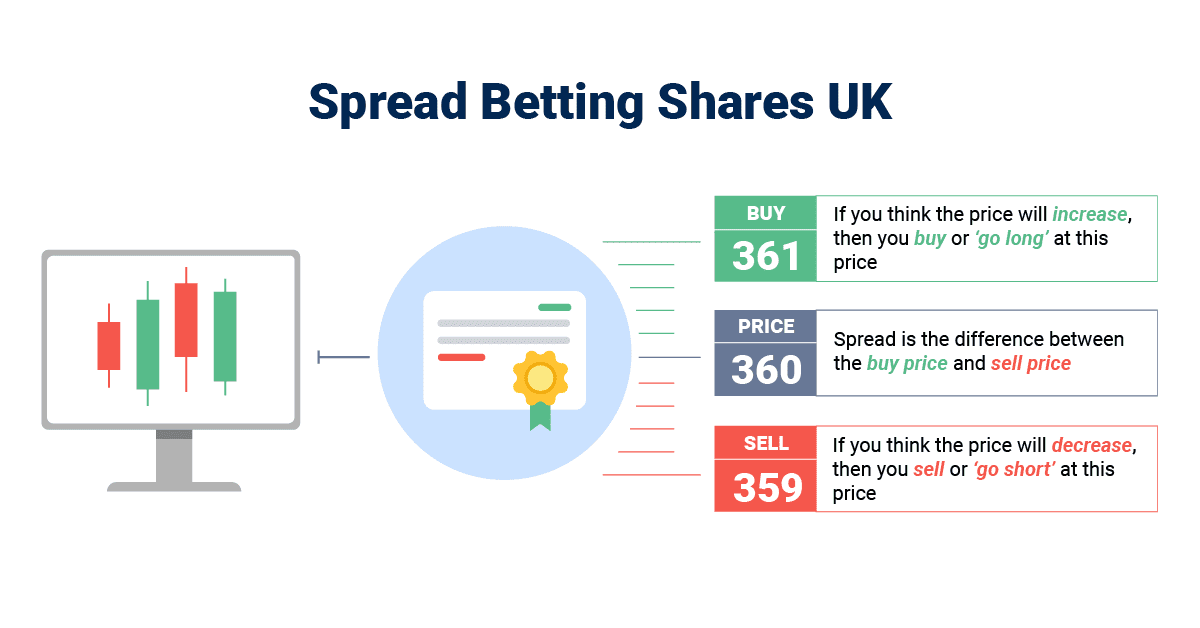

Share spread betting involves speculating on whether a stock will rise or fall without actually buying the share. A spread betting broker sets the price offered and is popular in the UK as it’s tax free compared to share trading.

Spread betting on shares works by selecting a stock that you think will rise above the buy price or fall below the sell price and placing a bet in that direction. If the price of the underlying instrument or security moves as you predicted, you will make a profit.

To place the bet, you stake an amount per point, and for every point the market moves in your favour, you’ll make a profit. Equally, for every point the market goes against you, you will make a loss. For example, if you bet on the price of Vodafone rising at £1 (your stake size) per point, for every 1p Vodafone rises, you’ll earn £1.

Why Spread Bet vs Trade Shares?

There are many reasons why you may want to spread bet compared to trading shares the traditional way; the most common benefit is the lower trading costs across all betting markets.

Spread betting also offers 24/5 markets, opening up the opportunity to speculate on the markets to bettors with 9 to 5 jobs and access to thousands of markets.

You can bet on the price direction of an asset rising or falling, making it attractive to day traders, while in share trading, you can only profit from rising markets.

Pros and Cons

All investments have pros and cons, so below, I’ll highlight the differences between spread betting and trading share:

| Features | Spread Betting | Trading Shares |

|---|---|---|

| Asset Ownership | No | Yes |

| Profit From the Direction of the Market | Rising (long) & falling (short) markets | Rising markets only |

| Trading Fees | Spread and rollover fees (nightly interest charges for leveraged positions) |

Spread + Commission (to open and close the trade) No rollover fees |

| Tax | No capital gains tax No dividend tax No stamp duty tax |

Pay capital gains tax on profits (can write off losses) Pay dividend tax when receiving dividends Pay stamp duty tax on every purchase |

| Markets Available | Popular, high-cap stock markets Indices Forex Commodities Bonds |

All stock markets, including shares from lower cap markets like FTSE 250 |

| Ideal Duration | Short-Term Trading | Long-Term Investing |

| Leverage/Margin Trading | Yes | No |

| Regulated | Yes, FCA | Yes, FCA |

Benefits

1. It’s A Tax-Efficient Trading Product

Spread betting profits are exempt from capital gains tax, making it an attractive choice if you are a UK trader so you can reduce your overall trading fees.

Additionally, because it is a derivative, you do not own the stock, so you do not pay stamp duty tax, offering even more savings when trading.

2. Leverage Exposure

You can gain exposure to larger position sizes through leverage, allowing you to control a larger position without funding the entire investment. The leverage can magnify your profits when the market moves in your favour and amplify your losses if it moves against you.

3. You Can Benefit From Falling Share Prices

Spread betting allows you to bet on the share price falling by going short (to sell), which allows you to hedge your portfolios or profit from volatile and bearish markets.

4. Bet With GBP Only

If you like to speculate on international shares like Apple or BMW, with spread betting, you only bet in GBP. Betting in GBP only means you don’t suffer from converting your GBP into another currency to buy the shares or contracts.

5. Simple Trading Fees

Spread betting has standard accounts with spread-only pricing, meaning you will not have to pay a commission on your bets.

Limitations

1. Stock Trading Has Higher Fees

If you trade stocks, you’ll be subject to the following fees:

- The spread,

- Broker’s commission (usually a percentage of the total asset purchased) entry and exiting the stocks,

- Stamp duty tax,

- Capital gains tax (if you profit),

- Dividends tax (if you receive them),

- Currency conversion if it is an international stock.

Whereas in spread betting, the fees are minimal and straightforward, the fees include:

- The spread

- Rollover fees (if you keep a bet open overnight, you get charged interest).

As you can see, spread betting offers lower fees than stock trading.

2. You Cannot Profit In Falling Markets With Share Trading

With share trading, you can only profit when the share price rises, which means you can only profit in rising (bullish) markets.

As you know, the markets don’t always rise, so by share trading, you miss out on profiting from falling (bearish) markets, and these can be more lucrative opportunities.

How To Manage Risk When Spread Betting Shares?

There are many methods to manage risk when spread betting shares, so it is a good idea to develop your own risk management strategy. Below, I’ll highlight the tools available to manage risk with spread betting shares:

Stop Loss Orders

A stop loss is a separate pending order that automatically executes and closes your bet at a set price if the market moves against you too much.

Stop-loss orders are essential to limit your losses and can be executed while you are away from your trading platform; these orders are found on all trading platforms for free.

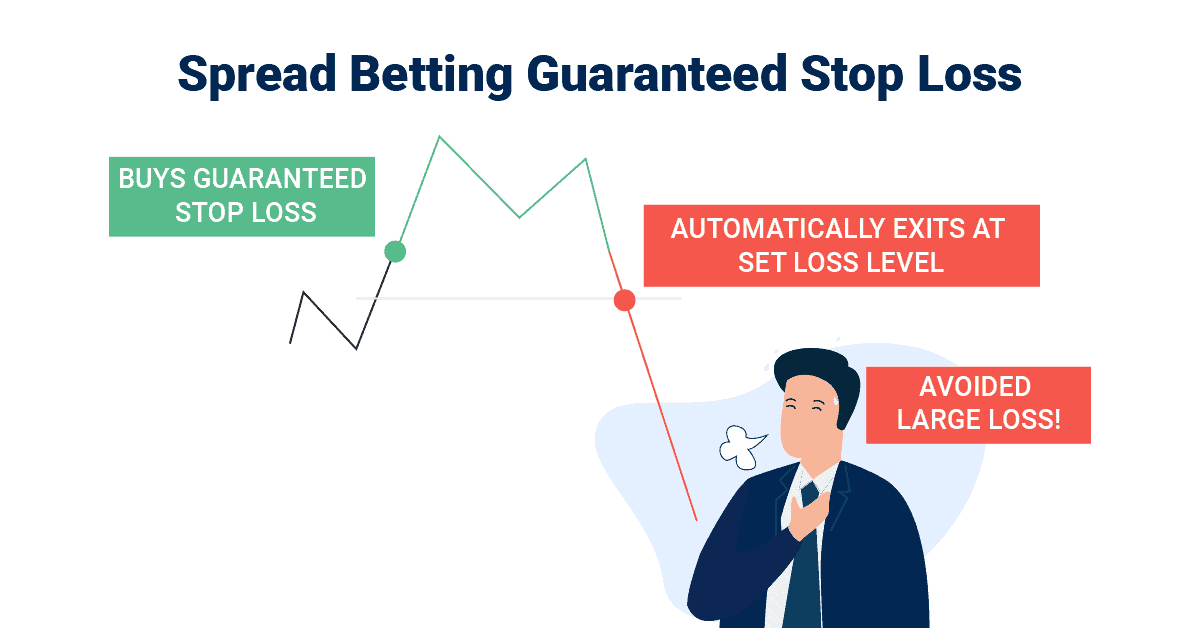

Guaranteed Stop Loss Orders

A guaranteed stop-loss order (GLSO) will close your position at the set price even if there is slippage (price difference between your requested price and the executed price, impacted by volatility).

If you spread bet volatile markets or just want the security of no slippage, the GLSO is a solid risk management tool and can save you from losing more money.

Take Profit Orders

Take Profit Orders

Take profit orders helps you lock in profit by automatically closing your bet in a profitable position after the market has reached a set price. The take-profit order is an excellent tool for managing greed (squeezing out more pips) and sticking to your risk management strategy.

What Costs Does Shares Spread Betting Have?

The costs of share spread betting consist of a spread, which is the difference between the buy and sell price a broker offers. Your broker charges you this to cover their services, and you only pay the spread when you place your spread bet.

When working out your profits, you should use a spread betting calculator to determine your overall profit (or loss), including the costs.

Commission

One advantage of share spread betting is the low trading costs, as you do not pay commissions when executing your bets.

Compared with CFD and traditional share dealing (which charges up to 2% of your total position size), spread betting is more cost-effective for speculating on shares.

Taxes

Spread betting is also exempt from taxes, further lowering the trading costs for share spread betting, meaning you do not have to pay capital gains or stamp duty tax. By not paying taxes, you can save up to 20% of your profits per year and 0.5% in stamp duty fees per bet.

Can You Use Margin To Increase Exposure?

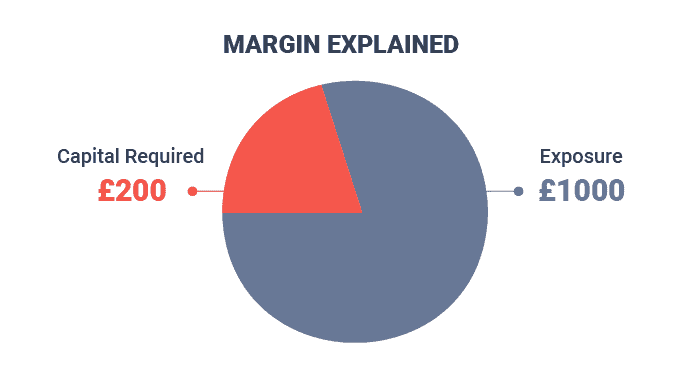

The margin is the amount of money you need to open a spread bet position, and it is collateral to the broker against any potential losses from your leveraged bets. Funding with margin is a fraction of the total value of the bet you want to make.

For example, the margin requirement in stocks is usually 20%, meaning you must have the funds to cover 20% of the leveraged bet. So, if you wish to open a spread bet for a position of £10,000, you must have £2,000 in your account as a margin. You cannot open the spread bet if you do not meet the margin requirements.

Examples Of Spread Betting With Shares

Below, I will go through some financial spread betting examples with shares to help demonstrate how you can profit (or lose) by going long or short in the markets.

Spread Betting Shares Example – Going Long

Let’s say you think British Telecoms Group (BT) will rise over the next few days, and you want to go long on the share price. You open a spread bet on BT at 110p with a stake of £10 per point.

The next day, BT opens positively at 120p per share, rising 10p (or 10-points), making you a healthy profit of £100 (10 points x £10 stake per point).

However, if BT opened negatively to 100p, you’d lose £100 (10 point fall x £10 stake per point).

Spread Betting Shares Example – Going Short

In this scenario, you believe that Tesco’s share price will fall based on your technical analysis. To take advantage of this, you open a spread bet on Tesco at 250p with a stake of £1 per point.

A week has passed, and the share price of Tesco fell from 20p to 230p, so you decide to close, making a £20 profit (20 points x £1 stake per point).

However, if the share price of Tescos rose from 250p to 280p (an increase of 30p), you would have lost £30 (30-point move x £1 stake per point).

What Shares Can You Spread Bet on?

You can bet on the price movements of individual shares worldwide, where a spread betting company offers popular stock markets from the UK, US, EU, and Asian markets. These include shares such as Vodafone, Apple, Amazon, and BMW.

If you want to focus on shares and also broader markets, then there are different types of markets you should try that are related to the stock market:

Share Options

Share options are the right, but not the obligation, to buy or sell the underlying stock at a set price, profiting if the price increases before the expiry date.

Options spread betting allows you to increase your profit potential with volatility if the market moves in your favour while limiting your risk to the premium you paid.

ETFs (Exchange Traded Funds)

Some brokers also offer popular ETFs to spread bet, allowing you to bet on professional funds that develop strategies to track indices, commodities, or a basket of assets.

ETFs are a top choice if you like to speculate (either long or short) on specific industries like energy or finance.

Other Spread Betting Instruments

Spread betting allows you to speculate on more markets than just shares; these include indices, forex, and commodities. Each market has different spreads and volatility, allowing you to diversify your spread betting strategies to take advantage of different markets.

Commodities

The commodities market covers a variety of commodities to spread bet on, allowing you to capitalise on price movements or hedge against stock portfolios; these include:

- Gold

- Silver

- Platinum

- Copper

- US Crude Oil

- Brent Oil

- Natural Gas

- Wheat

- Soybeans

- Coffee

Indices

Indices are popular with spread betting as you can bet on indices like the FTSE 100, DAX 40, or S&P 500. So, indices are a solid choice if you want to bet on the overall market move instead of individual companies.

Forex

The forex markets are the most liquid and cheapest to trade markets available, offering plenty of opportunities to spread bet during the day. You can spread bet on currency pairs like EUR/USD, USD/JPY, and GBP/USD.

FAQ

When Spread Betting, Do You Own The Shares?

You do not own the shares when financial spread betting because it is a derivative of the underlying asset. This means you are speculating on the direction of the asset’s price instead of buying and holding (owning) the shares.

Which Is Cheaper, Spread Betting Or Share Dealing?

It is cheaper to use spread betting compared to share dealing as you do not pay capital gains and stamp duty taxes nor pay commissions when purchasing a spread bet.

If you want to find out your profit (or loss) from a spread bet, use a spread betting calculator that can give you the overall PnL of a position.

Can You Lose More Than You Invest With Spread Betting?

The Financial Conduct Authority ensures all spread betting companies offer negative balance protection, meaning the broker will bear the losses if the market causes your spread betting account to fall beyond zero.

To protect your account from suffering from this, you can place a stop-loss on your spread bet, which automatically closes a bet when the financial market moves against you.

Is Spread Betting Gambling?

Spread betting is considered gambling in the eyes of the HMRC (which collects the taxes), which is why spread betting is exempt from capital gains tax.

However, spread betting is regulated by the FCA because the underlying markets you bet on require experience, knowledge, and expertise to profit from them (making it a skill and not luck).

Can You Make Profits With Shares When Spread Betting?

You can profit with shares using spread betting in rising and falling markets, as spread betting allows you to bet long and short on the markets. Being able to bet in both directions can give more opportunities to be successful in spread betting.

Is CFDs Or Spread Betting Better For Shares

Spread betting is better than CFDs for share trading as spread bets are exempt from tax, and you do not have to pay a commission on your bets, saving you money. You have access to the same markets as CFD trading, so if you are a consistently profitable bettor, then spread betting is best.

How Do You Choose A Spread Betting Broker?

You should choose a spread betting broker that provides tight spreads, a decent choice of markets, fast execution speeds and a choice of spread betting platforms to use. The best spread betting brokers will provide all of the above and match it with excellent customer service and additional tools to improve your betting experience.