We take a look at what a guaranteed stop loss order is, how they work, and how much they cost. We also look at whether they are more beneficial to the trader than using traditional stop losses.

A spread betting stop loss is a useful risk management tool to help you exit trades automatically once a pre-set price point is triggered

In this comprehensive, we will explore what a stop-loss order is, how it works in spread betting, and why it’s an essential component of a trader’s toolkit.

What is A Stop Loss Order?

A stop-loss order is a risk management tool designed to limit potential losses by automatically closing a position when the market reaches a specified price level. It acts as a safety net, helping traders avoid significant financial downturns in volatile markets.

How Does A Stop Loss Order Work In Spread Betting?

In spread betting, a stop-loss order functions similarly to trading other asset classes, such as forex trading and CFD trading. When a trader initiates a spread bet, they can set a stop-loss order at a predetermined level. If the market moves against their position and reaches the specified level, the stop-loss order is triggered, automatically closing the trade to minimize potential losses.

How Does A Stop Loss Minimize Risk?

Risk mitigation is a primary objective of a stop-loss order. By setting a predetermined exit point, traders can control the amount they are willing to lose on a particular trade. This proactive approach ensures that losses are capped, allowing traders to protect their capital in unpredictable market conditions.

Why Use A Stop Loss?

A stop-loss will help to ensure your survival as a trader, by helping you to avoid large losses that wipe out your capital.

Here’s a quick look at the pros and cons of using stop-loss orders:

The Advantages and Risks of using a Stop-loss

Here are some of the advantages and disadvantages of using a stop-loss for spread betting:

Advantages

Risks

Risk Management: Control and limit potential losses by setting predetermined exit points.

Premature Exits: Placing tight stop-losses may lead to early exits due to short-term market fluctuations.

Emotional Control: Provide a rational and disciplined approach, mitigating the impact of emotions on decision-making.

Whipsaw Effect: Volatility can trigger stop-losses only to see the market reverse, known as the “whipsaw” effect.

Consistency: Maintain consistency in trading strategy by adhering to predetermined risk levels.

Market Gaps: During high volatility, market gaps may prevent stop-loss execution at expected levels, leading to larger losses.

Time Efficiency: Automate the exit process, allowing focus on other aspects of the trading strategy.

How Do I Use A Stop Order?

Using a stop-loss order in spread betting is a straightforward process. Traders need to understand the mechanics of placing a stop order and the factors to consider when determining the optimal stop-loss level.

Most spread betting companies will offer easy-to-use trading platforms, and you’ll be able to learn how to place stops, as well as entry and exit orders via a demo account without having to risk any capital.

Example Of A Stop Loss Order

To help you get your head around using stops, here’s a practical example of a stop loss order:

Market: Unilever Shares

Direction: Short (betting on the price to decrease)

Stake Size: £1 per point

You decide to short Unilever shares based on your analysis, predicting a short-term decline in the stock price.

- Entry Point: £151.59

- Stop-Loss: £155.82

- Stake Size: £1 per point

You place a spread bet with a stake size of £1 per point. If the market moves against your prediction, you want to limit your potential losses, so you set a stop-loss order at £155.82.

After a few days, Unilever’s share price indeed decreases, reaching £145.00.

Exit Point: £145.00

Profit: £6.59 (£1 x (151.59 – 145.00))

Your analysis was correct, and you made a profit of £6.59 as the market moved in your favor.

Types Of Stop Loss Orders

There are two main types of stop orders that you’ll likely use when spread betting:

- Stop-Loss Orders:

- A stop-loss order is a risk management tool that automatically sells (or buys) an asset when its price hits a predetermined level. It helps traders limit potential losses by ensuring a timely exit from a position, providing a crucial element of financial protection.

- Stop-Entry Orders:

- A stop-entry order is a type of order that becomes a market order to buy or sell an asset when its price reaches a specified level. Traders use this order to enter the market at a more favourable price, activating the trade only when a predefined price level is reached. It enables traders to seize opportunities without constant monitoring.

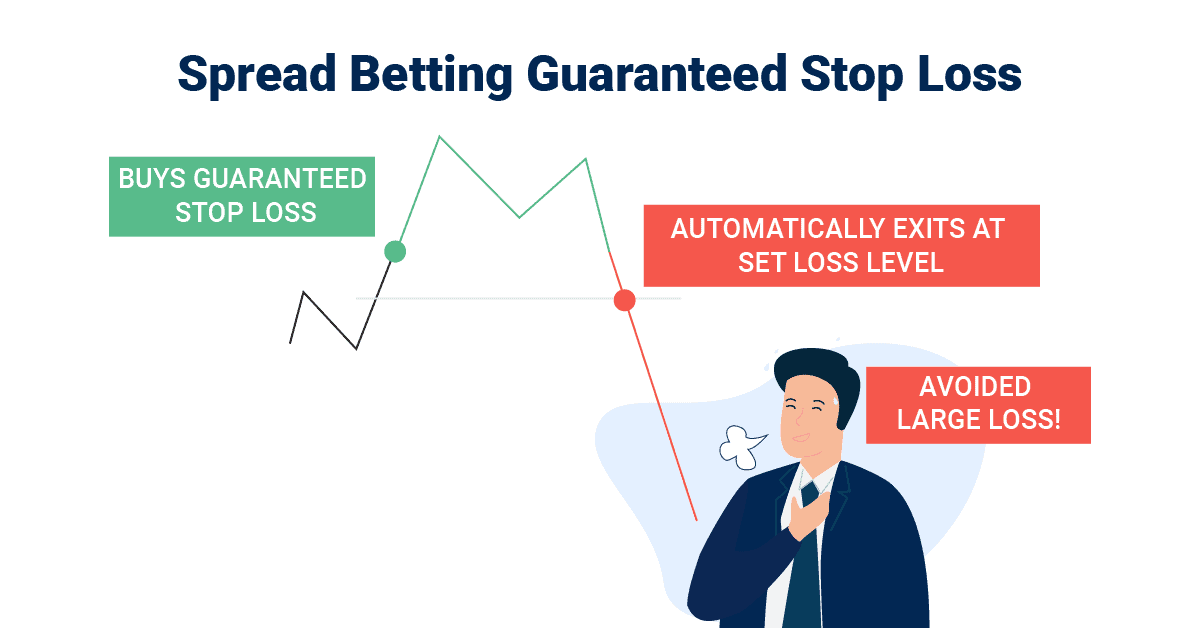

Guaranteed Stop Loss Orders (GSLO)

Guaranteed stop-loss orders eliminate slippage, providing traders with a guaranteed exit price. However, they come with certain drawbacks, mainly upfront costs, or increased spreads.

What Other Risk Management Tools Can You Use With Spread Betting?

There are a number of risk management tools and techniques that you can use in spread betting. These include:

- Take Profit Orders: These orders automatically close a position when the asset reaches a specified profit level. They lock in gains and prevent potential reversals.

- Trailing Stop Orders: This dynamic stop-loss order adjusts as the asset’s price moves in a favourable direction, helping lock in profits while allowing for potential further gains.

- Position Sizing: Determine the size of each position based on a percentage of your overall trading capital. This helps control exposure and prevents significant losses.

Why Stop-Loss Orders Are Needed When Using Margin?

Without a stop-loss, losses in margin trading could escalate beyond the borrowed amount, resulting in a margin call—a demand for additional funds to cover losses or potential forced liquidation of the position, resulting in a wipeout of your trading capital.

Should Beginners Use Stop Loss Orders?

Beginners in spread betting should use stop-loss orders as part of their risk management strategy. Stop-loss orders help protect traders from significant losses by automatically closing positions when the market moves against them.

For beginners, who may still be learning the ropes and may not have extensive experience in market analysis, stop-loss orders act as a safety net. They provide a predefined exit point, limiting potential losses and preventing emotional decision-making during market fluctuations.

Do Professionals Use Stop Orders?

Yes, professionals in the spread betting arena commonly use stop orders as an integral part of their trading strategies.

Professional traders who don’t use stop-orders will generally only have trades on while they’re in front of the screen, or they’ll have a trading associate watching the markets while they’re away from the screens. They do this often to not display their intentions to other market participants.

Do Day-Traders Use Stop Orders?

Day traders frequently use stop orders as a key element of their trading toolkit. In the fast-paced world of day trading, where market conditions can change rapidly, stop orders act as a risk management tool.

Which Brokers Have The Best Stop Orders?

Stop orders are offered by every spread betting broker, and in general, they’re simple enough that most brokers are similar.

What’s more important in selecting the right broker has to do with what sort of products you want to trade, the trading platforms you need access and what level of customer service you require. A consistent favourite of the CompareForexBrokers team is Pepperstone, but it’s important to find the right one for you.

Does MT4 Trading Platform Have Stop Orders?

Yes, the MT4 (MetaTrader 4) trading platform supports stop orders, including stop-loss orders and take-profit orders. Traders using MT4 can easily set stop orders to manage their positions and control risk.

Some tips on Using a Stop-Loss

In our opinion, using a stop loss in spread betting is about the most important thing you can do to protect your capital. Here are a few tips to consider:

- Understand Your Risk Tolerance: Before placing a spread bet, know how much you’re willing to risk on a trade. This will help you determine the appropriate distance for your stop loss.

- Set Realistic Stop Levels: Place your stop loss at a level that gives your trade enough room to breathe while still protecting you from significant losses. Consider the volatility of the market and the historical price movements.

- Use Technical Analysis: Utilize technical indicators and chart patterns to identify potential support and resistance levels. Placing your stop loss just beyond these levels can help avoid premature triggering.

- Consider the ATR (Average True Range): The ATR is a volatility indicator that can help you set stop loss levels based on the current market conditions. Adjust your stop loss according to the volatility of the asset.

Tight Stop Losses vs Wide Stop Losses

Using a tight stop loss involves setting a close exit point, limiting potential losses but increasing the risk of premature exits due to market volatility. It suits traders with a short-term focus, aiming for quick gains.

Conversely, a wide stop loss allows for more price fluctuation, reducing the likelihood of premature exits but exposing the trader to larger losses. This approach is favored by those with a long-term perspective, willing to endure market noise.

Both strategies have pros and cons, emphasizing the importance of aligning stop-loss placement with individual risk tolerance, market conditions, and overall trading objectives.

FAQ

Is Using Stop Loss Order A Good Strategy?

Using a stop-loss order is generally considered to be a crucial part of an overall trading strategy.

A stop-loss order is a risk management tool that helps traders limit potential losses by automatically closing a position when the market reaches a predetermined price level. This proactive approach to risk control is crucial in volatile markets and can protect traders from significant downturns.

Which Market Should I Use A Stop Loss On?

Using a stop-loss order is advisable in any market where you engage in trading or investing.

The decision to use a stop-loss should be driven by your risk tolerance, market conditions, and specific trading strategy rather than being limited to a particular market. With most spread betting brokers, you’ll be able to trade currencies, stocks, commodities, indices and many more.

Can you use a Stop Loss When Spread Betting Crypto?

It’s entirely possible to use a stop-loss when spread betting with crypto, in fact, we heavily advise you to use stop-loss orders.

Cryptocurrencies are highly volatile, and with the leverage inherent in spread betting, it’s incredible important to manage your risk with things such as stop-loss orders.

Where Can You Learn About Risk Management?

Education regarding risk management can be found in many places from trading books, to broker educational portals and even YouTube videos.

If you really want to get serious about your trading, and take your abilities to the next level, consider taking a trading course that will teach you things such as market analysis and risk management tactics.