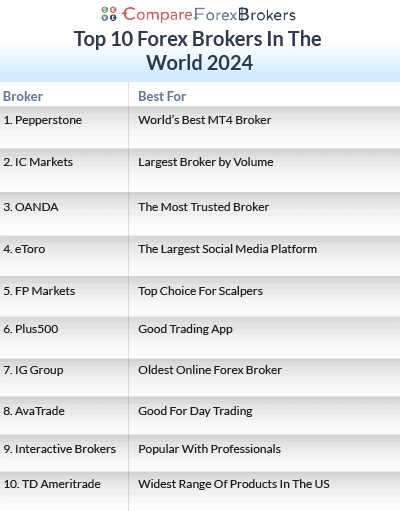

Top 10 Forex Brokers In 2024

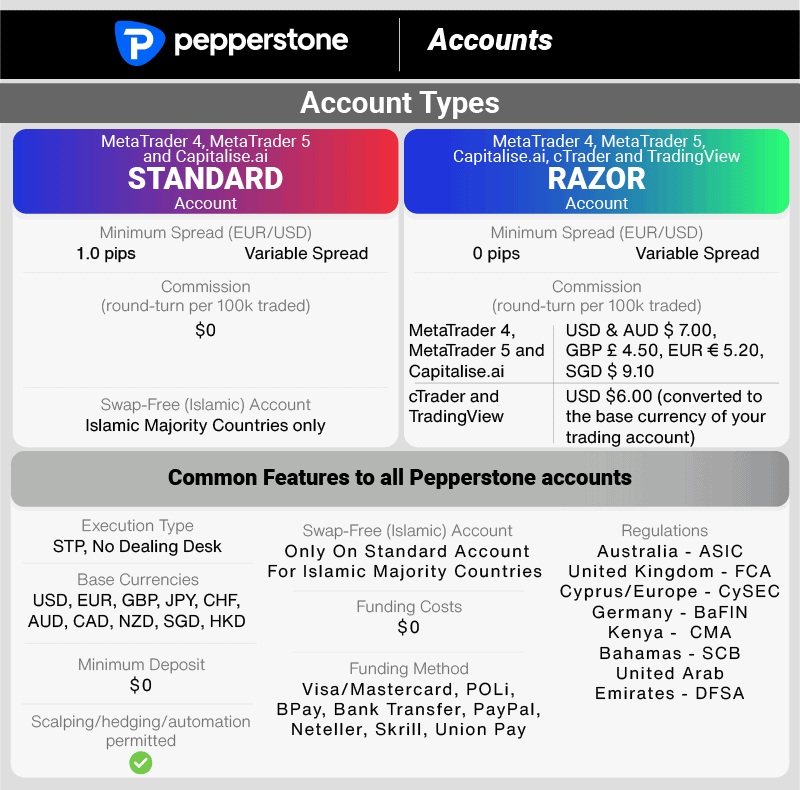

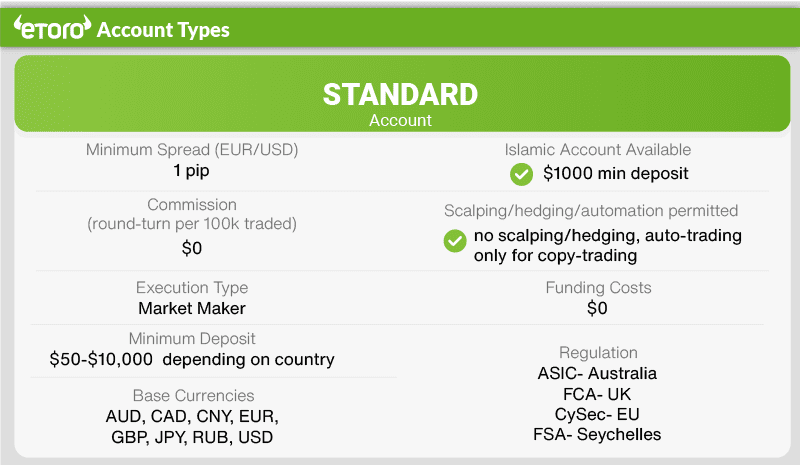

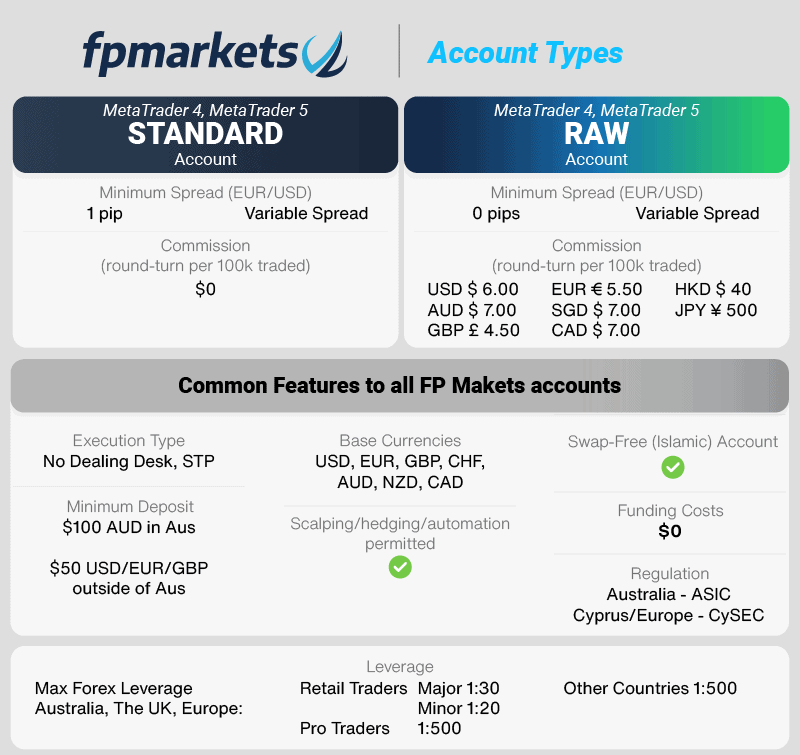

The top 10 forex brokers in the world were determined based on global forex regulation, spreads and the best forex trading platforms. The companies that made the top 10 list were outstanding in a unique forex trading category.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert