Spread betting on indices is a popular way to gain exposure to the world’s major stock markets without buying shares directly. In this guide, I will cover what indices are with examples of how to bet on them.

Why Spread Bet With Indices?

There are good reasons why you might wish to spread bet with indices. Here are some of the main reasons:

1. Low Spreads

Low spreads play a large role in the appeal of spread betting on indices. With spreads as little as .07 points, you can enjoy very low-cost market access to the world’s largest stock indices.

Low spreads minimise entry and exit expenses, this will appeal to you if you are an active trader, such as a day trader or swing trader. Spreads can be the difference between a profitable or losing day, week, month, or year.

2. Market Diversification

Indices represent a basket of stocks, offering traders diversified exposure to various companies and sectors within a specific market.

When you spread bet on indices, you’re betting on the overall market, and not just a single stock that could fluctuate for the smallest of reasons, such as a change of CEO or a bad showing at an industry event.

3. Out Of Hours Betting

Unlike traditional stock markets, indices can be traded 24/7. This flexibility allows you to capitalise on market opportunities beyond standard trading hours and can allow you to actively trade while working a day job.

4. No Commissions

A notable advantage of spread betting on indices is the absence of commissions. All trading fees are incorporated into the spread, simplifying the cost structure for traders.

With a no-commission spread bet broker, the price you’re offered is the price you’ll pay, you won’t have to keep an eye on the amount of commissions your trading is racking up.

5. Leverage

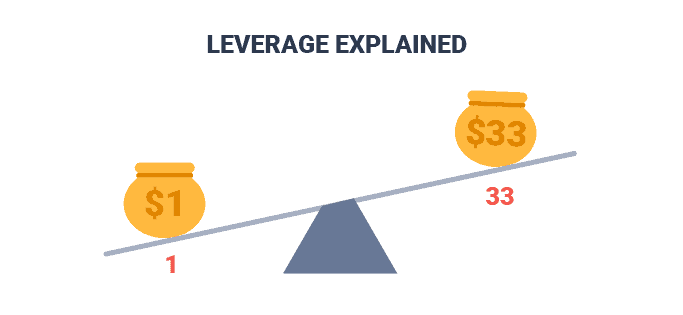

Spread betting on indices involves leverage, enabling traders to control larger positions with a smaller upfront investment. This means that a spread bettor with a relatively small amount of capital can potentially make huge profits.

While leverage amplifies potential profits, it can also amplify potential losses, so it’s important to manage risk intelligently.

What Is an Index?

An index is a numerical representation of the prices of a collection of underlying stocks. It serves as a barometer for overall market performance and is crucial for gauging a country’s economic health. Market indices, such as the FTSE 100 and S&P 500, track the value of top companies within their respective markets.

How Does Spread Betting With Indices Work?

Spread betting on an index allows you to speculate on the price direction of a stock market, without the need to own individual stocks. It involves betting on whether the index’s value will rise or fall, offering you a way to bet on an overall market, and overall economy, rather than picking individual stocks.

Examples of Indices Spread Betting

Spread betting on indices may sound complicated if you are a beginner to trading financial markets, but it’s quite simple. Here are a couple of practical examples where we examine two indices spread bets:

Example 1: Going Long On FTSE 100

You’ve been closely analyzing the FTSE 100 and you’ve noticed strong support at 7100. Believing that the market is poised for an upward movement, you decide to go long on the FTSE 100.

- Entry Point: You enter the trade at 7115 with a stake size of £3 per point.

- Reasoning: Your analysis suggests that the FTSE 100 will rise, and you want to profit from the potential upward movement.

- Outcome: Over the next week, the FTSE 100 indeed climbs, reaching 7260. You decide to close the position, making a profit of 145 points (7260 – 7115) or £435 (£3 x 145 points).

Example 2: Going Short On UK 100

After a period of extended gains in the FTSE 100, you start observing signs of overvaluation and foresee a correction. To capitalise on the potential downward movement, you decide to go short on the FTSE 100.

- Entry Point: You initiate the short position at 7325 with a stake size of £4 per point.

- Reasoning: Your analysis indicates that the FTSE 100 is likely to experience a decline, and you want to profit from the falling market.

- Outcome: Unfortunately, the market sentiment changes, and the FTSE 100 rallies to 7380. You decide to cut your losses and close the position, resulting in a loss of 55 points (7380 – 7325) or £220 (£4 x 55 points).

What Are the Most Popular Index Markets?

Spread-betting index markets tend to be made up of most of the world’s largest stock markets.

Some of the most popular index markets for spread betting include:

- FTSE 100: Represents the top 100 companies listed on the London Stock Exchange.

- DAX 30: Comprises the 30 major German companies trading on the Frankfurt Stock Exchange.

- S&P 500: An index of 500 of the largest publicly traded companies in the United States.

- Dow Jones Industrial Average: Tracks the performance of 30 large publicly-owned companies in the U.S.\

- NASDAQ 100: Consists of 100 of the largest non-financial companies listed on the NASDAQ stock exchange.

- CAC 40: Represents the top 40 companies on the Euronext Paris market.

- Nikkei 225: Measures the performance of the top 225 companies listed on the Tokyo Stock Exchange.

- Hang Seng Index: Tracks the performance of the 50 largest companies listed on the Hong Kong Stock Exchange.

Which Broker is Best for Spread Betting Indices?

The truth about spread betting brokers is that there’s no single best broker that matches every trader’s requirements.

Some people will need higher amounts of customer service, certain trading platforms, or a wider range of products to trade. In general, we’re a big fan of Pepperstone for spread betting, but it’s really up to you to find what’s best for you.

How Do I Start Spread Betting Indices?

Getting started in the world of spread betting is extremely easy. Here are the steps you need to follow to go from newbie to advanced:

- Learn the basics of spread betting

- Choose a reliable spread betting broker

- Open an account

- Fund the account

- Develop a trading strategy

- Select your trading platform:

- Practice spread betting with a demo account:

- Place your first spread bet

- Set your stop-loss

- Monitor and Manage

- Close your position

What Is the Leverage for Indices Spread Betting?

For spread betting in the UK, all firms are regulated by the Financial Conduct Authority (FCA). The FCA permits leverage of 20:1 (5% margin) for major indices and 10:1 (10% margin) for minor indices. Leverage allows you to take a position of 10 or 20 times the trading margin you have in your account.

The only way to change this amount is by upgrading your account to professional status, which allows you to trade with up to 500:1 leverage on certain products.

What Are Good Index Spread Betting Strategies?

Effective index spread betting strategies can involve all kinds of analysis, including technical analysis, fundamental analysis, and statistical analysis. Here are a few strategies you might consider:

- Trend Following: Here you identify the overall trend of the index using technical indicators (moving averages, trendlines) and Go long (buy) in an uptrend and go short (sell) in a downtrend.

- Range Trading: Here you identify key support and resistance levels where the index tends to range. The idea is to ‘go long’ near support and ‘go short’ near resistance.

- Breakout Trading: Monitor for breakouts from significant price levels. Technical indicators or chart patterns can help confirm breakouts.

- News-Based Trading: This strategy involves keeping informed about economic indicators, geopolitical events, and news that can impact the index and acting accordingly.

Is Indices Spread Betting Good For Beginners?

Indices spread betting is one of the best spread betting opportunities for beginner traders.

Betting on Indices allows you to get exposure to a broad market, reducing stock-specific risk, plus the volatility of indices can lead to rapid gains or losses, allowing for quick lessons to be learned.

Understanding market dynamics, economic indicators, and risk management is crucial are all subjects that a beginner spread bettor should study.

We advise beginner spread bettors to start with demo accounts, practice risk management, and learn to read price action and charts.

Is Indices Spread Betting Good For Professionals?

Indices spread betting is well-suited for professional spread bettors, who often possess extensive market knowledge and advanced trading skills.

Professionals can leverage their skills by identifying trading opportunities in global indices, and then take advantage of the huge liquidity and continuous volatility that is often inherent in stock indices.

If you’re looking to one day become a professional spread bettor, focusing on indices would be a smart idea.

Is Indices Spread Betting Good For Day Traders?

Indices spread betting can be well suited to day traders due to the intraday volatility of most major indices.

The significant price movements within a single day offer frequent trading opportunities and deep liquidity ensures swift entry and exits with minimal slippage. And by using leverage when spread betting, day traders can amplify profits in the short term, resulting in quick gains when markets move as predicted.

However, intraday trading comes with challenges and risks, as well as being quite a demanding activity while the market is open. Make sure your day is as clear of distractions as possible before trying to day trade.

FAQs

What Is A Good Spread In Indices?

A good spread in indices spread betting is one that is narrow or tight, indicating a smaller difference between the bid (sell) and ask (buy) prices. The spread represents the cost of entering a trade, and a narrower spread can be more favourable for traders as it reduces the overall cost.

As a general rule, lower spreads contribute to lower trading costs and can potentially enhance the profitability of your trades. It’s advisable to compare spreads across different brokers and choose one that offers competitive and transparent pricing.

How Profitable Is Spread Betting?

The profitability of spread betting varies widely and depends on individual trading strategies, risk management, market conditions, and the trader’s skill level. Spread betting can be profitable for some, but it comes with inherent risks.

A better question to ask is how profitable is trading financial markets. For this, we know that it’s possible (yet, unlikely) to become a billionaire, as some hedge fund managers and private traders are listed on global rich lists.

What Is a Gold Index For Spread Betting?

A Gold Index for spread betting typically represents the aggregated performance of gold-related assets, providing a way for traders to speculate on the price movements of gold without owning the physical commodity.

This index may include various components such as gold mining stocks, gold ETFs, or other financial instruments tied to the price of gold.

Can You Spread Bet Crypto Indices?

Spread betting with individual cryptocurrencies is banned for retail traders in the UK but some firms do offer it for professional traders who meet certain conditions. Crypto indices such as Crypto 10 are available with selected spread betting firms but only for professional traders.