BlackBull Markets vs Axi 2025

This BlackBull Markets and Axi review shows a comparison of their STP execution and trading platforms. While both brokers offer MT4, BlackBull Markets provides MT5 and TradingView as well. Clearly, it’s BlackBull Markets who wins in this review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are noticeable differences between BlackBull Markets and Axi:

- Both brokers use STP execution, but BlackBull offers MT5 and TradingView, while Axi does not.

- Axi offers better regulatory protection for traders in Australia and the UAE than BlackBull Markets.

- BlackBull Markets boasts a wider range of tradeable instruments for share CFDs trading, overshadowing Axi’s offerings.

1. Lowest Spreads And Fees – Axi

Axi and BlackBull Markets are prominent forex brokers offering competitive trading platforms and features. While Axi is famous for its regulatory compliance and advanced tools, BlackBull Markets excels in providing tight spreads and diverse trading instruments. Both cater to traders who are looking for cost-effective and efficient trading experiences.

Spreads

Spreads significantly impact trading costs, especially for their major currency pairs such as AUD, GBP, EUR and USD. Tight spreads are crucial for cost-effective trading. Here, BlackBull Markets offers tighter RAW spreads, such as 0.14 pips for EUR/USD and 0.30 pips for AUD/USD, which makes it ideal for cost-conscious traders in the market. Meanwhile, Axi provides competitive spreads, with their EUR/USD at 0.2 pips and AUD/USD at 0.5 pips, which is higher compared to BlackBull Markets.

| RAW Account | BlackBull Markets Spreads | Axi Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.64 | 0.64 | 0.72 |

| EUR/USD | 0.14 | 0.2 | 0.28 |

| USD/JPY | 0.45 | 0.5 | 0.44 |

| GBP/USD | 0.43 | 0.5 | 0.54 |

| AUD/USD | 0.3 | 0.5 | 0.45 |

| USD/CAD | 0.41 | 0.5 | 0.61 |

| EUR/GBP | 0.75 | 0.5 | 0.55 |

| EUR/JPY | 0.87 | 0.6 | 0.74 |

| AUD/JPY | 1.1 | 0.7 | 0.93 |

| USD/SGD | 1.3 | 1.8 | 1.97 |

Commission Levels

Commissions are a key factor for traders in the market, this is particularly for those who engage in high-frequency trading. Clearly, BlackBull Markets charges a lower commission of $3.00 per lot which will benefit traders who aim to minimise costs. On the other hand, Axi is slightly higher at $3.50 per lot but is still competitive within the industry average.

| Commission Rate | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| BlackBull Markets | $3 | $4.5 | N/A | N/A |

| Axi | $3.5 | 3.5 | £2.25 | €3.25 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Standard Account Fees

Standard account fees also include spreads and other charges, which influence the overall trading experience. For BlackBull Market, they offer standard spreads like 1.10 pips for EUR/USD and 1.20 pips for AUD/USD, this aligns with the industry norms in the trading industry. Meanwhile, Axi is slightly higher with their spreads, such as 1.20 pips for EUR/USD and 1.30 pips for AUDUSD, but this is compensated with their sturdy and durable trading tools.

According to our dedicated team’s findings, both Axi and BlackBull Markets provide excellent trading opportunities. BlackBull Markets stands out for its tighter spreads and lower commissions, while Axi offers advanced tools and strong regulatory backing. Choosing the right broker will depend on traders’ trading priorities and strategies.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.20 | 1.50 | 1.40 | 1.40 |

|

1.20 | 1.30 | 1.20 | 1.30 | 1.10 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.20 | 1.80 | 1.90 | 1.90 | 1.60 |

|

1.32 | 1.95 | 1.37 | 1.70 | 1.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Our Lowest Spreads and Fees Verdict

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

2. Better Trading Platforms – BlackBull Markets

BlackBull Markets and Axi are two reputable forex brokers who provide a resilient and powerful trading platform. BlackBull Markets shine with its diverse platform choices, including MetaTrader 5 and TradingView, while Axi offers a simple yet reliable setup. We see here that both brokers cater to traders of AUD, GBP, EUR, and USD, this will ensure more effective trading across major currency pairs.

| Trading Platform | BlackBull Markets | Axi |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

We have developed a software questionnaire to help you determine which platform best fits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

MetaTrader platforms are among the most preferred tools for forex trading, this offers advanced charting and trading automation features. For BlackBull Markets, they give support to both MetaTrader 4 and MetaTrader 5, this gives traders full access to cutting-edge analysis tools and automated trading features. Axi, on the other hand, offers MetaTrader 4 but is without MetaTrader 5, which limits the platform’s capabilities compared to BackBull Markets.

Advanced Platforms

Having full access to vastly advanced trading platforms can enhance traders’ experiences by providing detailed insights and efficient trade execution. Here, BlackBull Markets features MetaTrader 5 and TradingView, which provide advanced technical analysis and flexibility for traders. Meanwhile, Axi relies on MetaTrader 4, and despite it being a strong platform, still lacks the advanced functionalities found in more modern platforms.

Copy Trading

Copy trading allows traders to replicate the strategies of successful investors, this makes it an attractive option for beginners. BlackBull Markets includes features such as copy trading options with seamless integration into its multiple platforms, which provides a flexible platform for traders. On the other hand, Axi also supports copy trading, particularly with its partnerships, which allow traders to follow experienced professionals.

Our assessment for this topic is that BlackBull Markets truly excels with its wider range of platforms, this includes MetaTrader 5 and TradingView, while Axi remains solid but is more limited regarding features and platforms. Both brokers ensure their traders, especially those focusing on their AUD, GBP, EUR, and USD, have access to features that enhance their trading strategies and overall experiences.

Our Better Trading Platform Verdict

Ultimately, BlackBull Markets steals the crown from the contender due to their better trading platform.

3. Superior Accounts And Features – A Tie

This part of the review will focus on both brokers’ superior accounts and features. Hands down, both Axi and BlackBull Markets are two highly reputable forex brokers in the industry who offer competitive features for traders, new or seasoned, globally. We see here that both brokers provide key account types, which include no-commission and RAW accounts, this is to accommodate vast and diverse trading needs from traders in the market. They also cater to traders of AUD, GBP, EUR and USD, this ensures a tailored solution for evolving trading strategies.

| Blackbull Markets | Axi | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Both BlackBull Markets and Axi present variable spreads with their market execution, this is suitable for CFD and forex trading. Distinctly, BlackBull Markets excels in offering super-fast execution speeds and advanced platforms, this includes MetaTrader 5. In contrast to Axi, this broker also stands out with their resilient and sturdy educational resources and strong trust ratings. We see here that both brokers share similarities, such as zero inactivity fees and flexibility in base currencies, this makes them appealing to traders with different priorities.

Bringing it all together, BlackBull Markets and Axi provide competitive advantages for forex traders. BlackBull Markets impresses with cutting-edge platforms and performance, while Axi wins in trust and market diversity. Together, they empower traders with the tools and resources needed for success in the forex industry. Long story short, the trader’s choice will always depend on their individual priorities and trading goals.

Our Superior Accounts and Features Verdict

It’s neck-to-neck for both BlackBull Markets and Axi in this segment, thanks to both of their superior accounts and features.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

4. Best Trading Experience – BlackBull Markets

This segment provides insights into both brokers’ best trading experiences. Axi and BlackBull Markets are two respected forex brokers that cater to traders globally. While Axi is recognised for its secure trading environment and wide market diversity, BlackBull Markets excels in high leverage, fast execution speeds, and advanced social trading options. To sum up, they empower traders with their platforms which are suited to different trading styles.

We see here that BlackBull Markets impresses with exceptional execution speeds, which leads the rankings with a limit order speed of 72ms and sturdy automation tools, this includes ZuluTrade and Myfxbook. It also offers unmatched leverage options, which are ideal for experienced traders. Axi, on the other hand, stands out for its reliability in regulated regions such as Australia and the UAD, this also provides traders with secure and stable environments. Both brokers ensure competitive spreads and automation tools, which accommodate the evolving needs of forex traders, especially in AUD, GBP, EUR and USD markets.

- BlackBull Markets shines with high leverage, taking the crown for the highest leverage offered.

- Fastest Execution? BlackBull doesn’t disappoint. Our tests revealed that they’re leading the pack in execution speeds.

- Automation is the future, and while both brokers offer automation tools, BlackBull Markets has an edge with its diverse social trading options such as Myfxbook, ZuluTrade, and BlackBull Copy Trader.

- Axi offers a more secure trading environment, especially for traders in Australia and the UAE.

As a final point, BlackBull Markets and Axi deliver distinct advantages in forex trading. BlackBull Markets attracts traders with high-speed execution and cutting-edge tools, while Axi wins favour for security and reliability. These brokers bring valuable opportunities to the forex trading landscape, which ensures traders can choose platforms aligned with their strategies and goals.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| BlackBull Markets | 72ms | 1/36 | 90ms | 5/36 |

| Axi | 90ms | 8/36 | 164ms | 25/36 |

Our Best Trading Experience and Ease Verdict

Without any doubt, BlackBull Markets outperforms the other thanks to their best trading experience and ease.

5. Stronger Trust And Regulation – A Tie

Axi and BlackBull Markets are two forex brokers who provide essential trading features and platforms. Axi offers secure trading under Tier-1 regulations such as ASIC and FCA, which ensures trader protection, BlackBull Markets, on the other hand, although less regulated, impresses with high leverage and fast execution, which makes these brokers valuable for traders with different trading preferences.

Here, we see that Axi has a better trust score of 61, in contrast to BlackBull Markets’ 50.

BlackBull Markets Trust Score

Axi Trust Score

Axi has a better trust score compared to BlackBull Markets at 50.

BlackBull Markets caters to traders who are looking for a rapid execution speed while boasting a limit order speed of 72ms and offering up to 500:1 leverage for offshore accounts. Its automation and social trading tools, which include ZuluTrade and Myfxbook, provide further flexibility. Axi stands out for its sturdy regulatory compliance in Australia and the UAE under Tier-1 oversight, alongside negative balance protection. Despite their differences in their trust scores – which are 30/100 for BlackBull Markets and 39/100 for Axi; both brokers still align with their forex trading priorities on all major currency pairs like AUD, GBP, EUR, and USD.

| BlackBull Markets | Axi | |

|---|---|---|

| Tier 1 regulators* | None | ASIC, FCA |

| Tier 2 regulators | FMA NZ | DFSA, FMA, FSCA |

| Tier 3 regulators | FSA Seychelles. | Registered as a business in St Vincent and Grenadines |

| Negative Balance Protection | No. | Yes |

| Trust Score | 30/100 | 39/100 |

* Australian Securities & Investment Commission (ASIC); Monetary Authority of Singapore (MAS); Financial Markets Authority NZ (FMA); Swiss Financial Market Supervisory Authority (FINMA); Financial Conduct Authority (FCA); Commodity Futures Trading Commission (CFTC); Comisión Nacional del Mercado de Valores (CMNV); Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), Cyprus Securities Exchange Commission (CySEC). Dubai Financial Securities Authoriy (DFSA), National Futures Association USA (NFA), Commodity Futures Trading Commission (CFTC).

| BlackBull Markets | Axi | |

|---|---|---|

| Tier 1 Regulation | FMA (New Zealand) | FCA (UK) ASIC (Australia) FMA (New Zealand) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | FSA-S (Seychelles) | SVGFSA |

To wrap things up, our dedicated team surmises that Axi and BlackBull Markets offer unique strengths to forex traders. BlackBull Markets excels in speed and leverage, while Axi ensures a secure and regulated trading environment. Both brokers cater to their various trader profiles, which ensure a versatile and rewarding trading experience. We can only presume that the choice will ultimately depend on traders’ priorities and trading strategies.

Our Stronger Trust and Regulation Verdict

It is a draw for both BlackBull Markets and Axi, this is due to both of them having stronger trust and regulation.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

6. Most Popular Broker – BlackBull Markets

BlackBull Markets gets searched on Google more than Axi. On average, BlackBull Markets sees around 18,100 branded searches each month, while Axi gets about 11,000 — that’s 39% fewer.

| Country | BlackBull Markets | Axi |

|---|---|---|

| Australia | 1,900 | 9,900 |

| New Zealand | 1,900 | 1,900 |

| United Kingdom | 1,600 | 27,100 |

| Germany | 1,600 | 9,900 |

| India | 1,300 | 210 |

| United States | 880 | 260 |

| South Africa | 720 | 2,900 |

| Canada | 590 | 18,100 |

| Spain | 480 | 9,900 |

| Mexico | 480 | 9,900 |

| Italy | 320 | 8,100 |

| Netherlands | 320 | 4,400 |

| France | 210 | 14,800 |

| Pakistan | 210 | 2,400 |

| Thailand | 210 | 4,400 |

| Austria | 210 | 1,300 |

| Malaysia | 170 | 5,400 |

| Colombia | 170 | 3,600 |

| Nigeria | 170 | 2,900 |

| Poland | 170 | 6,600 |

| Argentina | 170 | 4,400 |

| Cyprus | 170 | 320 |

| Indonesia | 140 | 190 |

| United Arab Emirates | 140 | 3,600 |

| Switzerland | 140 | 2,400 |

| Sweden | 140 | 5,400 |

| Brazil | 110 | 9,900 |

| Singapore | 110 | 5,400 |

| Kenya | 110 | 720 |

| Turkey | 90 | 9,900 |

| Morocco | 90 | 880 |

| Greece | 90 | 1,000 |

| Vietnam | 70 | 3,600 |

| Bangladesh | 70 | 1,600 |

| Ecuador | 70 | 2,400 |

| Portugal | 70 | 2,900 |

| Sri Lanka | 70 | 1,000 |

| Ireland | 70 | 1,300 |

| Japan | 50 | 449 |

| Philippines | 50 | 9,900 |

| Venezuela | 50 | 720 |

| Algeria | 50 | 480 |

| Peru | 50 | 2,400 |

| Chile | 50 | 2,900 |

| Ghana | 50 | 720 |

| Uganda | 50 | 210 |

| Egypt | 40 | 2,900 |

| Saudi Arabia | 40 | 2,400 |

| Dominican Republic | 40 | 480 |

| Hong Kong | 30 | 2,900 |

| Bolivia | 30 | 2,400 |

| Tanzania | 30 | 260 |

| Uzbekistan | 30 | 70 |

| Botswana | 30 | 70 |

| Taiwan | 20 | 6,600 |

| Ethiopia | 20 | 720 |

| Cambodia | 10 | 480 |

| Jordan | 10 | 390 |

| Panama | 10 | 260 |

| Mongolia | 10 | 210 |

| Mauritius | 10 | 260 |

| Costa Rica | 10 | 390 |

2024 Monthly Searches For Each Brand

BlackBull Markets - Australia

BlackBull Markets - Australia

|

1,900

1st

|

Axi - Australia

Axi - Australia

|

9,900

2nd

|

BlackBull Markets - New Zealand

BlackBull Markets - New Zealand

|

1,900

3rd

|

Axi - New Zealand

Axi - New Zealand

|

1,900

4th

|

BlackBull Markets - Germany

BlackBull Markets - Germany

|

1,600

5th

|

Axi - Germany

Axi - Germany

|

9,900

6th

|

BlackBull Markets - US

BlackBull Markets - US

|

880

7th

|

Axi - US

Axi - US

|

260

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with BlackBull Markets receiving 415,000 visits vs. 993,000 for Axi.

Our Most Popular Broker Verdict

BlackBull Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

7. CFD Product Range And Financial Markets – BlackBull Markets

Both Axi and BlackBull Markets cater to diverse trading interests in the forex industry, both offer competitive forex and CFD trading opportunities. Axi focuses on variety, with more indices and cryptocurrencies available, while BlackBull Markets dominates in the share CFDs, which provides over 26,000 instruments. Both brokers support forex traders in the AUD, GBP, EUR, and USD markets.

BlackBull Markets excels in share CFDs, which boasts an impressive 26,000+ instruments and 22 futures options, this makes it ideal for traders with an investment focus, Meanwhile, Axi shines with a selection of forex pairs – 72 vs. 55 – and 37 cryptocurrencies, surpassing BlackBull Markets’ 16. Axi also stands out for its variety in indices, this includes 17 indices and 14 index futures, whereas BlackBull Markets only offers 12 indices. However, neither broker supports bonds, treasuries, or ETFs, limiting their offerings for more traditional traders.

| CFDs | BlackBull Markets | Axi |

|---|---|---|

| Forex Pairs | 55 | 72 |

| Indices | 12 | 17 Indices 14 Index Futures |

| Commodities | 10 Metals 3 Energies 7 Soft Commodities 9 Hard Commodities | 3 Metals (5 Gold crosses) 2 Energies 3 Metals Futures 3 Energy Futures 3 Softs Futures |

| Cryptocurrencies | 16 | 37 |

| Share CFDs | 2,000+ | 50 |

| ETFs | No | No |

| Bonds | No | No |

| Futures | Futures 22 | No |

| Treasuries | No | No |

| Investments | Yes 26,000 | No |

In the end, both Axi and BlackBull Markets offer unique advantages. Axi appeals with its wider range of forex pairs and indices, while BlackBull Markets dominates share CFDs and futures trading. Finally, depending on a trader’s trading priorities, either broker can provide a tailored and dynamic trading experience to enhance the trader’s strategies.

Our Top Product Range and CFD Markets Verdict

Undoubtedly, BlackBull Markets truly shines in this segment, by reason of its top product range and CFD markets.

8. Superior Educational Resources – Axi

Here, Axi and BlackBull Markets demonstrate their commitment to empowering traders by offering extensive educational resources and tools. While Axi provides in-depth articles and market analysis BlackBull Markets excels in its webinars and community-driven learning. Both brokers are dedicated to equipping traders with the skills and knowledge needed for success in online forex and CFD trading.

Distinctly, BlackBull Markets focuses on their interactive educational experiences, while offering webinars, eBooks, video tutorials and community forums to foster collaborative learning. Meanwhile, Axi prioritises comprehensive written content, market insights and quizzes, this allows the trader to test and expand their knowledge. BlackBull Markets and Axi provide demo accounts, which enable practical learning without financial risk. These educational tools align with their evolving trader needs, they cover major currency pairs such as AUD, GBP, EUR, and USD, this ensures relevant and actionable knowledge for success in trading in volatile markets.

Let’s delve into what each broker brings to the table:

- BlackBull Markets offers a comprehensive suite of educational tools, including webinars, eBooks, and video tutorials tailored for beginners and seasoned traders.

- Axi, on the other hand, boasts an extensive library of articles, market analysis, and expert insights that can be invaluable for traders looking to deepen their market knowledge.

- Both brokers provide a demo account, allowing traders to practice and hone their skills without risking real money.

- Interactive quizzes and tests are available with Axi, ensuring traders can assess their knowledge and identify areas for improvement.

- BlackBull Markets places a strong emphasis on community learning, with forums and discussion groups where traders can exchange ideas and strategies.

- Axi complements its educational offerings with regular webinars hosted by industry experts, providing real-time insights into market trends and trading techniques.

Both brokers bring unique strengths to their educational offerings. BlackBull Markets emphasises community and interaction, while Axi leads with detailed and analytical content. Both brokers ensure traders can enhance their understanding and improve strategies by addressing their diverse learning styles. This process makes them indispensable allies in the forex trading journey.

Our Superior Educational Resources Verdict

Axi secures the top spot here owing to their superior educational resources.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

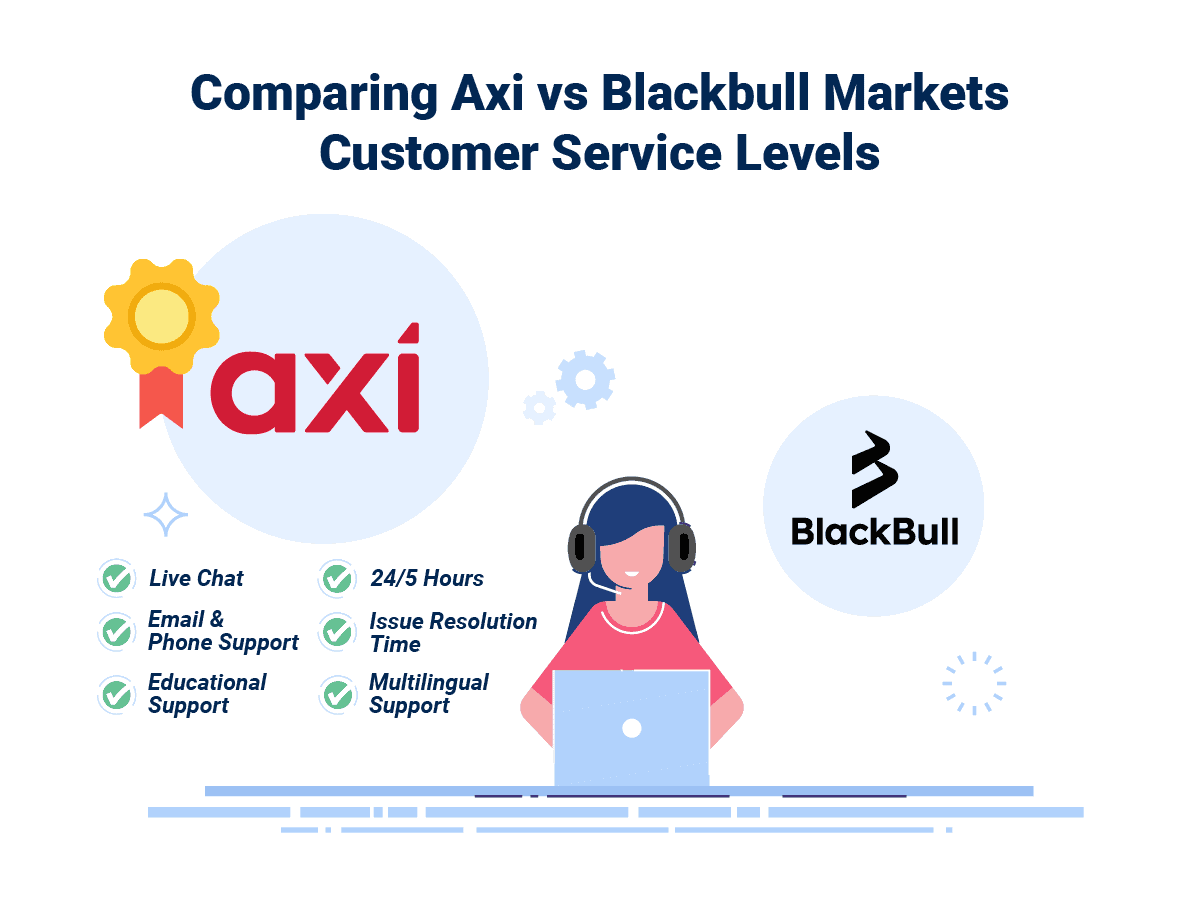

9. Better Customer Service – Axi

This segment points out to both brokers better customer service, so let us break it down. Clearly, Axi and BlackBull Markets understand the critical role of customer service in the fast-paced trading industry. Both brokers invest in responsive and accessible support systems to meet the needs of traders worldwide. Their multilingual options and multiple channels ensure traders receive timely assistance whenever required.

BlackBull Markets provides a responsive support team available 24/6 through live chat, phone and email, this ensures traders can resolve issues efficiently. On the other hand, Axi emphasises its in-depth customer assistance and operates 24//5, which offers guidance and insights for informed decision-making. We can see that both brokers can deliver strong multilingual support, yet Axi’s quick resolution times and proactive approach give it a slight edge. These features will align well with their forex trading priorities for the major currencies like AUD, GBP, EUR and USD.

| Feature | BlackBull Markets | Axi |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/6 | 24/5 |

| Multilingual Support | Yes | Yes |

Both Axi and BlackBull Markets excel in offering dependable customer service. Axi leads with its quicker response times and detailed support, while BlackBull Markets emphasises responsiveness and availability. Together, they enhance traders’ experiences making them a solid choice for those seeking reliable broker support.

Our Superior Customer Service Verdict

It’s plain to see that Axi excels in this niche because of its superior customer service.

*Your capital is at risk ‘71.4% of retail CFD accounts lose money’

10. More Funding Options – BlackBull Markets

Both Axi and BlackBull Markets excel in diverse funding options to ensure smooth and reliable transactions for forex traders. With methods that range from traditional bank transfers to cryptocurrency payments, both brokers cater to the evolving needs of traders and prioritise efficiency, this enhances the overall trading experience in a competitive marketplace

BlackBull Markets stands out with its range of funding methods including PayPal, but not offered by Axi. We see that both brokers support essential payment methods like credit cards, debit cards, and cryptocurrency, this ensures global accessibility. They also facilitate seamless transactions with Skrill, Neteller, and POLi/bPay, which emphasises quick and secure fund transfers

| Funding Option | BlackBull Markets | Axi |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our final analysis: Axi and BlackBull Markets both provide dependable funding solutions. BlackBull Markets edges out with its PayPal inclusion and wider diversity, while Axi delivers consistency with essential funding methods. To sum up, these brokers ensure traders can manage funds efficiently, which supports success in the dynamic forex trading landscape.

Our Better Funding Options Verdict

BlackBull Markets takes home the crown in this category on account of its better funding options.

11. Lower Minimum Deposit – BlackBull Markets

Finally, let us break down our thoughts on low minimum deposits from both brokers. BlackBull Markets and Axi are two trusted forex brokers that cater to traders, new or seasoned, in the industry of forex trading. Both brokers offer $0 minimum deposit accounts, which provides flexibility for beginners and professionals alike. Their accessible account structures make starting a trading journey seamless and appealing to a wider range of trading styles.

BlackBull Markets provides an EXN Standard account with no minimum deposit, this makes it particularly advantageous for our new traders or those who are testing strategies without a significant financial commitment. On the other hand, Axi similarly offers a $0 minimum deposit for its Standard and Pro accounts, but with a lower recommended deposit of $200 compared to BlackBull Markets’ $500. This difference highlights BlackBull Markets’ versatility for investment and Axi’s focus on affordability. Both brokers make sure that accessible options for traders will focus on their currencies such as AUD, GBP, EUR and USD.

| Minimum Deposit | Recommended Deposit | |

| BlackBull Markets | $0 | $500 |

| Axi | $0 | $200 |

BlackBull markets and Axi deliver competitive and flexible deposit options. While Axi’s lower recommended deposit may attract budget-conscious traders, BlackBull Markets shines with its adaptability to its various trading strategies and investments. Put together, both will provide inclusive opportunities for traders who are looking for reliable and accessible platforms.

Our Lower Minimum Deposit Verdict

BlackBull Markets rides high in this category on account of their lower minimum deposit.

So is Axi or BlackBull Markets the Best Broker?

BlackBull Markets takes home the throne in this review because it has a majority of advantages in key areas that traders value the most, such as trading platforms, product range, funding options, and minimum deposit requirements. The table below summarises the key information leading to this verdict:

| Categories | BlackBull Markets | Axi |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | Yes |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Axi: Best For Beginner Traders

Axi is better suited for beginner traders due to its superior educational resources and customer service.

BlackBull Markets: Best For Experienced Traders

BlackBull Markets is the top choice for experienced traders because of its advanced trading platforms and wider range of product offerings.

FAQs Comparing BlackBull Markets Vs Axi

Does Axi or BlackBull Markets Have Lower Costs?

Axi generally offers lower costs when compared to BlackBull Markets. This is evident from the competitive spreads they offer, especially for major currency pairs. For instance, the EUR/USD spread starts from as low as 0.0 pips with Axi. For a more detailed comparison on broker costs, you can check out this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Axi and BlackBull Markets offer MetaTrader 4, a popular trading platform among forex traders. However, BlackBull Markets provides additional features and plugins for MT4, enhancing the trading experience. If you’re keen on exploring more about MT4 brokers, this list of the best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

BlackBull Markets stands out when it comes to social trading, offering platforms like Myfxbook and ZuluTrade. Social trading allows traders to follow and replicate the strategies of experienced traders, making it easier for beginners to get started. For those interested in diving deeper into social trading platforms, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither Axi nor BlackBull Markets currently offer spread betting. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of market movements without owning the underlying asset. For those interested in exploring brokers that offer spread betting, you can refer to this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Axi is the superior choice for Australian forex traders. Axi is ASIC regulated, ensuring a high level of trust and security for Australian traders. Furthermore, while both brokers cater to the Australian market, Axi has its roots in Australia, making it more attuned to the needs of Aussie traders. If you’re keen on exploring more about forex trading in Australia, this list of Best Forex Brokers In Australia provides a detailed overview.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe Axi holds a slight edge over BlackBull Markets. Axi is FCA regulated, which is a significant trust factor for UK-based traders. While both brokers cater to the UK market, it’s essential to note that neither broker was founded in the UK. However, Axi’s adherence to FCA regulations and its comprehensive offerings make it a top choice. For a deeper dive into forex trading in the UK, this guide on the best forex brokers in UK is a valuable resource.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How old are BlackBull Markets?

BlackBull Markets was founded in 2014

How much leverage does BlackBull broker give?

Leverage if up to 1:500 when trading Forex is available with BlackBull.