Go Markets vs Pepperstone: Whis One Is Best?

We review and compare GO Markets vs Pepperstone for 2024, using what we consider to be the key features when selecting a broker to help you choose.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

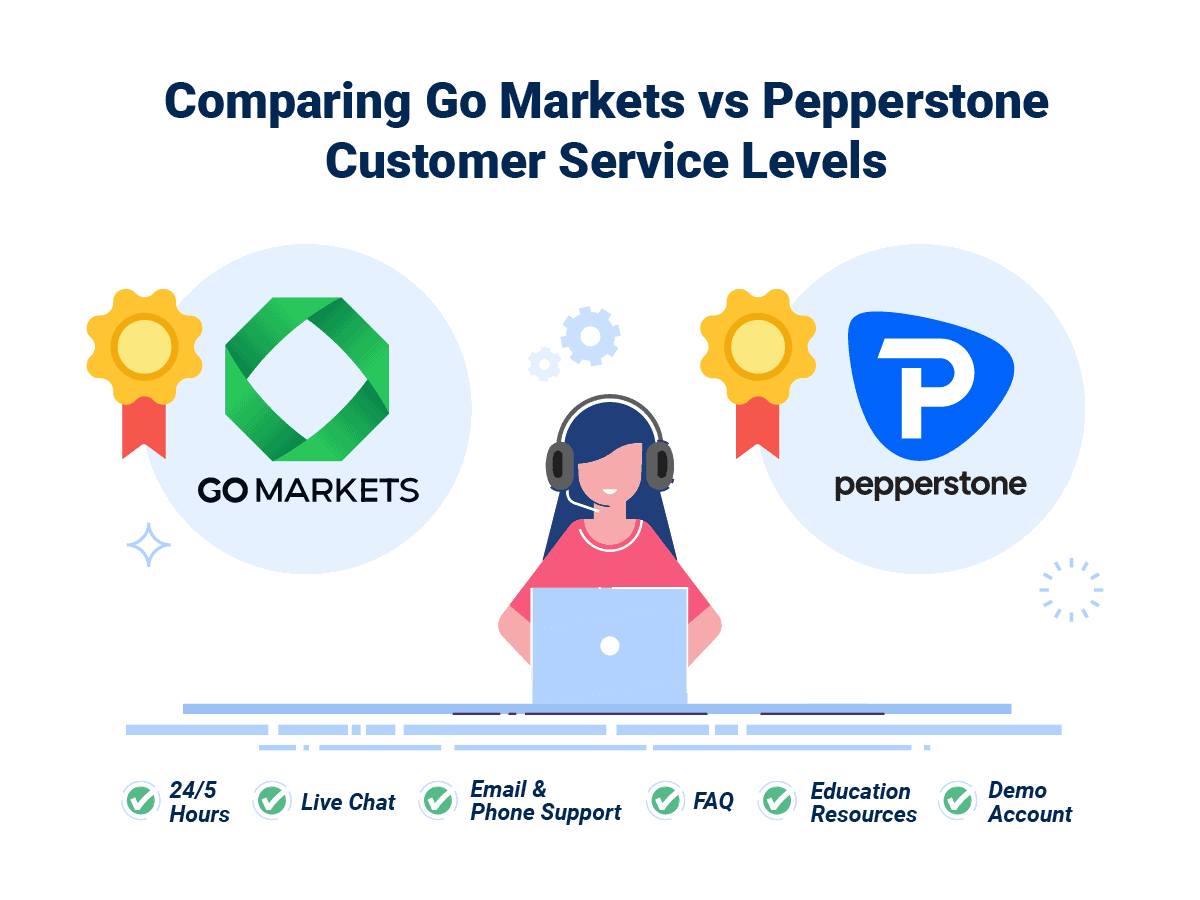

erstone active trader program; however, general customer support is available 24/5. Investors can contact Pepperstone via live chat, phone or email. Toll-free calls are available in Australia and the UK, while a local number is available in Thailand.

erstone active trader program; however, general customer support is available 24/5. Investors can contact Pepperstone via live chat, phone or email. Toll-free calls are available in Australia and the UK, while a local number is available in Thailand. work”, “Basic Terminology”, “Fundamental Analysis”, and “Technical Analysis”, so you can read and learn about different aspects of forex.

work”, “Basic Terminology”, “Fundamental Analysis”, and “Technical Analysis”, so you can read and learn about different aspects of forex.

Ask an Expert