VantageFX Review Of 2026

We found VantageFX to have tight spreads and low commissions, beyond that the Forex broker is quite generic with MT4 and MT5 trading platforms and 50+ Forex pairs along with other CFD products.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

VantageFX Summary

| 🗺️ Tier 1 Regulation | ASIC, FCA |

| 🗺️ Tier 3 Regulation | FSCA, VFSC |

| 💰 Trading Fees | Low trading costs |

| 📊 Trading Platforms | MT4, MT5, Vantage App and Protrader |

| 💰 Minimum Deposit | $50 |

| 🛍️ Instruments Offered | CFDs (Forex, Indices, Metals, Energies, Bonds, ETFs) |

| 💳 Funding Methods | Wire Transfer, Visa, Mastercard, Skrill, Neteller, UnionPay |

Why Choose VantageFX

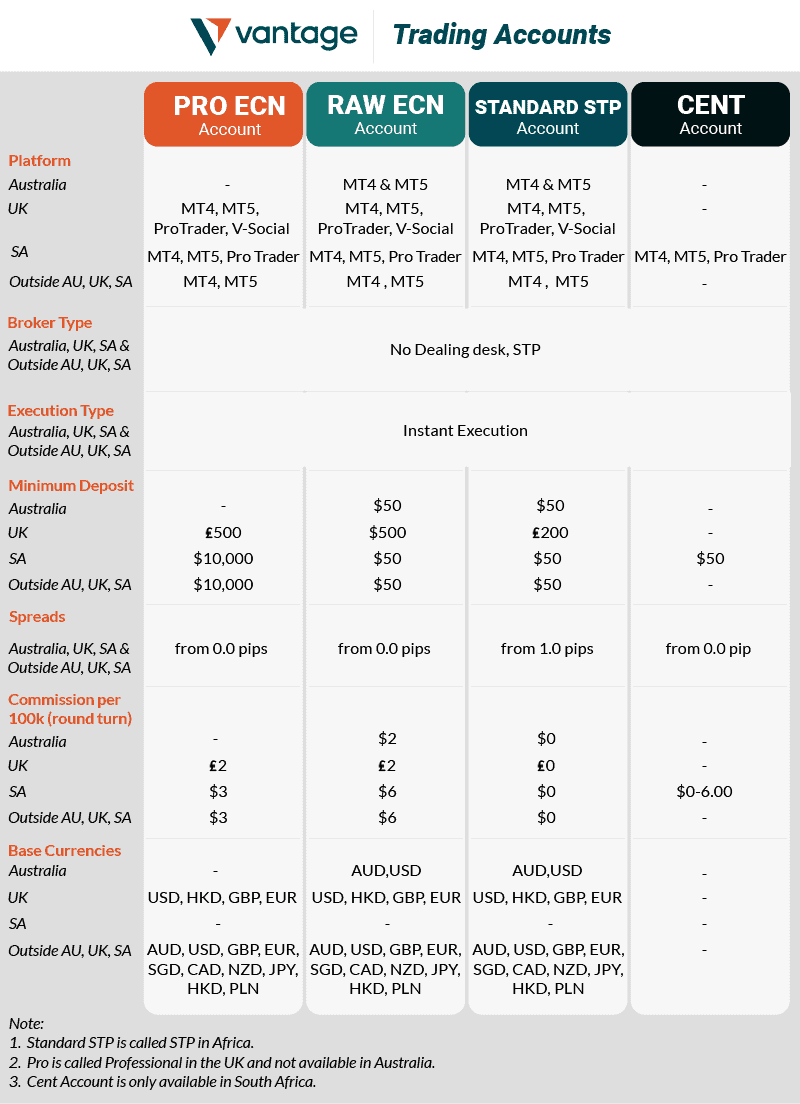

We think VantageFX is a good choice for traders who want a choice of commission (RAW, Pro) and no commission (Standard) trading accounts with low trading costs thanks to their no-dealing desk model with STP or ECN style trading execution.

Beyond the tight spreads and commission, VantageFX is a relatively generic broker offering MT4 and MT5 with a good range of CFD trading products. While they could certainly provide better in-house trader education and analytical tools (features that would give them a more distinctive selling point), we think most traders will be happy to overlook this in return for the lower trading costs.

VantageFX Pros and Cons

- Good selection of charting platform options

- Spreads are competitive

- Very low commissions

- MT4 and MT5 trading platforms

- Customer support was hit-and-miss

- Advanced educational resources could be improved

- Vantage doesnt accept Canadian trader

- Lack platform variety

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

VantageFX is a non-dealing desk broker, using liquidity from liquidity providers such as tier-1 investment banks and prime brokers to offer straight-through processing (STP) pricing for their clients.

1. Raw Account Spreads

VantageFX like many brokers, provide their average spreads on their website. We keep a record of 40 such brokers that do this such as Pepperstone, IC Markets and Go Markets, doing this allows us to not only compare the average spreads between brokers but also compile an industry average.

In the case of VantageFX, they only provide the average for their commissions-based account (specifically their RAW ECN Brokers) so we are able to compare this type of account.

ECN Forex Spread Comparison | |||||

|---|---|---|---|---|---|

| 0.18 | 0.60 | 1.19 | 0.36 | 0.85 |

| 0.14 | 0.31 | 0.62 | 0.39 | 0.75 |

| 0.06 | 0.20 | 0.10 | 0.10 | 0.20 |

| 0.10 | 0.10 | 0.90 | 0.30 | 1.30 |

| 0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

| 0.90 | 0.13 | 0.17 | 0.14 | 0.14 |

| 0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

| 0.10 | 0.20 | 0.50 | 0.30 | 0.20 |

| 0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

| 0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

| 0.80 | 0.40 | 1.30 | 0.50 | 0.90 |

| 0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

| 0.51 | 1.15 | 0.99 | 0.94 | 1.28 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Despite the fact VantageFX round their average spreads (we assume down, not up), we can say their spreads compare favourably to the industry average. But our results do suggest there may be certain currency pairs to look out for, for example, our test suggests the spreads for the AUD/JPY pair might be a bit high.

| Raw Account Spreads | Vantage FX | Average Spread |

|---|---|---|

| Overall | 0.65 | 0.74 |

| EUR/USD | 0.18 | 0.21 |

| USD/JPY | 0.35 | 0.39 |

| GBP/USD | 0.14 | 0.48 |

| AUD/USD | 0.6 | 0.39 |

| USD/CAD | 0.45 | 0.53 |

| EUR/GBP | 0.36 | 0.55 |

| EUR/JPY | 0.85 | 0.74 |

| AUD/JPY | 1.19 | 1.07 |

| USD/SGD | 1.7 | 2.34 |

Ross Collins, our chief researcher tested the Raw Account Spreads for 20 MT4 brokers for RAW-style accounts and found Fusion Markets and IC Markets to be among the top choices for tight spreads. At this time, we haven’t tested the spreads with VantageFX ourselves but when we do, we will update this page.

2. Raw Account Commission Rate

For Vantages Raw ECN Account, the commission fee per round turn is $6, or $3 per side, for a full lot ($100,000 trading size).

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Vantage FX Commission Rate | $3.00 | $3.00 | £2.00 | €2.50 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

In case you are wondering how these commissions compare to other brokers, Ross Collins did an extensive comparison. We think you will agree that commissions with VantageFX are very good when you see our Commission Fees results.

3. Standard Account Fees

The Standard STP Account account is designed to cover the needs of most non-professional traders, and is commission-free, but comes with higher (more expensive) trading spreads compared to the more professional account options. Spreads with this account start from 1 pip.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Vantage FX Average Spread | 1.3 | 0.27 | 1.8 | 1.4 | 1.6 | 1.6 | 1.8 | 2 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

While we haven’t tested the spreads with this account, Ross Collins, our chief researcher tested the Standard Account Spreads for 20 other MT4 brokers. These tests found IC Markets to be the best choice for low spreads.

If you’re just starting out, or you only going to take the occasional trade, the standard account is probably right for you.

If you’re a serious trader and you’re going to be doing a lot of volume, or making a large amount of trades throughout the day, you’ll probably want to save on trading spread costs with an ECN account.

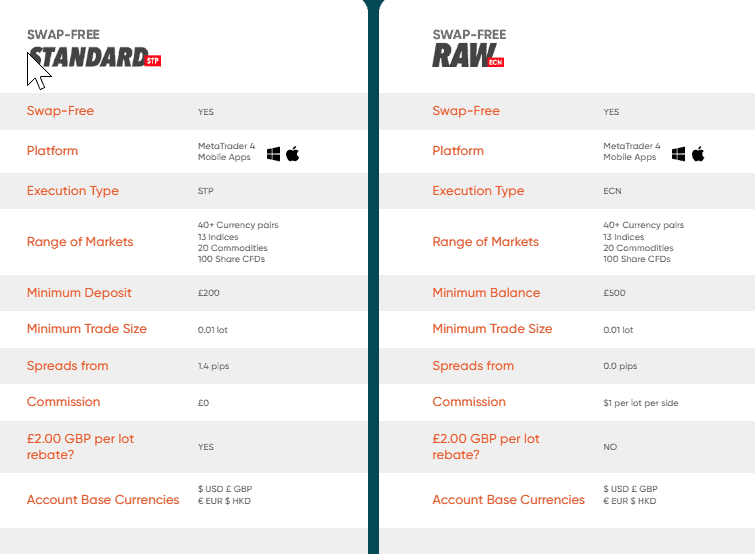

4. Swap-Free Account Fees

If you are of Islamic faith and comply with Sharia law then the use of a riba is forbidden. In the case of trading, a swap fee (sometimes called an overnight charge or rolling fee) is considered a form of riba and is therefore not permitted. For this reason, a Swap Free Islamic Accounts is available provided you can prove your eligibility.

If you do take up a swap-free account, do note that swap costs are replaced with a daily administration charge so one could argue this account is not a true sharia law compliant Islamic account.

Spread Betting Account

If you are in the UK you can open a spread betting broker account is available. Spread betting is a popular alternative to CFD trading, mostly because you do not need to pay a capital gains tax on your spread bet winnings. The flip side is, that you can’t declare the losses for tax credits.

All CFD trading products are available for spread betting and since they both have the same underlying instruments, the spread or points will be the same. Spread betting accounts do not have commission costs in addition to the spread.

Open Demo AccountVisit Vantage FX

*Your capital is at risk ‘68.4% of retail CFD accounts lose money’

Leverage

Vantage offers leverage amounts anywhere from 2:1 to 500:1.

The amount of leverage that you’re offered depends on a number of things including which product you want to trade, your account type, and which government body regulates your particular account.

For example, retail traders from the UK and Australia are offered 30:1 leverage on major forex pairs such as the EURUSD, AUDUSD, and GBPUSD.

If you jump through the hoops to be labeled as a professional or have multiple millions of dollars, you can be offered up to 500:1 leverage on those same currency pairs.

For traders outside the UK and Australia, all currency trading comes with 500:1 leverage.

This all has to do with the rules of specific regulatory bodies. The Australian Securities and Investment Commission (ASIC) and England’s Financial Conduct Authority (FCA) are both very tight on how much leverage is allowed for retail traders.

5. Other Fees

The good news is there are no charges when it comes to deposits, withdrawals, and inactivity.

Verdict on Fees

So, what’s the right account for you? If you’re an active trader or professional trader, trading more than a few times per week, you’ll almost definitely want to use the raw ECN account. If you’re located in Australia or the UK, it’s a no-brainer to take advantage of the low commissions on the raw ECN account.

Open Demo AccountVisit Vantage FX

*Your capital is at risk ‘68.4% of retail CFD accounts lose money’

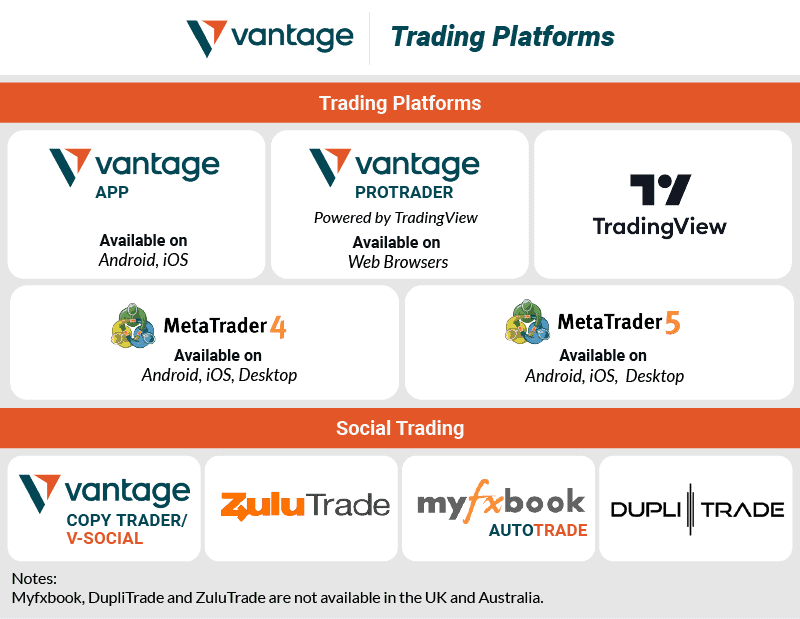

Trading Platforms

We were impressed by the trading platform options offered by Vantage.

| Trading Platform | Available With VantageFX |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

MetaTrader 4

Firstly, there’s MetaTrader4 (MT4), which is the industry standard work-horse software. This is the ultra-reliable, Toyota Hilux of the forex industry, which will solidly run on desktop, Mac, Android, or iPhone. MT4 has a ton of features, including use of Expert Advisor tech for custom trading analysis. For more insights, check out our list of the best MT4 Forex brokers in the UK.

MetaTrader 5

Next, there is the more recent MetaTrader5 (MT5), which is a more feature-rich version of MT4 and can be great for traders who need specific technical indicators or chart time frames.

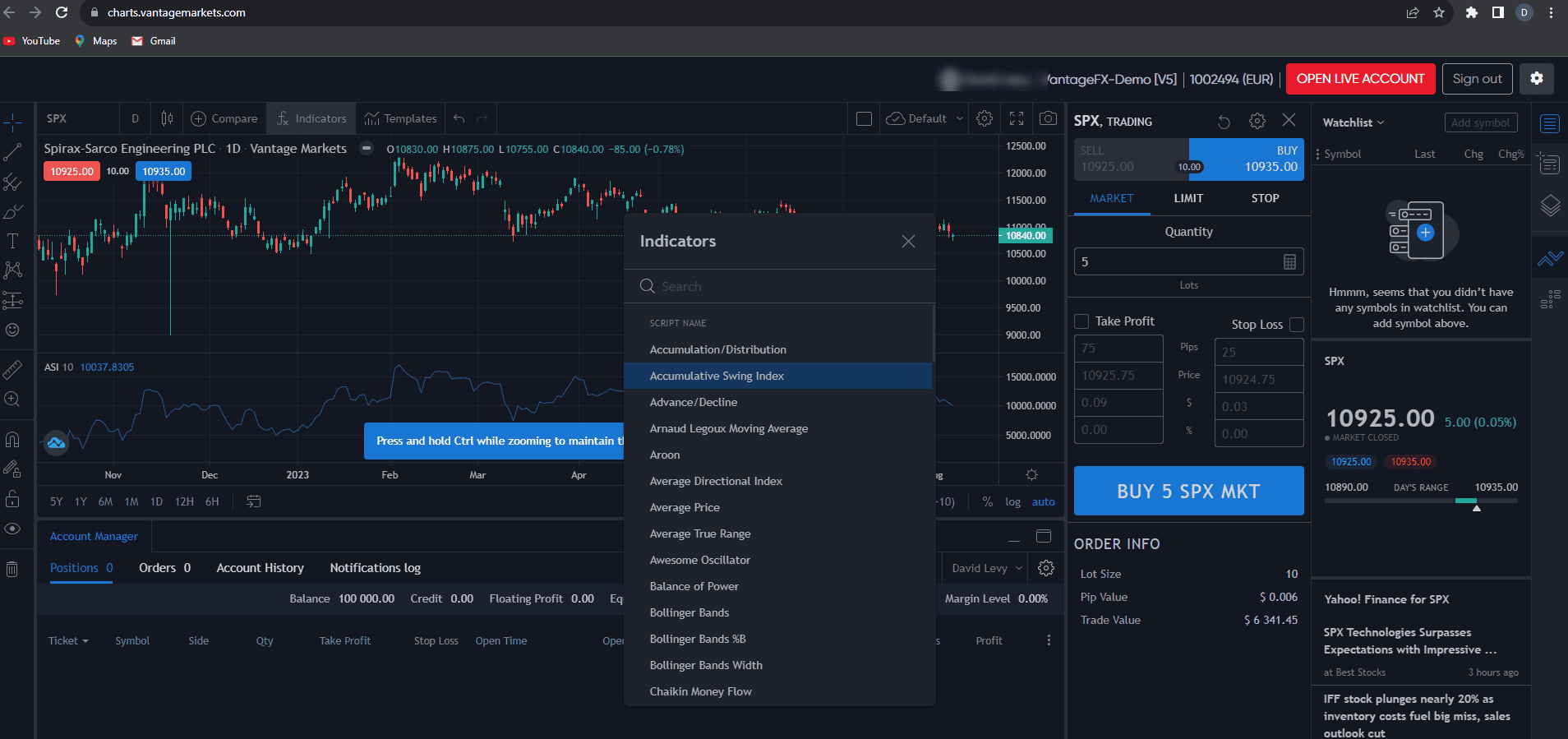

Moving over to Vantage branded options, we had the pleasure of viewing Vantage ProTrader. This is a web-browser-based charting solution that is essentially a branded version of TradingView.

Vantage ProTrader is fantastic, in that there are huge amounts of customisable trading indicators, you can do fancy things such as correlation analysis, and it has just about all the bells and whistles you’ll ever need (for charting, at least).

One particular downside with Vantage ProTrader is that it’s browser-based, which could be a problem if you have a slower computer. The other downside is that it’s just a charting platform at the moment, Vantage doesn’t offer trade order entry through it.

For actual trading orders, you’ll need something like MT4 or MT5. Personally, my easy choice would be to combine TradingView charting with MT4 for order entry.

For traders who are located in countries outside the UK and Australia, Vantage also offers a range of social trading platforms.

These allow you to either copy another person’s trades or publish your trades and allow others to ride along with you.

These trading platforms can be great if you find an impressive trader and you’re confident they have a good strategy and legitimate edge, but our advice is to always be skeptical when following other traders.

Lastly, there are a range of options for trading from your smartphone. MT4 and MT5 are both offered, which will run on either Android or iOS. There is also the Vantage App, which is essentially a branded version of the MT5 mobile app.

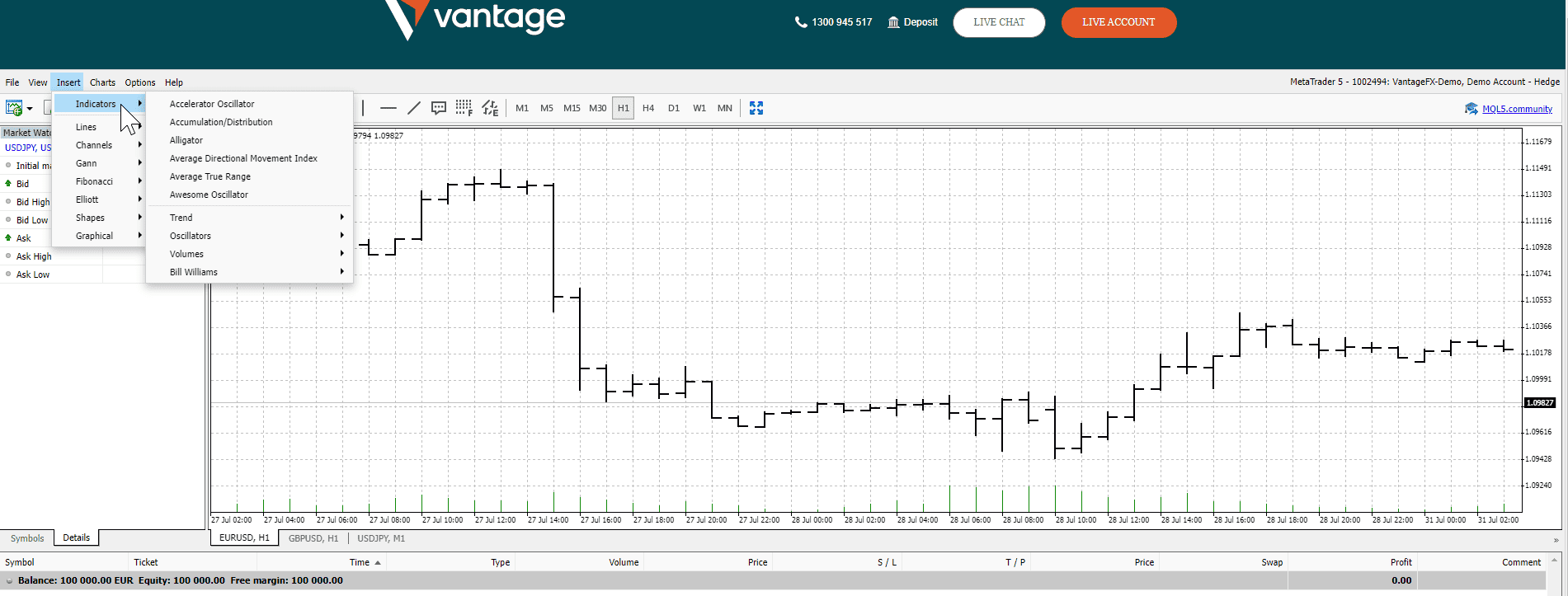

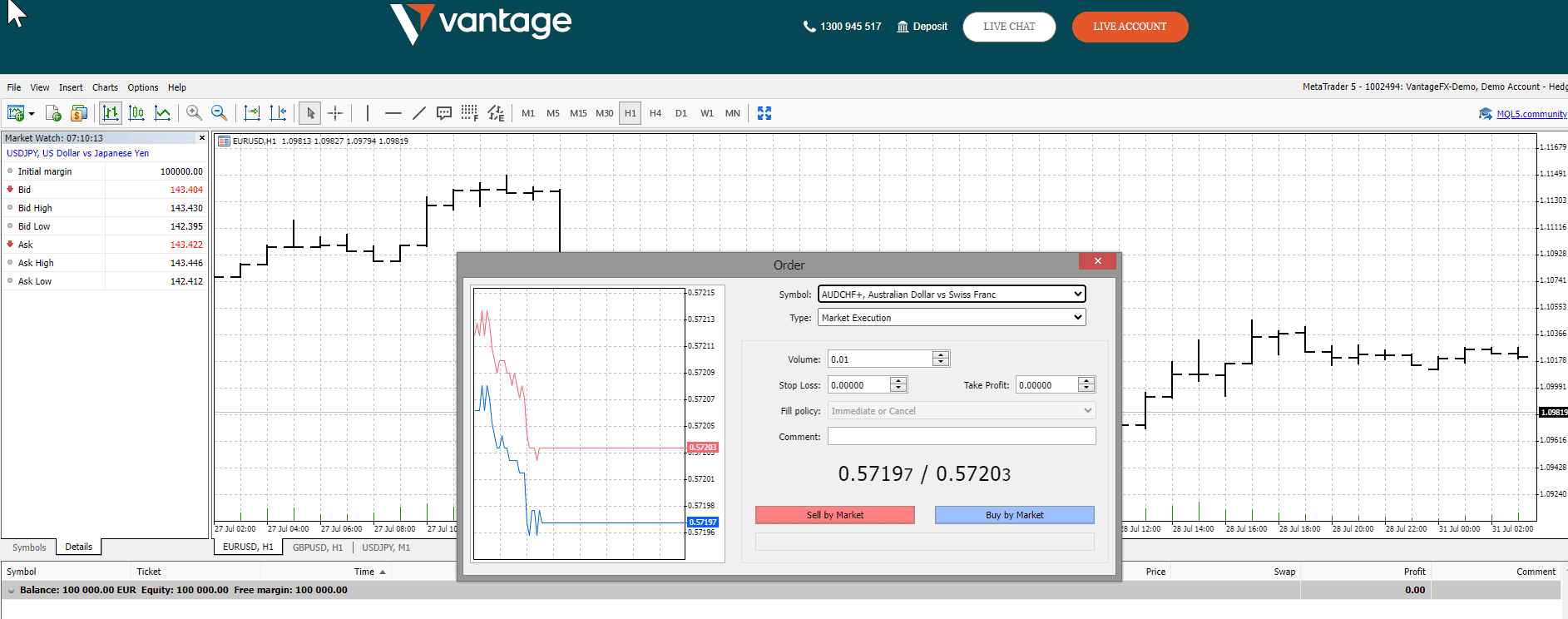

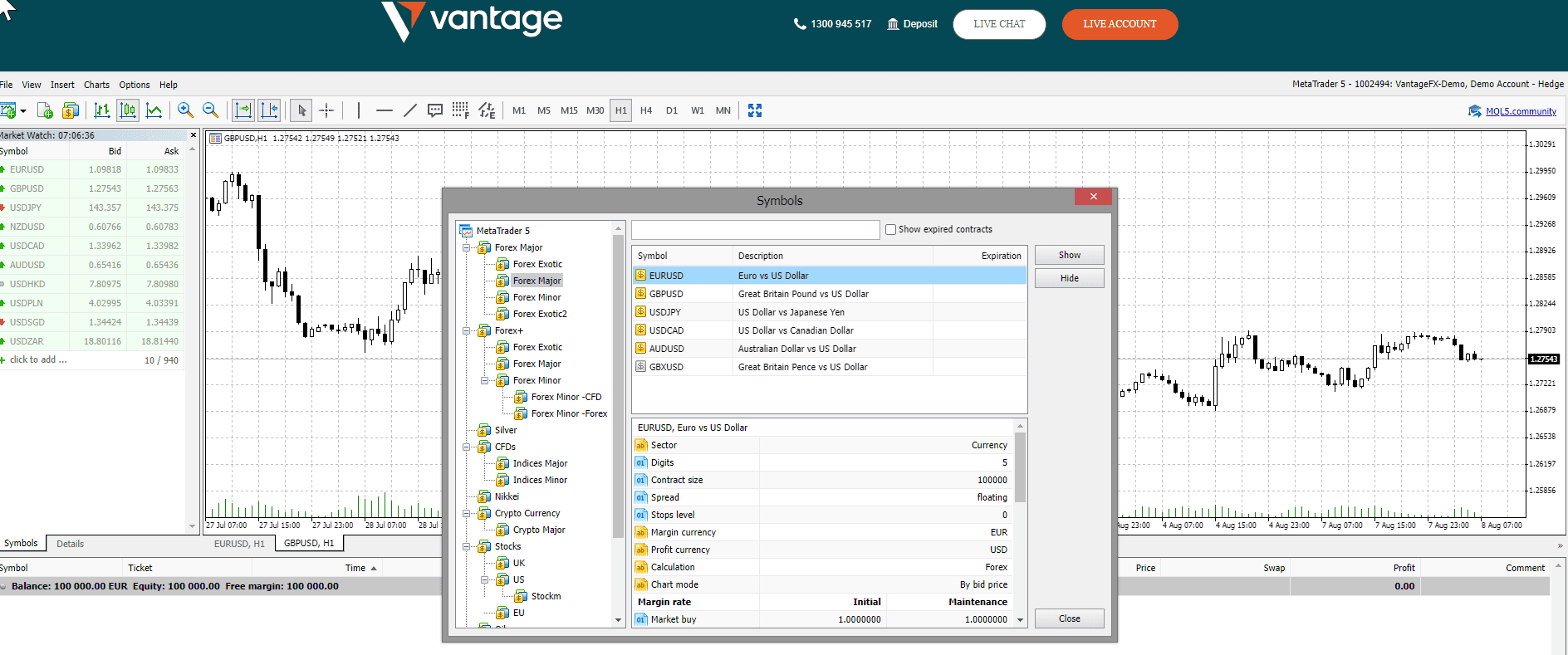

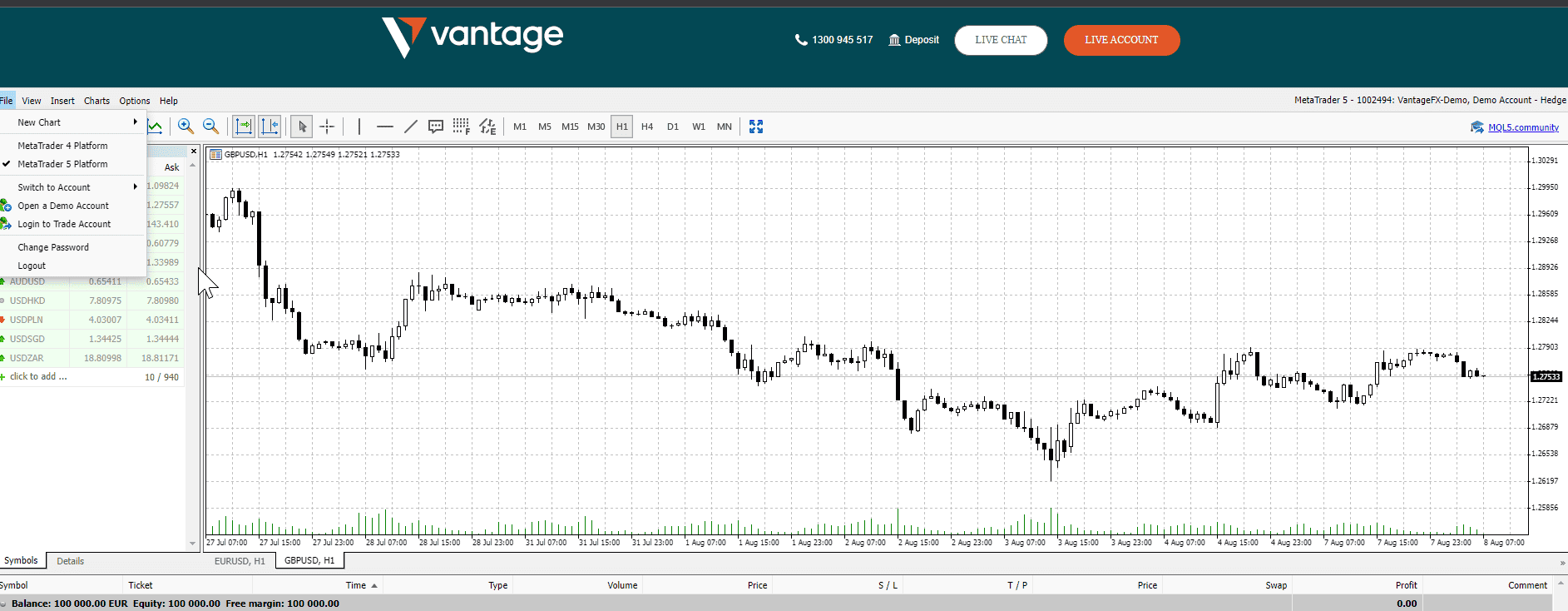

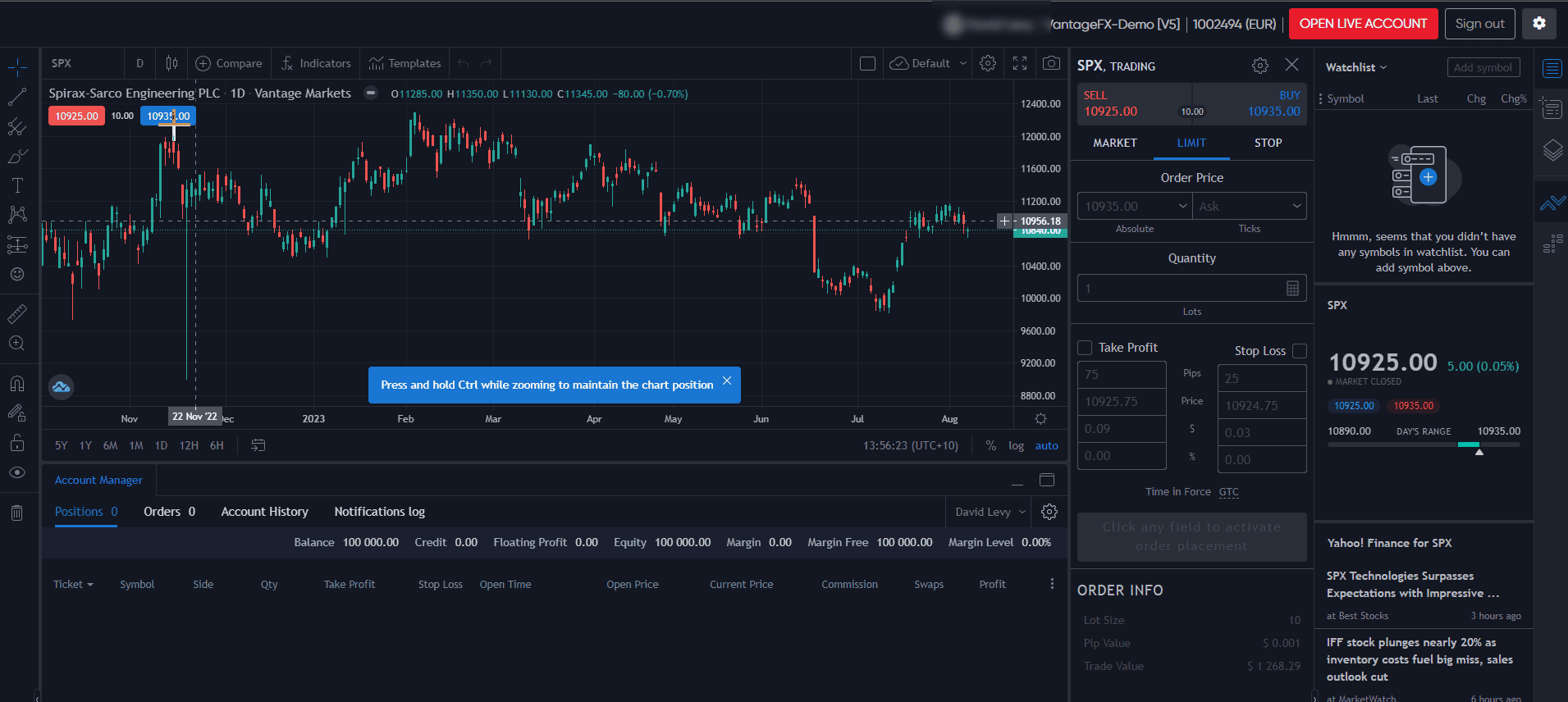

We tested the MT5 Trading Platform

Getting started with the MetaTrader trader is quite straightforward. We covered how to sign up for a Demo Account and Live account elsewhere on this page. MT4 and MT5 are somewhat similar, MT5 is the successor to MT4 so offers much of what MT4 has but more charts, indicators and tools overall. For this reason we only tested the MT5 trading platform.

More information can be found in our MetaTrader 4 vs MetaTrader 5 guide. .

As you can see, MT5 has a very clean and intuitive interface, which is great for keeping trading stress levels to a minimum.

Placing orders in MT5 is very simple, select your order type and trading parameters, then click the blue or red buy and sell buttons.

Selecting which markets to look at is very simple.

If you have multiple accounts, you can switch between them in seconds with MT5.

Charts By TradingView offers what we believe are some of the best charting options for retail traders.

There are countless chart indicators in TradingView, all accessible at the click of a button.

Is VantageFX Safe?

Vantage FX earns a 6/10 Trust Score, giving it an average rating for safety and reliability.

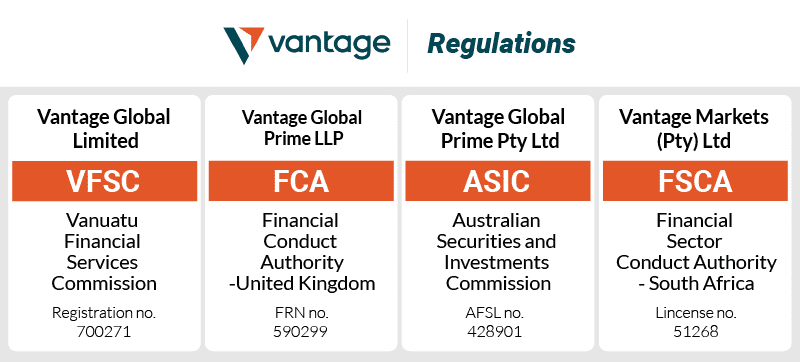

1. Regulation

The Vantage group of companies is licensed by two tier-1 regulators and two tier-3 regulators across four different jurisdictions.

These jurisdictions are Australia, the UK, Vanuatu, and South Africa.

| Vantage FX Safety | Regulator |

|---|---|

| Tier-1 | ASIC (Australia) - Australian Securities and Investments Commission FCA (United Kingdom) - Financial Conduct Authority |

| Tier-2 | X |

| Tier-3 | VFSC (Vanuatu) - Vanuatu Financial Services Commission FSCA (South Africa) - Financial Sector Conduct Authority |

If you’re located in Australia, the UK, or South Africa, your account will be regulated by your country’s regulatory body.

For traders outside of those particular countries, your account will be regulated by Vanuatu’s VFSC (Vanuatu Financial Services Commission). Vantage is a member of The Financial Commission, which is an independent dispute resolution body.

In terms of where your funds are held, Vantage holds client funds in top-tier banks, and in trust accounts as funds that are separate from company funds.

The company has been around for close to 15 years, and in our opinion, looks to be rather solid and safe when it comes to holding your trading capital.

Of course, it’s always a good idea to hold only a fraction of your trading capital in any one trading account at one time.

Vantage is also a member of The Financial Commission which is a body formed exclusively for solving any disputes between brokers and traders in a smooth, seamless manner. The Financial Commission while impartial, is not a government body or regulator.

A few notable brokers such as Pepperstone, IC Markets, FXTM, AXI and Exness use this body to resolve disputes and on average claims take about 5 days to resolve.

2. Reputation

Vantage Markets (Also known as Vantage FX, Vantage Global Prime, and Vantage Global Limited) is a foreign exchange and CFD broking firm, headquartered in Sydney, Australia. Founded in 2009 as MXT Global, Vantage now has over 1,000 staff across 30 offices located around the globe.

The broker demonstrates strong visibility in the online trading space. With approximately 301,000 monthly Google searches, it ranks as the 10th most popular forex broker among the 65 brokers analyzed. Web traffic data confirms this strong positioning, with Similarweb reporting 2,509,000 global visits in August 2025, placing Vantage as the 13th most visited broker.

Vantage has expanded its global footprint to include regulatory oversight from authorities across multiple jurisdictions. While the broker doesn’t publicly disclose its exact client numbers, it reports serving clients in more than 180 countries. Vantage’s trading volume has shown significant growth, with the company reporting over $160 billion in monthly trading volume in 2024, reflecting its established position among the top tier of global forex brokers.

| Country | 2025 Monthly Searches |

|---|---|

| India | 3,600 |

| United Kingdom | 2,900 |

| Malaysia | 1,600 |

| Indonesia | 1,000 |

| Brazil | 1,000 |

| South Africa | 880 |

| Germany | 880 |

| Netherlands | 880 |

| Italy | 880 |

| Spain | 880 |

| United Arab Emirates | 880 |

| United States | 720 |

| Nigeria | 720 |

| France | 720 |

| Australia | 590 |

| Philippines | 590 |

| Thailand | 590 |

| Singapore | 390 |

| Poland | 390 |

| Hong Kong | 390 |

| Vietnam | 320 |

| Kenya | 260 |

| Pakistan | 260 |

| Sweden | 260 |

| Portugal | 260 |

| Turkey | 210 |

| Switzerland | 210 |

| Colombia | 210 |

| Mexico | 170 |

| Cyprus | 170 |

| Ireland | 170 |

| Argentina | 170 |

| Canada | 140 |

| Austria | 140 |

| Bangladesh | 140 |

| Taiwan | 140 |

| Greece | 110 |

| New Zealand | 110 |

| Peru | 110 |

| Uzbekistan | 110 |

| Japan | 90 |

| Morocco | 90 |

| Egypt | 70 |

| Saudi Arabia | 70 |

| Dominican Republic | 70 |

| Venezuela | 70 |

| Chile | 70 |

| Ghana | 50 |

| Sri Lanka | 50 |

| Ecuador | 50 |

| Mongolia | 50 |

| Uganda | 40 |

| Panama | 40 |

| Algeria | 30 |

| Bolivia | 30 |

| Cambodia | 20 |

| Botswana | 20 |

| Uruguay | 20 |

| Costa Rica | 20 |

| Ethiopia | 10 |

| Tanzania | 10 |

| Mauritius | 10 |

| Jordan | 10 |

3,600 1st | |

2,900 2nd | |

1,600 3rd | |

1,000 4th | |

1,000 5th | |

880 6th | |

880 7th | |

880 8th | |

880 9th | |

880 10th |

3. Reviews

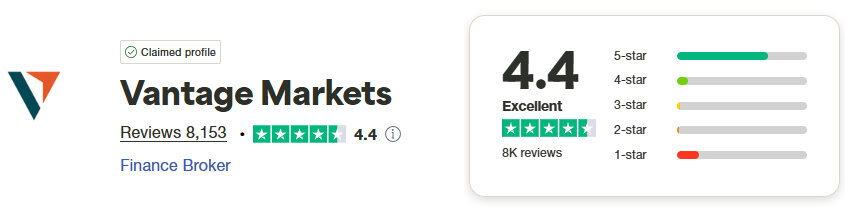

VantageFX has a TrustPilot score of 4.4 out of 5 from 8,153 reviews.

Open Demo AccountVisit Vantage FX

*Your capital is at risk ‘68.4% of retail CFD accounts lose money’

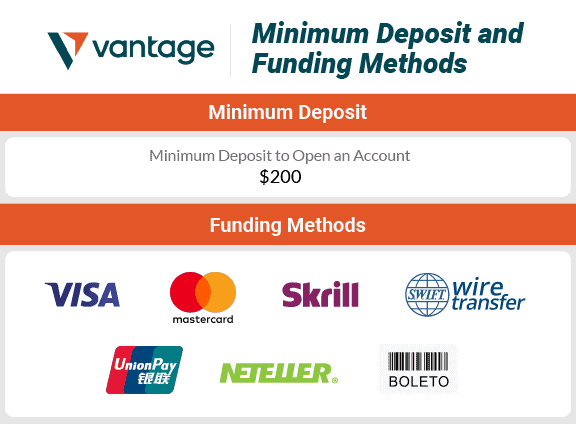

Deposit and Withdrawal

Vantage has a range of deposit methods, making it pretty easy for most traders around the globe to fund their accounts.

The deposit options are especially good for traders in Australia, with a number of instant or completely fee-free options. The minimum account deposits depend on what type of account you’ve opened.

What is the minimum deposit at VantageFX?

For the cent account (available for South African traders only), you can deposit as little as $50 USD. For standard STP accounts, the minimum deposit is $200 USD or the equivalent in the base currency you’ve chosen. The ECN accounts come with a $500 USD minimum account balance, or the equivalent in your chosen base currency.

Deposit Options and Fees

In terms of funding methods, we found a number of options, but some are better than others.

You can elect for a wire transfer, which will incur $0 fees from Vantage, but may have fees charged by the bank that you’re sending funds from.

You can use PayPal, or your Visa or MasterCard for an instant deposit. Be careful if using a credit card, as the deposit may be labeled as a cash advance and come with added fees or interest charges.

There are also e-wallet providers such as Neteller or Skrill, which can help you to segregate your trading funds from your personal bank account. These deposits are fee-free when depositing to Vantage.

If you’re from Australia, you’re spoiled for choice, with a number of impressive deposit methods.

You can elect for an electronic funds transfer from an Australian Bank, or a BPay transfer, which will be fee-free but take a couple of days. Probably a better method would be to use a PayID transfer which should be close to an instant deposit.

Withdrawal Options and Fees

All of the deposit and withdrawal options come with zero fees from VantageFX themselves, but some options may have fees from a specific bank or financial company.

Open Demo AccountVisit Vantage FX

*Your capital is at risk ‘68.4% of retail CFD accounts lose money’

Ease To Open An Account

Opening an account with Vantage was a relatively painless and streamlined process, allowing us to be set up in about 5 minutes.

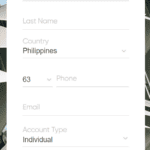

The first step required us to share our name, country of residence, and phone number.

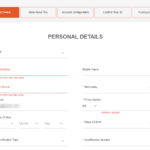

At the next step, we had to provide some more of our personal details, such as date of birth and identification document details.

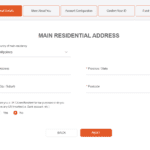

Then we had to provide details about our address and whether we’re a US resident for tax purposes.

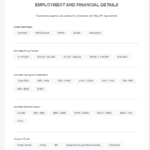

Next, we had to share details of our employment status and financial position. Vantage is required to do this due to regulatory KYC (Know Your Client) processes.

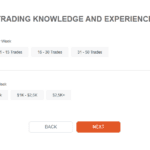

Up next, we had to share some basic details regarding our trading history and experience.

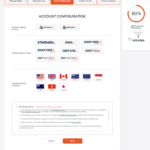

Just a couple minutes after we’d started the process, we were picking our desired currency to keep our account in, and the specific account type we wanted to open.

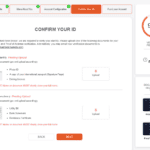

A last step in the account opening process required that we upload a picture of our driver’s license, as well as a proof of address document.

When all of that was complete, we were ready to deposit funds into the account. It was all very quick and pain-free.

Open Demo AccountVisit Vantage FX

*Your capital is at risk ‘68.4% of retail CFD accounts lose money’

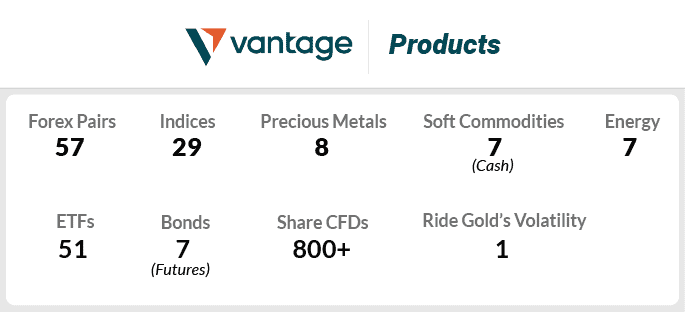

Product Range

When it comes to the range of trading instruments available with Vantage, there are plenty, but not as many as companies like Pepperstone or IC Markets.

CFDs

All up, there are 57 forex pairs, which is all of the major FX pairs, as well as most of the major cross-currency pairs.

There are also 29 stock indices, such as the S&P500, the Australian SPI200, and the FTSE100. These are great if you want to take a position on the direction of a country’s stock market, or even a segment of a particular stock market.

You’re able to speculate on the price of precious metals, such as gold, silver, and platinum.

We were also happy to see that trading commodities were easily accessible with Vantage. There are options to trade products such as cotton, cocoa, sugar, orange juice, wheat, and even soybeans.

Energy commodities are another option. We could easily trade crude oil, natural gas, Brent crude, and even more exotic options like low sulfur gasoil.

There were over 800 CFD options for trading individual stocks. These are stocks listed in the US, UK, Australia, and a few European countries.

Exchange Traded Funds (ETFs) were another option, which is a great way to pursue a specific trading or investing theme. For example, if you’re bullish on agricultural stocks, you may choose to purchase an agricultural ETF.

There were also bond CFDs, allowing us to speculate on interest rate changes. It was very simple to bring up price quotes for products like the 10-year German government bond.

All in all, Vantage has a solid product offering, not as much as some other major brokers, but it should be enough for most traders.

Open Demo AccountVisit Vantage FX

*Your capital is at risk ‘68.4% of retail CFD accounts lose money’

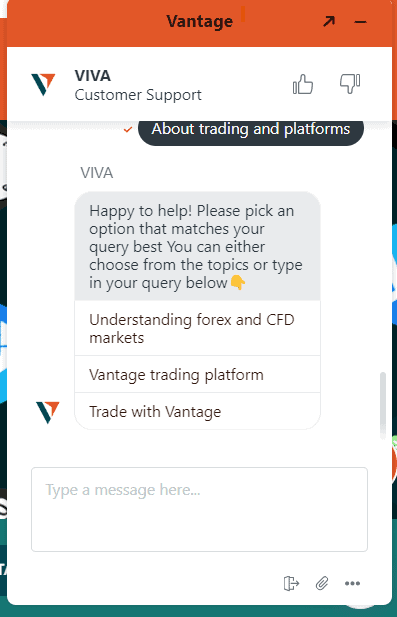

Customer Service

If you ever have a problem or an inquiry regarding your Vantage account, there are a number of ways you can contact the customer support team to have things resolved.

These are via live chat on the website, via email, via phone, and by connecting with the company’s Telegram chatbot.

The company offers 24/7 customer support, but we found that different hours of the day offered different quality levels of customer service.

We found that during the Australian daytime (due to Vantage being headquartered in Australia), you would get more useful answers from the customer support team.

Outside of these hours, we would sometimes run into a chatbot on live chat, or deal with a customer support representative who seemed less knowledgeable than their Australian counterparts..

In general, the customer service team seemed patient with the rather advanced questions we threw at them. If they didn’t know an answer off-hand, they would take a moment and then send us a bunch of information that would likely help us with our inquiries.

Our conclusion is that while the customer service processes at Vantage could be improved, they should be sufficient for most traders

Open Demo AccountVisit Vantage FX

*Your capital is at risk ‘68.4% of retail CFD accounts lose money’

Research and Education

We’re quite strict on how we rate particular broking firms with regard to forex trader education, as we believe it’s an area the industry could greatly improve on.

With Vantage, there are a number of educational resources, mainly aimed at beginner traders who are new to forex and CFD trading.

There are mini-course-like articles that offer an introduction to forex trading and information like how to set up the MT4 trading platform.

There are regular educational webinars, which are run by a trading education firm called Trade With Precision which focus on topics such as specific technical indicators and trader psychology.

There’s an easy-to-use economic calendar, which is very useful for staying up to date with announcements that could move the markets.

The Vantage platform also has trading tools, such as the sentiment indicators which are graphics showing whether Vantage clients tend to be long or short in a particular market.

We looked through the company’s trade ideas articles which largely had generic market information with some basic technical analysis for certain CFDs and currency pairs.

All up, things aren’t too bad on Vantage’s education front, but we aren’t very impressed.

If you’re a rank beginner, you’ll probably find some of the articles useful for learning the terminology and basic concepts.

But will the trade ideas, trading tools, and sentiment analysis type information give you an edge in the markets? In our opinion, very likely not.

Vantage, as well as many other broking firms, could improve in this regard, especially with providing education and tools for the experienced trader.

Open Demo AccountVisit Vantage FX

*Your capital is at risk ‘68.4% of retail CFD accounts lose money’

Final Verdict On VantageFX

Vantage is overall a solid choice for most CFD and forex traders.

The firm offers MT4, MT5, and TradingView-based platforms, which in our opinion is exactly what the average retail trader should be using.

If you’re a complete beginner and want to learn how to trade, you can find better educational options elsewhere. But, if you somewhat know what you’re doing, Vantage offers competitive spreads and commissions.

For traders in Australia, you should strongly consider using Vantage’s raw ECN account as commission rates are extremely competitive.

Open Demo AccountVisit Vantage FX

*Your capital is at risk ‘68.4% of retail CFD accounts lose money’

FAQs

What types of accounts does VantageFX offer?

VantageFX offers Standard STP, Raw ECN, and Pro ECN accounts, each tailored to different trading needs with varying spreads and commissions.

Does VantageFX offer a demo account?

Yes, VantageFX provides a free demo account with virtual funds, allowing traders to practice and refine their strategies without risking real money.

What are the deposit and withdrawal options?

VantageFX offers multiple deposit and withdrawal options, including bank transfers, credit/debit cards, and e-wallets.

What platforms are supported by VantageFX?

VantageFX supports MetaTrader 4, MetaTrader 5, and their proprietary platform, Vantage App.

Is VantageFX regulated?

The Vantage Group of companies is regulated by financial bodies in a number of jurisdictions across the globe. Most prominently, the firm is regulated by Australia’s ASIC (Australian Securities and Investment Commission, but also by England’s FCA (Financial Conduct Authority), Vanuatu’s VFSC (Vanuatu Financial Services Commission) and South Africa’s FSCA (Financial Sector Conduct Authority).

Does Vantage Offer Prop Trading?

Yes, in 2024 prop trading was added through the Vantage Elite Trader program. You can view our sister site ‘prop-firms.com’ where we evaluate the best prop firms and where traders can read the exclusive Vantage Elite Trader review.

Compare Vantage FX Competitors

Versus, comparison pages of alternative online brokers to Vantage FX are listed below.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert