CMC Markets vs IG Group: Which One Is Best?

In this review, we’ll analyze our findings on which broker—CMC Markets or IG Group—provides the superior features and platform. Ultimately, the decision rests with the trader, as personal preferences will dictate which brokerage offers the best trading experience. What about you? Which one do you prefer?

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Pro 2: 250:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most crucial trading factors between CMC Markets and IG.

- IG is the world’s largest forex broker, founded in 1989.

- IG shines with its AUD/USD spread, offering a rate of 1.01, significantly lower than CMC Markets’ 1.64.

- IG provides a lower brokerage and offers more trading platforms, including the renowned MetaTrader 4.

- CMC Markets boasts the most financial instruments, including 339 currency pairs.

- CMC Markets generally has lower spreads across most forex pairs, such as EUR/USD, GBP/USD, and AUD/USD.

- Both brokers are market makers, but neither uses a dealing desk; they source rates via their network of interbank providers.

1. Lowest Spreads And Fees – IG Group

Low spreads and fees are a significant advantage for both new and experienced traders. This feature allows traders who frequently execute trades to save on transaction costs, ultimately boosting their overall profitability. For brokers, offering competitive spreads and fees can attract a larger client base, resulting in increased trading volumes and heightened business success.

We can see here that both brokers are market makers. However, it’s interesting to note neither broker uses a dealing desk. Instead, both brokers source their rates via their network of interbank providers.

Looking at the forex broker no commission 2026 spreads table below (updated monthly), IG was found to be significantly lower.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.13 | 1.01 | 2.06 | 1.71 | 2.27 |

| 0.90 | 1.30 | 1.70 | 1.40 | 1.40 |

| 0.70 | 2.20 | 2.20 | 1.10 | 1.60 |

| 1.10 | 1.10 | 1.90 | 1.60 | 2.00 |

| 1.20 | 1.30 | 2.00 | 1.30 | 1.50 |

| 1.00 | 1.00 | 1.50 | 1.27 | 1.30 |

| 0.89 | 1.37 | 2.56 | 1.41 | 3.01 |

| 1.18 | 1.45 | 1.80 | 1.40 | 1.80 |

| 1.10 | 1.10 | 1.90 | 1.30 | 2.10 |

| 0.70 | 0.70 | 1.10 | 0.90 | 1.00 |

| 1.70 | 1.60 | 1.40 | 1.70 | 2.50 |

| 1.40 | 1.60 | 2.40 | 1.40 | 2.10 |

| 0.70 | 0.80 | 2.00 | 1.30 | 2.40 |

| 0.50 | 0.60 | 1.10 | 0.70 | 1.20 |

| 1.40 | 1.90 | 3.20 | 1.30 | 1.90 |

| 1.20 | 1.30 | 1.20 | 1.20 | 1.20 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

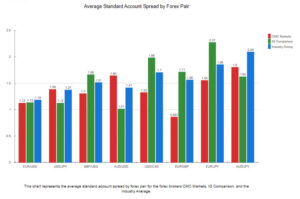

Standard Account Spreads

When it comes to standard account spreads, there’s a clear difference between CMC Markets and IG. Let’s take a closer look.

CMC Markets tends to have lower spreads across most forex pairs. For instance, the EUR/USD spread is 1.12, compared to IG’s 1.13. This trend continues across other pairs, such as GBP/USD and AUD/USD, where CMC Markets consistently outperforms IG.

| Standard Account | CMC Markets Spreads | IG Group Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.53 | 1.62 | 1.6 |

| EUR/USD | 1.3 | 1.13 | 1.2 |

| USD/JPY | 1.3 | 1.12 | 1.4 |

| GBP/USD | 1.5 | 1.66 | 1.6 |

| AUD/USD | 1.5 | 1.01 | 1.5 |

| USD/CAD | 1.5 | 1.98 | 1.8 |

| EUR/GBP | 1.5 | 1.71 | 1.5 |

| EUR/JPY | 1.7 | 2.27 | 1.9 |

| AUD/JPY | 1.9 | 2.06 | 2.1 |

Standard Account Analysis Updated January 2026[1]January 2026 Published And Tested Data

However, IG shines in the AUD/USD pair, where it offers a spread of 1.01, significantly lower than CMC Markets’ 1.64. This suggests that IG may be a better choice for traders who frequently trade this pair.

When we compare these brokers to the industry average, both offer competitive spreads. However, CMC Markets generally comes closer to the industry average, suggesting it offers more consistent value across a range of forex pairs.

In conclusion, while both brokers offer competitive spreads, CMC Markets generally offers better value across a range of forex pairs. However, traders who frequently trade the AUD/USD pair may find better value with IG. As always, it’s important to consider your trading habits and preferences when choosing a broker.

Key Features IG Retail Investor Accounts:

- Only one type of Account for retail investors (Forex Direct is for professional investors)

- Access to over 90 currency pairs

- Hedging

- No commissions

- Risk management tools

- Cash rebate program

- Automated Trading (only via MT4 Platform)

Key Features Of CMC Markets Retail Investor Accounts:

- One account type

- Market Maker

- Access to over 348 currency pairs

- Hedging

- No commissions

- Risk management tools

- Cash rebate program

- Automated Trading is available

As you can see, both brokers offer similar features.

Additional Costs

Both brokers require payment for the following fees

- Holding costs / Overnight fees – fees to hold your position overnight

- Market data fees – fees to access live data

- Guaranteed stop-loss order charges – fees to open a GSLO

Based on these data given, we can presume that IG has significantly lower spreads when comparing standard accounts (commission-free accounts). In fact, IG has the lowest standard spreads of any forex broker. This doesn’t apply for ECN accounts (which have a commission but substantially lower spreads) in which IC Markets is the lower. For this comparison, though, even considering other trading fees, it’s concluded that IG is the winner when it comes to costs.

Our Lowest Spreads and Fees Verdict

IG Group definitely takes the crown here thanks to their lowest spreads and sheets.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

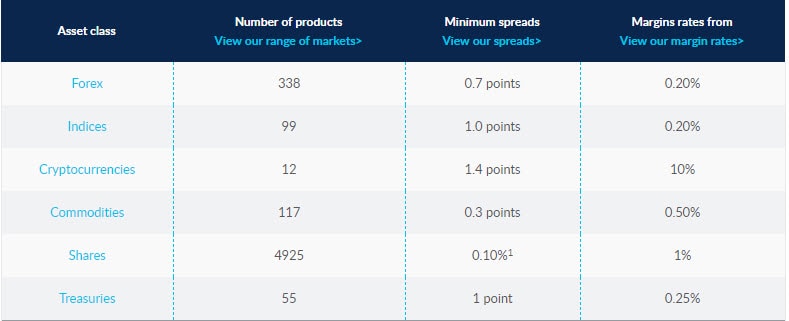

2. Better Trading Platform – A Tie

Brokers that provide advanced tools, rapid execution, and dependable performance truly capture the admiration of traders in the forex market. Why is this the case? Because these features empower traders to make informed decisions, ultimately driving their success and satisfaction in trading.

As we go through this section, we can see that both brokers offer MetaTrader 4 (MT4) but also offer a selection of other platforms. This includes its proprietary platform.

| Trading Platform | CMC Markets | IG Group |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

MetaTrader 4 (MT4)

MetaTrader 4 is a relatively recent addition to each broker’s platform offerings. For example, CMC Markets has only offered MT4 since late 2018. CMC Markets appear to prefer you use their proprietary platform, given that MT4 is somewhat hidden on their website.

MetaTrader 4 Competitive Advantages:

- More brokers offer this platform than any other platform – this means you can easily switch brokers without needing to change platforms

- More traders use this platform than any other – this means there is a large MT4 community that can help you with all your needs online

- It is one of the oldest existing platforms, which means it is reliable as it has continually been improved over the years

Features Of MT4

What MT4 Does Not Offer:

- Neither CMC Markets nor IG appears to have share trading via MT4

CMC Markets Next Generation Platform

Next Generation is CMC Markets’ own award-winning proprietary. This trading platform is available via the web browser and on iOS and Android mobile devices. The platform offers the following:

- Over 35 drawing tools

- Over 80 technical indicators (30 overlaps and 50 studies)

- Price history going back up to 20 years

- Ability to switch between chart intervals ranging from 1 second to a month

- 4 types of closeout methods (standard, last in first out, largest position loss first, largest position margin first)

- 5 types of order execution – Market, Limit and stop entry orders, guaranteed stop-loss orders, regular stop-loss orders, trailing stop-loss orders, take-profit orders

- Customisable charts

- Ability to trade directly from charts

- Projection and pattern recognition tools

- Online trading community to discuss trading

- Social trading with other traders via a chat forum

For a long time, CMC Markets did not offer an alternative platform to ‘Next Generation’. This could be interpreted as confidence their platform is superior to other platforms.

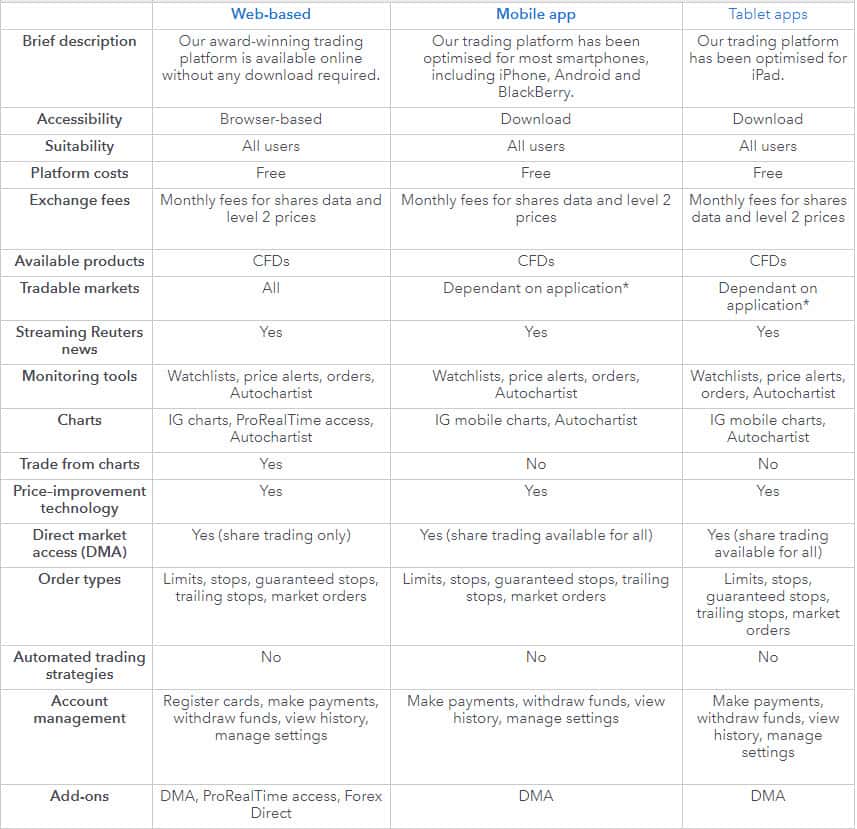

IG Markets Trading Platforms

IG places most of its efforts into its proprietary platforms (see Web-based, mobile and tablet apps) as it allows its clients easy access to their large portfolio of instruments in a user-friendly and easy-to-use manner. MT4, for example, can’t quite match this. Their platforms are award-winning and have a good range of charts and indicators designed in such a way that you will not feel overwhelmed by the volume of data being displayed.

There are, however, may be times when using MT4 is beneficial. For example, if you wish to use robots. Unless you have a Forex Direct account (which is only available for professional traders), you will not be using an L2 dealer, and ProRealTime is best avoided as there are steep monthly fees. This platform is best if you like coding, have lots of indicators and want to do backtesting.

We can easily surmise here that in this category, it will boil down to your, basically, personal preference. While it is true both brokers offer a good choice of platforms, most traders are only going to need one platform. We generally recommend MT4 because this is a well-known and proven platform, with the added benefit being it is available with many other brokers should you switch brokers. Use of CMC Markets’ ‘Next Generation’ platform or IG proprietary platforms means you will be locked into their trading ecosystem, which can make it difficult to trade in future.

Our Better Trading Platform Verdict

It is a draw for both brokers in this category in light of having better trading platform.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

3. Superior Accounts And Features: IG Group

In the industry of trading, the right account features can elevate your experience from good to exceptional. Both CMC Markets and IG have been in the game long enough to understand this, and they’ve tailored their offerings accordingly. But how do they fare when pitted against the best in the industry? Let’s take a closer look into what we found.

- Best MT4 Broker: Pepperstone stands out, although neither CMC Markets nor IG clinch this title.

- Best MT5 Broker: IC Markets is the top dog here, showcasing its prowess in the MT5 platform.

- Best for Automation: Pepperstone takes the crown with innovative features like Capitalise.ai.

- Best ECN Account: Eightcap leads the pack, offering traders unparalleled access to market depth.

Now, when we zoom in on CMC Markets and IG, it’s evident that both brokers have their strengths. IG, for instance, offers a plethora of advanced trading tools, while CMC Markets impresses with its diverse account types. It’s all about finding the right fit for your trading style and needs.

| CMC Markets | IG Group | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | Yes |

We can assume here that IG slightly edges out with its advanced trading tools, making it the superior broker in terms of accounts and features based on our comprehensive analysis and testing.

Our Superior Accounts and Features Verdict

IG comes out on top due to their superior accounts and features.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – A Tie

Trading can be a complex endeavour, but with the right platform and tools, it can feel like a breeze. Both CMC Markets and IG have invested heavily in ensuring their users have a seamless trading experience. But how do they compare to the industry’s best? Let’s dive into our findings and personal experiences.

- Best MT4 Broker: Pepperstone truly shines here, offering an unmatched MT4 experience.

- Best Trading App: ThinkMarkets, with its ThinkTrader app, sets the bar high for mobile trading.

- Best for Beginners: OANDA stands out, catering exceptionally well to novice traders.

- Fastest Execution: Blackbull ensures your trades are executed in a flash, leading the pack in this category.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| CMC Markets | 138ms | 18/36 | 180ms | 26/36 |

| IG Group | 174ms | 26/36 | 141ms | 19/36 |

Presumably, while focusing on CMC Markets and IG, both brokers offer intuitive platforms that cater to both beginners and seasoned traders. IG, with its advanced charting tools, and CMC Markets, with its customisable layouts, both aim to simplify the trading process. It’s all about finding that sweet spot where functionality meets ease of use.

Our Best Trading Experience and Ease Verdict

Both CMC Markets and IG are tied to this category as a result of their best trading experience and ease.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

5. Stronger Trust and Regulation – IG Group

A broker with stronger trust and regulation are, simply, the most reputable and competitive in the industry of forex trading. These brokers ensure a secure and transparent trading environment for traders.

CMC Markets Trust Score

IG Group Trust Score

CMC Markets and IG are two of the larger brokers worldwide, but which one should you trust more? To answer this question, we focused on how many licences each broker has with different regulators, the popularity of each broker and reviews. Firstly, let’s start with regulation, which is the most important factor.

Regulation

CMC Markets has four ‘tier 1’ regulators, which are:

- ASIC (Australia)

- FCA (UK)

- BaFin (Germany)

- CIRO (Canada)

The broker also licences with two ‘tier 2’ regulators, including the FMA in New Zealand and MAS in Singapore. The broker was a finalist in the Best Forex Brokers In Australia and Best forex UK broker lists.

IG has the most ‘tier 1’ regulation of any forex broker we have compared, including:

- ASIC (Australia)

- FCA (UK)

- BaFin (Germany)

- FINMA (Swiss)

- NFA/CFTC (USA)

- CySEC (Cyprus)

It also has just as many ‘tier 2’ regulations, including DFSA in Dubai (UAE), FMA in New Zealand, FSCA in South Africa, JFSA in Japan and finally MAS (Singapore). They also have ‘tier 3’ regulation with BMA in Bermuda. The provider was a finalist in the list of the Best Forex Brokers In NZ and the Best Forex Brokers In UAE.

Overall, when it comes to trust, with one more ‘tier 1’, three more ‘tier 2’ and two more ‘tier 3’ (6 more in total), IG is the clear winner when it comes to regulation. We gave IG the perfect score of 50 vs 40 for CMC Markets when it comes to regulation.

Age And Broker Reputation

The next section focused on the history of each broker. Both brokers scored well again here. IG was founded in 1974, while CMC Markets was founded in 1989. Their headquarters are both in London, UK. The only slight tarnish on either of the brokers related to IG in recent history was when it came to the 2021 Short Squeeze. This related to GameSpot and other shares being shorted and firms, including IG, restricting trading, leading to a class action.

The final score when it came to this criterion was a perfect 30 for CMC Markets vs 28 for IG.

Reputation

IG is the more popular broker. This was based on monthly searches (over 12 months) on Google, with IG receiving 20,400,000 compared to just 90,500. Also, IG has more reviews, with 6,008 vs 1,573 for CMC. IG also has a superior score of 4.1 vs 3.90 for CMC.

This led to IG scoring a superior score for this category, 14 vs 10 with CMC.

We can surmise that IG Group is the more trusted broker, with our team scoring it an almost perfect 95/100 compared to 91/100 for CMC Markets. These scores are both high, and Canadian traders should trust CMC Markets more since they are the only brokers with CIRO (formerly IIROC) regulations.

Reviews

As shown below, IG Group has more reviews than CMC Markets. CMC Markets, on the other hand, has a slightly higher score.

Our Stronger Trust and Regulation Verdict

IG Group ranks highest in this category as a result of having stronger trust and reputation.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

6. Most Popular Broker – IG Group

CMC Markets is searched on Google about twice as often as IG Group. On average, CMC Markets receives around 110,000 branded searches each month, while IG Group gets about 74,000 — roughly 33% fewer.

| Country | CMC Markets | IG Group |

|---|---|---|

| Brazil | 60,500 | 2,900 |

| India | 9,900 | 8,100 |

| Uzbekistan | 5,400 | 320 |

| United Arab Emirates | 3,600 | 1,900 |

| Thailand | 3,600 | 1,000 |

| Bangladesh | 2,400 | 880 |

| Mongolia | 2,400 | 210 |

| Argentina | 1,600 | 1,600 |

| Colombia | 1,600 | 1,000 |

| Ecuador | 1,600 | 90 |

| Poland | 1,000 | 2,900 |

| Peru | 880 | 2,400 |

| Philippines | 880 | 90 |

| United States | 720 | 390 |

| Nigeria | 720 | 70 |

| Netherlands | 590 | 590 |

| United Kingdom | 590 | 480 |

| Ghana | 590 | 140 |

| Germany | 480 | 480 |

| Singapore | 480 | 260 |

| Pakistan | 390 | 390 |

| Greece | 390 | 260 |

| Jordan | 390 | 110 |

| Hong Kong | 320 | 320 |

| Saudi Arabia | 320 | 170 |

| Algeria | 320 | 110 |

| Morocco | 320 | 50 |

| Sweden | 260 | 320 |

| Italy | 210 | 260 |

| Turkey | 210 | 90 |

| Malaysia | 210 | 70 |

| South Africa | 170 | 90 |

| Canada | 140 | 170 |

| Austria | 140 | 50 |

| Portugal | 140 | 20 |

| Australia | 110 | 110 |

| Taiwan | 110 | 70 |

| Uruguay | 110 | 40 |

| Cambodia | 110 | 30 |

| Vietnam | 90 | 110 |

| Bolivia | 90 | 30 |

| Ethiopia | 90 | 30 |

| Indonesia | 70 | 70 |

| Switzerland | 70 | 30 |

| Botswana | 70 | 30 |

| Spain | 50 | 50 |

| Cyprus | 50 | 20 |

| Chile | 50 | 20 |

| Mexico | 40 | 50 |

| New Zealand | 40 | 20 |

| Mauritius | 40 | 20 |

| Ireland | 40 | 10 |

| Venezuela | 30 | 10 |

| Sri Lanka | 30 | 10 |

| Japan | 30 | 10 |

| Kenya | 30 | 10 |

| Tanzania | 20 | 30 |

| Uganda | 20 | 10 |

| Costa Rica | 20 | 10 |

| Egypt | 10 | 10 |

| Panama | 10 | 10 |

| Dominican Republic | 10 | 10 |

| France | 10 | 10 |

49,500 1st | |

6,600 2nd | |

9,900 3rd | |

2,900 4th | |

4,400 5th | |

2,900 6th | |

3,600 7th | |

5,400 8th |

Similarweb shows a different story when it comes to August 2025 website visits with IG Group receiving 10,070,000 visits vs. 1,592,000 for CMC Markets.

Our Most Popular Broker Verdict

IG Group is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

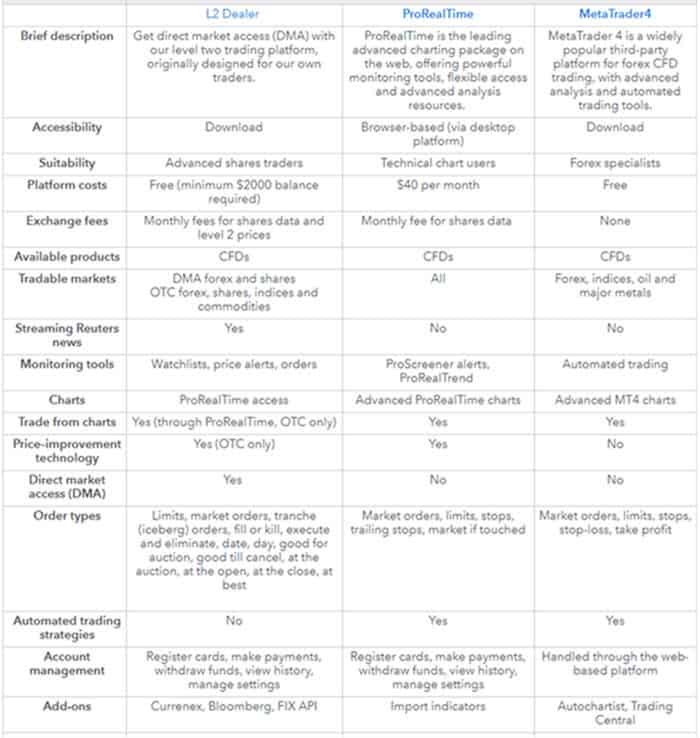

7. Top Product Range And CFD Markets – CMC Markets

Choosing a broker that offers an extensive range of top-tier products and CFD markets in the forex trading industry is essential. Such brokers empower traders with enhanced opportunities to diversify their portfolios while effectively managing financial risks.

We can see here that both brokers offer a very large range of CFDs when you compare them with other brokers. It is worth noting the sheer size of currency pairs CMC Markets offer. These forex pairs consist of majors, minors and exotics. CMC Markets also offer more commodities. IG, on the other hand, offers you a far larger range of indices and shares.

When it comes to margin, CMC offers a better margin (leverage). Minimum spreads are slightly in IG’s favour.

CMC Markets CFDs

In addition to the above, CMC Markets also offer Binaries and Countdowns.

CFDs – IG

| CFDs | CMC Markets | IG Group |

|---|---|---|

| Forex Pairs | 338 | 110 |

| Indices | 82 | 130 |

| Commodities | 124 | 11 Metals 7 Energies 23 Softs |

| Cryptocurrencies | 19 | 13 (+ Crypto 10 Index) |

| Shares | 10000+ | 13000+ |

| ETFs | 11265 | 2000+ |

| Bonds/Treasuries | 55 | 14 |

| Other Products(Options,Futures) | Yes | Yes |

Presumably, we can say that while both CMC Markets and IG offer a diverse range of products, CMC Markets stands out with its broader CFD offerings, making it the broker with the best range of CFDs and Markets.

Our Top Product Range and CFD Markets Verdict

CMC Markets takes the cake due to their top product range and CFD markets.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

8. Superior Educational Resources – IG Group

We live in a world where technology is always evolving, and we, us humans, need to keep up with the times. This is where education comes into play because learning is the key to evolution.

In this section, we can clearly see that both CMC Markets and IG understand the importance of equipping their users with top-notch educational resources. Whether you’re a newbie looking to grasp the basics or a seasoned trader aiming to refine your strategies, having the right educational tools can be a game-changer. Let’s see how these two giants fare in this department.

- Webinars & Workshops: Both brokers offer regular webinars, but IG takes it a notch higher with in-person workshops.

- Tutorial Videos: CMC Markets boasts an extensive library of tutorial videos catering to all levels.

- E-books & Articles: IG shines with its comprehensive collection of e-books and in-depth articles.

- Demo Account: Both brokers provide demo accounts, allowing users to practice without risking real money.

- Trading Glossary: CMC Markets offers a detailed trading glossary, helping users understand complex jargon.

- Customer Support: IG stands out with its 24/7 customer support, ensuring users get assistance whenever needed.

Clearly, we can see here that IG offers superior educational resources, making it the go-to broker for traders keen on continuous learning, based on our testing and scores.

Our Superior Educational Resources Verdict

IG Group out performs the challenger here due to their superior educational resources.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

9. Superior Customer Service – IG Group

This part of trading is really vital for traders because it enhances the overall trading experience while it ensures that traders can navigate the market effectively and efficiently.

Customer Support – IG

IG Markets customer support is available almost 24/7. Customer support is available throughout the week, but hours are limited on Saturdays. Support from IG is available via email, phone, live chat and Twitter. IG also has a community forum where all members of the IG community can provide support to each other.

| Feature | CMC Markets | IG Group |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Customer Service – IG

Education

The IG Academy is a great resource for trading education. The academy includes the following features:

- Online courses – There is a range of trading courses designed for all levels made up of videos, quizzes and interactive exercises.

- Live Sessions – 30-minute webinars by IG and the DailyFX team experts are run around the clock, covering all sorts of trading topics.

- Mobile – IG Academy is available as a mobile app.

Other Education Tools:

- News and Analysis

- Financial Events –

- Risk Management Education – Covering a range of risk management strategies

- Key trading terms glossary

- Personal Platform Tour – Step-by-step guide when using the IG platform

- Economic Calendar

Customer Support – CMC Markets

CMC Markets customer support for CFDs is available Monday 8 am to Saturday 8 am. This means they are open when there is a CFD market open somewhere in the world. Customer support for shares is only open during Australian stock exchange hours: Monday, 7.30 AM to 5.30 PM, Friday. The following means are available to get in touch with the customer support team:

- Live chat

- Phone (toll-free within Australia)

In addition to the above methods, you can get in touch with CMC Markets via Twitter and Facebook. Using these two mediums has some advantages, as CMC Markets can directly link you to resources and guides that may benefit you.

Customer Service – CMC Markets

CMC Markets provides a solid range of customer services, including:

Research:

- Dedicated news and analysis – here, you can find a wealth of material for successful forex trading. CMC Markets experts are on hand to lend their knowledge, and access to charts and technical and fundamental analyses are also available. You will also find an economic calendar and live news such as Reuters available.

Education:

- CMC Markets have articles, eBooks, videos, seminars and webinars tailored for varying levels of trading experience. These tools take you through just about everything you will need to know about CFD trading.

Other Tools:

- Glossary: Here you can find explanations of all terms about trading

- FAQ: This is a collection of answers to commonly asked questions about trading with CMC Markets.

- Demo Account: $10,000 of virtual funds is available in a demo account for you to develop and test your trading strategies. The account will remain available as long as you have a CMC Markets account.

Demo Account:

$20,000 of virtual funds is available in a demo account for you to practice your trading. The demo account will not allow you to practice with ‘slippage’; you will find that trades are not rejected due to size or price.

We believe IG customer service and support is superior; not only is customer support available each day of the week, but you can use a greater range of communication mediums to reach them.

Our Superior Customer Service Verdict

IG Group takes the lead in this category in light of their superior customer service.[/highlight]

*Your capital is at risk ‘71% of retail CFD accounts lose money’

10. Better Funding Options – CMC Markets

We see that both brokers offer funding options that could really benefit traders, but according to our research, only one of these two offers the best funding option.

CMC Markets Funding

You can fund your CMC Markets account using three primary methods. These are credit cards, debit cards, and bank transfers. In addition to these, you can use alternatives like POLi, BPAY and PayPal. When making a deposit or withdrawal, there is a 1% processing fee for credit cards and 0.6% for debit cards. There are no minimum deposit requirements.

IG Markets Funding

Your account can be funded with credit cards, debit cards, bank transfers and via PayPal and BPAY. When funding by card, you can deposit a maximum of $50,000 and withdraw a maximum of $35,000 per day. For larger deposits and withdrawals, you should use bank transfers.

There are no charges when using debit cards or BPAY, but there is a 1% charge when using Visa or PayPal and a 0.6% charge when using MasterCard.

| Funding Option | CMC Markets | IG Group |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | No | No |

| Neteller | No | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

We can surmise that CMC Markets offer more funding options and don’t apply the same daily volume limits when using cards, so we recommend CMC Markets.

Our Better Funding Options Verdict

CMC Markets comes out on top due to having better funding options.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

Initial deposit is important when dealing in the industry of trading. We are not talking about the amount to invest, but the broker’s capacity to give traders ease of use. Whether you are a newbie or seasoned, a traders deserves a flexible and the ability to, initially, start in smaller investments, thus reducing financial risk. Here’s what we discovered:

In our comprehensive research and testing, we observed that both CMC Markets and IG have set their minimum deposit requirements at $0. This approach is incredibly accommodating, allowing traders to start without any financial barriers.

Minimum Deposit Comparison:

| Broker | Minimum Deposit |

|---|---|

| CMC Markets | $0 |

| IG Group | $0 |

It’s vital to understand that a lower minimum deposit doesn’t necessarily indicate a compromise on the platform’s quality or its features. It’s about providing traders with options. Whether you’re just dipping your toes or diving in headfirst, it’s imperative to select a broker that resonates with your financial objectives and trading ambitions.

We can easily surmise that both CMC Markets and IG offer a $0 minimum deposit, ensuring traders can begin their journey without any initial financial constraints.

Our Lower Minimum Deposit Verdict

It is a draw for both CMC Markets and IG owing to their lower minimum deposit.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

Is CMC Markets or IG Group The Best Broker?

IG takes the cake in this review because of its comprehensive service offerings, competitive pricing, and user-friendly platform. The table below summarises the key information leading to this verdict:

| Categories | CMC Markets | IG Group |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | Yes | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | Yes | Yes |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | Yes |

CMC Markets: Best For Beginner Traders

For those just starting out, CMC Markets provides an intuitive platform and a wealth of educational resources, making it the top choice for novice traders.

IG Group: Best For Experienced Traders

For seasoned professionals seeking advanced tools and a robust trading environment, IG Group is the go-to broker, catering specifically to the needs of experienced traders.

FAQs Comparing CMC Markets Vs IG Group

Does IG Group or CMC Markets Have Lower Costs?

IG offers more competitive pricing overall. They consistently rank among the top brokers for low spreads and commissions. For instance, their average spread for major currency pairs is notably lower than many competitors. For a more detailed breakdown of costs, you can check out this comprehensive list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

When it comes to MetaTrader 4, CMC Markets edges out slightly over IG. Both brokers support the platform, but CMC Markets offers a more seamless integration and enhanced features. For traders keen on exploring the best MT4 brokers globally, this comprehensive list of top MT4 brokers can be a valuable resource.

Which Broker Offers Social Trading?

In the realm of social and copy trading, IG stands out between the two. While both brokers have ventured into this innovative trading approach, IG has a more established platform for traders to follow and replicate the strategies of experienced traders. For those interested in diving deeper into social trading, this guide on the best social trading platforms offers a wealth of information.

Does Either Broker Offer Spread Betting?

Yes, IG prominently offers spread betting services. This form of trading is especially popular in the UK due to its tax benefits. CMC Markets also provides spread betting, but IG’s platform is often recognised for its user-friendly interface and comprehensive tools. For a detailed comparison of spread betting brokers in the UK, you can refer to this comprehensive guide on the best spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, CMC Markets is the superior choice for Australian Forex traders. Both CMC Markets and IG are ASIC-regulated, ensuring a high level of trust and security for traders down under. While IG has its roots overseas, CMC Markets was founded right here in Australia, giving it a home-ground advantage and a deeper understanding of the local market dynamics. For those keen on exploring more options, this guide on Best Forex Brokers In Australia offers a comprehensive overview.

What Broker is Superior For UK Forex Traders?

From my perspective, IG stands out as the top choice for UK Forex traders. Both IG and CMC Markets are FCA-regulated, ensuring robust oversight and trader protection in the UK. IG, with its origins in the UK, has a deep-rooted understanding of the British trading landscape, while CMC Markets, though a global player, was founded overseas. For traders in the UK looking for more insights, this comprehensive guide on the Best Forex Brokers In UK is a must-read.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is it easy to withdraw money from CMC Markets?

It is easy to withdraw funds from CMC Markets. To do this select Funding Tab or go to Account Tab and select withdrawal and then bank transfer. Generally you need to withdrawal back to the same account you made your deposit from. Card withdrawals and digital wallets are generally within the hour while withdrawals to banks will take longer.

Which broker do most traders use?

Between CMC Markets and IG, I would say IG is larger.

Do both brokers offer demo accounts for practice trading?

Yes, most brokers offer a free demo account for testing. This is usually available for 60 days and does not require sign up or a deposit with the broker