Our team has designed a guide to help make sense of spread betting, forex, and CFDs to help you choose which trading technique is best for you. This includes exploring the taxi implications for UK residents, the level of risk, and the regulatory environment. We also have a resource with the best spread betting brokers if you choose this trading option.

Key Takeaways

- Spread betting allows for tax-free profits and is categorised as gambling, while Forex CFD trading may be subject to capital gains tax.

- Forex trading involves leverage and margin, where a small deposit controls a larger position but with greater risk.

- Spread betting is conducted in GBP, avoiding currency conversion fees and potentially increasing profits from favourable exchange rates.

- Both Forex trading and spread betting offer leverage and are exempt from stamp duty, but they carry high risks and the potential for significant losses.

- Spread betting is considered higher risk than Forex CFD trading due to rapid value fluctuations and is tax-free only in certain jurisdictions like the UK and Ireland.

What Is Financial Spread Betting?

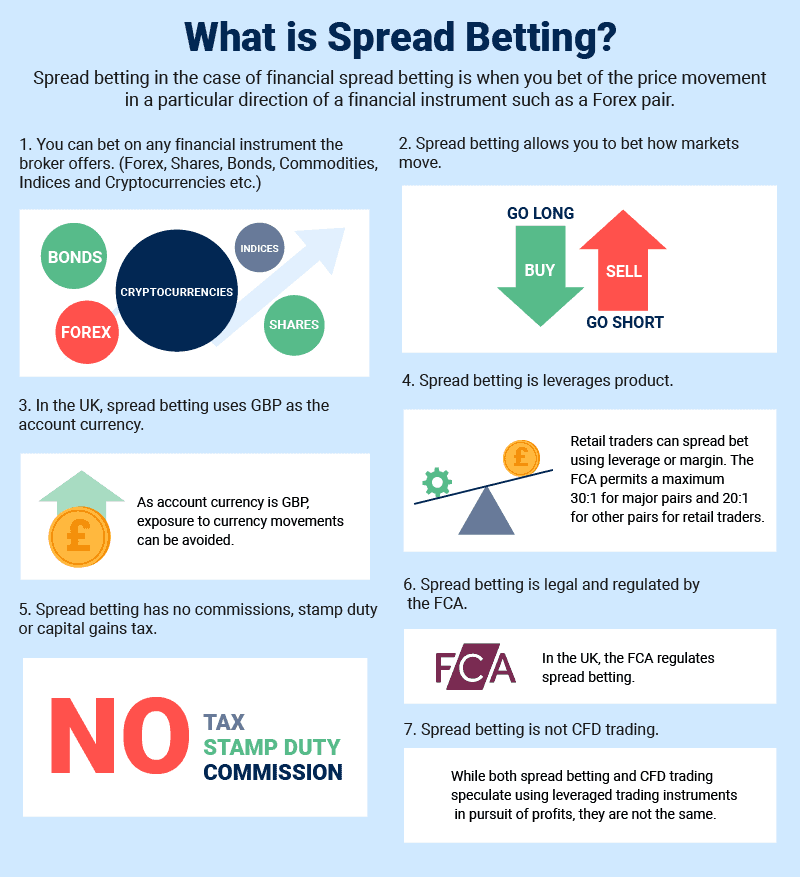

Spread betting is a type of financial betting that allows you to speculate on the price movement of financial instruments, such as stocks, indices, currencies, and commodities across global markets. It is a way to profit from market movements without buying the underlying asset.

Financial spread betting was invented by Stuart Wheeler, who founded IG Group in 1974 so that its clients could speculate on the price of gold. It then opened up spread betting to other products like forex and stocks.

One of the many unique benefits spread betting brings is that it is categorised as a gambling product instead of a tradeable asset (or contract) like a CFD. This means you are exempt from paying capital gains tax on your profits (making it an attractive derivative).

Spread Betting Example

Let’s say you have analysed the EURUSD with the opinion that it will continue to go lower now that it has broken an important support level. You place a short spread bet on EURUSD at 1.2103 with a £1 per point stake. For every one pip the EURUSD moves, you stand to win or lose £1.

The EURUSD continued to fall in your favour and you decided to exit the position after it hit your next significant support level.

During this period, the market fell from 1.2103 to 1.1719, generating a move of 384 pips. As you staked £1 per pip, you made £384 profit from this spread bet, and because you used a spread bet, these profits are tax-free.

What Is Forex Trading?

Forex CFD (Contract for Difference) trading is a way to speculate on the price movements of currency pairs without actually owning the underlying asset. CFDs are financial derivatives that allow you to take a position on the price movement of an asset, such as a currency pair, without actually buying or selling the asset itself. The forex market is the largest, with an incredible $7.5 trillion exchanged per day, which engulfs other markets in terms of volume. The forex market is the largest, with an incredible $7.5 trillion exchanged per day, which engulfs other markets in terms of volume.

Here is an example of forex CFD trading in GBP (British Pound):

Let’s say you think the GBP/USD currency pair will rise in value. You can open a long (buy) position on the GBP/USD currency pair using a CFD. If the market moves in your favour and the GBP/USD currency pair rises in value, you can then close your position and realise a profit. On the other hand, if the market moves against you and the GBP/USD currency pair falls in value, you can close your position and realise a loss.

In forex CFD trading, you only need to put up a small percentage of the value of the trade as a margin, which is a type of collateral that is required to open and maintain a position. This means that you can trade larger positions with a smaller amount of capital, but it also means that your potential losses can be greater than your initial investment.

I made a spread betting vs CFD guide if you want to understand more of the differences between these trading strategies.

What Are Spread Betting Vs Forex Trading Difference?

Forex spread betting and forex CFD trading are two different ways to speculate on the price movements of currency pairs, and they have some key differences.

Taxes

One of the stand-out differences between forex CFDs and spread betting is how each product is taxed. If you profit from a forex CFD, then you will be subject to capital gains tax, which can increase your overall trading fees. Meanwhile, with spread betting, you do not pay capital gains tax on your profits, which makes them attractive if you are consistently profitable.

Trading Fees

The trading fees with spread betting are very streamlined and have spread-only costs, limiting your choice of how to pay for your services to variable spreads only. On the other hand, forex CFDs typically offer a selection of accounts and ways to pay. You can pay by either variable spreads (like spread betting) or through commission-based accounts with tighter spreads (usually from 0.0 pips on EURUSD).

Key Definition: The Spread

The spread is the difference between the bid (to buy) and ask (to sell) price, and brokers charge this as a markup for the service they provide. If you see the buy price of EURUSD at 1.0500 and the sell price at 1.0499, you will be paying a spread of 1 pip (1.0500 – 1.0499 = 1). I.e.) If you place a stake of £10 per point with a one-pip spread, it will cost £10 to enter the bet.

Commission

For spread betting, there is no commission on any bets because the spread betting broker earns their revenue through the spreads they offer price. While with CFDs, you can choose to have a commission-based account with tighter spreads (usually from 0.0 pips).

Only Spread Bet In GBP

My personal highlight is that spread betting is based in GBP only, meaning you will only bet and profit (or lose) in GBP. This can reduce your costs because there are no currency conversion charges when trading forex or international assets like US stocks.

Here’s the best bit: while you are betting on the same underlying market as the CFDs, the amount you earn will vary because of the currency conversion rate. Meanwhile, with spread bets, you will always win (or lose) in GBP, which can increase your profit (or losses) while speculating and benefiting from the same market movements.

For example, you bought $10,000 of EURUSD at 1.0500 with a CFD (which moves at $1 per pip), and you bought £1 per point on EURUSD at 1.0500 with a spread bet.

If the EURUSD moves up ten pips, the CFD would earn $10, while the spread bet would earn £10. At the time of writing, $10 equals ~£8.20, meaning with spread betting, you are earning an extra 20%+, making it a better choice if you want to maximise your profits.

Similarities of Forex Trading and Spread Betting

With their differences out of the way, forex trading and spread betting have a lot in common:

Both Are Leveraged Products

To speculate on forex CFDs and spread betting, you need to use leverage. This mechanism allows you to provide a small deposit (a margin) to control the entire position of an asset. I.e.) You can deposit £100 to take control of a £1,000 posi, and this is shown as a leverage ratio of 1:10 – for every £1 you deposit as margin, the broker loans you £10. Although leverage can amplify your profits on smaller market movements, it can also magnify your losses.

Both Are Tax Exempt From Stamp Duty

Because forex CFDs and spread betting are derivatives, you never own the underlying market, exempting you from paying stamp duty on your purchases. This is useful as it saves you from extra costs associated with trading.

Both Can Profit In Rising And Falling Markets

Each product allows you to bet on an underlying market by going long (buy) or shorting (sell) the market. This is helpful to utilise volatile markets that can trend up and down within short time frames, which is another reason why these products are attractive.

Forex Trading vs Spread Betting: Pros and Cons

Forex Trading Pros

- Lower trading costs with tighter spreads and low commissions.

- You don’t have to pay stamp duty.

- Write off your losses against your profits when doing capital gains tax.

Forex Trading Cons

- You have to pay capital gains tax.

- Currency conversion fees.

- Overnight funding fees can be expensive.

Spread Betting Pros

- Exempt from stamp duty and capital gains tax.

- All bets are made in GBP, so you do not pay currency conversion fees on any international asset.

- Spread-only accounts simplify the trading costs.

Spread Betting Cons

- It is limited to UK and Ireland citizens.

- You cannot bet on all markets.

- Spreads can be more expensive compared to forex trading.

Should I Try Spread Betting or Financial Spread Betting?

Ultimately, the decision between forex spread betting and financial spread betting depends on your circumstances and financial goals. Both types of spread betting involve significant risks and can result in significant losses, so it is essential to understand the risks and have a solid understanding of financial markets before engaging in any form of spread betting.

When deciding which form of spread betting to pursue, consider the following:

1. Knowledge and experience

Do you have a strong understanding of the forex market or the financial markets in general?

If you have better knowledge of other financial markets like gold or equities, it would make sense to focus on financial spread betting to start with (you can always transition to forex spreading).

Alternatively, If you are a beginner, then you may want to start with forex spread betting as there are many free resources available to learn how to trade the currency markets; you could learn through a broker resource or learning with Babypips, which is a popular choice.

2. Appetite for risk

Spread betting carries a high level of risk, and both forex and traditional spread betting can result in significant losses. It is essential to consider how much risk you can tolerate and your financial goals before deciding which type of spread betting is right for you.

You should open a demo account and place a few bets across different markets like gold, shares, indices and forex. Then, watch how each market moves individually and see if the market movements suit you. For example, you may find that the forex markets move too quickly and settle on spread betting shares.

Other spread bettors may find indices a better choice for their risk appetite. It’s a personal preference at the end of the day, and the most important factor for you is whether you can profit from the markets while managing your risk. By using a demo account with forex and financial spread betting products, you’ll get a better understanding of how each market moves and if they are too volatile for you.

3. Accessibility

Some spread betting firms may not offer all types of spread betting markets (such as OANDA, which doesn’t offer shares), so it may be easier to access one type. Regarding financial spread betting, the most popular areas of trading include the FTSE 100, currencies and indices.

Should I Spread Bet or Trade Forex CFDs?

Spread betting and trading forex contracts for difference (CFDs) are ways to speculate on the price movement of financial instruments. Still, they have some critical differences that you should consider before deciding which is suitable for you.

Here are some things to consider when deciding between spread betting and trading forex CFDs:

1. Risk tolerance

Spread betting is generally considered a higher-risk activity than trading forex CFDs, as the value of your bet can fluctuate rapidly based on market conditions. It is important to carefully consider your risk tolerance and financial goals before deciding which is right for you.

2. Tax implications

Spread betting is generally tax-free in the UK and Ireland, while profits from trading forex CFDs may be subject to capital gains tax. This can be an important consideration if you are based in one of these countries.

3. Leverage

Both spread betting and trading forex CFDs allow you to use leverage to increase the size of your trades. However, the amount of leverage available may differ depending on the broker and the type of instrument you are trading. It is important to carefully consider the amount of leverage you are using and the risks involved.

4. Regulation

Spread betting and CFD forex brokers are regulated by the Financial Conduct Authority (FCA). This can be an important consideration if you are concerned about the safety of your funds or the integrity of the firm you are dealing with.

It should be noted that where you plan to trade should also be considered. For example, many individuals need to trade on their phones, so they should review the best spread betting apps before making their final decision.

Trading on Margin in Forex Spread Betting

In spread betting, margin trading refers to using borrowed funds from a broker to increase the size of a trade. When you trade on margin, you borrow money from your broker to make a larger trade than you can make with your capital alone.

Margin trading allows you to leverage your capital and potentially make more significant profits, but it also carries a higher level of risk. If the trade does not go in your favour, you may be required to pay back the borrowed funds plus any interest or other fees the broker charges. This can result in significant losses if the trade moves against you.

Margin Trading Example

Let’s say you want to place a long (buy) bet on a stock Vodafone (VOD is the ticker symbol) trading at 77p per share. You want to buy 1,000 shares with only £500 in your betting account.

The broker will require you to deposit 20% of the total notional value size (1,000 shares x 77p = £770 total notional size) as your margin, while the broker will loan you the remaining 80% (£615) to open the bet. So you will deposit ~£155 as margin and control £770 worth of VOD shares.

The stock price rises to 85p, so you close the bet at a profit. As you exit the bet, you pay back the loan of £615, leaving you with £235 in your account, and when you remove the margin you deposited, it leaves you with £80 profit (£235-£155).

Another way to work out your profit is (85p – 77p) x 1000 shares = 8p x 1000 = £80.

It is essential to consider the risks and benefits of trading leveraged products before using margin to amplify your positions. It is also vital to choose a reputable and trustworthy broker and to carefully read and understand the terms and conditions of any margin agreement.

What Spread Betting Risk Management Tools Are Available?

Most reputable spread betting providers offer several tools to help you manage your risk and prevent significant losses when trading. While there is no guarantee of success in this kind of trading, you can reduce the likelihood of financial difficulty by only betting with money you can afford to lose, educating yourself about the financial markets, and using any educational resources published by your brokerage.

In addition to practising good sense, these tools can help you to control your potential losses and maximise your profits:

1. Stop-loss orders

This is a type of order that automatically closes your trade at a predetermined price level, either above or below the current market price, depending on the direction of your trade. For example, if you are long (buying) a currency pair and you want to limit your potential loss, you can set a stop-loss order at a lower price level.

Should the market move against you and the currency pair hits your stop-loss price, your trade will be closed automatically, limiting your loss to the size of your stop-loss.

If you are a beginner, always set a stop-loss, and some platforms like TradingView remember your last betting settings, which helps you always set your stop-loss.

2. Limit orders

This is a type of order that allows you to specify the price at which you want to enter or exit a trade. For example, if you are long (buying) a currency pair and you want to take profit at a certain level, you can set a limit order at that price. If the market reaches your limit price, your trade will be closed automatically, realising your profit.

If you use strategies like breakout or price action trading, limit orders are excellent tools, saving you time from monitoring the markets and executing the bet manually.

3. Trailing stops

A type of stop-loss order that adjusts itself automatically as the market moves in your favour. For example, if you are long (buying) a currency pair and you want to lock in some of your profits as the market moves in your favour, you can set a trailing stop at a certain distance from the current market price.

If the market moves in your favour and the currency pair rises, your trailing stop will also rise, locking in more of your profit. Or, if the market then turns against you and the currency pair falls below your trailing stop, your trade will be closed automatically, protecting your profit.

I like using trailing stop losses to keep me in bets that are doing better than expected, allowing me to capture more profit and lock in a defined minimum. If the market reverses and hits the stop loss, I’ve at least benefited from the extra pips generated from the same betting idea.

4. Risk-reward ratio

A type of stop-loss order that adjusts itself automatically as the market moves in your favour. For example, if you are long (buying) a currency pair and you want to lock in some of your profits as the market moves in your favour, you can set a trailing stop at a certain distance from the current market price.

If the market moves in your favour and the currency pair rises, your trailing stop will also rise, locking in more of your profit. Or, if the market then turns against you and the currency pair falls below your trailing stop, your trade will be closed automatically, protecting your profit.

I like using trailing stop losses to keep me in bets that are doing better than expected, allowing me to capture more profit andlock in a defined minimum. If the market reverses and hits the stop loss, I’ve at least benefited from the extra pips generated from the same betting idea.

Spread Betting Calculator

Our Spread Betting UK Calculator feature is an essential resource for UK traders. It facilitates the testing of spread betting strategies in a realistic setting, utilising real market data and industry-standard spreads from over 40 brokers. The calculator is compatible with six major currency pairs and allows custom data input.

Moreover, the tool is designed to provide accurate calculations for margin requirements, as well as potential profits and losses. It is updated continuously to reflect current market conditions. Future enhancements are planned to expand its capabilities, including new financial markets and instruments.

How Do I Start Betting on Forex?

Beginner spread bettors may open a demo account before fully committing to a spread betting broker to learn more about trading platforms and risk management tools. Demo accounts are also an excellent way to experiment with forex trading and financial spread betting or to test betting strategies.

For more knowledgeable or experienced traders, the process of opening a spread betting account or forex trading account will follow these steps:

1. Choose a spread betting firm or forex broker

There are many spread betting providers and UK based forex brokers offering retail investor accounts, so it is essential to research and select a reputable and trustworthy firm that meets your needs.

Consider factors such as the firm’s reputation, available trading platforms, the types of instruments offered, the available spreads, and any fees or commissions charged.

2. Complete an application

Most spread betting firms will require you to complete an online application form to open a spread betting account. This may include providing personal and financial information, such as your name, address, and employment status. You may also be required to provide identification documents, such as a copy of your passport or driver’s license.

3. Select a trading platform

You should choose a broker that provides a trading platform that meets your needs; fortunately, most brokers offer a solid selection of trading platforms. The most popular trading platform is MetaTrader, which is owned by MetaQuotes, and there is a range of MT4 spread betting brokers available to use in the UK.

Other popular trading platforms include MetaTrader 5, TradingView (my personal preference), and cTrader.

4. Open and fund your spread betting account

Once the broker approves your application, you must make a minimum deposit to start spread betting. This can typically be done by making a bank transfer or using a credit or debit card.

5. Start spread betting trading

Once your account is funded, you can start spread betting by placing a bet on the instrument of your choice. Be sure to carefully consider the risks and have a solid understanding of financial markets before placing any bets.

At CompareForexBrokers, we recommend the Pepperstone spread betting account based on its fees, trading platform, and customer service levels. If you’re looking for more information on getting started, then view our page on how to start spread betting.

Key Learnings

- While forex trading involves actual asset trading with potential tax liabilities, spread betting is considered gambling, offering tax-free profits in the UK.

- You now understand that leverage in forex can amplify both profits and losses, as it allows for larger bets with less capital.

- You discovered that spread betting is in GBP and can generate additional profit due to eliminating currency exchange fees and exchange rate fluctuations.

- It is clearer that both forex and spread betting provide opportunities to profit in rising and falling markets.

FAQS

Is Spread Betting Legal in the United Kingdom?

Financial spread betting is legal in the UK and regulated by the FCA. Sports spread betting is also legal in the UK and regulated by the UK Gambling Commission, which is the national regulatory authority for gambling in the UK.

The UK Gambling Commission is responsible for regulating all forms of gambling in the UK, including online and offline gambling, to ensure that they are conducted fairly and responsibly.

Do I Pay Tax on Spread Betting Earnings?

In the UK, spread betting is considered to be tax-free. This means that you do not have to pay income tax, stamp duty or capital gains tax on your profits. However, it is important to note that this tax treatment applies only to spread betting and not to other forms of financial trading or gambling.

It is important to accurately report your earnings from all sources, including spread betting, on your tax returns and to comply with all relevant tax laws. Failure to report your spread betting profits could result in penalties and fines.

What Markets Can I Spread Bet On?

You can spread bet on a wide range of markets similar to CFDs. The most common markets are forex, stocks, indices, and commodities like gold, while some brokers like IG also offer you spread bet options.

If you are hoping to spread bet on the crypto markets, unfortunately, as a retail spread bettor, you will be unable to access this market because the FCA banned it. However, if you are a professional spread bettor, then you can apply for a professional account, which will allow you to spread bet cryptos in the UK.

Risk Warning

The UK’s Financial Conduct Authority (FCA) warns that spread betting carries a high level of risk. Spread betting may not be suitable for all investors, and you should ensure that you fully understand the risks involved before trading. The FCA also warns that leveraged products, such as forex trading and spread betting, are not suitable for all investors as they carry a high degree of risk to your capital.

You should carefully consider your investment objectives and level of experience before deciding to trade forex or engage in spread betting. If you are uncertain about the suitability of these products for you, you should seek independent financial advice.