Fusion Markets vs Admirals 2024

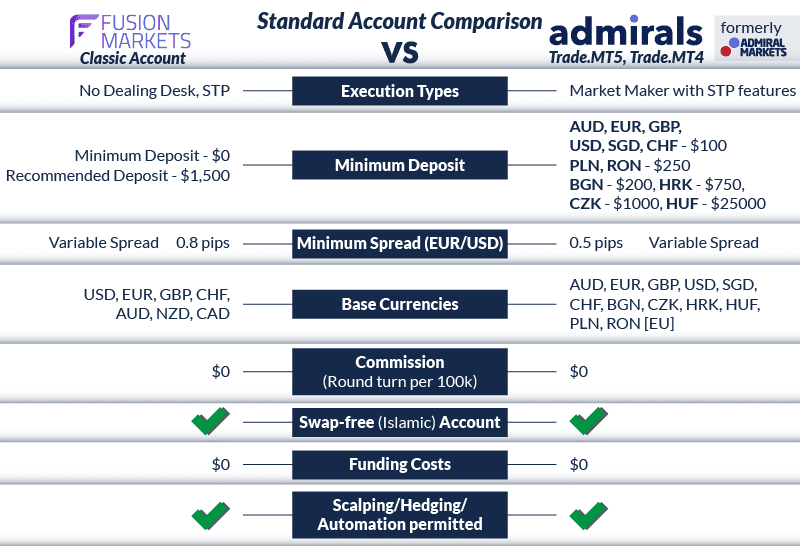

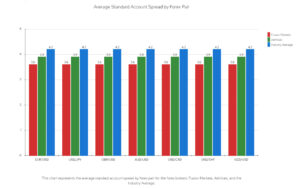

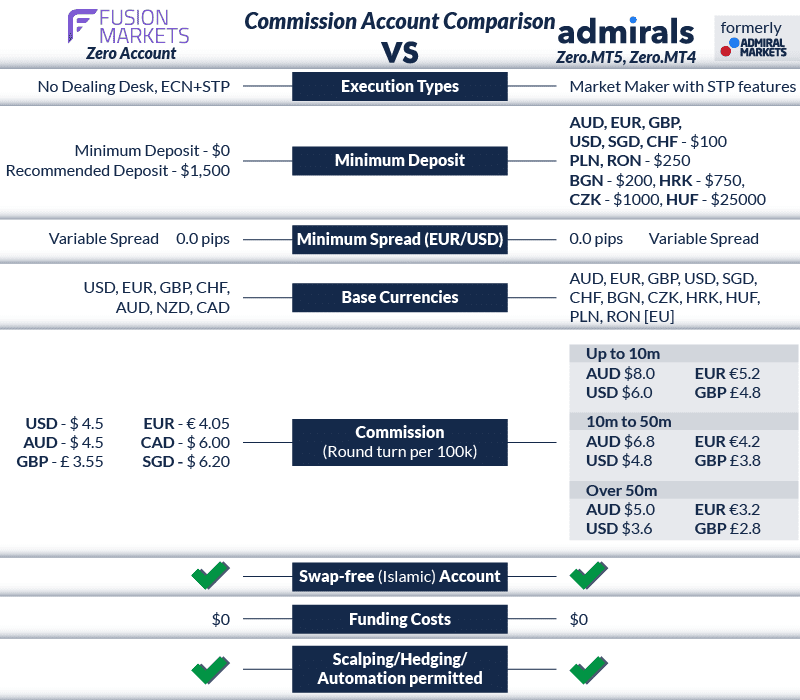

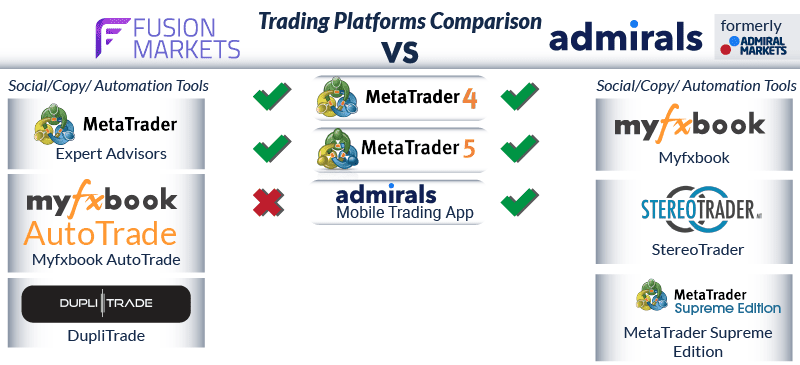

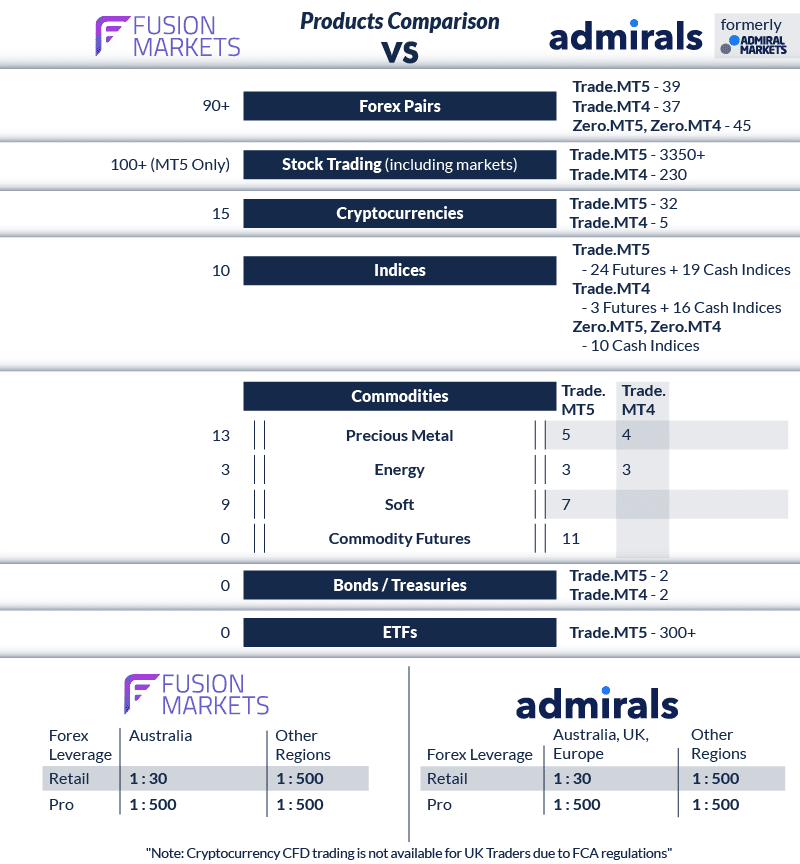

This Fusion Markets and Admirals forex broker review found both offer low commissions and tight spreads. Both have MetaTrader 4 trading platforms, with Fusion having 90 forex pairs and Admirals over 2000 stocks.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert