How To Choose A Forex Broker In 2026

Choosing a forex broker is never easy. Our expert team gives 10 things to look for when picking a broker. Some considerations for selecting a forex broker include regulation, costs, speed, trading platforms and customer service.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

What is a forex broker?

A forex broker is your gateway to the global currency market, acting as an intermediary that allows you to trade currency pairs without owning the actual currencies. They facilitate your transactions and often provide additional services like leveraged trading to amplify your trading capacity. They provide traders with access to forex trading platform(s) as the software to trade markets including apps on mobile and tablet devices.

How To Choose A Forex Brokers?

Our team made a forex broker comparison in 2026 based on set criteria. We go over these criteria to help you compare forex brokers yourself to determine the best broker for your needs.

1. Regulatory Compliance

Financial regulation varies between jurisdictions. Traders should research the investor protection they will receive, as trading with a regulated broker overseen by a top-tier financial authority ensures traders are not victims of scams.

Brokers in the EU and UK face some of the strictest regulations, with brokers overseen by the FCA and ESMA required to enforce leverage caps and closeout margins while providing negative balance protection to traders.

Most top-tier financial authorities such as ASIC (Australia), CySEC (Cyprus), FCA (UK), ESMA (Europe) and MAS (Singapore) require brokers to segregate client funds, ensuring traders’ funds are not used as operational capital.

Major regulatory bodies around the globe include:

- Financial Conduct Authority, United Kingdom (FCA)

- The European Securities and Markets Authority (ESMA)

- Australian Securities and Investments Commission (ASIC)

- Financial Markets Authority, New Zealand (FMA)

- National Futures Association (NFA) and The Commodity Futures Trading Commission, United States (CFTC)

- Monetary Authority of Singapore (MAS)

- Cyprus Securities Exchange Commission (CySEC)

- Switzerland Financial Market Supervisory Authority (FINMA)

- Financial Sector Conduct Authority, South Africa (FSCA)

- Dubai Financial Services Authority (DFSA)

- The Federal Financial Supervisory Authority, Germany (BaFin)

2. Spreads And Commission Rate

When choosing a broker, an obvious consideration is pricing or transaction costs. With cut-throat competition between the best brokers around the globe, retail investor accounts can now access ultra-tight institutional-grade pricing.

Many brokers offer traders a choice of fixed or variable spreads and commission fee structures when trading forex. ECN-style trading accounts that charge flat-rate, round-turn commission fees allow for ultra-competitive spreads that can be as low as 0.0 pips, while standard accounts offer wider spreads, yet traders face no commission fees.

Account Types

Variable Spread Account Types: fluctuates with market conditions

- Commission Accounts: Low spreads with flat-rate commission fees, often referred to as ECN-style account types.

- No Commission Standard Accounts: No commission fees are charged on top of the spread

- Fixed Spread Accounts(micro accounts): predetermined fixed spreads remain constant regardless of market conditions

Commission Account Spreads

Those who choose to pay flat rate commission fees usually gain access to tighter spreads than those signed up to fixed spread or standard account types. Some of the best forex brokers such as Pepperstone, IC Markets and FP Markets offer tight spreads on major currency pairs such as the EUR/USD which averages 0.09 – 0.13 pips, and GBP/JPY which averages 0.82 – 1.20 pips.

Note* Low-spread forex brokers are compatible with day traders and scalpers.

As shown below, there can be significant variation between the average spreads for currency trading offered by different brokers, with certain brokers having strengths within certain markets. For instance, Pepperstone offers the tightest spreads for the AUD/USD FX pair, while FP Markets provides the lowest spreads for the EUR/USD currency pair. Therefore, when choosing a broker and variable spread account type, it is best to research the average spreads for the specific financial instruments you want to include in your trading strategies.

See All Commission Spreads | |||||

|---|---|---|---|---|---|

| 0.02 | 0.23 | 0.27 | 0.85 | 0.03 |

| 0.08 | 0.39 | 3.50 | 1.28 | 0.35 |

| 0.10 | 0.30 | 0.20 | 1.00 | 0.10 |

| 0.10 | 0.20 | 0.30 | 0.60 | 0.20 |

| 0.16 | 0.59 | 0.54 | 2.00 | 0.29 |

| 0.20 | 0.60 | 0.50 | 10.00 | 0.40 |

| 0.10 | 0.50 | 0.50 | 4.50 | 0.40 |

| 0.10 | 2.00 | 0.60 | 3.10 | 0.50 |

| 0.10 | 0.20 | 0.30 | 1.80 | 0.20 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Commission Fees

Commission fees are based on trade sizes and are charged per side or round turn. To minimise trading costs and maximise forex account profits, traders should seek brokers with low commission fees. For example, Pepperstone is one of the best brokers, as round-turn commission fees are low at $7 per 100k traded.

No Commission Spreads

As no-commission account types do not pay any additional commission fees on top of the spread, spreads are wider than commission account types.

See All No Commission Spreads | |||||

|---|---|---|---|---|---|

| 1.13 | 1.01 | 1.71 | 2.27 | 1.98 |

| 0.90 | 1.30 | 1.40 | 1.40 | 1.80 |

| 0.70 | 2.20 | 1.10 | 1.60 | 1.60 |

| 0.10 | 0.20 | 0.30 | 1.00 | 0.50 |

| 1.10 | 1.10 | 1.60 | 2.00 | 1.90 |

| 1.20 | 1.30 | 1.30 | 1.50 | 2.00 |

| 1.00 | 1.00 | 1.27 | 1.30 | 1.20 |

| 0.94 | 1.48 | 1.45 | 3.24 | 2.03 |

| 1.20 | 1.41 | 1.47 | 1.85 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Fixed Spreads

While the average fixed spreads offered by the best brokers are significantly wider than variable spread account types, beginner traders may prefer the constant pricing structure as it is easier to determine potential profits and losses.

See All Commission Spreads | |||||

|---|---|---|---|---|---|

| 0.90 | 1.10 | 1.50 | 1.80 | 2.00 |

| 0.70 | 1.20 | 1.50 | 1.80 | 2.00 |

| 1.94 | 2.36 | 2.11 | 2.24 | 2.05 |

| 1.20 | 1.50 | 1.30 | 2.00 | 1.40 |

| 1.50 | 1.80 | 2.00 | 2.00 | 2.00 |

| 3.00 | 3.00 | 3.00 | 3.00 | 3.00 |

| 4.00 | 4.00 | 3.00 | 5.00 | 5.00 |

| 1.00 | 1.00 | 1.50 | 2.00 | 1.50 |

| 2.00 | 3.00 | 3.00 | 3.00 | 4.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Trading and Account Fees

- Overnight Financing Fees: As well as commission fees and spreads, traders that keep leveraged positions open for longer than one day must pay overnight financing fees (aka swap rates). Depending on whether a trader’s leveraged position is long or short, a financing cost that is derived from interest rates will be paid or received.

- Inactivity Fees: If a trader leaves their account dormant, and doesn’t make any trades for a short-term period (usually 6-24 months), many brokers will charge monthly inactivity fees.

3. Leverage And Margin Requirements

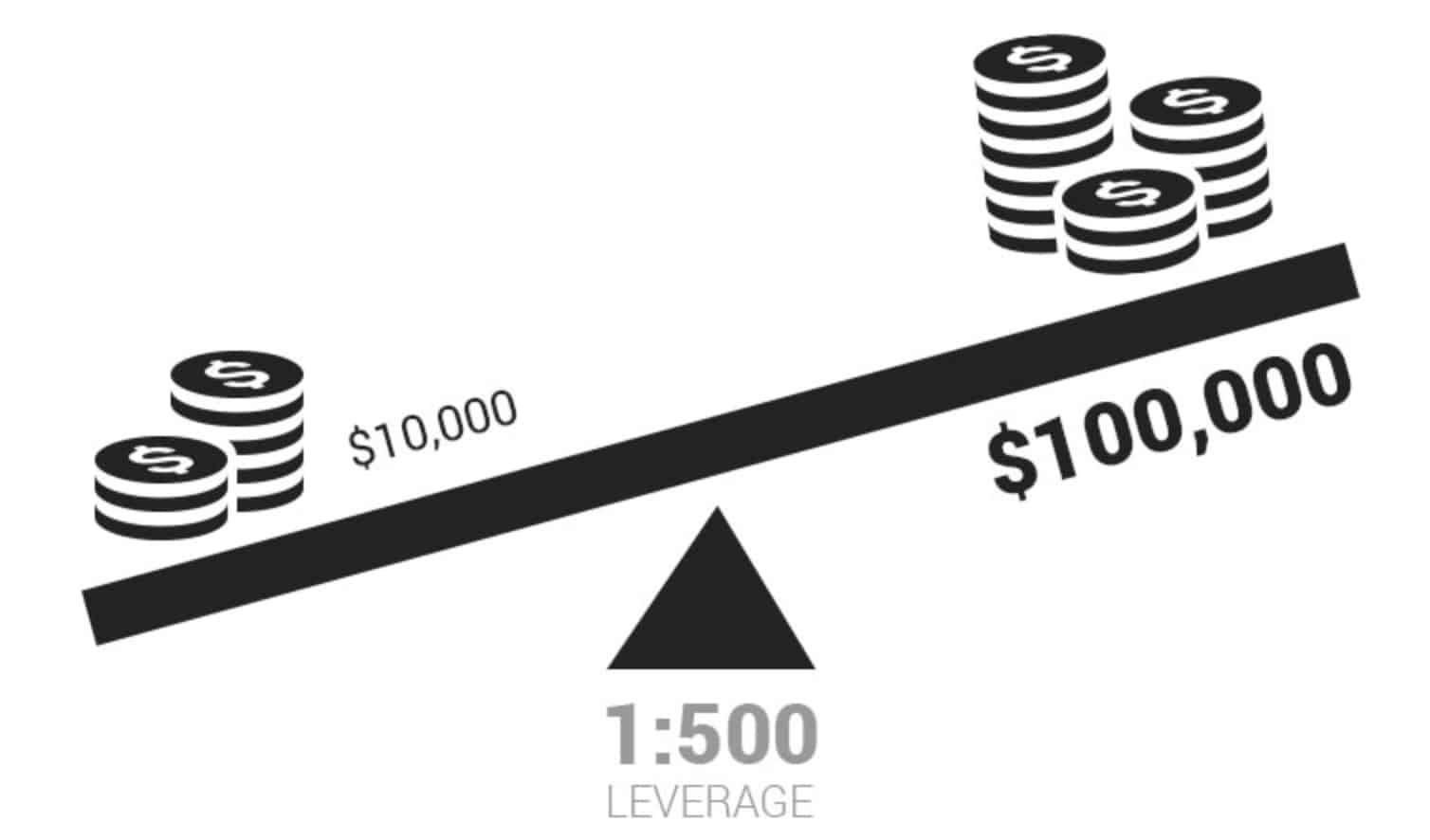

Depending on a broker’s location and regulation, plus the asset class being traded, a broker will offer a maximum amount of leverage to traders. Leveraging (aka trading on margin), allows traders to put forward a percentage of a position’s total value, magnifying both profits and losses made on a trade. While some brokers allow traders to manually set their preferred leverage (up to the maximum), this is not a common feature among many good forex brokers.

As trading forex and CFDs is a high-risk investment activity, traders should be cautious when opening highly leveraged positions, as there is a high chance of losing money.

4. Deposit And Withdrawals

Initial minimum deposits, deposit and withdrawal methods, and funding fees all vary between brokers. When selecting a broker, it is important to check whether fees are attached to your preferred payment method.

Minimum Deposits

To start trading, brokers require customers to make an initial deposit into their trading account. Some brokers such as Pepperstone do not enforce a specific minimum deposit, allowing traders to test the waters first. Some brokers require very high minimum deposits that may deter some customers or beginner traders.

Common Funding Methods

- e-wallet payment methods such as Skrill, Neteller, PayPal and Bitcoin Wallets

- Credit cards, commonly restricted to Visa and Mastercard

- Bank transfer, wire transfer and broker-to-broker transfer

Deposit and Withdrawal Fees

One factor we often use when we compare online brokers is their fee schedules. For example, some brokers allow free unlimited withdrawals; others provide one free withdrawal per month, with any subsequent withdrawals incurring a fee, while a few charge a fee for every withdrawal. If we do not see a concise fee schedule on the broker’s website, this raises flags for us, so we call or write and ask the tough questions in our quest to choose the right online broker.

5. Trading Platforms

Whether you want to focus on social trading or develop complex algorithmic strategies, it is paramount to choose a trading platform that provides the market access and trading tools required to achieve your investment objectives.

Confidence that the broker’s trading platform can be relied upon to perform as expected is vital, therefore many traders choose brokers that offer third-party platforms with an established trading community and a wide range of trading tools.

Another consideration is the device you are going to use for trading. While experienced traders may require advanced desktop platforms that mimic an institutional trading environment, new traders may prefer simple software designed for mobile apps. Many brokers also offer web trader platforms that offer the advantage of being accessible from any computer and browser.

Brokers Offering the Best Trading Platforms

Trading Style and Features

Algorithmic Trading

The three most popular third-party forex trading platforms are MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. As well as the ease of use and technical analysis tools, each platform is highly regarded for its automated trading features. MetaTrader’s Expert Advisors (EAs) and cTrader’s cBots allow traders to develop (or download) complex trading algorithms that automatically enter and exit trades and scan markets for opportunities. Although certain proprietary platforms offer automated trading features, Expert Advisors and cBots provide the tools required for advanced algorithmic strategies, along with large marketplaces to purchase or download free trading robots.

Social-Copy Trading

Social-copy trading is another method of automated trading that may be more accessible to those new to forex trading. While platforms such as MT4 and MT5 offer copy trading through Forex Signals, certain brokers offer account mirroring services through pure social trading platforms. For instance, eToro’s social trading network allows users to copy the trades of more experienced investors while keeping up to date with markets via newsfeeds and community forums.

6. Currency Pairs And Markets Offered

The availability of major currency pairs such as EUR/USD and GBP/USD is a given with most brokers. However, a broker that stands out will offer a more diverse range of currency pairs, including minor and exotic options. Traders should consider a broker that not only provides the major pairs but also caters to niche trading interests.

Beyond the realm of forex, most brokers offer a variety of other trading markets. This includes commodities like oil and gold, as well as indices and shares. A trader should understand what markets they want to trade in and ensure the broker offers them. It should be noted that regulators may restrict certain tradable instruments (eg cryptocurrency CFDs are banned by the FCA) limiting what the broker can offer in different regions.

7. Account Features

To protect themselves against market volatility and the high risk of forex trading, many investors seek brokers with a range of risk management tools such as order types and demo accounts.

Order Types

Order types can help minimise your losses when price movements for currency pairs are not in your favour. Market Orders and Stop Loss Orders are available with all trading platforms, while advanced order types such as Guaranteed Stop Loss Orders (GSLOs) are only available with certain platforms.

A GSLO allows you to guarantee your trade will be closed when the price you specify is triggered, regardless of gapping or market volatility. Usually, a small premium will need to be paid since the broker takes on the risk and that is why many brokers do not offer this feature.

Demo Accounts

Whether you are a new trader wanting to find an easy-to-use interface, or an experienced investor seeking advanced trading tools, demo accounts allow traders to test trading strategies and familiarise themselves with the trading platform before opening a live account. As traders can practice strategies and test trading robots with real-time market data, demo accounts are an excellent way to reduce the high risk of forex trading. While some brokers allow unlimited access and virtual trading balances, some demo accounts have time restrictions and limited virtual funds.

8. Trading Hours

Forex trading is a 24-hour operation, with key centres like London, New York, Tokyo, and Sydney setting the pace. However, trading hours can vary between brokers. While many offer standard 24/5 trading, exceptional brokers like IG extend their services to include weekends and out-of-hours trading on indices and key forex pairs such as GBP/USD.

For example, a UK-based trader focusing on the USD/AUD pair would benefit from a broker that offers extended hours, given that New York’s trading day starts at 12 pm UK time and Sydney’s at 9 pm. IG, for instance, allows trading on over 80 major, minor, and exotic FX pairs from Monday to Saturday, including exclusive weekend markets. This extended access provides traders with the flexibility to seize opportunities beyond standard market hours.

9. Educational Tools

As well as customer support teams, many brokers offer extensive educational resources that will help traders of all levels of experience. Brokers provide a wealth of information that can improve a trader’s understanding of forex and CFD markets. Resources to look out for include:

- Online courses, lessons and ‘academies’

- Trading platform tutorials

- Webinars and videos

- eBooks

10. Customer Service

Getting in touch with your broker should be quick and easy. As well as contact methods, it is important to note the hours of operation. Many brokers will offer 24/5 customer service, with few providing support 24 hours a day, 7 days a week.

Common contact methods include email, phone and live chat. Online live chats are becoming increasingly popular as traders can instantly connect with customer service representatives and have their questions answered.

Depending on your location, multilingual customer support may be necessary. A top forex broker should provide multilingual customer support, with minor languages supported.

Customer support is vital for beginner traders starting out. Whether you run into technical issues or have account funding queries, being able to find solutions quickly and efficiently is helpful for those new to forex trading.

11. Reputation And Reviews

With today’s online resources, it is easy to gauge a broker’s reputation within the forex trading community. To learn more about a forex broker and their reputation among traders, the following resources can be used:

- Broker comparisons

- Forex reviews from past and present Forex traders

- Forums where brokers, forex trading, and trading platforms are discussed

- Awards from respected industry voices

We have provided individual broker reviews to help compare the best brokers.

12. Execution Speed And Slippage

Forex markets are volatile, thus choosing a broker with fast execution, and minimal slippage is important for trading strategy success. Slippage refers to the difference between the expected price when an order is placed and the actual price at the time the trade is executed. To reduce the chance of frequent slippage, traders can choose brokers with fast execution.

To ensure quick order execution, many brokers use fibre optic cables to connect to major liquidity providers such as financial institutions and banks. Equinix servers in New York and London allow brokers to achieve low latency regardless of the broker’s location, with data centres in the major financial hubs.

Market Orders

To find the best broker with the least amount of slippage, market order and limit order execution speeds are compared. Commonly used for automated trading, market orders are placed at the current market value. As shown below, Pepperstone’s execution speeds are significantly faster than its competitors, such as IC Markets and GO Markets.

Limit Orders

On the other hand, limit orders are automatically executed when the trader’s pre-set desired buy or sell price is met. When comparing limit order execution speeds, Pepperstone is significantly faster, with an execution time of 77ms, compared to FP Markets at 225ms. While both brokers provide reliable order execution, Pepperstone clearly has the advantage in speed.

13. Risk Management Options

Risk management is a cornerstone of successful trading, and the tools a broker offers can significantly impact your trading experience. Every leading broker provides free access to demo accounts. These accounts allow traders to simulate real trading conditions using virtual funds, serving as an invaluable tool for both beginners and seasoned traders.

Demo accounts are not just for testing the broker’s platform and pricing; they’re also excellent for trying out new trading strategies without financial risk. Beyond demo accounts, it’s crucial to check if the broker supports essential order types, such as stop-loss and take-profit orders, to help you manage your trading risks effectively. Some brokers that target novice brokers may charge higher fees but also offer advanced risk management features such as fixed spreads, deal cancellation and guaranteed stop losses.

What Are The Types Of Brokers?

Four basic types of brokers offer retail investor accounts for forex trading. These are Market Makers, Electronic Communication Networks (ECN), Direct Market Access (DMA) and Straight Through Processing (STP) brokers.

Market makers are dealing desk brokers, while ECN, DMA and STP brokers provide no dealing desk (NDD) order execution. Using a Dealing Desk broker or NDD broker can affect the spreads and associated trading costs.

1. Dealing Desk Brokers

Using dealing desks, market makers set their bid/to ask spreads and traders aren’t connected with global liquidity providers. Market makers match orders internally and therefore are the counterparty to any trade.

2. No Dealing Desk Brokers

ECN, DMA and STP brokers that offer NDD execution match orders with external liquidity providers, eliminating the need for intermediaries. While ECN and STP brokers both connect traders with major global liquidity providers, STP brokers have control over their liquidity sources while ECN brokers do not. Likewise, customers of DMA brokers gain direct access to markets and can view all available prices offered by different liquidity sources. Sometimes, brokers may offer hybrids of the above execution methods or even different technologies for various trading accounts they offer.

NDD brokers offer the tightest spreads, with the business model suited to day trading, scalping and those using Expert Advisors.

FAQs When Selecting A Broker

How to choose a broker on MetaTrader 4?

Selecting a MetaTrader 4 broker comes down to features such as low spreads, a good range of FX pairs and CFD instruments, fast order execution speed, no downtime, minimum slippage and other exclusive trading tools that other MT4 brokers don’t offer.

For further guidance, our team at CompareForexBrokers compiled a list of the Best MT4 Brokers here.

What is the best broker for new forex traders?

Brand new forex traders require a trading platform with a user-friendly interface, low minimum deposit, copy trading feature, low trading costs and excellent training and educational service among others.

Check out our Forex Trading Courses guide for more information.

How do I choose a broker?

Review the following 10 steps on how to choose a forex broker:

- Needs to have low spreads, costs and good trading conditions

- Assert what type of business model the broker operates on

- Execution speed and slippage

- Regulatory oversight

- Professional customer support service

- Range of trading platforms

- Leverage and margin requirements

- Risk management tools

- Deposit and withdrawal methods

- Reputation

What Is Forex Trading?

Forex trading is the buying and selling of currencies on a global market. Utilising platforms like MetaTrader, traders aim to profit from fluctuations in currency values.

How does a forex brokerage account work?

A forex brokerage account enables currency trading. After depositing funds, platforms such as MetaTrader facilitate buy or sell orders. Fees include spreads for standard accounts and commissions for RAW accounts.

Conclusion

The bottom line is that the wide array of brokerage choices is both a blessing and a curse. The blessing is that many choices translate to the opportunity to select a broker that will mesh precisely with your most important needs. The curse is that with so many choices, confusion is a distinct possibility. The key thing is to give yourself as much time as you need to choose the right online broker. The financial markets were there before you came along and will be after you are gone.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Ask an Expert

Are there months to avoid in forex trading?

Forex is the most liquid market in the world so generally speaking there is always something happening.