Learning how to spread bet successfully requires a lot of practice and effort but can result in significant financial rewards if correctly and consistently applied over time. Success with spread betting is not easy, and you will lose money from time to time, as with financial markets such as Forex, shares, and indices such as the FTSE 100, but there are things you can do to improve your chances of success.

Since spread betting involves high risk as you are speculating on unpredictable and highly volatile markets with leverage, it is essential to educate yourself and have a solid trading plan before you start betting. For this reason, to be successful with spread betting, you should learn the key concepts and identify (and test) proven strategies before risking your own capital.

Key Points For How To Spread Bet Successfully

- Spread betting involves high risk as you speculate on price movements of financial derivatives using leverage.

- Understanding how to spread bet and how it works is the first step to being successful.

- A structured betting or trading plan is the cornerstone of a good spread betting strategy.

- Understand the markets you plan to trade in.

- Use risk management tools to protect your bets and only bet what you can afford to lose.

- Practice spread betting with a demo account before using your own capital.

1. Learn What Spread Betting Is And How It Works

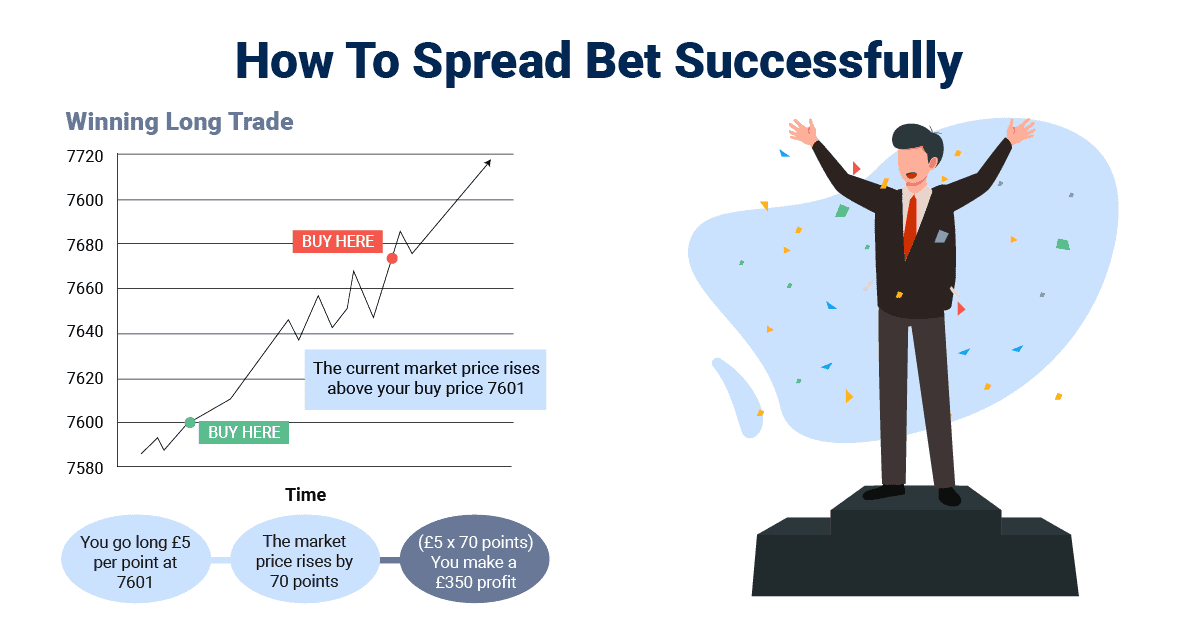

Spread betting allows you to profit in rising and falling markets, providing unique trading opportunities compared to traditional investing. To profit with a spread bet, you stake how much you wish to risk per point, multiplied by the number of points the market moves in your direction (or against you).

Here is an example of how spread betting works:

Lets say you notice the stock of Apple is trading at a sell price of £100.10 and a buy price of £100.20. As a spread bettor, you believe Apple’s share price is primed to increase, so take a long position of £10 per movement at £100.20. Apple’s share price goes up as you expected, so you sell at £100.40, a difference of 20 points (£100.40 – £100.20). As the price did move in the direction you bet on, you have made a profit of £200 (£10 x 20 points).

2. Create A Structured Trading Plan

A structured trading plan will make betting easy as you’ll be prepared for your expectations, goals, and methods of succeeding. A plan is also helpful in identifying where you are going wrong (like not sticking to your risk-reward or trading multiple markets at once). The plan will help you stick to what you know is successful and how to do it while rooting you to your goals by helping you improve over time.

A. Defining Your Trading Goals

I think it’s a good idea to set achievable and scalable goals over time as you improve and increase your capital. Ideally, you want to focus on a non-monetary goal, such as performing five trades a week, because if you have confidence in your strategy, then the money will follow. You set this goal, so choose something you can confidently achieve to help build your capital.

B. Defining Your Risk Tolerance

Knowing your risk tolerance or how much you are willing to lose before you stop trading is essential as part of a trading plan. One way I like to define this is by setting myself a “hard stop loss” for the day, where I will shut down the trading terminal if I lose too much capital on the same day. For me, this is a signal that the markets are not favourable for me, and I should walk away as I know there are always new opportunities around the corner.

For example, you may be willing to lose 2% of your total trading capital before you stop trading for the day. The idea is to stop and reset for the next day because not every day will be profitable while preventing you from trying to chase the loss.

C. Defining Your Markets

There are thousands of markets to choose from, each with its own advantages and disadvantages, so it is best to find one or two markets you can stick with and learn how they move throughout the day.

D. Defining A Set Risk Reward Ratio

Having a risk-reward ratio in mind is good for your risk management and outlook when trading. This ratio is a useful metric of your success as helps you keep your trading rational and prevents you from taking excessive risks,

E. Use A Trading Diary For Accountability

Trading diaries are an excellent tool for noting market behaviours and reactions from bets you enter. A diary can help identify mistakes you repeat; once identified, you can learn from the mistake and improve for a future bet.

Noting down your thoughts on the entry and exit of a position may sound tedious, but it’s an excellent way of judging your analysis at the execution point. If you are repeating the same thoughts and the bets are losing, it’s a clear correlation to adjust your analysis. Without identifying this, you could modify a successful trading strategy or try something else that can put you back at square one in your betting career.

3. Develop And Test A Trading Strategy

A decent trading strategy allows you to follow rules to find new trading opportunities that you know can generate results, adding confidence to execute the ideas. With a trading strategy prepared, you can repeat the exact steps each time you find a potential idea and know how to execute and manage the trade. This makes betting easier, as the hard work is already done. You just have to follow the strategy each time to find successful trades.

Additionally, if you lose a trade, you can revert to the strategy and see where you may have gone wrong. This brings accountability to your trading, a trait you must have if you want to be successful. With that said, sometimes trades can be lost when they are out of your control, like a major event that can affect the whole market.

Strategies you might wish to research include:

- Day trading

- Breakout

- Technical indicators

- Positions trading

- Trend trading

- Swing trading

- Dividend trading

4. Decide What Instrument And Market To Spread Bet

Spread betting brokers offer an excellent range of markets, and you may feel tempted to experiment with many. For example, you may decide to flutter on the FTSE 100, then tomorrow you try your luck with US stocks, then shift your focus to different currency pairs.

You must realise that many of the top spread bettors specialise in just a handful of markets, depending on their focus. They can focus on a small basket of currency pairs like GBP/JPY and EUR/USD or specialise on indices during each market session. For example, focus on the FTSE 100 and DAX 40 during the London session and NASDAQ and S&P 500 during the US session.

Popular markets to bet on include:

- Forex

- Shares

- Indices

- Hard Commodities –

- Metals (i.e. gold, silver, platinum, copper)

- Energies (gas, oil)

- Soft commodities (coffee, rice, livestock)

- ETFs

- Bonds and treasuries

Successful bettors know that each market has a personality, which you must know and learn to be profitable (not all markets react the same way to the same event). The only way to learn a market’s personality is to concentrate on it instead of juggling between different assets.

If you are a beginner, it is a good idea to focus on one market to begin with and get used to how the markets and trading platforms work. You can expand to different financial markets to capture more trading opportunities as you improve and have a decent trading strategy.

When choosing a market bet on consider the following factors:

- Liquidity: markets with high trading volumes and low spreads are easier to open and close trading positions.

- Volatility: the more prices more, the more profit opportunities you will have.

- Market trading hours: you will want to be sure the market is open when you intend to trade

- Transparency/regulation: Regulated markets allow you to be more sure of the pricing and legitimacy of your trades. These markets often have a centralised exchange or are over-the-counter assets.

- Technical factors: Markets that show chart patterns and a tendency for support and resistance levels can allow you to make more informed decisions when trading.

5. Tailor A Risk Management Strategy

Knowing how to manage your risk and having a spread betting strategy to help analyse the financial markets is just as important. Most successful traders know their risk and how they will exit before entering the markets, so it’s a good idea you do too. The strategy will be your personal preference and risk tolerance, so everyone’s risk management will differ.

Here, you can set your risk-reward ratio and keep that in mind when looking for trading ideas. For example, if the idea doesn’t fit your risk-reward metric, it may mean it’s not worth taking the trade. This can help validate good trades from bad opportunities, as not all trading ideas are equal.

You can also use risk management tools to protect your trading positions. These tools can help protect you from losses due to slippage or market volatility. Risk management tools that may help you include:

- Stop-loss order: A stop-loss will close your position at the level you see automatically. However, gapping can still occur.

- Guaranteed stop-loss orders (GSLO) – a GSLO will close your position at the level you set automatically regardless if gapping occurs.

- Negative balance protection – This protection ensures your trading account will never have debts as your balance cannot go into negative.

- Take-profit with limit orders – Same as a stop-loss but in reverse. Your position will automatically be closed when your set level is triggered.

- Trailing stop-loss – Similar to a stop-loss but the trigger level will move in line with your profits rather than be set in stone.

- Alerts – Be notified by email or text of any price changes you should be aware of.

- Margin calls – be notified to exit your position when your equity level falls below a set level.

6. Determine Your Leverage Level And Position Size

Spread betting is a leveraged instrument, meaning you can trade on margin. This means you only need to use a small amount of your own capital to open a trading position since the broker will lend you the remainder of your trade.

Since leverage can lead to outsized losses when price movements do not go in your favour, it is wise to be conservative with how you use leverage. As a beginner, 10:1 leverage is a good starting point or better use position sizing of no more than 1-5% of total capital per trade. It is also a good idea to practice with a demo account.

Depending on which asset class you wish to bet on will determine your leverage; below is a table of assets and their leverage:

| Product | Leverage |

| Forex (Majors) | 1:30 |

| Forex (Minors) | 1:20 |

| Indices | 1:20 |

| Metals | 1:20 |

| Commodities | 1:10 |

| Stocks | 1:5 |

You can request your broker to lower your leverage if you think it’s too high. Or, if you are a professional spread bettor, you may be allowed to open a professional spread betting account with up to 1:500 leverage.

7. Practice To Avoid Common Spread Betting Mistakes

The path to successful spread betting isn’t easy and requires a lot of practice and experience of what the markets do on a second-by-second basis. You can open a spread betting demo account to experience this risk-free without depositing any capital, which is ideal if you are a beginner. Here are two typical financial spread betting mistakes:

Trying to predict a trade before it’s confirmed

It’s a thrill to enter a market when it meets our spread betting strategy rules, but entering too early can kill our enthusiasm and knock our confidence. I always say only to enter the bet once the trade idea is confirmed, I’d rather wait for an extra five pips for a valid entry than second-guess the market.

Overtrading to chase losses

Like the above, it’s easy to get caught up with the emotions of losing money, which can make you adjust your strategy to find trading ideas quickly to ensure you recover your losses. Making irrational decisions can cause you to make more mistakes and more losses, causing a downward spiral of chasing the losses. If you trust the process of setting up a robust trading plan and strategy, you will know that losses happen and can recover from them – there is no need to chase the losses.

Other common mistakes to avoid:

- Inadequate preparation

- Not using risk management tools

- Using too much leverage

- No keeping a trading diary

- Not setting your ego aside

- Averaging down

- Only going long (consider going short)

- Not having realistic expectations

- Taking on too much risk

8. Develop Good Trading Habits

Good trading habits include patience, discipline, self control, acceptance and continual learning. Such habits ensure you trade with the right mindset for success and keep your emotions in check and help you avoid (and repeating) mistakes.

What Is Spread Betting Success?

Spread betting success can be attributed to financial gain through spread betting, but how much gain can differ from each bettor. Some spread bettors may target to increase their capital by 5% over the year, while others target 5% over the month. Equally, some spread bettors have a target amount of money they want to earn, while others just want to be profitable each month, which is success in their eyes.

What Is Spread Betting?

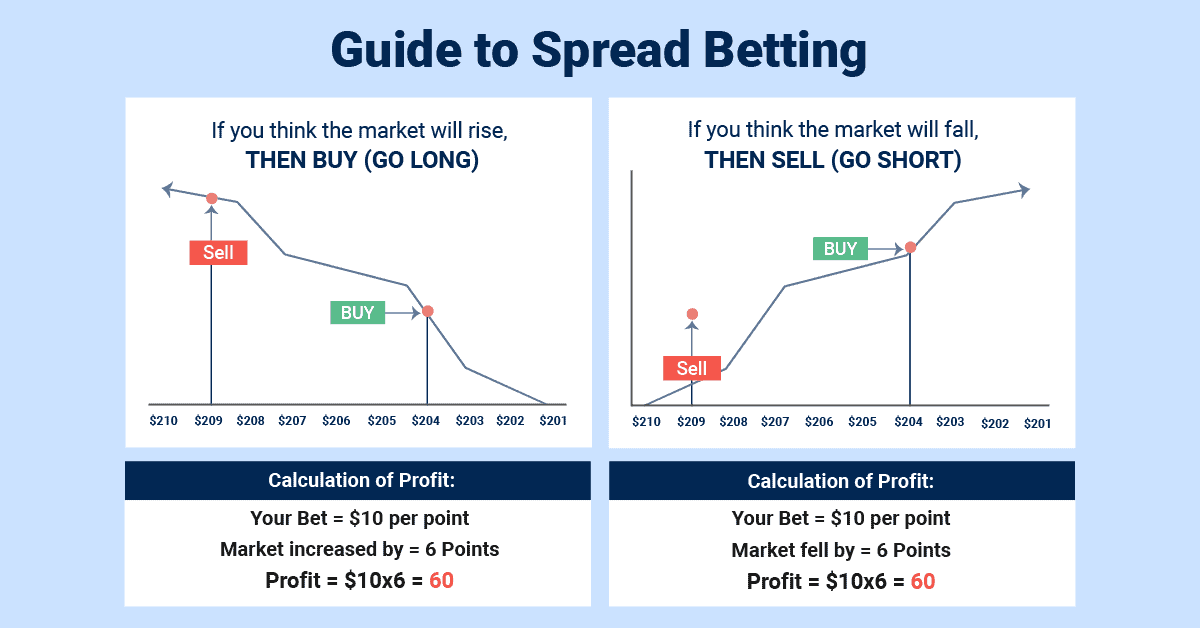

Spread betting is a form of financial trading that you use to speculate on the price movement of an asset (like forex and commodities) without owning the underlying market. You can bet in either price direction by going long or short in the market, allowing you to profit in rising and falling markets.

How Does Spread Betting Work?

Spread betting works by predicting the direction of the underlying market and profiting for every point the asset’s price moves in your favour. A benefit of financial spread betting is that you can bet on the price moving up or down, allowing you to profit in bullish and bearish markets.

You place your bet size (stake), which is how much you want to risk per point the asset price moves. If the market moves in your favour, you will earn the bet size multiplied by the amount of points the market has moved. However, if the market moves against your prediction, then you will lose the bet size multiplied by the number of points the price has moved against you.

To take advantage of spread betting, you will use leverage, which allows you to borrow funds from the broker to control a large bet size. To control the bet size, you must put up collateral (the margin), a percentage of the total asset value.

For example, if you wanted to spread bet of £10,000 in forex with a leverage of 1:30, you would need 3.33% capital as a margin (£333) to open the bet. So, with just £333, you can control £10,000 worth of the currency pair, allowing you to amplify your winnings (and losses).

Can Spread Betting Be Profitable?

Spread betting can be profitable just like any other form of investing, the difference is that you can use leverage in spread betting, which brings a degree of high risk. To be profitable with spread betting, you should have a solid trading strategy, achieving consistent results without taking trading ideas outside of your rules.

CompareForexBroker has developed a spread betting calculator to check out your bets’ profitability for free, helping you decide whether the trade idea is worth the risk.

What Spread Betting Platform Offers The Most Success?

A key factor in choosing a spread betting platform is how low the spreads are because the lower the spreads, the easier it is for you to profit.

For example, if a broker offers a spread of 3 pips to enter the market, your bet will have to move three pips in your favour before you break even; only after the 4th pip will you be profitable.

While if the broker offers a spread of 0.5 pips, you will be profitable when the market moves by one pip. Spreads can impact your profits and cost you more if your broker provides wide spreads, especially if you are a scalper or day trader where spreads must be tight.

The best spread betting brokers have tight spreads and are commission-free, keeping your trading costs low. Some brokers also offer free trading tools like AutoChartist, which will automatically find new trading ideas throughout the day and can help with your success.

What Are Some Examples Of A Spread Bet?

Let’s take a look at some spread betting examples:

Spread Betting Example: Shares

Imagine you bought Tesco shares because you predicted they would rise with the increase in inflation. You buy a spread bet on Tesco at 245p and stake £5 per point so that you will make £5 every time the Tesco share price rises by a penny.

If the price of Tesco rises 10 points to 255p, you will have made £50 profit (£5 staked per point x 10 points increase). If the price of Tesco falls 10 points to 235p, you will have lost £50 (£5 stake x 10 points decrease).

Spread Betting Example: Forex

Let’s say you thought the EUR/USD price would fall based on your technical analysis. The current sell price of EUR/USD is 1.0505, and you wish to stake £10 per pip, making £10 for every pip if the price falls below 1.0505.

Your prediction is accurate, and the price of EUR/USD falls to 1.0465, which is a 40-pip drop. The fall in price makes you £10 per point the market fell below 1.0505, which is 40 pips x £10, making you £400 profit.

If the price increased above 1.0505 to 1.0525 (20 pips), you would have lost £200 (£10 x 20 pips).

FAQ

How Do You Open A Spread Betting Account?

To open a spread betting account, you must first choose a broker like Pepperstone, which has low spreads, fast execution speed, and a decent range of markets. When you are on the broker’s website, you can apply for an account by completing a short application that asks for your personal details and experiences with trading.

Once you have completed this and submitted your ID docs, you’ll have your account opened and ready to fund your account and start trading.

Is Spread Betting Risky?

Spread betting risk is considered high due to the product using leverage and margin trading, which can amplify your losses and profits. You can manage your risk through solid risk management tools like stop loss orders to limit losses.

What Are Some Reasons To Consider Spread Betting?

There are many advantages of spread betting compared to methods, with the prime benefit being that spread betting has lower trading fees through tax exemption, commission-free trading, and no currency conversion fees when betting on foreign markets.

Can You Really Make Money Spread Betting?

Yes, it is possible to make money spread betting as you are speculating on the same markets as professional and institutional traders, just using a different derivative to profit from the movements.

What Is Better, Spread Betting Or Buying Shares?

Buying shares is best if you want the benefits of owning a stock, such as receiving voting rights and dividends (if the company issues them). If you only care about the price and want a lower-cost method of trading shares, spread betting shares are the better choice.

How Do You Win A Spread Bet?

To win a spread bet, the market has to move in your favour by a number of points before closing the bet in a profit. You can win by finding trading ideas using technical and fundamental analysis.

Is Spread Betting Suitable For Beginners?

Spread betting is suitable for beginners for many reasons. I believe the main reasons are that the trading fees are simple: just paying a spread and not having to worry about end-of-year taxes.

The other reason is that it is easy to enter a bet because you enter how much you wish to risk per point. This way is better for beginners compared to CFDs, where you enter how many contracts/size of the asset you want to trade. Other reasons why it is suitable for beginners are:

- Low deposit is required to bet on the markets

- Leverage trading allows spread bettors with small accounts to bet

- Simple trading fees through spreads

- Simplified execution methods with bet sizes vs. contracts

- Lower trading fees give you a greater chance to profit from the markets

You’ll find many beginner-friendly spread betting brokers available with low deposits, spread betting demo accounts, low spreads and a variety of markets to choose from.