Eightcap vs GO Markets 2026

Eightcap vs. GO Markets has key aspects such as spreads, trading platforms, and account types. both provide 0 pip spreads and over 50 forex pairs, with Eightcap excelling in TradingView integration and GO Markets offering strong MT4 support. Having competitive features, these two brokers are evenly matched in this review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Eightcap Markets and GO Markets:

- Go Markets has lower commission costs.

- EightCap, which was founded in 2009.

- Both EightCap and GO Markets standard accounts start from 1.0 pip, but their spread structures differ.

1. Lowest Spreads And Fees – A Tie

In this portion, we will review both GO Markets and Eightcap’s lowest spreads and fees. GO Markets and Eightcap are prominent forex brokers offering competitive trading platforms for beginners and professionals. In this comparison we probe into their key features, such as spreads, commissions, and account fees, to help our dear traders, especially those dealing in AUD, GBP, EUR, and USD, through our review, decide which broker suits your trading style.

Spreads

Spreads play an essential role in forex trading costs. GO Markets offers competitive RAW spreads for AUD/USD at 0.2, while Eightcap offers 0.27. Similarly, for GBP/USD, Eightcap’s RAW spread is 0.23, compared to GO Markets’ 0.2. Both brokers provide a standard spread of 1.0 for EUR/USD. These options allow traders to choose spreads that align with their strategies and trading style.

| RAW Account | Eightcap Spreads | Go Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.42 | 0.42 | 0.75 |

| EUR/USD | 0.06 | 0.1 | 0.22 |

| USD/JPY | 0.23 | 0.3 | 0.38 |

| GBP/USD | 0.23 | 0.2 | 0.53 |

| AUD/USD | 0.27 | 0.2 | 0.47 |

| USD/CAD | 0.2 | 0.5 | 0.56 |

| EUR/GBP | 0.30 | 0.30 | 0.55 |

| EUR/JPY | 0.59 | 1 | 0.80 |

| AUD/JPY | 0.49 | 0.6 | 0.96 |

| USD/SGD | 1.37 | 0.6 | 2.29 |

Commission Levels

Commission levels can significantly impact trading costs. GO Markets offers a lower commission fee of #2.50 per lot for USD-based accounts, compared to Eightcap’s $3.50. For AUD-based accounts, GO Markets charges $3.00, while Eightcap charges $3.50. These lower commissions are particularly advantageous for high-frequency traders dealing with AUD, GBP, EUR, and USD pairs.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Eightcap | $3.50 | $3.50 | £2.25 | €2.75 |

| Go Markets | $2.50 | $3.00 | £2.00 | €2.00 |

Standard Account Fees

Standard accounts are commission-free but come with wider spreads. For AUD/USD, GO Markets maintains an average standard spread of 1.0, while Eightcap’s is 1.2. GBP/USD spreads are slightly wider, with Eightcap at 1.2 and GO Markets at 1.3. The standard account structures cater to traders who prefer simplified cost models.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.20 | 1.00 | 1.00 | 1.10 |

| 1.00 | 1.00 | 1.20 | 1.30 | 1.00 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

GO Markets and Eightcap provide distinct advantages to forex traders. GO Markets stands out with its lower commissions and competitive spreads, while Eightcap offers a wider array of funding methods and instruments. By choosing a broker aligned with their trading preferences and goals, traders can optimise their forex experience for AUD, GBP, EUR, and USD trading.

The standard account for each broker has no commission costs. This is because standard accounts artificially widen the spreads to cover their costs.

Our Lowest Spreads and Fees Verdict

Both brokers here are neck to neck due to their lowest spreads and fees.

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

2. Better Trading Platform – A Tie

Next, we will discuss both brokers’ better trading platforms. GO Markets and Eightcap are well-known forex brokers in the industry providing traders with their advanced tools and competitive features. This analysis focuses on their MetaTrader Platforms, advanced functionalities, and copy trading features, this offers valuable insights for those trading major currency pairs like AUD, GBP, EUR, and USD. Here’s how they stack up under these segments.

| Trading Platform | Eightcap | GO Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | Yes |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

MetaTrader is an essential platform for forex traders in the industry, this offers robust tools and flexibility. Both GO Markets and Eightcap provide access to MetaTrader 4 or MT4, and MetaTrader 5 or MT5. GO Markets edges ahead by offering additional tools like MT4 Genesis and AutoChartist, which enhance market analysis and automated trading forex pairs like AUD/US, GBP/USD, and USD/EUR.

Advanced Platforms

GO Markets shines in its range of advanced trading tools, integrating features like a-Quant for AI-based trading signals and MyfxBook for social trading. Eightcap stands out for its crypto trading, which provides access to over 250 cryptocurrencies. These enhancements cater for traders interested in diverse instruments alongside forex currency pairs like USD, GBP, EUR, and AUD.

Go Markets has the edge over Eightcap because they provide extra tools to help when trading. These include:

- a-Quant which uses artificial intelligence to produce trading signals for you to

- AutoChartist, which scans the market to produce technical analysis for you

- MyfxBook for Social Trading

- MT4 Genesis, which is a suit of expert advisors such as Indicators and other trading tools

- Trading Central with analysis tools such as market buzz for trading sentiment

Eightcap also has a few tools but doesn’t match Go Markets’ offering. These include:

- Capitalise.ai to create an algorithm with no coding knowledge

- FX Blue, which is similar to MT4 Genesis

Copy Trading

Copy trading simplifies forex trading for beginners and time-strapped investors. Both brokers support copy trading via platforms like TradingView. GO Markets enriches this experience with Trading Central, offering sentiment analysis and insights, Eightcap features tools like CApitalise.ai, which allows a no-code algorithm for automated trading strategies on AUD, GBP, EUR, and USD pairs.

Based on our team’s expert opinion, GO Markets and Eightcap cater to diverse trader needs with distinct strengths, GO Markets excels in advanced analytics and tools, and Eightcap dominates crypto trading. So, we can surmise that choosing the right broker ultimately depends on your trading priorities, this ensures an enhanced experience for forex traders focused on AUD, GBP, EUR, and USD markets.

EightCap Is Our 2026 Winner For Best Cryptocurrency Broker

The cryptocurrency offerings provided by EightCap are incomparable to other brokers, with over 250 crypto options and tight spreads. These options include 120 coins paired against the USD and 5 cryptocurrency indices.

Retail traders in Australia have access to 2:1 leverage. However, if you are a professional trader or are located outside of Australia, EightCap allows you to trade crypto with 5:1 leverage.

EightCap even allows you to deposit funds via cryptocurrency, although this is not available for Australian traders, who can only deposit using Bitcoin, TRC20, and ERC20.

Other products you can trade with Eightcap include 40 forex pairs, Gold, Silver, Oil, and 10 indices,

Both MetaTrader 5 Brokers Are Excellent, But EightCap Wins

MetaTrader 5 (MT5) is a more powerful platform than MT4 and provides access to even more technical indicators and analysis tools.

Unlike its predecessor, MetaTrader 5 (MT5) provides access to both centralised and decentralised markets. This means that products previously unavailable on MT4 such as some shares and cryptocurrencies are now available for you to trade.

It is complemented by EightCap, which stands out for its cryptocurrency offering compared to other brokers. In addition to cryptocurrencies, Eightcap has a good range of CFD shares in the US Markets.

Go Markets Share Trading

In addition to 50+ forex pairs, 80+ US shares, 14+ indices, Gold, Silver, Copper, Oils, and 10 Cryptos, Go Markets also offers Share Trading to Australian clients.

With a flat fee commission of $7.70, traders can purchase over 2500 shares on the ASX.

Traders will need to use the GO Markets trading platform to purchase shares.

Our Better Trading Platform Verdict

In this segment, it is a draw for both Eightcap and GO Markets this is due to their better trading platform.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘73% of retail CFD accounts lose money’

3. Superior Accounts And Features – GO Markets

Eightcap and GO Markets are two leading forex brokers in the market, who empower traders with competitive spreads, diverse trading platforms, and advanced features. Our analysis highlights their account offerings, commission structures, and regulatory standards, providing valuable insights for traders focusing on major currency pairs like AUD, GBP, EUR, and USD.

Eightcap and GO Markets cater to different trading needs with unique strengths, Eightcap impresses with its lower RAW spreads for EUR/USD and popularity among traders, while GO Markets stands out with more affordable commission costs and additional European regulatory oversight through CySEC. Eightcap and GO Markets offer standard and RAW accounts with access to pairs, yet they lack swap-free account options for their Islamic traders. The brokers’ versatile trading platforms include MetaTrader 4 and 5, which enhance user experience, with GO Markets providing added tools like MT4 Genesis for a deeper and more reliable market analysis. Their strong and reliable offerings cater to a spectrum of traders in the forex market.

As per our research, while Eightcap appeals with its competitive RAW spreads and growing popularity, GO markets excel with lower commissions and extended regulations. Both brokers deliver strong platforms and features, which help traders achieve better trading experiences and informed decisions in global forex markets, most especially when trading AUD, GBP, EUR, and USD pairs.

| Eightcap | GO Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | No |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

Go Markets ranks high in this segment due to their superior accounts and features.

Our Lowest Spreads and Fees Verdict

Both brokers here are neck to neck due to their lowest spreads and fees.

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Eightcap

We will scrutinise both brokers’ best trading experience and ease. Eightcap and GO Markets are highly reputable forex brokers, offering advanced trading platforms and innovative features. Both brokers cater to traders globally with their focus on usability, tools, and trading efficiency especially those trading key currency pairs like AUD, GBP, EUR, and USD. This review will explore more of their strengths in platforms, tools, and trading experience.

Eightcap and GO Markets share strong and resilient MetaTraders’ 4 and 5 offerings, this ensures a seamless trading experience for both beginners and seasoned. GO Markets, on the other hand, excels in enhancing usability with tools like a-Quant, AutoChartist, and MT4 Genesis. Meanwhile, Eightcap stands out with their cryptocurrency trading, they provide over 250 crypto enthusiasts. Both brokers prioritise speed, with Eightcap achieving marginally better order execution times. GO Markets’ lower commission costs, add a competitive edge, while Eightcap’s intuitive features like Capitalise.ai further distinguish its platform.

Eightcap and GO Markets provide exceptional trading environments, combining advanced platforms with cutting-edge tools. GO Markets excels in value-driven features for traditional forex traders, while Eightcap dominates the cryptocurrency segment. Both brokers are compelling choices, this offers traders reliable and high-performing solutions for AUD, GBP, EUR, and USD currency pairs.

Here are some of the standout features based on our testing:

- Platform Offerings: EightCap and Go Markets offer MetaTrader 4 and 5, which are among the most popular forex trading platforms globally.

- Ease of Use: The platforms are user-friendly, with intuitive interfaces that cater to beginners and seasoned traders.

- Tools & Add-ons: Go Markets provides extra tools like a-Quant, AutoChartist, and MT4 Genesis, enhancing the trading experience. On the other hand, EightCap stands out with its offerings like Capitalise.ai and FX Blue.

- Cryptocurrency Trading: EightCap shines in the cryptocurrency domain, offering over 250 crypto options, making it a preferred choice for crypto enthusiasts.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Eightcap | 143ms | 19/36 | 139ms | 17/36 |

| Go Markets | 144ms | 20/36 | 145ms | 20/36 |

Our Best Trading Experience and Ease Verdict

Clearly, EightCap steals the show due to their bets trading experience and ease.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘73% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

Eightcap and GO Markets are well-known for their forex brokers offering tailored services to enhance trading experiences. We see that Eightcap excels in popularity and cryptocurrency offerings, while GO Markets stands out with its strong regulations and broader regional oversight. This review examines their important features, which aid traders in navigating global forex markets, particularly AUD, GBP, EUR, and USD pairs.

Eightcap Trust Score

GO Markets Trust Score

Based on their trust scores, Eightcap has a better score compared to GO Markets. But this does not stop here. Let us go deeper with their other features and platforms.

Regulations

Founded in 2006, GO Markets has established itself as one of the oldest online brokers, while Eightcap, which was founded in 2009, has rapidly gained popularity, and has recorded significantly more visitors in recent years. Both brokers provide resilient and strong platforms, with their regulatory safeguards, and risk management features. GO Markets is regulated by CySEC and ASIC, this ensures strong trader protection in the EU and Australia, while Eightcap primarily relies on ASIC regulations. It is clear that Eightcap shines with their extensive cryptocurrency offerings, this attracts crypto enthusiasts worldwide. However, neither broker offers swap-free accounts, which limits options for Islamic traders. Their shared commitment to efficiency and accessibility makes these two brokers reliable in forex trading

While Go Markets only recorded 69.4 thousand visits to their home page, EightCap recorded 426.8 thousand. This can be partially attributed to EightCap’s great cryptocurrency offerings, with ‘crypto’ being the second top keyword driving traffic to EightCap.

| Eightcap | GO Markets | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | SCB (Bahamas) | FSA-S (Seychelles) FSC-M (Mauritius) |

Reviews

Eightcap has a Trustpilot score of 4.2 out of 5 from over 3,100 reviews. GO Markets scores 4.7 out of 5, based on about 680 reviews. While both brokers are well-regarded, GO Markets appears to deliver a more consistently smooth experience according to Trustpilot reviews.

Our Stronger Trust and Regulation Verdict

Obviously, it is a draw for both brokers here. This is due to their stronger trust and regulations.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘73% of retail CFD accounts lose money’

6. Most Popular Broker – Eightcap

Eightcap gets searched on Google more than Go Markets. On average, Eightcap sees around 40,500 branded searches each month, while Go Markets gets about 4,000 — that’s 90% fewer.

| Country | Eightcap | Go Markets |

|---|---|---|

| Thailand | 9,900 | 590 |

| Australia | 2,400 | 1,600 |

| Canada | 2,400 | 720 |

| United States | 1,900 | 9,900 |

| United Kingdom | 1,600 | 590 |

| India | 1,300 | 720 |

| Germany | 1,000 | 170 |

| Brazil | 1,000 | 170 |

| Malaysia | 880 | 720 |

| Spain | 720 | 170 |

| France | 720 | 210 |

| Colombia | 720 | 110 |

| Italy | 590 | 170 |

| Indonesia | 590 | 1,900 |

| Argentina | 590 | 210 |

| South Africa | 480 | 260 |

| Netherlands | 480 | 70 |

| Singapore | 390 | 170 |

| Nigeria | 390 | 90 |

| Pakistan | 320 | 260 |

| Sweden | 320 | 20 |

| Mexico | 320 | 27,100 |

| Dominican Republic | 320 | 590 |

| Poland | 260 | 590 |

| Morocco | 210 | 30 |

| United Arab Emirates | 210 | 70 |

| Philippines | 210 | 480 |

| Portugal | 210 | 30 |

| New Zealand | 210 | 50 |

| Kenya | 170 | 20 |

| Switzerland | 170 | 30 |

| Vietnam | 170 | 5,400 |

| Hong Kong | 170 | 140 |

| Bangladesh | 140 | 30 |

| Taiwan | 140 | 170 |

| Austria | 140 | 20 |

| Japan | 140 | 170 |

| Peru | 140 | 90 |

| Chile | 140 | 210 |

| Turkey | 110 | 320 |

| Algeria | 110 | 50 |

| Venezuela | 110 | 30 |

| Ireland | 110 | 40 |

| Ecuador | 110 | 90 |

| Greece | 90 | 70 |

| Cyprus | 90 | 50 |

| Egypt | 90 | 320 |

| Cambodia | 90 | 30 |

| Uzbekistan | 90 | 40 |

| Saudi Arabia | 70 | 40 |

| Ghana | 70 | 10 |

| Uganda | 70 | 10 |

| Mongolia | 70 | 50 |

| Sri Lanka | 50 | 50 |

| Ethiopia | 30 | 10 |

| Tanzania | 30 | 20 |

| Jordan | 30 | 10 |

| Botswana | 30 | 10 |

| Bolivia | 30 | 30 |

| Costa Rica | 30 | 90 |

| Mauritius | 20 | 20 |

| Panama | 20 | 30 |

9,900 1st | |

590 2nd | |

2,400 3rd | |

1,600 4th | |

2,400 5th | |

720 6th | |

1,600 7th | |

590 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Eightcap receiving 259,000 visits vs. 50,000 for Go Markets.

Our Most Popular Broker Verdict

Eightcap is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘73% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – GO Markets

Eightcap and GO Markets are two leading forex brokers who are known for their diverse offerings in both CFDs and forex instruments. They both come with products which range from forex pairs to share CFDs and cryptocurrencies, they also provide traders with their extensive opportunities for growth and diversification. In this review, we will analyse further into their key features and competitive advantages.

Eightcap stands out with its 95 cryptocurrency CFDs and 56 forex pairs, which cater to traders looking for broader crypto exposure and forex options. Alternatively, GO Markets displays a strong and resilient 1,190+ share CFDs and wider and extensive commodities coverage, which appeals to those trading traditional markets. While both brokers offer 16 indices but lack ETFs or futures, GO Markets offers added bonds and treasuries for diversification. Notably, both brokers provide MetaTraders 4 and 5 platforms, this ensures top-tier trading tools. However, traders must first evaluate which brokers align with their asset preferences and trading goals.

When it comes to the range of products and CFD markets, both Eightcap and Go Markets have a diverse offering. Here’s a comparison based on our findings:

| CFDs | Eightcap | Go Markets |

|---|---|---|

| Forex Pairs | 56 | 47 |

| Indices | 16 | 16 |

| Commodities | 8 Commodities Softs and Metals | 3 Metals 5 Energies 2 Softs |

| Cryptocurrencies | 95 Crypto | 14 |

| Share CFDs | 586 | 1190+ |

| ETFs | No | No |

| Bonds | No | 5 |

| Futures | No | No |

| Treasuries | No | 5 |

| Investments | No | No |

As per our team’s research, Eightcap excels in cryptocurrency and forex variety, while GO Markets leads in share CFDs and commodities. Both Eightcap and GO Markets offer versatile platforms and extensive tools, which enhance the trading experience for diverse trader profiles. Both brokers’ offerings make them integral players in the forex and CFD industry, which appeals to global traders.

Our Top Product Range and CFD Markets Verdict

Go Markets takes the cake in this segment by reason of their top product range and CFD markets.

Our Lowest Spreads and Fees Verdict

Both brokers here are neck to neck due to their lowest spreads and fees.

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

8. Superior Educational Resources – Eightcap

Here, we will examine both brokers’ superior educational resources. Both Eightcap and GO Markets are prominent forex brokers famous for empowering traders through extensive educational resources and expert tools. By offering structured learning pathways, market insights, and tailored content, they contribute significantly to skill development and informed trading, which caters to both beginners and experienced traders across global forex markets.

Eightcap stands out with its comprehensive educational offerings, which include webinars, a learning center, and structured pathways for beginners. This ensures continuous learning by providing updated tools and expert market analysis. GO Markets complements this by offering a variety of resources from e-books to specialised workshops, tailored for all trader levels. The broker’s collaborative efforts with trading experts enrich the trading experience. With their diverse strategies and a focus on keeping traders informed, both brokers contribute immensely to market understanding and skill enhancement for AUD, GBP, EUR, and USD currency pairs.

Eightcap:

- Offers a comprehensive range of educational resources.

- Provides in-depth webinars and seminars for traders.

- Features a dedicated learning center with articles and tutorials.

- Supports beginner traders with a structured educational pathway.

- Gives access to expert market analysis and insights.

- Ensures continuous learning with updated resources and tools.

Go Markets:

- Prioritizes education with a variety of learning materials.

- Conducts regular training sessions and workshops for clients.

- Boasts a rich library of e-books, videos, and articles.

- Tailors educational content to cater to both novices and professionals.

- Collaborates with trading experts for specialized content.

- Encourages traders to stay informed with regular market updates.

Our team’s final analysis on this topic is that both Eightcap and GO Markets excel in trader education and skill development, making them vital players in the forex industry. Their commitment to comprehensive resources and specialisied content foster better trading outcomes, which reinforces their appeal to traders who are looking to navigate the complexities of global forex markets effectively.

Our Superior Educational Resources Verdict

Evidently, Eightcap ranks highest in this segment by reason of their superior educational resources.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘73% of retail CFD accounts lose money’

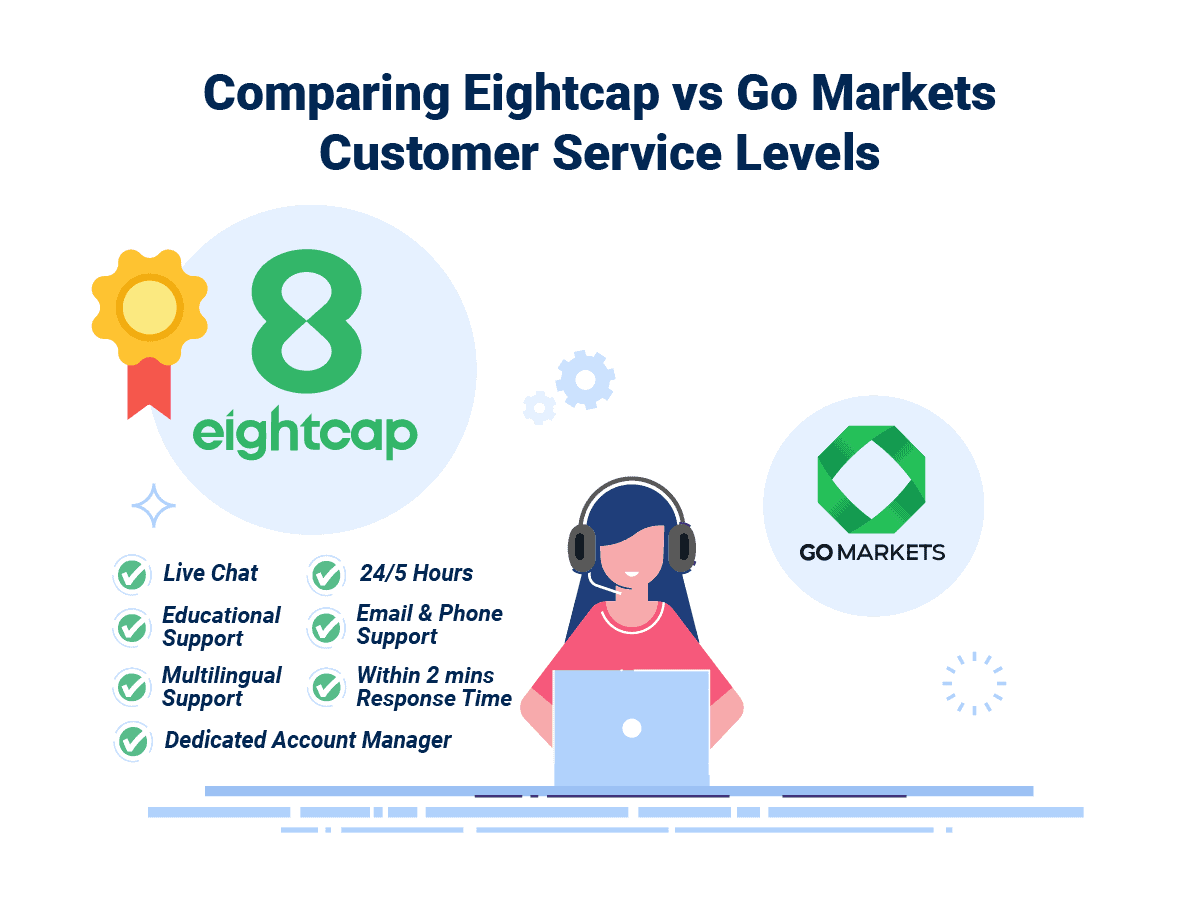

9. Superior Customer Service – Eightcap

Eightcap and GO Markets are leading forex brokers who are prioritising exceptional customer service to enhance the trading experience. With features like live chat, email, and multilingual support, they offer timely assistance. In this review, we will explore both brokers commitment to effective and empathetic support which ensures a seamless trading journey for AUD, GBP, EUR and US traders.

Both brokers excel in customer service, this ensures accessibility through live chat, email, and phone support. Eightcap offers round-the-clock assistance, while GO Markets operates 24/5, catering effectively to different trader needs. Multilingual support underscores their global presence. These features highlight their commitment to resolving trader issues with speed and professionalism. While GO Markets emphasises targeted service within specific hours, Eightcap’s 24/7 availability makes it particularly appealing to traders needing constant access to assistance. Together, their investments in support systems underscore their dedication to fostering trust and satisfaction in the forex community.

From our extensive testing and the data gathered, here’s a comparison of the key customer service features that each broker offers:

| Feature | Eightcap | Go Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Based on our team’s expertise, they surmises that Eightcap’s 24/7 support and GO Markets’ tailored service hours underline their unique approaches to trader assistance. Both brokers succeed in blending accessibility, efficiency, and empathy, which solidifies their positions as reliable partners for AUD, GBP, EUR and USD forex traders, while strengthening their standing in the competitive forex industry.

Our Superior Customer Service Verdict

In this case, Eightcap rides high in this category thanks to their superior customer services.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘73% of retail CFD accounts lose money’

10. Better Funding Options – GO Markets

Eightcap and GO Markets are forex brokers that stand out for their diverse funding options, that offer traders flexibility and convenience. By accommodating various methods, such as credit dares, e-wallets, and crypto, they also cater to modern financial needs while ensuring secure and seamless transactions for a global trading audience.

In conjecture, both Eightcap and GO Markets provide a vast array of funding options that include credit cards, debit cards, bank transfers, Skrill and Neteller, as well as crypto, this means meeting traders’ preferences for traditional and modern methods. Both brokers excel in creating flexibility; however, neither supports PayPal or Rapic Pay. Eightcap’s crypto funding option gives it a slight edge for traders who are inclined toward digital currencies. Additionally, POLi/bPay availability emphasises their commitment to offering localised funding solutions. The brokers’ efficient and accessible funding systems enhance the overall trading experience, which ensures traders can focus on global markets, particularly for currencies like AUD, GBP, EUR, and USD.

Our teams assessment suggests t hat Eightcap and GO Markets deliver diverse and flexible funding solutions, empowering traders to manage their accounts effectively. Their shared commitment to convenience and security solidifies their positions as reliable brokers, which makes them attractive choices for forex traders who are navigating AUD, GBP, EUR and USD markets.

In our extensive testing, we analysed the funding options provided by both brokers. The table below showcases the available funding methods for each broker, with ticks indicating the availability and crosses denoting the absence of that particular method.

| Funding Option | Eightcap | Go Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

Seemingly, it’s GO Markets who tops the charts in this portion, this is due to their better funding options.

Our Lowest Spreads and Fees Verdict

Both brokers here are neck to neck due to their lowest spreads and fees.

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

Eightcap and GO Markets are known brokers in the industry of forex trading. Both offer flexible funding options to meet the needs of diverse traders. From Low minimum deposit requirements to fee-free transactions, their features enable smooth account management and accessibility for traders who are navigating AUD, GBP, EUR and USD markets.

In this section, we will show traders that Eightcap impresses with their international minimum deposit of $100, which makes it an accessible choice for a wide range of traders. In Australia, deposits are slightly higher at $250 for RAW spread accounts and $500 for their standard accounts. GO Markets standardises its deposit requirements at $200 globally, this offers flexibility for Australian and international clients, with their varying rates in Europe. Bot brokers support diverse methods, such as credit cards, bank transfers, Skrill, and Neteller, this enhances convenience for traders. The absence of deposit and withdrawal fees highlights their trader-centric approach, though additional provider fees may apply, most especially for international transfers.

| Minimum Deposit | Recommended Deposit | |

| Eightcap | $100 | $100 |

| Go Markets | $200 | $200 |

Our findings indicate that Eightcap’s low minimum deposits and GO Markets’ standardised global requirements cater to various trader needs. Their shared commitment to accessible funding and fee-free transactions reinforces their status as reliable brokers, they also empower traders to focus on opportunities in key markets like AUD, GBP, EUR, and USD.

Our Lower Minimum Deposit Verdict

Distinctly, it’s a deadlock for both Eightcap and GO Markets owing it to both of their lower minimum deposit.

View Eightcap ReviewVisit Eightcap

*Your capital is at risk ‘73% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: GO Markets or Eightcap?

It’s a tie! Both Eightcap and GO Markets excel in different areas, making them equally commendable choices for traders. The table below summarises the key information leading to this verdict:

| Categories | Eightcap | Go Markets |

|---|---|---|

| Lowest Spreads And Fees | Yes | Yes |

| Better Trading Platform | Yes | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | Yes | Yes |

Eightcap: Best For Beginner Traders

Eightcap is the preferred choice for beginner traders due to its comprehensive educational resources and user-friendly platform.

GO Markets: Best For Experienced Traders

GO Markets stands out for experienced traders, offering a wider product range and more advanced account features.

FAQs Comparing Eightcap Vs GO Markets

Does GO Markets or Eightcap Have Lower Costs?

GO Markets generally offers lower costs than Eightcap. The broker boasts competitive spreads, especially on major currency pairs. For instance, the average spread for the EUR/USD pair is notably lower with GO Markets. Traders looking for cost-effective trading options might find GO Markets more appealing. For a more detailed comparison on low commissions, you can check out this comprehensive Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and GO Markets are excellent choices for MetaTrader 4. They offer seamless integration with the platform, ensuring a smooth trading experience. MT4 is renowned for its advanced charting tools, and both brokers have optimised their services to leverage its features. If you’re keen on diving deeper into MT4 offerings, this list of best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

Eightcap is the broker that offers social trading options. Social trading allows traders to follow and copy the trades of professional traders, making it easier for beginners to get started. Copy trading, in particular, has gained immense popularity due to its user-friendly approach. For those interested in exploring more about social trading platforms, here’s a detailed review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Eightcap nor GO Markets offer spread betting. Spread betting is a popular trading method in the UK, allowing traders to bet on the direction of a financial market without owning the underlying asset. For those interested in exploring brokers that provide spread betting, this comprehensive guide on the best spread betting brokers might be of interest.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap is the superior choice for Australian forex traders. Both Eightcap and GO Markets are ASIC regulated, ensuring a high level of trust and security for traders. However, Eightcap stands out due to its local presence, being founded in Australia, while GO Markets, although popular, originates overseas. For those keen on understanding the Australian forex landscape better, this detailed review of the Forex Brokers In Australia provides valuable insights.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe GO Markets has a slight edge. Both brokers are FCA regulated, ensuring they adhere to stringent regulatory standards. However, GO Markets offers a more tailored experience for UK traders, with localised services and support. While Eightcap is a strong contender, GO Markets’ offerings align more closely with the needs of UK traders. For a deeper dive into the UK forex scene, here’s a comprehensive list of the Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does TradingView support Eightcap?

Yes, you can trade on TradingView with Eightcap for all regions except in Europe where only MT5 is available. If you are in the UK, Eightcap is the only broker to exclusively offer TradingView and no other trading platform.