Eightcap vs Plus500: Which Broker is Better?

We compare two prominent online trading platforms, Eightcap and Plus500, focusing on their key differences to help traders make an informed decision. See our Eightcap vs Plus500 review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors. Eightcap offers MetaTrader 4 and 5 platforms, while Plus500 uses a proprietary platform. Plus500 provides a wider range of CFD instruments compared to Eightcap.

Eightcap has more competitive spreads and lower fees than Plus500. Plus500 offers a guaranteed stop loss, which is not available with Eightcap. Eightcap provides more educational resources and tools than Plus500.

1. Eightcap: Lowest Spreads And Fees

Eightcap offers both commission and commission-free account types with lower spreads than Plus500, which only offers one commission-free account type. This is because Plus500 is a market maker with a dealing desk, while Eightcap operates as a no dealing desk broker and utilises external liquidity provider.

- Eightcap Raw Spreads: Raw spreads from 0 pips + $3.50 commission fee per side, per 100k traded

- Eightcap Standard Spreads: Spreads from 1.0 pip with no commission fee

- Plus500 Standard Spreads: Spreads from 1.1 pips with no commission fee (other fees apply)

As Eightcap uses multiple liquidity providers, they can offer tighter spreads compared to Plus500.

EightCap Has More Competitive ‘Standard Account’ Spreads Than Plus500

| Standard Account | Eightcap Spreads | Plus500 Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.16 | 1.75 | 1.7 |

| EUR/USD | 1 | 1.8 | 1.2 |

| USD/JPY | 1.2 | 2.3 | 1.5 |

| GBP/USD | 1.2 | 2 | 1.6 |

| AUD/USD | 1.2 | 1.1 | 1.6 |

| USD/CAD | 1.2 | 2 | 1.9 |

| EUR/GBP | 1.1 | 1.6 | 1.5 |

| EUR/JPY | 1.2 | 4.1 | 2.1 |

| AUD/JPY | 1.2 | 4 | 2.3 |

Our analysis revealed that Eightcap‘s Standard Account consistently offers lower spreads than Plus500. By comparing the average spreads of major forex pairs for each broker, we found Eightcap’s no-commission spreads were up to 57% lower than Plus500’s.

Eightcap’s pricing for the EUR/USD pair is 41% more competitive than Plus500’s, and for GBP/USD, the 1.3 pip difference between the two brokers translates into significant potential savings.

Try the Plus500 vs Eightcap fee calculator below based on the most popular forex pairs and base currencies.

Only Eightcap Has A Raw Spread Account

Unlike Plus500, which offers just one commission-free trading account (other fees apply), Eightcap stands out with its Raw Spread Account, where you pay a flat rate commission fee but gain access to tighter spreads.

The spread table below compares published spreads from some of the biggest forex brokers in the industry and is updated each month. As you can see, Eightcap’s Raw Spreads are competitive when compared to the forex industry at large, with spreads as low as 0.2 pips for the USD/CAD.

Eightcap’s Raw Account is well-suited to high-volume traders because it provides a more cost-effective trading environment for those who trade frequently or in large volumes, where every pip counts towards overall profitability.

Our Lowest Spreads and Fees Verdict

Eightcap offers no commission spreads up to 57% tighter than Plus500, with competitive commission spreads as well, making Eightcap a more cost-effective broker.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

2. Eightcap: Better Trading Platforms

While Plus500 users are restricted to their proprietary trading platform, Eightcap offers a combination of proprietary software and third-party platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView.

These platforms, renowned for their advanced features and customisation options, are particularly suited to experienced traders. In contrast, Plus500’s is built from the ground up with feedback from traders so has useful charting tools, forex education and a guaranteed stop loss order for riskmanegement.

| Trading Platform | Eightcap | Plus500 |

|---|---|---|

| MetaTrader 4 | Yes | No |

| MetaTrader 5 | Yes | No |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | No |

| Proprietary Platform | No | Yes |

All platforms are available as mobile apps for Android and iOS devices, as well as WebTrader options.

Eightcap’s MetaTrader Offering

These include advanced charting capabilities, a comprehensive suite of technical analysis tools, and the flexibility to use automated trading strategies through Expert Advisors (EAs).

EightCap goes above and beyond with its MetaTrader suite by offering the following integrations:

- Fx Blue Labs contains 11 trading apps and 17 indicators that can help with your trading.

- The Amazing Trader can also help automate your trading with a charting algo and comes with built-in risk management.

- Cryptocrusher is useful for finding crypto trade ideas, scanning the markets and determining crypto market sentiment.

While MT4 has all the features you will need when trading forex, Eightcap only offers crypto and share trading on MT5.

TradingView is also available for comprehensive charting and social trading insights.

Plus500 Has Their Own Proprietary Trading Platform

While Plus500 does not offer MT4 or MT5, their proprietary trading platform has its own useful features.

A major benefit of Plus500’s platform for new traders is the risk management features. As a market maker, the broker offers guaranteed stop loss orders (GSLOs) to help you manage risk when starting out. GSLOs ensure that traders can limit their losses effectively, providing a safety net for those still learning the ropes.

One significant limitation of the Plus500 trading platform is that there is no automation or algorithmic trading, nor does it permit social or copy trading. Scalping is also not allowed, and there are no third-party integrations available to incorporate any advanced features.

Our Better Trading Platform Verdict

Eightcap offers better trading platforms and tools with various MetaTrader integrations, while Plus500 has better risk management.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

3. Tie: Superior Accounts And Features

The brokers tie when it comes to account types and features as Eightcap offers both a Standard and Raw Account, while Plus500 offers a Swap Free Account for Muslim traders.

Plus500’s Islamic Account Option

Recognising the needs of Muslim traders under Sharia Law, which prohibits interest payments (‘riba’), Plus500 offers an Islamic or swap-free account. This account, tailored for Islamic traders, eliminates overnight swap fees, facilitating access to forex and CFD markets. However, it’s primarily available in select Middle Eastern countries.

Eightcap Offers More Versatile Pricing

While Eightcap does not offer an Islamic account option like Plus500, it provides more versatile pricing. It caters to a range of trading preferences with its Standard and Raw Account options, offering flexibility in pricing and trading conditions to suit various trading strategies.

| Eightcap | Plus500 | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | No | No |

| Active Traders | No | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

It’s a tie: Plus500’s Swap Free Account meets specific needs under Sharia Law, while Eightcap’s diverse Standard and Raw Accounts offer broader pricing flexibility.

*Your capital is at risk ‘79% of retail CFD accounts lose money’

4. Eightcap: Best Trading Experience

Eightcap operates on a no dealing desk model while Plus500 is a market maker. After testing each platform, I found that Eightcap offers a seamless and intuitive experience on MetaTrader platforms and TradingView.

On the other hand, Plus500 provides a more basic proprietary platform.

- EightCap offers MetaTrader and TradingView platforms with advanced trading tools

- Plus500’s proprietary platform is suited to risk averse traders needing risk management tools

- Both brokers provide mobile versions for trading on the go.

Our Best Trading Experience and Ease Verdict

Eightcap stands out for advanced traders with its MetaTrader and TradingView platforms, while Plus500 is better for risk management and commission free trading.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

5. Plus500: Stronger Trust And Regulation

Plus500’s trust score is 90 vs 85 for Eightcap. Therefore, Plus500 is the slightly stronger CFD provider in terms of trust and safety.

Plus500 Trust Score

Eightcap Trust Score

Regulations

Eightcap is regulated by the Australian Securities and Investment Commission (ASIC) and the Securities Commission of the Bahamas offshore; Plus500, on the other hand, has numerous top-tier regulators, including ASIC, the UK’s Financial Conduct Authority (FCA), and the Monetary Authority of Singapore (MAS).

Plus500’s offshore regulator is the Financial Services Authority of Seychelles (FSA).

| Eightcap | Plus500 | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) FMA (New Zealand) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) EFSRA | |

| Tier 3 Regulation | SCB (Bahamas) | FSA-S (Seychelles) FSCA (South Africa) |

Reputation

Both EightCap and Plus500 have offered their brokerage services for over a decade and are regarded as among the top online forex brokers available. You will be safe trading with either broker.

Reviews

Eightcap has a TrustPilot score of 4.2/5 stars, while Plus500 has a score of 4.1/5 stars.

Our Stronger Trust and Regulation Verdict

Plus500 edges slightly ahead with a higher overall trust score and broader regulatory oversight, yet both Plus500 and Eightcap demonstrate strong levels of trust and regulation.

*Your capital is at risk ‘79% of retail CFD accounts lose money’

6. Most Popular Broker – Plus500

Plus500 gets searched on Google more than Eightcap. On average, Plus500 sees around 270,000 branded searches each month, while Eightcap gets about 40,500 — that’s 85% fewer.

| Country | Plus500 | Eightcap |

|---|---|---|

| Italy | 22,200 | 590 |

| Germany | 18,100 | 1,000 |

| United Kingdom | 14,800 | 1,600 |

| Spain | 9,900 | 720 |

| Australia | 8,100 | 2,400 |

| Netherlands | 8,100 | 480 |

| Poland | 8,100 | 260 |

| United States | 5,400 | 1,900 |

| South Africa | 5,400 | 480 |

| Switzerland | 5,400 | 170 |

| United Arab Emirates | 4,400 | 210 |

| Portugal | 4,400 | 210 |

| Greece | 4,400 | 90 |

| Mexico | 2,900 | 320 |

| Sweden | 2,900 | 320 |

| Austria | 2,900 | 140 |

| Hong Kong | 2,400 | 170 |

| France | 1,900 | 720 |

| Singapore | 1,900 | 390 |

| Argentina | 1,600 | 590 |

| Colombia | 1,300 | 720 |

| New Zealand | 1,300 | 210 |

| Taiwan | 1,300 | 140 |

| India | 1,000 | 1,300 |

| Cyprus | 880 | 90 |

| Malaysia | 720 | 880 |

| Turkey | 720 | 110 |

| Ireland | 720 | 110 |

| Saudi Arabia | 720 | 70 |

| Chile | 590 | 140 |

| Japan | 390 | 140 |

| Egypt | 390 | 90 |

| Thailand | 320 | 9,900 |

| Canada | 320 | 2,400 |

| Brazil | 320 | 1,000 |

| Indonesia | 320 | 590 |

| Nigeria | 320 | 390 |

| Pakistan | 320 | 320 |

| Morocco | 210 | 210 |

| Philippines | 170 | 210 |

| Vietnam | 170 | 170 |

| Bangladesh | 170 | 140 |

| Algeria | 170 | 110 |

| Dominican Republic | 140 | 320 |

| Costa Rica | 140 | 30 |

| Jordan | 140 | 30 |

| Cambodia | 110 | 90 |

| Peru | 90 | 140 |

| Venezuela | 90 | 110 |

| Panama | 90 | 20 |

| Kenya | 70 | 170 |

| Uzbekistan | 70 | 90 |

| Ghana | 70 | 70 |

| Ecuador | 40 | 110 |

| Sri Lanka | 40 | 50 |

| Uganda | 30 | 70 |

| Tanzania | 30 | 30 |

| Ethiopia | 30 | 30 |

| Bolivia | 20 | 30 |

| Botswana | 20 | 30 |

| Mongolia | 10 | 70 |

| Mauritius | 10 | 20 |

590 1st | |

22,200 2nd | |

1,000 3rd | |

18,100 4th | |

1,600 5th | |

14,800 6th | |

2,400 7th | |

8,100 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Plus500 receiving 6,888,000 visits vs. 259,000 for Eightcap.

Our Most Popular Broker Verdict

Plus500 is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘79% of retail CFD accounts lose money’

7. Plus500: CFD Product Range And Financial Markets

EightCap offers over 360 CFD products, including forex, commodities, indices, shares, and cryptocurrencies. Plus500 offers over 2,800 financial products for CFD trading, including forex, shares, commodities, and options.

| Feature | Eightcap | Plus500 |

|---|---|---|

| Forex Pairs | 55 | 65+ CFD forex pairs |

| Indices | 16 | 65 |

| Commodities | 4 Metals (vs USD, AUD, EUR) 2 Energies | 5 Metals 7 Energies 10 Softs |

| Stocks | 600+ | 2,000 shares on CFDs |

| ETFs | No | 97 |

| Cryptocurrencies | 86 pairs | 18 |

| Bonds | No | No |

| Options/Futures | No | No |

EightCap Has An Exceptional Cryptocurrency Offering

We have awarded EightCap our 2026 award for best cryptocurrency broker. EightCap’s various cryptocurrency offerings and the tools they provide to enhance your crypto trading experience are simply unparalleled.

You can trade over 250 different cryptocurrencies on EightCap, ranging from popular picks like Bitcoin or Ethereum to smaller options such as Algorand and Dogecoin.

Around 120 of these options are coins vs the USD, with 20 coins also available to trade against other fiat currencies such as AUD, GBP, EUR, CAD and MXN. You even have the option of trading cryptocurrencies against themselves- such as the Ethereum/Bitcoin pair.

The list of options is endless, but if you can’t decide on which coin to trade, EightCap has five crypto indices allowing you to track a diversified group of coins.

In addition to crypto, Eightcap has the standard trading instruments you find with most brokers. This includes 40 Forex pairs, 10 indices, 400+ Stocks and 4 Commodities.

Plus500 Is A CFD Provider With Some Alternatives To Eightcap

Plus500 prefers to call itself a CFD provider rather than a broker, and its product range is more extensive than EightCap’s.

Along with 71 CFD forex pairs, they also have 2000+ CFDs on shares (covering 25 global stock exchanges), 30 indices, 98 ETFs and 308 options.

Our Top Product Range and CFD Markets Verdict

Plus500 wins this round with more product offerings.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

8. Eightcap: Superior Educational Resources

Eightcap outperforms Plus500 in the realm of educational resources, offering a more comprehensive and varied range of forex training materials.

With its Education Center, Eightcap caters to traders at all levels through detailed webinars, video tutorials, and a selection of eBooks and trading guides, which provide in-depth knowledge and practical insights. Additionally, the frequently updated FAQ section effectively addresses common trading queries.

Conversely, Plus500’s educational offerings include a mix of video tutorials, FAQs, e-books, beginner’s guide, and webinars. For premium clients, it also offers an economic calendar, technical and fundamental analysis tools, and instrument analysis.

However, Eightcap’s broader and more detailed educational content makes it the superior choice for traders seeking to enhance their trading knowledge and skills.

Our Superior Educational Resources Verdict

Based on our team’s testing, Eightcap scores higher in educational resources, making it the better choice for traders looking to expand their knowledge.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

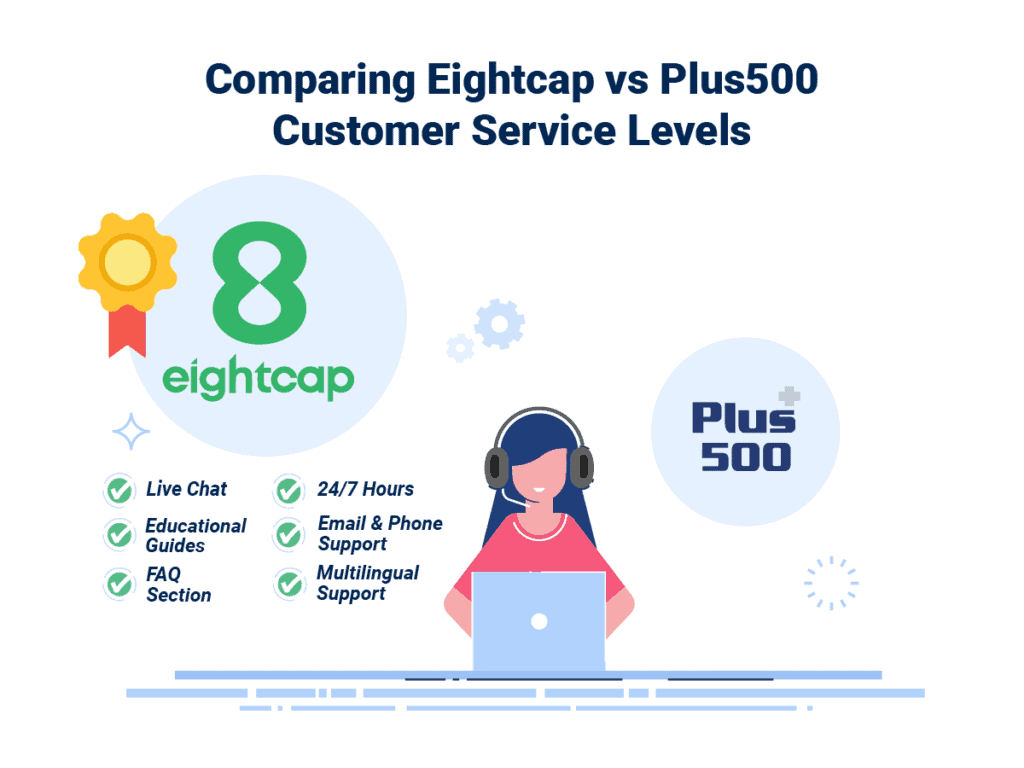

9. Eightcap: Superior Customer Service

Eightcap and the Plus500 team are available 24/7, ensuring traders have access to support whenever.

Eightcap provides a multi-lingual support team that’s accessible throughout the trading week and is prepared to assist traders with various issues. Plus500, while also offering a multilingual team, complements its service with a more extensive FAQ section and provides continuous support availability, even during weekends.

In terms of communication methods, both brokers are well-equipped. They offer multiple channels, including live chat, telephone, and email support, allowing traders to choose the mode of communication that suits them best. This flexibility ensures that traders can easily get in touch with the support team in a manner that is convenient and efficient for them.

| Feature | Eightcap | Plus500 |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | No |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Overall, Eightcap takes a slight lead in customer service, thanks to its 24/7 availability and extensive FAQ section. This comprehensive support structure ensures that traders can get assistance at any time, including weekends, which can be particularly beneficial for addressing urgent issues or queries that arise outside of standard trading hours.

Our Superior Customer Service Verdict

Eightcap offers a slightly superior customer service experience with its round-the-clock support and a more thorough FAQ section, making it a preferable choice for traders who value continuous access to support.

*Your capital is at risk ‘79% of retail CFD accounts lose money’

10. Eightcap: Better Funding Options

Both Eightcap and Plus500 offer a diverse range of funding options to cater to their global clientele. Traders can choose from a variety of payment methods, including traditional bank transfers and modern e-wallet solutions. However, the availability of these options may vary based on the region of the trader and the operational policies of the broker.

Eightcap, for instance, has been known to provide a broader spectrum of e-wallet solutions, making it convenient for traders who prefer quick and hassle-free transactions. Plus500, on the other hand, while offering a commendable range of options, tends to be more selective, especially when it comes to certain e-wallet services. This distinction becomes evident when we look at the comparative table below:

| Funding Option | Eightcap | Plus500 |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | No |

| Crypto | Yes | No |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

Based on the available funding options, Eightcap appears to offer a more comprehensive range, making it the preferred choice for traders seeking diverse deposit and withdrawal methods.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

11. Tie: Lower Minimum Deposit

Eightcap and Plus500 both have a minimum deposit requirement of $100 to open an account. The main difference between the two brokers is their variety of payment methods.

Below, you will see Eightcap’s minimum deposit features, where a couple of payment methods are not available for some currencies.

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | N/A | $100 | €100 | N/A |

| Neteller | N/A | $100 | €100 | N/A |

In contrast, Plus500’s $100 minimum applies everywhere, as seen in the table below.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Paypal | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Skrill | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

Our Lower Minimum Deposit Verdict

Technically, it’s a tie between Eightcap and Plus500, as they both have a $100 minimum deposit requirement. The method of payment you prefer could be the possible tiebreaker on which broker you’d choose.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

Is Plus500 or Eightcap The Best Broker?

Eightcap is the winner because it outperforms in multiple key areas, offering traders a comprehensive and competitive trading environment. The table below summarises the key information leading to this verdict:

| Criteria | Eightcap | Plus500 |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platforms | Yes | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience | Yes | No |

| Stronger Trust And Regulation | No | Yes |

| CFD Product Range And Financial Markets | No | Yes |

| Superior Educational Resources | Yes | No |

| Better Customer Service | Yes | No |

| More Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | Yes |

Plus500: Best For Beginner Traders

For those just starting out in the trading world, Plus500 offers better risk management and superior educational resources.

Eightcap: Best For Experienced Traders

For seasoned traders looking for a robust platform with a wide range of products and competitive spreads, Eightcap stands out as the preferred choice.

FAQs Comparing Eightcap Vs Plus500

Does Plus500 or Eightcap Have Lower Costs?

Eightcap generally offers more competitive spreads and lower costs. On average, traders can expect spreads starting from 1 pip for popular currency pairs with Eightcap. Plus500’s EUR/USD spread, for instance, was around 0.8 pips when last checked. For a more detailed breakdown of low-commission brokers, you can refer to this comprehensive Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and Plus500 support MetaTrader 4, but Eightcap is often preferred by traders for its seamless integration with the platform. Plus500 offers its proprietary platform alongside MT4, which some traders might find advantageous. If you’re specifically looking for the best MT4 brokers, this list of top MT4 brokers can be a valuable resource.

Which Broker Offers Social Trading?

Eightcap offers social trading features, allowing traders to copy the strategies of successful traders. Plus500, on the other hand, doesn’t have a dedicated social trading platform. Social or copy trading can be a game-changer for many, especially beginners. If you’re interested in exploring more about this, check out this detailed guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Plus500 offers spread betting, allowing UK traders to take advantage of this tax-efficient way of trading. Eightcap, on the other hand, does not provide spread betting services. Spread betting can be a great way to capitalise on market movements without owning the underlying asset. For those interested in diving deeper into spread betting, this comprehensive guide on the best spread betting brokers in the UK can be invaluable.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap stands out as the superior choice for Australian forex traders. Not only is Eightcap ASIC regulated, ensuring a high level of trust and security, but it’s also founded in Australia, giving it a home-ground advantage. Plus500, while also ASIC-regulated, is headquartered overseas. Having a local presence in Australia can significantly help traders understand market nuances. If you’re keen to explore more about the best brokers in Australia, this detailed list of the Best Forex Brokers In Australia is a must-read.

What Broker is Superior For UK Forex Traders?

From my perspective, Plus500 has a slight edge for UK forex traders. The platform is regulated by FCA, which guarantees security and trustworthiness for UK traders. While Eightcap is a strong contender in the forex market, its location outside of the UK may be a factor for some traders. Plus500 has an advantage due to its strong regulatory framework and focus on the UK market. For those in the UK looking to dive deeper into forex trading, this guide on the Best Forex Brokers In UK is a great resource.

Article Sources

No commission account spread propriety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What countries are banned from Eightcap?

Countries that Eightcap does not accept include United States, Bulgaria, Turkey, Hong Kong, Canada, and Japan.