Pepperstone Razor vs Standard Account

The key difference between Pepperstone’s Standard vs Razor accounts is fees. The Razor account has the lowest fees with raw spreads from 0.0 pips and a modest commission while the standard account has 1 pip markup and no commission.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Pepperstone Trading Accounts

Pepperstone Standard Account

Pepperstone Razor MetaTrader 4

Pepperstone Razor MetaTrader 5

EUR/USD Avg. Spread

Commission

EUR/USD Avg. Spread

USD/AUD Commission

EUR/USD Avg. Spread

USD/AUD Commission

MetaTrader 4

MetaTrader 5

MetaTrader 4

MetaTrader 5

MetaTrader Signals

Myfxbook (N/A in UK/Europe)

DupliTrade

Pelican (UK/Europe)

MetaTrader Signals

Myfxbook (N/A in UK/Europe)

DupliTrade

Pelican (UK/Europe)

MetaTrader Signals

Pelican (UK/Europe)

Yes

No

No

$0

$0

$0

Beginner Traders

Discretionary Traders

Low Volume Traders

Day Traders

ECN Style Trading

Cost Saving

Multi-Asset Trading

Stock CFD Trading

Day Traders

What Is The Difference Between The Standard Vs Razor Account?

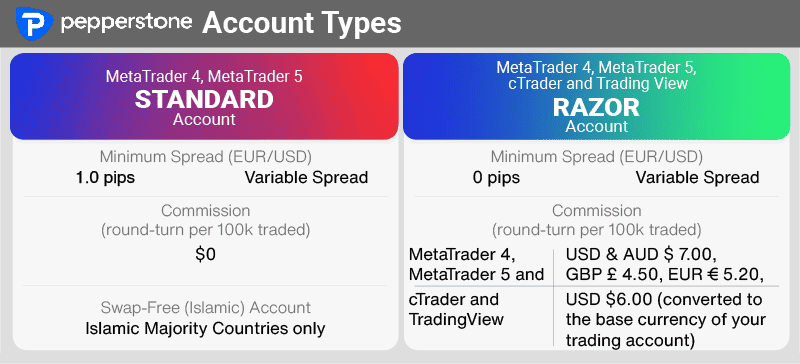

The fees are the only difference between the two accounts with the standard spread having spreads marked up one pip over the Razor account which instead has a commission added.

Our testing showed that the Razor account has the lowest fees and is the best option for traders[1]Finding From Live Spread Testing. Please note that the trading platform selected may limit which account type you can choose from.

Open Standard AccountOpen Razor Account

Below are the key features of the two Pepperstone trading accounts including from spreads to commission rates.

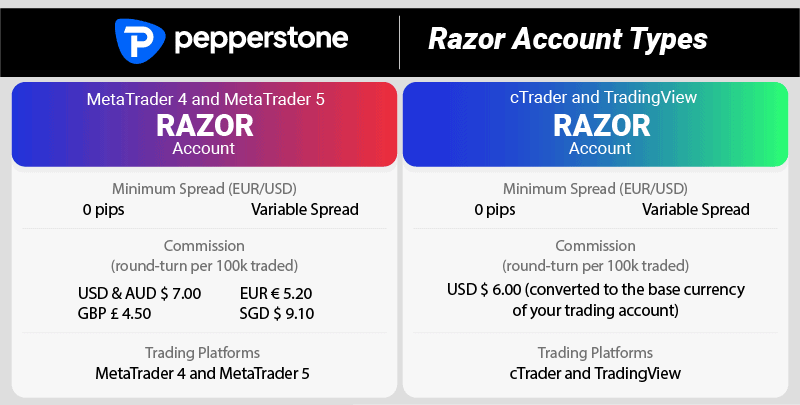

If using MetaTrader platforms, Pepperstone commission fees are AUD/USD 7.00 per standard lot (EUR 5.20, GBP 4.50) round-turn, per 100,000 lot. This account is best for traders wanting the lowest spreads, as well as algorithmic traders and scalpers.

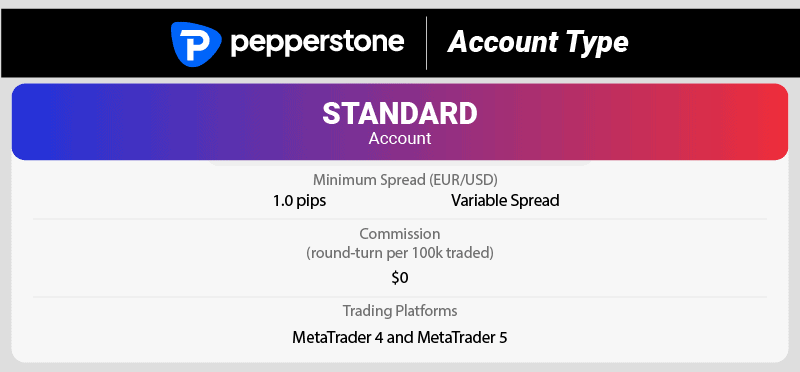

By comparison, the Pepperstone Standard account has a markup of 1.0 pips for most major pairs, such as EUR/USD (and sometimes higher minor and exotic pairs), however, there are no separate commissions. While the overall trading cost is slightly more than the Razor, it is not significant enough to concern the occasional trader, unless you trade frequently or in high volumes.

The reason traders choose the standard account is that it provides simplicity to trading with no need to calculate the impact of commission costs. This is therefore more popular for beginner traders.

The other notable difference is the choice of available trading platforms. While MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are available with both the Standard and Razor Account, cTrader and Trading view have their own special Razor Account, because commissions are applied differently to MetaTrader trading platforms.

Choosing an account with the right trading platform matters. To automate trading, MetaTrader 4 may be the best choice. That’s because it can integrate with Capitalise.ai, a tool designed to help with automation. One thing to note, though, is that MT4 is not a great choice for stock trading. TradingView is known for its enormous range of indicators, while cTrader is good for Depth of Market (DoM) trading. MetaTrader 5 has features that cover the best of all these platforms.

Note: This review does not look at the Pepperstone Spread Betting account which is available on in the UK.

The overall rating is based on review by our experts

Pepperstone Account Trading Cost Comparison

The best way to compare the difference in cost between the Razor account and Pepperstone’s Standard account is to look at the average spreads for the AUD/USD currency pair for each account type. (As with other average spreads showcased in these comparison reviews, these figures are sourced directly from Pepperstone.)

First off, let’s explore the cost to open a position (sideways costs), and detail the cost of a round-turn trade.

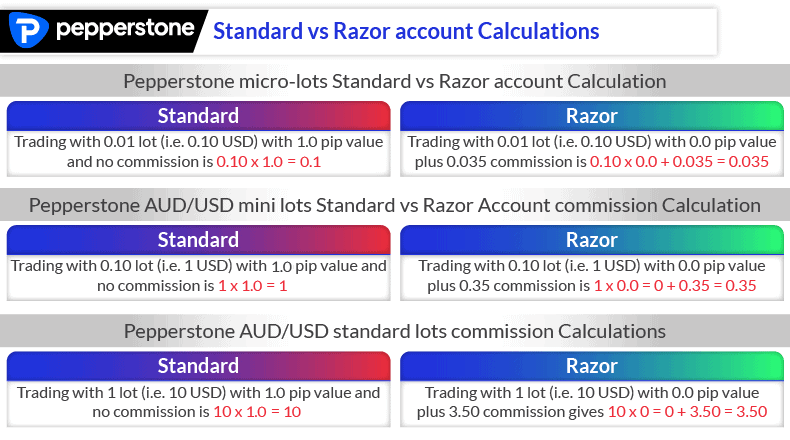

By examining the minimum spreads, it’s clear that the Pepperstone Razor account clocks in at the expected 0.0 pips for this currency pair, vs 1.0 pips for the Standard account.

Note that the base currency is AUD and the quote currency is USD.

This means that, for each standard lot of 100,000 units, there is a commission of AUD$10 when using a Standard account. To trade mini and micro-lots of .01 and .10, you’ll pay a commission of AUD$1 and AUD$0.10 to open a position.

Compared with the Razor account, using the same base and quote currencies, the low, fixed commission, combined with the 0.0 spread, means that a standard lot of 100 units USD costs USD $3.50 to open. Mini and micro-lots are also less expensive, at USD $0.35 and USD $0.040 per 0.10 and 0.01 lot.

Doubling the sideways cost of opening a position reveals the cost of a round-turn trade using either the Standard account or the Razor account.

For example, if you open and close an AUD/USD position of one standard lot using the Standard account, you’ll pay USD $20 to execute the trade. With a Razor account, a transaction of the same size means that you’ll owe a commission of USD $7.

Those figures are crystal clear. The Razor account wins on price – no matter what the transaction volume is. Unless you’re a high-volume trader or using a scalping strategy – someone who opens and closes multiple positions within a matter of hours – analysing whether those savings may or may not add up over time, though, is up to you.

Similar Features Between The Razor vs Standard Account

1. Straight-through processing with no dealing desk

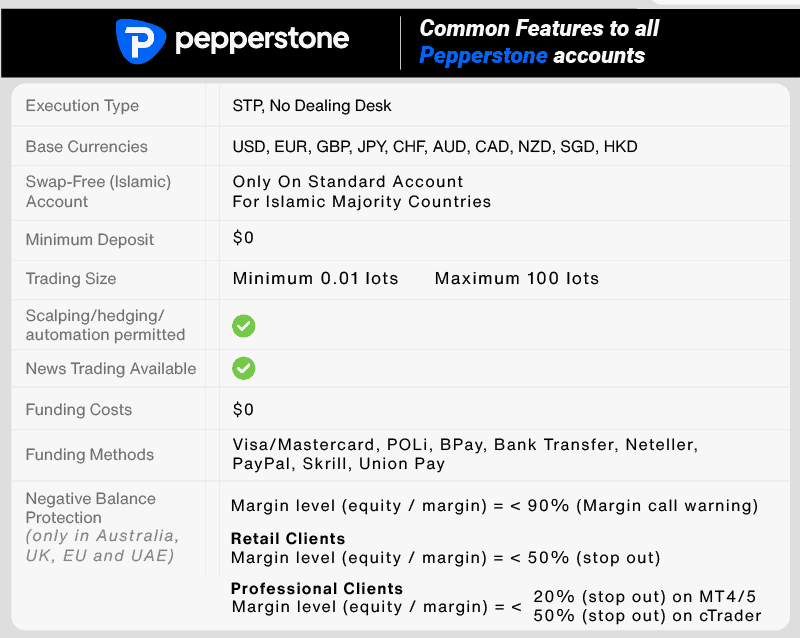

Both trading accounts use Straight-through Processing (STP) with no dealing desk. In short, this means Pepperstone quotes you the spreads sourced from the broker’s large pool of liquidity providers. We deep-dive into what this means in our Pepperstone ECN write up.

2. Minimum deposit and funding methods

Neither account requires a minimum deposit to open an account, however the broker does recommend starting with at least AUD/USD 200 or GBP/EUR 500. These accounts can be funded using a range of deposit methods, including:

- Credit Card (Visa, Mastercard)

- Debit Card (Visa, Mastercard)

- Bank transfer

- BPay/POLi (in Australia)

- PayPal

- NETELLER

- Skrill

- Union Pay

eWallets are limited in the UK (except for PayPal) and Europe. We look at these funding methods more closely as part of Pepperstone minimum deposit and withdrawal methods.

3. Base currencies

Traders can choose from 10 types of currency as their base currency. Most traders will want to use their home currency as their base. Having multiple accounts – each with a different nominated base currency – is an option.

4. Products

You can trade all products with either account, just be aware that some products are available with certain trading platforms. MetaTrader 5 is the best choice, since you can trade all Pepperstone products, including Forex, Crypto, Stocks, ETFs, Commodities, Bonds/Treasuries and indices. Both cTrader and TradingView are limited to Stocks and ETFs in the US and you can’t trade stocks or ETFs with MetaTrader 4.

5. Negative Balance Protection

All traders, regardless where one is located, will get negative balance protection. To prevent your account from going into negative, Pepperstone uses a margin call warning system when the equity in your account falls below 90% and a stop-out when equity falls below 50%. While these protections don’t guarantee your account balance going below zero, it at least ensures you are not left with large debts.

Just note that, if you’re using a Professional account (available in Australia, the UK, Europe and in the UAE), you will lose this protection.

6. Trading Size

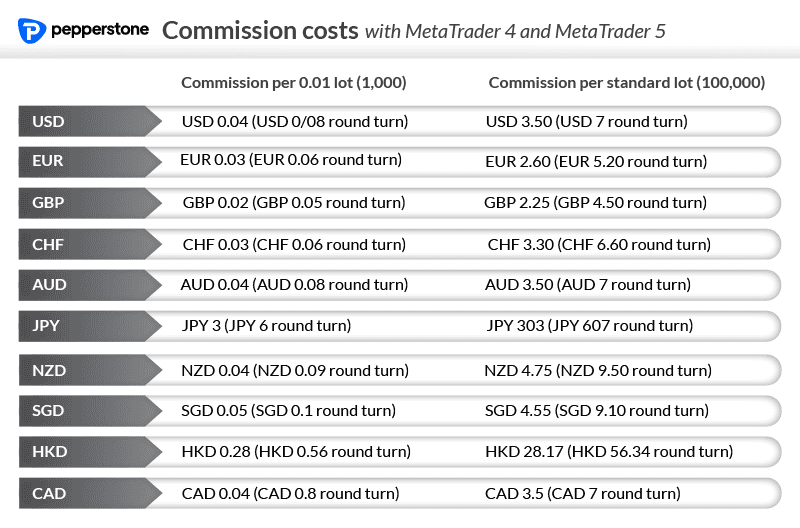

Trades can be done using micro lots (1,000 units), micro lots (10,000 units) or standard lots (100,000). Commission costs with the Razor account are quoted based on standard lots. If using micro or mini lots, the commission will be pro-rata.

7. Leverage

Leverage or margin is not dependent on the account type you choose. The maximum leverage you can trade with will depend on the product being traded and the maximum allowed by the regulator of the jurisdiction you trade from. You can find out more about the brokers leverage on our Pepperstone Leverage page.

8. Regulation

Pepperstone offers the same trading account in all countries they offer trading services to. These accounts are not dependent on the regulator that manages the jurisdiction you are trading from.

You can find out more about the Pepperstone entities and regulators in our comprehensive breakdown of Pepperstone Safety.

9. Scalping/hedging

Pepperstone – like any genuine no dealing desk, ECN, STP-style broker – allows scalping and hedging. With an execution speed of < 30 ms, Pepperstone is a good choice for traders that want to trade frequently, with few restrictions. Scalping and Hedging can be done with either account but, with lower spreads, the Razor account is a better choice.

10. Automation / Social Trading / Copy Trading

You can automate, social trade or copy trade with any of the trading accounts. The main limitation is not the trading account but the trading platform.

To automate trade using Expert Advisors (EAs), you can use MetaTrader 4 or 5. If you are using MetaTrader 4, you have the option of Capitalise.ai to automate trading. Trading automation is also possible with cTrader Automate.

For social trading and copy trading, MetaTrader Signals, Myfxbook (outside the UK and Europe), DupliTrade and Pelican (only within the UK and Europe) are available. If you are using cTrader, cTrader Copy is available.

TradingView is not suitable for automation or social trading.

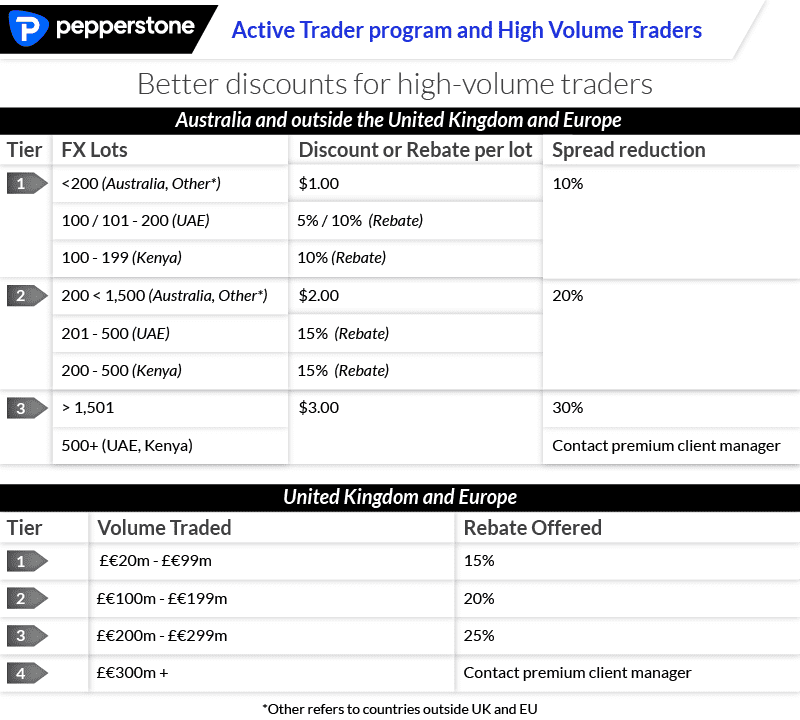

An Active trader account is available with both the Standard account and Razor account – but only for high-volume traders. Qualifying for this account means you will get rebates or discounts. The more you trade, the larger savings you can get. To be eligible, you will need to apply via customer services with Pepperstone and trade a minimum number of lots per month.

Pepperstone Razor Account Key Features

How does Pepperstone deliver tight spreads for traders that are true to the best market price? Instead of widening spreads to recover their own costs, the Pepperstone Razor account charges account holders a low, fixed commission for each lot traded. So your final trading cost will be spreads + commission along with any overnight costs.

This decision to remove itself from determining spreads means that the brokerage operates under a genuine ‘no dealing desk’ basis – and that means no mark-ups that add extra unwanted costs to traders.

Access to advanced trading platforms, cTrader and TradingView, is another advantage of the Razor account from Pepperstone.

Pepperstone Razor Spreads And How They Compare to Competing Brokers

Whether you opt to trade through your Razor account using the MetaTrader 4, MetaTrader 5, cTrader and/or TradingView platforms, Pepperstone offers the same competitive spread costs.

To keep you informed about the best possible trading choices available, our monthly comprehensive reviews of average spreads, published by forex brokers, highlight a select range of currency pairs and compile them for easy analysis.

The table below compares the average spreads of contracts for difference (CFD) forex brokers that provide no dealing desk, or ECN-like accounts, similar to the Pepperstone Razor account.

These average spreads give you deeper insights into how most forex brokers stack up when it comes to their trading costs. It’s important to note, though, that other trading costs, such as commissions, swap fees (also known as overnight fees), or minimum deposits aren’t taken into account.

We’ll cover more detailed information about the additional fees later.

For now, though, this quick look (below) at average spreads across forex brokers shows that Pepperstone only charges swap fees and commission fees in line with other regulated international brokers – NO added funding costs included! so there are no unexpected fees for you.

ECN Broker Spreads | |||||

|---|---|---|---|---|---|

| 0.30 | 0.30 | 0.10 | 0.30 | 0.10 |

| 0.51 | 0.57 | 0.14 | 0.39 | 0.31 |

| 0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

| 0.30 | 0.50 | 0.30 | 0.50 | 0.40 |

| 0.24 | 0.70 | 0.16 | 0.54 | 0.29 |

| 0.30 | 0.70 | 0.20 | 0.50 | 0.40 |

| 0.40 | 1.40 | 0.80 | 0.50 | 0.40 |

| 0.64 | 1.59 | 0.51 | 0.94 | 1.15 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Pepperstone Razor account traders have access to variable spreads that compare positively with other ECN-like, no dealing desk brokers. While it’s true that other online trading brokerages, such as FP Markets, AxiTrader, or IC Markets, might offer lower spreads for particular currency pairs, the fact remains that Pepperstone remains consistent in boasting the best overall spreads for all currency pairs.

MetaTrader 4 + 5 Razor Account Commissions

We’ve already mentioned those low commissions that Pepperstone charges to cover their trading costs, plus the added bonus of avoiding costly mark-ups or wider spreads. Now, this is where all that really matters.

In exchange for direct access to market-set spreads, Pepperstone Razor account holders who trade with MetaTrader 4 or MetaTrader 5 pay a commission fee (in addition to the spread) on each round-turn trade they make. What that means for you is that Pepperstone only charges a small fixed-fee for each purchased lot (side-ways), as well as each lot you close (round-turn), with a standard lot comprising 100,000 units. The below table shows both side-ways and round-turn commissions.

The commission costs associated with Pepperstone’s Razor account align with industry standards. To calculate the round-turn commission cost on a standard lot, simply double the sideways cost, with commissions increasing slightly if you trade in micro-lots.

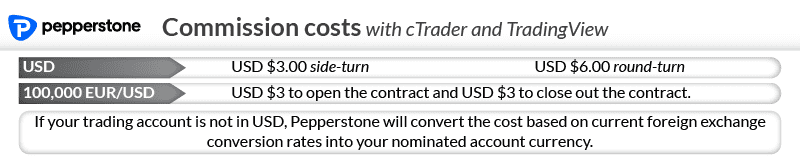

cTrader + Trading View Account Commissions

Both the Razor cTrader and TradingView Accounts base their commission rates on USD. That means you can expect to pay $6.00 round-turn per standard lot (I.E. every 100,000 units ordered) – an amount that will then be converted to your account currency using the current spot rate.

Razor Account – Our Verdict

Even with commissions, the tight variable spreads and variety of trading platforms add up to the Pepperstone Razor account being a solid choice for experienced traders who appreciate the advantage of advanced functionalities or trading strategies. Volume traders who employ a scalping or automated trading strategy and rely on Expert Advisors (EAs) will also benefit from the lower spread costs available with the Razor account, compared to the Standard Pepperstone account.

Pepperstone Standard Account Key Features

To properly compare the differences between these two Pepperstone accounts, it’s time to explore the Pepperstone Standard account.

One obvious point of difference is the fact that, compared to the Razor account, the Standard Pepperstone account has wider variable spreads. For beginners, though, the Standard account offers an attractive combination of features in a no-dealing desk account.

In your early days of forex trading, things can seem complicated – and that means that, for novice traders, the simplicity of the Pepperstone Standard account pricing model may be worth the higher real-time variable spread. This starts from 1 pip for major currency pairs but, depending on the currencies and the time of day, this may be higher.

With the Standard account, the broker’s commission costs help determine the spread, which makes it quick and easy for even the most inexperienced trader to accurately calculate the cost of each trade.

Even with a slight mark-up to cover its service fees, the Pepperstone Standard account enables traders to access the best spreads from their pool of liquidity providers, thanks to STP trade execution.

Pepperstone Standard account users can choose from either the MetaTrader 4, or MetaTrader 5 trading platforms.

Standard Account Spreads Vs Other Broker Non-Commission Accounts

Pepperstone offers standard account spreads from 1 pip, which is the industry standard.

While there are market-making forex brokers with tighter non-commission account spreads such as CMC Markets, IG Markets, and Markets.com, Pepperstone still offers a competitive Standard account. When looking at the ‘Top 5 Most Traded Average Spread’, Pepperstone has an average spread of 1.40 compared to the industry average of 1.52 for major pairs. The commitment to retaining its commission-free pricing on its Pepperstone Standard account has ensured that it is a genuinely competitive option, when compared to many other top global brokers, regardless of type: no dealing desk or market-maker.

Standard Account Final Verdict

Yes, the 1 pip vs 0.0 pips is a wider spread – but the Pepperstone Standard account still offers significant benefits for beginner traders still finding their feet in the forex world. The simplified pricing structure the Standard account delivers gives new traders the opportunity to develop your trading strategy and hone your skills, and reap the rewards of an ECN-like trading environment, complete with STP execution and the ability to avoid market-maker account mark-ups that can add unwanted costs.

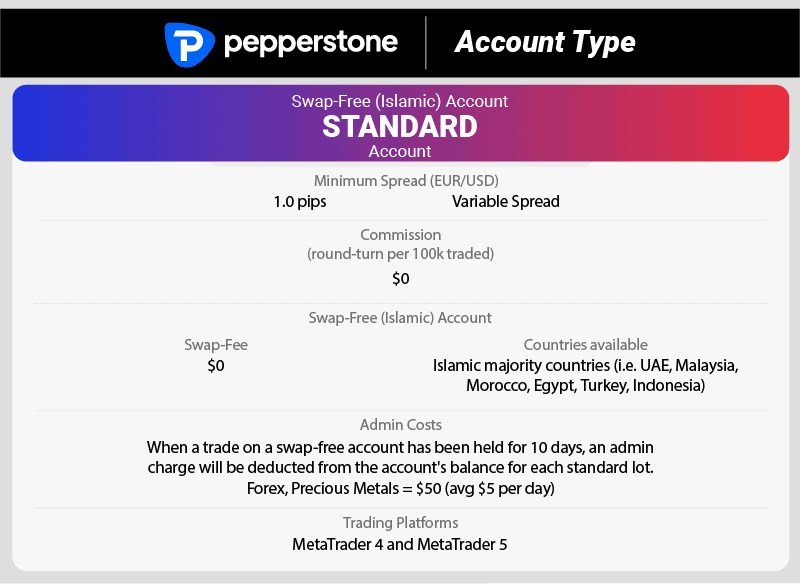

Pepperstone Swap-Free (Islamic) Standard Account

For people who want to trade forex but are unable to pay or receive any associated swap fees, Pepperstone also offers an Islamic account that is, essentially, a swap-free variation on their Standard account. With this special version of the Standard account, there are no overnight charges or rolling charges.

Instead, traders can expect this interest-free account to carry an administration fee of USD$50 per 100,000 standard lot. The broker deducts that fee from any forex position that is held open for more than ten consecutive days.

There are also administrative fees for other products and these range from USD$1.5 for crypto, to USD$10 for indices, and USD$20 for Crude and Brent Oil.

Traders who need to open a Pepperstone swap-free Standard account must reside in a Muslim-majority country, including UAE, Malaysia, Egypt, Morocco or Turkey, and must also provide a letter from an Imam, or other evidence of their Islamic faith.

Full Range of Pepperstone CFD Trading Products

While the range of available products depends (to some degree) on which trading platform you choose, Pepperstone account holders who choose MetaTrader 5 have access to all of Pepperstone’s financial instruments. When it comes to other trading platforms, though, traders may discover that trading with certain instruments is limited.

Assume all products are available with all platforms, except:

- cTrader – no stocks or ETFs outside of the USA (No AU or UK stocks)

- TradingView – no stocks or ETFs outside of the USA

- MetaTrader 4 – share trading and ETFs are not available

Pepperstone Trading Account Checklist

If our exploration of the unique differences and multiple similarities between the Pepperstone Standard account and the Pepperstone Razor account still leave you feeling uncertain about which account will suit you best, keep reading.

Commission or Commission-Free? MetaTrader, cTrader or TradingView?

If low commissions and tight spreads is what you’re after, the Razor account offers variable spreads from 0.0 for major currency pairs and commissions that start from USD$6 for a round-turn trade of a 100,000-unit standard lot.

A convenient, single, predictable cost might be more attractive – and if you fit that category of traders exploring your account options, the Standard account is probably your preferred pick. The variable spread on this account includes the fixed commission that covers Pepperstone’s service fees. You’ll find spreads that start as low as 1 pip, but may be wider for some major currency pairs.

The next considerations are your trading platform and products you wish to trade. Remember MT4 is not a great choice if you wish to trade stocks.

Do you follow sharia law for religion reasons? Then you will want to request a swap-free account which is closely match the standard account with its commission structure.

| Feature / Account | Standard | Razor MetaTrader | Razor cTrader / MetaTrader |

|---|---|---|---|

| Execution | STP + No Dealing Desk | STP + No Dealing Desk | STP + No Dealing Desk |

| Commission per 100,000 lot | $0 | $7.00 Base Currency | $6.00 USD |

| Spreads | From 0.8 pips | From 0.0 pips | From 0.0 pips |

| Trading Platforms | MetaTrader 4 (MT4) MetaTrader 5 (MT5) | MetaTrader 4 MetaTrader 5 | cTrader TradingView |

| Islamic Account | In Islamic countries | No | No |

| Trading Products | All except Stocks and ETFs with MT4 | All except Stocks and ETFs with MT4 | No stocks or ETFs outside of the USA (No AU or UK stocks) with cTrader. |

Our Verdict – Which Pepperstone Account Should You Choose?

Weighing up the pros and cons is ultimately a personal decision, based on your own forex trading experience, your appetite for risk, and, of course, your individual investment goals and preferred online trading strategy.

Come back to this comparison article to help you decide the best possible Pepperstone account for you.

To help you absorb the info that really matters, here’s a quick recap of the most important points we’ve detailed.

Main difference between the Pepperstone Razor and Pepperstone Standard accounts? Fee structure.

Pepperstone Standard accounts price factor a fixed commission into the available spread.

Pepperstone Razor accounts calculate commission based on the size of each lot traded.

The result is that a Razor account offers tighter spreads – and this can make a significant difference for high-volume traders using scalping, algorithmic trading and social or copy trading.

Remember that, whatever Pepperstone account you choose, any high-volume traders will be keen to explore the Pepperstone Active Trader program for access to money-saving rebates and discounts. And if religious restrictions limit your trading style, you can benefit from a swap-free account.

Pepperstone Account FAQs

Is Razor or Standard More Popular?

In most countries including Australia, the Razor account is the most popular based on the lower spreads.

Is There A Difference In Leverage And Minimum Deposit?

No. The leverage and the minimum deposit level are the same across all Pepperstone account types. If you are a high-volume trader, the active trader program is designed for the Razor account only and is recommended for you. Read our full Pepperstone Review for more information.

Disclaimers

The UK Financial Conduct Authority recently updated regulations governing CFD trading to prohibit brokers from offering retail investors access to cryptocurrency markets or trading.

Trading in CFDs, including in the foreign exchange market, carries a high degree of risk. Retail investors are therefore strongly advised to limit exposure, engage in ongoing education and utilise risk management tools and strategies, such as demo accounts and order types.

Article Sources

Spread Testing By Ross Collins Raw Account Spreads

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Open A Pepperstone Trading Account

Visit

Ask an Expert

The Pepperstone Razor account has the tightest spreads (even with commission costs) so is the best choice, especially if you have trading experience

As Kenyan resident of Qatar. Can trade with pepper stone live aaccount What are the requirements?

Pepperstone is regulated by the CMA in Kenya so they can offer services to Kenyan Residents. You are best to spread with Pepperstone via their live chat to confirm how to do this

Between razor account and standard which account is best for bigginers using scalping strategies

What is the maximum withdrawal from Pepperstone?

There is no minimum or maximum withdrawals with Pepperstone. You must withdrawal back to the same account you made your deposit from. Withdrawal methods include Visa, Mastercard, POLi, Bank transfer, BPay, PayPal, Neteller, Skrill and Union Pay

What is the lot size for a Pepperstone razor account?

You can choose between Standard lots (100,000), Mini lots (10,000) and Micro lots (1000) when trading with Pepperstone

You can choose between Standard lots (100,000), Mini lots (10,000) and Micro lots (1000) when trading with Pepperstone.

Good morning pepperstone team.as a novice trader. Between razor account and standard account , if I do trade on micro and mini lots. Which account will be cheaper to me. And one more question suppose if i hold any currency pair trade for more than 30 days approximate how much SWAP fee i will pay. Thanks

Spreads for micro and mini lots are the same. While you will pay more commission using mini lots, micro lots commission are higher pro rata compared to mini lots.