

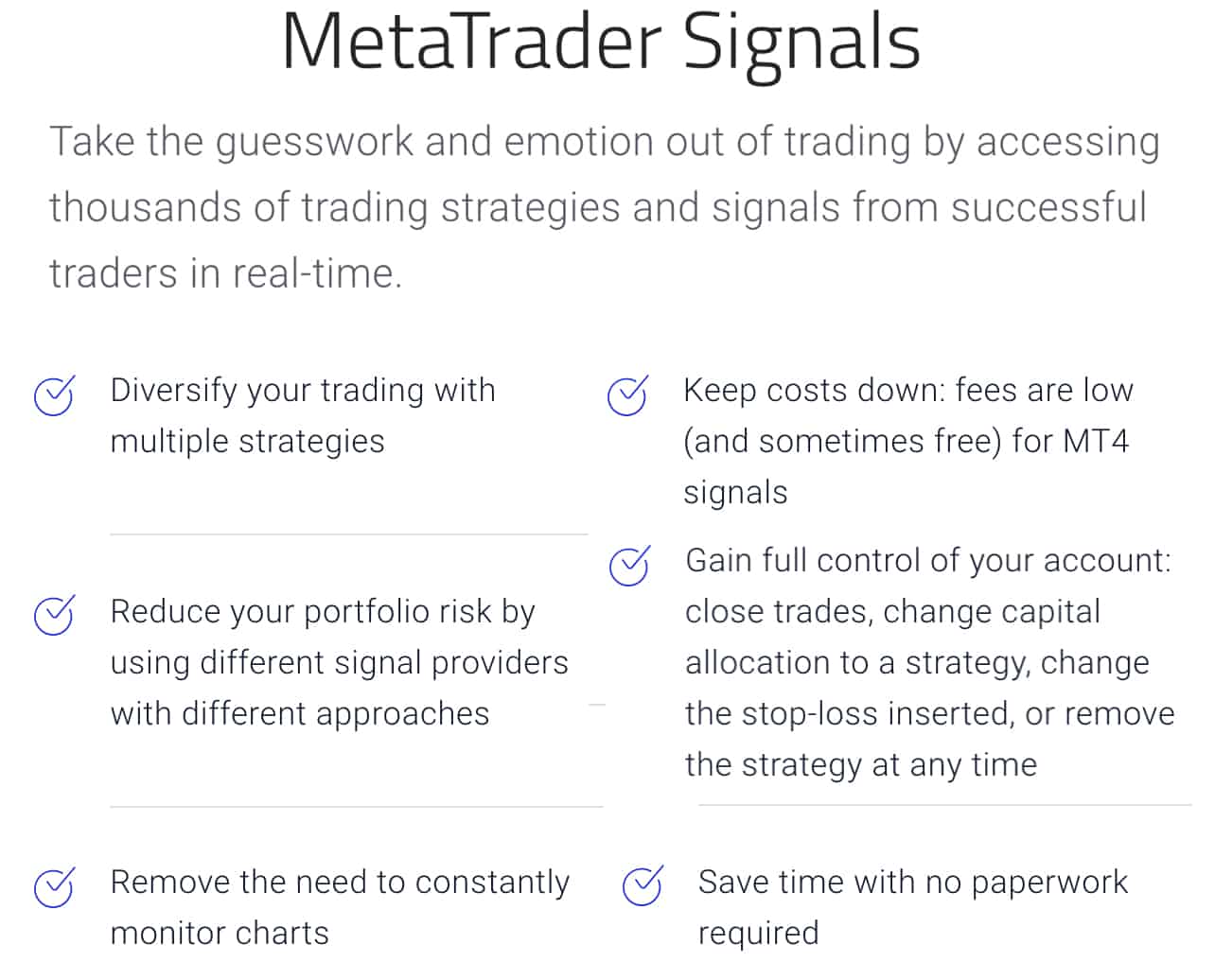

Social-Copy Trading

Social-copy trading is an excellent option for novice traders wanting to learn more about forex trading from experienced investors. MetaQuotes proprietary account mirroring service, MetaTrader Signals, is available to all Pepperstone UK customers using MT4. You can copy seasoned traders’ trades, strategies and signals, eliminating the constant need to monitor financial markets while learning from the best.

Charting Tools

The wide range of trading tools (such as charting, technical analysis, and risk management tools) allow users to develop complex strategies on the MT4 platform. Inbuilt technical analysis, charting, and risk management tools include:

- 30 technical indicators

- 24 graphical objects

- 9 timeframes

- Stop and limit pending order types

- Stop loss and take profit

- Alerts and notifications (desktop platform and mobile apps only)

As well as the pre-installed trading tools, Pepperstone offers MT4 add-ons such as additional indicators and the broker’s Smart Trader Tools package. To supplement MT4’s pre-installed charting tools, users can download 2,000 free and 700 paid technical indicators from the MetaTrader Marketplace online.

Pepperstone’s MT4 Smart Trader Tools

The broker’s Smart Trader Tools is a free add-on package for Pepperstone MT4 users. Comprising 28 additional technical indicators and Expert Advisors, Smart Trader Tools enhance your trading environment with different order and risk management tools and market data and analysis features. To learn how to use the broker’s various add-ons, you can explore Pepperstone’s educational resources, which range from tutorials to webinars.

Pepperstone’s Demo Account

A demo account is available to explore the MT4 platform and unique trading tools offered by Pepperstone. MT4 users can access demo accounts for 30 days, with the broker providing $50,000 in virtual funds. The virtual account balance allows beginner and experienced traders to practise different trading CFDs and forex within a risk-free environment before signing up for a live account.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money with Pepperstone’

2. XTB - Top MT4 Broker With Low Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.09 GBP/USD = 0.14 AUD/USD = 0.13

Trading Platforms

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

Our tests found that XTB offers some of the lowest RAW spreads on the market like 0.09 pips average for EUR/USD and 0.13 pips average for GBP/USD. Not only are spreads low, but the broker promises no requotes for transparency.

Trading can be via MT4 or xStation 5 but regardless of the platform, you can trade choose from 71 currency pairs, 33 indices, 28 commodities, 40 crypto among others.

Pros & Cons

- Supports a variety of payment options

- Offers a swap-free Islamic account

- Multi-regulated throughout EU and the UK

- Customer support works on 12/5 schedule

- Lacks proper educational resources

- Charges a €10 monthly inactivity fee

Broker Details

XTB Allows Trading Of Various CFD Products With MT4

When trading CFDs with XTB, you can choose three asset classes – forex, indices, and commodities. Although the broker also offers shares and ETFs, these asset classes are only available on the broker’s proprietary trading platform (xStation 5), not MetaTrader 4 (MT4).

The broker offers two account types depending on your desired commission fee structure. If you want to trade forex with simple pricing, XTB’s Standard Account is commission-free. The broker’s Pro account is charged flat-rate commission fees, yet you can access tighter spreads.

Forex

XTB provides access to over 57 different forex markets when using MT4. As discussed above, the broker’s two account types offer different average spreads:

- Standard Account: Average spreads of 0.7 pips (EUR/USD) with no commission fees.

- Pro Account: Average spreads of 0.3 pips (EUR/USD) + £6 round turn commission fee.

Due to the high-risk nature of forex trading, the FCA allows higher leverage for frequently traded major currency pairs and enforces lower leverage caps for less commonly traded forex pairs. When trading major forex pairs with XTB, such as the GBP/JPY, EUR/USD, and GBP/CAD, maximum leverage is capped at 30:1, while minor and exotic currency pairs, such as the NZD/CHF or USD/PLN, the maximum leverage offered by XTB is limited to 20:1.

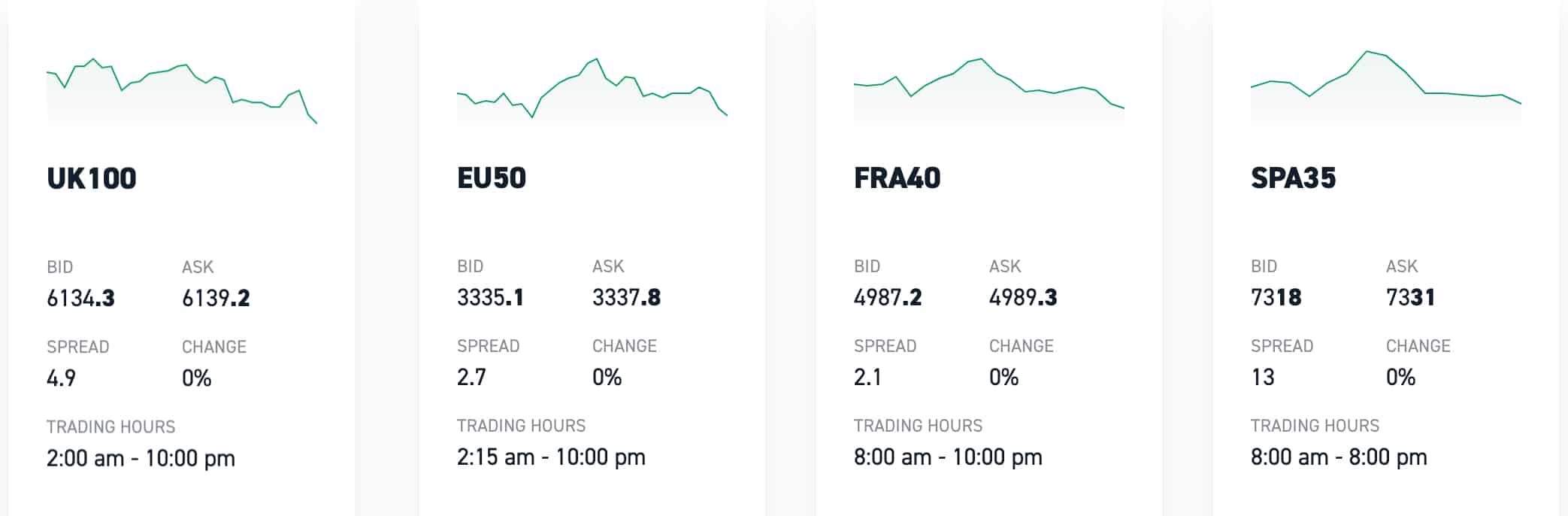

Indices

Like forex trading, XTB’s Pro account holders trading commodities and indices are charged a round-turn commission fee of £6. Standard accounts can trade commodities and index CFDs commission-free.

Over 37 index CFDs derived from major financial exchanges around the globe are offered by the broker. Although the FCA allows maximum leverage of 20:1 when trading indices, limits vary between financial products. For example:

- Maximum leverage of 20:1 on the world’s largest indices, i.e. UK100, US500, and JAP255

- 10:1 leverage for less commonly traded indices such as ITA40, SPA35, RUS50, NED25 and USCANNA (US Cannabis Index)

- 5:1 for high-risk indices like VOLX (Volatility Index) and the USDIDX (US Dollar Index)

Commodities

XTB offers access to 22 different commodity CFDs. Apart from a few specific asset classes (gold, emissions, and government-issued financial securities), MT4 users are not charged overnight financing fees when trading commodities. Maximum leverage of 20:1 available.

Commodity CFDs derived from Gold permit leverage up to 20:1, while those trading emission contracts, T-Notes, or Bonds can use maximum leverage of 5:1. XTB’s full range of commodity CFDs is shown in the table below:

| Gold | Silver | Platinum | Palladium | Aluminium |

| Zinc | Copper | Cocoa | Coffee | Corn |

| Cotton | Soybean | Sugar | Wheat | TNOTE (Treasury Note, US Govt) |

| BUND10Y (10 Yr Bond, German Govt) | SCHATZ2Y (2 Yr Bond, German Govt) | NICKEL | Oil | OIL.WTI (Crude Oil) |

| EMISS (C02 Emissions) | NATGAS (Natural Gas) |

MT4 Demo Account

To practise trading forex, commodities, and indices on MT4, XTB offers an excellent demo account with a £100,000 virtual trading balance.

*Your capital is at risk ‘75% of retail CFD accounts lose money with XTB’

3. ThinkMarkets - Good MT4 Broker For Zero Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

ThinkMarkets is a no-dealing desk broker that offers a low average RAW spread of just 0.1 pips for the EUR/USD pair.

Ross Collins from our team also tested its ThinkZero account and the broker was at zero pips spread 97.93% of the time, outside of the rollover period.

While the minimum deposit for ThinkZero is high, we do like the ability to trade using MT5, MT5 and the in-house developed Thinktrader. Overall we gave them a score of 66/100.

Pros & Cons

- Responsive 24/7 customer support

- 4-star rating on Trustpilot

- Low commission of just £2.50

- Relatively low spreads on standard account

- Doesn’t offer an Islamic account

- $500 minimum deposit for the ThinkZero account

- No option for cent accounts

Broker Details

ThinkMarkets Allows Tax-Exempt Gains From Spread Betting On MT4

ThinkMarkets FCA regulated branch offers spread betting to the United Kingdom and Northern Ireland residents. Similarly to CFD trading, spread betting allows investors to speculate on the price movements of a financial instrument without buying or selling the physical asset.

Benefits Of Spread Betting

The key difference between spread betting and trading CFDs is that spread betting is more tax-efficient. While any profit from trading CFDs is exempt from stamp duty, the gains are subject to Capital Gains Tax (CGT). On the other hand, profits from spread betting are exempt from both stamp duty and CGT. You can learn more on the best MT4 spread betting broker page.

MT4 Spread Betting Product Range

When spread betting with ThinkMarkets, the pricing structure is similar to the broker’s standard account type, where traders pay no additional commission fees on top of the spread. Spread betting is offered for four asset classes, with the following financial instruments available:

- Major currency pairs: Minimum spreads of 0.8 pips with 30:1 leverage:

- EUR/USD, USD/JPY, GBP/USD, USD/CHF, EUR/AUD, EUR/CAD, EUR/CHF, EUR/GBP, EUR/JPY, GBP/CAD, GBP/CHF, GBP/JPY, and USD/CAD.

- Minor and exotic FX pairs: Minimum spreads from 0.8 pips with 20:1 leverage:

- AUD/CAD, EUR/NOK, EUR/NZD, GBP/AUD, GBP/NZD, NZD/CAD, NZD/CHF, NZD/JPY, NZD/USD, USD/CNH, USD/NOK, USD/SGD, USD/TRY and USD/ZAR.

- Indices: Target spreads starting from 0.9 pips with 20:1 maximum leverage:

- ASX, CAC, DAX, FTSE, S&P, DOW, ESTX and Nikkei.

- Metals: Average spreads of 20 cents with a maximum leverage of 20:1 for Gold and average spreads of 3 cents with max leverage of 10:1 for Silver:

- XAU/USD and XAG/USD.

- Commodities: Spreads averaging 0.04-0.05 points with 10:1 maximum leverage:

- WTI Crude Oil and Brent Crude Oil.

MT4 And Spread Betting

When spread betting on MT4 with ThinkMarkets, which is included in our list of MT4 spread betting brokers in the UK, traders gain access to the same technical analysis and trading tools as those using the platform for CFD trading. To establish whether CFD trading or spread betting is your best trading style, ThinkMarkets offers a demo account for MetaTrader 4.

*Your capital is at risk ‘72.55% of retail CFD accounts lose money with ThinkMarkets’

4. FXCM - Best MT4 Broker For High Volume Traders

Forex Panel Score

Average Spread

EUR/USD = 0.3 GBP/USD = 0.9 AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$300

Why We Recommend FXCM

With FXCM, you’ll get a $25 rebate for every million USD you trade in a month, at tier 5. So, if you trade 400 million, you’ll get $10,000 back, which would cover a significant portion of your trading costs such as commission. Because of this, we recommend the broker to high-volume MT4 traders.

At 0.6 pips, FXCM also has an average RAW spread for the EUR/USD pair that is 0.6 pips lower than the industry average.

Pros & Cons

- Regulated by 7 different institutions

- Supports many different payment options

- Offers large rebates to active traders

- Has a good in-house trading platform

- $300 minimum deposit for standard account

- Customer support is not available on weekends

- Needs better educational resources

Broker Details

FXCM Clients Copy Trade Using MT4’s Account Mirroring Services

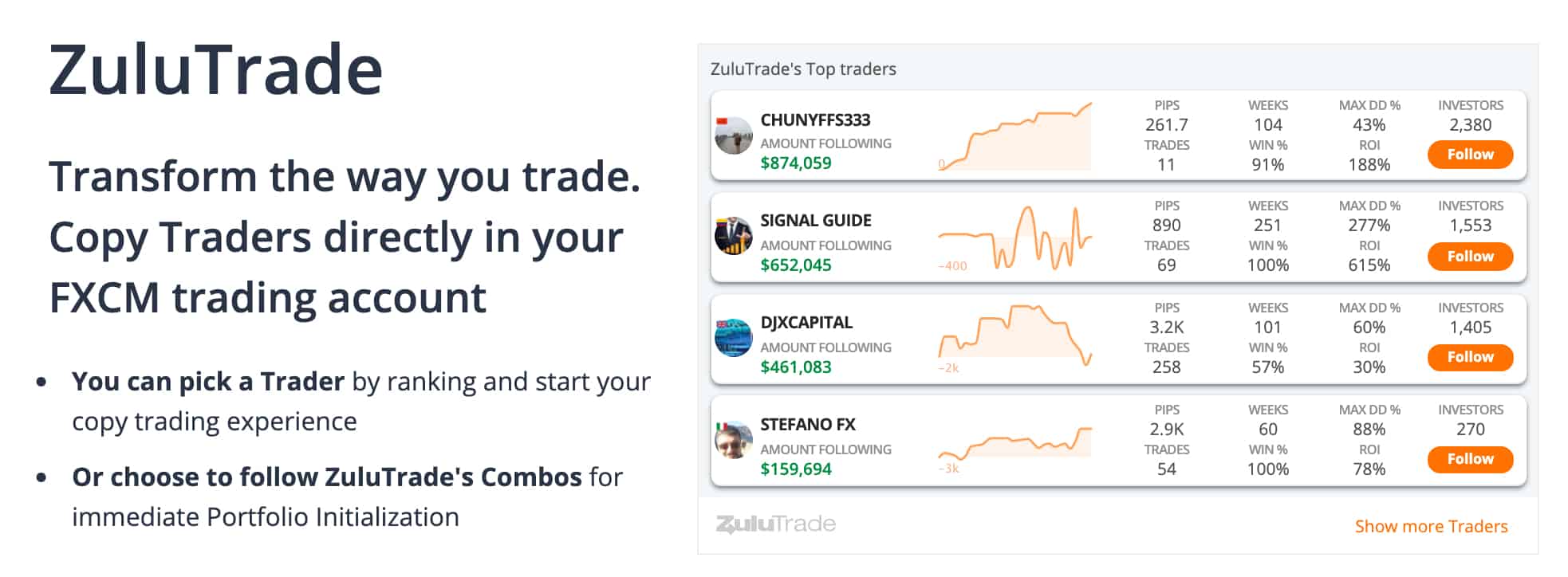

Social-copy trading is becoming increasingly popular as it reduces the time one needs to develop and execute trading strategies. As an FXCM client using MetaTrader 4 (MT4), there are two ways to automate trading via account mirroring services – ZuluTrade and Trading Signals.

ZuluTrade is a third-party social-copy trading network that can be directly integrated into the MT4 platform, while Trading Signals is MetaTrader’s proprietary account mirroring service. Regardless of your copy trading provider, FXCM offers two main pricing structures.

- Standard Account: offers commission-free trading with spreads starting from 1.3 pips (EUR/USD).

- Active Traders: Those trading high volumes receive discounted spreads with rebate pricing.

ZuluTrade

ZuluTrade, one of the most popular account mirroring providers, enables FXCM customers to implement copy trading strategies directly within the MT4 platform.

ZuluTrade’s established social network allows you to follow and copy the strategies of successful traders, eliminating the need for lengthy technical analysis and constant monitoring of financial markets. FXCM clients can automate trading by either:

- Copying the trades of individual traders.

- Copying a bundle of different traders’ strategies, known as Combos.

Beginners and seasoned traders can enjoy the benefits of copy trading with ZuluTrade on MT4. Newbie traders can learn from the best while building confidence, and experienced investors gain the opportunity to earn additional profits by developing strategies for others to copy.

Trading Signals

Alternatively, FXCM MT4 customers can use MetaQuotes’ proprietary social-copy trading network to automate trading. As the social-copy trading features are inbuilt into the MT4 trading platform, you can easily find strategies to follow based on signal providers’ past trades, risk profiles, and success rates.

FXCM allows you to explore the benefits of Trading Signals via a demo or live account through the ‘Signals’ tab on the MT4 platform.

*Your capital is at risk ‘65% of retail CFD accounts lose money with FXCM’

5. City Index - Best No Commission MT4 Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.7 GBP/USD = 1.1 AUD/USD = 0.5

Trading Platforms

MT4, TradingView, Web Trader

Minimum Deposit

$0

Why We Recommend City Index

With average spreads of 0.7 pips for EUR/USD and 1.1 for GBP/USD and EUR/GBP with no commissions, we think CIty Index spreads are impressively low. MT4 with City Index comes with Expert Advisors for automated trading, advanced indicators from FX Blue and integrated news and analysis to keep you up to date on the latest trading new news.

Owned by the StoneX group which is listed on the NYSE (SNEX), we scored the broker 83 for reputation and 86 for the positive online review they have.

Pros & Cons

- Fast execution speed for limit orders

- No deposit or withdrawal fees

- Good spreads for GBP pairs

- Minimum deposit of $150 for both accounts

- Charges a $15 monthly inactivity fee

- No interest-free Islamic account

Broker Details

City Index’s MT4 Users Have Order Types To Manage High Trading Risk

When trading with City Index MetaTrader 4 clients gain access to over 80 foreign exchange markets. There is no choice of account types or ECN-style pricing, with all spreads commission-free, averaging 1.8 pips for the GBP/USD FX pair.

The broker offers two key risk management features – order types and a demo account to minimise losses and maximise gains. As forex and CFDs are complex instruments, it is crucial to utilise risk management tools while acknowledging the broker’s various risk warnings.

MT4 Order Types

As a City Index MT4 user, four order types can be used to manage the high trading risk. The three basic order types that City Index freely offers are stop-loss, limit, and trailing stop orders. A premium order type (guaranteed stop loss) is available, yet traders must pay a fee.

Stop-Loss Order

Stop losses can be used to minimise losses when markets move in unfavourable directions. To eliminate the risk of enormous losses, you can specify a price (worse than the market price) where the trade will be automatically closed.

Limit Order

To lock in profits, limit orders automatically close trades when a preset price that is better than the current price is met.

Trailing Stop Loss Order

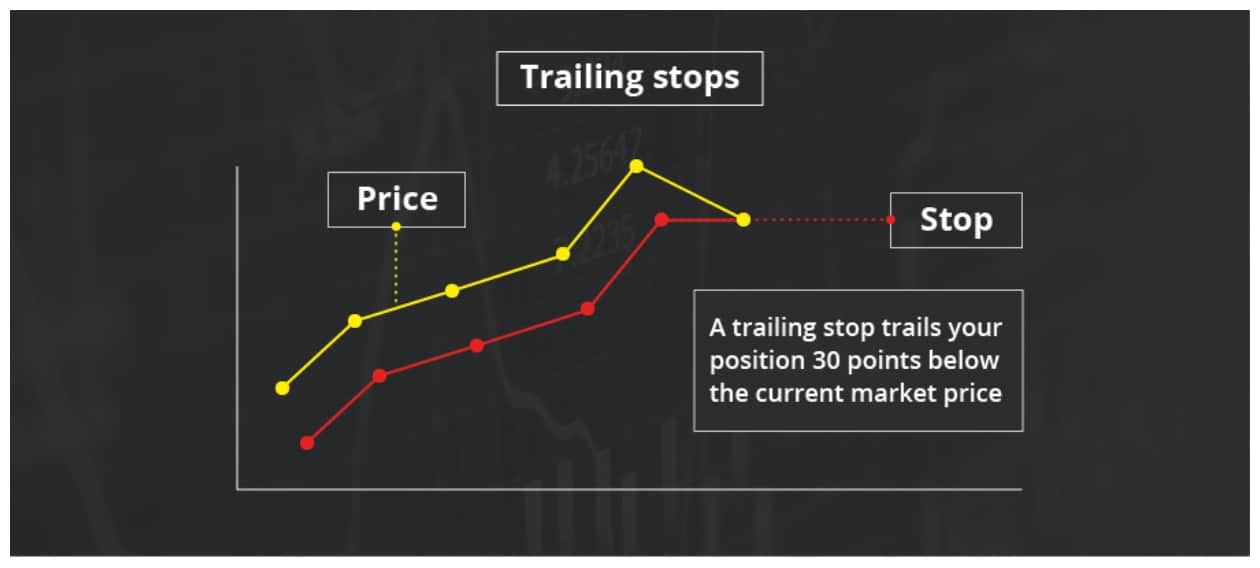

Similar to a standard stop loss, those using trailing stops specify a particular number of pips away from the current price, allowing the stop to move with the current market price. By trailing the current price by a certain amount, profits are protected while gains are not limited.

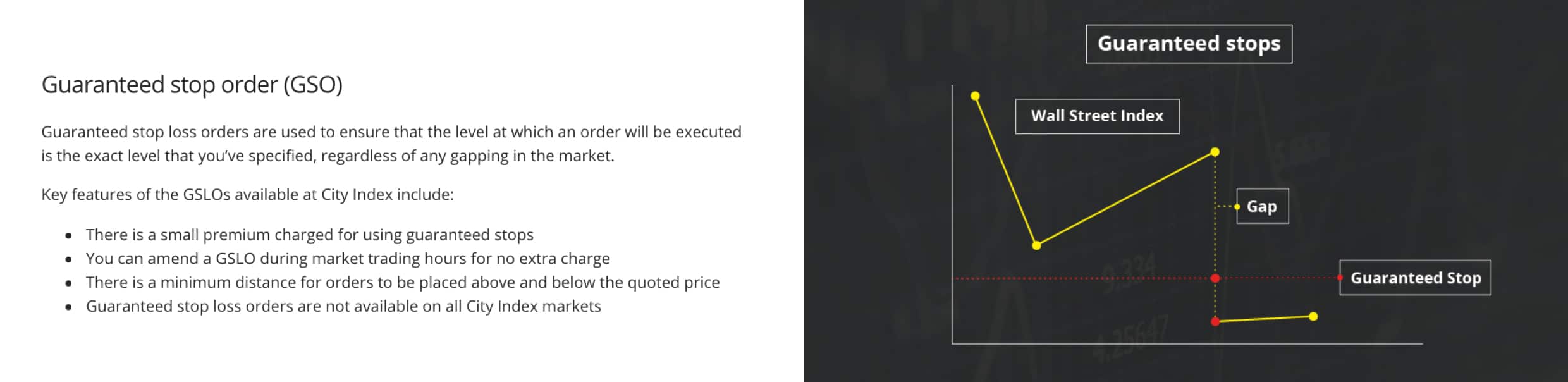

Guaranteed Stop Loss (Premium Order)

Premium order types for a small fee guarantee that an order will be executed at your specified price. While basic order types may be performed at a different price from what you desire because of gapping, guaranteed stop-loss orders ensure an order will be filled at a price specified regardless of price gapping.

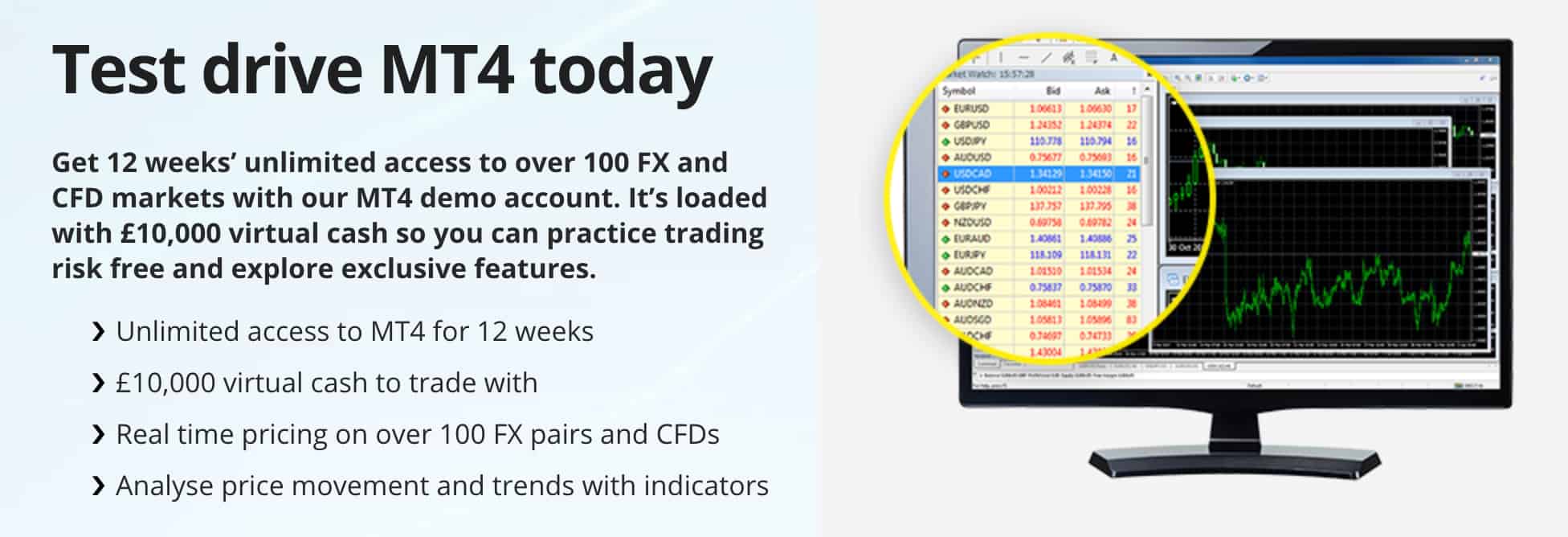

MT4 Demo Account

Whether you are a beginner starting with no forex trading background or a seasoned trader with years of experience, demo accounts are an excellent risk management tool for all experience levels.

With 12 weeks’ access and a £10,000 virtual trading balance, MT4 demo account users can explore different financial markets, practise trading strategies, and learn to use the wide range of technical analysis tools available on MT4. Before signing up for a live account with a high risk of losing money, demo accounts allow you to learn in a risk-free environment in real-time.

*Your capital is at risk ‘69% of retail CFD accounts lose money with City Index’

6. FxPro - Great MT4 Fixed Spreads Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.5 GBP/USD = 0.75 AUD/USD = 0.58

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$0

Why We Recommend FxPro

FxPro is different to other brokers on this list because you can trade with fixed spreads for ten currency pairs and or choose instant execution meaning you can accept or reject any requotes.

Fixed spreads include 1.96 pips for the EUR/USD, 2.34 for AUD/USD and 2.19 pips for EUR/GBP, while these may seem high compared to variable, the spreads are no affectived by slippage. This make FxPro a good choice to scalpers who need predictable spreads for their trading strategy.

Pros & Cons

- No minimum deposits

- Supports MT5 and cTrader as well

- Offers an Islamic accountRegulated by FCA, CySEC, and FSCA

- Below-average order execution speed

- 9/5 customer support availability

- Charges a $5 monthly inactivity fee

Broker Details

FxPro Saves You Time And Effort With Its Free Access To Trading Analysis Tools

As conducting research and technical analysis can be time-consuming, choosing a broker with strong technical analysis tools can help you easily stay up to date with forex and CFD markets.

While MetaTrader 4 offers advanced inbuilt technical analysis tools, FxPro provides online and third-party resources that can save you time and effort when trading. The four essential analysis tools FxPro offers are:

- Trading Central: A third-party source of technical analysis freely available to FxPro’s MT4 customers

- Market Holidays: As holidays can affect market volatility, you can check out upcoming trading holidays online

- Market News: The broker’s online newsfeed provides free articles explaining the latest news regarding financial markets

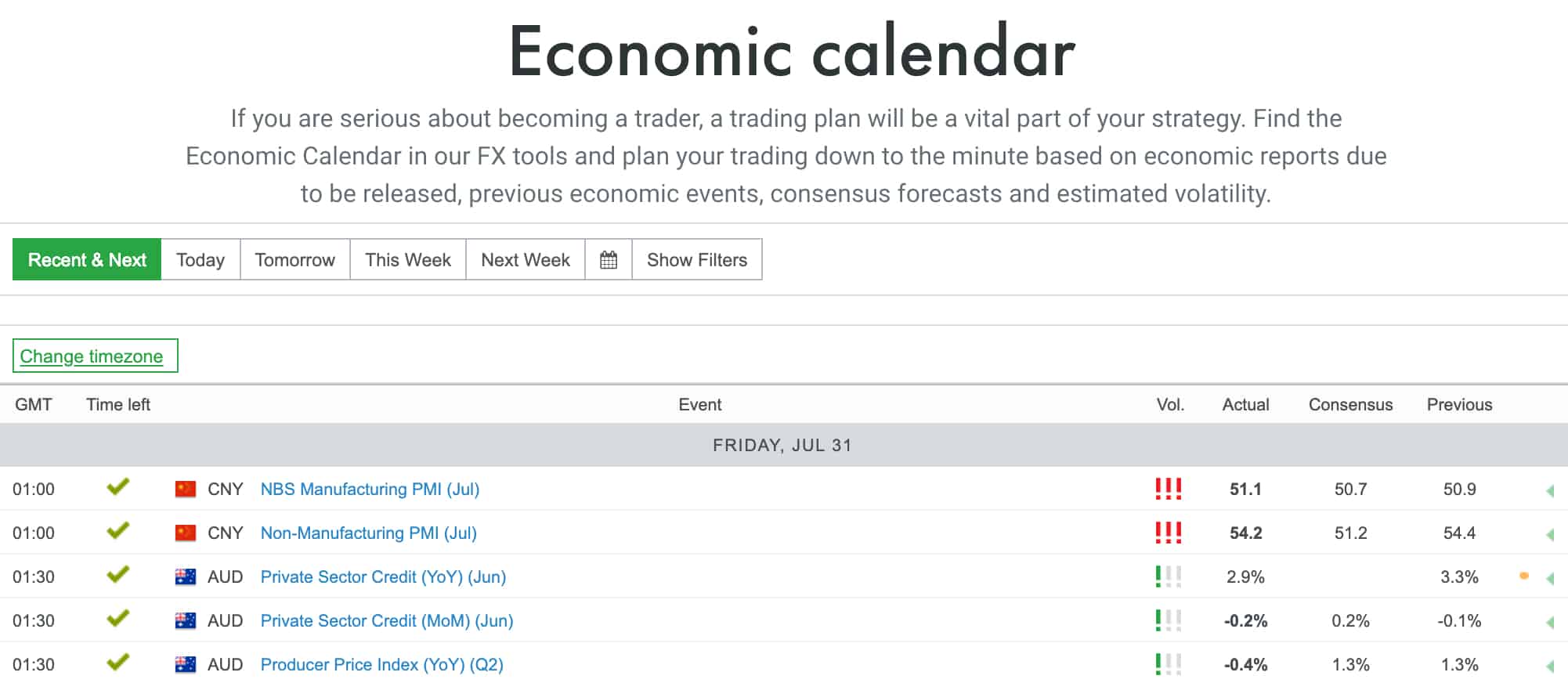

- Economic Calendar: FxPro’s economic calendar outlines upcoming releases of reports and information that will influence exchange rates, CFD pricing, and market volatility

Trading Central

The third-party technical analysis provider uses multiple sources of information to monitor and analyse a range of financial instruments, saving you time and effort in conducting research. Trading Central provides these technical analysis features:

- Sophisticated graphical analysis

- Mathematical indicators

- Support and resistance level analysis

- Candlestick charts

- Long-term and intraday forecasts

Trading Central is fully compatible with MetaTrader 4. Although the third-party service usually costs a subscription, FxPro MT4 users gain free access to the technical analysis features.

FxPro’s economic calendar, market news, and holidays can be viewed on the broker’s website, while MT4’s features and tools can be trailed via a demo account.

*Your capital is at risk ‘76% of retail CFD accounts lose money with FxPro’

7. FOREX.com - MT4 Forex Broker With Good Research

Forex Panel Score

Average Spread

EUR/USD = 0.21 GBP/USD = 0.23 AUD/USD = 0.17

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

FOREX.com offers above-average spreads for its standard account. For example, it has a 1.4 pips spread for the AUD/USD pair which is 0.14 pips below the industry average. Similarly, its spread for the EUR/GBP currency pair is 0.16 pips below the industry average as well.

Still, we think FOREX.com has some good features, namely good educational and research resources such as complete courses, quizzes, and in-depth guides.

FOREX.com also supports MetaTrader 5 and has its own platform FOREX.com which includes a guaranteed stop loss.

Pros & Cons

- Supports 7 different base currencies

- Has an Islam-compliant trading account

- Regulated by FCA in the UK

- Thorough educational resources

- $2500 minimum deposit for RAW account

- Doesn’t support PayPal

- Customer support is unavailable on weekends

Broker Details

FOREX.com Provides Market Access to A Wide Forex Range On MT4

With over 90 FX pairs available on MT4, FOREX.com offers exceptional market access compared to many of the best forex brokers in UK. Competitors such as IC Markets offer less than 60 currency pairs, with fewer minor and exotic FX pairs available to trade than FOREX.com.

With a wide range of currency pairs yet limited CFDs, FOREX.com is best-suited to those wanting to focus on forex trading as products such as Share CFDs are not accessible.

Forex Spreads And Account Types

FOREX.com’s standard account and pricing structure are commission-free, with no additional fees charged on top of the spread. Examples of minimum and typical spreads for commonly traded FX pairs are:

- AUD/USD: Average spread 1.6 pips, minimum spread 0.8 pips.

- EUR/GBP: Average spread 1.9 pips, minimum spread 1.0 pip.

- EUR/USD: Average spread 1.3 pips, minimum spread 0.8 pips.

If you prefer an ECN-style account over commission-free pricing, you can sign up for a DMA Account. Direct market access (DMA) allows commission account holders to access tighter spreads and view multiple pricing levels from top-tier liquidity sources (market depth).

As well as the depth of market pricing, DMA Accounts are rewarded with reduced commission fees for trading high volumes. Unfortunately, though you can trade lower spreads with potentially discounted commission charges, DMA Accounts cannot trade FOREX.com’s full forex range, with only 58 currency pairs available.

To practice trading currencies on MT4, FOREX.com offers a demo account with a $10,000 virtual balance and access granted for 30 days.

*Your capital is at risk up to ‘74% of retail CFD accounts lose money with FOREX.com’

8. AvaTrade - Best Day Trading Broker With MT4 Platform

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We like AvaTrade for the low fixed spreads when trading popular currency pairs. You will find there is a 1.5 pip spread for GBP/USD which is 0.64 pips below the industry average. Other pairs include 1 pip for the USD/JPY pair and 0.9 pips for EUR/USD.

Other features of AvaTrade that we liked is the inclusion of 3rd part copy trading tools like AvaSocial which leverages the MetaTrader Signals community and DupliTrade. Both unusual offerings for a market maker.

Pros & Cons

- Regulated by 13 different institutes

- Has 4.6 stars on Trustpilot

- Does not charge any commission

- Offers a decent in-house trading platform

- Doesn’t take payments from PayPal

- Has a minimum deposit of $100

- No option for a RAW account

Broker Details

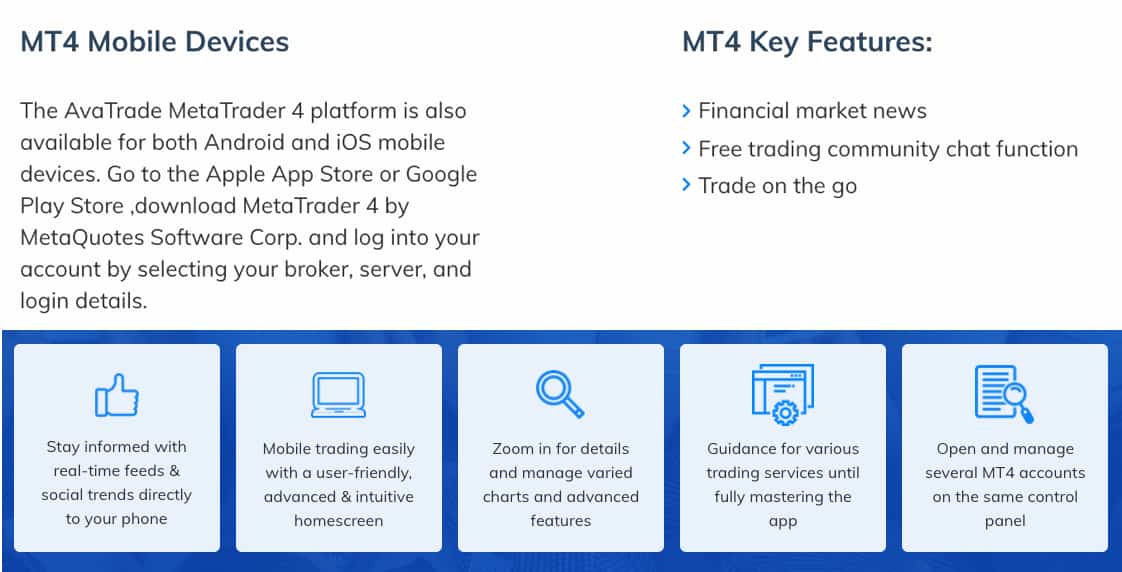

AvaTrade Allows Trading CFDs On The MT4 Mobile App

AvaTrade is an MT4 broker that offers the software as a desktop trading platform, WebTrader, or mobile trading app. An excellent option for those trading on the go, AvaTrade requires a low minimum deposit of $100 to start trading CFDs on the MT4 mobile apps. Likewise to MT4’s WebTrader and desktop platforms, advanced technical and fundamental analysis tools can be used to identify trading opportunities. In contrast, order types can be used to manage the high risk of CFDs.

As well as trading CFDs derived from a range of asset classes, AvaTrade’s MT4 users based in the UK and Ireland can execute tax-efficient spread betting strategies that are not liable to Capital Gains Taxes (CGT). Regardless of whether you are trading CFDs or spread betting, you can access over 60 financial markets, including shares, which many brokers do not offer on MT4:

- Forex

- Commodities

- Indices

- Shares

Mobile trading apps are available on iOS and Android devices and can be downloaded via Apple’s app store or Google Play. Desktop, WebTrader, and mobile apps can all be used to access the broker’s demo accounts that are funded with a $100,000 virtual trading balance.

*Your capital is at risk ‘66% of retail CFD accounts lose money with AvaTrade’

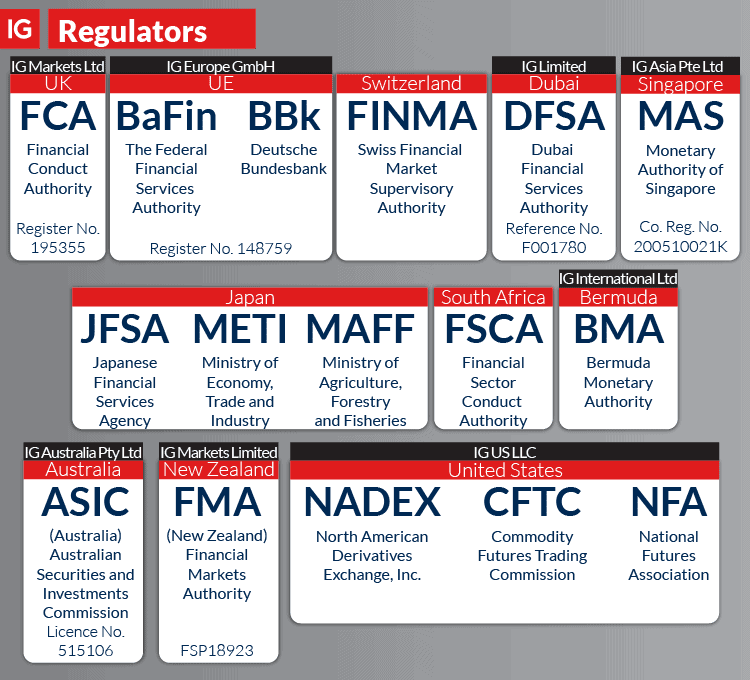

9. IG Group - MT4 Forex Broker With Top Range of Markets

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

We think it hard to go past an online broker that is not only one of the oldest but also the largest. IG Group’s range of markets is impressive, with over 17,000 markets including forex pairs, commodities, indices, cryptocurrencies, stocks and even futures and options.

IG Group has an average spread of 0.32 pips spread when you combine the spreads for the 5 major currency pairs which is 0.12 pips below the industry average so you can also trade these markets with low RAW spreads.

Pros & Cons

- Responsive 24/7 customer support

- Largest range of trading markets

- Regulated by 13 different institutes

- Received a 10/10 score in trust

- $450 minimum deposit for RAW accounts

- Doesn’t support Skrill

- No Islamic account

Broker Details

IG’s MT4 Demo Account: A Gateway to Risk-Free Trading Mastery

IG is recognised as a top choice for traders seeking an exceptional MT4 demo account experience. With its expansive market reach and intuitive interface, IG’s MT4 platform is not just versatile and high-performing, but also an ideal training ground for both new and experienced traders. Here’s why IG’s MT4 demo account is a standout:

Comprehensive Market Access

IG offers access to over 17,000 markets, including a diverse range of forex pairs, commodities, indices, and cryptocurrencies. This wide selection is particularly beneficial for demo account users, who can practise trading strategies across various market conditions within the MT4 platform.

Advanced Trading Platforms

Beyond its acclaimed MT4 platform, IG also offers other platforms like ProRealTime and its own IG Platform. These are equipped with advanced charting tools and technical indicators, providing a rich environment for analysis and strategy development in the demo account.

Features of IG’s MT4 Demo Account

IG’s MT4 demo account is specifically designed to mirror the real trading environment, offering:

- Customisable charts and layouts to simulate actual trading setups.

- A full range of technical indicators and drawing tools for comprehensive market analysis.

- The ability to test automated trading strategies using Expert Advisors (EAs).

- Full functionality on both mobile and desktop devices, replicating the flexibility of real trading.

Strong Regulatory Standards

IG’s adherence to strict regulatory standards in multiple jurisdictions ensures a secure and reliable trading environment. This is crucial for traders practising on the demo account, as it provides a realistic sense of security and operational integrity.

Exceptional Support and Educational Resources

IG is known for its excellent customer support and extensive educational resources. These are particularly useful for demo account users, offering insights into market analysis, trading strategies, and platform functionalities.

IG’s MT4 demo account is an excellent choice for traders looking to hone their skills in a risk-free environment. Its extensive market access, realistic trading platform features, stringent security measures, and comprehensive educational support make it the ideal platform for mastering MT4 trading.

*Your capital is at risk ‘69% of retail CFD accounts lose money with IG Group’

Ask an Expert