Best ECN Brokers For UK Trading

UK forex traders can access some of the world’s top ECN brokers without a dealing desk. ECN forex brokers give UK traders access to lower spreads like GBP/USD and direct market access for price transparency, so there are no markups.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

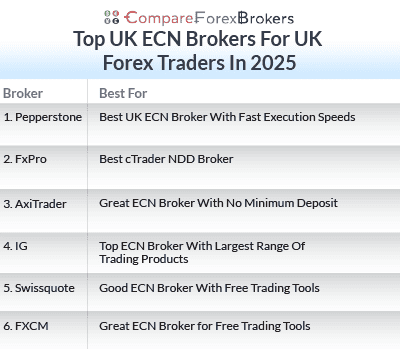

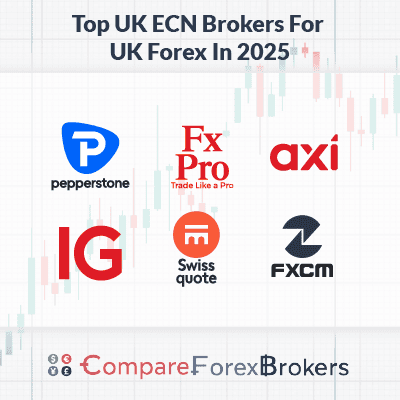

Our list of the best brokers for ECN trading were the following:

- Pepperstone - Best UK ECN Broker With Fast Execution Speeds

- FxPro - Best cTrader NDD Broker

- AxiTrader - Great ECN Broker With No Minimum Deposit

- IG Group - Top ECN Broker With Largest Range Of Trading Products

- Swissquote - Good ECN Broker With Free Trading Tools

- FXCM - Great ECN Broker for Free Trading Tools

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

FCA CySEC, BaFin |

0.10 | 0.30 | 0.20 | £2.25 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

59 |

FCA CySEC |

0.32 | 0.37 | 0.51 | £2.63 | 1.32 | 1.7 | 1.95 |

|

|

|

151ms | $0 | 69+ | 30+ | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

67 | FCA | 0.44 | 0.85 | 0.42 | $3.50 | 1.2 | 1.3 | 1.3 |

|

|

|

90ms | $0 | 72+ | 11+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

71 |

FCA BaFin, CySEC |

0.16 | 0.59 | 0.29 | £3.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $450 | 100+ | 12+ | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

29 |

FCA CySEC, CSSF |

- | - | - | 2 | 1.7 | 2 | 1.6 |

|

|

|

170ms | $1000 | 76+ | 26+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

70 |

FCA BaFin, CySEC |

0.30 | 0.90 | 0.40 | $3.00 | 1.3 | 1.4 | 1.7 |

|

|

|

150ms | $300 | 42+ | 7+ | 30:1 | 500:1 |

|

What Are UK’s Best ECN Forex Brokers?

Based on our top UK forex broker list, we shortlisted the ECN brokers with straight-through processing and rated each provider based on spreads, trading platforms and customer service. This included an interactive spread module to demonstrate the depth of liquidity provided by each forex broker.

1. Pepperstone - Best UK ECN Broker With Fast Execution Speeds

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We gave Pepperstone a high rating of 97/100 due to fast execution speeds, tight spreads, and choice of 4 trading platforms – MT4, MT5, cTrader and TradingView.

Pepperstone has an impressive 77ms execution speed (the lowest recorded in our tests) and their Razor account has an average spread of 0.1 pips plus 0 pips spread 100% of the time outside rollover for the EUR/USD pair.

We think these features will reduce your trading costs making Pepperstone a compelling choice.

Pros & Cons

- Fast execution speeds

- Tight spreads from zero pips

- Decent selection of trading platforms

- DMA access is limited to MT5 and cTrader

- Demo account limited

- No guaranteed stop-loss orders

Broker Details

Pepperstone’s Tools And Features Allows For Fast Speed And Tight Spreads Making It The Best ECN MetaTrader Broker

We rated Pepperstone the best ECN broker in the UK based on five factors:

- Lowest spread standard account

- Fast execution speed based on our platform tests

- London-based customer service level

- Trading platform options, including Trading View

- Trust with FCA regulation and other tier 1 licences

Pepperstone ReviewVisit Pepperstone

Like all ECN brokers, we’re dealing with an entity that abides by the standards and rules imposed by the local regulatory watchdogs and more:

- The UK regulator oversees Pepperstone UK branch, the Financial Conduct Authority (FCA), with registration number 684312

- Pepperstone AU headquarters is an ASIC-regulated broker (the Australian Securities and Investments Commission) with AFSL licence number 414530

- Pepperstone also operates in Dubai (DFSA), Kenya (CMA), The Bahamas (SCB), Germany (BaFin) and elsewhere in Europe (CySEC).

According to our research, Pepperstone is the best UK ECN MetaTrader broker due to its superior financial services that come in the form of:

According to our research, Pepperstone is the best UK ECN MetaTrader broker due to its superior financial services that come in the form of:

- Lightning-fast execution speed of 60 milliseconds (and 30ms for Australian traders)

- Best bid and ask pricing (GBP/USD spread starts as low as 0.44 pips)

- Powerful trading tools, including Smart Trader Tools, Autochartist, tools for scalpers, algorithmic strategies, and day traders

- One trading account gives UK traders access to both MetaTrader 4 and MetaTrader 5

- Trading platforms are available to download for desktop, macOS, mobile trading (iOS and Android), tablet trading, and including a web trading app

Our team of industry experts will highlight the main Pepperstone features that recommend this ECN broker as the top choice for UK traders.

Pepperstone offers Low-Cost Pricing ECN Account

At Pepperstone, UK traders can benefit from tight forex spreads with no markups (available on the Pepperstone Razor account). The bid and ask prices are derived from a wide range of liquidity providers. The multiple sources of liquidity providers allow Pepperstone to supply UK forex traders with the best raw spreads. Study the table below for a quick spread comparison offered by UK ECN forex brokers.

| Average Spreads (02/01/2020) | EUR/USD | USD/JPY | AUD/USD | GBP/USD |

|---|---|---|---|---|

| Pepperstone | 0.16* | 0.25* | 0.27* | 0.49* |

| IC Markets | 0.1* | 0.2* | 0.2* | 0.4* |

| IG Markets | 0.263* | 0.293* | 0.512* | 0.992* |

| CMC Markets | 0.805 | 0.879 | 0.751 | 2.793 |

| AxiTrader | 0.44* | 0.62* | 0.42* | 0.85* |

If you’re looking for the lowest-spread ECN brokers in the UK, the top choices are Pepperstone and IC Markets. On the other hand, among the ECN forex brokers examined, CMC Markets has the worst spreads. The EUR/USD spread is 0.805 pips and 2.793 on the GBP/USD pair.

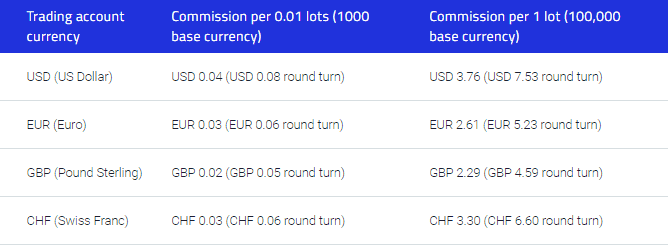

Pepperstone also keeps the commissions extremely competitive. Pepperstone UK has introduced transparent ECN commissions, which are determined by the trading platform used and the trading account currency:

- MT4 Razor account commission of GBP 2.29 per one standard lot traded (or GBP 4.59 round turn). The USD-based trading account charges a commission of $7.53 round turn.

- MT5 Razor account commission of GBP 2.29 per one standard lot traded (or GBP 4.59 round turn). The USD-based trading account charges a commission of $7 round turn.

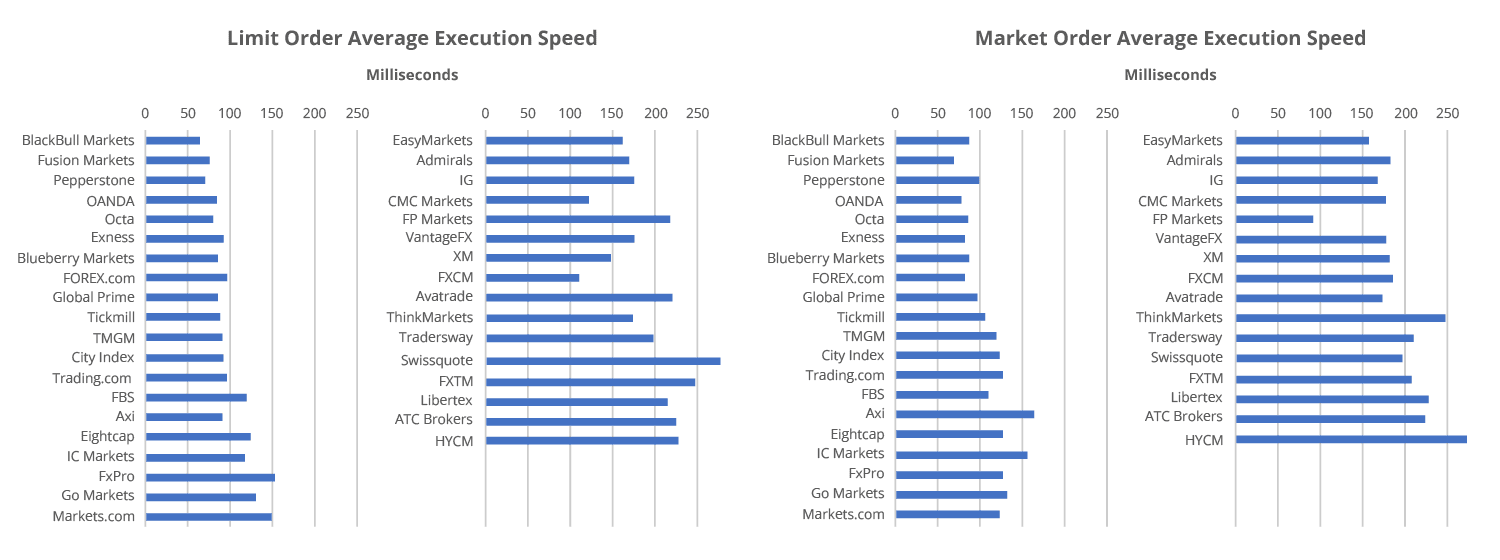

ECN Forex Brokers with Fast Speed

ECN Forex Brokers with Fast Speed

The benefit of true ECN forex brokers is that you can trade with fast order execution speed. Pepperstone can offer UK forex traders the ability to rapidly deal through MT4 and MT5 trading platforms. Pepperstone executes $12.55 billion worth of trades daily. Most orders are filled in less than 60 milliseconds.

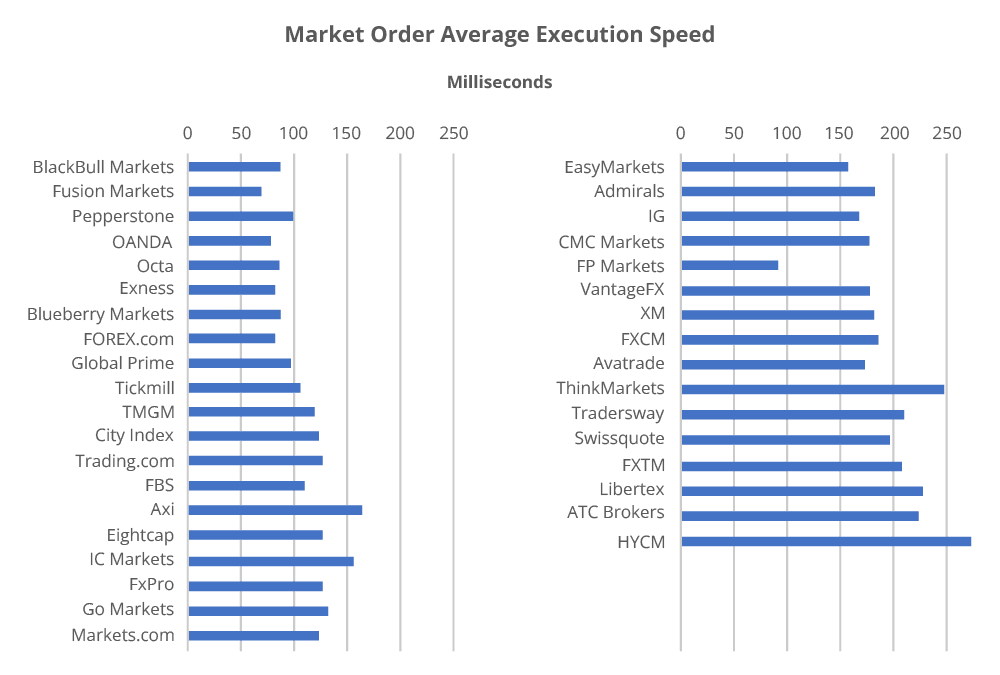

Our team of experts used third-party scripts to test the market order execution speed. The speed testing results confirmed that Pepperstone is the best forex broker in the UK. The Australian-based broker boosted an 85-millisecond average execution speed.

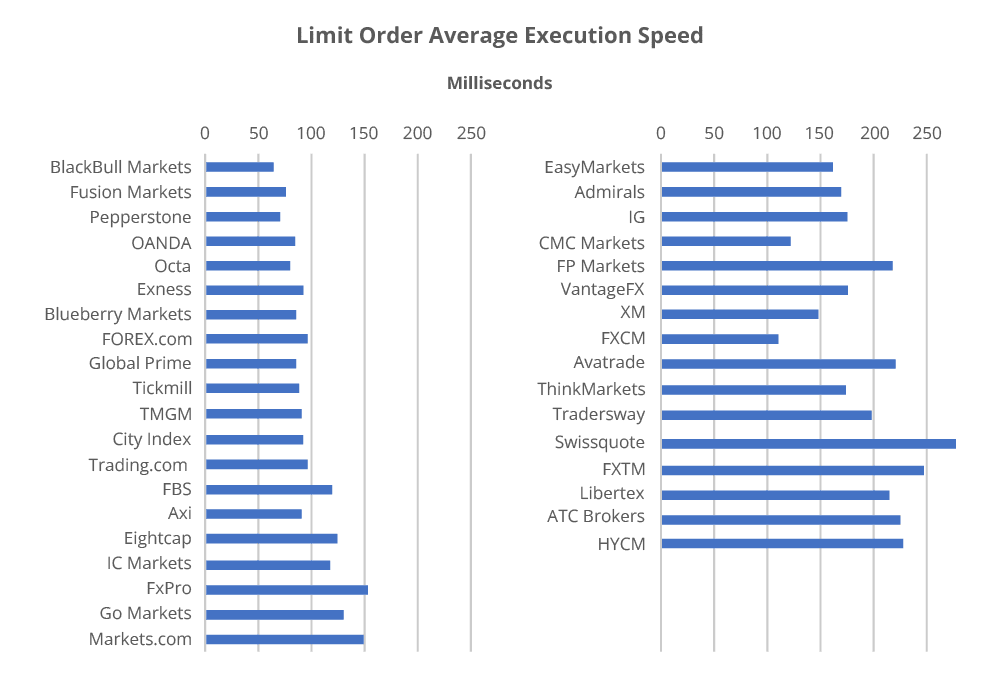

Our order execution speed comparison among the best ECN forex brokers in the UK can be seen below.

Note* The ECN speeding test was conducted using FX spot orders executed at the best available market prices. We also ran the tests via a MetaTrader 4 demo account.

Our Final Thoughts On Why We Rated Pepperstone The Best ECN Forex Broker

The automatic price improvement technology used by Pepperstone, and the tools and features, mentioned above made this true ECN broker the best forex broker in the UK. Pepperstone doesn’t interfere with the bid and asks prices because it doesn’t operate a dealing desk. With no mediator between the UK retail investors and the foreign exchange market, you can trade with peace of mind directly on the interbank spot rates.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. FxPro - Best cTrader NDD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.2

AUD/USD = 0.5

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why We Recommend FxPro

While technically FxPro is a No Dealing Desk broker, the execution speed, low spreads, and commissions closely mirror an ECN, offering an ECN-style experience. we liked using the cTrader platform with FxPro, which has an excellent graphical user interface and is easier to use than MetaTrader 4 while offering better tools for scalping, like one-click trading.

However, its average spread for EUR/USD is slightly above the industry average at 0.32 pips (vs. 0.22 pips).

Pros & Cons

- Low spreads on cTrader

- High-quality market analysis provided

- No minimum deposit

- Best services only on cTrader

- Inactivity fees

- Not a true ECN broker

Broker Details

FxPro’s Asset Range, Execution Speed, And Tight Regulation Make It The Best NDD Broker

UK-based traders who want unfiltered access to the forex market can conduct business through a no-dealing desk (NDD) forex broker like FxPro. Headquartered in London, FxPro operates across 173 countries worldwide. FxPro also has 4 industry licences (FCA, CySEC, FSCA, and SCB) which show that the brokerage trading firm operates lawfully and your funds are safe.

No dealing desk execution is superior for the following reasons:

Trade execution speed (FxPro advertise 11.06 milliseconds average execution time)

Trade execution speed (FxPro advertise 11.06 milliseconds average execution time)- The sophisticated order execution engine

- Reduced slippage (negative slippage on only 12.53% of FxPro client orders)

- No requotes (98.60% of client orders are executed at the desired price)

- Access to 6 major markets, including cryptocurrency

- VIP trading account dedicated to high-volume UK traders (comes with reduced spreads – 30%)

- Decent trading commission of $4.5 per side (only applied to currency pairs and metal trading via the FxPro’s cTrader trading platform)

How FxPro No Dealing Desk Execution Model Works?

To understand how FxPro processes your orders, our devoted team of experts has tested whether or not FxPro is a true ECN broker. Unlike dealing desk brokers who mark up the wholesale price feed, ECN brokers can offer raw spreads. After conducting a real-time spread comparison, our rigorous process concluded that the spread size shown by FxPro is higher. Most UK ECN brokers can keep the spread lower.

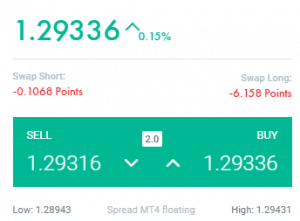

For example, the GBP/USD spread depends (fixed spreads and variable spreads) on the trading platform used and the execution model:

- MT4 market execution model with a spread of 2.0 pips (live spread as of 02.11.2020)

- MT4 instant execution model with an average spread of 2.52 pips

- MT5 market execution model with an average spread of 2.52 pips

- cTrader market execution model with an average spread of 1.02 pips + $4.5 per 1 standard lot

The total costs offered by FxPro are more comparable with market maker forex brokers. This begs two questions that our experts at Compare Forex Brokers will answer:

- Is FxPro an ECN broker?

FxPro is not a true ECN broker because it matches some client orders internally. In the electronic communication network environment, the forex brokers pass the orders to their liquidity providers. FxPro can be considered a hybrid type of ECN broker as there is no dealing desk intervention.

- Is FxPro an STP broker?

FxPro is not a true STP (Straight Through Processing) broker, but at the same time, they use STP technology with their order execution engine. FxPro uses its price aggregator Quotix, which is co-located inside the Equinix FX Ecosystem (LD5 London or Amsterdam).

ECN Brokers Real-Time Speed Test

FxPro claims its price engine is ultra-fast, as orders are executed in less than 11.06 milliseconds, with up to 7,000 trades processed each second. Our team of experts tested the fast order execution speed claim and found the following real-time ECN execution speeds:

- For instant orders (market orders), the tested execution speed was 110 milliseconds

- For limit orders, the tested execution speed was 110 milliseconds

Compared to other UK-based forex brokers, FxPro comes in third place for both market order and limit order execution speed. Only Pepperstone and FP Markets can boost award-winning execution speeds.

Summary – Why FxPro is Among the Best Forex Brokers with NDD Model

The wide range of asset classes, fast order execution speed, reduced slippage, and tight regulation have boosted FxPro to the top of the list for the best forex brokers with No Dealing Desk Brokers execution models. Check the top five reasons to choose the FxPro trading account here FxPro Review and learn why FxPro is one of the best spread betting platforms UK. Please note that to gain access to a demo account, you must follow the standard procedures for opening a live trading account and submit your legal documents.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

3. Axi - Great ECN Broker With No Minimum Deposit

Forex Panel Score

Average Spread

EUR/USD = 0.44

GBP/USD = 0.85

AUD/USD = 0.42

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

With Axi, the absence of a minimum deposit requirement offers a gentle entry to forex markets. Our tests reveal competitive average spreads, particularly the 0.2 pips for GBP/USD, nearly 50% below the industry average.

We gave Axi a rating of 67/100, making them a top choice for an ECN broker. However, MT4 is the only platform they offer prevented a higher score despite the platform’s overall quality.

Pros & Cons

- Tight spreads with low commissions

- No minimum deposit

- Fast execution speeds

- Only offers MT4 platform

- The selection of markets is limited

- Charges inactivity fees

Broker Details

Axi Has A Wide Range Of Financial Instruments And Markets To Trade

UK retail traders can directly access 145 currency pairs and CFDs in total. Axi blends the bid and asks for quotes from multiple sources of liquidity providers. It allows Axi to have low spreads starting from as low as 0.0 pips. However, the typical average spreads found with the Axi trading account are:

72 currency pairs (major, minor, and exotic pairs)

72 currency pairs (major, minor, and exotic pairs)- CFDs on metal trading (10 metal pairs that include Gold, Silver, and Platinum)

- Commodity Cash CFDs (2 pairs of US crude oil and UK crude oil)

- Commodities Futures CFDs (9 financial instruments)

- Index CFDs (31 global indices from across 4 continents)

- Index Futures CFDs contracts (14 tradable instruments)

UK retail traders can directly access 145 currency pairs and CFDs in total. Axi blends the bid and asks for quotes from multiple sources of liquidity providers. It allows Axi to have low spreads starting from as low as 0.0 pips. However, the typical average spreads found with the Axi trading account are:

UK retail traders can directly access 145 currency pairs and CFDs in total. Axi blends the bid and asks for quotes from multiple sources of liquidity providers. It allows Axi to have low spreads starting from as low as 0.0 pips. However, the typical average spreads found with the Axi trading account are:

- 0.44 pips on EUR/USD

- 0.85 pips on GBP/USD

- 0.40 pips on EUR/GBP

Note* Trading CFDs and forex trading on Axi Pro account come with a commission fee of GBP 4.50 per side per one standard lot (or $7.00 commission round-turn trading costs).

UK Forex Brokers with Price Improvement Technology

Not all MetaTrader 4 trading platforms can bring advanced trading capabilities. However, Axi combines its vast pool of liquidity providers (global banks and financial institutions), its dedicated collocated infrastructure, and fibre optics to provide UK forex traders with improved price technology.

The ECN trading liquidity can give UK-based traders a superior advantage, especially during volatile times when the exchange rates can suddenly move. The price stability offered by Axi creates a suitable trading environment for scalping.

Summary – UK ECN Brokers with Biggest Range of Markets

Overall, Axi can be the one-stop trading partner for UK residents seeking to trade CFDs and forex trading from one platform. Axi MT4 standard and Pro accounts don’t require an up-front initial deposit. This is a positive as you can start testing your trading strategies without risking, which is the case for the best forex brokers in UK.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

4. IG Group - Top ECN Broker With Largest Range Of Trading Products

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

While IG Group is a market maker, their DMA account for professional traders has ECN-like trading.

Broadest array of trading products. Scoring an impressive 81/100 in our review, IG Group excels across all categories—boasting low spreads, swift execution speeds, and top-notch customer service. The highlight is the extensive market range, with over 17,000+ markets, providing diverse opportunities from forex to indices. This makes IG Group an excellent fit for day traders and scalpers, ensuring a continuous stream of opportunities throughout the day.

Pros & Cons

- Top choice for range of markets

- Decent range of forex platforms

- Live market news & analysis with IGTV

- Lacks social trading tools

- ProRealTime isn’t beginner-friendly

- Doesn’t support TradingView

Broker Details

IG Markets’ Liquidity Providers Include Numerous Financial Institutions And Major Banks

For our ECN Brokers UK review, we assessed the forex institutional liquidity providers included by the UK forex brokers and discovered that IG Markets has the biggest liquidity providers. Our team of FX experts has conducted a detailed analysis of the best UK ECN forex brokers to see who has a better relationship with the FX liquidity providers.

IG Markets unites liquidity providers of around 12 financial institutions and major world banks, including:

- Global banks (tier one banks)

- Financial institution

- Prime brokers

- Non-bank liquidity providers

- Licenced investment companies

All these liquidity providers compete equally to give UK-based traders the best available bid and ask quotes. In theory, the more forex liquidity providers supply their feeds, the more competitive the spreads are.

Forex Brokers with Dedicated DMA Trading Platform

IG DMA passes client orders directly to the liquidity providers via their dedicated L2 Dealer platform. This proprietary trading platform was developed in-house by IG experts, and it can give UK traders direct market access to:

- Trading UK CFDs via Shares DMA

- Forex Trading via Forex Direct

Note: Forex DMA is only available for UK professional traders such as investment managers, fund managers, and forex analysts who make a salary in the financial field.

To qualify for an IG professional account, UK residents must meet at least two criteria from the following requirements:

- Significant trading activity in the past year

- Financial instrument portfolio exceeding €500,000

- Relevant work experience in the financial sector

The L2 Dealer DMA platform offers a superior technological solution for both CFD trading and forex trading. Besides gaining access to top ECN liquidity providers, the IG DMA platform offers the following advantages:

- Share trading with prices derived directly from stock exchanges, market makers, and MTF dark pools

- Market depth directly from the London Stock Exchange LSE

- Order book that consolidates the bid and asks quotes

- Smart order-routing

- Complex order types, including pegged, fill or kill, execute and eliminate, good for auction, etc.

- Professional Iceberg orders aimed for big orders to be divided into smaller sizes

- No requotes

- Trading directly from the price ladder

- Customizable DMA interface

- Access to over 16,000 financial instruments to trade

- No manual intervention

What are the Total Costs Trading via DMA Platform?

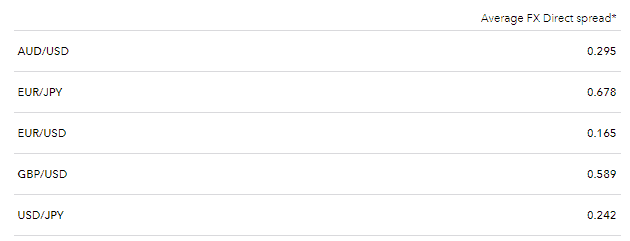

At IG DMA, there is no dealing desk intervention. UK-based traders execute their orders with no additional markups on the spread. The forex prices are quoted directly from IG’s liquidity providers. The IG typical average spreads are 0.165 pips for EUR/USD respectively 0.589 pips for GBP/USD (according to the data compiled for the 12 weeks ending 19th Nov 2019).

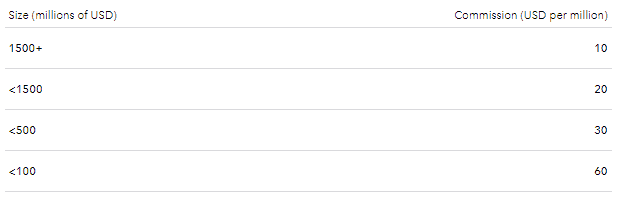

While IG Markets doesn’t mark up the spreads for the DMA account, it charges a commission based on the volume traded in the prior month. UK forex traders can expect to pay $6 in commissions for every 100,000 units traded (based on $100 million volumes traded.). Traders must generate at least $500 million in volume to benefit from more competitive spreads. The forex commission drops to $3 per side for this type of trading volume. With Pepperstone and IC Markets you can get lower forex brokerage fees without the need to generate such a high trading volume.

Read the full Pepperstone Review and IC Markets Review for more information.

Note* For share trading, besides the regular fees, you may be liable for paying exchange data fees.

Note* For share trading, besides the regular fees, you may be liable for paying exchange data fees.

Summary – IG The Best UK Broker with the Most Liquidity

The IG DMA account is equipped to give UK traders direct market access to trading forex and CFDs. Due to the strong relationship with the leading providers, IG Markets can offer UK traders fast order execution speed of 14 milliseconds. IG is a trustworthy name with a rich history and infrastructure to satisfy the needs of the most sophisticated UK traders. You can download the L2 Dealer platform for free for desktop and mobile trading.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

5. Swissquote - Good ECN Broker With Free Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.5

AUD/USD = 0.5

Trading Platforms

MT4, MT5, CFXD

Minimum Deposit

$1,000

Why We Recommend Swissquote

We endorse Swissquote for a robust ECN broker experience with complimentary trading tools.

Offering spreads from zero pips and a $3.00 per lot charge, Swissquote caters well to active traders. However, the $10,000 deposit requirement for the Elite account may be a hurdle.

Their suite of free tools, especially AutoChartist for real-time chart pattern identification, enhances technical analysis. If you can meet the deposit, Swissquote stands as a compelling choice, delivering an ECN-like experience with tight spreads and valuable tools for serious traders.

Pros & Cons

- Tight spreads available

- Good variety of trading platforms

- Over 80 forex pairs to trade

- High minimum deposits

- Inactivity fees are charged

- Not all research tools are free

Broker Details

Swissquote’s Retail Investor Accounts Have Zero Commission Trading

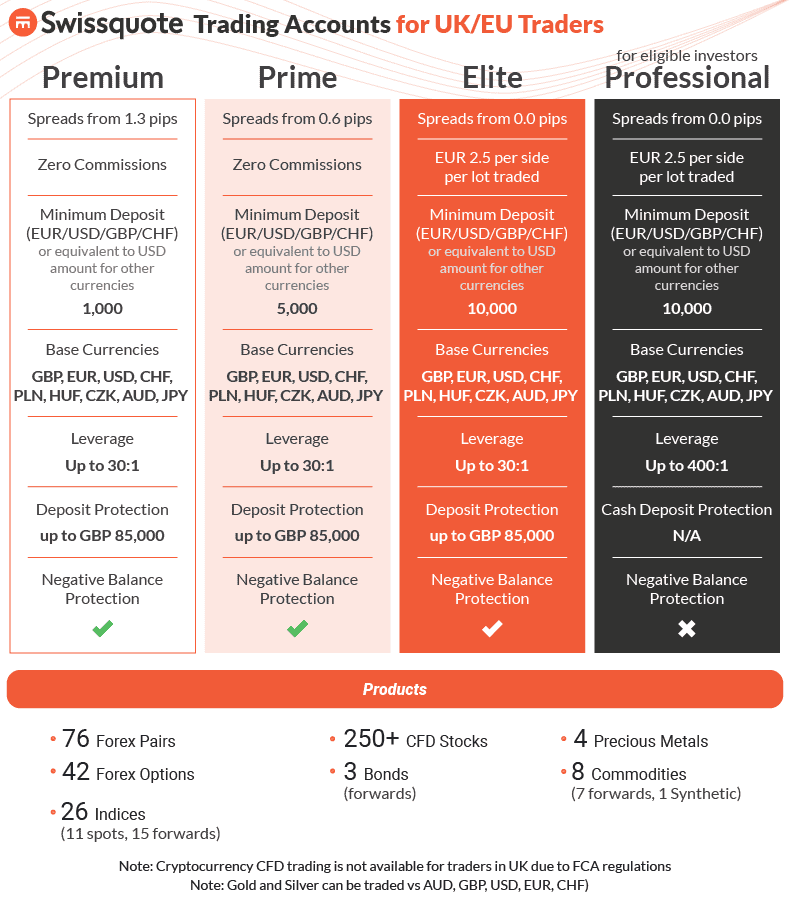

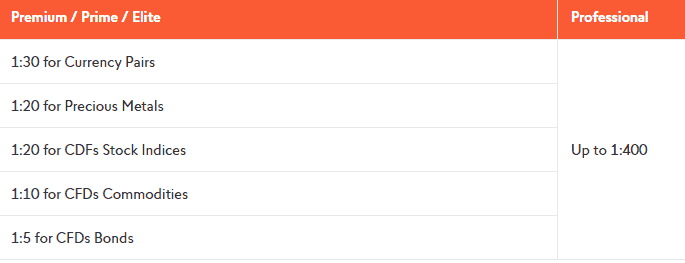

With more than CHF 30.5 billion in client assets, Swissquote has been awarded for its competitive trading conditions and transparent pricing policy. Compared to other UK ECN brokers, Swissquote ranked on top of our star scoring system for the best variable spreads. The Swissquote offering includes 4 account types, but there are only 2 retail investor accounts, namely:

- Premium Account – spread starts from 1.3 pips, and you must make a minimum deposit of $1,000.

- Prime Account (the most popular) – spread starts from 0.6 pips, and a minimum deposit of $5,000 is required.

Both of the retail investor accounts have 0 commission trading. Swissquote offers variable spreads on over 130 currency pairs and CFD instruments (precious metals, stock indices, commodities, and bonds).

Note* Swissquote Elite and Professional accounts charge the raw spreads and the typical ECN commission.

What are the Typical Variable Spreads Offered by Swissquote?

Our team of FX experts conducted a detailed comparison of the variable spreads offered by the UK’s best forex brokers. We have concluded that Swissquote has the best offering. The variable spread accounts typically have no commissions on trades or any other additional fee. UK traders can expect a minimum spread of:

- 1.0 pips for both EUR/USD and GBP/USD on the Prime account

- 1.3 pips for both EUR/USD and GBP/USD on the Premium account

Risk Warning: Please note that depending on the market conditions, the floating spreads can widen considerably. The table below compares the market maker spreads offered by UK forex brokers with spread-only accounts.

| Currency Pair | Swissquote Prime | OANDA | AvaTrade | FXCM | Dukascopy | EasyMarkets |

|---|---|---|---|---|---|---|

| EURUSD | 1.0 | 1.1 | 1.3 | 1.4 | 1.8 | 1.8 |

| EURGBP | 1.2 | 1.4 | 2.0 | 2.4 | 1.4 | 3.0 |

| AUDUSD | 1.0 | 1.2 | 1.8 | 0.8 | 1.7 | 2.6 |

| GBPUSD | 1.0 | 1.7 | 2.0 | 1.2 | 2.3 | 3.3 |

| USDJPY | 0.6 | 1.2 | 1.5 | 1.6 | 1.7 | 3.0 |

Benefit from Fast Order Execution and Flexible Leverage

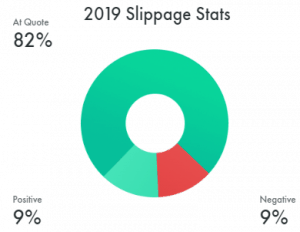

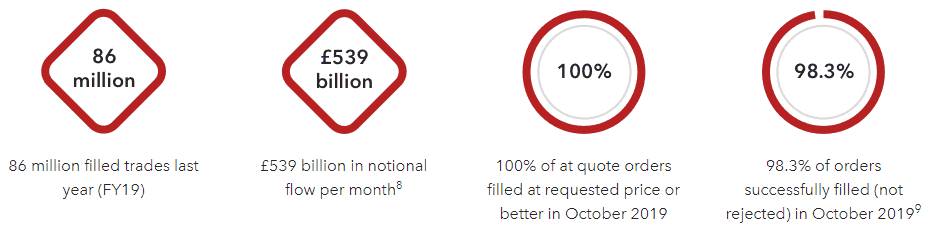

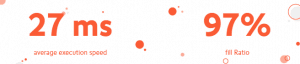

With Swissquote, you can benefit not only from the reduced variable spreads but also from fast forex execution speed and flexible leverage. Swissquote client orders are filled 97% of the time with an average execution speed of 27 milliseconds. The Swissquote execution model can boost the following additional advantages:

15% of client orders get price improvements (positive slippage)

15% of client orders get price improvements (positive slippage)- 63% of client orders receive no slippage

- 12% of client orders receive negative slippage

Swissquote also offers flexible leverage that can start from 1:30 for forex trading and can go up to 1:400 if you are eligible for the professional account. The table below compares the different levels of leverage offered by Swissquote.

Summary – Best Variable Spread Forex Brokers

The only disadvantage of floating spreads is that the bid and asks prices can widen during financial market distress. The UK-based traders can open a Swissquote trading account in over 15 supported funding currencies. Three bespoke trading platforms (MetaTrader 4, MetaTrader 5, and Advanced Trader) await Swissquote clients to conquer the financial markets.

*Your capital is at risk ‘82.48% of retail CFD accounts lose money’

6. FXCM - Great ECN Broker for Free Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.9

AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

FXCM impresses us with its top-tier trading tools, notably Capitalise.ai, facilitating strategy automation without coding.

Earning a score of 75/100 in our review, FXCM excels in Trading Experience, Platforms, Trust, and Customer Experience.

We feel one weakness are their trading costs, with average spreads marginally higher than industry norms for major pairs. Despite this, FXCM remains a solid choice, particularly for traders valuing advanced tools and a comprehensive trading experience.

Pros & Cons

- Excellent trading tools are available

- Good educational resources

- Multiple platforms for automated trading

- Limited product range

- Slightly higher than average spreads

- Does not support MetaTrader 5

Broker Details

FXCM’s Free Demo Account Lets You Learn How CFD Trading Works

FXCM offers the best demo account that perfectly mimics the same conditions found with a live ECN trading account. For every online broker we assessed, we checked whether they offered demo accounts as an integrated tool of their trading platform. Trading complex instruments such as Forex currency pairs and CFDs carries a high-risk level.

- You can sign up for free and claim your practice account

- Up to $50,000 in virtual money

- Risk-free trading environment, practice forex trading risk-free

- Trade on the live feed prices

- Trade popular currency pairs, gold, silver, and CFDs

- Choose from multiple trading platforms (Trading Station and MetaTrader 4) available on desktop, web trader, and mobile

Note* The only downside found on the FXCM MT4 demo account is the maximum account balance restrictions of $50,000. Other ECN and STP brokers have more flexible demo accounts with custom balances.

Summary – Best ECN Trading Account to Practice Trading Risk-Free

FXCM demo account allows potential clients to test the financial services offered by ECN forex brokers. The demo account also permits UK FX traders to learn how CFDs work before risking their hard-earned money. FXCM’s trading platforms are fully equipped with all the tools to satisfy the needs of all traders. Click the link below to sign up for your free MT4 demo account.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

The top level has tier-one liquidity providers like Deutsche Bank, Barclays Capital, JP Morgan, Citi, etc.

The top level has tier-one liquidity providers like Deutsche Bank, Barclays Capital, JP Morgan, Citi, etc.

Ask an Expert