Pepperstone vs TMGM: Which One Is Best?

In this review, we will thoroughly examine both brokers, Pepperstone and TMGM, evaluating their top features, offerings, and platforms, as well as their drawbacks. This analysis is crucial for gauging a trader’s success in forex trading. Before you jump in, take a moment to explore the insights on these two brokers.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

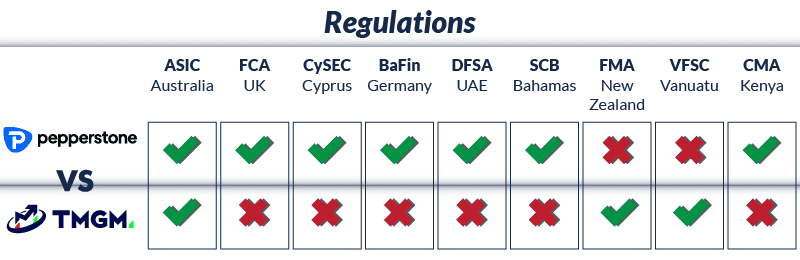

Regulations and Licenses

Brokerage

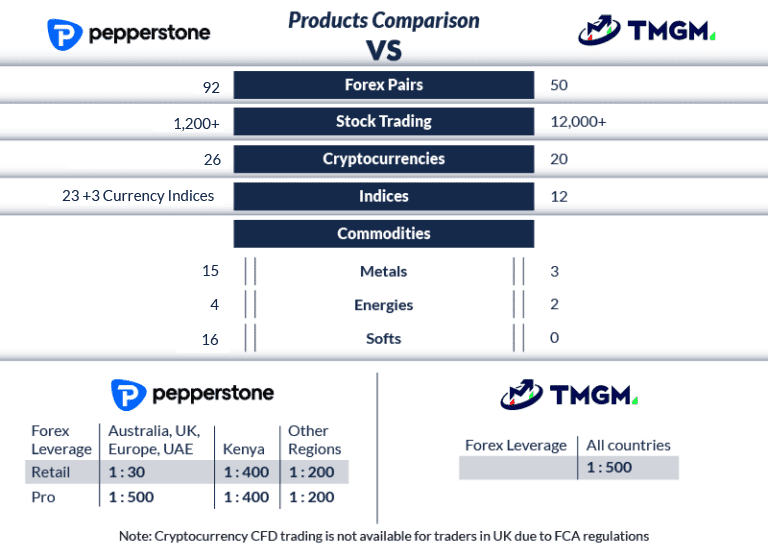

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and TMGM:

- Pepperstone offers 93 forex pairs.

- Pepperstone is regulated by 5 top-tier and 2 third-tier regulators.

- Pepperstone received 2.1 million visits in August 2022.

- Pepperstone offers 4 platforms in total.

- TMGM has a minimum deposit requirement of $100 in AUD or USD.

- TMGM is regulated by 2 top-tier and 1 third-tier regulator.

- TMGM has over 12,000 share CFDs.

1. Lowest Spreads And Fees – Pepperstone

In forex trading, brokers offering low spreads and competitive fees provide traders with cost-effective opportunities, reducing transaction costs and enhancing profitability. Tighter spreads benefit high-frequency traders by reducing costs per trade. Brokers like TMGM Markets and Pepperstone attract clients and boost trading volumes with their low spreads and competitive pricing, enhancing the trading experience and profitability for both traders and brokers.

Spreads

As of February 2025, Pepperstone features an EUR/USD spread of 1.10, while TMGM boasts a narrower spread of 1.00. In terms of AUD/USD, Pepperstone’s spread is 1.20, as opposed to TMGM’s 1.11. The average industry spreads for these pairs are 1.20 and 1.50, respectively. Overall, Pepperstone’s average spread rests at 1.35, just slightly lower than TMGM’s 1.36, with the industry average at 1.60.

Pepperstone remains a robust option for traders, providing an extensive array of trading platforms and tools. Meanwhile, TMGM holds its ground as a formidable competitor with lower spreads and a solid trading framework. Both brokers offer a diverse selection of account types and funding methods, effectively addressing the varied needs of traders around the globe.

Pepperstone is an Best Forex Brokers In Australia founded in 2010. The broker has grown to become one of the largest forex CFD brokers in the world, with over USD 9 billion worth of transactions processed per day. While Pepperstone has a global presence (they are regulated in 7 countries), Canadian and US traders will be unable to trade with Pepperstone.

| Standard Account | Pepperstone Spreads | TMGM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.35 | 1.36 | 1.6 |

| EUR/USD | 1.1 | 1 | 1.2 |

| USD/JPY | 1.3 | 1.09 | 1.4 |

| GBP/USD | 1.3 | 1.32 | 1.6 |

| AUD/USD | 1.2 | 1.11 | 1.5 |

| USD/CAD | 1.4 | 1.28 | 1.8 |

| EUR/GBP | 1.2 | 1.9 | 1.5 |

| EUR/JPY | 1.8 | 1.5 | 1.9 |

| AUD/JPY | 1.5 | 1.7 | 2.1 |

Try the Pepperstone vs TMGM fee calculator below based on the most popular forex pairs and base currencies.

Commission Levels

Pepperstone and TMGM stand out in the trading landscape with their competitive commission structure, charging just $3.50 per lot per side on their Razor and Edge accounts. While Pepperstone imposes no minimum deposit requirement, a suggested initial deposit of $200 is recommended to satisfy margin conditions. On the other hand, TMGM mandates a minimum deposit of $100, with a recommended amount of $500 for optimal trading. Both brokers provide a diverse array of funding options: Pepperstone boasts over 16 methods, including bank transfers, credit/debit cards, and various e-wallets, whereas TMGM offers more than 5 options, such as Visa/Mastercard and bank transfers. Impressively, neither broker imposes inactivity fees, and both accommodate traders who prefer swap-free accounts, ensuring flexibility for all trading preferences.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| TMGM | $3.50 | $3.50 | N/A | N/A |

Standard Account Fees

In the industry of forex trading, transaction costs play a crucial role in determining a trader’s profitability, making it essential for traders to carefully consider these expenses. Pepperstone stands out in this aspect by providing highly competitive spreads, specifically averaging an impressive 0.1 pips for the EUR/USD pair, 0.4 pips for GBP/USD, and 0.2 pips for AUD/USD, which can lead to significant savings on overall trading costs. On the other hand, TMGM also offers attractive pricing structures, featuring EUR/USD spreads that can be as low as 0.3 pips and GBP/USD spreads at around 1.4 pips, presenting an appealing option for traders who prioritize cost-effective trading conditions. Both brokers, therefore, facilitate a trading environment that allows traders to minimize their transaction costs, ultimately enhancing their potential for profitability.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.20 | 1.40 | 1.40 | 1.40 |

|

1.00 | 1.11 | N/A | 1.32 | 1.09 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.50 | 1.60 | 1.50 |

|

1.10 | 1.20 | 1.30 | 1.30 | 1.30 |

|

1.20 | 1.80 | 1.90 | 1.90 | 1.60 |

|

1.32 | 1.95 | 1.37 | 1.70 | 1.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

Our Lowest Spreads and Fees Verdict

Pepperstone takes the cake due to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

Effortless and adaptable funding options are crucial for an optimal forex trading experience. Brokers today provide an extensive array of deposit and withdrawal methods, including bank transfers, credit and debit cards, digital wallets such as PayPal, Skrill, and Neteller, and even cryptocurrencies. This variety allows traders to manage their funds easily and minimize fees. Such diverse payment solutions guarantee quick transactions, enhanced accessibility, and a more seamless trading experience.

| Trading Platform | Pepperstone | TMGM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

Pepperstone offers a variety of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. Similarly, TMGM provides access to MetaTrader options and IRESS. Both brokers excel in the trading environment with their competitive commission structures, with Pepperstone charging $3.50 per lot per side on their Razor and Edge accounts, while TMGM offers equally attractive rates.

Pepperstone has no minimum deposit requirement, although it recommends an initial deposit of $200 to meet margin conditions. In contrast, TMGM requires a minimum deposit of $100, with a suggested amount of $500 for enhanced trading capabilities. Both brokers offer a wide range of funding options: Pepperstone features over 16 methods, including bank transfers, credit/debit cards, and various e-wallets, while TMGM provides more than 5 options, such as Visa/Mastercard and bank transfers.

Remarkably, neither broker charges inactivity fees, and both cater to traders who prefer swap-free accounts, ensuring versatility to accommodate various trading styles.

Advanced Platforms

When evaluating trading platforms, Pepperstone and TMGM stand out for their diverse offerings. Pepperstone provides a range of options, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView, catering to various trading preferences. In contrast, TMGM offers the MetaTrader suite and IRESS, supporting a robust trading experience. Both brokers charge competitive commissions of $3.50 per lot per side on their advanced accounts. With no minimum deposit for Pepperstone and a recommended deposit of $200, compared to TMGM’s $100 minimum and $500 recommended deposit, traders have flexible entry points. Both brokers also offer a variety of funding options and ensure no inactivity fees, making them attractive choices for forex traders seeking cost-effective and versatile trading solutions.

Pepperstone

Pepperstone provides a variety of advanced trading platforms to cater to different trading styles and needs:

- MetaTrader 4 (MT4): The world’s most popular forex trading platform, offering advanced charting, technical analysis, and automated trading capabilities.

- MetaTrader 5 (MT5): An enhanced version of MT4 with additional features, including more advanced charting tools and the ability to trade stocks and futures.

- cTrader: Known for its intuitive design and advanced order execution capabilities, cTrader is ideal for active traders.

- TradingView: Offers powerful charting tools and integrates with Pepperstone’s trading platforms, allowing for seamless trading and analysis.

- Pepperstone’s Proprietary Platform: A user-friendly platform designed specifically for Pepperstone traders, featuring quick switch views, real-time streaming prices, and customizable watchlists.

TMGM

TMGM offers a range of advanced trading platforms to support various trading strategies:

- TradeMonster Web Platform: A robust web-based platform that provides access to a wide range of markets, including forex, stocks, options, and futures.

- MetaTrader 4 (MT4): Similar to Pepperstone, TMGM offers MT4 for forex trading with advanced charting and automated trading features.

- ThinkorSwim: A powerful platform known for its advanced charting, technical analysis, and trading tools, suitable for both novice and experienced traders.

- TD Ameritrade’s Mobile App: Allows traders to access markets on-the-go with a user-friendly mobile interface.

Both Pepperstone and TMGM offer a variety of advanced trading platforms to suit different trading preferences and styles.

Copy Trading

When assessing the copy trading platforms and features of Pepperstone and TMGM, it’s essential to recognize their unique offerings and competitive advantages. Both brokers excel in providing strong copy trading capabilities, allowing traders to mirror the strategies of seasoned professionals. Pepperstone distinguishes itself with its wide array of platform options, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and a proprietary mobile dashboard. Conversely, TMGM prioritizes MetaTrader solutions while offering a comprehensive social trading experience with features like Signal Start and real-time copying. This analysis will explore the distinct advantages of each broker, guiding you in selecting the ideal platform to meet your trading needs.

Pepperstone

Platforms:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- TradingView

- Proprietary Platform

Features:

- CopyTrading by Pepperstone: Allows you to filter through thousands of signal providers and copy their trades directly onto your MT4 or MT5 account.

- Simplicity: No complicated setups. Just download the app, create an account, and link it.

- Full Control: Set risk parameters such as position sizing and drawdown limits.

- Copy or Be Copied: You can copy traders or become a signal provider and get paid on performance.

- Mobile Dashboard: Monitor the action through the mobile dashboard.

TMGM

Platforms:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

Features:

- Social Trading: Allows users to follow and copy the trades of experienced traders.

- Signal Start: Connects traders of all experience levels to engage in a shared trading environment.

- Risk Management: Set restrictions on volume, number of trades, drawdown, and other variables.

- Real-Time Copying: Trades are copied instantly.

- Performance Tracking: Monitor the performance of your chosen trader and make adjustments as needed.

Both platforms offer robust copy trading features, but Pepperstone stands out with its additional proprietary platform and mobile dashboard. TMGM, on the other hand, focuses on integrating social trading and signal start features.

Our Better Trading Platform Verdict

Pepperstone ranks highest in this portion this is due to their trading platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

When you trade in the world of forex trading, exceptional account offerings equip traders with personalized options that cater to their distinct needs. These include competitive spreads, low commissions, and cutting-edge trading tools. Brokers like Pepperstone and TMGM provide a diverse array of account types, such as spread-only accounts and RAW pricing accounts, designed to align with various trading styles. Additionally, many of these accounts offer demo versions for practice, swap-free alternatives, and a comprehensive selection of financial instruments. Features like social trading, automated trading, and outstanding customer support enhance the trading experience, ensuring client satisfaction and fostering loyalty.

As of February 2025, Pepperstone sets itself apart by offering a variety of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. It excels with competitive fees and sophisticated trading tools. Enhanced by a solid regulatory framework governed by five top-tier and two third-tier regulators, Pepperstone gives traders access to an impressive selection of 93 forex pairs and over 1,000 share CFDs. Notably, there is no minimum deposit requirement, though a recommended initial deposit of $200 is advised for optimal trading conditions.

In contrast, TMGM is pivoted primarily towards MetaTrader platforms and IRESS, with plans to launch MetaTrader 5 shortly. The broker presents an impressive offering of 50 forex pairs and an astounding 12,000+ share CFDs, underscoring its dedication to share trading. TMGM operates under the regulation of two top-tier and one third-tier regulator, requiring a minimum deposit of $100, while a suggested deposit of $500 is recommended for ideal trading conditions. Both brokers offer a diverse range of funding options, impose no inactivity fees, and support swap-free accounts, making them compelling choices for forex traders in search of economical and flexible trading solutions.

Both brokers have their strengths, with Pepperstone excelling in forex trading and regulatory coverage and TMGM shining in share CFD offerings.

| Pepperstone | TMGM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

Pepperstone come up trumps this is due to their superior accounts and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

In forex trading, an optimal experience is achieved through a combination of advanced trading platforms, efficient execution speeds, competitive spreads, and robust customer support. Brokers such as Pepperstone and TMGM provide robust platforms and applications, including both web and mobile trading options, empowering traders to make well-informed decisions and manage their accounts with ease. With features like user-friendly interfaces, real-time market data, and sophisticated charting tools, the trading experience is not only streamlined but also enjoyable and efficient.

Following a thorough analysis of both the Pepperstone and TMGM trading platforms, combined with extensive testing, it is clear that each broker possesses its own distinct advantages. Pepperstone stands out for its MT4 platform, renowned for its intuitive interface and advanced charting capabilities. Additionally, our testing emphasized Pepperstone’s expertise in automation, particularly with tools which truly distinguish it.

Conversely, TMGM provides a powerful platform emphasizing low-latency execution and in-depth market research tools. Each platform is tailored to accommodate different trading styles and preferences, making them well-suited for a wide array of traders.

- Pepperstone’s MT4 platform is top-notch, offering a seamless trading experience.

- TMGM, while not as versatile as Pepperstone in platform offerings, still provides a robust MT4 experience.

- Both brokers ensure a smooth trading journey, but Pepperstone edges ahead with its diverse toolset.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| TMGM | 94ms | 11/36 | 129ms | 13/36 |

Our Best Trading Experience and Ease Verdict

Pepperstone outperforms the challenger in this category by the reason of their best trading experience and ease.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Pepperstone

In forex trading, robust regulatory oversight is essential for maintaining a secure and transparent environment. Regulated brokers follow strict standards like registration and audits, ensuring fair practices and protecting traders from fraud. This builds market confidence and attracts more clients, enhancing their reputation in the competitive forex industry.

Pepperstone Trust Score

TMGM Trust Score

To stay safe when trading, you should trade with a broker regulated in the country or region you are trading from. We divide regulators for you to compare broker safety quickly.

Pepperstone is regulated by 5 different top-tier regulators plus two third-tier regulators:

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Federal Financial Supervisory Authority (BaFIN) in Germany

- The Cyprus Securities and Exchange Commission (CySEC) in the EU

- The Dubai Financial Services Authority (DFSA) in the UAE

- Capital Markets Authority (CMA) in Kenya and Africa

- The Securities Commission of the Bahamas (SCB), in the Bahamas (a third-tier regulator used by the broker for countries that don’t have a regulator.

Meanwhile, TMGM is only regulated by two top-tier and one third-tier regulator. These are:

- Australia Securities Investment Commission (ASIC), in Australia

- The Financial Markets Authority (FMA) in New Zealand

- The Vanuatu Financial Services Commission (VFSC), with global regulatory coverage

| TMGM | Pepperstone | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FMA (New Zealand) | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | VFSC FSC-M (Mauritius) | SCB (Bahamas) CMA (Kenya) |

Our team of experts assumes that it is more likely that you are covered by one of Pepperstone’s top-tier regulators, but if not, you can rest assured knowing that you will get global coverage via either the SCB on Pepperstone or VFSC with TMGM.

Our Stronger Trust and Regulation Verdict

Pepperstone dominates this category, this is in light of their stronger trust and regulations.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than TMGM. On average, Pepperstone sees around 110,000 branded searches each month, while TMGM gets about 18,100 — that’s 83% fewer.

| Country | Pepperstone | TMGM |

|---|---|---|

| Australia | 8,100 | 1,900 |

| Brazil | 6,600 | 70 |

| United Kingdom | 5,400 | 720 |

| Thailand | 4,400 | 1,600 |

| United States | 4,400 | 880 |

| Malaysia | 4,400 | 2,400 |

| Kenya | 4,400 | 20 |

| Germany | 3,600 | 140 |

| Colombia | 3,600 | 30 |

| Hong Kong | 3,600 | 1,000 |

| Mexico | 3,600 | 30 |

| South Africa | 2,900 | 40 |

| India | 2,900 | 260 |

| Spain | 1,900 | 110 |

| Italy | 1,900 | 90 |

| Mongolia | 1,900 | 10 |

| Singapore | 1,600 | 590 |

| Indonesia | 1,600 | 320 |

| Peru | 1,600 | 10 |

| Turkey | 1,600 | 90 |

| Pakistan | 1,300 | 170 |

| Nigeria | 1,300 | 70 |

| Argentina | 1,300 | 20 |

| Bolivia | 1,300 | 10 |

| France | 1,000 | 210 |

| United Arab Emirates | 1,000 | 90 |

| Taiwan | 1,000 | 2,400 |

| Ecuador | 1,000 | 10 |

| Chile | 1,000 | 20 |

| Netherlands | 880 | 170 |

| Philippines | 880 | 90 |

| Dominican Republic | 880 | 70 |

| Vietnam | 720 | 1,600 |

| Morocco | 720 | 40 |

| Poland | 720 | 50 |

| Canada | 720 | 590 |

| Tanzania | 720 | 10 |

| Japan | 480 | 260 |

| Portugal | 480 | 10 |

| Cyprus | 480 | 70 |

| Costa Rica | 480 | 10 |

| Algeria | 390 | 10 |

| Bangladesh | 390 | 20 |

| Egypt | 390 | 20 |

| Sweden | 390 | 20 |

| Venezuela | 390 | 10 |

| Uganda | 390 | 10 |

| Ethiopia | 390 | 10 |

| Botswana | 390 | 10 |

| Sri Lanka | 320 | 10 |

| Switzerland | 320 | 20 |

| Austria | 320 | 10 |

| Panama | 320 | 10 |

| Cambodia | 320 | 70 |

| Saudi Arabia | 260 | 20 |

| Ireland | 260 | 10 |

| Ghana | 260 | 10 |

| Jordan | 260 | 10 |

| Greece | 210 | 20 |

| New Zealand | 170 | 110 |

| Uzbekistan | 140 | 10 |

| Mauritius | 110 | 50 |

2024 Monthly Searches For Each Brand

Pepperstone - Australia

Pepperstone - Australia

|

8,100

1st

|

TMGM - Australia

TMGM - Australia

|

1,900

2nd

|

Pepperstone - Brazil

Pepperstone - Brazil

|

6,600

3rd

|

TMGM - Brazil

TMGM - Brazil

|

70

4th

|

Pepperstone - Thailand

Pepperstone - Thailand

|

4,400

5th

|

TMGM - Thailand

TMGM - Thailand

|

1,600

6th

|

Pepperstone - Germany

Pepperstone - Germany

|

3,600

7th

|

TMGM - Germany

TMGM - Germany

|

140

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 100,000 for TMGM.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

In the ever busy and complicated world of forex trading, brokers that provide a diverse selection of Contracts for Difference (CFDs) across multiple asset classes—including forex pairs, commodities, indices, and cryptocurrencies—enable traders to enhance their portfolios and take advantage of fluctuating market conditions. This extensive range not only heightens profit potential but also enriches the trading experience, catering to a variety of strategies and risk preferences. Prominent brokers like Pepperstone and TMGM exemplify this model by offering an impressive array of CFD options, encompassing stocks, commodities, indices, currencies, ETFs, and cryptocurrencies.

A contract-for-difference (CFD) is a powerful financial instrument that enables you to trade various assets without the need for ownership. With CFDs, you can engage in trading forex, shares, indices, ETFs, commodities, and cryptocurrencies, all while bypassing the complexities of holding the underlying assets directly.

Pepperstone provides you with 93 different currency pairs and over 1,000 share CFDs. Other instruments can be seen in our product comparison image.

Pepperstone offers leverage at the maximum levels permitted by regulatory authorities. Retail traders can enjoy leverage of up to 30:1, while professional traders can access an impressive 500:1 leverage. However, in Kenya, regulations differ slightly, allowing a maximum leverage of 400:1. For traders outside prominent markets such as the EU, UK, or Australia, the maximum leverage is set at 200:1.

TMGM only has 50 forex pairs available for you to trade, but they have many more share CFDs at 12,000+. While leverage for retail traders is the same as Pepperstone, pro traders get up to 400:1 leverage when trading with TMGM.

| CFDs | Pepperstone | TMGM |

|---|---|---|

| Forex Pairs | 93 | 61 |

| Indices | 26 | 12 |

| Commodities | 40 Commodities 15 Metals, 4 Energies, 16 Softs, 5 Hard | 3 Metals 2 Energies |

| Cryptocurrencies | 27 | 12 |

| Share CFDs | 1,200+ | 12000+ |

| ETFs | 108+ | 0 |

| Bonds | 0 | 0 |

| Futures | 42 | 0 |

| Treasuries | 0 | 0 |

| Investments | 0 | 0 |

Clearly, the broker with a stronger range of products is Pepperstone. Although TMGM does offer more share CFDs with a strong IRESS offering, Pepperstone has more CFD options, like with forex pairs or stock indices.

Our Top Product Range and CFD Markets Verdict

Pepperstone steals the show in this section, owing it to their top product range and CFD markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

When trading with forex, access to outstanding educational resources is vital for traders aiming to master the markets with confidence and expertise. A diverse array of comprehensive learning materials—such as webinars, articles, video tutorials, and structured courses—empowers traders with the critical knowledge and skills necessary to make informed decisions and refine their trading strategies.

Platforms like Coursera offer a multitude of forex courses that allow traders to learn at their own pace and convenience. Moreover, forums like Global-View.com enable traders to share insights and stay abreast of market trends. By engaging with these premium educational resources, traders cultivate continuous learning and development, significantly enhancing their prospects for long-term success in the forex market.

When it comes to educational resources, both Pepperstone and TMGM have made significant efforts to cater to traders of all levels. Here’s a breakdown of what each broker offers:

Pepperstone:

- Webinars & Seminars: Regularly hosts webinars and seminars to educate traders.

- Trading Guides: Comprehensive guides that cover various trading topics.

- Market Analysis: Provides in-depth market analysis to help traders make informed decisions.

- Tutorials: Offers tutorials on how to use their trading platforms effectively.

- Economic Calendar: A tool that highlights important financial events that can impact the markets.

- Customer Support: Dedicated support team to assist with any educational queries.

TMGM:

- Webinars: Offers webinars that cover a range of trading topics.

- Educational Videos: A collection of videos that teach trading concepts and strategies.

- E-books: Provides e-books that delve into various trading topics.

- Market News: Keeps traders updated with the latest market news.

- Glossary: A comprehensive glossary that explains trading terms.

- Support Team: A team that can assist with educational materials and queries.

Our Superior Educational Resources Verdict

Pepperstone secures first place in this category, this is on account of their superior education resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

9. Superior Customer Service – Pepperstone

In forex trading, exceptional customer service is crucial for ensuring traders receive timely support and guidance, fostering a seamless and confident trading experience. Brokers such as TMGM and Pepperstone have earned acclaim for their exceptional customer service, providing prompt assistance in various languages. This commitment to support allows traders to quickly address any issues, significantly improving satisfaction and fostering trust in the brokerage.

Our research and studies on customer service offerings from brokers reveal that both Pepperstone and TMGM truly recognize the importance of exceptional support. They have made substantial investments in delivering outstanding customer service to their traders. Our own testing clearly indicates that both brokers have made impressive advancements in this area.

In the competitive forex trading industry, exceptional customer support is crucial for a seamless trading experience. Pepperstone offers 24/7 assistance via phone, live chat, and email, ensuring traders receive timely and effective support. Similarly, TMGM provides robust customer service through multiple channels, including live chat, phone, email, and social media platforms, catering to traders’ diverse needs. This commitment to responsive and accessible support enhances trader confidence and satisfaction.

| Feature | Pepperstone | TMGM |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Both brokers have shown a commitment to ensuring that their traders have the support they need. However, the nuances in their offerings can make a difference depending on individual trader preferences.

Our Superior Customer Service Verdict

Pepperstone excels in this section against the contender, this is because of their superior customer service.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

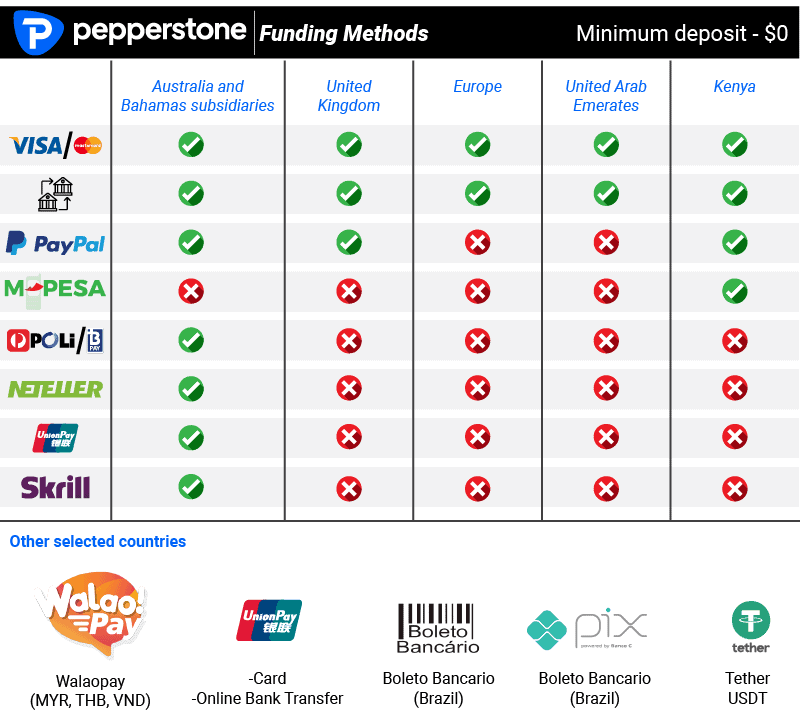

10. Better Funding Options – Pepperstone

In forex trading, having access to a variety of funding options enhances flexibility and convenience for traders. Brokers like Pepperstone and TMGM stand out by offering more than 30 funding options, including bank transfers, credit and debit cards, and electronic wallets, all without any deposit fees. Likewise, Pepperstone and TMGM boasts a variety of deposit methods, such as debit cards and bank transfers, while also waiving fees for incoming deposits—although traders should be aware of potential external bank charges. By providing a wide range of funding methods with minimal or no fees, these brokers empower traders to manage their accounts with ease, ensuring smooth deposits and withdrawals, which ultimately enriches the trading experience.

To begin trading, it’s crucial to fund your account to satisfy margin requirements. Pepperstone offers the flexibility of having no minimum deposit, enabling traders to start with any amount they choose. However, the broker suggests a deposit of $200 to provide adequate margin coverage for your trading endeavors.

| Funding Option | Pepperstone | TMGM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Funding methods in forex trading vary by country, with options such as bank transfers, credit/debit cards, and digital wallets like PayPal, Skrill, and Neteller commonly available. However, availability depends on regional regulations and broker policies. For instance, in the UAE, retail traders may have limited access to certain funding methods. Additionally, international bank transfers may incur fees, so it’s advisable to consult your broker’s guidelines and local regulations to understand the specific funding options and any associated costs applicable in your region.

However, TMGM does have a minimum deposit requirement, which is $100 in either AUD or USD. However, the recommended minimum deposit is higher, at $500. While TMGM does offer Visa/Mastercard and bank transfers, the only eWallet available for you to deposit with is POLi.

For the IRESS accounts, the minimum deposit is USD 5,000,000, $10,000, and $50,000, respectively.

Our Better Funding Options Verdict

Pepperstone come out on top as a result of their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

A reduced minimum deposit in forex trading has become a game changer, making it possible for a diverse array of traders—including newcomers and those with limited funds—to enter the market. With brokers now accepting deposits as low as $5, accessing the forex market is easier than ever. This level of inclusivity encourages wider participation, enabling traders to gain practical experience and hone their strategies without the burden of a significant initial investment.

Pepperstone has a lower minimum deposit of $0 compared to TMGM, which requires traders at least $100. They vary in their recommended deposits as well, as we show in the table below:

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| TMGM | $100 | $500 |

Our Lower Minimum Deposit Verdict

Pepperstone steals the crown here, on the account of their lower minimum deposit.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

So Is TMGM or Pepperstone The Best Broker?

Pepperstone steals the show in this review because it consistently outperforms TMGM across multiple key areas that traders value the most. The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | TMGM |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Pepperstone: Best For Beginner Traders

For those just starting out in the trading world, Pepperstone offers a more comprehensive and user-friendly experience, making it the ideal choice for beginner traders.

Pepperstone: Best For Experienced Traders

For seasoned traders looking for advanced tools, diverse trading pairs, and superior platform options, Pepperstone remains the top choice, catering to their sophisticated needs.

FAQs Comparing Pepperstone Vs TMGM

Does TMGM or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs compared to TMGM. Traders often prefer Pepperstone due to its competitive spreads and reduced commission fees. For a detailed breakdown of spread data, you can refer to our comprehensive comparison of the lowest spread forex brokers.

Which Broker Is Better For MetaTrader 4?

Both TMGM and Pepperstone offer MetaTrader 4, but Pepperstone is often favoured for its enhanced MT4 features and tools. Their platform integration is seamless, and traders can benefit from a range of additional plugins. For more insights on the best MT4 brokers, check out our best MT4 forex brokers comparison.

Which Broker Offers Social Trading?

Pepperstone stands out when it comes to offering social or copy trading options. They provide traders with a platform that integrates with various social trading tools, allowing them to follow and replicate the strategies of experienced traders. For a deeper dive into the world of social trading, explore our guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither TMGM nor Pepperstone offer spread betting to their clients. Spread betting is a unique form of trading popular in the UK and some other regions. If you’re keen on exploring brokers that provide spread betting, our best spread betting broker guide offers comprehensive insights.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is the superior choice for Australian Forex traders. Founded in Australia and regulated by ASIC, Pepperstone has a strong local presence and understands the unique needs of Aussie traders. TMGM, while also offering services in Australia, is not originally founded there. For a broader perspective on the best brokers in the region, you can refer to our Best Forex Brokers In Australia comparison.

What Broker is Superior For UK Forex Traders?

From my viewpoint, Pepperstone again takes the lead for UK Forex traders. While both brokers offer services in the UK, Pepperstone’s FCA regulation gives it an edge in terms of trustworthiness and compliance. TMGM, on the other hand, doesn’t have the same level of local regulatory oversight. For those in the UK looking for a comprehensive trading experience, our Best Forex Brokers In UK guide provides a detailed overview.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.