Eightcap vs Swissquote 2026

While Swissquote has 76 forex pairs compared to Eightcaps’ 56 pairs, this review found Eightcap spreads are lower and have more trading platform options. This Swissquote vs Eightcap review compared the two forex brokers.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most crucial trading factors to help you decide between Eightcap and Swissquote.

- Eightcap offers lower spreads across major forex pairs compared to Swissquote.

- Swissquote has a more stringent minimum deposit requirement, starting at $1,000 USD for their Premium account.

- Eightcap provides a wider range of funding methods, including crypto, whereas Swissquote is limited to bank deposits and Visa/Mastercard.

1. Lowest Spreads And Fees – Eightcap

Standard or commission-free accounts only have spread fees. The spread represents the difference between the price you can buy and sell a financial instrument at. The tighter the gap or spread, the less cost it is for each trade. Because there is no commission, your broker increases spreads over market prices as a form of brokerage.

Regarding standard account spreads, there’s a clear distinction between Eightcap and Swissquote. Eightcap consistently offers lower spreads, with particularly competitive rates for pairs like EUR/USD. Swissquote, on the other hand, tends to have higher spreads, especially for pairs like USD/CAD and EUR/JPY.

| Standard Account | Eightcap Spreads | Swissquote Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.16 | 2.04 | 1.7 |

| EUR/USD | 1 | 1.7 | 1.2 |

| USD/JPY | 1.2 | 1.6 | 1.5 |

| GBP/USD | 1.2 | 2 | 1.6 |

| AUD/USD | 1.2 | 1.6 | 1.6 |

| USD/CAD | 1.2 | 2.7 | 1.9 |

| EUR/GBP | 1.1 | 1.7 | 1.5 |

| EUR/JPY | 1.2 | 2.5 | 2.1 |

| AUD/JPY | 1.2 | 2.5 | 2.3 |

Standard Account Analysis Updated March 2026[1]March 2026 Published And Tested Data

As can be seen in the table above, Eightcap spreads are superior to Swissquote. The minimum spread on an Eightcap standard account is 1 pip wide. This is available for all of their major forex pairs, like the EUR/USD. You’ll even get a 1 pip minimum on some minor pairs – the EUR/CAD and EUR/GBP. The minimum deposit required is at $500 for Australians and $100 outside of Australia.

In the UK or EU, Swissquote has two standard accounts:

- The Premium account has a 1.3 pip minimum spread, and the spreads in the table above are for this account type. The minimum deposit for this account is set at $1,000 USD.

- The Prime account has a 0.6 pip minimum, making it the only account with a lower minimum spread than EightCap’s standard account. However, the Prime account has a massive minimum deposit requirement of $5,000 USD.

Outside of the UK and EU, there are three standard accounts:

- The Standard account with a minimum spread of 1.7 pips and a minimum deposit of $1,000.

- Premium with a 1.4 pip minimum and $10,000 deposit.

- Prime with 1.1 pips and a $50,000 minimum deposit.

In my view, Eightcap is the cheaper option when it comes to standard account spreads. Their consistently lower spreads across various forex pairs give them a distinct advantage, especially for traders who deal with these pairs frequently. However, it’s important to consider other factors as well, such as the range of services, customer support, and trading platforms offered by each broker.

This fee calculator shows how reduced spreads affect trading. Choose your base currency, trade amount, and pair to view the cost.

Funding methods

To trade, you have to actually fund your account first. EightCap let you fund with a wide set of deposit methods. These include, but are not limited to: Bank transfers, Visa/Mastercard credit cards or debit cards, BPay/POLi (Aus), Neteller/Skrill/PayPal. On top of these, EightCap even lets you fund your account in crypto if you want to.

In contrast, you can only fund a Swissquote account are more limited, with just a bank deposit or Visa/Mastercard available.

Our Lowest Spreads and Fees Verdict

EightCap has lower spreads on almost all of their accounts, on top of lower minimum deposits- making it far easier for you to set up an EightCap account and begin trading. As a result, our broker for cheaper trading accounts is EightCap.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

2. Better Trading Platforms – Eightcap

Both brokers offer quite a range of platforms and trading tools for you to use. For this part, we’ll explore the platforms available.

| Trading Platform | Eightcap | Swissquote |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

EightCap has both MetaTrader 4 and MetaTrader 5 available, and TradingView.

MT4 and MT5 are the two most popular forex trading platforms in the world, and even beginner forex brokers will probably have heard of them.

TradingView is a premier chart-trading platform, with chart types and indicators galore to help you become a successful trader.

Swissquote also offers both MetaTrader options. On top of them, they make a proprietary platform, Advanced Trader, available. They advertise the customisability of the platform, as you can create DIY tools and use a combination of charts to trade with.

- Eightcap offers MetaTrader 4 and 5, along with TradingView for technical analysis and charting.

- Swissquote provides MetaTrader platforms and their proprietary Advanced Trader.

Our Better Trading Platform Verdict

Eightcap takes the lead in this category as well, thanks to its integration with TradingView, which offers advanced charting and technical analysis tools, setting it apart in the trading platform arena.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

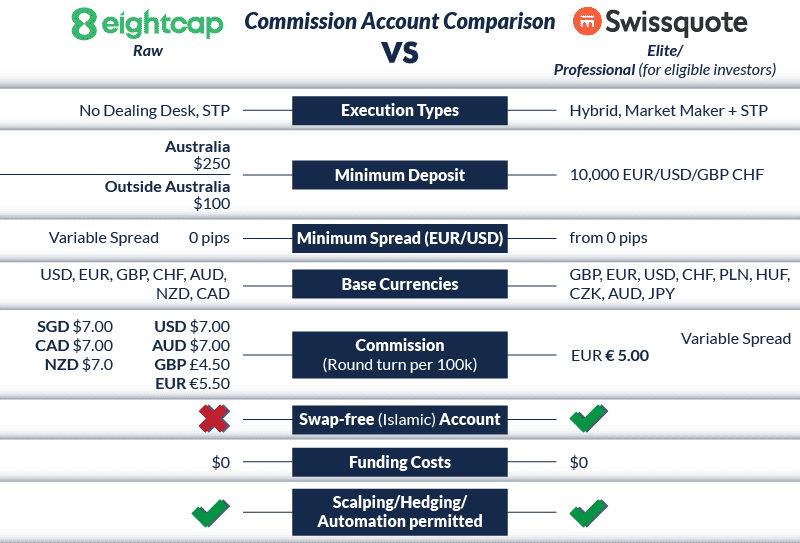

3. Superior Accounts And Features – Eightcap

- Eightcap offers two types of accounts: Standard and Raw.

- Swissquote offers more variety with Standard, Premium, and Prime accounts.

- Eightcap provides higher leverage of up to 1:500.

- Swissquote offers lower leverage of up to 1:100.

| Eightcap | Swissquote | |

|---|---|---|

| Standard Account | Yes | |

| Raw Account | Yes | |

| Swap Free Account | No | |

| Active Traders | No | |

| Spread Betting (UK) | No |

Our Superior Accounts and Features Verdict

Eightcap wins in this category for its higher leverage options, although Swissquote offers more account types. The higher leverage makes Eightcap more appealing for traders looking for higher risk and reward.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

4. Best Trading Experience – Eightcap

Eightcap is my top choice for trading experience. They offer both MetaTrader 4 and MetaTrader 5, which are industry standards. But what sets them apart is TradingView, a powerful charting and technical analysis platform.

- Eightcap offers MetaTrader 4 and 5

- Swissquote also provides MetaTrader and their proprietary Advanced Trader

- Eightcap integrates with TradingView for advanced charting.

- Swissquote’s trading tools include AutoChartist and Trading Central

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| Eightcap | 143ms | 19/36 | 139ms | 17/36 |

| Swissquote | 258ms | 36/36 | 198ms | 30/36 |

Our Best Trading Experience and Ease Verdict

Eightcap wins hands down in providing a seamless and versatile trading experience. Their integration with TradingView enhances the trading experience with advanced charting and analysis tools.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Swissquote

A broker with stronger trust and regulation are, simply, the most reputable and competitive in the industry of forex trading. These brokers ensure a secure and transparent trading environment for traders.

Swissquote Trust Score

Eightcap Trust Score

Regulations

When it comes to trust and regulation, both Eightcap and Swissquote have their merits. Eightcap is regulated by the Australian Securities and Investments Commission (ASIC), one of the most respected regulatory bodies in the forex industry. This makes it a reliable choice, especially for traders based in Australia. They also offer client funds segregation and negative balance protection, which are essential features for safeguarding traders’ investments.

Swissquote, on the other hand, has a dual regulatory framework. They are regulated by the Financial Conduct Authority (FCA) in the UK and the Swiss Financial Market Supervisory Authority (FINMA) in Switzerland. This dual regulation provides an extra layer of security and trustworthiness. Swissquote has also been in the business for 25 years, giving them a long-standing reputation in the industry. Like Eightcap, they offer client funds segregation and negative balance protection.

| Eightcap | Swissquote | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) | FCA (UK) CYSEC (Cyprus) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) MFSA (Europe) SFC CSSF FINMA (Switzerland) | |

| Tier 3 Regulation | SCB (Bahamas) |

Reviews

Eightcap is rated 4.2 out of 5 from over 3,000 reviews, with users frequently praising its responsive customer service, tight spreads, and reliable trading platforms. Swissquote, on the other hand, has a score of 3.7 out of 5 based on a similar volume of reviews. Eightcap tends to receive more consistently positive feedback, while Swissquote’s reviews reflect a more mixed experience.

Our Stronger Trust and Regulation Verdict

When it comes to stronger trust and regulation, Swissquote takes the crown. Their dual regulation by both FCA and FINMA, coupled with their 25 years in the business, makes them a more reliable and trustworthy choice for traders who prioritize security.

Swissquote ReviewVisit Swissquotes

*Your capital is at risk ‘82.25% of retail CFD accounts lose money’

6. Most Popular Broker – Swissquote

Swissquote gets searched on Google more than Eightcap. On average, Swissquote sees around 135,000 branded searches each month, while Eightcap gets about 40,500 — that’s 70% fewer.

| Country | Eightcap | Swissquote |

|---|---|---|

| France | 720 | 8,100 |

| Germany | 1,000 | 5,400 |

| United Kingdom | 1,600 | 2,400 |

| Spain | 720 | 1,900 |

| United Arab Emirates | 210 | 1,900 |

| Italy | 590 | 1,900 |

| Turkey | 110 | 1,300 |

| South Africa | 480 | 1,000 |

| United States | 1,900 | 1,000 |

| Thailand | 9,900 | 880 |

| India | 1,300 | 720 |

| Brazil | 1,000 | 720 |

| Netherlands | 480 | 720 |

| Saudi Arabia | 70 | 720 |

| Austria | 140 | 720 |

| Poland | 260 | 590 |

| Portugal | 210 | 590 |

| Greece | 90 | 590 |

| Singapore | 390 | 480 |

| Hong Kong | 170 | 480 |

| Cyprus | 90 | 480 |

| Mexico | 320 | 390 |

| Australia | 2,400 | 320 |

| Colombia | 720 | 320 |

| Canada | 2,400 | 320 |

| Argentina | 590 | 320 |

| Egypt | 90 | 260 |

| Sweden | 320 | 260 |

| Japan | 140 | 260 |

| Ireland | 110 | 260 |

| Malaysia | 880 | 210 |

| Taiwan | 140 | 210 |

| Morocco | 210 | 170 |

| Indonesia | 590 | 170 |

| Chile | 140 | 170 |

| Costa Rica | 30 | 170 |

| Panama | 20 | 170 |

| Nigeria | 390 | 140 |

| Philippines | 210 | 140 |

| Peru | 140 | 140 |

| Mauritius | 20 | 140 |

| Vietnam | 170 | 110 |

| Ecuador | 110 | 110 |

| Algeria | 110 | 90 |

| Uzbekistan | 90 | 90 |

| Pakistan | 320 | 70 |

| Dominican Republic | 320 | 70 |

| Venezuela | 110 | 70 |

| Jordan | 30 | 70 |

| Kenya | 170 | 50 |

| New Zealand | 210 | 50 |

| Cambodia | 90 | 50 |

| Bolivia | 30 | 40 |

| Bangladesh | 140 | 30 |

| Switzerland | 170 | 30 |

| Ghana | 70 | 30 |

| Sri Lanka | 50 | 20 |

| Tanzania | 30 | 20 |

| Uganda | 70 | 10 |

| Ethiopia | 30 | 10 |

| Mongolia | 70 | 10 |

| Botswana | 30 | 10 |

8,100 1st | |

720 2nd | |

5,400 3rd | |

1,000 4th | |

2,400 5th | |

1,600 6th | |

1,900 7th | |

210 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Swissquote receiving 531,000 visits vs. 259,000 for Eightcap.

Our Most Popular Broker Verdict

Swissquote is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Swissquote ReviewVisit Swissquotes

*Your capital is at risk ‘82.25% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – Eightcap

Eightcap offers 56 forex pairs and over 141+ crypto trading options. Swissquote provides 76 forex pairs but only 34 crypto options.

| CFDs | Eightcap | Swissquote |

|---|---|---|

| Forex Pairs | 56 | 80 |

| Indices | 19 | 10 |

| Commodities | 3 energies, 7 metals (plus gold vs 5 flats and silver vs 3 flats), 6 soft | 10 |

| Cryptocurrencies | 20 high cap crypto 20 mid cap cryptos 97 low cap cryptos 1 crypto indices (coindesk 20) 3 crypto ETFs stocks | 0 |

| Shares CFDs | 360+ | 15 |

| ETFs | 14 Australian ETFs 30 US ETFs | 0 |

| Bonds | No | 5 |

| Futures | No | 5 |

| Treasuries | No | 5 |

| Investment | No | 5 |

Our Top Product Range and CFD Markets Verdict

Eightcap is the go-to broker for traders who want a broad range of trading options, especially in the burgeoning crypto market. Their extensive crypto offerings make them a standout choice.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

8. Superior Educational Resources – Swissquote

Eightcap offers limited educational resources, focusing more on its trading platforms and tools. Swissquote provides a comprehensive educational package.

- Eightcap offers basic educational resources

- Swissquote provides webinars

- Eightcap lacks advanced educational content

- Swissquote offers trading tutorials

Our Superior Educational Resources Verdict

Swissquote is the clear winner for traders who prioritize educational resources. Their structured approach, including webinars and tutorials, provides a well-rounded educational experience for traders of all levels.

Swissquote ReviewVisit Swissquotes

*Your capital is at risk ‘82.25% of retail CFD accounts lose money’

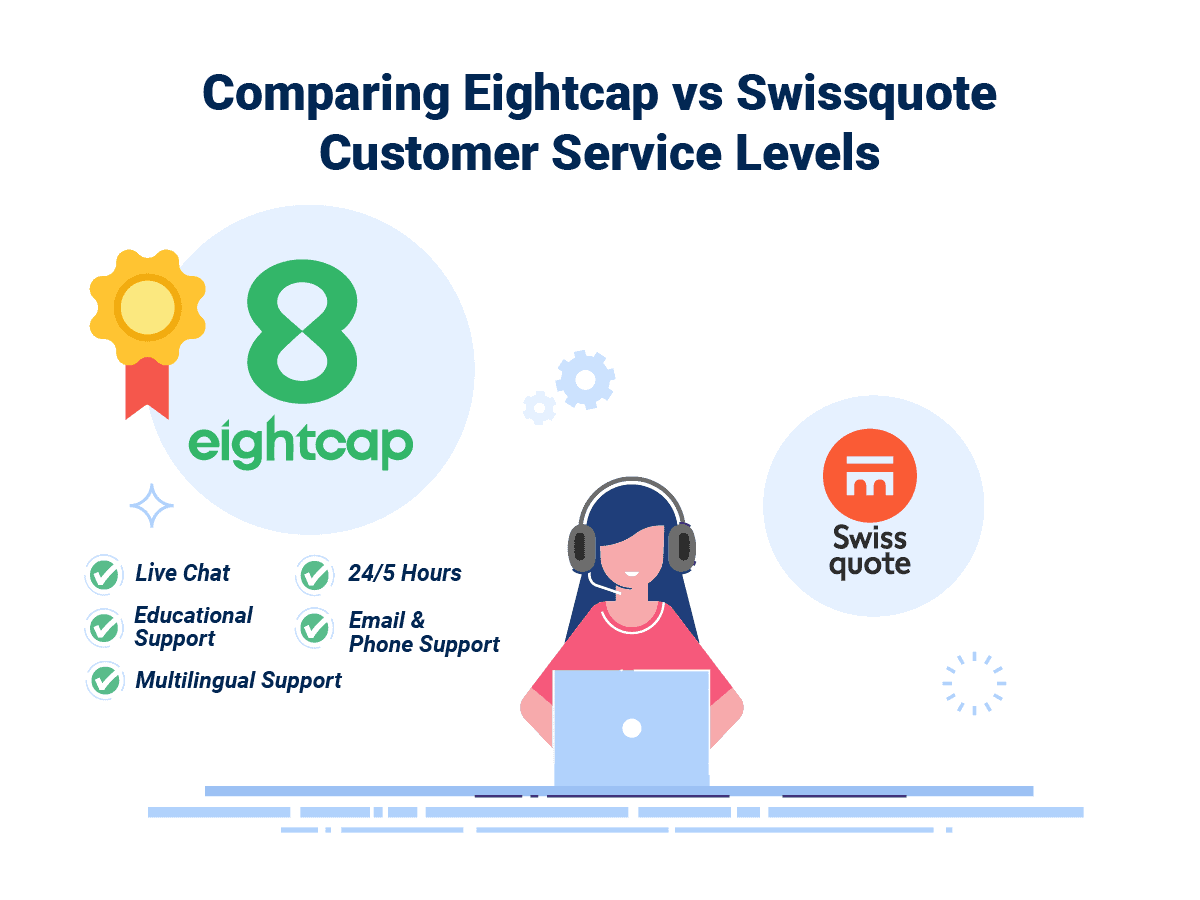

9. Superior Customer Service – Swissquote

Eightcap offers 24/5 customer support via live chat, email, and phone. Swissquote also provides 24/5 support but adds multilingual capabilities.

| Feature | Eightcap | Swissquote |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Swissquote takes the cake in customer service, thanks to their multilingual support. This makes them more accessible to a global audience, setting them apart in the customer service arena.

Swissquote ReviewVisit Swissquotes

*Your capital is at risk ‘82.25% of retail CFD accounts lose money’

10. More Funding Options – Eightcap

Eightcap offers a wide range of funding options, including bank transfers, credit/debit cards, and crypto. Swissquote is limited to bank transfers and Visa/Mastercard.

| Funding Option | Eightcap | Swissquote |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | No |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | No |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

Eightcap is the broker of choice for traders looking for diverse and flexible funding options. The inclusion of cryptocurrency as a funding method gives them a significant edge over Swissquote.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Eightcap

Eightcap has a minimum deposit of $100 for international clients, while Swissquote’s minimum deposit starts at $1,000 for their Premium account.

| Broker | Minimum Deposit | Recommended Deposit |

| Eightcap | $100 | $100 |

| Swissquote | $1,000 | $0 |

Our Lower Minimum Deposit Verdict

Eightcap is the more accessible broker, especially for newcomers or those who prefer to start with a smaller investment. Their lower minimum deposit requirement makes it easier for traders to take the plunge.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

So is Swissquote Or Eightcap the Best Broker?

Eightcap is the winner because they offer a more balanced package that caters to both beginner and experienced traders. They excel in trading experience, funding options, and have a lower minimum deposit, making them more accessible. Below is a table that summarises the key information leading to this verdict.

| Criteria | Eightcap | Swissquote |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

Eightcap: Best For Beginner Traders

For beginner traders, Eightcap is the better choice due to its user-friendly platforms and lower minimum deposit.

Swissquote: Best For Experienced Traders

For experienced traders, Swissquote is preferable for its advanced trading tools and robust educational resources.

FAQs Comparing Eightcap vs Swissquote

Does Swissquote or Eightcap Have Lower Costs?

Eightcap has lower costs. They offer spreads as low as 0.0 pips on major forex pairs. Swissquote’s spreads start at 1.3 pips. For more information on low-cost brokers, you can visit our Lowest Commission Brokers page.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and Swissquote offer MetaTrader 4, but Eightcap edges out with its lower spreads and fees. For more details, check out our list of best MT4 brokers.

Which Broker Offers Social Trading?

Neither Eightcap nor Swissquote offers social or copy trading. If social trading is crucial for you, you might want to look at other options listed on our best social trading platforms page.

Does Either Broker Offer Spread Betting?

Spread betting is not available with either Eightcap or Swissquote. If you’re specifically looking for this feature, you’ll need to explore other options. We have a detailed list of the best spread betting brokers in the UK that you can check out on our dedicated spread betting page.

What Broker is Superior For Australian Forex Traders?

For Aussie traders, Eightcap is the go-to, thanks to its ASIC regulation and competitive spreads. For more Aussie-friendly brokers, check out our Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

In the UK, Swissquote wins with its FCA regulation and long-standing reputation. For more UK options, see our Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert