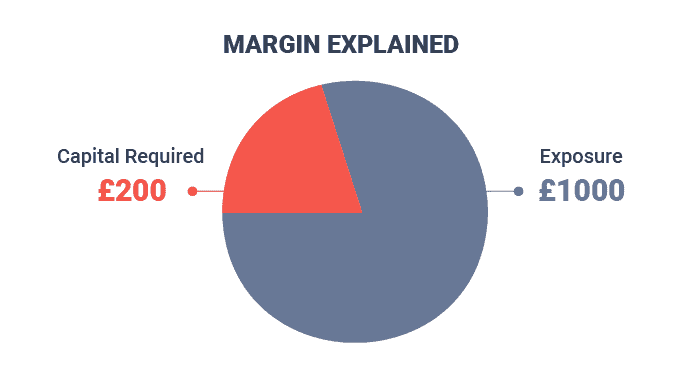

In spread betting, the margin is the capital you need in your trading account to place a spread bet. Since spread betting is a leveraged product, your account must have enough funding to cover the margin requirements to open and maintain a betting position. Margin essentially acts as a guarantee you can fulfill the terms of the bet.

The amount of margin you will need in your trading account is based on a percentage of your total position size. Margin requirements (also called the ‘notional trading requirement’ will vary depending on the financial market you bet on. More volatile assets, typically require larger deposits in your trading account.

What Is Leverage?

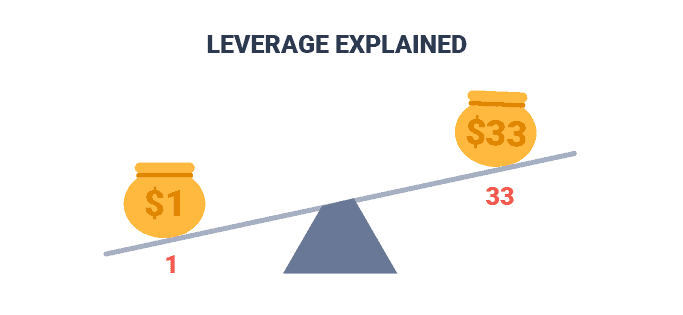

In spread betting, leverage is when a broker loans you extra funds to use when betting on the financial markets. These funds allow you to use less of your own capital (compared to buying the underlying market in full) but still take large enough positions to generate a reasonable return.

How Leverage Works

To understand how much leverage you are using, you will see it written in a leverage ratio like 1:33, which means for every £1 you deposit in margin the spread betting provider will loan you £33.

Even though you are using less capital to fund your trades, you still control 100% of the asset, and this is when leverage can get risky. Because you control $100,000 of EURUSD with just $3,300, every pip that moves up or down is amplified.

For example, a small 10 pip move on an unleveraged $100,000 position would be $100, or 0.1% movement. With the leveraged position, it would also be a $100 move, but relative to your $3,300 margin, this would be a 3% move.

This is why leverage is known to be a double-edged sword because small movements can magnify profit and losses.

Understanding The Margin And Leverage Relationship

Margin and leverage are two sides to the same coin when it comes to spread betting and CFD trading.

Margin is the capital you deposit with your broker to open a position, often the required margin is a small fraction of the total position size.

Leverage is the amount that your broker lets you hold above your margin.

For example, if you open a long position in the GBPUSD of £100,000 and your broker requires a 2% margin.

Your margin will be £2,000 (2% of the entire position) and your leverage would therefore be £98,000.

How Margin Works In Spread Betting?

Every spread betting financial market has different minimum margin requirements. For example, with forex majors, it’s 3.33%, and for Indices like FTSE 100, it’s 5%. The margin required is always expressed as a % and the less margin required, the more leverage you can use, this leverage is expressed as a ratio. The required margin of 3.33% converts to 30:1 leverage while 5% converts to 20:1.

When you want to open a bet, the broker will show you the required margin for the position.

For example, if you want to open a spread bet on the FTSE 100 index, the broker will want you to deposit 5% of the margin as a minimum (1:20 leverage). This means for every £1 you deposit in margin, the broker will give you £20. So, if you want to bet £1 on the FTSE 100 at 7000, the margin required will be £350.

What Are Some Margin Examples?

The required margin to open a spread betting position depends largely on the asset class you’re interested in trading, and whether your account is designated as either retail or professional level.

For major currency pairs, most brokers offer 30:1 leverage, so if you’d like to take a position of £150,000, you’ll need to have £5,000 available in your account to meet the margin requirement.

If you have a professional-level account, where most brokers offer 500:1 leverage, you’ll need a much smaller account for margin. To take a £150,000 position at 500:1 leverage, you’ll only need to have £300 available for margin.

Margin Amplifying Profits

When using margin for spread bets, you are only using a fraction of the capital required to control 100% of the total asset. This means that for every point that the asset moves in your favour there will be more profit in your account, even though you’ve only put up a fraction of the capital in margin.

Let’s say you bet on the FTSE 100 at 7000 by going long and staking £1 per point, with the margin as £350 to open the bet. If you bet on the FTSE 100 without margin, you must pay £7,000 to open the bet and for every one point it moved, you’d make (or lose) £1.

So, if the FTSE went up 50 points, you would have made £50 profit or 0.71%. However, you used margin and controlled £7,000 worth of the FTSE 100; a 50-point move also means you made £50. This means you made ~14% (£50 profit / £350 margin), making your returns 20x greater than the unleveraged position.

Margin Increases Losses

Similar to how margin trading magnifies profits, it can easily amplify losses when the asset moves against you, exposing you to the total price movement in the underlying asset. That’s why it’s always important to manage risk in spread betting.

Using the same example above, if the FTSE 100 moved 50 points lower on an unleveraged position, you would lose £50 (0.71% of your total value), which isn’t very much. However, when using margin, you would have lost the £50 in your £350 margin, which is a ~14% loss. While using margin, even the slightest market movements can accelerate your losses.

Margin Calculator

If you want to calculate the spread betting margin, CompareForexBrokers has a spread betting calculator that automatically shows you the margin rate required for your bet. You can access the spread betting calculator here.

What Are Spread Betting Margin Requirements?

With spread betting being a leveraged derivative, you will always need the margin before placing your bet. The platform will display how much margin is required to open the bet, and if you have enough funds, you can open the bet. You’ll have to deposit the funds into your account if you do not have the margin requirement. Below are the average margin requirements to open a bet:

| Asset | Margin Required | Leverage Amount* |

| Forex (Majors) | 3.33% | 1:30 |

| Forex (Minors) | 5% | 1:20 |

| Indices | 5% | 1:20 |

| Commodities | 10% | 1:10 |

| Metals | 5% | 1:20 |

| Shares (UK) | 20% | 1:5 |

| Shares (US) | 20% | 1:5 |

| Shares (EU) | 20% | 1:5 |

*Note: margins and leverage are for retail bettors. A professional bettor will have higher leverage.

What Is A Margin Call

A margin call is when your account margin falls below the minimum threshold, and results in the broker requesting you to either increase account funds or close your losing positions to release the margin. This will happen if you have many bets open at once, with a majority of your bets losing.

The threshold for a margin call is set differently for each spread betting firm, but on average, it’s around 50% of the required margin to open a trade.

To ensure you can cover potential losses, the broker will require you to have a minimum balance, known as the maintenance margin. The broker will issue a margin call if your account drops below this level.

How To Manage Your Risks When Using Margin?

Trading on margin means that both your profits and losses will be amplified compared to if you weren’t using margin, therefore it’s extremely important to intelligently manage risk.

Managing risk in spread betting, and most other forms of trading is reasonably simple, but many beginner traders overlook the process.

To intelligently manage risk, you should have a well-thought-out plan for how much capital you’ll risk on any one trade, where you’ll place your stop-loss orders to limit the size of your losses, and how you’ll manage trades that have become profitable.

Which Brokers Have The Best Leverage?

As spread betting in the UK is highly regulated by the Financial Conduct Authority (FCA), we find that most spread-betting brokers have exactly the same leverage due to regulatory guidelines.

Where leverage differs generally depends on whether your account is classed as retail or professional level, with most brokers extending more leverage for professional accounts.

FAQ

Can you spread bet without using Margin?

In theory, it’s possible to spread bet without using margin but it will be harder to make significant profits. Most of the time, markets generally don’t change significantly day to day, making it hard to generate good profits without the extra capital margin made possible with margin. The higher potential returns made possible with leverage is why it is popular with professional traders.

What are good strategies to use with Margin?

The most important strategy to use when trading with margin isn’t about finding good trades, or selecting which market to trade, it’s about intelligently managing risks.

One of the biggest benefits of spread betting is the easy access to large amounts of leverage, which can greatly increase the size of your profits, but on the flipside, potentially increase your losses.

Having a well-thought-out plan that includes how much to risk per trade, where to place your stop-loss orders, and when to take profits is paramount to spread betting success.

Is leverage suitable for beginners?

Leverage is a standard part of spread betting, so it will need to be used no matter if you’re a beginner or a veteran trader.

The important thing for beginner traders is only risking small amounts of capital when they begin trading, choosing the right broker and trading platform, and focusing on developing their trading skills as opposed to making big profits.

Can Leverage help you make money?

Leverage can absolutely help you to make money, but on the flip side, it can also cause you to lose money very quickly.

If you’re a beginner trader, you should focus on only risking small amounts of capital, and building your trading skills. Higher-risk trading and maximising leverage should be reserved for when you’re experienced and have advanced trading skills.