Die besten Broker in Deutschland

BaFin reguliert den deutschen Forex Trading Markt. Unser Expertenteam hat unsere besten von der BaFin autorisierten Online-Devisenbroker auserwählt, um deutschen Devisenhändlern CFD- und Leveraged-Handelsdienstleistungen anzubieten. Sehen Sie unsere Auswahl der besten Broker in Deutschland.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Nachstehend finden Sie die Besten Broker mit BaFin Regulierung in Deutschland, sortiert nach Kategorien:

- Interactive Brokers - Die beste Plattform für Forex Trading

- XTB - Gut zum Sparen geeignet, mit niedrigen STP Spreads

- Admiral - Die beste Handelsplattform für MetaTrader 4

- Plus500 - Das Beste für fortgeschrittenen Handel mit Risikomanagement

- IG - Gut geeignet für flexiblen Handel mit verschiedenen Märkten

- eToro - Sozialer Handel mit den Besten

- CMC Markets - Gut geeignet für Accounts ohne Mindesteinzahlungen

- HYCM - Das Beste für MetaTrader 5

Wer sind die besten Broker mit BaFin-Regulierung in Deutschland?

Die besten Broker in Deutschland müssen einen deutlichen Vorteil im Vergleich zu anderen Brokern bieten. Deutsche CFD- und Forex-Trader achten in der Regel auf Faktoren wie niedrige Gebühren, eine gute Auswahl an Märkten und solide Trading-Plattform-Funktionen. Dies ist eine Liste der besten Broker, die ihre Dienstleistungen deutschen Tradern anbieten.

Interactive Brokers – Die Besten Forex Broker

Interactive Brokers bietet 3 entscheidende Vorteile:

1. Geringe Handelsgebühren

– Kommission ab 1 USD pro Lot und niedrige Spreads.

2. Fortschrittliche Trading Plattformen

– Hochmoderne Plattform für Desktop-PC und mobile Endgeräte.

3. Verschiedene Instrumente

– Interactive Brokers bietet CFD und reale physische instrumente.

4. Große Auswahl an Finanzierungsmöglichkeiten

– Mehrere Zahlungsoptionen zum Ein- und Auszahlen von Geldern

Stärke 1 – Interactive Brokers bietet die niedrigsten Kommissionsgebühren

Interactive Brokers kombiniert die Kursbewegungen der 14 größten Devisenhändlern der Welt, um geringe Spreads zu erzielen. Forex CFD Spreads fangen bei 1,0% für EURUSD an und können bei größerem Kontobestand auf bis zu 0,5% sinken. Exotische Währungspaare und Kreuzpaare weisen generell größere Spreads auf, da diese recht unbeständig sind. Die Spreads von Interactive Brokers sind variabel und können sich daher während wichtigen Wirtschaftsereignissen ausweiten.

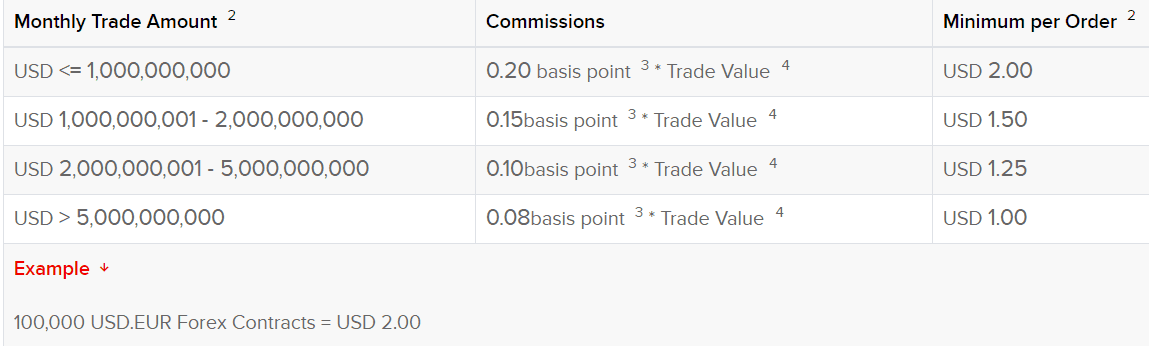

Provisionen auf Forex-Paare beginnen bei einem Minimum von $2,00 USD pro Auftrag mit 0,20 Lotgröße. Je größer Ihre Lots sind, desto höher ist der Wert Ihrer Kommission.

Provisionen auf Forex-Paare beginnen bei einem Minimum von $2,00 USD pro Auftrag mit 0,20 Lotgröße. Je größer Ihre Lots sind, desto höher ist der Wert Ihrer Kommission.

Deutsche Trader können durch das Handeln mit großen Aufträgen die Vorzüge niedriger Kommissionen genießen.

Wenn es darum geht, die Provisionskosten mit anderen Brokern zu vergleichen, haben wir festgestellt, dass Interactive Brokers einige der preiswertesten Broker anbietet.

Interactive Brokers berechnet eine Inaktivitätsgebühr von 10 USD pro Monat für Konten mit einem Guthaben von weniger als 2.000 USD und für Konten, die nicht mindestens 20 USD an Provisionen generieren. Für Konten mit einem Guthaben von 2.000 USD oder mehr wird eine monatliche Inaktivitätsgebühr von 10 USD erhoben.

Stärke 2 – Fortschrittliche Trading Plattformen

Interactive Brokers bietet verschiedene Trading Plattform Optionen an. Diese stehen sowohl für den Desktop-PC, als auch für mobile Anwendungen zur Verfügung:

Client Portal

Die ‘Client Portal’ Plattform zeichnet sich dadurch aus, dass sie alle wichtigen Trading Tools, die Sie benötigen, in einem einzigen Portal vereint. Das Client Portal ermöglicht dies, indem es auf ein harmonisches Design und hohe Funktionalität ausgerichtet ist, welche die Schaltfläche übersichtlich und geordnet darstellen und dadurch den zusätzlichen Vorteil bietet, dass Sie auf weitere Monitore verzichten können. Diese Eigenschaften machen die Plattform perfekt für Einsteiger.

Die Client Portal Accounts können ohne weitere Downloads eingerichtet werden. Zu den wichtigsten Merkmalen gehören:

- Schneller Handel mit einfacher Auftragserteilung, Verwaltung offener Aufträge und Zugang zu den letzten getätigten Trades.

- Erweitertes Charting mit detaillierten Kursdaten und Live-Nachrichten-Feed

- Die Rückverfolgung Ihrer Aufträge mit Portfolio-Performance

Desktop TWS (Trader Workstation)

Lange Zeit wurde die Interactive Brokers Desktop TWS Plattform als die Premium Plattform für professionelle Trader angesehen. Nun ist sie auch für Trader mit unterschiedlichem Kenntnisstand azugänglich. Die Plattform besticht durch die Möglichkeit mit mehreren Tradinginstrumenten zu arbeiten, da Sie mit Desktop TWS die Fülle der Angebote, die Interactive Brokers unter ihren mehr als 1000 Produkten zu bieten hat, in vollem Umfang nutzen können. Zu den wichtigsten Funktionen gehören:

- TWS-Mosaik, das Zugang zu Charts, Handelsaufträgen, Watchlisten und einem anpassbaren Arbeitsbereich bietet

- Papierhandel, der Handel ermöglicht, ohne den Verlust Ihres Geld zu riskieren. So können Sie Ihre Handelsfertigkeiten üben

- Zugang zu über 100 Auftragsarten und Algorithmen

- Echtzeit-Überwachungstools, damit Sie zu jeder Zeit im Detail sehen können, wie der Erfolg Ihres Handelskontos zunimmt

- Umfassende Finanzanalysen und Live-Marktnachrichten aus Quellen wie Reuters, Dow Jones und Morningstar

IBKR WebTrader IBKR PRO

IBKR Pro ist Interactive Brokers webbasierte Trading Plattform. Sie ist dem Desktop TWS sehr ähnlich, verfügt jedoch über eine noch übersichtlichere Schaltfläche. Der IBKR WebTrader ist die beste Option, wenn Sie von unterwegs Traden möchten.

IBKR Mobile

IBKR ermöglicht es Ihnen, von Ihrem Mobiltelefon oder Tablet aus auf Ihr Handelskonto zuzugreifen. Mit Schwerpunkten auf:

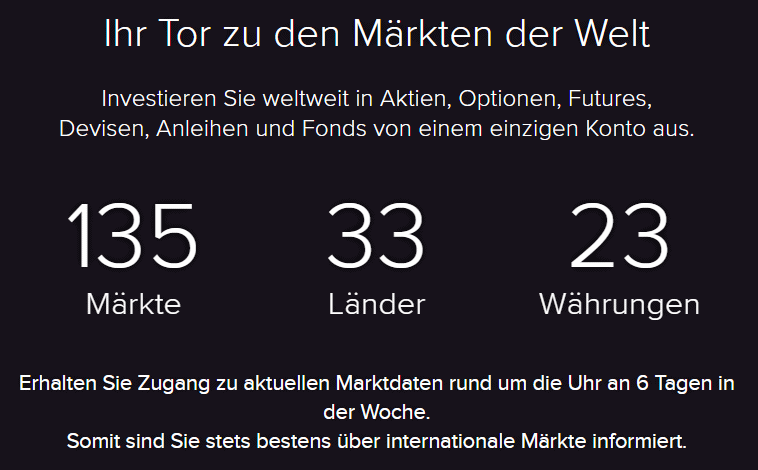

- Zugang zu mehr als 135 Märkten weltweit, inklusive innovativer Handelsinstrumente

- Schnelle Vorautorisierung von Großaufträgen, um Sicherheit zu gewährlsiten

- Kontoschutz mit Interactive Brokers Zwei-Faktor-Sicherheits-Schlüssel hält Ihr Konto mit einem Passcode sicher

- Schnelle und direkte Einzahlung von Geldern auf Ihr Konto auch über Ihr Handy oder Tablet

IBot

lBot ist das durch künstliche Intelligenz angetriebene Interface, welches auf allen Interactive Brokers-Plattformen verfügbar ist und Ihnen die Möglichkeit bietet, Aufträge zu erteilen, Kurse einzusehen und nach Daten und Informationen zu suchen, wobei Sie Ihre eigenen Wörter und Formulierungen verwenden können:

- Textbefehle in natürlicher Sprache

- Mit einfachen Wörtern sofortigen Zugriff auf Diagramme erhalten

Die Verwendung der natürlichen Sprache bei der Auftragserteilung hilft Ihnen dabei, schnell und einfach das zu finden, wonach Sie suchen und so zu handeln, wie Sie es möchten. Diese Funktion macht die IBKR-Plattformen ideal für Anfänger, da sie bei der Durchführung von Aktionen auf Verwendung spezifischer und komplexer Begriffe verzichtet.

IBKR PRO API

Optimieren Sie Ihre Trading Plattform nach Ihren Wünschen mit:

- API-Technologie, mit der Sie Ihre eigenen Handelsanwendungen erstellen können.

Stärke 3 – Die Auswahl der zum Handel verfügbaren Instrumente

Interactive Brokers bietet eine ganze Reihe von Märkten zum Handel an. Der Top-Broker bietet Zugang zu 135 Märkten in 33 verschiedenen Ländern mit 23 Währungsarten. Interactive Brokers ist einzigartig in der Online-Forex-Brokerage-Branche, da es die Möglichkeit bietet, sowohl mit dem zugrunde liegenden Instrument als auch mit dem CFD zu handeln, wodurch Sie mit vielen Börsen handeln können, die von anderen Online-Brokern nur selten angeboten werden.

- Der Forex- und Forex-CFD-Handel ist für 23 Währungen weltweit ohne versteckte Spreads und Provisionen möglich. Interactive Brokers verwendet eine ECN-ähnliche Marktstruktur, um knappe Spreads zu erzielen.

- Aktien- und CFD-Handel in über 135 Märkten aus 33 Ländern auf einem einzigen Konto. Zu den besonderen Börsen gehören Tel Aviv, Wien, Deutschland, Australien, Hongkong, Indien, Singapur und Japan.

- Index-CFD – Dies ermöglicht Ihnen, einen Einblick in die breiten Marktprovisionen von 0,005% bis 0,01% zu gewinnen.

- Optionshandel mit Kommissionssätzen zwischen $0,15 und $0,70 pro US-Optionskontrakt

- Der Futures/FOP-Handel ist an mehr als 35 Marktplätzen weltweit verfügbar. Zu den Marktzentren gehören Eurex (DTB) in Deutschland, EUREX (Soffex) in der Schweiz, Bosa Italiana in Italien und die Singapore Exchange.

- Der Metallhandel bietet Handelsinstrumente wie Gold und Silber mit niedrigen und transparenten Provisionen

- Anleihenhandel von über 38.000 Anleihen, 850.00 Kommunalobligationen und 33.00 CDs

- Börsengehandelte Fonds (ETFs), die an 28 Börsen in 14 Ländern für den Handel mit Anleihen- und Aktienindizes zur Verfügung stehen

- Die Exchange for Physical (EFP) bietet sich dafür an, wenn Sie Aktien verkaufen und sie für eine zukünftige Lieferung zurückkaufen, indem Sie Single Stock Future (SSF) erwerben, oder Sie die Aktie kaufen und SSF verkaufen

Stärke 4 – Einzahlung & Abhebung

Interactive Brokers setzt keine Mindesteinzahlungssumme für Ihre Forex-Konten voraus.

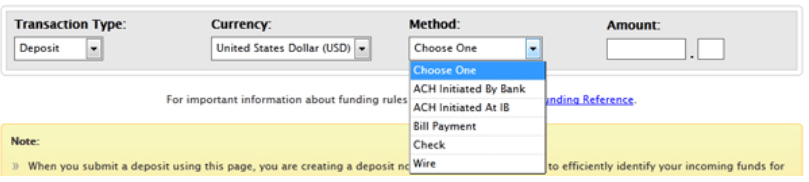

Zu den von Internative Brokers unterstützten Einzahlungsmethoden gehören:

- Banküberweisung

- Bankscheck

- Online-Rechnungszahlungsscheck

- Automatisierte Clearing House (ACH)-Überweisungen, die von Interactive Brokers initiiert werden

- Direct Rollover (nur bei IRA-Renten-Konten)

- Treuhänder-zu-Treuhänder (Nur für IRA-Pensionärskonten)

Für alle Zahlungsarten werden keine Gebühren erhoben. Beachten Sie, dass bei Interactive Brokers keine Einzahlungen mit Kredit- und Debitkarten wie Visa, Mastercard oder PayPal möglich sind.

Folgende Auszahlungsmethoden werden unterstützt:

- Banküberweisung

- SEPA Lastschriftverfahren (Eurozone Payment Area), welche durch Interactive Brokers eingeleitet werden müssen

- BACS (Auszahlungen nur in GBP möglich)

- GIRO/ACH (nur in HKD, CNH, SGD möglich)

- NZD ACH (Auszahlungen in NZD möglich)

Interactive Brokers erlaubt eine kostenlose Auszahlung pro Kalendermonat, alle anderen Transaktionen sind gebührenpflichtig. Für Auszahlungen mit Banküberweisung wird eine Gebühr von 8 Euro erhoben.

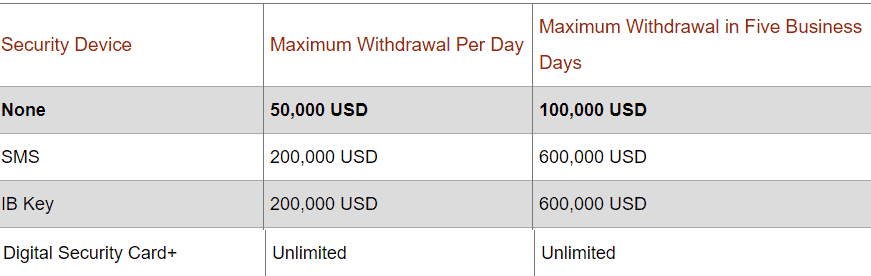

Auszahlungslimits gelten für jeden Tag und insgesamt über 5 Werktage. Ein sicheres Login-System ermöglicht unbegrenzte Auszahlungen.

Abhebungen müssen auf ein Konto in Ihrem Namen erfolgen und werden in der Regel am selben Tag vorgenommen, wenn ein Antrag vor der Schließung gestellt wird.

Zusammenfassung von Interactive Brokers

Interactive Brokers ist unser bester Forex-Broker in Deutschland, der für Händler geeignet ist, die mit einer großen Auswahl an CFDs und sogar den zugrunde liegenden Instrumente mit niedrigen Spreads und einigen der besten Provisionen in der Brokerbranche handeln möchten.

Die Broker bieten eine große Auswahl an Handelsplattformen, die für Händlern mit unterschiedlichem Kenntnisstand geeignet sind und die alle Arten von Handelsplattformen nutzen wollen, gleichzeitig aber nicht auf einzigartige Angebote wie den IBot verzichten wollen.

The overall rating is based on review by our experts

XTB – Sparen Sie mit niedrigen STP Spreads

Mit mehr als 15 Jahren Erfahrung und zahlreichen Auszeichnungen als europäischer Broker liegen die Hauptstärken von XTBs auf:

1. Niedrigen Spreads

2. Kundensupport Zufriedenheit & Auszeichnungen

3. Lehrinhalten

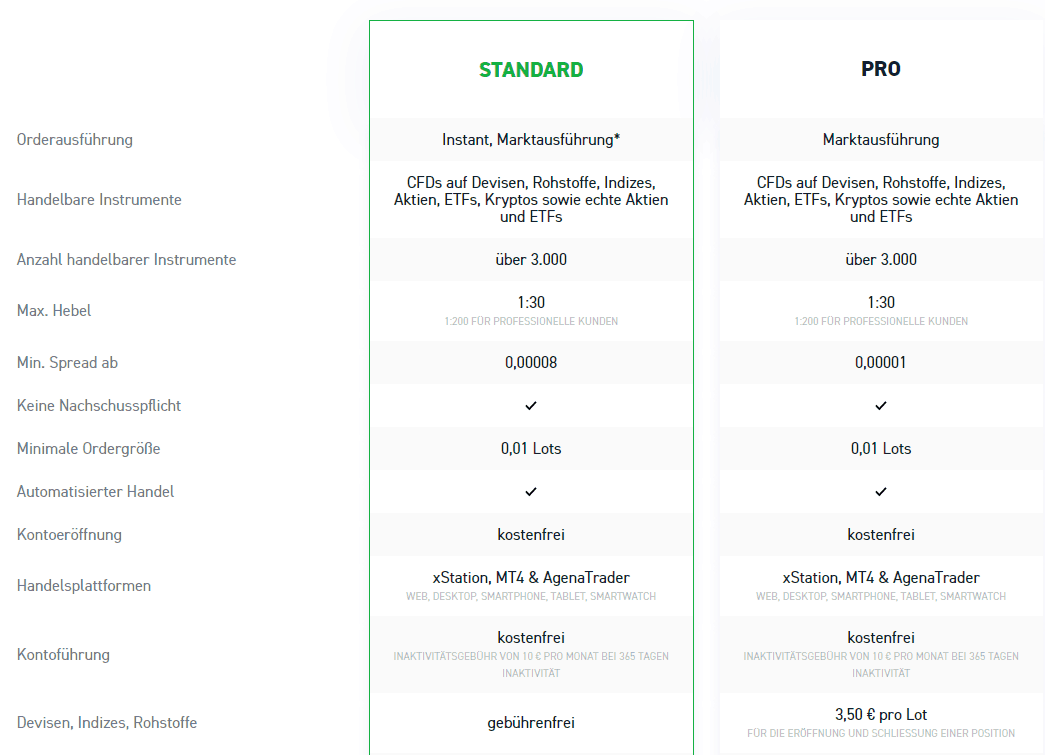

Schlüsselkompetenzen- XTB beinhaltet niedrige Spreads und Kosten

XTB bietet niedrige und wettbewerbsfähige Spreads für die meisten der wichtigsten Paare des Online-Handels. Die Spreads für das Standard-Devisenhandelskonto ohne Provision beginnen ab 0,70 Pips für EUR/USD-Paare und die Spreads für Konten mit Provision beginnen ab 0,30 Pips für EUR/USD. Index-CFDs beginnen mit Spreads von 0,5 Pips und es werden insgesamt 42 Indizes angeboten. Commodity-CFD-Instrumente beginnen bei 0,01 Pips und insgesamt werden 22 Rohstoffe angeboten. Kryptowährungs-Handelspaare haben einen Spread von 0,5% des Marktpreises und 25 Kryptowährungen wie zum Beispiel Bitcoin, Ethereuem und viele mehr stehen zum Handel zur Verfügung.

Die niedrigsten Spreads erhalten Sie mit dem XTB pro-Konto. Dieser Kontotyp verwendet eine Straight-Through-Processing (STP)-Methodik, um niedrige Spreads bei schneller Ausführung zu erzielen. Mit diesem Konto zahlen Sie 3,50 € pro Lot Side Trip oder 7 € Round-Turn beim Forex-Handel. Für Kryptowährungen fällt ebenfalls eine Gebühr von 3,50 € an, während die Kommission für Aktien-CFDs und ETD-CFDs bei 0,08% pro Lot beginnt.

Standard-Spreads | |||||

|---|---|---|---|---|---|

| 0.90 | 1.70 | 1.30 | 1.40 | 1.40 |

| 0.70 | 2.20 | 2.20 | 1.10 | 1.10 |

| 1.10 | 1.90 | 1.10 | 1.60 | 1.80 |

| 1.20 | 2.00 | 1.30 | 1.30 | 1.50 |

| 1.00 | 1.50 | 1.00 | 1.27 | 1.20 |

| 0.89 | 2.56 | 1.37 | 1.41 | 1.54 |

| 1.18 | 1.80 | 1.45 | 1.40 | 1.49 |

| 1.10 | 1.90 | 1.10 | 1.30 | 1.30 |

| 0.50 | 1.10 | 0.60 | 0.70 | 0.90 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Wenn Sie beim Handel keine Kommissionskosten zahlen möchten, können Sie eine Standardkontoart wählen. Dieses Konto hat im Vergleich zum Pro-Konto größere Spreads und weist daher eine andere Kostenstruktur auf.

Kommissionskonto-Spreads | |||||

|---|---|---|---|---|---|

| 0.09 | 0.13 | 1.70 | 0.14 | 1.40 |

| 0.02 | 0.03 | 0.50 | 0.23 | 0.14 |

| 0.08 | 0.35 | 7.60 | 0.39 | 0.60 |

| 0.10 | 0.10 | 0.90 | 0.30 | 0.30 |

| 0.10 | 0.20 | 0.60 | 0.20 | 0.30 |

| 0.16 | 0.29 | 1.50 | 0.59 | 0.24 |

| 0.20 | 0.40 | 0.60 | 0.60 | 0.30 |

| 0.10 | 0.40 | 1.30 | 0.50 | 0.40 |

| 0.10 | 0.50 | 0.70 | 2.00 | 0.60 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Nachstehend finden Sie Informationen zu jedem Konto. Sie werden feststellen, dass beide Konten eine Hebelwirkung von 1:30, den Handel von Lots ab 0,1 und eine Auswahl an xStation- und MT4-Plattformen bieten. Der einzige Unterschied zwischen den Kontoarten besteht darin, dass das Pro-Konto eine Kommissionskostenstruktur besitzt, während das Standard-Konto keine aufweist.

Active Trader Discount

XTB bietet ein aktives Händlerrabattprogramm an, mit dem Sie Rabatte auf Spreads zwischen 5% und 30% erhalten, wenn Sie mit bestimmten Volumina handeln.

- Um einen 5% Spreads-Rabatt zu erhalten, müssen Sie mit mindestens 20 Lots handeln

- Um einen 10% Spreads-Rabatt zu erhalten, müssen Sie mit mindestens 50 Lots innerhalb von 30 Tagen handeln

- Um einen 20% Spreads-Rabatt zu erhalten, müssen Sie mit mindestens 300 Lots handeln

- Um einen 30% Spreads-Rabatt zu erhalten, müssen Sie mindestens mit 1000 Lots handeln

Stärke 2 – XTB ist ein mehrfach ausgezeichneter Broker

XTB erhielt zahlreiche Auszeichnungen und Erfolge, was das hohe Niveau der angebotenen Dienstleistungen widerspiegelt. Zu den Auszeichnungen, die sie besitzen, gehört:

- 2019 FinTech Business Awards – Finalist – Investment Innovator of the Year Investitionsinnovator des Jahres

- 2019 FinTech Business Awards – Finalist – Personal Finance Innovator of the Year Finalist – Persönlicher Finanzinnovator des Jahres

- CSS Design Awards – SPECIAL KUDOS

- Creative International Awards – SILVER

- Die Webseite des Tages – Website Design Awards

XTB bietet sehr gute Kundenbetreuung und Dienstleistungen

XTB ist an 11 Standorten mit Büros in Europa und Asien tätig und bietet folgende Dienstleistungen an:

- Live Chat – 24 Stunden am Tag und 5 Tage in der Woche verfügbar

- E-Mail-Support – 1 Tag Reaktionszeit und 7 Tage in der Woche verfügbar

- Telefonnummer – Erreichbar 24 Stunden am Tag und 5 Tage die Woche.

Stärke 3 – XTB ist führend bei Forex-Lehrinhalten

XTB bietet Bildungsinhalte von einfachen bis hin zu fortgeschrittenen Lektionen mit kostenlosen Kursen, Artikeln und Webinaren. Die Bildungskurse umfassen 4 Erfahrungsstufen mit dem Basispaket, in dem elementare Lektionen über Forex erklärt werden, sowie das Zwischenpaket für Fortgeschrittene, das aus Lektionen der technischen und grundlegenden Analyse besteht. Im Expertenmodus lernen Sie fortgeschrittene Handelstechniken, und das Premium-Paket besteht aus Premium-Materialien einschließlich der Beratung durch die besten Trader.

XTB Zusammenfassung

XTB bietet niedrige und wettbewerbsfähige Spreads an und ist einer der besten Deutschen Forex-Broker, der geringe Gebühren im Forexmarkt anbietet.

Um mit dem Handel beginnen zu können, ist eine Mindesteinlage von $250 erforderlich, während für neue Händler kostenlose Schulungsinhalte zur Verfügung gestellt werden, damit Sie Ihre Handelsfertigkeiten verbessern können.

XTB besitzt die Regulierung der BaFin in Deutschland, zusätzlich zu der Regulierung durch die Financial Conduct Authority (FRN 522157)

Admiral Markets – handeln Sie mit der MetaTrader 4 & 5 Plattform

Admiral Markets bietet Ihnen eine umfassende Erfahrung mit den wichtigsten Vorteilen:

1. MetaTrader 4 für Forex and CFD Handel

2. MetaTrader 4 Supreme Edition

3. Flexible Trading Accounts

Vorteil 1: MetaTrader 4 für Forex and CFD Handel

Die von MetaQuotes Software entwickelte Handelsplattform MetaTrader 4 (MT4) deckt den Bedarf von Millionen von Händlern auf der ganzen Welt ab. Kunden von Admiral Markets können den MetaTrader 4 im Download-Center der Handelsplattform in vier verschiedenen Versionen herunterladen:

- Download MT4 für Desktop-PC

- Download MT4 für Mac

- Download MT4 für iOS

- Download MT4 für Android

Der Hauptunterschied zwischen der Standardplattform MetaTrader 4 und der MT4 Supreme Edition besteht darin, dass die Supreme Edition mit über 60 zusätzlichen Plug-ins und einem erweiterten Indikatorenpaket ausgestattet ist. Admiral Markets betreibt die MetaTrader 4 Plattform mit der neuesten Technologie, die sicherstellt:

- Blitzschnelle Ordergeschwindigkeiten (90% der Orders werden in weniger als 150 ms ausgeführt)

- Ausführung von STP-Aufträgen

- Inklusive Kursbuch und Auftragsbuch

Die ADVFN International Financial Awards für die besten Forex-Plattformen im Jahr 2019 zeichnet die Bemühungen von Admiral Market aus, den Forex-Händlern einen hervorragenden technischen Service zu bieten.

Mit der Admiral Markets MT4-Plattform können Sie den Handel in über 4.000 globalen Märkten durchführen:

- Forex-Währungspaare (50 CFDs auf FX-Paare) mit Spreads ab 0,0 Pips und Hebelwirkung bis zu 1:30

- Kryptowährung-CFDs (32 Krypto-Währungspaare) mit einem Hebel von 1:2 und Handel über das Wochenende

- Index-CFDs (43 globale Indizes) mit einer Hebelwirkung von bis zu 1:20

- Aktien-CFDs (3509 Aktien) mit Hebelwirkung 1:2

- Anleihen CFDs (2 Staatsschatzanleihen) mit Hebelwirkung 1:5

- ETFs CFDs (397 ETF-Kontrakte) mit Hebelwirkung 1:5

- Rohstoffe (27) mit Hebelwirkung 1:20

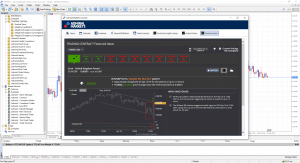

Vorteil 2: MetaTrader 4 & MetaTrader 5 Supreme Edition

MetaTrader 4 und die Supreme Edition steigern Ihre Handelserfahrung mit den fortschrittlichsten Tools, um Ihre Erfahrungen im Traden zu Verbessern. Die Plattform wurde entwickelt, um Ihnen die Möglichkeit zu bieten, Ihre Fähigkeiten im Handel voll auszuschöpfen. Sie bietet tägliche Wirtschaftsnachrichten und ermöglicht es Ihnen, Ihre Handelsergebnisse in Echtzeit zu analysieren. Ein Paket mit den neuesten Indikatoren bietet Ihnen mehr Chartinformationen. Die Mini-Chart-Funktion zeigt Ihnen kleine Charts in verschiedenen Zeitrahmen an, um Ihre Handelserfahrung besser analysieren zu können. Einige der wichtigsten Funktionen und Tools sind:

- Global Opinion Widget Globales Meinungs-Widget

- Mini Terminal

- Trade Terminal

- Echtzeit News

- 10+ Indikatoren

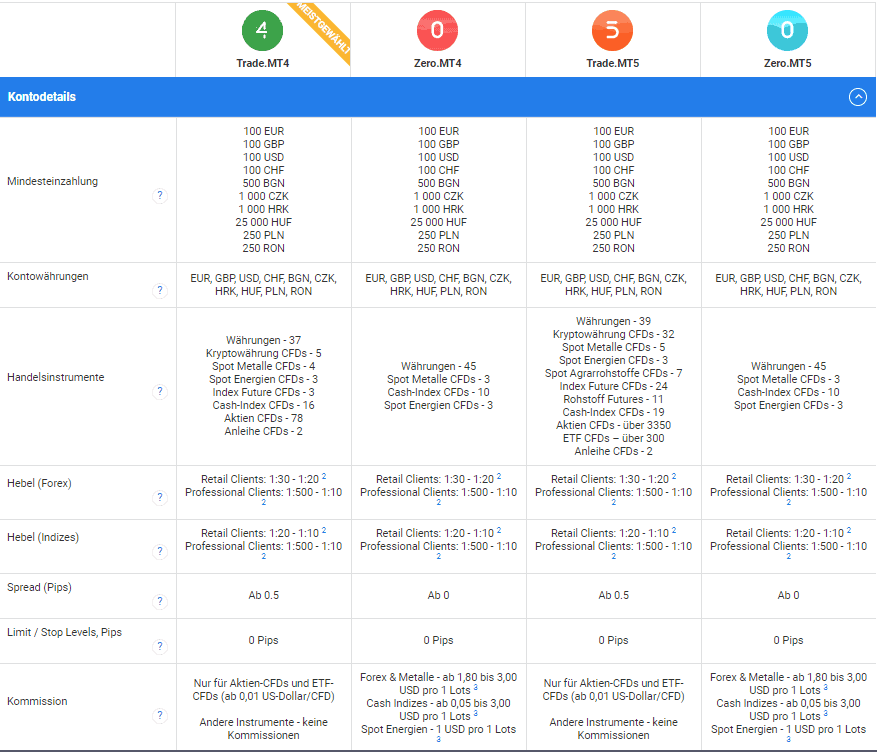

Vorteil 3: Admiral Market bietet flexible Handelskonten

Admiral Markets ermöglicht Ihnen die Auswahl aus 4 Arten von Handelskonten, die Ihnen die Flexibilität geben, ein Handelssystem zu wählen, das Ihren Präferenzen entspricht.

Zwei dieser Konten sind für Händler gedacht, die die MetaTrader 4 Handelsplattform bevorzugen. Dies sind die Konten ‘Handel MT4’ und ‘Null MT4’. Die anderen beiden Konten sind für Händler gedacht, die MetaTrader 5 bevorzugen. Bei diesen Konten handelt es sich um die Konten ‘Trade MT5’ und ‘Zero MT5’.

Bei den Konten “Handel MT4” und “Handel MT5” handelt es sich um provisionsfreie Konten mit Spreads, die im Vergleich zu den “Null”-Konten bei Hauptwährungspaaren um mindestens 0,5 Pips und bei kleineren und exotischen Währungspaaren näher an 1,0 (oft 1,5 Pips oder mehr) Pips liegen. Sie haben jedoch den Vorteil, dass Sie im Vergleich zu den “Null”-Konten aus einer größeren Auswahl an CFDs wählen können. Dazu gehören Anleihen, Aktien, Index-Futures, Kryptowährungen und Spot-Landwirtschaft. ETF-CFDs sind nur mit ‘Trade MT5’-Konten verfügbar.

Händler mit dem ‘Zero’-Konto haben engere Spreads und die folgenden Kommissionsgebühren, wobei je nach gehandeltem Volumen eine Kommission von 1,80 USD bis 3,0 USD gezahlt wird.

Der wichtigste Aspekt des Handelskontos von Admiral Markets ist die zulässige Flexibilität beim Devisenhandel. Sie können Einzahlungen aus einer großen Auswahl an Währungen vornehmen, die dann in die entsprechende Währung umgerechnet werden. Admiral Markets ermöglicht es Ihnen sogar, sich vor Währungsschwankungen zu schützen, indem Sie mehrere Konten gleichzeitig führen, und erleichtert den Transfer von Geldern zwischen internen Konten über deren Plattformen.

Da Admiral Markets, von der Financial Conduct Authority (FCA), FRN: 595450 und der Cyprus Securities and Exchange Commission (CySEC) Lizenznummer 201/13 reguliert wird, können Sie wählen, bei welcher Regulierungsbehörde Sie sich anmelden möchten, wenn Sie Admiral Markets beitreten.

Zusammenfassung

Wenn Sie mit der MetaTrader-Plattform handeln möchten und eine Auswahl an Handelskonten und Basiswährungen wünschen, stellt Admiral Markets eine sehr solide Option dar. Sie können den Handel auf dem MetaTrader 4 und MetaTrader 4 Supreme Edition mit einer Mindesteinzahlung von USD $200 beginnen.

Plus500 – Fortschrittlicher Handel mit Risikomanagement

1. Benutzerfreundliche und leicht zu bedienende Plattformen

2.Ausgezeichnetes Risikomanagement

3. Einzigartige CFD-Option

Stärke 1 Benutzerfreundliche Plattform

Plus500 bietet seine benutzerdefinierten CFD-Plattformen für Desktop- und Mobilgeräte an, um Ihnen ein umfassendes Handelserlebnis zu bieten. Die Plattform ist so konzipiert, dass Sie leicht zwischen den Handelsinstrumenten navigieren können und Kunden über die Desktop-Anwendung schnell Gelder einzahlen können.

MetaTrader 4 kann nicht in die Plus500-Anwendung integriert werden, und der algorithmische Handel wird nicht unterstützt. Die mobile Handelsapp bietet volle Funktionalität zur Überwachung der Märkte. Mit dem Umschalter vom Live- zum Demokonto können Händler den Handel schnell üben. Die mobile Anwendung kann von iOS-Geräten und Android-Geräten aufgerufen werden und unterstützt Windows Phone Apps.

Stärke 2 – Plus 500 Ausgezeichnetes Risikomanagement

Plus500 bietet ausgezeichnete Risikomanagement-Tools, mit denen Händler das hohe Risiko des Devisen- und CFD-Handels bewältigen können. Zu den wichtigsten Risikowerkzeugen zum Schutz Ihrer Investitionen gehören garantierte Stop-Loss-Orders (GSLOs) und ein garantierter Negativsaldo-Schutz.

Wenn Sie sich für einen garantierten Stop-Loss gegen eine geringe, im Spread enthaltene Gebühr entscheiden, hilft dabei, das Risiko zu begrenzen, garantiert jedoch keine Gewinne und schützt nicht vor Verlusten durch Marktbewegungen. Im Gegensatz zu anderen Plattformen führt die Plus500-Plattform den Stop-Loss-Kurs zu dem von Ihnen festgelegten Preis ohne Slippage aus. Garantierte Stop-Loss-Orders sind nicht für alle Instrumente verfügbar.

Wie alle Broker, die von einer europäischen Regulierungsbehörde beaufsichtigt werden, bietet auch Plus500 garantierten Negativsaldo-Schutz für Kleinanleger. Negativer Saldoschutz bedeutet, dass Ihr Guthaben auf dem Handelskonto nie unter 0 $ fällt. Diese Funktion ist inklusive, so dass Sie beim Handel kein Opt-in oder Opt-out vornehmen müssen.

Hinweis: Ein professionelles Konto ist ebenfalls verfügbar. Unter der Voraussetzung, dass Sie zwei der folgenden Voraussetzungen erfüllen, können Sie mit einem höheren Leverage als Einzelhändler handeln, verlieren jedoch automatisch den garantierten Negativsaldo-Schutz.

- Sie haben im letzten Jahr mindestens 10 bedeutende Transaktionen pro Quartal getätigt

- Ihr Portfolio übersteigt 500.000 EUR

- Sie sind seit mindestens einem Jahr in der Finanzbranche tätig

Stärke 3- Einzigartige CFD-Optionen

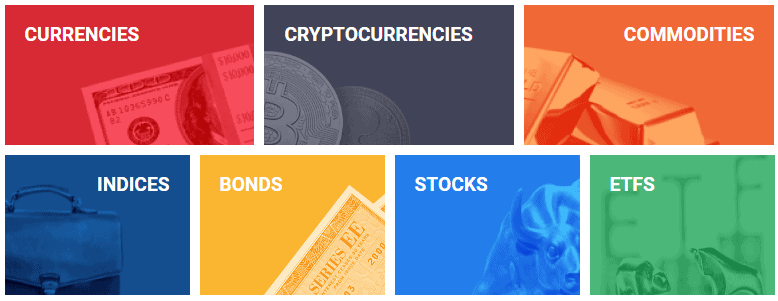

Plus500 bietet über 2.000 CFD-Handelsinstrumente an, darunter mehrere einzigartige Optionen, die nur von wenigen Online-Brokern angeboten werden.

Wie die meisten CFD-Anbieter bietet Plus500 Kryptowährungen, Indizes, Forex und Rohstoffe an, jedoch können beim Handel mit Soft Commodities auch einige ungewöhnliche Optionen gefunden werden, wie z. B. Schweine. Zu den verfügbaren CFDs gehören:

- 60+ Forex-CFDs mit einem Leverage von bis zu 30:1 für die wichtigsten Währungspaare

- Handeln Sie die größten CFD-Aktien der Welt an der NYSE, der NASDAQ und der Londoner Börse mit einer Hebelwirkung von 1:5

- Kryptowährungen CFD einschließlich XRP, IOTA, Stellar, EOS, Bitcoin Cash ABC, Cardano, Tron, Monero sind mit einem Hebel von bis zu 1:2 erhältlich

- 24 Rohstoffe einschließlich Schweine, Lebend- und Futterrinder. Die Hebelwirkung beginnt bei 1:20

Zusätzlich zu den üblichen Finanzinstrumenten und CFDs bietet Plus500 einige einzigartige Optionen, darunter

- Crypto 10 CFD: Ein Krypto-Währungsindex, der aus 10 verschiedenen Kryptos besteht.

- Sektor-Indizes CFD: Cannabis-Aktien, Batterien und Lithium, UK Brexit und Immobilien-Giganten

- Nationale Börsen-CFDs wie Deutschland, Japan, Frankreich, Australien, Belgien und Schweden

- 400+ Optionen mit Hebelwirkung von 1:5

- 93 ETFs mit Hebelwirkung ab 1:5

CFDs sind komplexe Instrumente und gehen aufgrund der Hebelwirkung mit einem hohen Risiko einher, schnell Geld zu verlieren. Diese Plattform richtet sich nicht speziell an Einsteiger.

Zusammenfassung

Mit seinen integrierten Risikomanagement-Funktionen ist Plus500 eine starke Wahl für CFD-Händler in Deutschland, die Wert auf strukturierte Risikokontrollen legen. Die Plus500-Märkte für den CFD-Handel eignen sich zudem für Händler, die Zugang zu einer breiten Auswahl an CFD-Instrumenten suchen.

Plus500 wird in der Europäischen Union über seine zypriotische Tochtergesellschaft Plus500CY Ltd von der Cyprus Securities and Exchange Commission (CySEC) reguliert und bietet seine Dienstleistungen damit auch in Deutschland an. Zusätzlich unterliegt die britische Tochtergesellschaft der Aufsicht der Financial Conduct Authority (FCA).

Plus500 BewertungBesuchen Sie Plus500

*Your capital is at risk ‘79% of retail CFD accounts lose money’

IG – Flexibles Trading mit CFD-Märkten

IG Markets ist ein etablierter Broker mit fast 50 Jahren Erfahrung in der Bereitstellung von Brokerage-Dienstleistungen. IG Markets wird von hochrangigen europäischen Finanzbehörden beaufsichtigt und von mehr als 178.000 Kunden auf der ganzen Welt als vertrauenswürdiger Broker angesehen. Der Broker ist nicht nur in Deutschland lizenziert und wird von der BaFin beaufsichtigt, sondern hält sich auch an die strengen Vorschriften der Financial Conduct Authority in Großbritannien.

Stärke 1 – Die CFD-Produktpalette

Kunden, die mit IG Markets handeln, erhalten Zugang zu über 17.000 Finanzinstrumenten aus einer Reihe von Anlageklassen:

- Forex: Wählen Sie aus fast 100 größeren, kleineren, exotischen und aufstrebenden Forex-Paaren ohne Provision und mit einem Leverage von bis zu 30:1

- Indizes: Über 80 Index-Märkte sind mit festen Spreads ab 0,4 Pips aus den folgenden Märkten verfügbar: FTSE 100, Deutschland 30 und Wall Street

- Aktien: Mehr als 12.000 globale Aktien-CFDs sind verfügbar, einschließlich der beliebtesten Indizes. Deutsche Aktien können ab 5 Euro gehandelt werden.

- Rohstoffe:26 Rohwaren sind verfügbar plus Terminkontrakte

- Kryptowährung: 5 Arten von Kryptowährungen, darunter Bitcoin und ein Krypto-10-Index

- Andere Märkte: Handelsmärkte wie Optionen, ETFs, Zinssätze, Marktsektoren und Anleihen

Mit 45 Jahren Geschäftstätigkeit und über 178.000 Kunden weltweit ist IG einer der ältesten Devisenmakler der Welt.

Stärke 2 – Die IG-Handelsplattform

IG Markets stellt seinen Kunden eigene leistungsstarke Handelsplattformen zur Verfügung, die über Desktop-Plattformen oder mobile Apps verfügbar sind. Darüber hinaus wird eine Auswahl anderer Plattformen angeboten.

Die IG-Handelsplattform verfügt über die folgenden Hauptmerkmale:

- Einfache und übersichtliche Schnittstelle mit einer Übersicht der Marktpreise, Spreads und Hebelwirkung

- Risikoschutzmerkmale wie garantierte Stop-Loss-Orders

- Optimierte und transparente Umrechnungsgebühr bei der Auswahl von Währungen für den Handel

- Auswahl von Tools zur automatischen Alarmierung bei Auslösung von Preisniveaus

- Automatisierung von Aufträgen mit bedingter Auftragseinstellung

- 28 technische Indikatoren

- 4 Zeitrahmen aus einem einzigen Diagramm

- Tick by Tick zur monatlichen Analyse des Leistungszeitrahmens

- Schnelle Ausführung – Die IG-Plattform verarbeitet jeden Monat 7 Millionen Aufträge von 130.000 Benutzern

- Teilausführungen, um die Wahrscheinlichkeit einer Ablehnung bei großen Auftragsgrößen zu minimieren

Weitere Plattformen umfassen ProRealTime Order, die für ihr Angebot an Diagrammen und Indikatoren bekannt ist und MetaTrader 4, die weltweit beliebteste Handelsplattform.

eToro – Mit sozialem Handel das Beste kopieren

Die Social-Copy-Handelsplattform von eToro hat sich schnell zu einem der führenden Kontospiegelungsdienste weltweit entwickelt. Das Social Newsfeed-Kopienhandelssystem bietet eine generationenübergreifende Social Trading-Plattform. Mit mobilem und Desktop-Handelszugang bietet eToro mehr als 10 Millionen Benutzern aus 140 Ländern der Welt den sozialen Kopienhandel an.

Stärke – Soziales Trading

Das Social-Copy-Handelsnetzwerk und die Plattform von eToro ermöglichen es Kleinanlegern, die Handelsstrategien erfahrener Händler zu kopieren. Kunden können die Geschäfte von eToros “Beliebten Anlegern”, die ihrem Risikoprofil und ihren Finanzinstrumenten entsprechen, verfolgen und kopieren. Um sich für Beliebte Investoren zu entscheiden, können eToro Kunden ihre Handelsgeschichte und ihren Erfolg zusammen mit Standort und Risikoniveau einsehen.

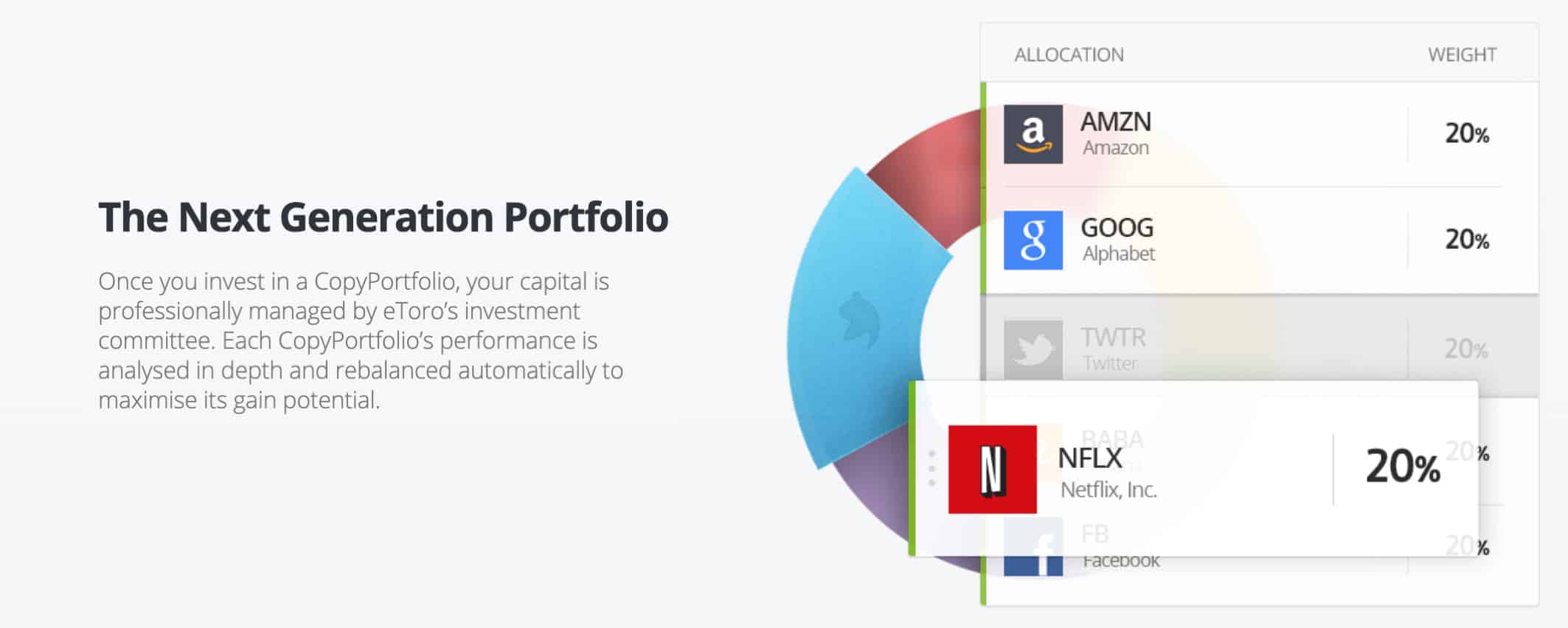

Zusätzlich können Händler wählen, in CopyPortfolios zu investieren. Der Portfoliomanagementservice ist als ein Bündel von eToro’s leistungsstarken Investoren oder als eine Mischung aus verschiedenen Finanzinstrumenten und Anlageklassen erhältlich und ermöglicht es Händlern, die Zeit, die für die Suche nach beliebten Investoren aufgewendet wird, zu minimieren und einfach zu kopieren.

eToro bietet eine breite Palette von Instrumenten an, darunter Krypto, ETFs, Aktien, Indizes, Rohstoffe und Devisen.

*Your capital is at risk ‘68% of retail CFD accounts lose money’

CMC-Märkte – Starten Sie ohne Mindesteinlage

Vorteil 1 – keine Mindesteinlage

CMC Markets ist ein vollständig regulierter Broker, der wettbewerbsfähige Spreads und einen breiten Marktzugang bietet. Mit dem CFD-Konto des Brokers können Händler ein Handelskonto ohne Mindesteinlage eröffnen. Die meisten Broker haben Mindesteinzahlungsanforderungen, die oft im Bereich von $200 oder höher liegen, weil sie nur seriöse Händler wollen, die mit Beträgen handeln, die dem Broker angemessene Gewinne bringen. Allerdings können Broker aus folgenden Gründen ein $0-Einzahlungskonto anbieten:

- Sie möchten einfach ein Konto eröffnen, um Zugang zu den Funktionen zu erhalten, die der Broker anbietet, wie z.B. Schulungswerkzeuge oder Support Desk.

- Sie möchten ein Konto eröffnen, aber zu einem späteren Zeitpunkt mit dem Handel beginnen

- Sie möchten ein Konto eröffnen und das Geld von einem anderen Konto überweisen

- Sie benötigen ein Konto für den Zugang zu den Demo-Plattformen

- Sie möchten nur einen kleinen Betrag einzahlen, damit Sie mit Mikro- oder Minilots handeln können.

Vorteil 2 – Die CMC CFD-Produktpalette

Kunden können zwischen zwei Konten wählen. Das erste Konto wird “Next Generation Account” genannt, da es die Broker-eigene Handelsplattform Next Generation nutzt. Das andere Konto ist das MetaTrader 4 (MT4)-Konto. Next Generation ist eine vollständig anpassbare Plattform, die für iPad, iPhone, Android und Desktop-PC verfügbar ist, während MT4 als Desktop-, Web-Trader- oder mobile App-Plattform angeboten wird.

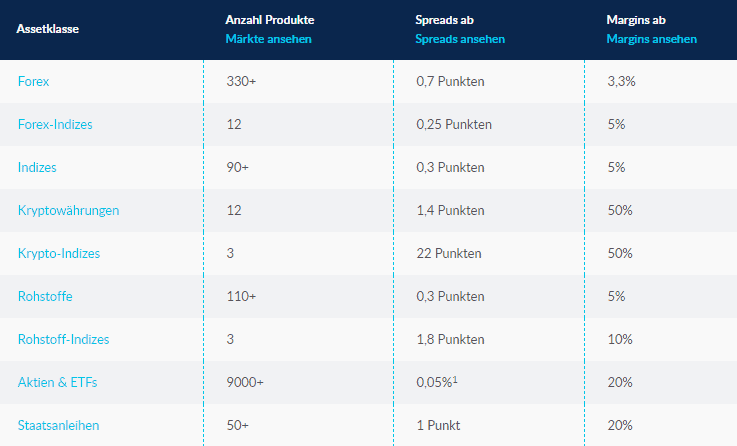

Kunden von CMC Markets können über 10.000 CFD-Produkte handeln, die Anlageklassen wie Forex, Indizes, Crypto, Treasuries, Aktien, ETFs und Rohstoffe abdecken.

Um diese CFD-Instrumente in vollem Umfang nutzen zu können, sollten Sie das Next Generation Account wählen, da mit dem MT4-Konto nur etwa 50 Handelsinstrumente zur Verfügung stehen. Kryptowährungen und ETFs sind z.B. auf MT4 nicht verfügbar.

Funktionen, die das Kontoangebot von CMC Markets umfassen:

- Erweiterte Charting- und technische Analyse-Tools

- Mehrere Auftragsarten einschließlich garantierter Stop-Loss-Orders

- Software für Stimmungsdaten und Mustererkennung von Kunden (Next Generation)

- Forex-Spreads mit bis zu 0,3 Pips bei den Hauptwährungspaaren

- Bargeld-Rabatte für CFD- und Firmenkonten.

- Bildungsressourcen einschließlich Seminare und Webinare

- Marktnachrichten in Echtzeit

HYCM – Das Beste für MetaTrader 5

HYCM ist einer der bekanntesten Namen in der Forex-Handelsindustrie mit mehr als 40 Jahren Erfahrung. HYCM bietet Zugang zu 140 Ländern mit BaFin-Regulierung in Deutschland und ist auch von der Financial Conduct Authority of the UK (FCA), Cyprus Securities and Exchange Commission (CySEC) innerhalb Europas lizenziert.

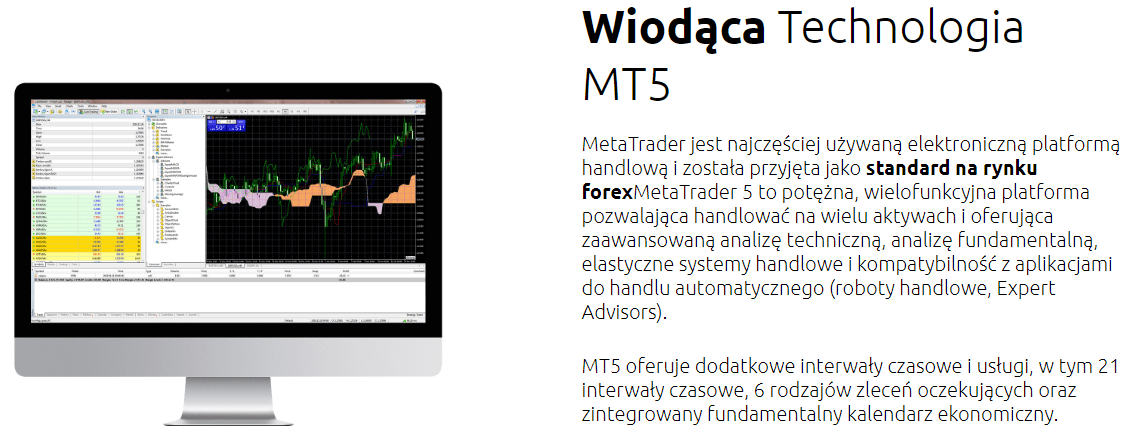

Stärke 1 – MetaTrader 5

Diejenigen, die CFDs und Forex mit MetaTrader 5 und HYCM handeln, kommen in den Genuss einer Reihe von fortschrittlichen Handelswerkzeugen. Die Drittanbieter-Handelsplattform ist bekannt für ihre Expert Advisor-Funktionen, mit denen Händler automatisierte Handelsstrategien unter Verwendung der Programmiersprache MQL5 entwickeln oder die EAs anderer vom MetaTrader-Marktplatz herunterladen können. Zusätzlich können MT5-Benutzer die folgenden Handelsplattformen nutzen:

- Multi-Asset-Produktpalette, einschließlich Aktien

- Automatisierter Handel mit Expertenberatern und Handelssignalen

- Multi-Thread-, Multi-Währungs-Backtesting

- Ultra-schnelle Ausführung

- Umfangreiche technische Analysewerkzeuge

- Mehrere Auftragsarten zur Bewältigung des hohen Risikos beim CFD-Handel

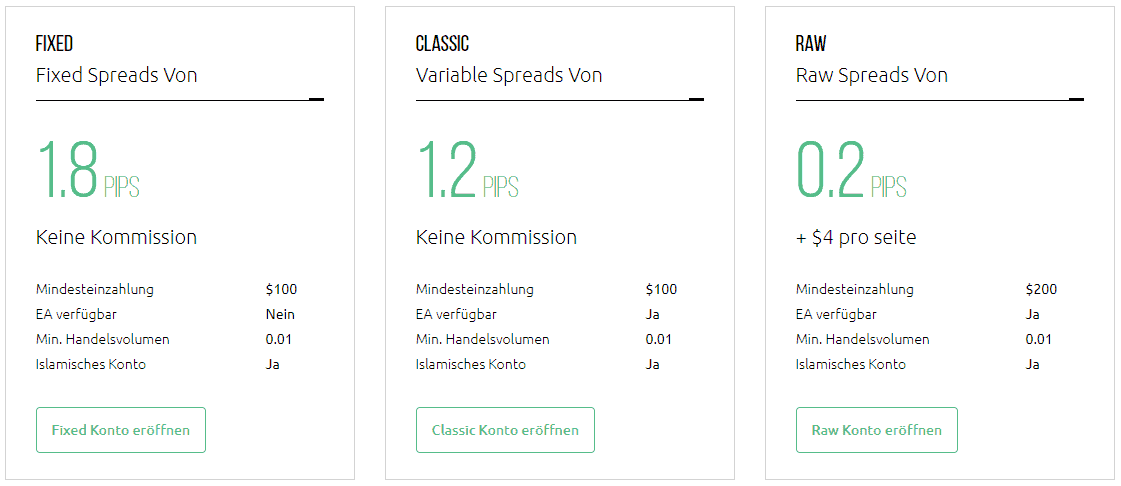

Stärke 2 – Konto & Gebühren

HYCM bietet drei Kontoarten für den Handel an: Fixed, Classic und Raw. Fixed-Konten haben feste Spreads ab 1,8 Pips ohne Provision. Inhaber eines Classic-Kontos erhalten Zugang zu variablen Spreads ab 1,2 Pips ohne Provision, während Inhaber eines Raw-Kontos mit Spreads ab 0,2 Pips handeln können, wobei sie eine Provision von 4 USD pro Runde zahlen.

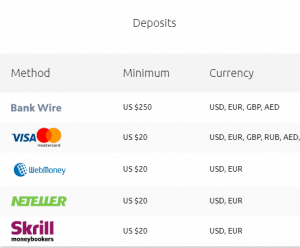

Stärke 3 – Einzahlung & Abhebung

Alle Ein- und Auszahlungsmethoden sind beim Devisen- und CFD-Handel mit HYCM gebührenfrei. Es stehen verschiedene Möglichkeiten zur Verfügung, wobei eine geringe anfängliche Mindesteinzahlung von $100 erforderlich ist, um den Handel zu beginnen. HYCM bietet Ein- und Auszahlungen mit Banküberweisung, Kreditkarte (Visa/Mastercard), WebMoney, Neteller und Skrill an.

Die Beliebtesten Forex-Broker in Deutschland

Im Folgenden finden Sie die vollständige Liste der von der FMA regulierten Forex-Broker sowie deren Beliebtheit auf Basis monatlicher Suchanfragen auf Google Deutschland.

| Brokers | Global Monthly Searches |

|---|---|

| eToro | 74,000 |

| OANDA | 40,500 |

| Admiral Markets | 33,100 |

| Interactive Brokers | 22,200 |

| Plus500 | 18,100 |

| XM | 14,800 |

| Capex | 14,800 |

| XTB | 12,100 |

| Axi | 9,900 |

| Roboforex | 9,900 |

| Trading 212 | 8,100 |

| Vantage | 8,100 |

| Libertex | 8,100 |

| IC Markets | 5,400 |

| Alpari | 5,400 |

| SwissQuote | 5,400 |

| IG Group | 5,400 |

| FBS | 4,400 |

| Exness | 3,600 |

| Pepperstone | 3,600 |

| CMC Markets | 3,600 |

| AvaTrade | 2,900 |

| Capital.com | 2,900 |

| ATC Brokers | 2,400 |

| HFM | 1,900 |

| Activtrades | 1,900 |

| Saxo Markets | 1,600 |

| BlackBull Markets | 1,600 |

| FP Markets | 1,300 |

| FxPro | 1,000 |

| Eightcap | 1,000 |

| FXCM | 1,000 |

| Blueberry Markets | 1,000 |

| Fusion Markets | 880 |

| TD Ameritrade | 880 |

| Tickmill | 880 |

| Octa FX | 720 |

| FOREX.com | 720 |

| IQ Option | 700 |

| easyMarkets | 590 |

| Xtrade | 590 |

| Startrader | 480 |

| Trade Nation | 390 |

| Trading.com | 390 |

| FXTM | 320 |

| Markets.com | 320 |

| ThinkMarkets | 260 |

| Hankotrade | 260 |

| HYCM | 210 |

| Go Markets | 170 |

| TMGM | 140 |

| Purple Trading | 140 |

| City Index | 140 |

| Global Prime | 110 |

| Multibank Group | 110 |

| KOT4X | 90 |

| ATFX | 90 |

| Tradersway | 70 |

| MiTrade | 70 |

| Hugosway | 50 |

| ACY Securities | 50 |

| Fondex | 40 |

| IUX Market | 10 |

| GMI Market | 10 |

| Ox Traders | 10 |

| Accendo Markets | 10 |

74,000 1st | |

40,500 2nd | |

33,100 3rd | |

22,200 4th | |

18,100 5th | |

14,800 6th | |

14,800 7th | |

12,100 8th | |

9,900 9th | |

9,900 10th |

Welcher ist der beste Online-Devisenbroker in Deutschland?

Unterschiedliche Broker decken verschiedene Bedürfnisse der Händler ab. Für diejenigen, die einen hervorragenden Marktzugang, Risikomanagement-Tools und Handelsplattformen wünschen,

ist Interactive Brokers eine

ist Interactive Brokers eine

ausgezeichnete Wahl. Wenn ein Händler sich andererseits rein auf den sozialen Handel konzentrieren will, ist eToro möglicherweise besser geeignet.

Ist der Devisenhandel in Deutschland legal?

Ja, Privatanlegerkonten können in Deutschland über CFD-Broker mit Devisen handeln. Die deutsche Aufsichtsbehörde BaFIN beaufsichtigt die Finanzmärkte des Landes und stellt sicher, dass die Anleger vor irreführenden Broker-Praktiken geschützt werden.

Wie wählt man einen Forex-Broker in Deutschland aus?

Bei der Auswahl eines Forex- und CFD-Brokers in Deutschland ist es wichtig, einen regulierten Broker zu finden, der einen guten Marktzugang, niedrige Spreads, eine geeignete Handelsplattform sowie Risikomanagement-Tools bietet. Broker sollten von der BaFin, CySec, FCA oder einer anderen Aufsichtsbehörde unter dem Dach der ESMA reguliert werden.

Wie verdienen Forex-Broker ihr Geld?

Als Ausgleich für die Erleichterung des Handels erhalten Broker eine kommissionsgebühr oder verdienen Geld über den Spread (die Differenz zwischen den vom Broker notierten Geld- und Briefkursen).

Was ist ein STP Forex-Broker?

Straight-Through-Processing (STP) bedeutet, dass ein Händlerauftrag ohne Eingreifen des Dealing Desk ausgeführt wird. Im Gegensatz zu ECN Brokers haben STP-Broker jedoch die Kontrolle über die externen Liquiditätspools.

Welche Forex-Broker bieten in Deutschland eine 'Negative Balance Protection' an?

Von der BaFIN (Bundesanstalt für Finanzdienstleistungsaufsicht) zugelassene und überwachte Broker sind nach deutschem Recht verpflichtet, einen Negativsaldo-Schutz auf Konten von Kleinanlegern zu bieten, um Händler vor übermäßigen Verlusten zu schützen. Plus500 ist bekannt für seine Risikomanagement-Tools wie Negativsaldo und garantierte Stopps.

Von der BaFIN (Bundesanstalt für Finanzdienstleistungsaufsicht) zugelassene und überwachte Broker sind nach deutschem Recht verpflichtet, einen Negativsaldo-Schutz auf Konten von Kleinanlegern zu bieten, um Händler vor übermäßigen Verlusten zu schützen. Plus500 ist bekannt für seine Risikomanagement-Tools wie Negativsaldo und garantierte Stopps.

About BaFin Über BaFin

Die BaFin-Regulierung gewährt den Betrieb von Forex- und CFD-Brokern in Deutschland durch die Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), die BaFin-Lizenz wird den Brokern nach Erfüllung ihrer Handelsbedingungen erteilt. Der deutsche Finanzdienstleistungssektor wird von der Deutschen Bundesbank und der Zentralbank in der Bundesrepublik Deutschland in Zusammenarbeit mit der Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) reguliert. Auch Broker, die im Rahmen einer Behörde mit der ESMA-Region reguliert werden, wie CySEC und FCA, können in Deutschland tätig werden.

Um zu überprüfen, ob ein Forex- und CFD-Broker die Lizenz der BaFin inne hält, müssen Sie die Registrierungsnummer der BaFin unten auf der Website des Brokers ausfindig machen.

Fazit

Der Devisenhandel ist in Deutschland legal und Devisenmakler müssen mit einer Betriebsgenehmigung der BaFin reguliert werden. Risikowarnung: Der Handel mit CFDs ist mit einem hohen Risiko verbunden, und um den richtigen Forex-Broker für den Online-Handel zu finden, haben wir in diesem Artikel die besten Forex-Broker in Deutschland für Gebühren, Plattformen, Spreads, Depositen und mehr aufgelistet.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Ask an Expert