What Are The Best Spread Betting Demo Accounts?

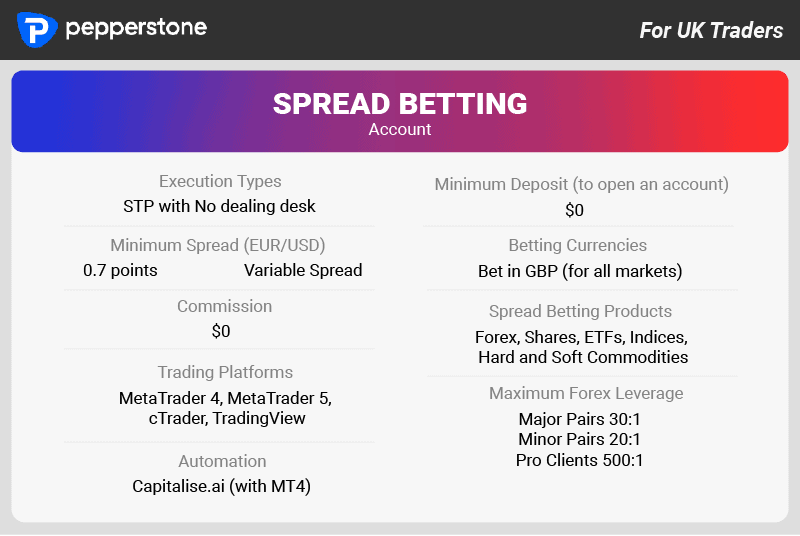

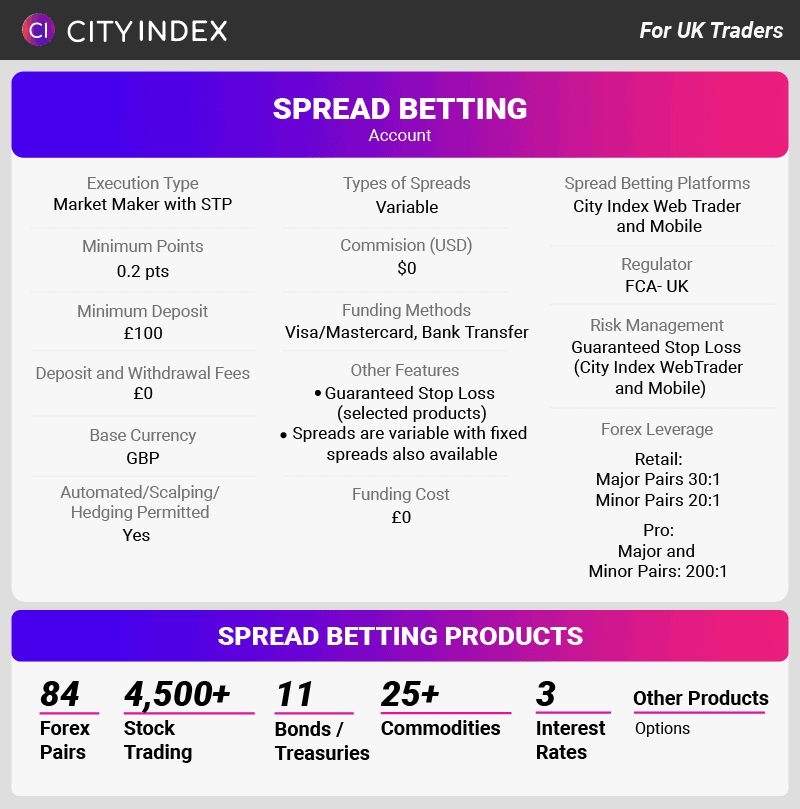

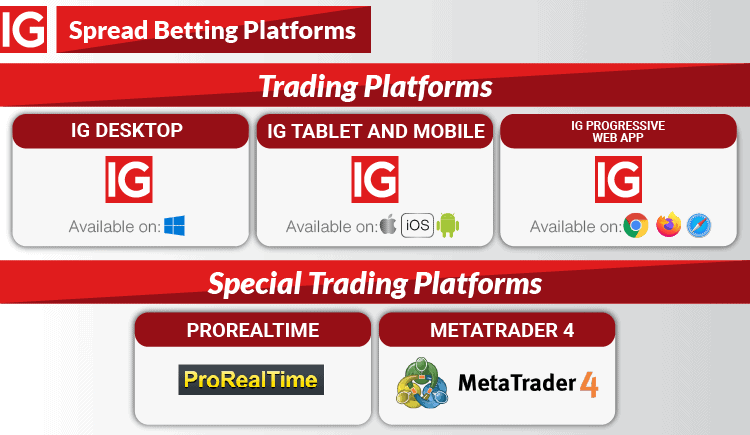

Good demo accounts allow at least 30 days to test the trading platform and $100,000 in virtual currency. MetaTrader 4 is one example of a top platform to practice with. Let’s look at the best spread betting demo accounts.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.