CMC Markets vs Pepperstone: Which One is Best?

This review is truly interesting and challenging because both contenders are highly competitive and evenly matched. However, only one will take the throne, while the other will have to keep on its track. And to keep you on the edge of your seat, read on to see the results.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 16:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are a few noticeable differences between CMC Markets and Pepperstone:

- CMC Markets offers over 300+ currency pairs, 12 cryptocurrencies, and 9000+ Shares.

- CMC Markets offers a Guaranteed Stop-Loss Order (GSLO) for a premium

- CMC Markets has a fixed spread inclusive of commission.

- Pepperstone provides 2 account types, and tighter ECN style spreads, and a choice of trading platforms.

- Pepperstone’s commission-free spreads are generally more competitive than those of CMC Markets for many currency pairs.

- Pepperstone offers a choice between commission-free spread or ECN-like pricing.

1. Lowest Spreads And Fees – Pepperstone

When evaluating forex brokers, the importance of lowest spreads and competitive fees cannot be overstated. Cost-effective trading options lower transaction costs, benefiting high-frequency traders seeking quick trades for profit. Competitive broker fees attract clients, boosting trading volumes and revenue. This synergy improves the trading experience for both traders and brokers. This chapter explores trends in spreads and fees shaping the current forex landscape.

Spreads

Both Pepperstone and CMC Markets offer competitive spreads, which are critical for traders looking to minimize transaction costs. For the EUR/USD pair, Pepperstone offers a spread of 0.1 pips, while CMC Markets offers 0.5 pips, with the industry average being 0.28 pips. For the AUD/USD pair, Pepperstone’s spread is 0.2 pips, compared to CMC Markets’ 0.6 pips, with the industry average at 0.45 pips. Overall, Pepperstone’s average spread is 0.47 pips, while CMC Markets’ average spread is 0.93 pips, indicating that CMC Markets’ spreads are slightly higher than Pepperstone’s. Both brokers continuously adjust their spreads to stay competitive in the dynamic forex market, ensuring they remain attractive options for traders.

| RAW Account | CMC Markets Spreads | Pepperstone Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.93 | 0.47 | 0.72 |

| EUR/USD | 0.5 | 0.1 | 0.28 |

| USD/JPY | 0.8 | 0.3 | 0.44 |

| GBP/USD | 0.9 | 0.3 | 0.54 |

| AUD/USD | 0.6 | 0.2 | 0.45 |

| USD/CAD | 1.3 | 0.4 | 0.61 |

| EUR/GBP | 0.7 | 0.2 | 0.55 |

| EUR/JPY | 1.2 | 0.711 | 0.74 |

| AUD/JPY | 1.2 | 0.5 | 0.93 |

| USD/SGD | 1.2 | 1.5 | 1.97 |

Commission Levels

For commission levels, both Pepperstone and CMC Markets have structured their fees to attract a wide range of traders. Pepperstone charges a competitive commission of $3.50 per lot per side on their Razor accounts, providing transparency and cost-efficiency for active traders. CMC Markets, while offering a base commission of $2.50 per lot per side, differentiates itself with a pricing model based on trade volume and account type. This flexibility allows traders to choose a commission structure that best suits their trading style and volume.

Both brokers offer a $0 minimum deposit, with Pepperstone recommending an initial deposit of $200 and CMC Markets recommending $100. Both brokers also provide swap-free accounts, catering to traders who prefer not to incur overnight fees. However, Pepperstone stands out by not charging inactivity or funding fees, whereas CMC Markets does impose these charges. This makes Pepperstone a more cost-effective option for traders who may not trade frequently or who prefer to avoid additional fees.

These insights reflect the latest trends in forex trading, where brokers are increasingly focusing on competitive pricing and flexible account options to attract and retain clients. By offering low commissions, no minimum deposits, and swap-free accounts, both Pepperstone and CMC Markets are well-positioned to meet the diverse needs of modern traders.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| CMC Markets | $2.50 | $2.50 | £2.50 | €2.50 |

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

Our team created a fee calculator showing that Pepperstone usually has the lowest fees for RAW accounts.

Standard Account Fees

Standard account fees are another important consideration for traders. Pepperstone offers low standard account fees, with no minimum deposit required, although a recommended initial deposit of $200 is suggested for optimal trading conditions. CMC Markets, in contrast, requires a minimum deposit of $100 but recommends $500 for an enhanced trading experience. Both brokers ensure that traders can manage their accounts effectively without incurring unnecessary costs, offering a variety of funding options and no inactivity fees.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.12 | 1.64 | 1.30 | 1.30 | 1.38 |

|

1.10 | 1.10 | 1.20 | 1.20 | 1.20 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Thanks to our dedicated team’s research and studies, this overview provides traders a comprehensive understanding of the costs and fees associated with trading through Pepperstone and CMC Markets, helping traders make informed decisions based on their individual needs and trading strategies.

Chapter 2

While trading fees vary with financial instruments and locations, it is evident that Pepperstone’s spreads are much more competitive than CMC Markets. When traders sign up to a Razor account type, Pepperstone clients will gain access to spreads on forex pairs that average 0.13 pips for the EUR/USD forex pair. When CMC and Pepperstone’s commission-free standard account types are compared, Pepperstone is once again the winner with tighter spreads.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

A superior trading platform is the backbone of a successful forex trading experience. Top platforms offer advanced charting, real-time data, and fast execution for traders. With customizable interfaces and automated trading, they ensure efficiency and security. This review compares Saxo Markets and Pepperstone for the best trading experience for all levels.

| Trading Platform | CMC Markets | PEPPERSTONE |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | Yes |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

In this section, we see that both brokers offer powerful MetaTrader platforms, but only Pepperstone provides both MT4 and MT5, while CMC Markets only offers MT4. These platforms are known for their user-friendly interfaces and advanced charting tools, providing traders with a range of technical analysis tools, automated trading capabilities, and customizable layouts to suit individual trading preferences. MT4 remains popular for its reliability and extensive community support, while MT5 offers additional features such as more timeframes, advanced order types, and a built-in economic calendar.

In addition to MetaTrader, Pepperstone offers cTrader and TradingView, which are known for their intuitive designs and advanced functionalities. Pepperstone also supports Copy Trading through platforms like Myfxbook AutoTrade, DupliTrade, and cTrader Copy, as well as their proprietary platforms. These options cater to a wide range of trading styles and preferences, making Pepperstone a versatile choice for traders.

CMC Markets, on the other hand, does not offer cTrader or TradingView but provides Copy Trading and their own proprietary platforms. These platforms are designed to offer robust trading experiences with advanced charting, risk management tools, and in-depth market analysis. Both brokers continue to adapt to the latest forex trading trends, ensuring they provide competitive and comprehensive trading solutions for their clients.

Advanced Platforms

Beyond MetaTrader, both brokers offer additional advanced platforms. Pepperstone provides cTrader, known for its intuitive design, advanced order execution capabilities, and integrated copy trading features. CMC Markets offers Next Generation, a proprietary platform with sophisticated charting, risk management tools, and in-depth market analysis. These advanced platforms cater to traders seeking more specialized tools and functionalities, enhancing their trading experience.

Copy Trading

Copy trading has become increasingly popular, allowing traders to replicate the strategies of experienced traders. Pepperstone supports copy trading through platforms like Myfxbook AutoTrade, DupliTrade, and cTrader Copy. These platforms enable traders to follow successful strategies and automate their trades. CMC Markets also offers copy trading via its proprietary platform, allowing clients to mirror the trades of expert traders. Both brokers provide robust risk management features, ensuring traders can control their exposure while benefiting from the expertise of top traders.

Through our team’s in-depth research, we therefore conclude that Pepperstone emerges as the superior choice, offering the three best trading platforms currently available to retail forex traders. With its advanced trading tools, Expert Advisors, cBots, and a variety of additional add-ons, Pepperstone provides a comprehensive and efficient trading experience. When compared to CMC Markets, Pepperstone’s platform offerings stand out, making it the preferred broker for traders seeking cutting-edge technology and versatility.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

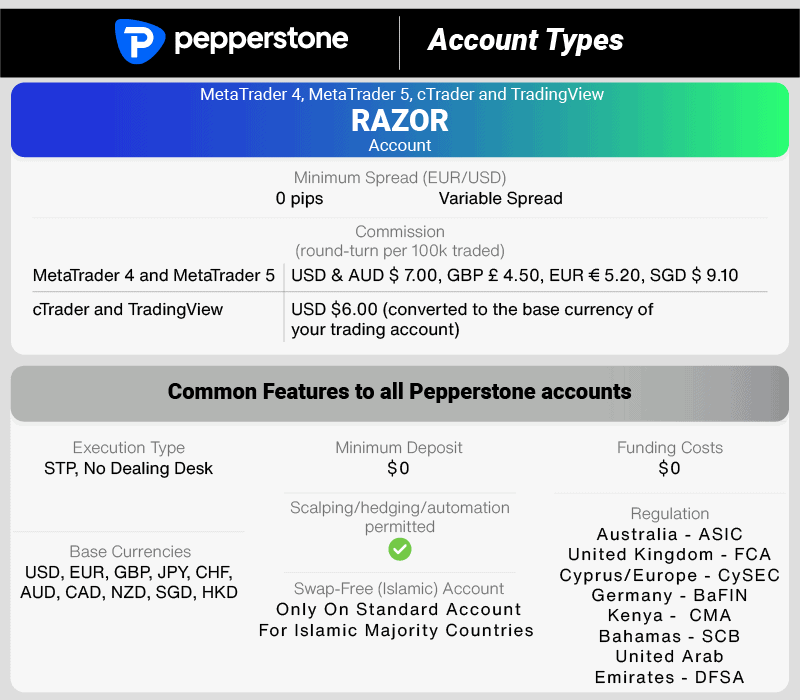

3. Superior Accounts and Features – Pepperstone

For traders, new or seasoned, choosing the right trading account is important for optimizing your forex trading experience. CMC Markets and Pepperstone provide a variety of account types tailored to accommodate diverse trading styles, including low-spread, commission-based accounts and swap-free options for specific traders. Their competitive spreads, advanced trading tools, and swift execution are essential differentiators that elevate the trading experience. Furthermore, with offerings such as demo accounts, automated trading solutions, and excellent customer support, traders can enjoy a comprehensive trading environment that meets their unique needs.

CMC Markets

CMC Markets offers a straightforward approach with a single CFD trading account, providing competitive spreads and commission-free trading. Traders can access spreads as low as 0.3 pips on select forex pairs, with the EUR/USD pair starting at 0.7 pips. This simplicity appeals to new traders as commission fees are included in the spread, eliminating the need to calculate commission costs for each trade executed. However, the lack of multiple account options may be a drawback for those seeking tailored trading conditions.

| CMC Markets | Pepperstone | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | Yes |

Pepperstone

Pepperstone offers a more flexible approach with two distinct account types: the Razor account and the Standard account. The Razor account caters to algorithmic traders and scalpers with experience trading CFDs, offering an ECN-like environment with ultra-tight spreads starting from 0.0 pips and a round turn commission fee of AUD $7 per $100,000 traded. This setup provides institutional-grade spreads, low fees, and ultra-fast execution, ideal for active traders. The Standard account is well-suited for new traders, following a spread-inclusive model similar to CMC Markets, with spreads starting from 1.0 pips. This dual-account structure allows traders to choose the trading environment that best suits their strategy, providing flexibility and tighter pricing.

Latest Insights

Both brokers continue to adapt to the evolving forex trading landscape by offering competitive spreads, commission-free trading, and flexible account options. The focus on providing cost-effective and efficient trading environments reflects the latest trends and insights in the forex market. With their respective strengths, both CMC Markets and Pepperstone present attractive options for modern traders seeking comprehensive and tailored trading solutions.

In the arena of forex trading accounts, Pepperstone distinctly emerges as the premier option, especially with its Razor account. Boasting ECN-like pricing, exceptionally narrow spreads starting from 0.0 pips, and competitive commission fees, it delivers an institutional-grade trading experience crafted for serious traders. The synergy of raw pricing and rapid execution makes it an enticing choice for scalpers and high-frequency traders seeking both cost efficiency and pinpoint accuracy.

CMC Markets offers a robust standard account featuring competitive spreads; however, it falls short of the flexibility and tighter pricing structure that Pepperstone brings to the table. As forex trading trends increasingly favor tighter spreads and enhanced execution speeds, Pepperstone’s Razor account stands out as an exceptional option for retail traders in pursuit of a professional trading atmosphere.

Our Superior Accounts and Features Verdict

Pepperstone, unmistakably, come up trumps in this portion this is due to their superior accounts and features. investors.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

In the busy and dynamic industry of forex trading, the key to a superior trading experience lies in the synergy of advanced trading platforms, efficient execution speeds, competitive spreads, and robust customer support. These components enable traders to make informed decisions, execute trades smoothly, and manage accounts easily. A user-friendly interface, educational resources, and diverse trading tools enhance the trading experience, making it both enjoyable and profitable. This chapter explores how these elements create an optimal trading environment for successful forex trading.

In assessing the overall trading experience and usability, CMC Markets and Pepperstone each present unique advantages. Each broker caters to diverse trader preferences, providing distinctive platform features and tools aimed at enhancing market engagement. Through rigorous testing and in-depth analysis, several key factors have surfaced that set these two industry frontrunners apart.

- Pepperstone shines with its MT4 offering, which is considered one of the best in the industry.

- The broker also excels in automation, with tools like Capitalise.ai enhancing the trading experience.

- CMC Markets, on the other hand, offers a more comprehensive range of instruments, giving traders a wider selection to choose from.

- Their platform is intuitive, making it suitable for both beginners and experienced traders alike.

However, it’s essential to remember that the best trading experience often boils down to personal preference. What works for one trader might not necessarily work for another. It’s all about finding a platform that aligns with your trading style and goals.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| CMC Markets | 138ms | 18/36 | 180ms | 26/36 |

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

Our Best Trading Experience and Ease Verdict

Clearly, we can see here that Pepperstone dominates in this niche, by the reason of them having the best trading experience.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – CMC Markets

When it comes to forex trading, trust and regulation are the backbone of a secure and transparent trading environment. Regulated brokers adhere to strict guidelines for trader protection, fair practices, and fund security. This oversight boosts trader confidence, allowing focus on strategies without fraud concerns. A broker’s credibility is tied to its regulatory framework, making compliance crucial in selecting a trading partner.

CMC Markets Trust Score

Pepperstone Trust Score

When we speak of trust and regulation, both CMC Markets and Pepperstone are governed by esteemed financial authorities, guaranteeing compliance with the highest operational standards and robust customer protection. CMC Markets is regulated by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Monetary Authority of Singapore (MAS), among others. Similarly, Pepperstone is under the regulation of the FCA in the UK, ASIC in Australia, and the Cyprus Securities and Exchange Commission (CySEC), among others.

In this case, Pepperstone and CMC Markets has an impressive trust score of 91. Evidently, both brokers prioritize the security of client funds by maintaining them in segregated accounts, effectively shielding these balances from utilization as operational capital. This critical measure safeguards client assets, particularly in the rare occurrence of financial challenges. Reputable financial authorities mandate that brokers comply with rigorous operational standards, which encompass regular audits, transparent financial reporting, and the maintenance of sufficient capital reserves.

Alongside regulatory oversight, the reputation of a broker within the industry and among traders is crucial. CMC Markets and Pepperstone have both distinguished themselves as reputable and dependable brokers, backed by years of experience and a proven track record of delivering exceptional service to their clients. This strong reputation, paired with solid regulatory frameworks, instills a high level of trust for traders looking to invest with these brokers.

- Regulatory Oversight: Both brokers are regulated by multiple top-tier financial authorities, ensuring adherence to the highest standards.

- Client Fund Protection: Client funds are held in segregated accounts, ensuring they are not used as operational capital by the broker.

- Reputation: Both CMC Markets and Pepperstone have built strong reputations in the industry, backed by years of experience and positive trader feedback.

| CMC Markets | Pepperstone | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) FMA (New Zealand) CIRO (CANADA) MAS (Singapore) | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | DFSA (Dubai) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) |

Our Stronger Trust and Regulation Verdict

Without a doubt, CMC Markets takes the cake in this category this is due to their stronger trust and regulation.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than CMC Markets. On average, Pepperstone sees around 110,000 branded searches each month, while CMC Markets gets about 90,500 — that’s 17% fewer.

| Country | CMC Markets | Pepperstone |

|---|---|---|

| Australia | 49,500 | 8,100 |

| Brazil | 140 | 6,600 |

| United Kingdom | 9,900 | 5,400 |

| United States | 4,400 | 4,400 |

| Malaysia | 480 | 4,400 |

| Kenya | 170 | 4,400 |

| Thailand | 210 | 4,400 |

| Germany | 3,600 | 3,600 |

| Colombia | 50 | 3,600 |

| Mexico | 90 | 3,600 |

| Hong Kong | 390 | 3,600 |

| India | 1,300 | 2,900 |

| South Africa | 720 | 2,900 |

| Spain | 3,600 | 1,900 |

| Italy | 880 | 1,900 |

| Mongolia | 10 | 1,900 |

| Singapore | 2,400 | 1,600 |

| Turkey | 260 | 1,600 |

| Indonesia | 480 | 1,600 |

| Peru | 40 | 1,600 |

| Nigeria | 720 | 1,300 |

| Argentina | 50 | 1,300 |

| Pakistan | 320 | 1,300 |

| Bolivia | 10 | 1,300 |

| France | 720 | 1,000 |

| United Arab Emirates | 390 | 1,000 |

| Taiwan | 140 | 1,000 |

| Chile | 30 | 1,000 |

| Ecuador | 20 | 1,000 |

| Philippines | 260 | 880 |

| Netherlands | 320 | 880 |

| Dominican Republic | 20 | 880 |

| Canada | 4,400 | 720 |

| Poland | 1,600 | 720 |

| Vietnam | 210 | 720 |

| Morocco | 110 | 720 |

| Tanzania | 30 | 720 |

| Japan | 210 | 480 |

| Portugal | 140 | 480 |

| Cyprus | 170 | 480 |

| Costa Rica | 30 | 480 |

| Sweden | 590 | 390 |

| Egypt | 90 | 390 |

| Bangladesh | 110 | 390 |

| Algeria | 90 | 390 |

| Uganda | 50 | 390 |

| Venezuela | 30 | 390 |

| Ethiopia | 40 | 390 |

| Botswana | 30 | 390 |

| Switzerland | 210 | 320 |

| Austria | 390 | 320 |

| Sri Lanka | 70 | 320 |

| Panama | 50 | 320 |

| Cambodia | 50 | 320 |

| Ireland | 390 | 260 |

| Ghana | 70 | 260 |

| Saudi Arabia | 90 | 260 |

| Jordan | 30 | 260 |

| Greece | 140 | 210 |

| New Zealand | 1,900 | 170 |

| Uzbekistan | 30 | 140 |

| Mauritius | 20 | 110 |

2024 Monthly Searches For Each Brand

Pepperstone - Australia

Pepperstone - Australia

|

8,100

1st

|

CMC Markets - Australia

CMC Markets - Australia

|

49,500

2nd

|

Pepperstone - UK

Pepperstone - UK

|

5,400

3rd

|

CMC Markets - UK

CMC Markets - UK

|

9,900

4th

|

Pepperstone - US

Pepperstone - US

|

4,400

5th

|

CMC Markets - US

CMC Markets - US

|

4,400

6th

|

Pepperstone - Germany

Pepperstone - Germany

|

3,600

7th

|

CMC Markets - Germany

CMC Markets - Germany

|

3,600

8th

|

Similarweb shows a different story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 1,747,000 for CMC Markets.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – A Tie

Traders engaged in forex must prioritize portfolio diversification and seize market opportunities. Access to a wide array of financial instruments is vital for success in this dynamic landscape. Both CMC Markets and Pepperstone offer extensive CFD markets, allowing traders to capitalize on various market conditions. From forex pairs and commodities to indices and cryptocurrencies, a diverse product range enhances trading flexibility and supports multiple strategies. In this review, we compare how these two brokers stack up in offering traders the variety and depth needed to maximize their trading potential.

Pepperstone and CMC both offer CFDs other than Forex pairs. With Pepperstone, clients can trade over 150+ financial instruments, while CMC Markets offers a staggering 9,500 products to choose from.

Pepperstone CFDs

- Commodity CFDs: products range from energy commodities to precious metals to products such as coffee and cotton.

- Index CFDs: commission-free trading on 14 different major stock exchanges with No Dealing Desk execution.

- Share CFDs (MT5 only): low commissions on popular US shares such as Tesla and Apple.

- Currency Index CFDs: USDX currency basket that measures 6 major currencies against the United States Dollar.

- Cryptocurrency CFDs: No commission fees and tight spreads on Litecoin, Dash, Ethereum, Bitcoin and Bitcoin Cash.

CMC Markets CFDs

- Indices: 90+ different cash and forward Index CFD products to choose from.

- Commodities: 100+ cash and forward Commodity CFDs

- Share CFDs (Next Generation only): 9000+ Share CFDs from 23 different countries, including Australia.

- Treasuries: Over 51+ government debt products such as Gilts, T-bills, and T-bonds.

- Cryptocurrency: 10+ Crypto CFDs.

| CFDs | CMC Markets | Pepperstone |

|---|---|---|

| Forex Pairs | 338 | 93 |

| Indices | 82 | 26 |

| Commodities | 124 | 29 Commodities 4 Metals, 4 Energies, 16 Softs, 5 Hard |

| Cryptocurrencies | 19 | 27 |

| Share CFDs | 10000+ | 1,200+ |

| ETFs | 11265 | 108+ |

| Bonds | 55 | No |

| Futures | Yes | 42 |

| Treasuries | 55 | No |

| Investments | Yes | No |

For traders focused on forex markets, Pepperstone provides exceptional access to a wide range of currency pairs, making it an ideal choice for forex enthusiasts. On the other hand, CMC Markets stands out by providing access to thousands of financial instruments, making it an ideal choice for traders looking to engage with a wide variety of CFDs.

It’s crucial to understand that, owing to FCA regulations, traders with CMC Markets UK plc and Pepperstone UK cannot engage in cryptocurrency trading, as such derivatives are currently prohibited. This regulatory framework is designed to uphold stringent operational standards and safeguard customers, ensuring these brokers remain in line with the latest trends and insights in the forex trading industry.

Our Top Product Range and CFD Markets Verdict

Our team can surmise that Pepperstone truly excels in this niche on account of their top product range and CFD markets.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

8. Superior Educational Resources – CMC Markets

Education is a cornerstone of success in forex trading, equipping traders with the knowledge and skills needed to navigate volatile markets with confidence. CMC Markets and Pepperstone prioritize investment in their educational resources, providing an extensive array of webinars, articles, video tutorials, and structured courses. These valuable tools assist traders in honing their strategies, effectively managing risk, and staying ahead of market trends. A comprehensive educational platform not only supports newcomers but also empowers seasoned traders to consistently enhance their skills, promoting long-term growth and success in the dynamic world of forex.

Education is a cornerstone of successful trading, and both Pepperstone and CMC Markets understand its importance. From our observations and testing:

- Pepperstone:

- Offers a robust library of video tutorials.

- Provides regular webinars with industry experts.

- Features a dedicated section for beginner traders.

- CMC Markets:

- Features a wide range of e-books and reading materials.

- Conducts weekly workshops on various trading topics.

- Has a section dedicated to market analysis and research.

Both brokers are committed to providing traders with the resources they need to succeed. Whether you’re a novice looking to get started or an experienced trader seeking to refine your skills, both brokers offer a wealth of educational materials to cater to your needs.

Our Superior Educational Resources Verdict

Based on our team’s testing, CMC Markets ranks highest in this niche in light of their superior educational resources.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘70% of retail CFD accounts lose money’

9. Superior Customer Service – A Tie

When it comes to forex trading, superior customer service can make all the difference in a trader’s experience. A broker that provides timely and efficient support ensures traders can navigate market challenges with confidence. CMC Markets and Pepperstone provide excellent multilingual support via live chat, phone, and email, ensuring traders can swiftly address their concerns. With round-the-clock service and attentive support teams, these brokers emphasize client satisfaction, fostering trust and boosting overall trading efficiency. But which broker truly excels in delivering the premier customer service experience? Let’s delve into a comparison.

CMC Markets and Pepperstone both offer 24/5 customer support via phone, live chat, and email. Alternatively, both brokers provide extensive FAQ sections on their websites.

| Feature | CMC Markets | Pepperstone |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Although CMC Market’s customer support is excellent, Pepperstone is highly regarded for its award-winning services.

Our Superior Customer Service Verdict

Unquestionably, both Pepperstone and CMC Markets are in a competitive standoff, driven by their exceptional and superior customer service and support.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

10. Better Funding Options – A Tie

When it comes to forex trading, seamless funding options are essential for maintaining efficiency and flexibility. Traders require a broker that provides a variety of deposit and withdrawal methods, minimal transaction fees, and quick processing times. Both CMC Markets and Pepperstone offer diverse funding solutions, encompassing bank transfers, credit/debit cards, and digital wallets, allowing traders to manage their accounts with ease. An effective funding system significantly improves the overall trading experience, enabling traders to concentrate on seizing market opportunities instead of dealing with payment issues. In this review, we evaluate how these two brokers compare regarding funding options, fees, and transaction speed.

CMC Markets and Pepperstone offer a range of funding methods and base currencies. Although the majority of funding methods offered by both brokers are fee-free, Pepperstone charges AUD $20 for withdrawals made via bank wire, while CMC Markets charges a 1% fee on deposits made with a credit card and a 0.6% fee for debit card deposits.

Minimum Deposits

When funding an account for the first time, Pepperstone clients are required by the broker to make a minimum deposit of $200. This deposit is not enforced as part of the account creation process, so it might be you don’t end up making any deposit.

CMC Markets, on the other hand, requires no minimum initial deposit from customers. Like with all brokers, when trading with leverage, accounts will need to meet minimum margin requirements to start trading.

Deposit And Withdrawal Methods

- CMC Markets: Bank Transfer, Credit Card, Payoneer, PayPal and Wire Transfer

- Pepperstone: Bank Transfer, Visa, Mastercard, Union Pay, POLi, BPay, PayPal, Neteller and Skrill

Base Currencies

- CMC Markets: AUD, GBP, CAD, EUR, NZD, NOK, SGD, USD, SEK and PLN

- Pepperstone: USD, AUD, NZD, CAD, EUR, GBP, CHF, HKD, SGD and JPY

Inactivity Fees

- CMC Markets: AUD $12 if a trader is inactive for 12 months

- Pepperstone: No inactivity fee

| Funding Option | CMC Markets | Pepperstone |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | No | Yes |

| Neteller | No | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Both CMC Markets and Pepperstone demonstrate their commitment to flexibility and convenience by allowing clients to set up accounts in a variety of base currencies. They provide an array of funding options such as e-wallets, credit cards, and bank transfers, allowing traders to select the most suitable method for their needs. Additionally, both brokers impose no fees on most deposit and withdrawal methods, aligning with the current trends in the forex industry that emphasize cost-effectiveness and user convenience. This dedication to catering to various financial preferences positions both CMC Markets and Pepperstone as appealing options for contemporary traders seeking smooth and efficient trading experiences.

Our Better Funding Options Verdict

Again, it’s a stalemate for Pepperstone and CMC Markets this is due to their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

When it comes to forex trading, a lower minimum deposit can be a game-changer, making the market accessible to traders of all experience levels. Brokers lower the entry barrier by allowing smaller capital investments, encouraging broader participation. This is beneficial for beginners seeking experience without significant upfront costs. An ideal broker offers a low minimum deposit and a strong trading environment, helping traders develop skills while managing risk.

When it comes to starting your trading journey, the initial deposit can be a significant factor. Pepperstone and CMC Markets have revolutionized trading accessibility by introducing a $0 minimum deposit requirement. This strategy reflects the current trends in the forex industry, where brokers are actively reducing entry barriers to engage new traders. For many, particularly those who are cautiously exploring the trading landscape, this removes the concern of committing substantial funds upfront. By abolishing the minimum deposit, both brokers create an inclusive environment that encourages a wider audience to seize the opportunities available in forex trading.

The table below provides a clear comparison of the minimum deposit amounts for both brokers:

| Minimum Deposit | Recommended Deposit | |

| CMC Markets | $0 | $100 |

| Pepperstone | $0 | $200 |

Having a low minimum deposit is beneficial as it allows traders to test the waters without a significant financial commitment. It’s also a testament to the broker’s commitment to making trading accessible to everyone, regardless of their financial situation.

Our Lower Minimum Deposit Verdict

Pepperstone and CMC Markets, undisputably, are neck to neck in this portion, in light of their lower minimum deposit.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

Is CMC Markets or Pepperstone The Best Broker?

Pepperstone steals the thron in this section due to their competitive and comprehensive offering, superior trading experience, and excellent customer service. The table below summarises the key information leading to this verdict:

| Categories | CMC Markets | Pepperstone |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | Yes |

| Better Funding Options | Yes | Yes |

| Lower Minimum Deposit | Yes | Yes |

CMC Markets: Best For Beginner Traders

For those just starting out, CMC Markets offers a more beginner-friendly environment with its extensive educational resources.

Pepperstone: Best For Experienced Traders

For seasoned traders, Pepperstone stands out with its advanced trading platforms and superior execution speeds.

FAQs Comparing CMC Markets Vs Pepperstone

Does Pepperstone or CMC Markets Have Lower Costs?

Pepperstone generally offers lower costs compared to CMC Markets. While both brokers have competitive spreads, Pepperstone’s ECN-style pricing often results in tighter spreads. For instance, the average EUR/USD spread with Pepperstone is around 0.13 pips. For a more detailed comparison of broker spreads, you can check out this guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Pepperstone and CMC Markets offer MetaTrader 4, but Pepperstone is often preferred due to its advanced tools and faster execution speeds. Their MT4 platform is equipped with features tailored for professional traders. If you’re keen on exploring more about MT4 brokers, this list of the best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

Pepperstone offers social trading features, allowing traders to follow and copy the trades of professionals. This feature is beneficial for those who might not have the time or expertise to analyze the markets themselves. If you’re interested in exploring more about social trading, you can dive into this comprehensive guide on the best copy trading platforms.

Does Either Broker Offer Spread Betting?

CMC Markets offers spread betting, a popular form of derivative trading in the UK. Spread betting allows traders to speculate on the price movement of financial instruments without owning the underlying asset. For those keen on exploring spread betting brokers, here’s a list of the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out for Australian forex traders. Not only is it ASIC regulated, but it’s also an Australian-founded broker, ensuring a deep understanding of the local market dynamics. Both brokers offer a range of trading instruments, but Pepperstone’s local roots give it an edge. For a more detailed comparison, you can check out this guide on the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally believe CMC Markets has the edge. Being FCA regulated and having a strong presence in the UK, they offer a level of trust and reliability. While both brokers provide excellent platforms and trading conditions, CMC Markets’ deep roots in the UK market make it a preferred choice. For more insights, you might want to explore this list of the Best Forex Brokers In UK.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert