Fixed Spread Forex Brokers

To help you find the best fixed spread broker for forex trading, our team has compared the top brokers with fixed spreads based on the financial services they offer, such as the different currency pairs, CFDs, trading platforms, account types and fixed spreads available.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

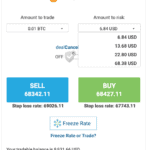

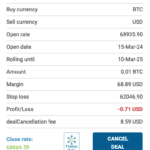

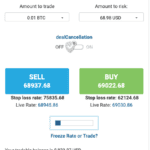

Our fee tests found AvaTrade’s EUR/USD spread of 0.9 pips to be competitive, considering it’s a fixed spread with no additional commission. This means the spread won’t widen during volatile market conditions or price spikes, potentially saving you money when day trading.

Our fee tests found AvaTrade’s EUR/USD spread of 0.9 pips to be competitive, considering it’s a fixed spread with no additional commission. This means the spread won’t widen during volatile market conditions or price spikes, potentially saving you money when day trading.

Ask an Expert

Are fixed spreads better than variable spreads?

Variable spreads are lower than fixed spreads so you will pay less however fixed spreads are more stable. When a major economic or political event occurs, variable spreads can change and this change can be dramatic which may lead to significant losses, especially if you are using leverage. While these economic events are rate which makes variable spreads are the better option most of the time, fixed spreads can end up being the safer option. Beginner traders, in particular, may wish to consider fixed spreads.