Axi vs easyMarkets

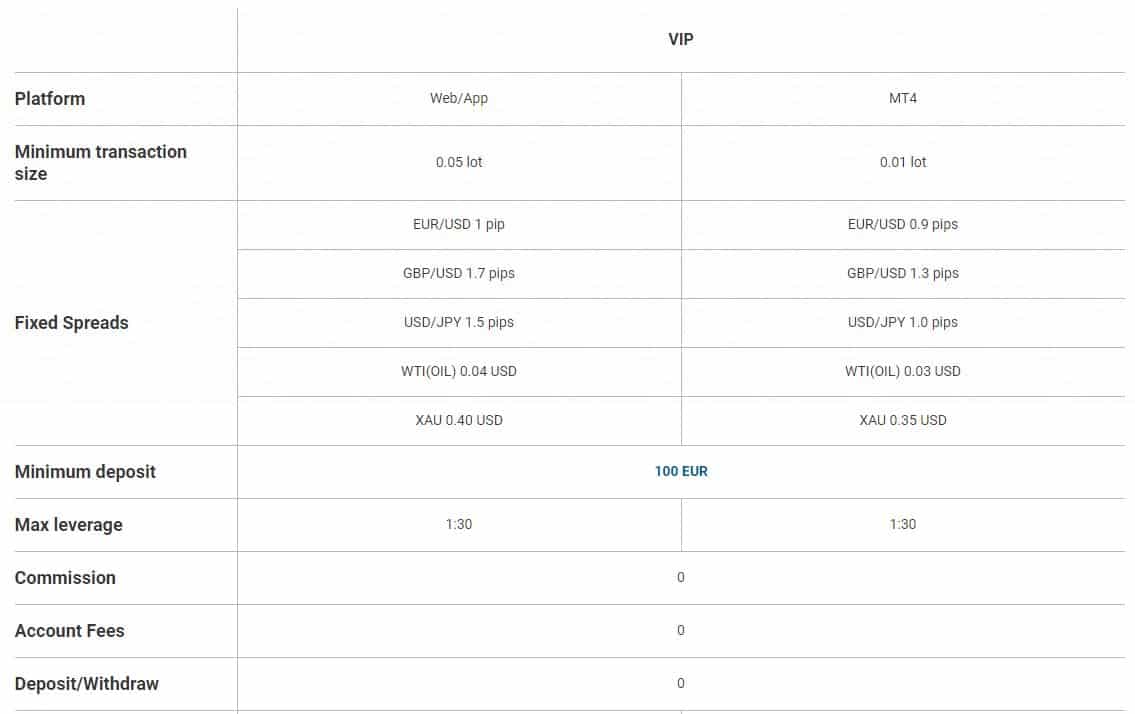

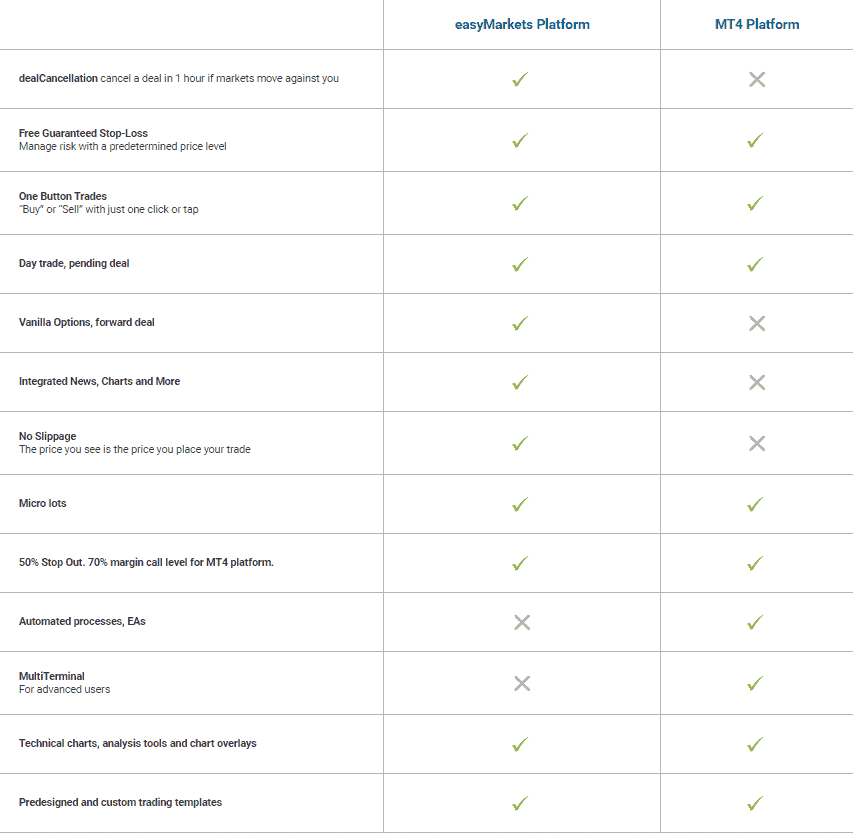

Forex broker Axi offers variable spreads for 80 currency pairs from 0.0 pips EUR/USD on the MetaTrader 4 platform. easyMarkets offers fixed spreads that are wider by 1.2 pips but includes innovative risk management features like dealCancellation and a choice of trading platforms.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert