To better understand how spread betting works, it’s best to review some spread betting examples. Spread betting is a popular method in the UK to speculate on rising or falling prices in financial markets. In this betting guide, you’ll find a range of spread betting examples and instructions on how to get started with spread betting.

Learn How To Spread Bet In 8 Steps

There seem to be multiple ways for you to learn how to spread bet, but where do you start? Below, I’ve broken down the process into eight simple steps:

1. Train Yourself In Spread Betting

Spread betting lets you speculate on price moments in financial markets without owning the underlying asset. This form of derivatives trading (betting) is attractive as it allows you to profit on rising or falling markets, provided you correctly predict the direction of the prices.

If you think the market price will rise, you will bet long (buy) and profit every time the market rises one point. Equally, if you think the market will fall, you can short (sell) the market and profit for every point the market falls.

2. Decide On A Spread Betting Brokers

You want a broker that offers an easy-to-use spread betting platform, low spreads and betting with the markets you wish to use.

All spread betting brokers are regulated by the Financial Conduct Authority, which installs trust in the brokers as they’ll have had to go through a rigorous framework to get authorised.

3. Use A Demo Account To Test The Platform

Testing platforms with a demo account is a good idea, allowing you to spread bet without risking your capital using virtual funds. Spread betting demo accounts are free and available with all spread betting companies.

4. Create A Trading Account

When you are ready to risk your capital, you must create a live trading account and deposit your funds. The account opening process is swift, and you can start financial spread betting with most brokers on the same day.

To fund your account, you can go to your spread betting broker’s account settings and initiate a deposit. Your funds should be processed and ready to spread bet immediately, depending on your funding method.

5. Select A Spread Betting Platform

You can choose from various spread betting platforms, such as the MetaTrader 4 platform, which has a clean design and customisable charts. The MetaTrader 5 platform is ideal if you want to automate your spread bets, as it has expert advisors that can be coded to follow your betting strategies. If you want a platform with excellent charting capabilities that works on any device, then TradingView would be an ideal choice.

I like to use TradingView because it has an impressive range of indicators built-in, including those not available on other platforms, such as the Hull Moving Average. Because TradingView syncs all of its software across multiple devices, allowing me to continue trading while I’m away from the computer.

6. Develop And Test Betting Strategies

A trading strategy for spread betting the markets is essential for your success; otherwise, you are just gambling. You can develop your spread betting strategy that fits how you want to bet. If you want a technical analysis-focused strategy, use technical indicators, charts and candlestick patterns.

I like to use a hybrid strategy to get an overall financial market bias using fundamentals to give me an idea of where the overall spread betting market is heading. Then, I will use technical analysis to find betting opportunities going in the same direction as my fundamentals.

7. Search Market For Opportunities

Use your spread betting strategy to analyse the markets and find potential trading ideas; it’s good to be slow and methodical by following your strategy step by step. Being slow at the start ensures you can find ideas that match your strategy and risk rules, giving you more confidence to place the bet.

8. Open, Monitor, Close Betting Positions

To do this, you will open a dealer ticket by selecting buy or sell on the asset you want to bet on. Then, complete your ticket by placing your stake size; you can add your stop loss order and take profit on the same deal ticket if you wish.

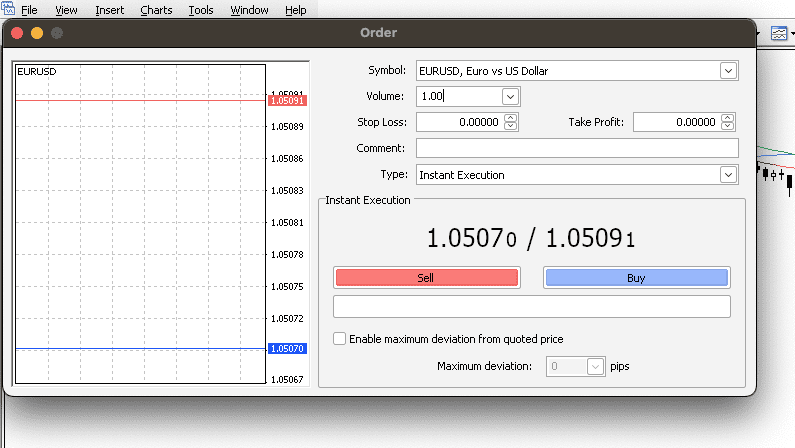

Once you have set up your deal ticket, select the “Place bet” button, and the broker will accept your bet, making it live. Below is an example deal ticket using the MetaTrader 4 platform. You should note that the deal ticket will look different on every platform, but all function similarly.

Spread Betting Examples

Below, I’ll go through different spread betting examples to demonstrate how you can profit (and lose) from various markets.

Example 1: Forex GBP/USD (going short)

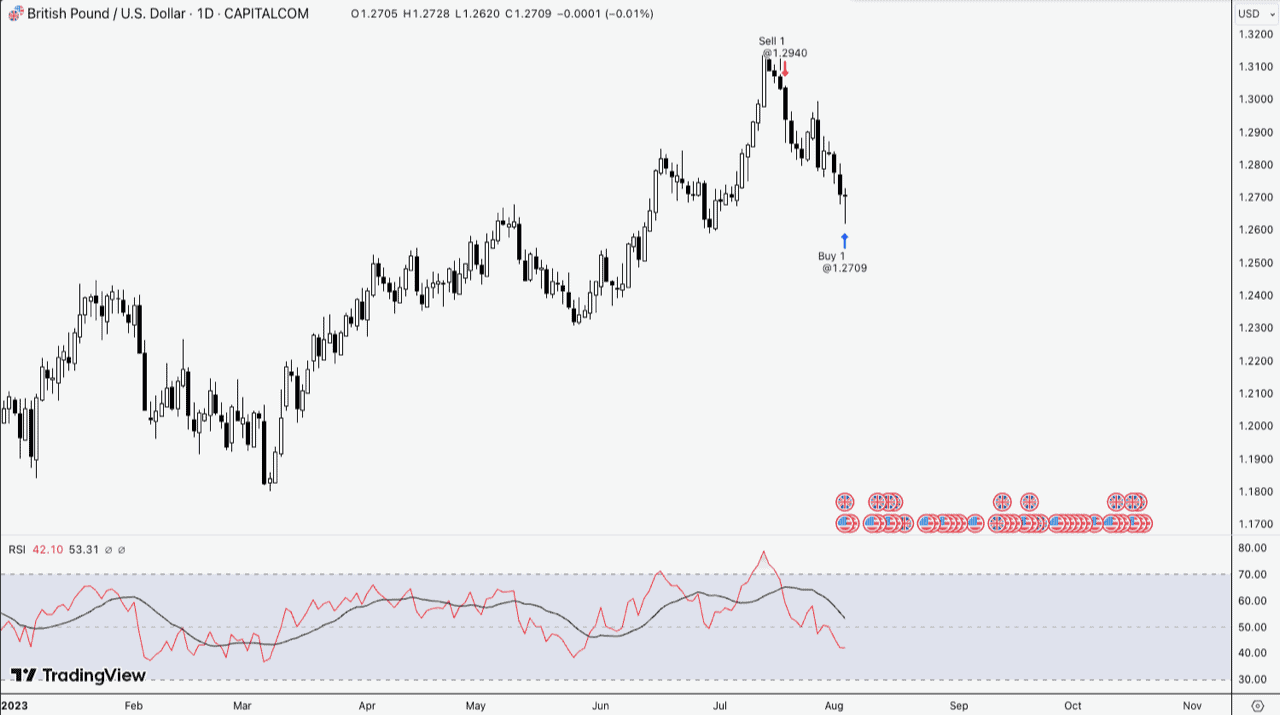

One of the most popular markets to spread bet on is forex, and I will share two examples of betting on the GBP/USD. Betting on forex is straightforward (especially if you’ve traded CFDs), and the point movement in each currency pair is one pip (0.0001).

Outcome A: winning bet

You are watching the price of GBP/USD shoot up, but you think that the market is reactivating too positively, so you look to place a short. With this analysis in mind, you look to place a short at 1.2940 with a stake of £1 per point moved with the hopes for the market to fall.

You can monitor it by looking at the Open Positions section of your account, and here, you can also amend your order with a stop loss or take a profit order.

To close your position, you will find that most platforms have a simple close (or a cross) button next to your open trade. Click that, and you’ll exit your position with the profit (or loss) you made during the bet.

Spread Betting Examples

Below, I’ll go through different spread betting examples to demonstrate how you can profit (and lose) from various markets.

Example 1: Forex GBP/USD (going short)

One of the most popular markets to spread bet on is forex, and I will share two examples of betting on the GBP/USD. Betting on forex is straightforward (especially if you’ve traded CFDs), and the point movement in each currency pair is one pip (0.0001).

Outcome A: winning bet

You are watching the price of GBP/USD shoot up, but you think that the market is reactivating too positively, so you look to place a short. With this analysis in mind, you look to place a short at 1.2940 with a stake of £1 per point moved with the hopes for the market to fall.

You hold on to the bet for several days and want to profit now that the GBP/USD is 1.2700. Exiting the bet at 1.2709 made you 231 points (1.2940 – 1.2709) profit, and because you staked £1 per point, this made you a £231 profit.

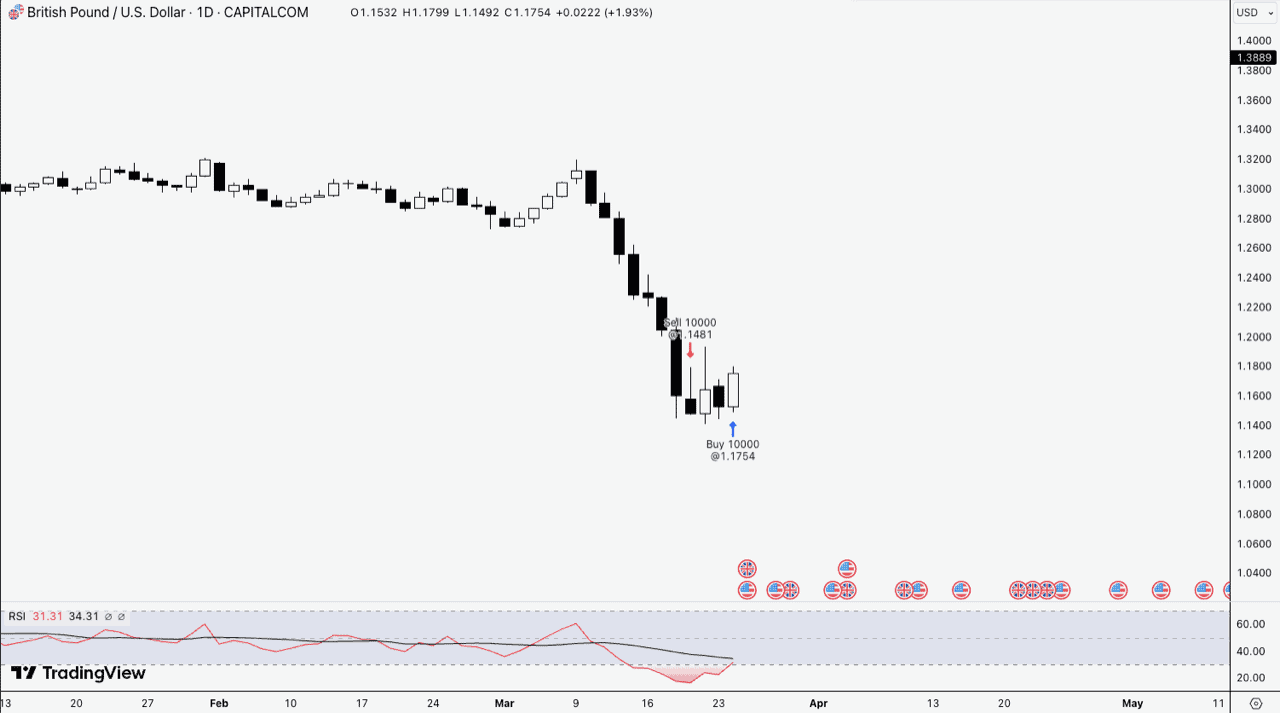

Outcome B: losing bet

You’ve been watching the GBP/USD for the past few days, and you’ve seen the GBP/USD plummet. So, you decided to get in on the action by shorting the GBP/USD at 1.1481 with a stake size of £1 per point thinking the downward pressure continues.

The market immediately finds its feet and has edged higher over the last few days. With this in mind, you close the position, taking the loss and exiting at 1.1754. In this example, you lost 273 pips, or £273.

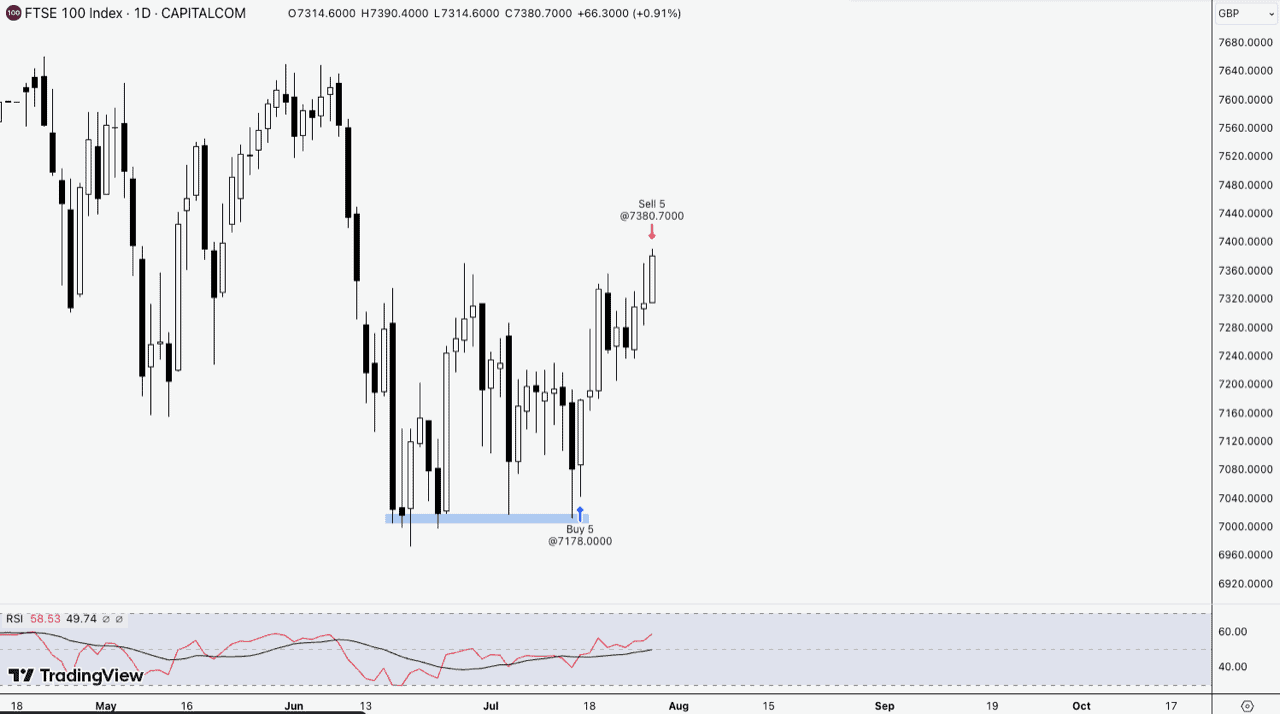

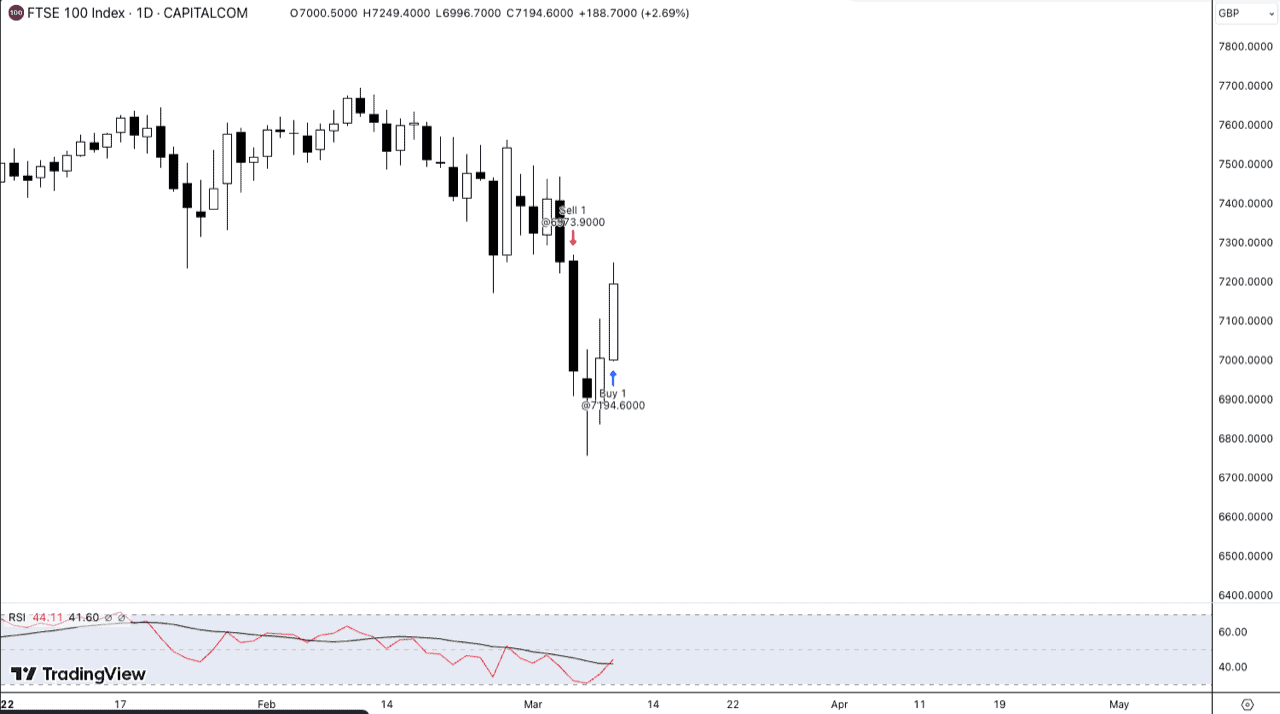

Example 2: FTSE 100 Indice (going long)

When spread betting indices, the point movement is one point (the last digit of the price on the index). Below, I’ll compare two more examples using the FTSE 100 (the UK100 on spread betting platforms).

Outcome A: winning bet

After performing your technical analysis on the FTSE 100 and noticed a nice area of demand where the price respected the supply zone that had formed above the 7000 level. You decide to bet long on the FTSE 100 at 7178 for £5 stake per point because you think it will rise now.

The analysis you did was accurate, and the markets rallied over the next week when you decided to close the bet at 7380.70. This generated 292.70 points profit (open price: 7178 – close price: 7380.70), or £1463.50 (£5 x 292.70).

Outcome B: losing bet

In this example, you thought the FTSE 100 would continue falling based on bearish movements in the last few weeks. Because of the recent drop, you shorted the FTSE 100 at 6973.90 at £5 stake per point.

After a couple of days, the FTSE 100 reversed and erased some of its losses from earlier in the week. This scared you as you believed you caught the bottom of the move, so you decided to cut your losses exiting at 7194.60, meaning you took a loss of 220.70 points (7194.60-6973.90), or £1103.50 loss (£5 x 220.7 points)

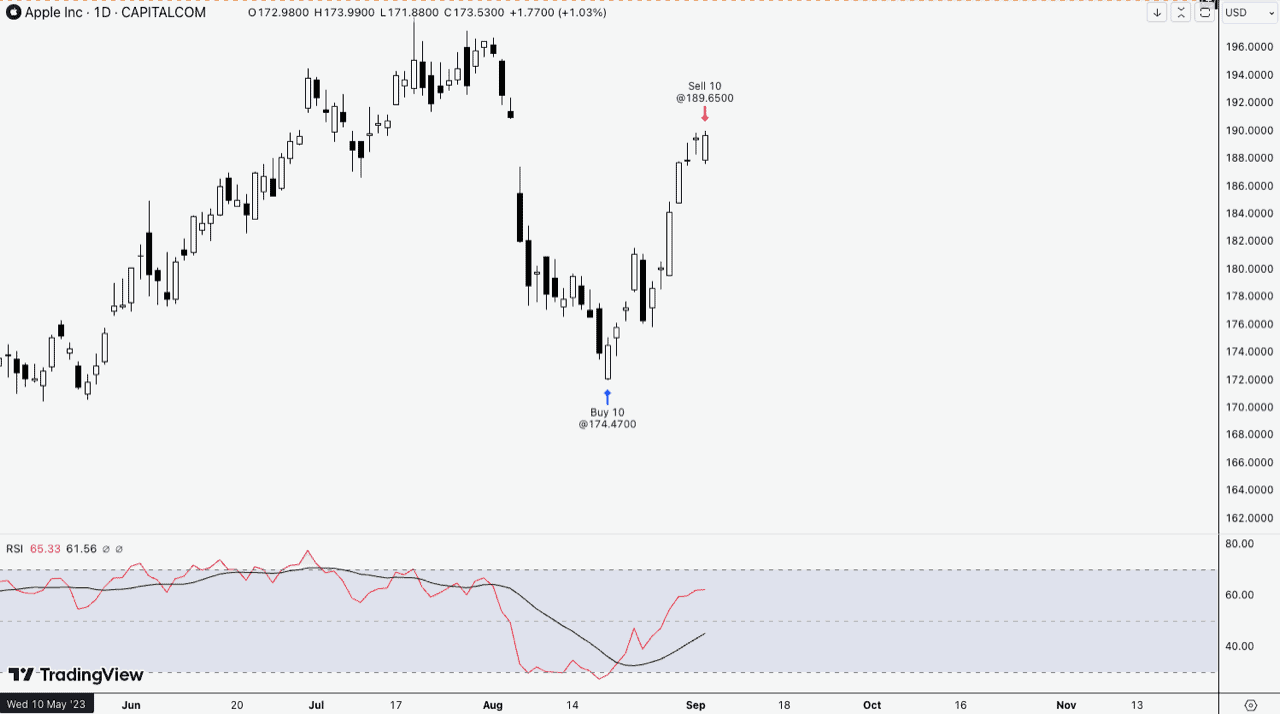

Example 3: Shares With APPLE (going long)

Below is an example of spread betting on shares with Apple, but you should note that each share has different price per point values and isn’t standardised like indices.

Outcome A: winning bet

Based on analyst forecasts on the upcoming iPhone and Apple Watches, you think Apple’s share price will rise. You open a spread bet at $174.47 with a £1 stake per point spread bet movement on Apple’s share price, meaning you will profit or lose £1 for every $0.01 Apple moves.

Three days later, Apple has risen from $174.47 to $181.11 on the back of the latest iPhone pre-order demand (which was better than expected). This means that the price has moved 664 points (189.65-173.96), and in this bet, you will have made £664 profit (£1 x 664 points).

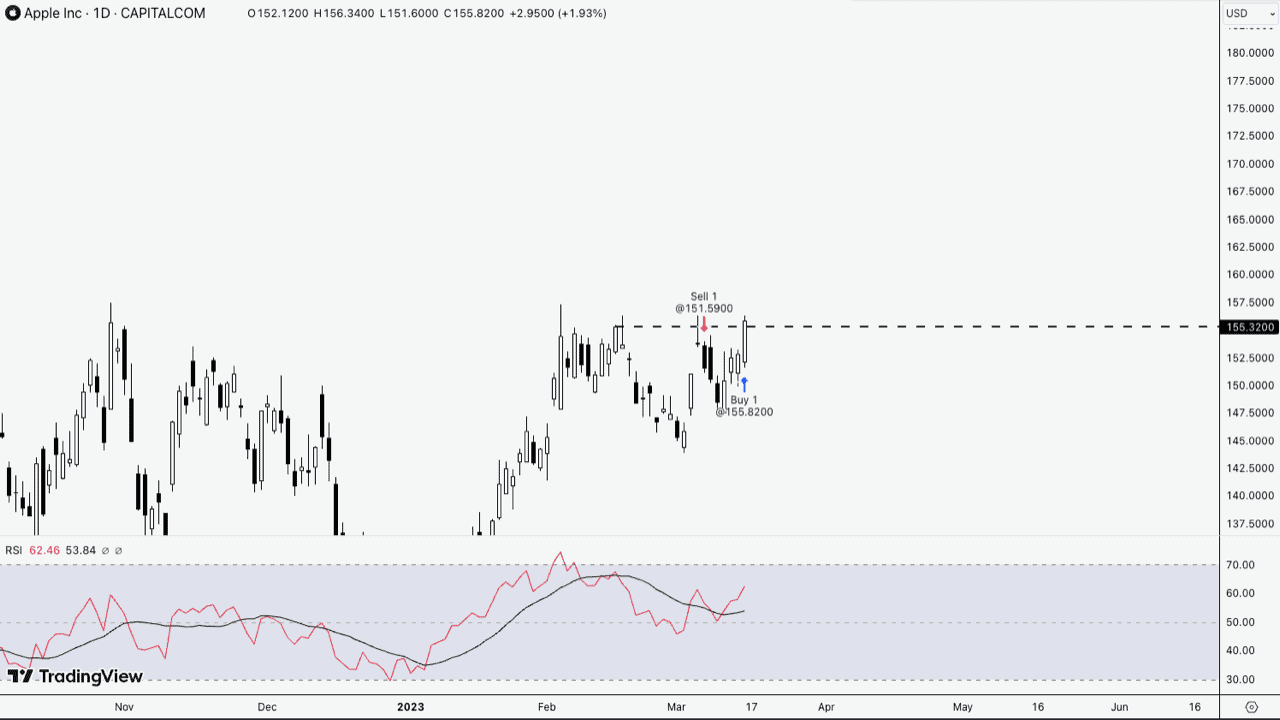

Outcome B: losing bet

You like Apple’s technicals and think the markets will be lower in the short term. So you decide to short Apple at $151.59 with a stake of £1 per point spread bet.

Unfortunately, several days later, Apple reversed the small downward move and hit your stop loss order, which was placed at $155.82, forcing you out of the short bet at a loss. In this scenario, you lost 423 points (155.82 – $151.59), and at £1 per point, that would be a £423 loss.

Example 4: Gold Commodities (going short)

There is also a wide range of spread betting commodity markets, from coffee to wheat and gold to platinum. Most brokers have an excellent range of commodities to bet on but may offer different point values for each commodity point movement value is different.

Outcome A: winning bet

You find an opportunity spread betting gold, thinking the price will break below the 2084.96 price to fall lower to around 2076.45 based on previous support levels. Based on this analysis, you enter a spread bet short, risking £5 per point, setting your take profit at 2076.45.

Your analysis was correct, and the market fell to 2076.45, an 8.51-point drop from the open price, netting you £42.55 profit. This is because you made £5 for every point the price of gold fell (£5 stake x 8.51 points fell).

Outcome B: losing bet

You decided the parabolic channel could give you an excellent breakout to the downside lower than a previous large wick candle. Based on the analysis, you place a short spread bet on gold at 2068.24 with a stop loss at 2070.35, risking £10 stake per point.

The market initially dropped in your favour before returning higher and hitting your stop loss at 2070.35.

You take the loss of 2.1 points (2070.35-2068.24), which gives you a total loss of £21 on this bet (2.1 points x £10 per point stake).

Example 5: Sports Football (going short)

Going short on a sports spread bet means you disagree with the spread betting company and think the outcome will be less than the spread offered. Below, I’ll give a quick example of sports spread betting by shorting a total goals market.

Outcome A: winning bet

In this betting example, the bookmaker offers you a spread bet on West Ham vs Manchester City to score more than 3.5 goals. You believe that there won’t be many goals in the game, so you sell (go short) the spread at 3.25 for a £10 stake per point.

Your wins are limited as a sell bet as you can only profit when there are no goals or less than three in this scenario. Let’s say the game ended 0-0 (no goals scored). You would win your stake £10 multiplied by the spread of 3.25, making your total profit £32.50.

If there had been a goal in the game, which ended 1-0 to West Ham, you would have made less profit. In this case, you would have made your spread 3.25 minus one goal, giving you a spread of 2.25 – so your profit would be £22.50.

Outcome B: losing bet

You feel that the Arsenal and Chelsea game isn’t going to be exciting, and don’t expect many goals scored. The bookmaker has a sell spread of 2.35 on total goals, which you accept and stake £10 per point.

The game was a 5 goal thriller, meaning you lost your bet. Your realised losses are based on the number of goals scored minus the spread (5 goals – 2.35 spread), giving you an outcome of 2.65. You then multiply your stake by the 2.65 to get your total losses, which was £26.50.

What Costs Apply When Spread Betting?

When spread betting, the only costs that apply are the spread and the rollover fee charged each night for each bet you have open. The spread is the difference between the buy and sell price the broker offers you for an asset.

So if the broker offers you a buy price of 1.2250 and a sell price of 1.2252 on GBPUSD, then the spread is two pips (1.2252 – 1.2250). If you staked £1 per point to enter the bet, it would cost you £2 to open it.

You should use a spread betting calculator If you want to understand your costs before entering a bet or after you have closed but are unsure how much you were charged.

What Are The Advantages Of Spread Betting?

Spread betting has many advantages, including simple trading fees, tax-free profits with no stamp duty, using leverage, and controlling your stake size in GBP.

The most popular advantage is that the profits from spread betting are exempt from capital gains tax, as the HMRC considers it as gambling. In addition, with it being a derivative of a financial instrument (don’t own the underlying asset), you don’t pay stamp duty either.

Which Brokers Are Best For Spread Betting?

In my options, the best brokers for spread betting is Pepperstone. This is because they have low average spreads from 1.12 pips on EUR/USD (better than the industry average). You can use any of 4 trading platforms – MetaTrader 4, MetaTrader 5, cTrader, and TradingView to bet a wide range of products include 60+ currency pairs, indices and stocks.

Which Broker Has The Best Demo Account?

The broker that has the best demo account for spread betting is CMC Markets because it offers long expirations and unlimited funds available; other brokers have expiration dates on the demo accounts. You can also use the demo accounts on MetaTrader 4 platforms, giving you a solid choice of platforms to use.

Which Broker Is Best For Beginner?

The best broker for beginners is OANDA with its user-friendly trading platform (OANDA Trade), which allows you to spread bet with stake sizes from 1p per point. Smaller stake sizes from 1p significantly reduce the risk to your capital, allowing you to transition from a demo to a live account without risking your whole account.

What Markets Can You Spread Bet On?

You can spread bet on a range of markets that include:

- Stocks – bet on price movements of companies listed on an exchange.

- Forex – speculate on currency pairs rising and falling.

- Indices – trade top indices including FTSE 100, S&P 500, and DAX 40.

- Bonds – bet on price movements of bonds from UK Gilts to German Bunds.

- Commodities – Speculate on the direction of popular commodities, including gold and oil.

Can You Spread Bet Using Cryptos like Bitcoin?

Spread betting on cryptos like Bitcoin is possible; however, it is a restricted activity in the UK, meaning only professional spread bettors can speculate on them. The Financial Conduct Authority restricted retail traders from speculating on the prices of Bitcoin and other cryptos in 2019.

To get access to the crypto markets through financial spread betting, you must become an elective professional, which means you have to meet two out of three of the following criteria:

- Work (or has worked) in the financial trading industry

- Have a liquid portfolio of €500,000 or more

- Has traded large values of spread bets in the last quarter

Can You Use Risk Management Tools When Spread Betting?

Each spread betting platform has the standard risk management tools you should utilise while spread betting, especially if you are a beginner.

The most common risk management tool is the stop-loss order, which automatically closes your bet at a price you define if the markets move against your betting direction. This tool is helpful as it eliminates the need to monitor the position as you will know your maximum loss.

Example Of Stop Loss

Let’s say you have a short spread bet on the EUR/USD at 1.0900 with a stake of £2 per point and a stop loss at 1.0920. The market moved against you after worse-than-expected NFP data, pushing the price above 1.0920 and hitting your stop loss.

Because the market increased to 1.0920, the stop-loss order automatically closed your position for a 20-pip loss, costing you £40 (20 pips x £2 per point).

Example Of Guaranteed Stop Loss

You are in a long position on the FTSE 100 at 7200, risking £5 per point and have placed a guaranteed stop loss at 7180. The market moved sharply lower to 7120 after an unexpected event that impacted the global economy. Fortunately, your stop loss was guaranteed, which closed your bet at 7180, losing £100 in this bet.

With a standard stop loss, you’d have slippage due to the volatility to the next available price (7120), falling 60 points and costing you £300 more in losses. This would bring your total loss to £400 vs £100 with the guaranteed stop loss.

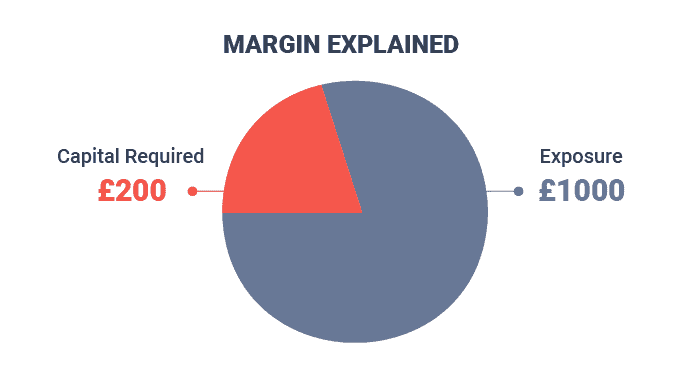

Can You Spread Bet On Margin?

You must have a margin for spread betting before you open a position, which allows you to use leverage. Margin is the amount of capital the broker requires from you to open and maintain a spread bet, expressed as a percentage of the total position (3.33% for forex).

Below is a table highlighting the margin required for each financial instrument:

| Asset | Margin Required | Leverage Amount* |

|---|---|---|

| Forex (Majors) | 3.33% | 1:30 |

| Forex (Minors) | 5% | 1:20 |

| Indices | 5% | 1:20 |

| Commodities | 10% | 1:10 |

| Metals | 5% | 1:20 |

| Shares (UK) | 20% | 1:5 |

| Shares (US) | 20% | 1:5 |

| Shares (EU) | 20% | 1:5 |

Example Of Spread Betting With Margin

Let’s say you want to open a spread bet on GBP/USD at £1 per point, and the broker requests you have a margin of 3.33% for betting with a major currency pair.

The current buy price of GBP/USD is 1.2763, at £1 per point, which means the total value of the position is £12,763, and you would need 3.33% of this as margin, therefore needing 425.08 to open the bet.

FAQ

How Does Spread Betting Work?

Spread betting works by selecting a market to speculate on a price’s rise (or fall) and placing a stake that increases (or decreases) for every point the market moves.

Let’s say you bought FTSE 100 at 7250 for £10 per point; for every point, the price rises above 7250, you make £10, and for every point below, you lose £10.

Is CFD Trading The Same As Spread Betting?

CFD trading is similar to spread betting as both allow you to speculate on the price movement of an asset without owning the underlying market. The main difference is that spread betting is exempt from paying taxes on its profits, while CFDs pay tax.

Is Forex Trading The Same as Spread Betting?

Forex trading and spread betting are not the same, as forex trading is a specific market you can speculate on using CFDs and spread betting. Spread betting is a derivative of an asset (like forex EUR/USD) that you use to bet on the price direction, and this is one of the products allowing you to trade forex.