FOREX.com Review Of 2026

We were most impressed with FOREX.com’s spread-only and commission-based trading with tight spreads, their platforms, and analytical tools. We look at some of the key features of FOREX.com to assess if FOREX.com is a broker you should consider.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

FOREX.com Summary

| 🗺️ Regulation | FCA, CIRO, NFA/CFTC, CySEC, CIMA |

| 💰 Trading Fees | Dealing Desk, STP |

| 📊 Trading Platforms | MT4, FOREX.com ,MT5 (outside the UK) |

| 💰 Min Deposit | $100 |

| 💰 Funding Fees | $0 |

| 🛍️ Instruments | Forex, CFDs, Crypto (varies by location) |

| 💰 Credit Card | Yes (outside US and Canada) |

Why Choose FOREX.com

We found FOREX.com offers many advantages including an excellent proprietary platform and a wide range of markets. FOREX.com is one of the oldest brokers and also one of the most trustworthy given their global presence and regulation in multiple countries. Their parent company, StoneX Group Inc. is even listed on NASDAQ stock exchange in New York.

Most traders with FOREX.com will trade commission-free if you can use their new RAW Pricing account good savings are possible. We also like their rebate program for high-volume traders. After testing and analysing all the major broker factors, we recommend FOREX.com for traders of all levels, particularly active traders.

This is an independent review and has not been influenced by the broker. FOREX.com has only provided general information about its services and offerings to ensure factual accuracy. All opinions expressed in this review are solely those of the reviewer.

FOREX.com Pros and Cons

- Great range of currency pairs

- Competitive spreads

- Reliable and multi-regulated

- Advanced range of trading platforms

- Good education resources

- Available for US traders

- No 3rd party social trading tools

- Limited crypto range (where offered)

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

The overall rating is based on review by our experts

Trading Fees

FOREX.com offers 3 main trading account types for retail traders as follows:

- Spread-Only (US only)

- Standard Account: no commissions (available for all traders outside the US)

- MetaTrader account (MT4 or MT5): no commissions (available for Canadian, European and emerging markets and commission available for Canadian markets with MT5

- MT4 account (MT4 only): no commission (available for the US, UK and Singapore)

- MT5 account (MT5 only): Commission and no commission (US),

- Raw Pricing account: commission-based (available outside the UK and Singapore)

Notes:

- Spread-Only and Standard are both commission-free accounts, but are renamed for specific regions.

- MetaTrader/MT4/M5 are all commission-free accounts using the MetaQuotes trading platforms

- Corporate accounts for institutional and retail business clients are also available; these accounts are not covered in this review

- A VIP account is available in Singapore. This account is not covered in this review

1. Raw Account Spreads

The RAW Pricing account (available outside UK and Singapore) is commission-based, meaning you pay the spread plus commission charges on top. With a RAW account, you can typically select any trading platform that FOREX.com provides. FOREX.com had higher than average spreads among the 39 raw accounts we evaluated in January 2026.

ECN Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.21 | 0.17 | 1.13 | 0.63 | 0.66 |

| 0.08 | 0.35 | 7.60 | 3.50 | 0.73 |

| 0.02 | 0.03 | 0.50 | 0.27 | 0.30 |

| 0.06 | 0.27 | 0.49 | 0.30 | 0.59 |

| 0.10 | 0.10 | 0.90 | 0.20 | 1.10 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.09 | 0.13 | 1.70 | 0.14 | 1.40 |

| 0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

| 0.10 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

| 0.38 | 0.92 | 0.65 | 0.70 | 0.86 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

However, when comparing the raw account spreads of FOREX.com to the average broker, it shows tighter spreads than the average.

| Raw Account Spreads | FOREX.com | Average Spread |

|---|---|---|

| Overall | 0.59 | 0.74 |

| EUR/USD | 0.17 | 0.21 |

| USD/JPY | 0.35 | 0.39 |

| GBP/USD | 0.29 | 0.48 |

| AUD/USD | 0.3 | 0.39 |

| USD/CAD | 0.65 | 0.53 |

| EUR/GBP | 0.42 | 0.55 |

| EUR/JPY | 0.68 | 0.74 |

| AUD/JPY | 1.11 | 1.07 |

| USD/SGD | 1.3 | 2.34 |

2. Raw Account Commission Rate

This account has lower spreads than the Spread-Only account, as low as 0 pips but you will also need to pay a commission. The RAW Pricing account charges $7 USD per $100K USD each way for clients in Canada and the US (i.e. $14 in round-turn) which is relatively standard for these financial markets.

If you are trading outside the UK, the US and Canada such as in Asia or Africa or Europe then the commission is $5 each way ($10 round-turn per lot).

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| FOREX.com Commission Rate | $7.00 | N/A | £7 | €5.00 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Commission-Free accounts

A. Spread-Only (US only)

B: Standard Account: Outside the US)

C. MetaTrader account (US, Canadian, European and emerging markets)

D: MT4 Account (UK and Singapore)

E. MT5 Account (Canada)

Commission-free accounts are available in all countries and have a number of names depending on where you are trading from. As far as you need to be concerned as far ass account name goes is the the trading platforms you can choose. For the Spread-Only or Standard account, you’ll have access to the FOREX.com trading platform, while to use MT4 or MT5, you’ll have to open a MetaTrader/MT4/MT5 account.

As we mentioned earlier, average spreads may vary depending on what country you’re in and what market you’re trading. If you are in the U.S. for example, the absolute minimum spread you can obtain is 1.2 pips but remember, the U.S. is trading with spot not CFDs. Minimum spreads outside the US using CFDs range from 0.8 to 1 pip for EUR/USD.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| FOREX.com Average Spread | 1.5 | 1.8 | 1.8 | 1.5 | 2.6 | 1.6 | 2.4 | 2.3 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

4. Swap-Free Account Fees

If you are unable to accept and pay swap fees (also called rollover or overnight costs) for religious reasons, a swap-free account is available on request.

5. Other Fees

There is no charge for deposits and withdrawals at FOREX.com. If your account becomes inactive, there is a fee of $15 per month after 12 months.

Verdict on FOREX.com Fees

Overall, while FOREX.com combines the benefits of a spread-based and commission-based account, there are more cost effective brokers from our observation.

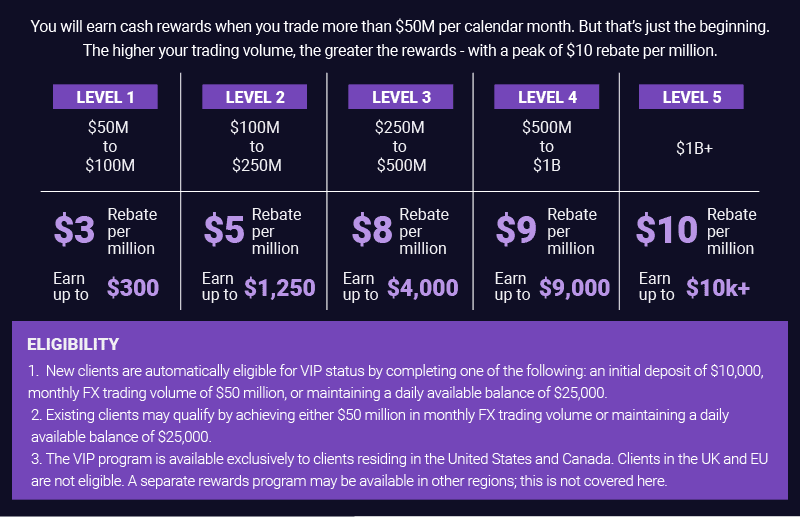

Active Trader Program (available in US and Canada)

Like a lot of top brokers out there, FOREX.com offers an Active Trader Program for high-volume traders.

You don’t have to apply to be an Active Trader, you simply need to deposit $10,000 or trade a certain amount of volume in a calendar month. In the U.S., this is $25K per month for an existing client and $50K per month for a new client.

The major benefit of the Active Trader Program is that you receive cash rebates for being an active trader (I.E. trading in high volume).

These rebates are tiered depending on how much volume you trade. The more you trade, the higher rebates you receive. Your rebates will also depend, again, on what country you are based in. We have only covered the U.S. (and Canada) here.

As an example:

If your monthly FX volume is US $200m, you qualify for Level 2 FX rebates and receive $5 for every $1m traded in the month

Your monthly volume rebate is $1000 (200 x $5).

If you live outside the U.S. or Canada, we recommend you check what specific cash rebates the Active Trader Program offers for you. We didn’t notice one for UK and EU markets.

With their Active Trader Program, we found FOREX.com a great choice if you trade in large volumes, which will apply to more experienced traders.

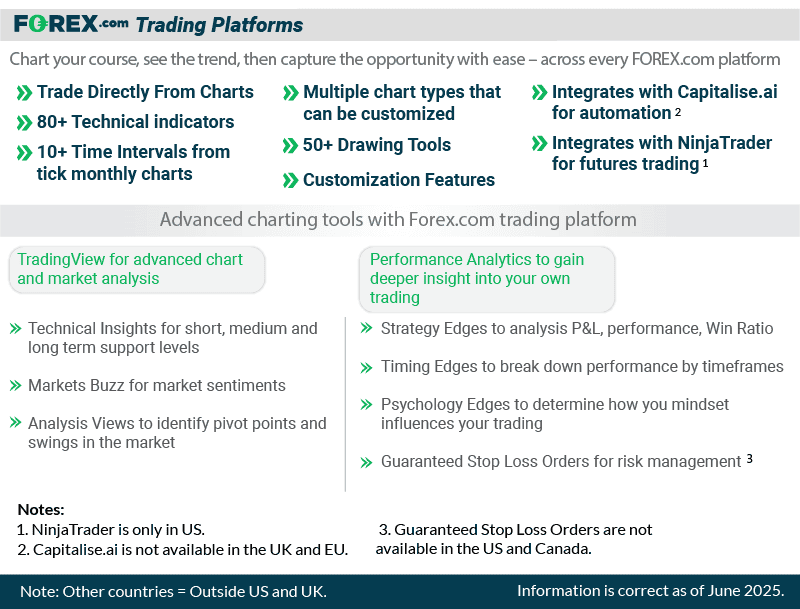

Trading Platforms

FOREX.com offers 5 main trading platforms, meaning they have one of the best brokers for choice of Trading Platforms.

| Trading Plaform | Available With FOREX.com |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

- FOREX.com: the broker’s proprietary software (available in all countries)

- MetaTrader 4: popular forex trading platform (not available in the EU)

- MetaTrader 5: upgraded version of MT4 (not available in the UK)

- TradingView: top charting platform

- NinjaTrader: For futures trading (only available in the US and with a FOREX.com account)

What platform you choose will depend on your market preference and what additional trading tools you like to use (for charting/algorithmic etc.).

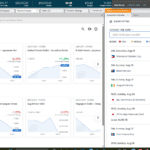

FOREX.com Trading Platform

FOREX.com’s proprietary platform is offered on desktop, as a WebTrader and via mobile app. In our opinion, the broker’s mobile app is one of the Best Forex Trading Apps as it is easy to use, with a fluid user interface and simple design. Highlights include powerful charts from TradingView with over 80 indicators, complex order types and an economic calendar.

FOREX.com’s desktop platform, meanwhile, is designed for experienced traders with sophisticated trading features such as 100 pre-defined charting indicators and a fully customizable dashboard.

The platform also comes with a guaranteed stop-loss provided you are not trading with the US or Canadian FOREX.com subsidiaries.

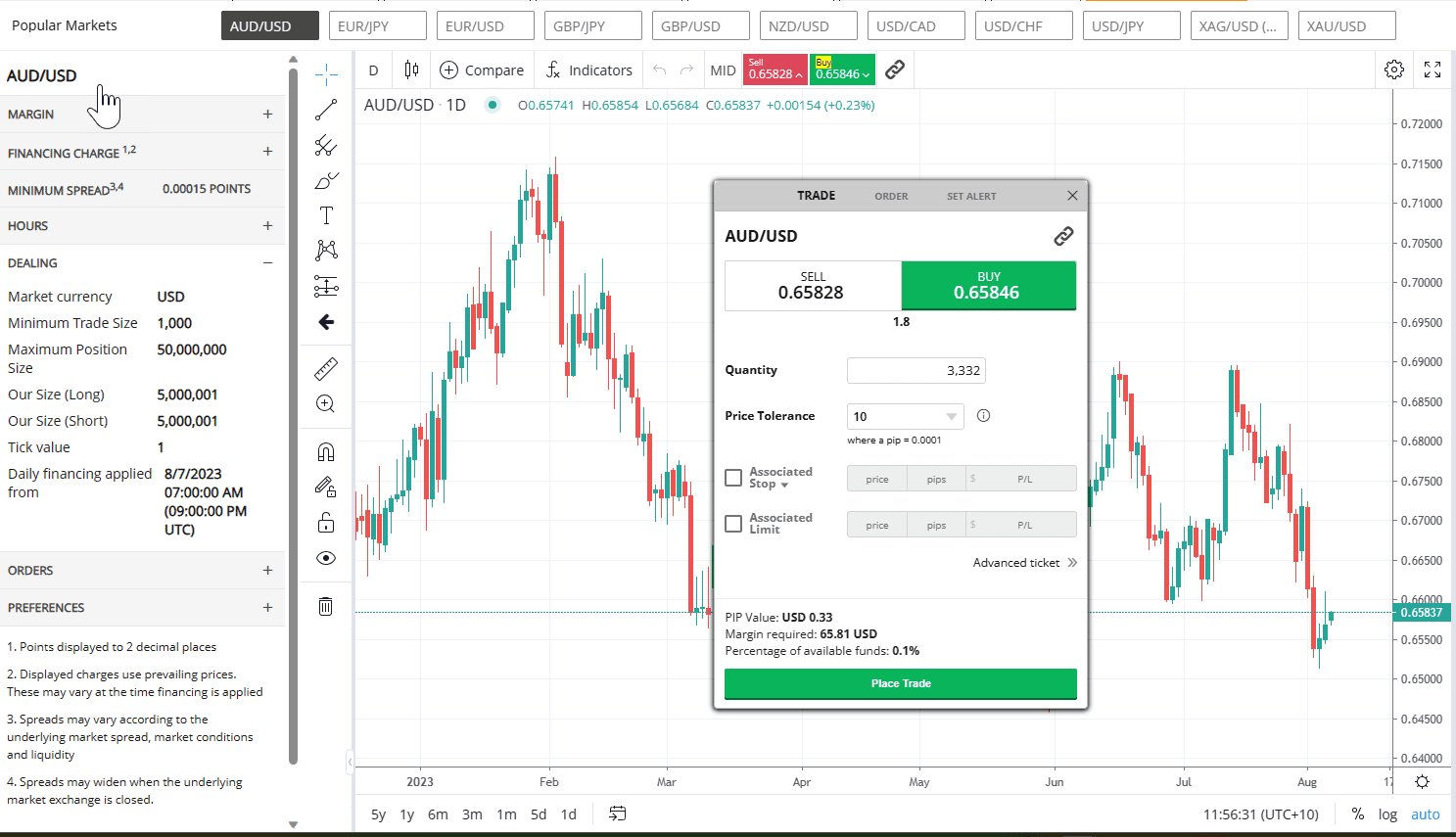

We, tested the broker’s WebTrader platform with our results reported below.

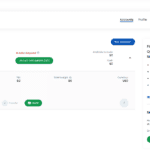

As you can see from the FOREX.com WorkSpace below, the WebTrader has a simple layout that is fairly easy to navigate. Your total balance and margin are displayed at the top of the window, with a 1-click trading toggle you can switch on and off. We particularly liked the ease at which you can browse through markets and place a trade.

There is also an economic news tab at the bottom right corner which has live market updates while you trade. We found this useful to gain market insights on the fly.

FOREX.com’s WebTrader also grants you access to Trading Central, which can be directly integrated into the platform, for more technical market analysis. From the window below, we have a tab for Trading Central as well as an economic calendar, which shows a list of bank holidays. We found this both useful and easy to have a quick glance at more technical market insights before switching back to trading.

While trading, you can maximise your window to just focus on one market. When we were trading AUD/USD, we found it simple to navigate market details such as margin and minimum spread (on the left-hand side). We also liked having the ability to customise our dashboard with news and an economic calendar on the right.

Making a trade is simply a matter of pointing and clicking, green to buy, red to sell. As mentioned earlier, you can toggle on 1-click trading, which will automatically buy or sell the desired market once you click. We prefer to leave this off, as you can set an associated stop or limit order in the trade ticket. There are also other useful details such as price tolerance and margin requirements which we found was a nice touch.

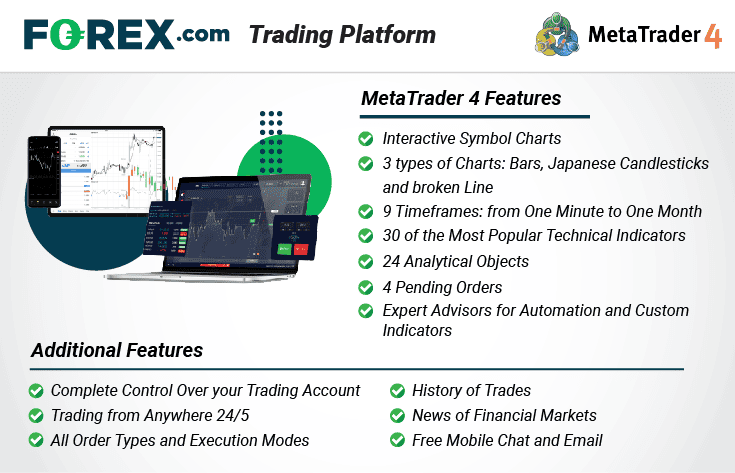

MetaTrader 4

FOREX.com also offers the MetaTrader 4 platform which is still one of the most popular forex platforms on the market. As a platform, it still ticks all of the boxes, without lashing out on features or trading tools.

Key features we like include the 30 technical indicators and 24 analytical objects available to analyse the markets. Additionally, the platform is robust and simple to use, hence its longevity (and popularity).

Overall, however, we think FOREX.com’s proprietary platform outshines it in nearly every way, from usability to features. Nowadays, MT4 is starting to look a little primitive compared to more advanced platforms like MT5.

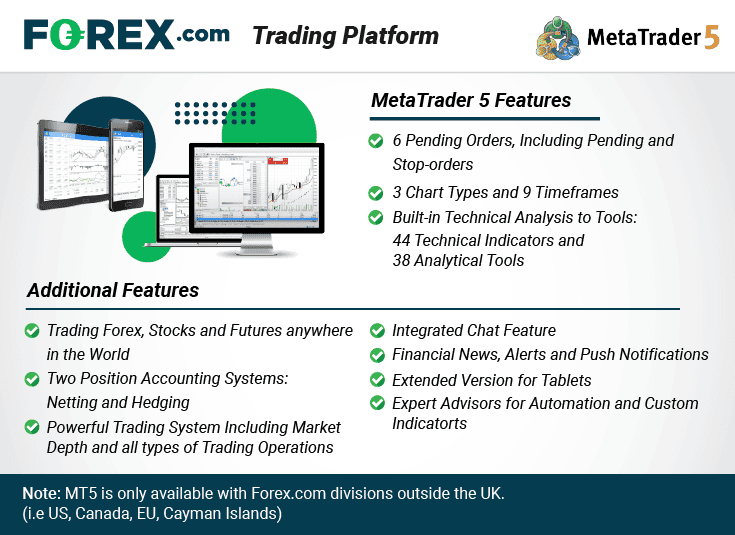

MetaTrader 5

Available in all countries except the UK, FOREX.com also offers MT4’s upgrade, MetaTrader 5. As is well documented, MT5 updated virtually every aspect of MT4 to deliver a superior platform performance in every way. We tend to agree.

Key highlights of MT5 include more indicators (44 technical indicators and 38 analytical objects), more order types (6 vs 4) and the ability to trade on centralised exchanges. The latter point means you can trade more products, including shares, as MT4 only allows trading on decentralised exchanges.

Overall, if MT5 is available to you, we think it stands up to the best platforms in the market.

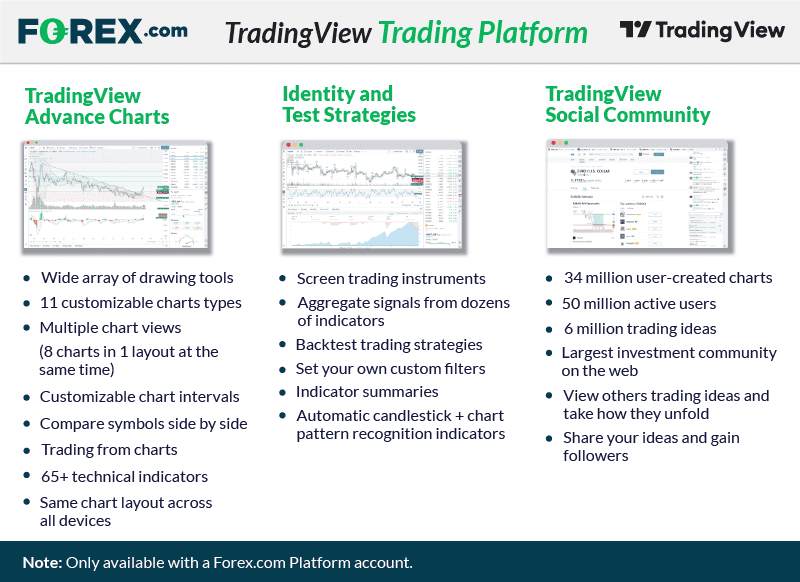

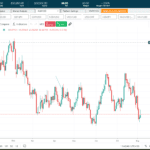

TradingView

As a FOREX.com client, you have the benefit of TradingView charts integrated into the platform. TradingView is a powerful charting platform that gives you access to useful trading tools for further technical analysis of the markets.

Having TradingView charts powering FOREX.com’s platform not only means you get access to more charting tools, it’s also easy-to-use, adding to a smooth trading experience.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

Is FOREX.com Safe?

FOREX.comhas a trust score 95, from its regulation, reputation, and reviews.

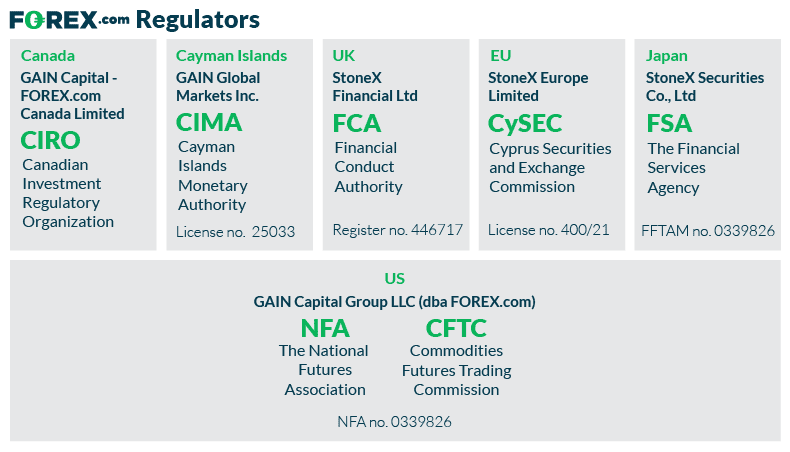

1. Regulation

As a sign of trust, FOREX.com is regulated in multiple jurisdictions all over the world. These regions include Europe, Canada, the UK and, of course, the U.S. A large reason for such a strong presence globally is FOREX.com’s parent company, StoneX Group Inc., a publicly traded company.

What this all means is that FOREX.com is a reputable and trusted brand, all over the world. In our own assessment, FOREX.com scores highly with a 9.5/10 for trust.

As one of the oldest forex brokers, FOREX.com is also one of the most trusted, especially given how many jurisdictions the broker offers trading services in.

| FOREX.com Safety | Regulator |

|---|---|

| Tier-1 | FCA CIRO NFA/CFTC CySEC |

| Tier-2 | JFSA |

| Tier-3 | CIMA |

2. Reputation

FOREX.com has been around since 1999, with headquarters in New Jersey, USA. Despite its premium domain name, Forex.com shows surprisingly moderate search visibility. With approximately 22,200 monthly Google searches, it ranks as the 36th most popular forex broker based on our analysis of 65 brokers.

However, its web traffic tells a different story, with Similarweb reporting 1,779,000 global visits in February 2024, placing it as the 16th most visited broker—a significant discrepancy between search volume and actual site visits.

FOREX.com is operated by StoneX Group Inc. (NASDAQ: SNEX), a Fortune 100 company with a 100+ year track record. StoneX is a major financial services organization ranked #66 in the 2024 Fortune 500 list of the largest United States corporations by total revenue.

Through its various subsidiaries (including City Index), StoneX serves more than 54,000 commercial, institutional, and payments clients, along with more than 400,000 active retail accounts across more than 180 countries.

| Country | 2025 Monthly Searches |

|---|---|

| United States | 5,400 |

| India | 1,900 |

| Pakistan | 1,000 |

| Canada | 880 |

| United Kingdom | 590 |

| Nigeria | 590 |

| Germany | 480 |

| South Africa | 480 |

| Indonesia | 480 |

| Kenya | 480 |

| Japan | 390 |

| Turkey | 260 |

| United Arab Emirates | 260 |

| Bangladesh | 260 |

| France | 210 |

| Poland | 210 |

| Singapore | 170 |

| Malaysia | 170 |

| Philippines | 170 |

| Spain | 170 |

| Mexico | 170 |

| Australia | 140 |

| Thailand | 140 |

| Netherlands | 140 |

| Ghana | 140 |

| Saudi Arabia | 140 |

| Uganda | 140 |

| Ethiopia | 140 |

| Italy | 110 |

| Brazil | 110 |

| Vietnam | 110 |

| Hong Kong | 110 |

| Colombia | 110 |

| Tanzania | 110 |

| Uzbekistan | 110 |

| Sweden | 70 |

| Morocco | 70 |

| Dominican Republic | 70 |

| Switzerland | 50 |

| Egypt | 50 |

| Argentina | 50 |

| Algeria | 50 |

| Taiwan | 50 |

| Sri Lanka | 50 |

| Cambodia | 50 |

| Botswana | 50 |

| Peru | 50 |

| Austria | 40 |

| Ireland | 40 |

| Greece | 40 |

| Cyprus | 40 |

| Venezuela | 40 |

| New Zealand | 30 |

| Portugal | 30 |

| Chile | 30 |

| Ecuador | 30 |

| Mauritius | 30 |

| Bolivia | 20 |

| Jordan | 20 |

| Uruguay | 10 |

| Costa Rica | 10 |

| Mongolia | 10 |

| Panama | 10 |

5,400 1st | |

1,900 2nd | |

1,000 3rd | |

880 4th | |

590 5th | |

590 6th | |

480 7th | |

480 8th | |

480 9th | |

480 10th |

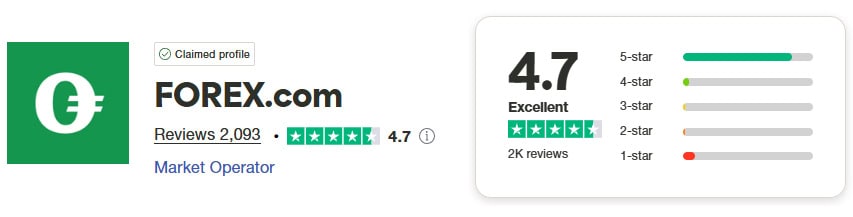

3. Reviews

FOREX.com has a TrustPilot score of 4.7 out of 5 from 2,093 users.

Deposit and Withdrawal

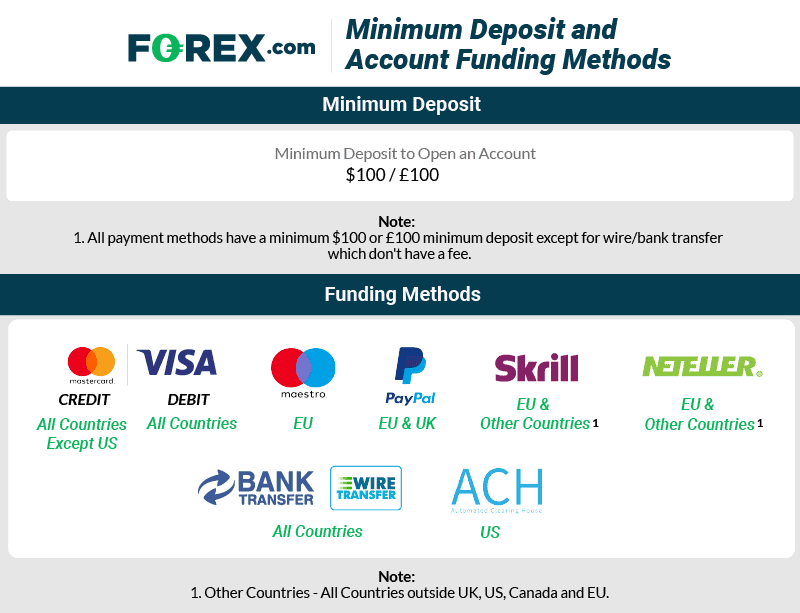

What is the minimum deposit at FOREX.com?

To open an account with FOREX.com, you only need to deposit $100 USD (or £100).

Deposit Options and Fees

Again, funding methods with FOREX.com vary according to the region you’re based. The traditional methods of bank wire/transfer and Visa debit are accepted by all countries. Digital wallet providers such as Skrill and Neteller are only accepted in Europe and selected countries. PayPal, on the other hand, is available in both the UK and the EU. In the US, you cannot fund your account with credit cards but debit cards will be accepted.

In the US, the following funding methods are available:

| Funding Method | Currency | Min/Max |

|---|---|---|

| Debit Card (Visa, MasterCard) | USD, GBP, EUR | $100/$10,000 |

| Bank Transfer (ACH) | USD | $100/$10,000 |

| Wire Transfer | No min/max |

In Canada the following funding options are possible:

| Funding Method | Currency | Min/Max |

|---|---|---|

| Debit Card (Visa) | $100 | |

| Wire Transfer | No min/max |

In the UK the following funding methods are available:

| Funding Method | Currency | Min/Max |

|---|---|---|

| Debit/Credit Card (Visa) | GBP, USD, EUR, CAD, JPY, CHF, AUD | £100/£99,999 |

| Bank Transfer (ACH) | USD | $100/$10,000 |

| Wire Transfer | No min/max |

Your account currency can be one of the following: United States Dollar (USD), Euro (EUR) and Great British Pound (GBP).

In Europe you can choose from the following funding methods and account base currency options:

| Funding Method | Currency | Min/Max |

|---|---|---|

Debit/Credit Card (Visa, Mastercard, Maestro) | GBP, USD, EUR, CAD, JPY, CHF, AUD | £100/£99,999 |

| Bank Transfer | GBP, USD, EUR, CAD, JPY, CHF, AUD | |

| Skrill | USD, EUR and GBP | $100/$10,000 |

| NETELLER | USD, EUR and GBP | $100/$10,000 |

| PayPal | EUR | €100/€10,000 |

Withdrawal Options and Fees

Funding methods with FOREX.com emerging markets (ie. outside Europe, UK, Canada, The US and Singapore)

| Funding Method | Currency | Min/Max |

|---|---|---|

| Debit/Credit Card (Visa) | USD, EUR and GBP | $100/$10,000 |

| Wire/Bank Transfer | USD, EUR and GBP | |

| Skrill | USD, EUR and GBP | $100/$10,000 |

| NETELLER | USD, EUR and GBP | $100/$10,000 |

Ease To Open An Account

We opened an account with FOREX.com in the U.S. to test out the Account Opening experience for ourselves.

We’ve listed the process, step-by-step below:

Step 1: Select a platform

To begin, you must select a trading platform, either FOREX.com’s proprietary software or MetaTrader 4.

Step 2: Select a Product

Next, you must choose what account (FOREX.com call it a product, but it is an account) you’d like. For U.S. clients, you can choose either the Spread-Only or Raw Pricing account.

Step 3: Account Information

Then comes the account information, which includes basic personal details as well as your home address.

Step 4: Home Address

In addition to your home address, you’ll have to provide your identification and citizenship details. If you are a U.S. citizen, you’ll need to provide your social security number. Otherwise, if you are not a U.S. citizen, you’ll have to provide your ITIN (Individual Taxpayer Identification Number).

Step 5: Financial Details

Next, FOREX.com asks you for your basic financial details, which aren’t too intrusive. Key information required includes your annual income, employment status and trading experience.

Step 6: Verify Personal Information

After that, you’ll have to verify your personal information. This is simply to go over the information you’ve provided and ensure it is all accurate.

Step 8: Review Agreements

Once you ensure all your personal information is accurate, you’ll have to review FOREX.com’s customer agreement, which includes agreeing to IRS Tax requirements.

Step 8: Processing Your Application

FOREX.com will then briefly process your application.

Step 9: Account Verification

Once your application is processed, you’ll have to upload 3 documents to properly verify your account.

Step 10: Upload Documents

These 3 documents include a proof of identity, proof of address and proof of social security number. You’ll have to make sure each document meets the specific requirements that FOREX.com stipulate.

These three documents can be uploaded via your MyAccount portal using the username and password you created on the application. You cannot fund your account until this is provided.

Product Range

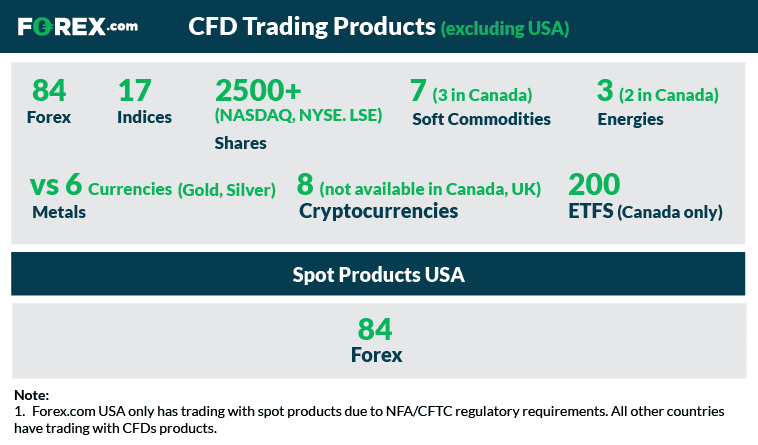

Before tackling the products FOREX.com offers, we think it important to emphasise that the brokers offerings do differ between regions. In the US, as we’ve mentioned a few times, you can only trade using spot products, all other countries have CFDs products.

CFDs

While only Forex spot pairs are available in the US, some 5,500+ CFD are available for all clients outside the US.

With 84 Forex pairs available in all regions they serve, the Forex offering is the broker’s strong suit. Most brokers only offer 40 to 65 pairs so FOREX.com does have one of the larger ranges of pairs we have covered

Outside of the U.S., such as in Canada, the UK and the EU the 5,500 CFD products are also available for trading. This range includes Shares, Indices, commodities, Best Brokers for Gold CFD Trading and if you are in Canada ETFs.

Overall, while we think the amount of forex products (and shares) is impressive, there are definitely brokers out there with better product ranges.

The products and services available to you at FOREX.com will depend on your location, and on which of its regulated entities holds your account.

Leverage

While FOREX.com don’t make it that clear, the broker uses Margin Trading in place of leverage. This may sound a little confusing but margin and leverage are basically the same thing.

As an example, if you have leverage of 50:1, that would equate to 2% leverage. So to place a trade of $1M USD/CAD, you’d only need $2000 to open that position.

In FOREX.com’s case, they use step margin which basically means the higher the trade size, the more margin is required to open that position.

Most of the margin requirements range from 3-5%, especially for major forex pairs. Again, it’s important to be wary of trading with higher volumes as the margin size could go up.

Step margin is not, however, present in the case of MT4 and MT5.

Overall, we like FOREX.com’s use of step margin as trading with high leverage (or low margin) is risky as you could incur significant losses. It’s easy to get carried away, trading large volumes with little actual capital so having a step margin in place is a good safeguard. Learn more about high leverage forex brokers and their various approaches to margin and risk management.

Customer Service

FOREX.com offers a decent coverage of customer support, from email, to phone to a chat bot. You can contact the support staff 24 hours a day via the chat bot, although you have to go through a few prompts before being transferred to a real person. We found the support staff knowledgeable and helpful, with relatively quick response times.

While support is available 24 hours a day, this is only between 3pm on Sunday (GMT) and 10pm Friday (GMT). As such, you won’t be able to speak with anyone on Saturday. While this is a slight downside, it’s wider coverage than a lot of brokers offer.

When emailing, we found most queries were addressed within 24 hours which is fairly standard. If your query is fairly typical, there is also a FAQ section to cover most major topics.

Lastly, for those that don’t speak English, support is also available in Spanish, Portuguese, German, Chinese, Arabic, Polish, Russian, Hindi and Japanese.

Research and Education

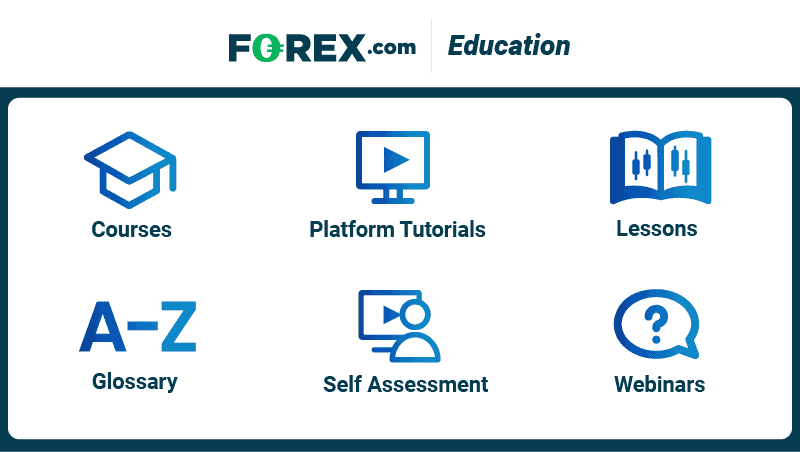

FOREX.com offers solid educational online resources, suited for beginners and experienced traders alike. This is separated out into education (courses, lessons and tutorials), news and analysis and webinars.

We particularly liked the courses that are split into beginner, intermediate and advanced for all levels of trader. There are also platform tutorials, which is particularly useful for newbies or even those wanting a good overview of FOREX.com’s trading platforms.

The lessons section includes almost a hundred written articles which, like the courses, are organized by experience level, from beginner to intermediate, and advanced users. I found these to be highly insightful and useful for general market analysis.

For more current market analysis, there are a range of research articles and trade ideas from the research team.

Lastly, there are a series of webinars, both old and new that you can register for. Each of these also specify how much trading experience is recommended for the webinar.

Final Verdict on FOREX.com

Overall, we think FOREX.com is a solid forex broker, offering an excellent proprietary platform, a wide range of forex products and rebates for high volume trading.

Most clients with FOREX.com will be directed to their Spread-Only account which offers good spreads, just make sure you choose the right trading platform for your needs.

And FOREX.com is one of the few brokers to offer commission based trading in the US and Canada through its RAW Pricing account. This account can result in some good savings given spreads are far lower than with a Spread-Only account. Unfortunately, there is no RAW Pricing account in the UK.

Last we should note that if you are outside the UK and EU, further savings are available with their Active Trader rebate program.

We thought the FOREX.com product range was solid. We especially liked their range of 84 forex pairs to trade. This is far above the industry average for forex brokers, who offer between 40-60 pairs.

Platform-wise, we found trading with FOREX.com’s platform to be smooth and user-friendly, with excellent charting tools. FOREX.com’s additional platform, TradingView, is a nice add-on to enhance your trading experience.

We also found opening an account with FOREX.com a smooth process and approved relatively quickly.

Lastly, FOREX.com is a trusted broker, regulated in multiple jurisdictions, which is a big tick for us. This proves the broker is committed to a safe trading environment for everyone.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

FOREX.com FAQs

Is FOREX.com a regulated broker?

Yes, FOREX.com is regulated by several financial authorities, including the FCA in the UK, the NFA in the US, and other global regulators. This provides traders with added security and trust in their trading operations.

What trading platforms does FOREX.com offer?

FOREX.com offers its own proprietary platform as well as MetaTrader 4 (MT4). Both platforms are user-friendly and support a wide range of tools for technical and fundamental analysis.

What are the account types available at FOREX.com?

FOREX.com offers multiple account types, including Spread-Only (Standard) and Commission (RAW Pricing). Each account type is designed to suit different trading needs, such as lower spreads or access to deep liquidity for larger trades.

Does FOREX.com offer educational resources?

FOREX.com provides a wide range of educational materials, including webinars, market analysis, and tutorials. These resources are valuable for both beginners and experienced traders looking to enhance their strategies.

What are the deposit and withdrawal methods at FOREX.com?

FOREX.com supports various deposit and withdrawal methods, including bank transfers, credit cards, and e-wallets like PayPal. Most transactions are processed quickly, though bank transfers may take longer depending on your location.

Compare FOREX.com Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

76%-78% of retail CFD accounts lose money.

Visit Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

What is the minimum deposit for Forex.com?

The minimum deposit to open an account with Forex.com is $100.

Does Forex.com have guaranteed stop-loss?

Yes for all clients except those in Canada and the USA.