easyMarkets vs IG Group: Which One Is Best?

These in-depth reviews of IG Group and easyMarkets present an intriguing comparison, as both offer effective and efficient features and platforms for traders. However, it’s essential to prioritize which brokerage to select based on their credibility in services and platforms. Which one will you decide on? Make your choice.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

$3,000 (Premium)

$10,000 (VIP)

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Pro 2: 250:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

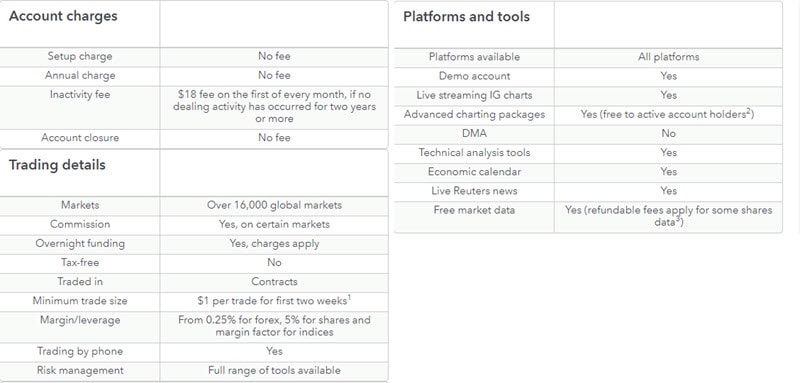

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five key differences:

- IG offers variable spreads for most currency pairs.

- IG has a broader range of CFD options.

- easyMarkets does not charge any fees for deposit and withdrawals.

- easyMarkets features a user-friendly interface for trader’s ease of use.

- Both brokers offer the MetaTrader 4 platform, but their proprietary platforms differ in features and tools.

1. Lowest Spreads And Fees – IG Group

In this review of IG Group and easyMarkets, we compare the spreads of these market makers, one can see that IG (formerly IG Markets) spreads are more narrow. While low spreads can be a good reason to choose a forex broker, it helps to understand why the spreads differ for each broker.

Spreads

Variable or floating spreads are spreads that do not have locked ‘ask’ and ‘bid’ prices. These quotes will vary depending on the supply and demand for the currency pair. Fixed spreads, on the other hand, are spreads that do not change. The difference between the changing ‘bid’ and ‘ask’ price is always the same, and these spreads remain constant except during extremely volatile market conditions.

| Standard Account | easyMarkets Spreads | IG Group Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.83 | 1.62 | 1.6 |

| EUR/USD | 0.8 | 1.13 | 1.2 |

| USD/JPY | 1.5 | 1.12 | 1.4 |

| GBP/USD | 1.3 | 1.66 | 1.6 |

| AUD/USD | 1.5 | 1.01 | 1.5 |

| USD/CAD | 2.3 | 1.98 | 1.8 |

| EUR/GBP | 2 | 1.71 | 1.5 |

| EUR/JPY | 2.2 | 2.27 | 1.9 |

| AUD/JPY | 3 | 2.06 | 2.1 |

IG uses variable spreads for most of its currency pairs. While minimum spreads are generally lower than those of easyMarkets, they can potentially also be higher depending on market conditions. Conversely, easyMarkets uses fixed spreads, a distinctive feature that ensures consistency regardless of market volatility. Historically, even during significant events like the Swiss Franc crash in November 2015, easyMarkets maintained its fixed spreads.

If you prioritize having the tightest available spreads, brokers like Pepperstone, which offer Electronic Communication Network (ECN) No Dealing Desk trading, may be worth considering.

Commission Levels

Neither IG nor easyMarkets charges commissions on standard trades. Instead, their costs are integrated into the spreads they offer. However, the absence of commissions does not mean the total trading cost is the same, as the type of spreads (fixed or variable) can influence the overall expense depending on market conditions.

We included a calculator to clarify how smaller spreads influence trading fees. Select your currency, amount, and pair to see the result.

Standard Account Fees

When it comes to deposit and withdrawal fees, easyMarkets stands out for its policy of no charges for deposits and withdrawals. In contrast, IG has the following fees:

- Deposits: $0; however, credit cards incur a 0.5%-1% charge.

- Withdrawals: $0 for standard options, but international transfers cost $30.

This difference in fees can influence a trader’s decision, particularly for those seeking to minimize additional costs.

Our Trading Fees Verdict

IG Group Definitely takes the lead in this category due to their lowest spreads and fees.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

2. Better Trading Platforms – A Tie

Both brokers offer MetaTrader 4, but only easyMarkets has MetaTrader 5.

| Trading Platform | easyMarkets | IG Group |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | No | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

easyMarkets Trading Platform

This broker offers a choice of two platforms. This is their proprietary platform and both MetaTrader 4 and 5.

The main reason to choose the easyMarkets trading platform is to access the exclusive risk management tools easyMarkets offers. While this platform covers all the basic and necessary features a broker would expect from any platform, nowhere else can you find ‘dealCancellation’ and ‘Freeze Rate.’

Key features of their platform include:

- ‘Inside Viewer’ – easyMarkets was the first to include market sentiment tools in the platform,

- ‘Market Explorer’ – This is a list of all the assets easyMarkets offers and trading key details. The feature makes it easy to select the assets and add them to your trading platform.

- ‘Live Rate Graphs – Graphs that can help you analyse forex movements

- ‘Financial Calendar’ – a summary of all major market events

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

MetaQuest makes the two platforms we recommend. These are MetaTrader 4 and 5. At this stage, IG only offer MetaTrader 4 while easyMarkets offer both MT4 and MT5. More brokers offer MT4 than any other platform, so it is no surprise this platform is the most popular with traders as a result.

MetaQuest makes the two platforms we recommend. These are MetaTrader 4 and 5. At this stage, IG only offer MetaTrader 4 while easyMarkets offer both MT4 and MT5. More brokers offer MT4 than any other platform, so it is no surprise this platform is the most popular with traders as a result.

MT4 is well known for its interface, which is easy to use, tools that can assist with fast execution, its range of chart options and ability to work with Expert Advisors (EAs).

IG Trading Platforms

IG offers a choice of more platforms than most other brokers offer. IG proprietary trading platform is available for web and browser. The platform’s most notable feature is its ability to offer basic risk management features such as stop loss and profit limits. This platform is an award-winning platform and offers a great collection of charts and indicators; however, it does not offer ‘Expert Advisors’.

If you wish to use EAs, then consider MetaTrader 4. If you wish to access more charts, then you may opt to use ProRealTime. This is available free, provided you meet minimum trade requirements each month. Given you can use ProRealTime with MT4, there is little reason to use ProRealTime on its own. The last platform, L2 Dealer, is only for professional traders with a Forex Direct account. So, it is unlikely to be a consideration for most traders.

We can easily say that whichever platform you go with is mostly a case of personal preference and what tools you want access to. Both brokers offer MetaTrader 4, an extra MT5 for easyMarkets, which is the platform we recommend, so it simply comes down to which broker you prefer. On the other hand, if you desire risk management tools, then you need to decide which risk features you desire and choose the appropriate platform.

Our Better Trading Platform Verdict

It’s a draw for both IG and easyMarkets due to both having better trading platforms

3. Superior Accounts and Features – A Tie

This portion is very essential part of a broker in the industry of forex trading in light of providing features and platforms that is flexible, better trading environment and having advanced tools.

easyMarkets

easyMarkets offers a choice of different accounts. These choices will vary depending on if you are in Europe or outside of Europe.

| easyMarkets | IG Group | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

Clients in the UK and Europe

If you are a retail client from the UK or Europe, then you only have one account to choose from. This is their VIP account.

Clients outside the UK and Europe

If you are outside the UK and Europe, then you have a choice of accounts to choose from. The higher your minimum deposit, the better your spreads will be.

IG

IG, on the other hand, offers basic types of accounts: Standard and Professional. This review is only focused on the Standard as Professional has restrictive requirements for eligibility, such as a minimum of $2.5 million in net assets.

The Standard Account offers the following:

Our Superior Accounts and Features Verdict

Again, both IG Group and easyMarkets are tied to this category as result of having superior accounts and features.

4. Best Trading Experience – A Tie

When it comes to the overall trading experience and ease of use, both easyMarkets and IG have their unique strengths. From our in-depth analysis of the website and our own hands-on testing, we’ve observed some distinct features that set each broker apart.

- easyMarkets boasts a user-friendly interface, making it a breeze for both beginners and seasoned traders.

- IG, on the other hand, offers a more comprehensive range of tools and resources for in-depth market analysis.

- Both platforms provide robust customer support, ensuring traders get the assistance they need.

- Additionally, their mobile trading apps are intuitive, allowing traders to manage their portfolios on the go.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| easyMarkets | 155ms | 24/36 | 155ms | 24/36 |

| IG Group | 174ms | 26/36 | 141ms | 19/36 |

With this details, we can speculate that while both brokers offer a commendable trading experience, the choice ultimately boils down to individual preferences. Some might lean towards easyMarkets for its simplicity, while others might appreciate the advanced features IG brings to the table. Whatever your choice, rest assured that both platforms are designed to offer a seamless trading journey.

Our Best Trading Experience and Ease Verdict

A deadlock for both IG Group and easyMarkets in this category thanks to their better trading experience.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – IG Group

These qualities are essential in the brokerage industry. It’s comforting to see a brokerage with a strong reputation for trust and credibility, as this guarantees a secure and transparent trading atmosphere.

easyMarkets Trust Score

IG Group Trust Score

The ability to use leverage is important when it comes to trade. Currency prices typically only change incrementally on a day-to-day basis, which can make it difficult to make a significant profit. The ability to use leverage to trade a large number of assets will allow you to amplify your profits and, therefore, make trading forex worthwhile.

As leverage means taking on debt, it is important to understand the risks with High Leverage Forex Brokers and speculative trading and, therefore, be responsible when you trade. If you have researched and tested your trading strategies and are confident in positive outcomes, then leverage is a very useful tool.

Each broker is limited by the maximum leverage allowed by their subsidiaries’ regulators. This means different maximum leverage may apply for different subsidiaries of the broker.

easyMarkets Leverage

Leverage with easyMarkets will vary depending on which regulator applies to your region and which trading platform you are using. Retail clients in the UK and Europe will find they have more restrictive leverage than clients in the UK and Europe.

Clients from the UK and Europe leverage

easyMarkets is regulated by CySEC or the Cyprus Securities Exchange Commission in the UK and Europe. Retail clients can trade with a maximum leverage of 30:1.

If your trading portfolio exceeds €500,000 and you have averaged at least 10 trades for each quarter over the previous 12 months, then you can apply for a professional client account. A professional account means you will have more generous leverage.

easyMarkets clients outside the UK and Europe

If you are an easyMarkets client from outside the UK or Europe, then easyMarkets apply protections in accordance with ASIC regulations requirements, which is the Australian Securities and Investments Commission or the Financial Services Authority of Seychelles (FSA)

The below table summarises the leverage for each region for easyMarkets

| Instrument Traded | easyMarkets Leverage |

|---|---|

| Forex (max) | 30:1 |

| Index CFDs (max) | 20:1 |

| Commodities (max) | 10:1 |

| Cryptocurrency (max) | 2:1 |

| Shares | 5:1 |

| Metals | 20:1 |

IG Leverage

Like with easyMarkets, IG leverage will vary depending on where you join from as regulation differs for different countries.

| Market | Retail Leverage (Australia, New Zealand, South Africa and most other regions) | Professional Leverage (Australia, New Zealand, South Africa and most other regions) | Retail Leverage (Europe and the UK) | Professional Leverage (Europe and the UK) | Leverage (Singapore) | Professional Leverage (Singapore) | Leverage (Dubai) | Professional Leverage (Dubai) |

|---|---|---|---|---|---|---|---|---|

| Forex | 1:30 | 1:250 | 1:30 | 1:222 | 1:20 | 1:50 | 1:50 | 1:222 |

| Indices (major) | 1:20 | 1:250 | 1:20 | 1:222 | 1:20 | 1:20 | 1:50 | 1:222 |

| Shares CFD | 1:5 | 1:25 | 1:5 | 1:22 | 1:10 | 1:10 | 1:10 | 1:22 |

| Commodities | Energies 1:10 Gold 1:20 Other metals 1:19 Softs - 1:10 | Energies 1:28 - 1:36 Other metals 1:23 to 1:63 Softs - 1:36 to 1:63 | 1:20 | 1:222 | 1:5 | 1:5 | ||

| Cryptocurrency CFD | 1:2 | 1:40 | 1:2 | 1:22 | 1:2 | 1:2 | 1:10 | 1:22 |

Regulations

IG has the following subsidiaries and regulators

- IG Markets Ltd (UK) – FCA

- IG Europe GmbH (Germany)- BaFin

- IG Markets Ltd, Australia (Australia) – ASIC

- IG Bank S.A.(Switzerland) – FINMA

- IG Markets South Africa Ltd (South Africa) – FSCA

- IG Asia Pte Ltd (Singapore) – MAS

- IG Markets Ltd, Australia (New Zealand) – FMA

- IG Limited (Dubai) – DFSA

- IG Securities Ltd (Japan) – JFSA

- IG US LLC (USA) – NFA and CFTC

Note: IG Markets Ltd, which is an IG UK subsidiary, cannot offer cryptocurrency due to FCA regulations.

| easyMarkets | IG Group | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) BaFin (Germany) FINMA (Switzerland) NFA/CFTC (USA) CYSEC (Cyprus) MAS (Singapore) FMA (New Zealand) |

| Tier 2 Regulation | JFSA (Japan) DFSA (Dubai) | |

| Tier 3 Regulation | FSC-BVI FSA-S (Seychelles) | BMA (Bermuda) FSCA (South Africa) |

Reviews

As shown below, IG Group has more reviews than easyMarkets. easyMarkets, on the other hand, has a score of 4.5/5, significantly above the average of the forex brokers we reviewed in 2025.

Our Stronger Trust and Regulation Verdict

IG Group outperforms the challenger in this category thanks to their stronger trust and regulation.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

6. Most Popular Broker – IG Group

IG Group gets searched on Google about twice as often as easyMarkets. On average, IG Group sees around 74,000 branded searches each month, while easyMarkets gets about 49,500 — that’s 33% fewer.

| Country | easyMarkets | IG Group |

|---|---|---|

| India | 320 | 8,100 |

| Poland | 18,100 | 2,900 |

| Brazil | 2,400 | 2,900 |

| Peru | 2,400 | 2,400 |

| United Arab Emirates | 320 | 1,900 |

| Argentina | 1,600 | 1,600 |

| Colombia | 2,400 | 1,000 |

| Thailand | 480 | 1,000 |

| Bangladesh | 110 | 880 |

| Netherlands | 90 | 590 |

| Germany | 880 | 480 |

| United Kingdom | 140 | 480 |

| United States | 720 | 390 |

| Pakistan | 390 | 390 |

| Uzbekistan | 210 | 320 |

| Hong Kong | 170 | 320 |

| Sweden | 90 | 320 |

| Singapore | 720 | 260 |

| Italy | 90 | 260 |

| Greece | 40 | 260 |

| Mongolia | 170 | 210 |

| Saudi Arabia | 590 | 170 |

| Canada | 70 | 170 |

| Ghana | 110 | 140 |

| Jordan | 1,000 | 110 |

| Vietnam | 320 | 110 |

| Algeria | 110 | 110 |

| Australia | 110 | 110 |

| Philippines | 480 | 90 |

| Ecuador | 320 | 90 |

| South Africa | 320 | 90 |

| Turkey | 140 | 90 |

| Malaysia | 2,900 | 70 |

| Indonesia | 390 | 70 |

| Nigeria | 320 | 70 |

| Taiwan | 170 | 70 |

| Morocco | 720 | 50 |

| Austria | 480 | 50 |

| Spain | 140 | 50 |

| Mexico | 140 | 50 |

| Uruguay | 260 | 40 |

| Cambodia | 320 | 30 |

| Bolivia | 320 | 30 |

| Switzerland | 170 | 30 |

| Ethiopia | 70 | 30 |

| Botswana | 70 | 30 |

| Tanzania | 70 | 30 |

| Portugal | 720 | 20 |

| Cyprus | 170 | 20 |

| Chile | 50 | 20 |

| New Zealand | 50 | 20 |

| Mauritius | 10 | 20 |

| Ireland | 390 | 10 |

| Uganda | 110 | 10 |

| Venezuela | 90 | 10 |

| Dominican Republic | 70 | 10 |

| Sri Lanka | 50 | 10 |

| Japan | 30 | 10 |

| Costa Rica | 30 | 10 |

| Panama | 30 | 10 |

| Kenya | 20 | 10 |

| Egypt | 20 | 10 |

| France | 10 | 10 |

320 1st | |

8,100 2nd | |

18,100 3rd | |

2,900 4th | |

2,400 5th | |

2,400 6th | |

320 7th | |

1,900 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with IG Group receiving 10,070,000 visits vs. 362,851 for easyMarkets.

Our Most Popular Broker Verdict

IG Group is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

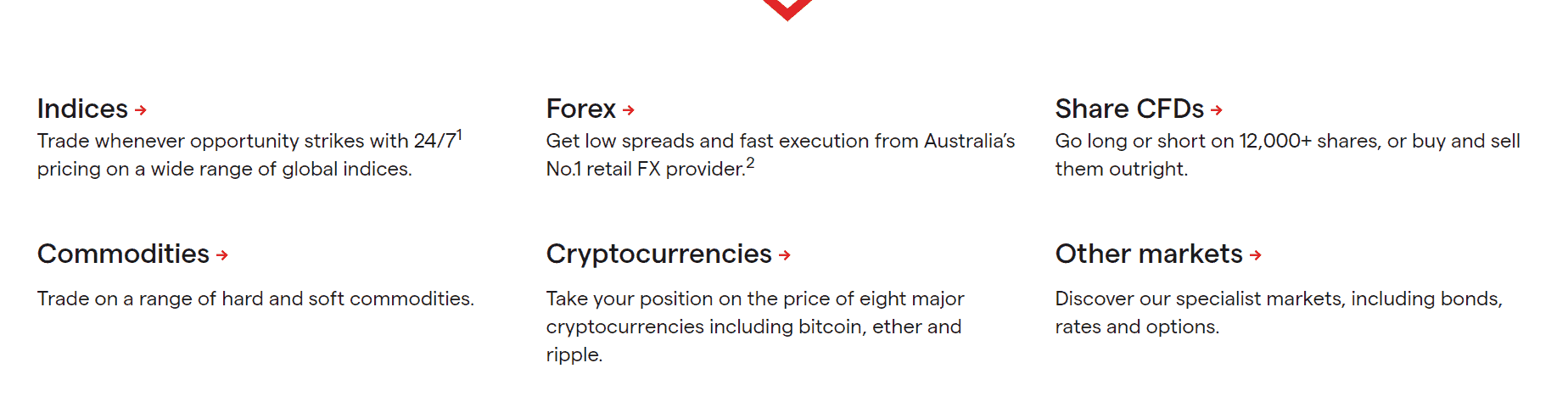

7. CFD Product Range And Financial Markets – IG Group

A brokerage that an array of CFD and product range and financial markets are attractive to traders both newbie and seasoned. This allows traders to diversify their portfolio and manage financial risks effectively.

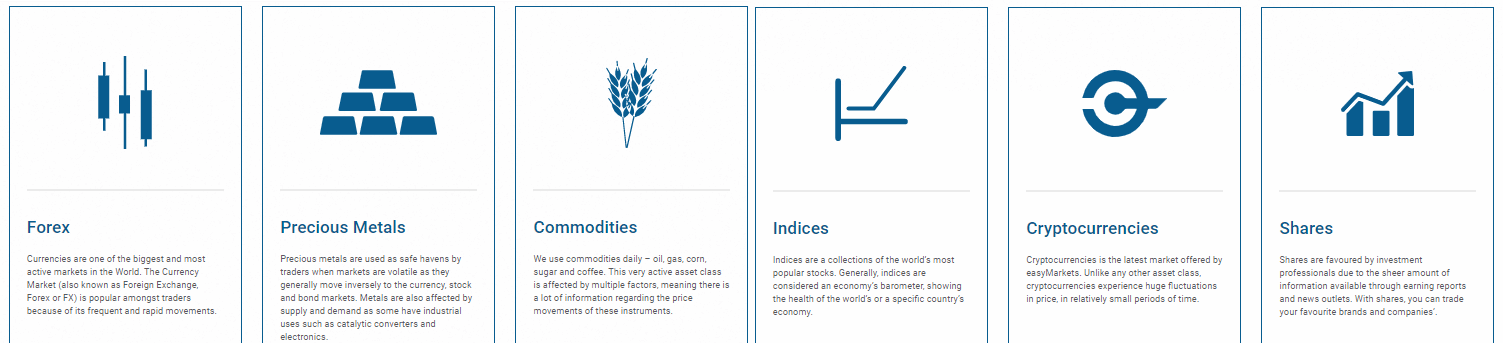

We see here that easyMarkets offers a small range of CFDs in addition to forex. These include cryptocurrencies, metals, commodities, indices and shares.

IG, on the other hand, offer a far more extensive range of CFDs. Not only are there more asset classes to choose from but there are more choices within the asset class. Asset classes include everything easyMarkets offers plus shares, bonds, options, IPO, interest rates, sectors, Exchange-traded funds and exchange-traded products.

Other markets IG offers include:

- Digital 100s (Binary Trading)

- Knockout Options

- Options

- ETFs

- Sectors

- Interest Rates

- Bonds

| Forex Pairs | easyMarkets | IG Group |

|---|---|---|

| Indices | 242 | 110 |

| Commodities | 14 | 130 |

| Cryptocurrencies | 5 Metals 5 Energies 7 Softs | 11 Metals 7 Energies 23 Softs |

| Shares CFDs | 3 | 13 (+ Crypto 10 Index) |

| ETFs | 60 (Varies by trading platform) (US, EU, AU, JA, HK exchanges) | 13000+ |

| Bonds | No | 2000+ |

| Futures | No | 14 |

| Treasuries | No | Yes |

| Investment | No | 14 |

| No | Yes |

We can assume that IG Group is an all-in-one broker that aims to make it easy for traders to trade in all sorts of derivatives. easyMarkets is primarily a forex broker who also offers some other CFD options.

One thing UK traders should be aware of when choosing IG is that they cannot offer cryptocurrencies to UK traders. This is due to FCA regulations, which do not allow this type of product for trade. easyMarkets use CySEC as their regulator, so do allow crypto trading.

Our Top Product Range and CFD Markets Verdict

IG Group Group excels in this area as a result of their CFD product range and financial market.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

8. Superior Educational Resources – A Tie

Education is a cornerstone for any trader, whether you’re just starting out or looking to refine your skills. Both easyMarkets and IG understand this and have invested heavily in their educational resources. Let’s dive into what each broker offers:

- easyMarkets:

- Provides a range of webinars tailored for traders at different skill levels.

- Offers comprehensive e-books covering various trading topics.

- Features video tutorials for visual learners.

- IG:

- Hosts regular seminars and workshops for hands-on learning.

- Boasts an extensive library of articles and research papers.

- Offers a demo account for practical trading without real money.

Our Superior Educational Resources Verdict

It’s a close call for both IG Groups and easyMarkets.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

9. Better Customer Service – IG Group

It is vital for a brokerage to feature customer service that is both efficient and reliable for traders, as this provides guidance and education while it resolves technical issues.

Customer Support – IG

IG offers customer support nearly 24/7. The hours on Saturdays end at 8 am and recommence at 3 pm (AEDT). IG support team are available via phone, email, live chat and, interestingly, via Twitter. Support can be found in 14 different countries, including Australia.

IG also has a peer support forum, which allows the IG community to support each other with all things trading.

Customer Service

Most IG learning tools can be found through their IG Academy. The Academy includes the following:

- Online trading courses – 8 step-by-step courses are available, covering beginner level through to advanced. The course is made up of videos, quizzes and interactive exercises.

- Live Sessions – These are webinars that are run around the clock and led by trading experts from the IG team and DailyFX. Most webinars run for around 30 minutes. A calendar is available so you can view upcoming events. One notable feature is that there is a mobile app for the IG Academy.

Other education tools include the following:

- News and Analysis – This is a separate webpage with lots of articles exploring news and discussing trade strategies.

- Financial Events – This is a page that brings you the latest important financial events.

- Risk Management Education – This page looks at different types of risk and explains how you can manage them.

- Glossary – A list of key trading terms

- Personal Platform Tour – when you sign up for your account, a personal manager will be able to take you through their platform and guide you with setup.

- Signal Centre – Free technical analysis that can help you with timing your trades.

- Economic Calendar – A list of data covering different events.

IG has a demo trading account that gives users access to $20,000 in virtual funds. Their account does have a few restrictions; for example, you will not experience ‘slippage’, and trades will not be rejected due to size or price.

Customer Support – easyMarkets

easyMarkets offers customer support 24/5, with the Australian week commencing at 8 a.m. on Mondays. The support team is located in Australia (Sydney) and Cyprus. You can reach the support team through several ‘unique features such as Messenger, Viber and WhatsApp, in addition to the usual live chat, email and fax.

Customer Service

easyMarkets also offers a good range of educational material. Available features include:

- Get Started – Here, one can learn about the fundamentals of trading, trading terms to be familiar with, and how to set up an easyMarkets account. Most of these features are in video format.

- Discover – This video series covers the most popular trading instruments easyMarkets offers.

- Free eBooks – 10 eBooks are available for download that cover topics ranging from trading to technical analysis and how to use their platforms.

- Knowledge Base – Here, you can find straightforward explanations to common topics.

- FAQ – This section provides answers to commonly asked questions from clients.

easyMarkets also provides market analysis. Here you can find the following:

- Markets News – live feeds of the latest and most important events on the market.

- Trading Charts – here, charts are available so you can analyse currency movements.

- Live Currency Rates – This is a table showing all currency rates.

- Financial Calendars – This feature advises you on policy changes and the impacts they have on the market.

- Trading Hours – Here, you can find out about the opening and closing times of markets in different regions.

- Forex News Blog – This blog keeps you up to date on forex news around the world.

Lastly, easyMarkets gives you access to a demo account. Their demo account does not expire and includes $15,000 in virtual currency. The demo account includes access to the risk management tools easyMarkets offers.

| Feature | easyMarkets | IG Group |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Evidently, we can see here that both brokers offer great customer support and customer service. We like the IG academy learning platform as it is well organised. We also like the range of tools available to get the information we need on demand.

Our Superior Customer Service Verdict

IG Group outperforms in this area thanks to their better customer service.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

10. More Funding Options – easyMarkets

Having these features are essential in the business of brokerage as it provides traders with flexibility and convenience as it allows traders to choose the most suitable method for their trading needs.

easyMarkets

This broker does not charge any fees for deposits or withdrawals, regardless of the transfer method you use. All their available credit/debit card, online banking and eWallets are free to use. Deposits are instant when using cards and can take 1-5 working days when using online banking tools.

IG Group

Unlike easyMarkets, IG does charge to use some of their funding services. Using a Visa card will result in a 1% fee while using MasterCard will cost you 0.5%. PayPal will also result in a fee of 1%. When using any of these services, you must deposit a minimum of $500 each time you deposit. BPAY and Bank Transfer are free and have no minimum deposits.

| Funding Option | easyMarkets | IG Group |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | No |

| Neteller | No | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

It’s easy to say that easyMarkets performed well in this area simply because they do not charge for you to deposit or withdraw. We also like that they have no minimum funding requirements.

Our Better Funding Options Verdict

easyMarkets stands out in this section as consequence of them having more funding options.

11. Lower Minimum Deposit – IG Group

For many traders, especially those just starting out, the minimum deposit can be a significant factor when choosing a broker. It’s not just about the amount but also about the flexibility and options provided by the broker. Both easyMarkets and IG cater to a wide range of traders, from beginners to professionals, and their minimum deposit requirements reflect this.

| Broker | Minimum Deposit |

|---|---|

| easyMarkets | $200 |

| IG Group | $0 |

While both brokers offer competitive minimum deposit amounts, it’s essential to consider the overall trading experience, platform features, and customer support. A lower minimum deposit can be an excellent way for new traders to dip their toes in the trading world without committing a significant amount of capital.

We can surmise that based on our team’s testing and the available data, IG offers a lower minimum deposit, making it a more accessible choice for traders looking to start with a smaller investment.

Our Lower Minimum Deposit Verdict

IG Group dominates this category by the reason of having lower minimum deposit.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

So is easyMarkets or IG Group The Best Broker?

IG Group definitely outshines the challenger thanks to their comprehensive offerings, user-friendly platform, and competitive pricing.

The table below summarises the key information leading to this verdict:

| Categories | easyMarkets | IG Group |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | Yes | Yes |

| Superior Accounts And Features | Yes | Yes |

| Best Trading Experience And Ease | Yes | Yes |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | Yes | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

easyMarkets: Best For Beginner Traders

easyMarkets is the ideal choice for beginner traders due to its intuitive platform and educational resources.

IG Group: Best For Experienced Traders

IG Group stands out for experienced traders because of its advanced tools and diverse product range.

FAQs Comparing easyMarkets Vs IG Group

Does IG Group or easyMarkets Have Lower Costs?

easyMarkets generally offers lower costs. They have competitive spreads and fewer hidden fees. For more detailed spread data, you can check out our Lowest Spread Forex Brokers page.

Which Broker Is Better For MetaTrader 4?

Both easyMarkets and IG support MetaTrader 4. However, easyMarkets provides a more seamless integration with MT4. For a list of top MT4 brokers, visit our Best MT4 Brokers guide.

Which Broker Offers Social Trading?

easyMarkets offers a robust social trading platform. Social trading allows traders to follow and copy the trades of professionals. For more on social trading platforms, see our Best Copy Trading Platforms page.

Does Either Broker Offer Spread Betting?

Yes, IG offers spread betting, a tax-efficient way of trading in the UK. For more on the best spread betting brokers, visit the best Spread Betting Brokers In UK page.

What Broker is Superior For Australian Forex Traders?

In my opinion, easyMarkets is superior for Australian Forex traders. Both brokers are ASIC regulated, but easyMarkets was founded in Australia, giving it a home advantage. For a comprehensive list, check out the Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally lean towards IG. They are FCA-regulated and have a strong presence in the UK market. For a detailed comparison of UK Forex brokers, you can visit the Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is IG trading only CFD?

No, depending on which subsidiary of IG you are trading with, other financial instruments may include Shares/Equities, Binaries (called Digitial 100s) and Spot.

Is IG good for day trading?

Yes especially with their DMA account but there are better brokers, those offering ECN style trading.