TMGM Review Of 2026

TMGM (formerly known as TradeMax Global Markets) is a multi-regulated forex broker with a powerful presence across Asia and New Zealand. We found has low spreads with ECN pricing, MetaTrader 4 and DMA execution for stocks with IRESS.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

TMGM Summary

| 🗺️ Country Regulation | Vanuatu (Global), New Zealand |

| 💰 Trading Fees | Low Spreads |

| 📊 Trading Platforms | MT4, MT5, IRESS, HUBX, TradeView X |

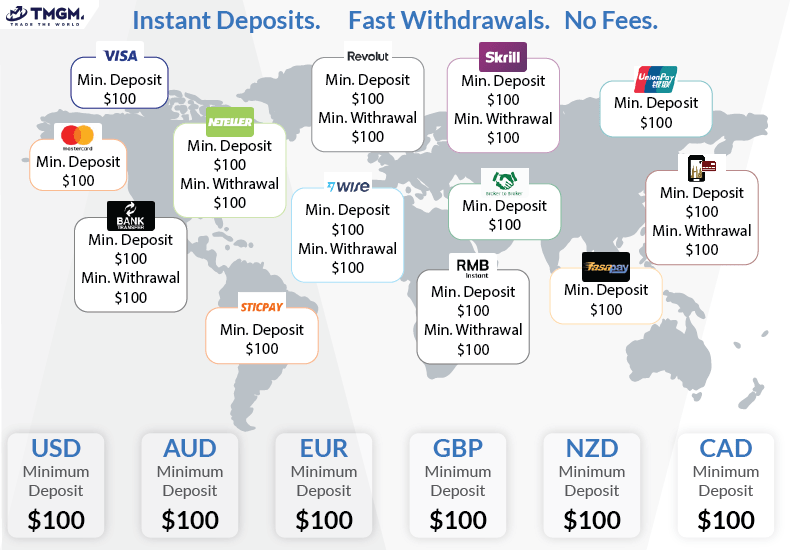

| 💰 Minimum Deposit | $100 |

| 💰 Withdrawal Fees | $0 |

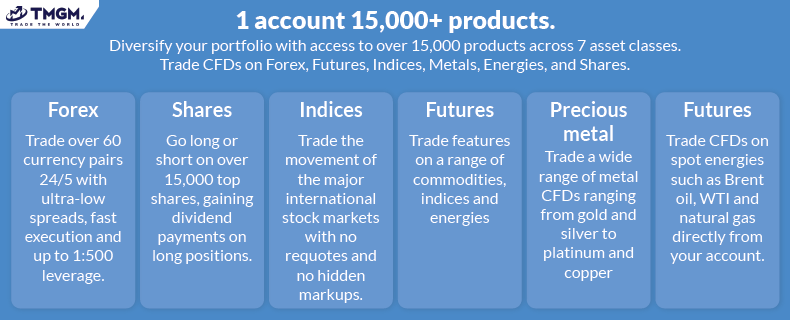

| 🛍️ Instruments Offered | CFDs inc.- Forex, Crypto, Shares, Indices, Energy, Metals |

| 💳 Credit Card Deposit | Yes |

Why Choose TMGM

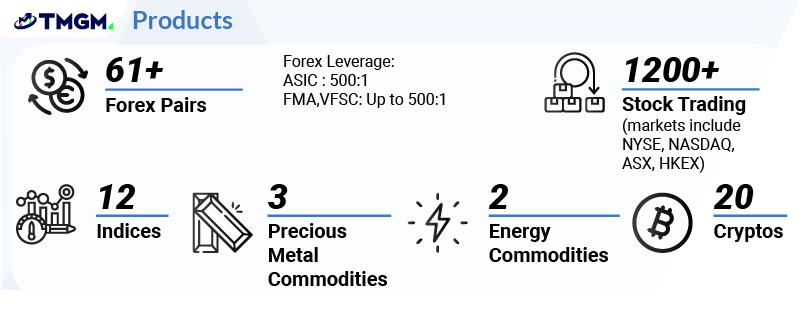

While TMGM has the features we expect to see in a no dealing desk ECN style broker like MT4 and MT5 platforms, competitive RAW spreads and a good range of trading instruments including over 60 Forex pairs, there are some features that will stand out. These include OneZero Financial technology for fast execution and the IRESS trading platforms for CFD shares trading.

Despite being a good broker overall and one we are happy to recommend, TMGM does lack social trading options and education tools, you will also find there is a small inactivity fee.

TMGM Pros and Cons

- Low fees

- No charge on deposit and withdrawal

- Easy account opening

- Inactivity fee

- Limited products

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

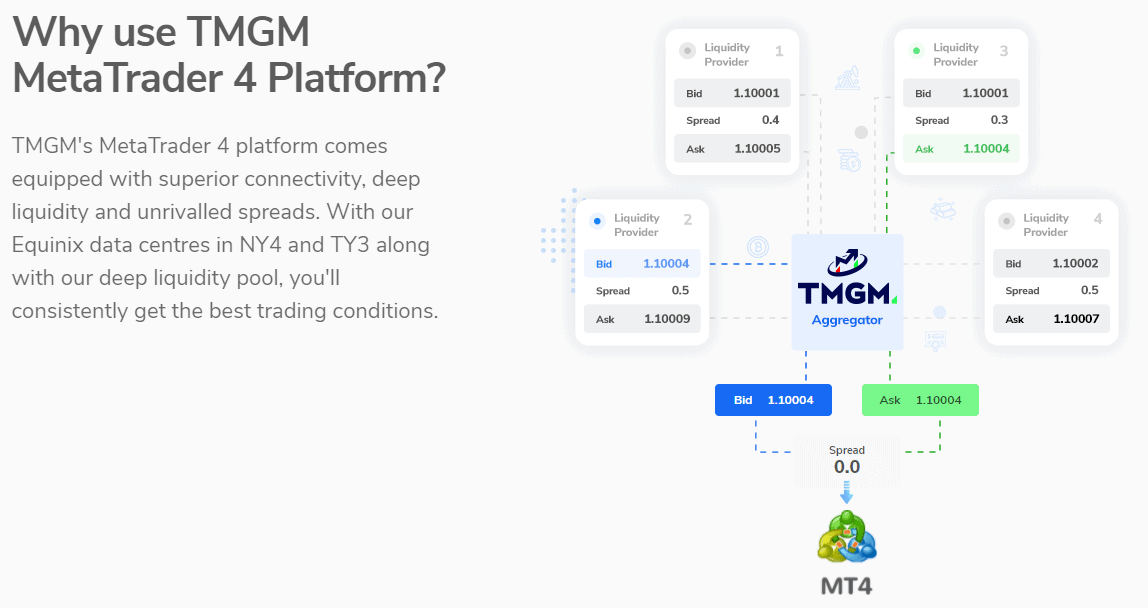

TMGM is a no dealing desk broker that uses electronic communication network (ECN) trading execution. They work with the best ‘prime of prime’ liquidity providers connecting investment banks and non-bank market makers and aggregating the quote they provide into one liquidity pool. This allows TMGM to deliver some of the best ECN pricing in the market.

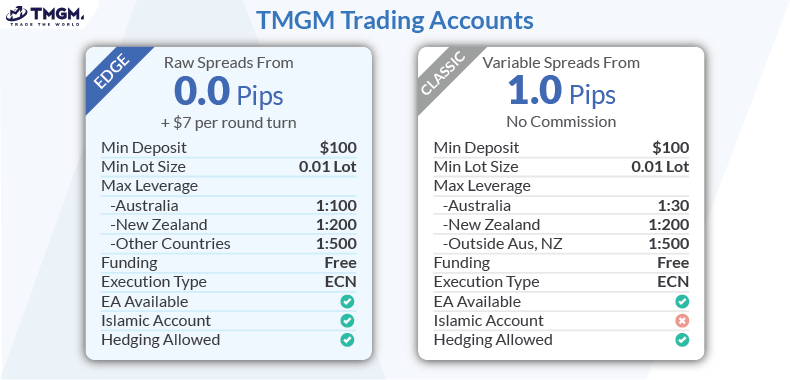

TMGM offers decent spreads, with a low of 0.0 pips with their Edge account and 1.0 pips for the standard account.

1. Raw Account Spreads

The Edge account is TMGM’s true ECN account where you will find TMGM’s lowest spreads. This account has TMGM’s lowest spreads since it uses ECN execution to source spreads directly from liquidity providers.

Each month, we compile the average spreads brokers list on their website for major forex pairs. The table below compares the average spreads for major forex pairs. As you can see, the average spread for the most popular pair (EUR/USD) is exceptionally tight and the best in the market.

ECN Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.10 | 0.21 | 0.54 | N/A | 0.40 |

| 0.08 | 0.35 | 7.60 | 3.50 | 0.73 |

| 0.06 | 0.27 | 0.49 | 0.30 | 0.59 |

| 0.10 | 0.10 | 0.90 | 0.20 | 1.10 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.09 | 0.13 | 1.70 | 0.14 | 1.40 |

| 0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

| 0.10 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

| 0.38 | 0.92 | 0.65 | 0.70 | 0.86 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

We also compared the spreads with the standard average and TMGM’s spreads are lower for most currency pairs.

| Raw Account Spreads | TMGM | Average Spread |

|---|---|---|

| Overall | 0.41 | 0.74 |

| EUR/USD | 0.2 | 0.21 |

| USD/JPY | 0.1 | 0.39 |

| GBP/USD | 0.3 | 0.48 |

| AUD/USD | 0.1 | 0.39 |

| USD/CAD | 0.5 | 0.53 |

| EUR/GBP | 0.6 | 0.55 |

| EUR/JPY | 0.7 | 0.74 |

| AUD/JPY | 0.5 | 1.07 |

| USD/SGD | 0.7 | 2.34 |

2. Raw Account Commission Rate

To keep spreads low and true to the quotes provided by liquidity providers, a commission to open and close a position is also charged. Users will pay a $7 commission round turn ($3.50 one way) for each standard lot.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| TMGM Commission Rate | $3.50 | $3.50 | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

This account has no commissions since the broker’s fees are included in the spreads. Most brokers call this their standard account.

Spreads with this account start from 0.9 pip, which is quite high compared to the Pepperstone Review and IC Markets Review, as well as some market maker brokers as shown in the Markets.com Review. However, they do fare well against the average broker.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| TMGM Average Spread | 1.2 | 1.4 | 1.2 | 1 | 1.2 | 1.2 | 1.2 | 1.2 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

4. Swap-Free Account Fees

If you can’t pay or receive interest because of your religious beliefs, TMGM also offers a Swap Free account. Swap-Free accounts are only available for Edge account types, which means they have a $100 minimum deposit, along, and a 0.01 lot minimum lot size.

Leverage

Leverage is a vital tool in trading. It’s often one of the first things a trader will explore. Whether they’re experienced or novice, traders want to know the leverage a new forex broker offers.

In New Zealand where TMGM is regulated by FMA, the maximum permitted leverage is 1:200 for forex, 1:100 for indices and energies and 1:200 for precious metals like gold, silver.

If you are trading with TMGM and you live outside these two countries, then the maximum leverage when trading forex is 1:500. Other products are the same as for New Zealand.

5. Other Fees

There are no charges for deposits and withdrawals. There is an inactivity fee of $30 per month if inactive for 6 months.

Verdict on TMGM Fees

TMGM offers competitive trading fees, with the Edge account featuring tight spreads and a commission, while the Classic account has no commission but wider spreads.

Trading Platforms

TMGM offers users a variety of easy-to-use and intuitive trading platforms on its site. These include its MetaTrader4, MetaTrader5, and IRESS options. Let’s inspect what these platforms offer.

| Trading Platform | Available With TMGM |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader4

MetTrader4 (MT4) is widely considered the gold standard trading platform for forex trading, so it is no surprise MT4 is TMGM’s most popular trading platform. This platform offers all the essential features both beginner and experienced traders need to quickly and easily analyse financial markets and trading conditions.

With MT4, traders can view live price feed, see up-to-date financial news, use analytical tools, and consult technical charts, giving users the best opportunity to make the right trading decisions.

The only weakness with choosing MT4 is the range of shares is limited compared to IRESS. Currently, you can only trade the 30 most popular US Stocks as CFDs and trading of these shares can only be done MT4 server time Monday-Friday 16:30~23:00 which is Eastern European Time (EET) or GMT+3.

The MT4 trading platform is available through TMGM in the following formats:

Desktop Platform

MT4 trading platform is available for all Windows desktops and is even available for MacOS desktops as long as you are using Mojave (10.14) or below (later versions will need an emulator such as WINE). The MT4 desktop trading platform provides a clean, stylish interface that’s especially great for novice traders as it means the screen avoid unnecessary clutter.

Traders can customise their dashboard with various charts while using dozens of technical indicators to know exactly what’s going on. With the TMGM MT4 desktop platform, traders have access to their trading positions, along with any other pertinent account information.

One of the key features is the ability to automate your trading using Expert Advisors (EAs). MT4 has one of the largest marketplaces of all platforms allowing you to access a wealth of trading robots along with indicators. Some of them are even free.

With the MT4 desktop platform, you’ll have access to:

- 9 timeframes

- 30 built-in indicators and 2000 free indicators

- 4 types of pending orders, including stop orders and trailing stops

- 70 paid indicators

- 1700 trading robots and 2100 technical indicators

- Expert Advisors (EAs) for trading automation (<30 ms trading execution)

- MT4 Strategy Tester for backtesting using historical market data on EAs and indicators

- If you prefer to trade via your browser, Web Trader is also available.

Mobile Platform

The MT4 platform is also available as a mobile app. Whether you use an Android device or prefer an iOS iPhone or iPad, you can take your trading platform with you anywhere you go. With the MT4 mobile trading platform, you can trade anytime, anywhere. With the MT4 mobile application, you’ll have access to the following:

Interactive real-time Forex charts with zoom and scroll options

- 9 timeframes (M1, M5, M15, M30, H1, H4, D1, W1 and MN)

- 30 technical indicators

- 24 analytical/graphical objects +

- 3 types of bar charts (bars, Japanese candlesticks and broken lines)

- Full execution modes and types

MetaTrader 5

As you would expect, MetaTrader5 (MT5), is the successor to the MetaTrader4 platform. While you’ll get all the same functionality and features you came to love with MT4, MT5 offers a few more advanced options.

The options include additional charting timeframes and order types, multi-currency strategy tester, a larger variety of trading tools, and depth of market (DOM) pricing. MT5 is not yet a live trading platform, but it should be available to traders later this year.

IRESS

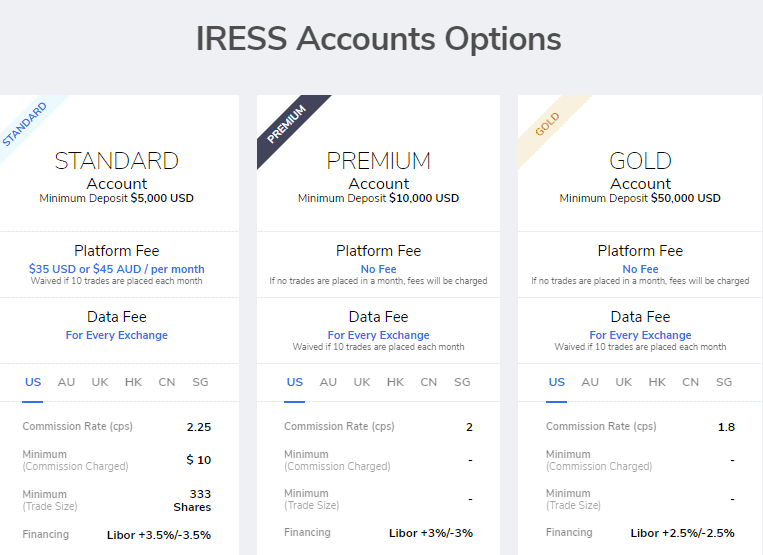

The IRESS platform is TMGM’s “next-generation, web-based trading platform.” The main reason to use this trading platform is in order to access TMGM’s full range of CFD shares, 24 hours a day. Making IRESS a better choice over MetaTrader 4 if you plan to trade shares since IRESS allows you to trade on exchanges in the following countries – United States, Australia, The United Kingdom, Hong Kong, China and Singapore.

The other benefit of IRESS is that it offers exchange pricing and market depth. This is because IRESS uses DMA Forex Brokers trading. DMA means you Level 2 Market Depth Order Book pricing, that is you can view live orders from institutional liquidity providers connected to the exchange. MetaTrader 4 does not offer DMA.

Data Feeds are also faster than with MetaTrader. Stock prices from US exchanges are shown live, while all other markets have just a 15-minute delay.

The main thing to be aware of is the high minimum deposit fee of $5,000 USD. So IRESS is for serious traders only.

A key feature of the IRESS platform includes the ability of traders to customise their workspace using a modular structure that provides the data and information that’s pertinent to them. The modules are flexible and easy to resize, add, or remove at any time, giving you complete control of what information you will view and how it will be viewed on the platform.

These templates give traders the breadth and depth of the market needed, all in the convenience of a single screen. With this comprehensive information at your fingertips, you can make better, faster decisions. Plus, IRESS gives users the ability to compare, overlap, and add several charts to quickly identify trading patterns and opportunities.

Choose IRESS for:

- Best range of stocks TMGM offers with 24-hour trading

- Direct Market Access (DMA) for Depth of Market and exchange pricing

- Price-streaming in real-time

- Advanced charting capability with TradingView

- Over 50 indicators

To use IRESS, you will need an IRESS account. Minimum deposits for IRESS are high, as DMA trading is mostly for professional traders. The cost will differ between stock exchanges. The below shows costs for US stock exchanges.

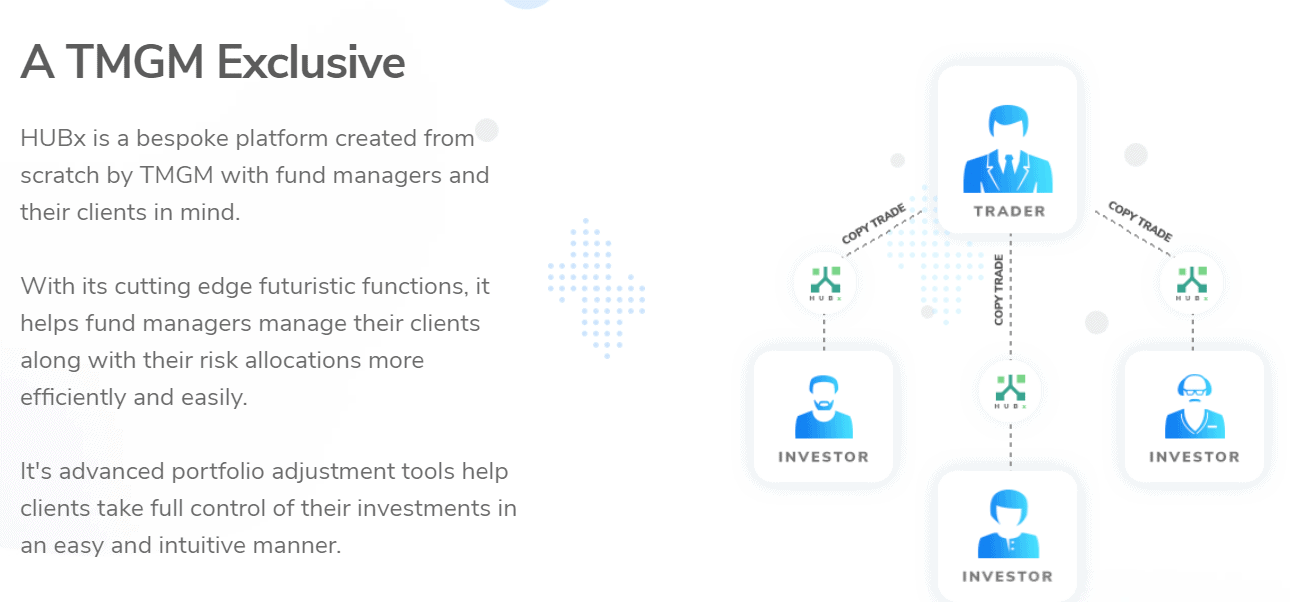

HUBX For Fund Managers

Developed by TMGM in partnership with LifeByte, this platform helps fund managers and their clients work together when trading. The product integrates with MetaTrader 4 and comprises 3 distinctive features.

Multi-Account Manager (MAM) For Fund Managers

This function is designed for fund managers to help them manage all their clients’ accounts through a single terminal. In simple terms, MAM is a master account to manage client accounts in one place. This in effect allows fund managers to create a forex trading fund since the fund managers’ trading strategies can seamlessly be allocated to the client account as well.

A unified Dashboard is available so fund managers can monitor their clients along with important data in one place.

Copy Trading

Much in the same way MAM allows fund managers to copy their trades to their clients, HUBX also has copy trading features, so trades can be copied across accounts.

Account Monitoring And Risk Management Tools For Clients

Clients can monitor and control what their fund manager does with their accounts through portfolio management controls. This feature captures all movements fund managers do with the client’s accounts and manages their positions along with risk allocations.

Risk Management

Since CFDs and forex are complex instruments that come with a high risk for investors and traders, risk management tools and regulations are vital. As a result, TMGM offers standard risk mitigation tools like stop orders, trailing stops, and take profits. However, you won’t have any special features like guaranteed stop loss.

ASIC requires brokers to offer negative balance protection to Australian traders and investors. Keep in mind that the Vanuatu Financial Services Commission and the Financial Markets Authority (New Zealand) does not require it, so these clients won’t have access to this feature.

However, TMGM takes additional steps to ensure risks are kept to a minimum on its platform. Here are a few other ways the site mitigates risk for its users:

External Audits

TMGM uses an independent, external auditor to ensure that regulatory obligations and compliance are met. These auditors also provide direction for platform obligations and operational processes.

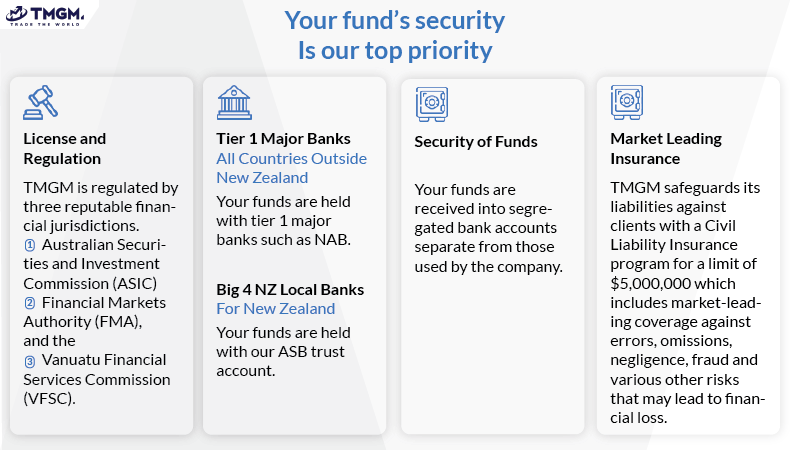

Trusted Banks

Your funds are stored in only the most trusted financial institutions. All client assets are kept in an Australian authorised deposit-taking institution (ADI), with an AA rating. The National Australian Bank is one of the largest banks in Australia. TMGM offers separate accounts for high net worth organizations and individuals. These accounts have access to log into dedicated bank accounts and check their balances whenever they want.

Protected Assets

TMGM focuses on a customer-first approach by providing professional liability insurance. This insurance is used to protect customer financial security while meeting the requirements of several regulatory entities. TMGM’s insurance company provides users up to AUD 5 million in coverage.

Is TMGM Safe?

TMGM has a trust score of 56 out of 100 according to the broker’s regulation, reputation, and reviews.

1. Regulation

In Australia, TMGM is regulated by ASIC (Australian Securities and Investments Commission), a tier-1 regulator known for maintaining high standards and ensuring strict compliance with financial regulations.

For those of you in New Zealand, TMGM falls under the umbrella of the Financial Markets Authority. FMA is the entity responsible for financial reporting and enforcing securities and other laws as they pertain to the financial market. TMGM has a derivatives license with FMA, FSP 569807.

Additionally, TradeMax Global Markets is controlled by Vanuatu Financial Services (VFSC), using registration number 40356. TMGM provides both individuals and businesses from countries such as Singapore, the Philippines, Canada, a way to set up an account in the country they live in. However, keep in mind that TMGM clearly states that they are not providing electronic trading facilities to citizens of the United States.

| TMGM Safety | Regulator |

|---|---|

| Tier-1 | ASIC FMA |

| Tier-2 | X |

| Tier-3 | VFSC FSC-M |

2. Reputation

TMGM was founded in 2013 in Sydney, Australia. This broker maintains a moderate profile in the forex trading space. With approximately 18,100 monthly Google searches, it ranks as the 42nd most popular forex broker among the 65 brokers we analyzed. Similarweb data from February 2024 shows a slightly lower positioning, with TMGM ranking as the 52nd most visited broker with 100,000 global visits.

They have reported serving over 100,000 clients globally across more than 150 countries. In terms of trading activity, the broker has claimed processing over $195 billion in monthly trading volume in 2024. This suggests that despite its middle-tier search and traffic rankings, TMGM has established a substantial operational footprint that may exceed what its online visibility metrics alone would suggest.

| Country | 2025 Monthly Searches |

|---|---|

| United States | 3,600 |

| Taiwan | 2,400 |

| Australia | 1,900 |

| Malaysia | 1,900 |

| Thailand | 1,300 |

| Hong Kong | 1,300 |

| Indonesia | 1,000 |

| Vietnam | 1,000 |

| Italy | 880 |

| United Kingdom | 720 |

| Singapore | 590 |

| Canada | 480 |

| Chile | 480 |

| Germany | 390 |

| Poland | 390 |

| Japan | 390 |

| India | 260 |

| Netherlands | 260 |

| Dominican Republic | 210 |

| France | 170 |

| Cyprus | 140 |

| Spain | 110 |

| New Zealand | 110 |

| Turkey | 110 |

| Cambodia | 110 |

| United Arab Emirates | 90 |

| Brazil | 70 |

| Nigeria | 70 |

| Philippines | 70 |

| Pakistan | 50 |

| South Africa | 40 |

| Mexico | 40 |

| Switzerland | 40 |

| Austria | 40 |

| Colombia | 30 |

| Bangladesh | 30 |

| Morocco | 30 |

| Sweden | 20 |

| Argentina | 20 |

| Portugal | 20 |

| Kenya | 20 |

| Greece | 20 |

| Egypt | 20 |

| Saudi Arabia | 20 |

| Mauritius | 20 |

| Mongolia | 10 |

| Ireland | 10 |

| Peru | 10 |

| Ecuador | 10 |

| Ghana | 10 |

| Venezuela | 10 |

| Algeria | 10 |

| Uzbekistan | 10 |

| Sri Lanka | 10 |

| Uganda | 10 |

| Botswana | 10 |

| Bolivia | 10 |

| Ethiopia | 10 |

| Panama | 10 |

| Costa Rica | 10 |

| Jordan | 10 |

| Tanzania | 10 |

| Uruguay | 10 |

3,600 1st | |

2,400 2nd | |

1,900 3rd | |

1,900 4th | |

1,300 5th | |

1,300 6th | |

1,000 7th | |

1,000 8th | |

880 9th | |

720 10th |

3. Reviews

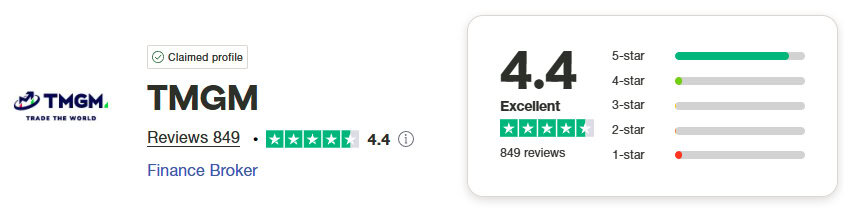

Despite the low search volume, they managed to have an excellent Trustpilot score of 4.4 out of 5 from 849 reviews.

Deposit And Withdrawal

What is the minimum deposit at TMGM?

When using MetaTrader, the minimum initial deposit amount for any TMGM is $100. If using IRESS, then $5,000.

Deposit Options and Fees

TMGM has no funding fees. To fund your account, you can use MasterCard, Visa, bank transfer, Skrill, UnionPay, Neteller, SticPay, FasaPay, and many others. Based on the site’s regulation and policy requirements, funds on the TMGM platform are stored in segregate client trust accounts. These accounts are kept in Australian banks like Westpac and NAB or if in NZ with local New Zealand banks.

Withdrawal Options and Fees

Along those same lines, users can withdraw their funds using the same methods and will pay no withdrawal fees. The clear communication about the company’s deposit and withdrawal methods is a sure sign that TMGM is not a scam. It’s a legitimate forex site that offers excellent features and benefits.

Product Range

CFDs

Besides forex trading, TMGM offers a variety of other CFD products. Let’s take a closer look at what the platform offers.

Forex

The forex market is the largest in the world with more than $6.5 trillion in daily trading volume. By comparison, the New York Stock Exchange does just $20 billion. It’s not even a comparison. It’s a market that offers trading for anyone in the world, as it’s available 24 hours a day, five days a week.

With TMGM, you’ll have access to all the most popular currency pairs, including over 61 major, minor, exotic, and cross-pairs. Spreads start at 0 pips and you’ll have access to 500:1 in New Zealand and most offshore locations..

Indices

Trading Indices provides a way for you to gain exposure to the stock markets of countries from around the world. With TMGM, you can trade on over 12 different Indices, including the US S&P 500, the German DAX, the Japanese Nikkei, and the UK FTSE 100.

Not only will you gain access to a variety of CFD markets, but you’ll also enjoy the features that TMGM has to offer with Index CFDs. For example, users can trade CFDs with a leverage of up to 1:100.

Some of the other features TMGM offers with Index CFDs include:

- Pay no commission when trading CFDs on Indices

- Always get filled with the best rates thanks to the deep liquidity pool created by Tier 1 liquidity providers on the TMGM platform.

Share Trading

If you’re interested in trading shares, TMGM is your gateway to markets throughout the globe. You’ll have access to a range of shares in places like Australia, Hong Kong, and the United States. TMGM gives traders the option to short (sell) and long (buy) many of the shares available. This includes taking part in the interest and dividends of holding these positions.

You can use either MetaTrader 4 or IRESS for trading stocks CFD however, MetaTrader 4 is limited to only the top 30 stocks in the US in business hours (GMT+3). IRESS allows access to the full range of shares TMGM offers across the US, Australia, UK, Hong Kong, Chinese and Singapore stock exchanges 24/7.

One of the biggest advantages of using TMGM for trading CFD shares is that you’ll gain exposure to stock price movements with just a small deposit. TMGM offers access to over 12,000 stocks, plus complete price transparency when traders take part in real market liquidity.

There are plenty more reasons to engage in CFD Shares trading with TMGM. These include:

- Low commissions on your CFD Shares trades

- Competitive CFD market prices when making trades using the IRESS platform

Precious Metals

One of the best ways to diversify your portfolio is through trading precious metals. That’s because precious metals are placed in the ‘safe haven’ asset class, which has a certain appeal during volatile and uncertain times.

When trading CFDs on precious metals, TMGM gives you the ability to enjoy the benefits of diversification and speculation without having to have the precious metals themselves in your possession.

With a TMGM MT4 account, you’ll have access to trade Gold, Silver, and Platinum CFDs. Plus, with the proprietary TMGM Aggregation engine, you’ll get the best spreads available, which start at 0.0 pips.

Energies

Another great way to diversify your portfolio is through trading CFDs on energies like gas and oil. With TMGM, you can access these markets without purchasing the energies themselves. For example, you can trade CFDs on Brent Crude Oil or WTI Crude Oil through the TMGM platform.

Not only that, but you can trade in the Natural Gas Market as well. Access to these markets offers a great way to trade in areas that aren’t often given as much attention. You’ll also have access to the best spreads, which start at 0.2 pips, thanks to TMGM’s proprietary Aggregation Engine.

Cryptocurrencies

TMGM also offers crypto trading for its investors and traders interested in digital assets. Traders have access to the 20 most popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Bitcoin Cash (BCH). You can trade your favourite digital assets right from the MT4 platform, so you don’t have to open up another window on your desktop.

Crypto markets are open 24 hours a day, 7 days a week, so you can trade anytime you want. Plus, TMGM is a regulated exchange, which means you have access to the most popular digital assets with the protection of ASIC and VFSC regulations.

Customer Service

If you regularly use an online trading platform like TMGM, there’s always a chance you can run into problems. Whether it’s a significant issue or a small snafu, it’s always nice to know that if you need someone, help is just a click or a phone call away.

For customer support, you can contact TMGM through live chat, over the phone, or via email. The live chat feature is fantastic. You’ll get quick responses that are relevant and helpful. Plus, you can provide your own feedback when the chat concludes.

If you need to chat with someone, you’ll get a real, live person, not a chatbot feeding you canned lines that you get with some other platforms. The representatives are knowledgeable, and if you need it, TMGM’s chat supports over 10 different languages. That means you’ll be speaking with someone who understands you.

Languages available include English, Chinese, Vietnamese, Portuguese, Spanish, Thai, Arabic, French, Indonesian, Italian and Filipino.

Similarly, TMGM’s email support team is quick to respond. While it won’t be as fast as the response you’ll get through chat, the team typically gets back to you within 24-hours. Phone support is a hit or miss. While calls are answered quickly, it can be difficult to find an expert advisor who can explain the answer to your question.

Keep in mind that these support channels are available 24-hours a day, five days a week. They are not available on weekends. So if you run into a problem on Saturday or Sunday, you’ll have to wait until Monday to get it resolved.

Research and Education

TMGM Academy

Besides customer support, TMGM offers a unique feature called TMGM Academy. Through the TMGM Academy, you can learn about the ins and outs of forex trading. There are three stages available, Beginner Stage, Intermediate Stage, and Advanced Stage.

Beginner Stage

This stage of the TMGM Academy prepares novice traders for their forex trading journey. The Beginner Stage develops a firm foundation based on understanding margin trading, how to read various types of charts, plus an introduction to trading instruments, oscillators, indicators, and support plus resistance.

Intermediate Stage

TMGM Academy’s Intermediate Stage focuses on more technical aspects of forex trading. This includes considering indicators like MACD, RSI, ATRs, Moving Averages, and more. TMGM introduces Fibonacci and Fundamental analysis, plus effective ways to employ them in trading.

Advanced Stage

The Advanced Stage in the TMGM Academy is where traders get deep into various trading strategies and how to apply them. This stage includes learning about advanced forms of Fibonacci extensions and retracements, RSI, correlation, and trade management.

Final Verdict on TMGM

This TMGM review found this online broker offers CFD and forex to professional institutions and retail traders. The platform offers clients a range of trading platforms and analysis tools that allow for in-depth market research. Having these tools provides users with a way to make informed, educated decisions.

Trading conditions on the TMGM platform are very competitive. However, with deep liquidity, enhanced executions, and lightning-fast servers, you’ll get the best prices possible on your trades. It doesn’t hurt that there are multiple account types from which you can choose, plus a wide range of funding options.

Users can fund their accounts with as little as $100 to get started with a variety of CFD markets. Whether you prefer forex, energy, precious metals, or shares, TMGM has the market for you. You’ll get excellent customer service and if you want to learn anything new, you can check out the TMGM Academy.

TMGM FAQs

What trading platforms does TMGM offer?

TMGM provides access to MetaTrader 4, MetaTrader 5, and IRESS platforms, catering to both beginner and advanced traders.

What are the account types available with TMGM?

TMGM offers Edge and Classic accounts, each with varying spreads and commission structures.

Is TMGM regulated?

Yes, TMGM is regulated by the Financial Markets Authority (in New Zealand) and the Vanuatu Financial Services Commission (VFSC).

What is the minimum deposit required to start trading with TMGM?

The minimum deposit required to open an account with TMGM is $100.

Does TMGM offer any educational resources for traders?

Yes, TMGM provides webinars, market analysis, and a variety of educational materials to support traders of all levels.

Compare TMGM Competitors

Versus, comparison pages of alternative online brokers to TMGM are listed below.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Hi, just wondering if there are any similar brokers that offer IRESS platform outside of Australia? Particularly in Asia countries. Interested in trading ASX CFD stocks with DMA.

As far as we are aware, TMGM is the only broker that offers IRESS for CFD trading outside Australia. Within Australia there is FP Markets

What is the volume of TMGM Trading?

The most recent available data comes from 2022 where TMGM achieved a monthly trading volume of $195 Billion. This is an increase of over 100% from the previous year where they average $90 Billion per month for Q2 and makes TMGM one to the 10 largest brokers in the world by volume.

What is the max leverage in TMGM?

In Australia, the max leverage is 1:30 for retail traders. Outside Australia Leverage for Forex trading can be up to 1:1000

What is the execution speed of TMGM?

Based on our test, TMGM has a fast execution speed of <30 ms. This speed is achieved because the broker's servers are located at the Equinix New York (NY4) data center. It's the same location where major liquidity providers like Citi, UBS, Credit Suisse, and Bank of America have their servers.

What is the difference between TMGM edge and classic?

The edge account has no dealing desk meaning spreads are provided by the liquidity provider without price manipulation from the broker, for this reason you pay a commission separate to the spread. The Classic account is a Standard account meaning commission costs are included in the spread.

What is the stop out level in TMGM?

TMGM has a stop level of 40%.