The UK is the most popular country to spread bet allowing residents to speculate on the rise or fall of financial markets. Find out why you may choose spread betting over trading CFDs and what to consider before trading.

In the UK, spread betting is a type of derivatives trading where you speculate on prices rising or falling using a range of financial assets, such as stocks and currencies. Spread betting is considered a form of gambling since you do not own the underlying instrument.

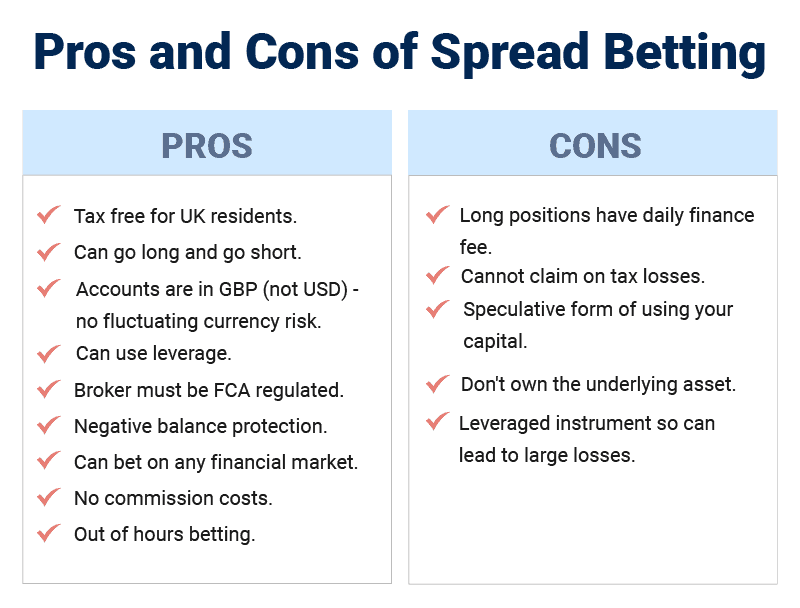

Spread betting lets you bet in both price directions by going long or short on an asset, allowing you to profit in bullish and bearish markets. It is popular with UK traders since there are no capital gains taxes.

How Does Spread Betting Work?

Spread betting is a derivative product which means prices are taken from the underlying instrument.

To action a bet, you stake how much you wish to risk per point the financial market moves, and you’ll profit for every point the price shifts in your favour. Your total profit is the difference between the opening and closing price, multiplied by the stake size of your spread bet.

1. Going Long Or Short In Spread Betting

You should assess market conditions before placing a spread bet to identify suitable currency pairs. If you believe a currency will rise in value compared to the other currency pair, you would take a long position and go short (sell) if the reverse happens.

2. Size and Duration

Then, you will choose the bet size (or stake) that you wish to risk per point the market moves, and this will be how much you profit (or lose) each time the asset’s price moves one point.

The standard duration of the spread bet is unlimited, but you are charged each night the position remains open (idea for day trading and very short-term trading ideas). If you want to lower the fees, you can use the futures market, which has lower overnight fees but higher spreads (ideal for long-term bets).

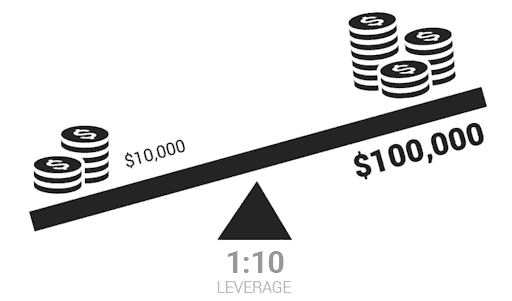

3. Leverage And Margin

Leverage is a key tool in spread betting that allows you to maximise your profits by borrowing funds from your spread betting provider, allowing you to control larger bets with smaller funds. Margin is the minimum funds you need to open a position with a spread bet.

4. Trading Platforms

To execute your bets, you will use a spread betting trading platform the broker provides you for free. You can use various platforms that provide advanced charting tools and execution methods. Popular platforms include MetaTrader 4, MT5, cTrader, and TradingView.

Why Spread Bet?

Many people in the UK choose to spread bet for the lower trading costs. These savings are because spreads are tight and they are exempt from tax.

Unlike other trading products, spread betting has no capital gains and stamp duty tax, which can save you a fair bit over time. The exemption to this rule is if spread betting is your sole or main source of income (I.e. you are a professional trader).

You will also save on currency conversion fees since bets are done in GBP not USD.

Additionally, spread betting is available across many popular markets, allowing you to take advantage of this tax-free product with lower spreads, such as US stocks, forex pairs, and commodities.

Examples: Spread Bet vs CFDs Stocks

In the UK, you can access several market speculation methods. Below, I’ve highlighted examples of each method.

1. Spread Bet Example

Unlike other trading products, spread betting provides a simplified approach to trading where you enter the bet size you wish to risk per point. Allowing you to control precisely how much you will profit (or lose) on the bet. Let’s take a quick look at a spread betting example:

If you wanted to buy EURUSD, you would enter your bet size as £1, meaning you would profit £1 for every pip the EURUSD moves in your favour. So if you bought EURUSD at 1.0190 and rose to 1.0205, you would have made £15 profit (tax-free). This makes spread betting more appealing to me (and other traders) than investing in shares or trading CFDs.

2 . CFD Trade Example

CFDs like spread betting are a popular leveraged trading product. There are some notable differences, for example, you own a contract representing the value of the asset (but not the underlying instrument itself). And you can only buy the asset using lot sizes. Lastly, CFD trading is popular across the world.

In this example, you buy 10,000 shares in VOD, but with trading CFDs, you can use leverage like spread betting. Most CFDs allow leverage of up to 1:10 in shares, so you can put down £800 in margin to control 10,000 shares of VOD.

VOD had a bullish run after stellar earnings and is now worth £1 per share, netting 20p profit per share. Because you control 10,000 shares of VOD, this results in a profit of £2,000 (while only putting £800 towards it), netting a solid profit.

When you close the position on a profit, you will pay a commission of 0.1% on the whole position, which is now £10,000, making the commission £100. In addition, you will be subject to CGT, which could be up to 20% of the profit made. So your overall profit would be:

£10,000 – £8,000 – £100 – £8, giving you a net profit of £1,892 before tax.

3. Stock Market Trade Example

While spread betting and CFD trading use leverage, buying and selling shares do not. If you want to invest in a stock such as Vodafone, you will own the shares outright and are subject to capital gains tax and stamp duty. However, unlike with spread betting, you will not have to pay nightly fees (swaps) to keep the trade open and you can claim losses on your tax return.

If you purchase 1000 shares in VOD (Vodafone) at 80p, you would have to put up the total amount, which is £800, then you would be charged a commission (usually 1% or a fixed fee), then stamp duty at 0.5%. So, to buy 1000 VOD shares, you would have to pay £812.

If the market rises in your favour, you can sell the VOD shares to the market. The VOD shares have risen to £1 (100p), making you a nice 20p profit per share before costs and taxes.

After selling 1000 VOD shares at £1.00, you will have received £1000 before costs, and the stock broker charges 1% (£10 commission), leaving you with £990 and £190 profit. The £190 made is subject to capital gains tax, up to 20% of the profits.

How To Manage Risk When When Spread Betting?

To manage risk when spread betting, you should use a range of tools like stop loss to limit losses and take profits to lock in profits. Below, I’ve broken down each tool you can use in risk management.

1. Standard stop-loss orders

A stop-loss order automatically closes your position at a level you request when the market moves against you. I recommend you learn how to spread bet with stop-loss orders, as they can limit your exposure to the markets.

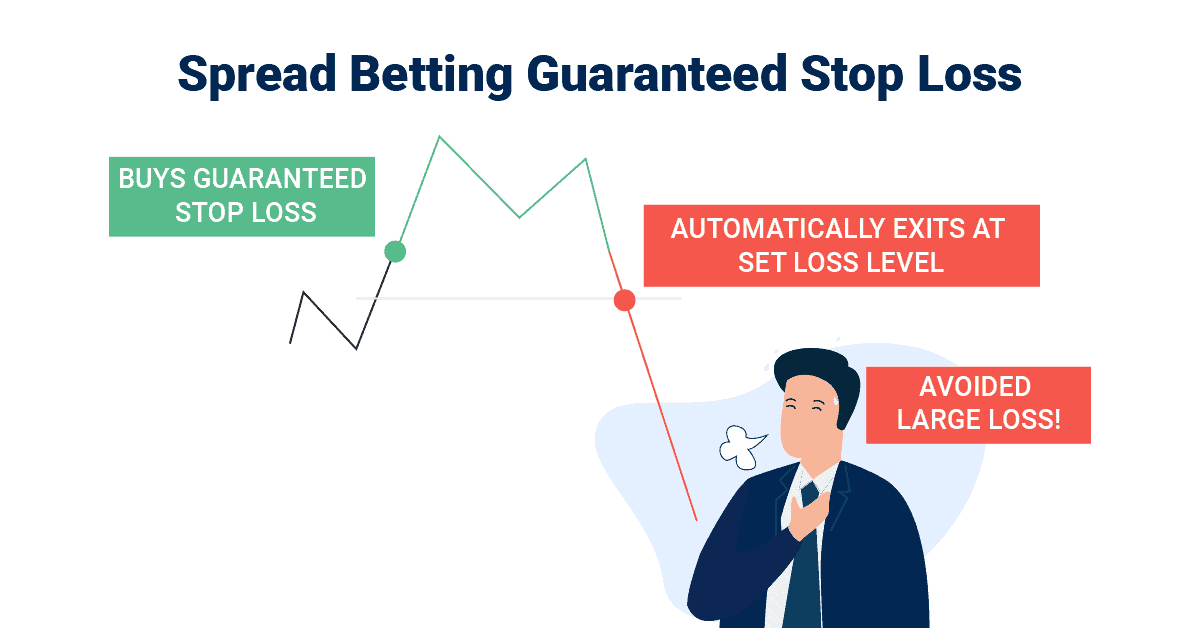

2. Guaranteed Stop-Loss Orders

The critical difference between guaranteed stop-loss orders (GLSOs) vs. stop-loss orders is that standard stop-loss orders can slip, which can end up costing you more money.

Meanwhile, with GLSOs, you pay a small premium for the spread betting broker to take you out at the GSLO price no matter what (you do not pay this premium if the GLSO is not used). It is beneficial when high volatility and standard stop losses could slip.

3. Take profit orders

A limit order automatically closes a trader’s position if the currency price rises to a pre-set point. Using limit orders can help ensure that you make a profit without having to monitor the markets all day.

4. Hedging

Hedging is limiting risk by opening opposing positions to balance wins and losses. Assume that when the dollar’s value rises, the euro’s value falls. In that case, a trader who opens a large USD/JPY position might protect against large losses by hedging risk with a similarly large EUR/GBP position.

5. Margin Calls

The broker may automatically close off the position (known as a margin call) if you run out of margin on an open bet.

All FCA-regulated brokers have negative balance protection, meaning the broker will close your position before you owe the broker more funds.

Trading Shares vs. Spread Betting

Traditionally, trading shares means owning the stocks and their benefits, like shareholder rights and receiving dividends. With you owning the shares, you are not charged a nightly rollover fee for holding them (while with spread betting, you do). However, you pay more in trading fees, including the spread, commission, stamp duty and capital gains tax.

Spread betting shares, however, lets you bet on the market direction to profit in rising and falling markets. The trading fees are substantially lower than trading shares as you pay a spread only (commission-free trading).

Benefits Of Spead Betting

Spread betting has many advantages compared to other products like CFDs and traditional forms of trading. These include:

Tax-Exemption

Based on UK tax laws, spread betting is exempt from stamp duty and capital gains tax, making it an attractive alternative to CFDs.

24 Hour Markets

Spread betting brokers provide access to spread betting markets 24 hours a day between Sunday evening and Friday close, allowing you to spread bet even with a full-time job.

GBP Staking

By spread betting in GBP, you can avoid currency conversion fees when speculating on foreign markets like the S&P 500, BMW shares, or EUR/USD, helping you reduce your costs further.

Leverage

Leverage allows you to control larger position sizes with a smaller spread betting account and can amplify your wins (or losses) so you can profit off smaller market movements throughout the day.

What Are The Features Of Spread Betting?

1. The Spread

The spread is the difference between the buy price (bid price) and the sell price the broker quotes you on their spread betting platform. The spread is the fee you pay the broker to enter the markets; the tighter the spread, the cheaper it is to bet on it.

2. Bet Size

The bet size (sometimes called ‘stake’ size) will affect how much profit or loss you will make. Every point that the price moves will multiply how much you gain or lose from the bet. So if your bet size is £10 per point, your profit or loss will increase or decrease by £10. When I first started spread betting, I started small with 50p per point bets, which was ideal as it allowed me to get used to how spread betting worked.

3. Bet Duration

The most common spread bet duration is daily funded bets (DFBs), which I stick to DFBs when I have a short-term view of the markets. They are meant for short-term positions with lower spreads but, if left open, are subject to overnight funding.

Quarterly bets are less common and expire at the end of each quarterly period; the spreads are higher, but they avoid the overnight funding fees of daily funded bets.

What Investment Assets Can You Spread Betting?

Spread betting offers a range of financial instruments for you to speculate on; these are:

1. Forex

Forex spread betting is one of the most popular markets as it has lots of liquidity and can be bet on 24/5 with low spreads, making it attractive to day trading.

2. Shares

You can speculate on shares from global markets, including the US, EU, Asia, and the UK. Most shares available to spread bet with are from popular markets, such as the FTSE 100 and S&P 500.

3. Indices

Indices spread betting allows you to speculate on assets like the FTSE 100, S&P 500, Dow Jones, and DAX 40.

4. Commodities

All spread betting companies provide access to commodity markets, which include gold, silver, natural gas, and oil.

FAQs

What Is Financial Spread Betting?

Spread betting is a form of derivative trading used in financial markets like shares and commodities, allowing you to profit from rising and falling markets without owning the underlying market.

What Can I Spread Bet On?

You can spread bet on various markets, including forex, indices, stocks, commodities, ETFs and bonds. Essentially any financial markets since all that is required is an underlying instrument to use for pricing when betting. You’ll find that the best spread betting brokers will offer a decent range of markets to spread bet on.

How Are Spread Bets Taxed?

In the UK, spread betting is exempt from capital gains tax and stamp duty because it is listed as a gambling product instead of an investment vehicle.

How Does Spread Betting Arbitrage Work?

Spread betting arbitrage is a strategy to lock in profit by taking advantage of price discrepancies across brokers. To do this, you would need to have a trading account with several brokers with MetaTrader 4 and have funds to cover the arbitrage in each of them.

What Is The Difference Between Spread Betting And CFDs?

The core difference between spread betting and forex trading CFDs is that spread betting is exempt from stamp duty and capital gains tax, which is attractive to traders. Meanwhile, CFDs are only exempt from stamp duty and not CGT.

How Do Dividends Affect Spread Betting Positions?

When a company pays dividends, your trading account will be adjusted to reflect the payments. If you have bought the shares, you’ll receive the dividend in your account to mirror the dividend payment. The dividend value will be deducted from your account if you are short.

How Much Do I Need To Start Spread Betting?

It is ideal to start spread betting with at least £1,000 to £2,000 if you are a beginner. However, some beginner-friendly spread betting platforms have lower minimum deposits, from zero to £250. It is always recommended to only trade with the amount of money you can afford to lose. You can always open a spread betting demo account if you wish to practise.

Is Spread Betting The Same As Day Trading?

No, spread betting is not the same as day trading. Spread betting is a derivative of the financial markets like the FTSE 100 that you can trade, while day trading is a short-term trading style you can use to trade the markets, where you only hold positions open during the same market hours.

How Can I Hedge With Spread Betting?

You can hedge with spread betting in several ways, but the most popular is to hedge against falling share prices. You can use a spread bet to short the share price, which locks in profits and protects them from losses during the downturn.

Is Spread Betting Gambling?

Legally speaking, yes, spread betting is considered gambling because the HMRC classifies spread betting as gambling, which gives the capital gains tax exemption.

However, it is regulated by the Financial Conduct Authority due to the underlying markets involved (real-world assets like shares, forex, etc.), meaning it takes skill (not luck) to speculate on the markets. We recommend considering a course or a demo account prior to real money.

Origins Of Spread Betting

Financial spread betting was introduced to traders by IG Group ( also known as IG Markets and IG Index) in the 1970s by an investment banker called Stuart Wheeler. The first spread betting market in the UK was used to speculate on the price of gold, but over the years, it has expanded and can now be traded on any market from forex to stocks.