Want to know what Spread Betting is, how it works, its advantages & disadvantages and how to use it to trade the markets? Then, take 5 minutes to read this guide.

This spread betting guide explains the basics of spread betting. With this type of derivates trading, you speculate on the price movements in financial markets which allows you to make profits if the underlying instrument moves as you predict. Spread betting is unique to the UK and highly popular because profits have no capital gain taxes.

How To Learn Spread Betting

If you’re interested in learning how to spread bet, the best place to start is by researching.

There are various educational resources available on the internet, and a good spread betting broker will typically offer its own education suite.

We’ve outlined some preliminary steps you can take to get started:

Research

The first step you should take is to conduct research into the best spread betting brokers.

There are various aspects to consider including:

- Reviews

- Markets available

- Platforms

- Spreads

- Customer support

Practice

Once you have done your initial research, it’s a good idea to practice. Fortunately, most brokers offer a free demo account that you can use to build up your skills without using your own funds.

1. Select A Trading Account

There are many different spread betting brokers, so comparing their fees and services is essential. To offer spread betting in the UK, the broker must be regulated by the FCA, so a good starting point is to check the broker has the appropriate FCA licencing. FCA licencing ensures the broker is legit and safe to trade with.

2. Research Spread Bet Strategies

The beauty of spread betting is that you can use various strategies to find profitable ideas daily. We have listed some of the more popular strategies you can learn below:

- Swing trading is a trend-following strategy where you aim to find the swing lows or swing highs of a market trend and look for the markets to reverse.

- Scalping is a strategy that uses leverage to take advantage of small price movements over a short timeframe (you’ll be in a bet for seconds or minutes at a time) to take little profits, but often.

- Breakout trading focuses on entering a position after the market breaks above a strong resistance or support level. This “break out” is usually strong enough to carry the price further so you can profit from it.

- Price action trading is a form of analysis that finds chart and candlestick patterns that can indicate a potential price reversal.

3. Decide On A Market To Spread Bet

From currencies, indices, commodities and shares, there are various financial markets available to you when spread betting. Some brokers such as also offer spread betting with sports.

All markets behave differently so we recommend choosing just one market to focus on and gain experience with that asset. This is because each market has its own patterns and behaviours which is why I think it’s best to become an expert in one.

4. Set Your Stake Size

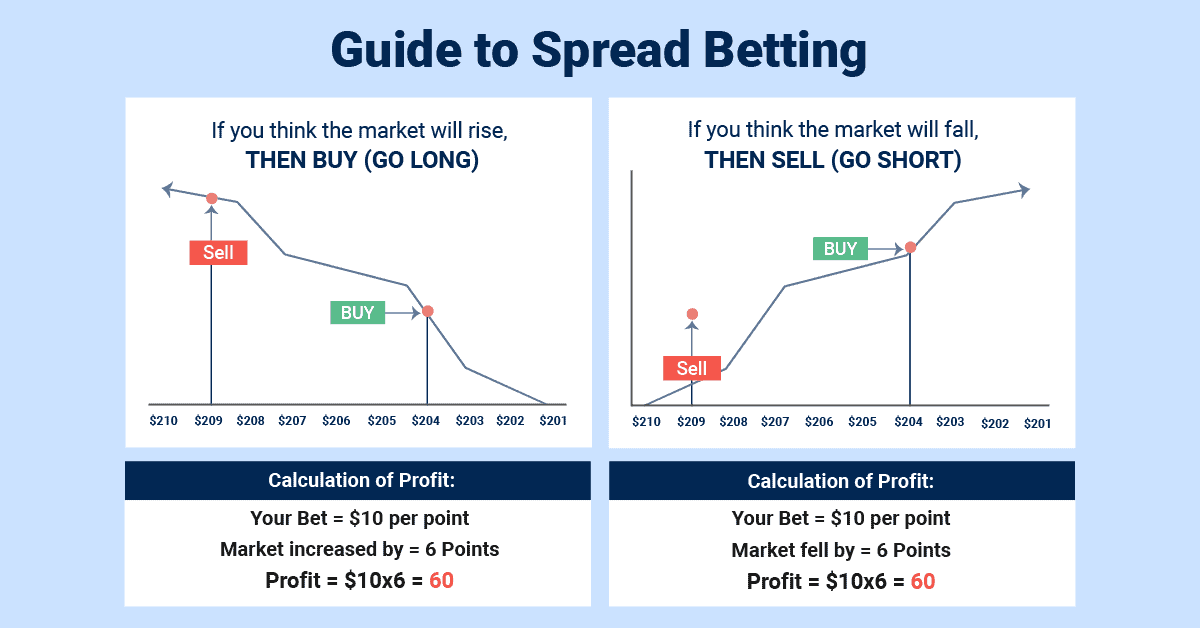

With spread betting you set a bet size (or stake) that you want to risk for every point the market moves. The bet size is a fixed amount and is how much you will win (or lose) with each point the market moves.

For example, setting your bet size to £10 means every point the market moves, you will profit (or lose) £10. If the market moves 10 points higher, you will make £100, and if the market falls 5 points against you, you will lose £50.

5. Choose To Buy Or Sell

As a derivative, spread betting allows you to speculate on market movements without owning the underlying asset. You can go long if you anticipate a rise or go short if you expect a fall, providing opportunities for short-term trading and capitalising on daily volatility.

To open your bet, you must choose to go long (buy) or short (sell).

Enter your stake size, which is the amount you wish to risk per point, and your deal ticket will show you how much margin is required to open the bet.

As you can see in the example above, my deal ticket shows I will be buying gold at $2012.95 and staking £1 per point, with a margin requirement of £100.54 to open the bet.

When you click the place deal button, it will instantly execute your order. You should note that other platforms may look different, but they all have a similar process.

6. Apply Risk Management Tools

Spread betting is considered a high-risk trading activity because it uses leverage and margin to open bets which can amplify profits and losses on small market movements.

Risk management is therefore crucial for protecting your capital while trying to grow it. Brokers provide some tools you can use to manage your risk including:

- Stop Loss Orders will automatically close your position if it reaches a specific price, limiting your losses if the market moves against you. Placing a stop loss is vital with spread betting given you could be away from your computer when an adverse move occurs. For a premium, a guaranteed stop-loss order can be used to ensure you will not experience slippage.

- Take Profit Orders will automatically close your position once it reaches a specific price. This order helps you lock in your profits when the market moves in your favour, allowing you to capitalise on your bets if you are away from your computer or if the market is volatile.

7. Action Your Bet

Initiate your bet by selecting either the “go long” (buy) or “go short” (sell) option. After making this decision, you can input your stake size which is the amount you’re willing to risk per point. The deal ticket will then display the required margin for opening the bet.

What is Spread Betting?

Spread betting is a derivative that allows you to speculate on the price movements of financial instruments, such as currencies, indices, commodities, and stocks, without owning the underlying asset.

For example, instead of buying an amount of the asset (such as one lot or 1,000 shares), you place a stake per point to win (or lose) for every point the market moves up or down.

Spread betting is regulated by the Financial Conduct Authority in the United Kingdom and is considered a form of gambling not trading.

Why Spread Bet?

There are various benefits available to you when it comes to spread betting. While there are some risks to be aware of, the preferential tax treatment and wide range of markets available can be an attractive proposition.

Below we have outlined some of the pros and cons of spread betting:

| Pros | Cons |

|---|---|

| Tax free for UK residents | Cannot claim tax losses |

| Can go long and short | Open positions have daily financing fees |

| Accounts are in GBP removing currency risk of USD-based accounts | Less pricing transparency |

| Can use leverage | Limited investor protections |

| Negative balance protection | Regulatory risks |

How Does Spread Betting Work?

The mechanics of spread betting markets involve several key elements, including the spread, stake size, margin, and leverage. Below we breakdown some of these elements so you can gain a better understanding of them:

- Spread: The spread is the difference between the buy (bid) price and the sell (ask) price of a financial instrument. It represents the broker’s profit.

When you enter into a spread bet, you do so at the current sell price, and the market must move in your desired direction to go beyond the spread for the trade to be profitable.

- Direction: You can decide whether to go long (buy) or go short (sell) based on your market analysis and prediction about the future price movement of an asset.

- Stake Size: The stake size is the amount of money you are willing to bet per unit of movement in the price of the asset. It is often expressed as “per point” or “per pip.” The larger the stake size, the greater the potential profit or loss you will incur.

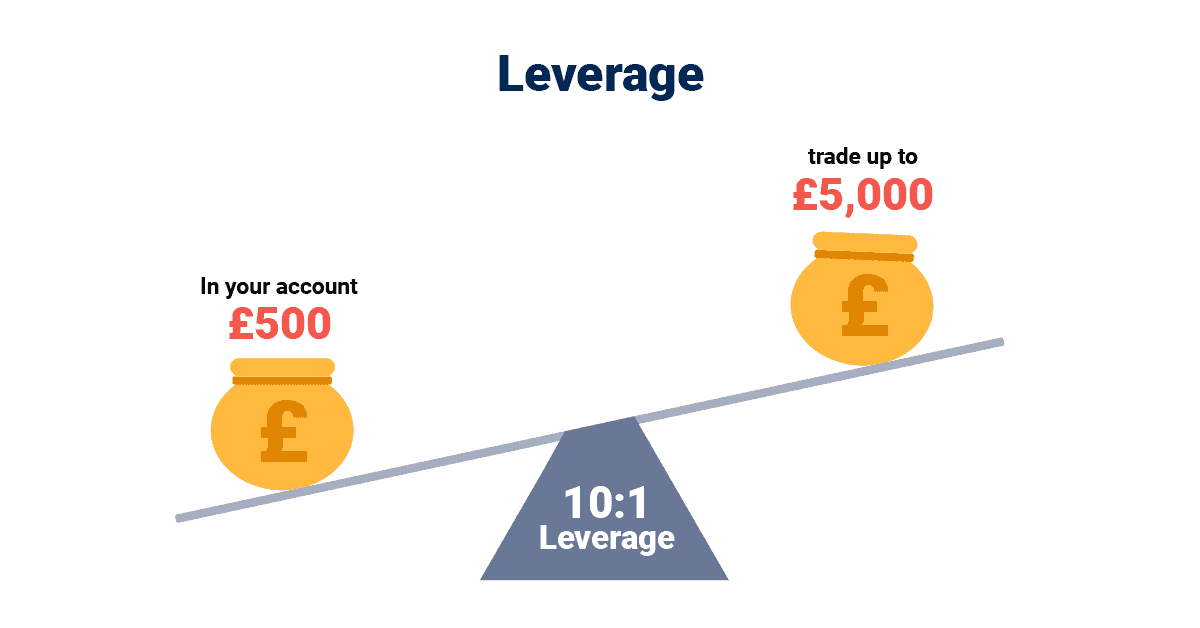

- Margin: Is the initial deposit required by the broker to open a spread bet. It is a percentage of the total position size and serves as a security against potential losses. Leverage is used to control a larger position with a smaller amount of capital.

- Leverage: Allows you to control a more substantial position, often many multiples of your initial deposit.

For example, if the leverage is 1:50, you can control a position worth $50,000 with a deposit of $1,000. While leverage can amplify profits, it also increases the risk of significant losses.

Spread Betting Examples

A spread bet broker will quote a two-way price and you will be able to bet whether that asset’s price will be going up or down with an associated cost per point.

We have provided some examples to demonstrate this:

Example 1. Winning Bet

A winning spread bet trade

- The FTSE 100 market might be quoted at 4200 – 4202

- You have the option of buying at 4202 (the offer price) or selling at 4200 (the bid price)

- If you expect higher prices, buy at 4202 perhaps risking £1 a point

- Assume you’re right; the market rallies, and you sell out at 4222

- 4222 – 4202 = 20 x £1 a point = Profit of £20

Example 2. Losing Bet

A losing spread bet trade

- The Gold price is quoted at $1,850 – $1,851

- You’re expecting prices to fall, so sell at $1,850, risking £1 a point

- However, the market rises, and you sell out at $1,855

- $1,850 – 1,855 = -50 x £1 a point = Loss of £50

What Is A Stake Size and Spread?

There are various terms which you will discover and will need to understand when it comes to spread betting, two of which include stake size and spread.

Stake Size

Unlike other trading methods, in spread betting, you specify a fixed bet size (or stake) that represents the amount you want to risk or gain for each point of market movement. This fixed bet size determines your potential profit or loss with every point the market moves in your favour.

For example, setting your bet size to £10 means that for every point the market moves, you will profit (or lose) £10. So if the market moves 10 points higher, you will make £100, and if the market falls 5 points against you, you will lose £50.

We have created a spread betting calculator to help you determine your position sizes.

Spread

The spread is the difference between the bid (buy) and ask (sell) price of the asset you pay to open a bet. The broker charges this for its services, which is a relatively small fee when you think about what they offer.

For example, If you want to buy USD/JPY and see a buy price at 150.50 and a sell price at 150.48, the difference between the two prices is two pips. So, if you wanted to stake £10 per point on USD/JPY, it would cost you £20 to enter the bet.

What Is Leverage?

Leverage in spread betting refers to the ability to control a larger position size in the market with a relatively smaller amount of capital. This means you can amplify both potential profits and losses, so it’s important to understand and use responsibly.

The use of leverage is a fundamental aspect of spread betting and is expressed as a ratio, such as 1:10 or 1:100.

With leverage of 1:10, every £1 you place as collateral (margin) provides you with £10 worth of exposure to the instrument you are trading. Therefore, if the position size is worth £1,000 the broker will request a £100 margin from you.

How Long Is The Bet Duration?

Bet duration in spread betting refers to the timeframe for which a spread bet remains open and active.

Different durations are available from daily to monthly spread bets, but costs can vary depending on the bet duration.

For example, the most common spread bet is called a Daily Funded Bet (DFB) which typically has the lowest spreads available but incurs rollover fees if you keep the bet open overnight.

These overnight fees can be expensive, so some brokers offer monthly spread bets with wider spreads but lower (or no) rollover fees, making them a better choice if your prediction is over a longer period.

How Does Going Short and Long Differ?

As a derivative, spread betting allows you to speculate on market movements without owning the underlying asset.

You can go long (buy) at the market price if you anticipate the market rising or go short (sell) if you expect declines.

This flexibility is particularly advantageous for short-term traders, enabling them to capitalise on daily market volatility by taking both long and short positions throughout the day.

Additionally, in some cases you can go long and short, a strategy commonly known as hedging.

What Are The Margin Requirements?

Margin in spread betting refers to the minimum amount of money that you need to deposit to open and maintain a leveraged position.

It is a percentage of the total position size and serves as a security against potential losses which you might incur.

What Markets Can You Spread Bet?

Spread betting provides access to a diverse range of financial markets, allowing you to speculate on the price movements of various instruments including:

- Forex (Foreign Exchange): Major currency pairs such as EUR/USD, GBP/USD, and USD/JPY are popular choices for spread betting, but you will have a vast range of major, minor and exotic pairs to choose from.

- Stocks: Most spread betting providers offer you the ability to speculate on the price movements of individual stocks. This means you can trade major US companies and potentially smaller companies from other jurisdictions as well.

- Cryptocurrencies: Some brokers offer spread betting on cryptocurrencies like Bitcoin, Ethereum, and other digital assets, providing you with the opportunity to get tax-free exposure to this volatile asset class.

- Indices: You will also be able to bet on the performance of stock market indices, such as the FTSE 100, S&P 500, or DAX along with other indices like the US Dollar index (DXY), enabling you to take a position on the overall performance of a market index.

- Commodities: Spread betting covers a range of commodities, including precious metals (gold, silver), energy commodities (oil, natural gas), and agricultural commodities (wheat, corn).

- Interest rates: Some spread betting brokers will also offer interest rates for you to trade, although these markets are generally less popular than forex, stocks and crypto.

Who Are The Best Spread Brokers?

Below we have included some of the best spread betting brokers you should consider:

Pepperstone – Best Overall Spread Betting Broker

We like Pepperstone and rate it as our best spread betting broker based on our tests, where the broker excelled in fast execution speeds, low spreads and a decent range of markets.

The broker offers 62 currency pairs, 1,000 stocks, 25 commodities, and 28 indices with low spreads from 0.7 pips on EURUSD.

Pepperstone supports several popular platforms, including MetaTrader 4, MetaTrader 5, cTrader and TradingView. If you are heavily invested in technical analysis, we recommend you try TradingView with Pepperstone.

Other brokers we like include City Index, IG Group, FXCM, FxPro, OANDA, CMC Markets and Spreadex.

Pepperstone ReviewVisit Pepperstone

FAQ

Which Trading Platform Is Best For Beginners?

From all the brokers we have reviewed, we think Pepperstone is the best performing broker overall due to the low spreads, great range of markets and ease of use.

Does Anyone Really Make Money From Spread Betting In The UK?

Like any form of investing and trading, some make money and others don’t.

If you’re able to demonstrate consistent skill and discipline, then you will have a greater chance of making money when spread betting.

What Is The Difference Between Spread Betting And CFD Trading?

Spread betting and Contracts for Difference (CFD) are both derivative products that allow you to speculate on financial instrument price movements without owning the underlying assets.

There are many similarities but also some key differences, namely that spread betting is only available for UK residents and any gains made are tax-free.

Is Spread Betting Risky?

Using any type of derivative contains some degree of risk which underscores the importance of doing your research into the products, brokers and markets available.