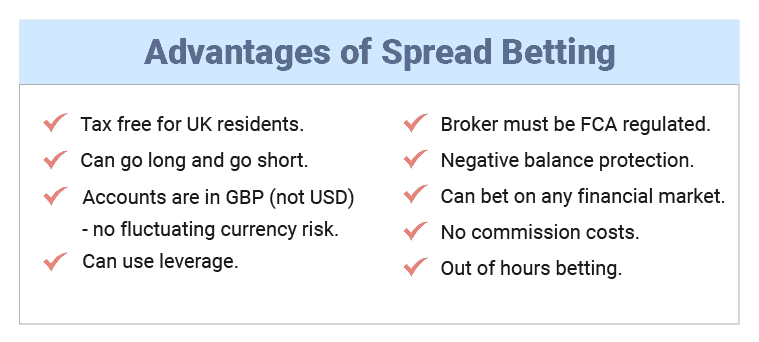

Like any financial product, spread betting has pros and cons that you may be unaware of. On this page, I’ll share the advantages and disadvantages of using spread betting.

The main advantages of spread betting include the ability to bet long and short, it is tax-free, and it is a leveraged instrument. These advantages make spread betting an attractive option compared to alternative methods such as CFDs and traditional share trading.

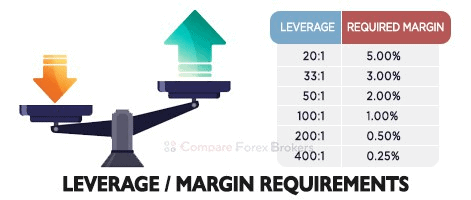

1. Leverage

Leverage is built into spread betting, and it can significantly amplify your profits (and losses) despite market movements being small. When you use leverage, you borrow capital to increase the size of your bet and give you control over a much larger position than you’d generally be able to afford.

For example, if you are betting on a currency pair like EUR/USD, it has a maximum leverage of 1:30. This means for every £1 you deposit in the margin (collateral against the bet), the broker will loan you £30.

2. No Capital Gains Taxes

Spread betting is exempt from capital gains tax as the HMRC deems this trading activity as gambling (although the FCA regulates it). Since you are not taxed on your profits, savings can be achieved compared to other types of trading.

3. No Stamp Duty

As spread betting is a financial derivative, you do not own the asset, which avoids the stamp duty tax charged when you purchase an asset. This tax exemption helps reduce trading costs compared to traditional market speculation methods, saving you 0.5% per transaction in stamp duty costs.

4. Bet Long Or Short

Spread betting allows you to bet long or short, which means you can profit if the market rises and falls. This is different from traditional methods like purchasing stocks, where you can only benefit from the rising stock price.

5. No Commissions

Unlike other financial products, spread-betting brokers typically use a spread-only pricing model. This means you will not pay any commission on your spread bets, and the spreads the brokers offer are generally low (especially compared to CFD standard account spreads).

6. No Currency Conversion

In the UK, spread betting is always done using GBP, which means you won’t have currency conversion fees. This is an advantage when spread betting on international markets and forex pairs as currencies may need to be converted to GBP.

For example, if you are long on the EUR/USD, your profits (and losses) are in euros; if you are betting on NYSE, your profits are in USD. These currencies must be converted back to GBP (costing you in the process). With spread betting, you are betting on the direction, therefore never having to convert your currency into foreign currency to access the bet

7. Can Bet Out Of Hours

Another advantage of spread betting is that it offers 24-hour markets during the trading week (Monday through Friday), allowing you to trade at any time of the day. The 24-hour nature allows you to react to market events outside of traditional market hours, which can lead to potentially profitable opportunities or an ability to hedge your positions quickly.

Can You Manage Risk When Spread Betting?

If you want to succeed with spread betting, managing your spread betting risk is essential to protect your capital. All spread betting platforms offer a series of tools that you can use to help manage your risk automatically; these are:

Standard Stop-Loss Orders

The stop-loss order appends to your current order and automatically closes your trade at a pre-set price, protecting your position against further losses.

For example, if you purchase gold at $1195.00 and expect the price to rise, you would place a stop-loss below your entry price – let’s say the stop-loss is at $1190.00. If the market falls to the $1190.00 level, then your stop loss will automatically close your bet at a loss, preventing your position from losing more capital.

A stop-loss is valuable, as it executes when your price condition is met, meaning if you are away from your devices, the stop-loss order will close your position. A stop-loss helps prevent excess losses which is why I always recommend adding a stop-loss to your orders, especially if you are a beginner.

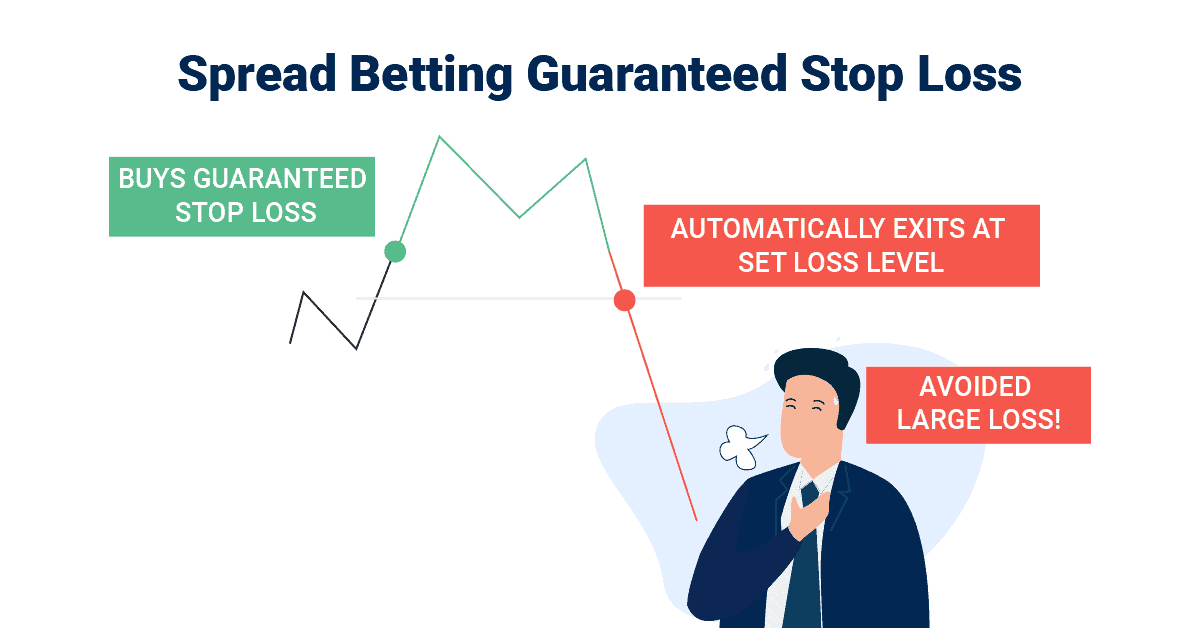

Guaranteed Stop-Loss Orders

A guaranteed stop loss order (GSLO) ensures your bet closes at the specified price level, eliminating slippage that can lead to extra losses during volatile times. The guarantee against slippage is what separates a GSLO from a stop-loss order.

A small premium will need to be paid to use a GSLO, but you only pay this if the GSLO executes. Only a handful of brokers, such as IG, CMC Markets, and City Index, offer a GSLO.

Take Profit Orders

You can think of take-profit orders as the opposite of stop-loss orders. They automatically close your bet at a pre-set price when you reach a profitable position, allowing you to secure your profits. A take-profit order is beneficial if you cannot monitor your positions all day because it can lock in your gains without direct intervention.

What Markets Can Your Spread Bet On?

Spread betting is a derivative product commonly applied to currency pairs, indices, shares, and commodities. There are also two types of spread betting you need to be aware of, these are:

Financial Spread Betting

Financial spread betting is the most popular of the two types of spread betting in the UK and is used to speculate on financial markets without owning the underlying asset. You can benefit from spread betting on various markets like the FTSE 100 index, EUR/USD, stock markets and bonds.

Sports Spread Betting

If you follow sports, you may be interested in sports spread betting, which works like the financial markets but with sports events instead.

You can spread bet on just about any sport such as football, golf, cricket, horse racing, basketball, and tennis. Unlike fixed-odds betting, you can earn multiples of your stake if you are accurate with your bets (and lose multiples if you are wrong).

Are All Spread Betting Brokers Regulated?

A spread betting broker must be regulated by the Financial Conduct Authority (FCA). This ensures all brokers follow strict frameworks to protect their clients.

Being regulated improves the broker’s integrity as it ensures you are protected with consumer rights and the broker follows the legal standards; if they don’t, the broker loses its license. No broker can offer financial services, let alone spread betting, without an authorisation and license from the FCA.

What Is A Spread Bet Example?

Let’s look at a spread betting example where we want to bet that the price of EUR/USD will rise.

You open a “buy” bet on EUR/USD at the price of 1.0750, staking £10 per point the financial market moves in your favour. So for every pip the market is above 1.0750, you’ll make £10 per pip, and for every pip below, you’ll lose £10 per pip.

As predicted, the price of EUR/USD increased to 1.0800 (a 50-pip increase), meaning you made £500 profit (£10 stake x 50 pips). If the price of EUR/USD fell to 1.0725 (a 25-pip drop), you’d have lost £250 (£10 stake x 25 pips).

Which Broker Is Best For Spread Betting?

Which Broker Is Best For Spread Betting?

In my experience, Pepperstone is the best broker to spread bet with. Spread an average of 0.8 pips for major currency pairs and you can choose from 4 leading trading platforms – MetaTrader 4, MetaTrader 5, cTrader and TradingView. If you like charting and technical analysis then TradingView is a good choice.

Other brokers we consider to be among the best spread betting brokers include OANDA, City Index, IG Group and SpreadEX.

FAQ

What Is The Purpose Of Spread Betting?

The purpose of spread betting is to accurately predict the underlying market’s direction and profit from this prediction. If you think the markets will rise, you’ll buy the market and profit from the difference between the open and close price. Or if you think the markets will fall, you short the market and profit from the distance between the open and close prices.

Why Do People Bet The Spread?

People like to spread bet to grow their capital as an alternative option to buying and holding shares or putting their money in a high-interest savings account. Spread betting successfully can be challenging but very rewarding with the proper risk management and strategies.

Which Is Better Spread Betting Or CFD Trading?

Which is better between spread betting and CFDs depends on preference. If you are in the UK, I think spread betting is a good alternative as you save on trading fees and taxes compared with CFD trading.

Alternatively, CFD brokers offer zero-spread accounts with a small commission, making it slightly cheaper to trade and ideal for scalpers. Plus, you can offset your losses against your profits with CFDs, reducing your overall tax liabilities.

Can You Spread Bet With Forex?

Yes, you can spread bet on the forex markets, and it’s one of the more popular markets to spread bet with. Most brokers offer an extensive range of forex pairs, including majors, minors, and exotics, for you to spread bet on. You’ll find that spread betting forex has many benefits compared to CFDs, such as no tax, no currency conversions and tight spreads, making it a cost-effective way of trading forex.