Accendo Markets Review Of 2026

Accendo Markets has over 5,000 instruments to trade and no broker commissions on any markets across their CFD, forex, and spread betting accounts, which is good. We reviewed its spread betting, FX and CFD trading to find out what the broker is like.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Accendo Markets Summary

| 🗺️ Regulation | FCA |

| 💰 Trading Fees | Variable Spreads |

| 📊 Trading Platforms | Traderoom |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Primary Markets | CFDs, Forex, Indices, Commodities |

| 💳 Credit Card Deposit | Yes |

Why Choose Accendo Markets

Pros we liked with Ascendo Markets are their large range of trading instruments (all without commission except for shares), this is especially true if you are in the UK, where you can choose between CFD trading, Forex spot trading, shares trading and spread betting. Other features that we like with Ascendo is their comprehensive education resources for beginners which includes text and video-based content.

Depsite these pros, the broker has major weaknesses. We found the website rather bland and there is lack of information about their trading platforms – you can’t even try the platform with a demo which doesn’t inspire confidence. Another feature lacking is live chat support, you can only contact customer support via phone or email.

Accendo Markets Pros and Cons

- Has spread betting

- Uses CMC Markets as their clearing house

- Regulated by FCA

- 24/7 customer support

- Good Education

- Can trade via phone (no cost)

- Spreads are wide

- No live chat on their website

- Don’t accept clients outside UK

- Website could be better

- Lack of deposit methods for funding

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Fees

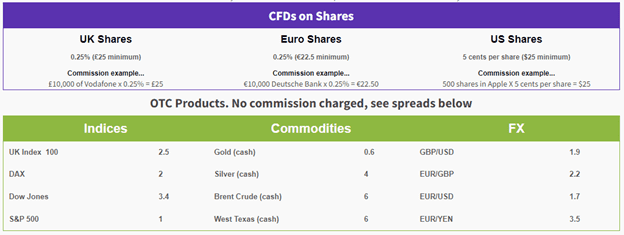

Spreads are variable rather than fixed and start from as low as just 0.6 pips/points, although average spreads are higher at around 1.7 on major pairs.

This is somewhat disappointing considering some brokers like Pepperstone have a standard average spread of 1.1. Industry leaders such as IC Markets and Plus500 are as low as 0.98 and 0.8 respectively.

Our Chief Technology Research at CompareForexBrokers, Ross Collins conducted tests in Standard Account Spreads to find out which brokers have the best spreads with no commissions. In his tests, Ross found that IC Markets have the best spreads at just 1.03 pips.

We think the way Ross went about finding the broker with the best spreads fairly represents all the brokers he tested. All brokers tend to be a better choice for some forex pairs and less so for other currency pairs. Ross largely negated this by combining the average spreads over 6 major currency pairs. The tests were then done over two 24-hour periods over 2 weeks.

In his finding, Ross found that IC Markets has the best spreads at just 1.03 pips. Given most brokers’ lowest average spreads is for the EUR/USD currency pairs, it is hard to see how one is getting good value with the 1.7 average advertised by Spreadex.

For CFDs on shares, Accendo Markets charges a 0.25% commission on UK and EUR shares, while 5 cents per share is charged on US shares.

Account types

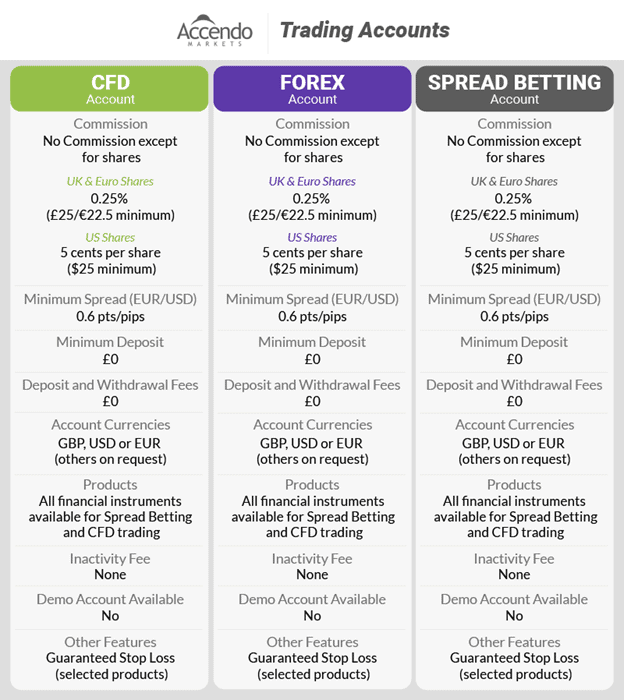

There are three account types that traders can open with Accendo Markets with currency denominated in either GBP, EUR, or USD. These include a CFD account, a forex account, and a spread betting account.

We especially like the fact that there are no minimum deposit amounts or any deposit/withdrawal fees. There are also no inactivity fees which is a small bonus.

Open Demo AccountVisit Accendo Markets

*Your capital is at risk ‘69% of retail CFD accounts lose money’

Leverage

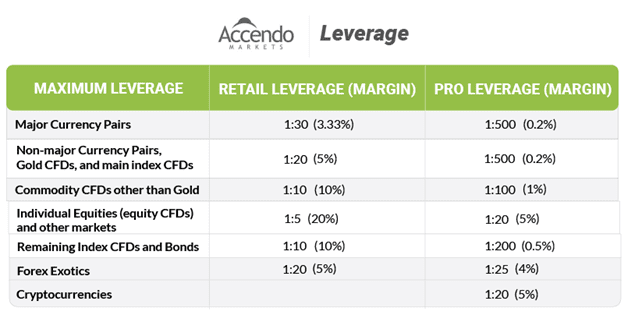

Accendo Markets offers a fairly standard leverage structure with minor forex pairs capped at 20:1 and majors at 30:1 for retail traders. It would be nice if Accendo Markets could have higher leverage for retail traders but we understand the leverage they can offer is set by the Financial Markets Authority (FCA).

The FCA regulates the financial markets of the UK and they limit the leverage the broker can have with their retail investor account. Pro traders, however, can trade with leverage up to 1:500 should they satisfy certain criteria.

Spread Betting

In addition to CFD trading, a spread betting account is also available. You can spread bet the same products as with CFDs with the same points or pips since they are matched to the same underlying instruments. And like CFD trading with Accendo Markets, there are no commission costs in addition to the spread.

While spread betting is similar to CFD trading in that they are both leverage instruments, spread betting does have some advantages. For example, spread bets are exempt from capital gains tax and stamp duty.

Accendo Trading Platform is used to spread bet with Accendo Markets. It is also available for demo with 100,000 virtual currency that you can top up as often as you wish.

Trading Platforms

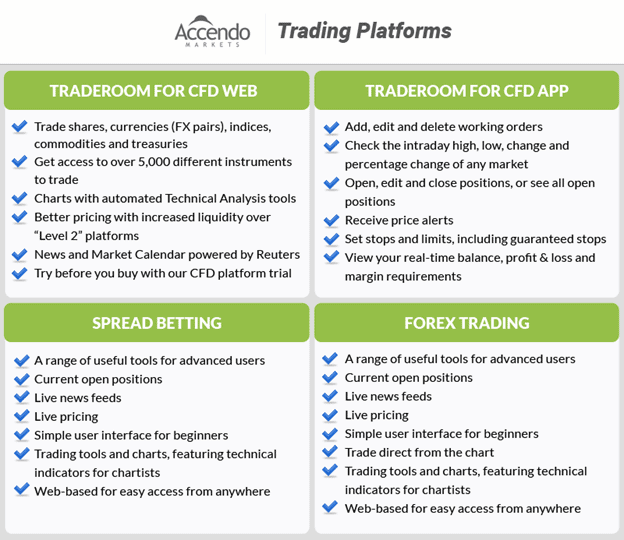

We were a little disappointed to discover from our review of Accendo Markets that trading is limited to their web-based trading platform, ‘Traderoom’. This means if you prefer to use a desktop or app like MetaTrader 4 (MT4), you might need to look elsewhere.

| Trading Plaform | Available With Accendo Markets |

|---|---|

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

Traderoom

Upon digging a little deeper, we discovered that Traderoom is some sort of white-labeled version of CMC Markets’ NGEN platform. This is by no means a bad thing as NGEN offers a range of powerful tools, backed by one of the industry leaders. Features include price alerts and push notifications, client sentiment reports, a customisable Reuters newsfeed, manual pattern recognition, automated trade execution, in-built risk management tools, and much more. All these tools are definitely of use to spread bettors and fx or CFD traders alike.

This all comes at a cost but we were unable to find any sort of pricing information on the Accendo Markets website. With that being said, they do offer a free trial with no credit card sign up, providing you with demo money and access to live data and prices.

In addition to the web trader, Traderoom is also available for use on iPhone iPad, and Android. You can get these trading and spread betting apps via the Play Store.

Side note: one interesting feature we noticed is the ability to make trades via phone. Accendo Markets has a trading room where you can call to make an offer. There is no cost to use this service.

Order types

A range of order types is available on Traderoom including all the standard order types but importantly, a guaranteed stop loss order and one-cancels-the-other. This provides you with a greater degree of certainty and security, preventing market volatility and slippage from bypassing traditional stop-loss orders.

When using guaranteed stop-loss orders, you will need to pay a premium that is between 0.3% to 1% of the trade size (on equity CFDs) for the asset traded.

Open Demo AccountVisit Accendo Markets

*Your capital is at risk ‘69% of retail CFD accounts lose money’

Is Accendo Markets Safe?

1. Regulation

Accendo Markets is only regulated by the Financial Conduct Authority (FCA) within the United Kingdom. While this doesn’t necessarily preclude you from opening an account from elsewhere, Accendo Markets state on their website that their services are not targeted to any traders outside of the UK.

| Accendo Market Safety | Regulator |

|---|---|

| Tier-1 | FCA |

| Tier-2 | X |

| Tier-3 | X |

We also thought it important to note that a key positive of choosing Accendo Markets is that funds will be protected by the Financial Services Compensation Scheme (FSCS) in the event of insolvency.

2. Reputation

Upon digging a little deeper into the legal documentation on the Accendo Markets website, we discovered much of it was branded with CMC Market’s livery. This was strange, but once we investigated further, we discovered that Accendo Markets actually uses CMC Markets as their clearing broker. They also leverage their platform and technology, as we touched on earlier.

To have such partnerships is certainly not abnormal within the forex industry, and to have a partnership with one of the industry’s leading forex brokers is undoubtedly an endorsement for Accendo Markets.

Accendo Markets shows minimal visibility in the online trading space. With just 90 monthly Google searches, it ranks as the 65th most popular forex broker among the 65 brokers analyzed—effectively placing it last in our rankings. Web traffic data confirms this limited presence, with Similarweb reporting only 1,000 global visits in February 2024, also positioning Accendo Markets as the 65th most visited broker.

Founded in 2007 and based in London, Accendo Markets focuses primarily on professional and high-net-worth traders. The company doesn’t publicly disclose its client numbers or trading volumes, but its extremely limited search and traffic metrics suggest a highly specialized boutique operation rather than a broker pursuing broad market reach. Accendo Markets appears to operate in a specific niche of the UK trading landscape, focusing on personalized service rather than volume-based business.

| Country | 2025 Monthly Searches |

|---|---|

| United Kingdom | 50 |

| India | 10 |

| Australia | 10 |

| United States | 10 |

| South Africa | 10 |

| Spain | 10 |

| Germany | 10 |

| Italy | 10 |

| Thailand | 10 |

| Malaysia | 10 |

| Indonesia | 10 |

| Nigeria | 10 |

| Philippines | 10 |

| France | 10 |

| Pakistan | 10 |

| United Arab Emirates | 10 |

| Netherlands | 10 |

| Vietnam | 10 |

| Kenya | 10 |

| Bangladesh | 10 |

| Colombia | 10 |

| Mexico | 10 |

| Morocco | 10 |

| Portugal | 10 |

| Hong Kong | 10 |

| Cyprus | 10 |

| Austria | 10 |

| Greece | 10 |

| Peru | 10 |

| Uzbekistan | 10 |

| Ireland | 10 |

| Botswana | 10 |

| Mauritius | 10 |

| Canada | 0 |

| Brazil | 0 |

| Turkey | 0 |

| Singapore | 0 |

| Chile | 0 |

| Japan | 0 |

| Taiwan | 0 |

| Venezuela | 0 |

| Poland | 0 |

| Algeria | 0 |

| Tanzania | 0 |

| Egypt | 0 |

| Saudi Arabia | 0 |

| Argentina | 0 |

| Cambodia | 0 |

| Switzerland | 0 |

| Sweden | 0 |

| Sri Lanka | 0 |

| Uganda | 0 |

| Ghana | 0 |

| Ecuador | 0 |

| Dominican Republic | 0 |

| New Zealand | 0 |

| Bolivia | 0 |

| Jordan | 0 |

| Uruguay | 0 |

| Mongolia | 0 |

| Panama | 0 |

| Ethiopia | 0 |

| Costa Rica | 0 |

50 1st | |

10 2nd | |

10 3rd | |

10 4th | |

10 5th | |

10 6th | |

10 7th | |

10 8th | |

10 9th | |

10 10th |

3. Reviews

As of this writing, there are no reviews for this broker on TrustPilot.

Deposit And Withdrawal

What is the minimum deposit at Accendo Markets?

There is no minimum deposit to open an account with Accendo Markets. You will obviously need to deposit funds for commence trading.

Deposit/Withdrawal Options and Fees

We were surprised to see so few funding options with Accendo Markets. Funding options are limited to credit debit cards or bank transfers. We did not notice any digital wallet options like PayPal, Skrill, or Neteller.

Ease To Open An Account

We found the account opening process to be straightforward, and a representative was very quick to jump on the phone to guide us through. When we emailed to ask some questions, they also responded very quickly, which we liked.

When opening an account you will need to go through the following steps:

- Get Started

- Personal Information

- Address

- Phone Number and Email

- Check Email for the final steps

If successful you will then be confirmed as having an account. It is at this point you will be able to start using the demo account with Accendo Markets and start testing the trading platform.

To commence proper trading. you will need to provide a photo of your passport or driver’s licence along with a secondary ID like a utility bill or bank statement to the secure client section of your account and deposit funds into your trading account.

Overall we found the account application process very straightforward. The application process takes under ten minutes and you can start with a demo account almost immediately. Once you have finished your application, Accendo Markets will have your account formally approved within a few hours. All traders will then be assigned a designated professional trader who will assist with anything you need to get started.

Open Demo AccountVisit Accendo Markets

*Your capital is at risk ‘69% of retail CFD accounts lose money’

Product Range

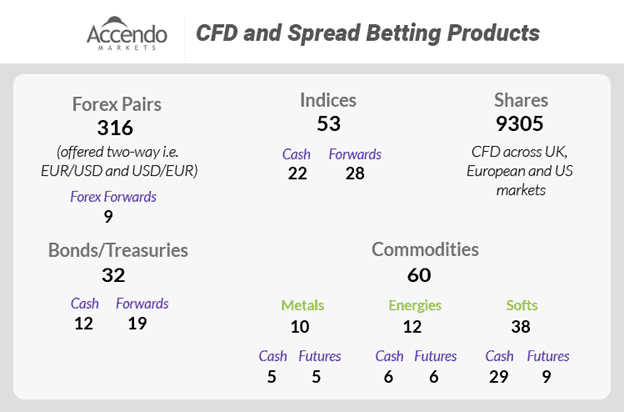

Accendo Markets offers over 316 forex pairs, 32 bonds, 53 indices such as ftse and S&P500 , 60 commodities, and thousands of shares. If you are wondering how Accendo Markets is able to offer 316 pairs for forex trading which is far more than the 60 to 100 fx pairs most CFD brokers offer, this is because they have counted the pairs twice (i.e. AUD/USD and USD/AUD). Some pairs are counted twice again using forwards.

We note that most CFD products are available as both Cash and Forwards which does increase the way you can trade with the same products.

Customer Service

Accendo Markets positions itself as a forex broker which offers personalised service. From their website, it appears you get access to their dealers and back office support 24/7, and also have access to a professional trader who is assigned as your account manager during regular UK market hours.

One weakness we found was that there is no live chat via their website. So if you need support, you either need to email Accendo Markets or call them. We sent the broker a few emails as part of our fact-finding and found their responses were mostly timely and helpful.

Research and Education

Beginner resources for spread betting and CFD trading on the website are fairly comprehensive and include text and video-based explainers on CFDs and spread betting. There are also various other useful explainer resources ranging from chart patterns to technical indicators.

The technical FAQs are also comprehensive, and the broker provides a daily morning report, although it does appear to be auto-generated and not overly insightful. Nonetheless, traders still might find it timely and useful.

The Accendo Markets’ Analyst and Trader Views section is a little stale with the latest video update published in May 2022. Likewise, their Special Reports section seems to have last been updated in 2019.

Our review reveals that the Accendo Markets team offers premium research and trade idea subscription packages for £1999 per annum, but this is provided at no cost for active traders on the platform. Additionally, they also offer 1-to-1 trading tuition conducted over the phone or in their office.

Open Demo AccountVisit Accendo Markets

*Your capital is at risk ‘69% of retail CFD accounts lose money’

Final Verdict on Accendo Markets

Accendo Markets offer a decent selection of markets for traders with various forex pairs, and plenty of CFD shares to choose from. We definitely think they have a good customer service offering, and we like the lack of commissions and fees across the broker.

With that being said, the spreads aren’t that competitive, the website is a little dull, and trading is limited to web-based and mobile trading platforms. Additionally, the broker is only regulated within the United Kingdom which is great for UK-based traders, but not so much for traders elsewhere.

Accendo Markets FAQs

What types of accounts does Accendo Markets offer?

Accendo Markets provides three account types: CFD, forex, and spread betting accounts. All accounts are available in GBP, EUR, or USD.

Is there a minimum deposit requirement?

No, there is no minimum deposit requirement. However, funds must be deposited to commence trading.

What are the available funding methods?

Funding can be done through credit/debit cards or bank transfers. Digital wallets like PayPal are not supported.

What leverage does Accendo Markets offer?

Retail traders can access leverage up to 30:1 for major forex pairs. Professional traders may access up to 500:1, subject to eligibility.

Which trading platforms are available?

Trading is done through the web-based Traderoom platform, which is also available on mobile devices. MetaTrader 4 (MT4) is not supported.

Alternatives to Accendo Markets

See how other brokers compare in terms of features, platforms, and trading experience.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert