HFM Review Of 2026

Our HFM (HF Markets) review looks at the key features this Forex broker has to offer. With ECN-like trading conditions, MT4 and MT5 trading platforms, and over 50 forex pairs, see what we say about the broker.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

HFM Summary

| 🗺️ Country Regulation | UK (FCA), Europe (CySEC), Dubai (DFSA) |

| 📊 Trading Platforms | MT4, MT5 Platform and HFM App |

| 💰 Trading Fees | Medium Spreads |

| 💰 Minimum Deposit | $0 |

| 🎮 Demo Account | Yes |

| 🛍️ Instruments Offered | CFDs (Forex, Metals, Energies, Crypto, Stocks, Bonds , ETFs) |

| 💳 Funding Methods | Debit Card, Wire Transfer |

Why Choose HFM

We think HFM’s (also called HF Markets and formerly Hot Forex) offering is typical of a broker using an electronic communication network (ECN) with no dealing desk execution model. However, they do have some extra offerings of interest.

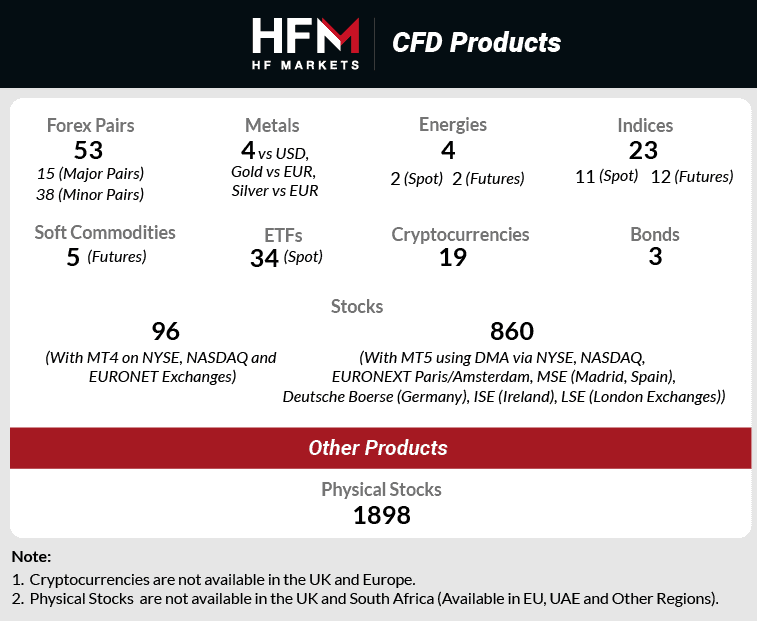

HFM has the usual range of CFD trading instruments such as Forex, cryptos, commodities, stocks and indices. Perhaps most interesting was the ability to purchase the physical stocks (i.e. the underlying instrument) but this feature is not available for UK and South African clients. Other good features we think are worth noting include being regulated in 6 different countries or regions.

HFM Pros and Cons

- Tight spreads for the major currency pairs

- Low minimum deposits for most trading accounts

- High leverage offered in certain jurisdictions

- Global analyst team producing large amounts of research

- Limited tradable products and markets

- Uncompetitive spreads on cross-currency pairs

- Unimpressive customer support facilities

- Less than desirable trader education for advanced topics

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

HFM offers two pricing options, a commission account and a non-commission account. Using in-house data collection at CompareForexBrokers, we got an insight into the size of the spreads offered by HFM. We take published spreads from the broker’s website and compare them with other brokers. Here is a sample of our findings vs other brokers.

1. Raw Account Spreads

When we look at HFM’s published average spreads on their website for the commission account (often called ECN or RAW) and compare them with the spreads other brokers advertise we can see that HFM is good for some currency pairs and weaker for other pairs.

ECN Broker Spreads | |||||

|---|---|---|---|---|---|

| 0.10 | 0.40 | 0.60 | 0.40 | 0.80 |

| 0.10 | 0.30 | 0.40 | 0.20 | 0.10 |

| 0.02 | 0.14 | 0.25 | 0.27 | 0.03 |

| 0.10 | 0.19 | 0.38 | N/A | 0.21 |

| 0.00 | 0.10 | 0.20 | 0.70 | 0.20 |

| 0.50 | 0.49 | 1.04 | 0.85 | 0.58 |

| 0.10 | 0.60 | 0.60 | 0.60 | 0.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

At the time of writing, spreads on HFM commission accounts were tight on major currency pairs, but wide and expensive once you step into currency crosses like the EUR/GBP. It does appear you get good value provided you use the right currency pair.

| Raw Account Spreads | HF Markets | Average Spread |

|---|---|---|

| Overall | 0.61 | 0.74 |

| EUR/USD | 0.1 | 0.21 |

| USD/JPY | 0.4 | 0.39 |

| GBP/USD | 0.4 | 0.48 |

| AUD/USD | 0.8 | 0.39 |

| USD/CAD | 0.6 | 0.53 |

| EUR/GBP | 0.4 | 0.55 |

| EUR/JPY | 0.8 | 0.74 |

| AUD/JPY | 1.0 | 1.07 |

| USD/SGD | 1.0 | 2.34 |

2. Raw Account Commission Rate

HFM’s commission account charges a commission of $3.00 per side for USD accounts. As an aside, while we haven’t physically tested the spreads ourselves with HF Markets, we have tested RAW spreads with other brokers like Pepperstone, IC Markets, and Fusion Markets. Our results are really interesting and overall we can say there are brokers with spreads that are lower (at least according to our results).

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| HF Markets Commission Rate | $3.00 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

HFM call its no-commission account a Premium account. In the sample below, we can see that HFM isn’t the best choice for spread-only trading given most other brokers perform better.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| HF Markets Average Spread | 1.4 | 1.8 | 1.6 | 1.6 | 1.9 | 1.4 | 2.1 | 2.4 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

We collected data from the websites of 50 different brokers so we think this sample size provides a fair base to calculate industry averages.

For the EUR/USD pair, HFM has a spread of 1.4 pips, which is higher than the industry average of 1.2. The GBP/USD pair has a spread of 1.6 for HFM, compared to the industry average of 1.6. The AUD/JPY pair sees a spread of 2.4 for HFM, while the industry average is 2.1.

While the numbers above use the spreads brokers publish on their website, Ross Collins from our team tested the Standard Account Spreads for 20 brokers to see how they performed. When we compare the published results we listed above with the results for our Standard Account testing for other brokers, the conclusion we make is that HFM performs poorly with their Standard account spreads.

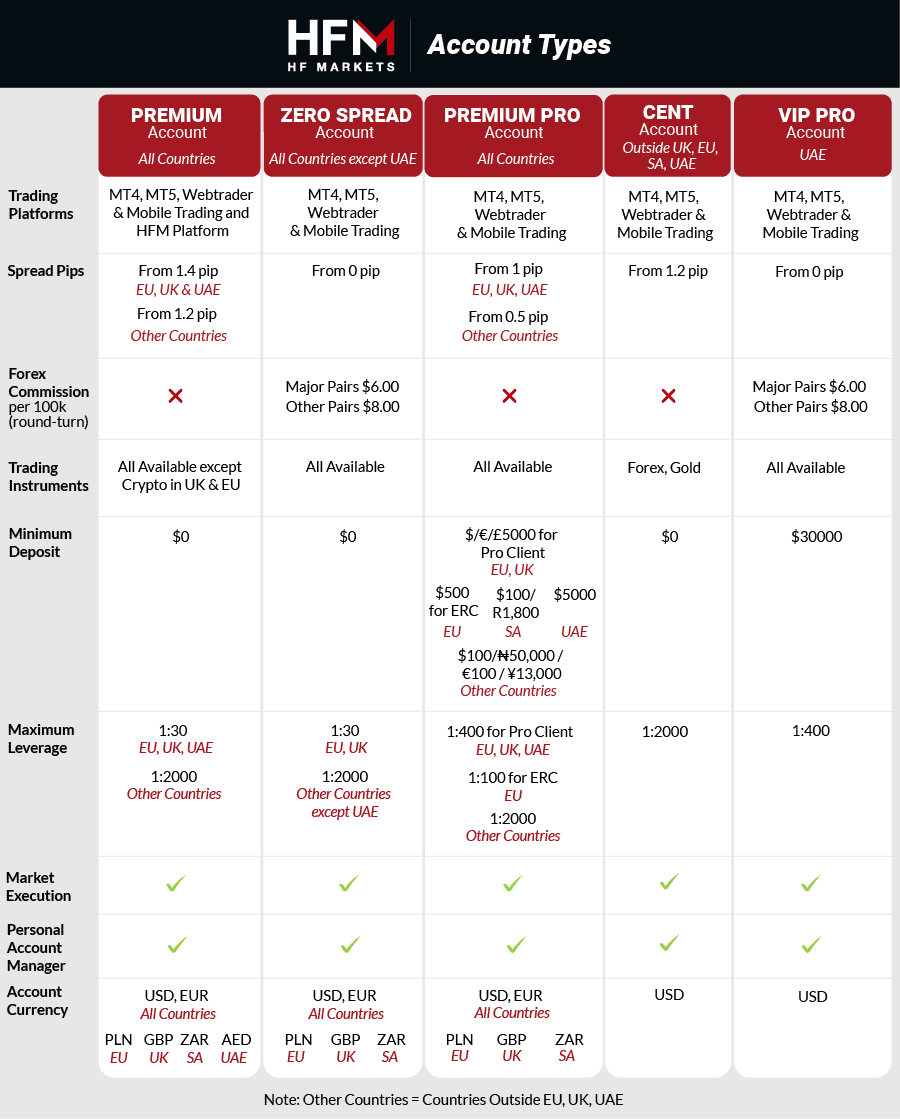

Accounts

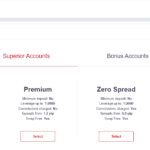

HFMarkets offers five different account types. Three are aimed at beginner to intermediate traders, with a separate pro account designed for more experienced traders. Just note that some accounts are only available in certain countries.

HFM account types are called:

- Cent Account: A type of micro account that allows traders to trade with ultra-small cent lots, which equal 0.01 of a standard lot size. With margin requirements of as little as 10 U.S. cents, the cent account is aimed at traders from low-income nations, who often have smaller trading capital.

- Zero Spread Account: This is positioned to be a zero spread account that has ultra-low spreads from zero pips, but where you have to pay a commission to trade. This type of account is a RAW, STP or ECN style account that is suited for highly active day traders and scalpers.

- Premium Account. An account for the majority of traders who are looking for reasonably tight spreads while not having to pay commissions. If you’re just starting, this is probably the account type for you.

- Premium Pro Account: Designed for traders who want to step up from the premium account. The HFM pro account offers ultra-low spreads and zero commissions but has a higher minimum deposit amount.

- VIP Pro Account: Only available for residents of the UAE, this account is essentially a copy of the zero spread account but has a minimum account size of $30,000.

All accounts come with a personal account manager, which is just a fancy word for a customer service agent. Don’t expect any hotshot trading advice from your account manager.

Advanced Account Types With HFM

HFM offers two interesting types of accounts which differ from the traditional trader and retail investor accounts.

These are the HFCopy account and the PAMM account.

A HFCopy account is a copy trading account, which allows you to sign up as either a strategy provider or a follower. This account allows you to use the HFCopy app which uses the MQL5 MetaTrader Signal network for social trading.

As a strategy provider, you can trade your strategy and earn additional revenue by allowing people to copy your trades. As a follower, you can deposit funds and elect to automatically copy the trades of a strategy provider.

This can be a good option if you have a very promising strategy, or if you’re able to find another trader whose strategy you’d like to follow.

A PAMM account takes copy trading to a more advanced level and allows you to sign up as a fund manager, where you can manage funds for investors at a pre-agreed percentage of profits.

This type of account is certainly for more advanced traders, and if you’re just getting started in the markets, could be a good thing to strive for in the future.

4. Swap-Free Account Fees

The swap-free account at HFM is available to all clients, and they also provide trading conditions for those who adhere to Sharia law.

Verdict on HFM Spreads

Of the accounts HFM offer, we think their no-commission accounts are a better choice, that said, we believe there are better options among lowest spread forex brokers to consider.

Trading Platforms

HFM offers you three trading platforms: MetaQuotes developed MetaTrader4 and MetaTrader5 along with the firm’s in-house HFM Platform for iOS and Android.

| Trading Plaform | Available With HF Markets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

MT4 is the industry-standard workhorse software of the retail forex industry and is offered by many brokers so is one we are very familiar with. We tested the platform with HFM and except for some personalised branding, MT4 with HFM has all the features we expect to see.

The team at CompareForexBrokers have long liked the ultra-intuitive, feature-rich experience that allows you to quickly analyse markets and enter and exit trades with a few mouse clicks. With this in mind, it’s not hard to see why MT4 is popular, finding trading opportunities and executing your trades is just really straightforward when using this platform.

MT4 also comes with 23 drawing tools to help identify support and resistance levels, or trend lines. We found making use of these very easy, just click on the drawing tool and select the points on the chart you’d like to draw a line through.

If you wish to automate your trading or build your custom indicators, MT4 allows you to build Expert Advisors (EAs) to do these. Being able to code is an advantage for building these EAs but if not, we found you can find many free or paid ones in the MT4 marketplace.

All-in-all, there is a good reason why in our mind MT4 is far and away the most popular trading platform for retail forex traders. If you want a program that has the fundamental features you need to trade without superfluous features that some competing platforms tend to have, then MT4 is an excellent choice. Just know that it is not the best option for stock trading, for this, you are better off using its more powerful successor MetaTrader 5.

MetaTrader 5

MT5 like MT4 is another platform that is commonly available with Forex brokers and one we are very familiar with. Given that MT5 is an updated version of MetaTrader4, with more advanced features and is still receiving new development and support from Metaquotes, we tend to recommend this platform to most traders. View the Best MT5 Brokers for more info.

Features MT5 offers over MT4 include the ability to trade stocks, more order types (6 vs 4), additional technical indicators (38 vs 30) and analytic tools (44 vs 23). You will also find 21 timeframes vs 9, a Depth of market indicator and even 64-bit (vs 32-bit)processing which makes MT5 a superior option for backtesting.

Generally speaking, we think the only real reasons to stick with MT4 are if you are already comfortable with MT4 or if you desire to use EAs built for MT4 since MT5 uses a different programming language).

Similar to its predecessor, MT5 runs on Windows and Mac desktops, Android, iPhones, and iPads.

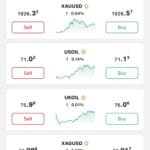

Mobile Trading Apps

HFM Trading App is the in-house app developed by HFM allowing traders to trade from their smartphones. The main benefit of using this app is that logging into your trading account is easier since it can be done with your HFM credentials. You also will not need to select the MT4 or MT5 server you wish to use and lastly funding your account can be done directly via the app.

The features found in the app are a bit more basic compared to the MT4 and MT5 apps and much more basic than the MT4 and MT5 webtrader and desktop versions.

Is HFM Safe?

HF Markets has a trust score of 68 out of 100. We gave them this score from evaluating their regulation, reputation, and reviews.

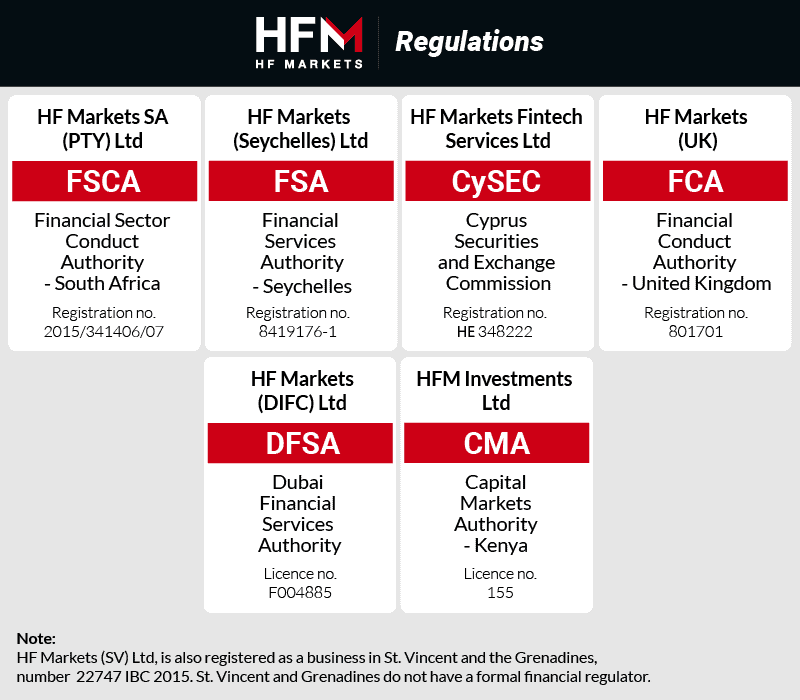

1. Regulation

The HF Markets Group is regulated by the Financial Conduct Authority (FCA) in the UK, the Dubai Financial Services Authority(DFSA) in Dubai, the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Authority (FSA) in Seychelles, CySEC in Cyprus, and the Capital Markets Authority (CMA) in Kenya.

| HFM Safety | Regulator |

|---|---|

| Tier-1 | CySEC FCA |

| Tier-2 | DFSA |

| Tier-3 | FSCA FSA-S CMA |

The safety of a forex broker has a lot to do with what government regulator is issuing the company a trading licence.

Client funds are segregated, and held by major global banks, in compliance with the regulations of government authorities.

The broker also offers negative balance protection, which protects you against going into debt in times of a losing trading position.

HFM has also taken out civil liability insurance up to €5,000,000, to protect client funds against broker error, negligence, fraud, and other risks.

2. Reputation

HF Markets Ltd. (formerly HotForex) has been registered in St.Vincent & the Grenadine since 2010. The broker maintains a solid presence in the online trading space. With approximately 201,000 monthly Google searches, it ranks as the 14th most popular forex broker among the 65 brokers analyzed. Web traffic data shows a similar positioning, with Similarweb reporting 2,103,000 global visits in August 2025, placing HFM as the 16th most visited broker.

They built a substantial global footprint across multiple regulatory jurisdictions. While the broker doesn’t publicly disclose its exact client numbers, industry estimates suggest it serves hundreds of thousands of traders across more than 200 countries and territories. HFM processes millions of trades monthly with a reported monthly trading volume exceeding $100 billion, reflecting its established position in the global forex brokerage landscape despite not ranking among the top 10 brokers by search visibility.

| Country | 2025 Monthly Searches |

|---|---|

| Indonesia | 60,500 |

| United States | 27,100 |

| Malaysia | 27,100 |

| Thailand | 12,100 |

| South Africa | 9,900 |

| Japan | 9,900 |

| Kenya | 8,100 |

| Nigeria | 6,600 |

| India | 5,400 |

| United Kingdom | 4,400 |

| Singapore | 4,400 |

| Canada | 3,600 |

| Pakistan | 2,900 |

| Australia | 2,900 |

| Vietnam | 2,400 |

| Philippines | 1,900 |

| Germany | 1,900 |

| Tanzania | 1,000 |

| Egypt | 880 |

| Uganda | 880 |

| Turkey | 880 |

| Bangladesh | 720 |

| Brazil | 720 |

| Colombia | 720 |

| Mexico | 720 |

| France | 720 |

| Saudi Arabia | 590 |

| Ghana | 590 |

| Netherlands | 590 |

| United Arab Emirates | 480 |

| Cyprus | 480 |

| Argentina | 390 |

| Cambodia | 390 |

| Hong Kong | 390 |

| Spain | 390 |

| Taiwan | 390 |

| Poland | 390 |

| Algeria | 320 |

| Venezuela | 320 |

| Peru | 320 |

| Italy | 320 |

| Botswana | 320 |

| Greece | 320 |

| New Zealand | 320 |

| Morocco | 210 |

| Dominican Republic | 210 |

| Switzerland | 210 |

| Sri Lanka | 170 |

| Ecuador | 170 |

| Sweden | 170 |

| Ireland | 170 |

| Mauritius | 170 |

| Chile | 140 |

| Austria | 140 |

| Ethiopia | 110 |

| Bolivia | 110 |

| Portugal | 110 |

| Uzbekistan | 90 |

| Jordan | 70 |

| Uruguay | 50 |

| Costa Rica | 40 |

| Panama | 30 |

| Mongolia | 20 |

60,500 1st | |

27,100 2nd | |

27,100 3rd | |

12,100 4th | |

9,900 5th | |

9,900 6th | |

8,100 7th | |

6,600 8th | |

5,400 9th | |

4,400 10th |

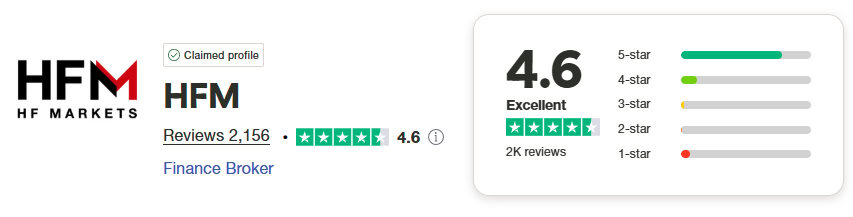

3. Reviews

HFM has a TrustPilot score of 4.6/5.0 from 2,156 reviews, which is considered good in our opinion.

Verdict on HFM’s Trustworthiness

Overall, we’d give HFM a 6/10 broker trust or safety rating.

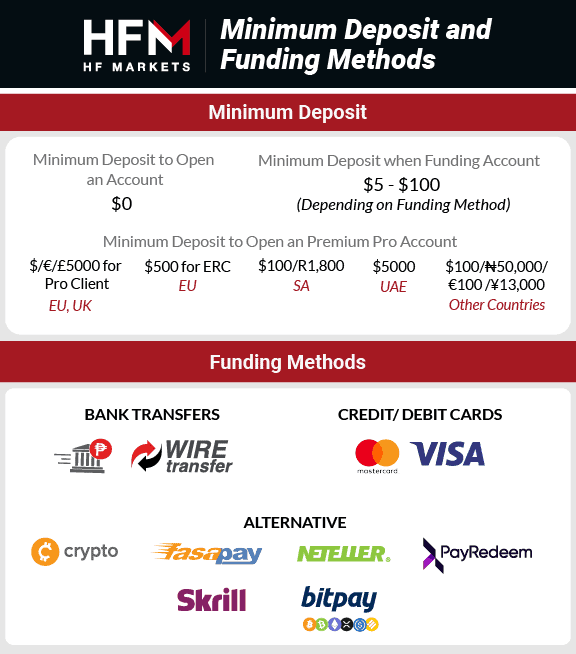

Deposit And Withdrawal

HFM makes depositing pretty easy with its minimum deposit and funding options.

What is the minimum deposit at HFM?

The broker does not have a minimum deposit requirement to open cent, zero, and premium accounts. Meanwhile, the Pro account requires a minimum deposit of $100 or a similar amount in your base currency.

Deposit Options And Fees

In terms of transferring your funds from your bank account into your HFM account, there are several options (some are better than others). Each has a differing minimum deposit amount, ranging from $5 to $100.

| Funding Option | Min Deposit Amount | Max Deposit Amount | Deposit Time | Deposit Fees |

|---|---|---|---|---|

| Bank Transfer | $100 | Unlimited | 2 to 7 Business Days | No Fees for deposits over $100 |

| Credit/Debit Cards | $5 | $10,000 | Up to 10 minutes | No Fees |

| FasaPay | $5 | $5,000 | Instant | No Fees |

| Neteller | $5 | $10,000 | Up to 10 minutes | No Fees |

| Skrill | $10 | $10,000 | Up to 10 minutes | No Fees |

| BitPay | $5 | $10,000 | Up to 10 minutes | No Fees |

| PayRedeem | $10 | Depends on your PayRedeem Tier | Up to 10 minutes | Fees by Payment Processor are not covered |

| Crypto | $30 | $10,000 | Instant | No Fees |

We must warn you, that some of the digital wallets have hefty fees and currency conversion spreads. That said, this is not a charge from the broker itself. Most traders should be electing to use wire transfers or credit/debit cards to deposit, depending on how much they’re transferring.

Withdrawal Options And Fees

With HFM, there are a similar amount of options to get your funds out of your HFM account as there are to deposit.

The simplest option would be a straight wire transfer, which will generally take 2 to 10 business days.

| Withdrawal Option | Min Withdrawal Amount | Withdrawal Time | Withdrawal Fees |

|---|---|---|---|

| Bank Transfer | $10-100 | 2 to 10 business days, depending on your correspondent bank | None |

| Credit/Debit Cards | $5 | 2 to 10 business days, depending on your correspondent bank | None |

| FasaPay | $5 | Instant | None |

| Neteller | $5 | Instant | None |

| Skrill | $5 | Instant | None |

| BitPay | $5 | Up to 2 business days | None |

| PayRedeem | $100 | Up to 10 minutes | None |

| Crypto | $10 | Up to 24 hours | None |

| WebMoney | $5 | Up to 10 minutes | None |

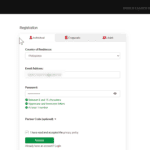

Ease To Open An Account

Opening an account with HFMarkets is a very straightforward, streamlined process.

The first step involves opening an account, using your email address and your desired password.

You’ll need to show your country of residence, as certain countries are only allowed certain accounts.

After you’ve opened your account, it’s time to verify your email address. This is a simple step to ensure HFMarkets that you’re a real person, providing real details. It only takes a minute.

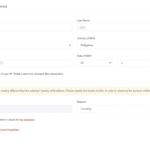

Next, you’ll need to give further personal details. These include your full name, gender, country of birth, phone number and the base currency you’d like your account to be held in.

When you get to the next step, it’s time to choose which account type you’d like to open. It’s important to pick an account type that matches your trading experience and strategy, so make sure to read the above section on account types.

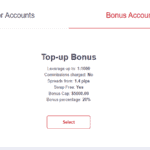

Next up, I was offered a top-up bonus, which is an incentive from HFM to deposit funds into the account. The bonus works by giving me some extra capital when I deposit, and I’m then required to turn over enough volume before I can withdraw it.

Not every account or every country is offered the same bonus (or offered one at all), so it’s important to read the terms & conditions if you’re considering taking up a bonus offer.

Clicking through to the next step, we have the account open. All that’s left to do is load our chosen trading platform and make a deposit. All up, a quick and easy process.

Or, you can choose to withdraw to a crypto account, or e-wallet such as Skrill or BitPay for a much quicker withdrawal. But, once again, these could come with a bunch of fees to pay.

Verdict on HFM Funding

With several options for deposits and withdrawals, and low minimum amounts, HF Markets scores high in this category.

Product Range

HFM offers a total of 38 FX pairs, which is a decent amount of currencies, but less than some other major brokers. Brokers like Pepperstone, IC Markets and Eightcap have about 60-65 currency pairs, while CMC Market and IG have over 100 pairs. All that said, HFM do have the most popular traded pairs which is all most traders will need. See our full Pepperstone review for more information.

Metals

You can elect to trade the Best Brokers for Gold CFD Trading palladium, and platinum. In the case of gold and silver, you can trade them vs Euro in addition to USD.

Commodities

There are also energy commodity products, both spot contracts and futures contracts, which allow you to speculate on the price of crude and Brent oil. Soft commodities, such as cotton, cocoa, and sugar are also available.

Shares

Should shares CFD shares be your preferred trading instrument, HFM offers a total of 96 shares to choose from with MT4 and 846 with MT5. MT4 shares are derived from NYSE, NASDAQ and EURONEXT exchanges while MT5 also include stocks from exchanges in Spain, The UK, Germany, Ireland and the Netherlands. MT5 has more shares since it is designed to enable trading via decentralised exchanges.

A commission charge of USD 0.1% is applied with MT4 while it is 0.01 USD or 0.02 EUR per deal with MT5. Some brokers like FP Markets, IG, and TMGM allow you to choose from 1000s of global shares so HFM might not be the best choice if you like trading and require a variety of shares CFDs.

Physical Shares

Interestingly, HFM also offers 1800 physical shares but only for clients based in Europe, the UAE and other countries outside the UK and South Africa. There are no commission costs and you can even buy fractional shares for $5.

Indices

Another way to trade shares CFDs is with indices and ETFs. 23 indices and 34 ETFs covering US, European and Japanese markets are available.

If you have an insight on interest rates, or where the bond markets will move, you can trade contracts based on the Bund, Gilt, and U.S. Treasuries.

Verdict on HFM Trading Products

While some other brokers offer even more markets to trade, we think HFM has a good range of products overall. You won’t have to look too hard to find a market that’s moving.

Customer Service

With HFM, customer service is available 24 hours per day, five days per week through email, phone, and live support.

When testing out the live chat feature, I found it to be error-prone, and not particularly useful for getting helpful information quickly or efficiently.

Initially, when trying to reach support, I was met with a completely blank chat screen and then had to randomly message, asking for help.

When I did get a hold of a customer support agent, I had to suffer through slow responses and less-than-perfect comprehension of my questions.

For urgent technical support or inquiries, calling the company’s phone line would be a much quicker option, but be aware that international calling may be costly.

For inquiries of a less urgent nature, I found that sending an email often resulted in a timely, useful reply.

The HFM website states that the firm supports 27 different languages, which seems quite impressive, so if English isn’t your chosen language, HFM may be a good option for you.

Verdict on HFM Customer Support

All up, I rate HF Market’s customer service experience at a 5/10.

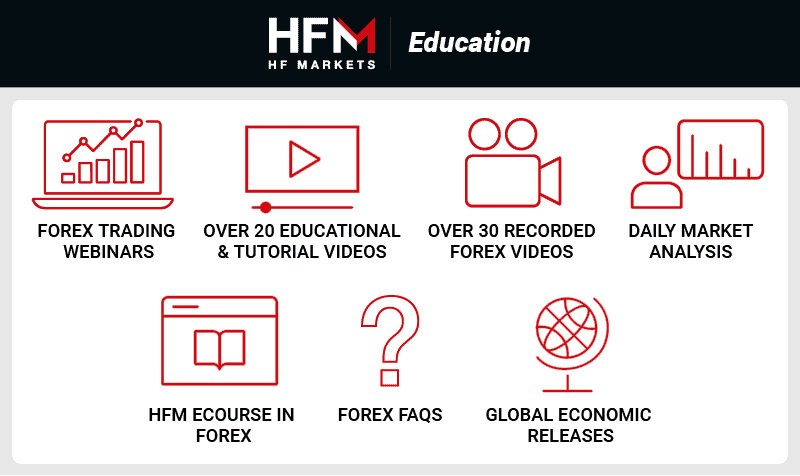

Research and Education

HFM offers a reasonably in-depth educational platform suited for reasonably new traders.

The lessons can be as simple as explaining basic market terms, and to advanced as learning how to build mathematical models to analyse and trade markets.

There are hours of webinars and recorded videos, as well as daily market analysis to keep you informed about current market movements.

There’s also an economic release calendar, which can be useful for knowing when to expect market volatility and changes in spread sizes.

All up, I wasn’t very impressed with the quality of education provided by HFM.

Sure, there’s plenty of content on how to enter an order, or telling you what a currency pair is and how many trillions of dollars are traded each day.

But, when it comes to developing trading skills that are going to mean the difference between profits and losses on your account, HFM isn’t going to help you get there.

You’d be better off purchasing a book on technical analysis, and perhaps another on trading risk management. Then put in some hours developing a back-tested trading strategy using techniques that make sense to you. We quite like the work of Davin Clarke

Overall, I can’t fault the HFM education resources, but make sure to take your own trading success into your hands, and educate yourself. It’s also a good idea to master your strategy on a demo account before switching to a live account.

Research

HFM also provides traders with a large amount of market research. This is comprised of numerous daily articles, and occasional webinars that are created by a team of analysts located around the globe.

I found the volume of research released by the analyst team to be more than sufficient for keeping most traders up to date with the latest market movements.

But, as a side note, no matter how great a broker’s research team is, you should always be formulating your trades and strategies using techniques that you’ve backtested and have found to be profitable for you.

Final Verdict On HFM

If you’re from the UK, Europe or the UAE, HFM is a highly regulated broker with a respectable amount of tradable products. If you’re Australian, you’ll need to find another broker, as HFM doesn’t offer their services to the land down under.

HFM is well suited for two types of traders in particular: beginner traders and traders who want a large amount of research.

Beginner traders will find it easy to deposit and withdraw from HFM and be able to trade with tiny amounts of capital.

For traders who are very news-driven and prefer fundamental analysis, the HFM research team produce a huge stream of research that should keep you busy and updated with what’s happening across the globe each day.

HFM FAQs

What is the Minimum Deposit at HFM?

There is no minimum deposit requirement at HF Markets Group. However, different payment channels require certain amounts ranging from $5 to $100.

What Demo Account Does HFM Offer?

HFM offers demo accounts across the MT4, MT5 and Webtrader platforms and for most of its trading account types. There is even a Demo Contest option available.

HFM demo accounts are easy to set up and come with live pricing, virtual account balances of up to $100,000 and unlimited usage.

Is HFM a Safe Broker?

HFM is a safe broker, considering they are regulated by top-tier financial authorities.

What Leverage Does HFM Offer?

The leverage that HFM offers you varies greatly, depending on where you’re located, whether you’re a retail or professional trader, and which products you choose to trade.

If you’re a retail trader in the UK, EU, and UAE, leverage on major FX pairs is subdued, at just 30:1. You’ll also be offered leverage on stocks at 5:1, major indices at 20:1 and commodities at 10:1.

The reason for these subdued levels of leverage is the regulatory bodies that govern brokerage firms in the UK, EU, and UAE have strict limits on how much leverage is allowed.

Who is HFM?

Formerly known as Hot Forex, HFM (HF Markets) is a forex and CFD broker that’s a good match for beginner to intermediate traders. Most features on offer are quite generic for typical no-dealing desk brokers. For example, trading via MetaTrader 4 and MetaTrader 5 trading platforms and a decent range of CFD trading products like Forex, cryptos, stocks, commodities and bonds.

Compare HF Markets Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert