Pepperstone vs easyMarkets: Which One Is Best?

Our Pepperstone vs easyMarkets comparison found that Pepperstone offers spreads with ECN pricing. easyMarkets offers low spreads but includes more features, such as risk management tools. Let’s have a closer look.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

$3,000 (Premium)

$10,000 (VIP)

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five key differences between Pepperstone and easyMarkets:

- Pepperstone uses ECN forex pricing, while easyMarkets operates as a market maker.

- While Pepperstone offers both commission and no commission accounts, easyMarkets provides only commission-free spreads.

- Pepperstone’s no-commission spreads are ultra-competitive, whereas easyMarkets has wider spreads.

- Both brokers offer MetaTrader 4, but Pepperstone also provides MetaTrader 5 and cTrader, while easyMarkets has its proprietary platform.

- Pepperstone focuses on fast execution speeds to reduce slippage, while easyMarkets offers various risk management tools, including dealCancellation and fixed spreads.

1. Lowest Spreads And Fees – Pepperstone

Pepperstone offers low spreads because it uses ECN forex pricing. The broker uses an ECN and STP networks to derive prices directly from liquidity pools with No Dealing Desk Brokers, requotes or price influence on the brokers’ behalf. easyMarkets, on the other hand, is a market maker, which means they are your counterparty when you buy or sell.

While Pepperstone offers two account types (commission and no commission pricing), easyMarkets only offers commission-free spreads. If you want ECN pricing, Pepperstone’s Razor account provides starting from 0.0 pips plus a commission of AUD 3.50. If you prefer commission-free trading, Pepperstone’s Standard account provides access to spreads from 1.0 pips.

|

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.10 | 1.20 | 2.10 | 1.40 |

|

0.70 | 2.20 | 1.10 | 1.60 | 1.60 |

|

1.90 | 2.00 | 2.40 | 2.30 | 2.50 |

|

1.40 | 2.50 | 2.50 | 2.60 | 2.60 |

|

1.20 | 1.80 | 1.90 | 2.30 | 2.30 |

|

1.46 | 2.06 | 1.52 | 2.04 | 1.78 |

|

1.30 | 1.70 | 2.10 | 1.70 | 2.10 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

The above table compared easyMarkets and Pepperstone’s no commission spreads to other Best Forex Brokers In Australia. The average spreads are sourced monthly directly from the broker’s website for accuracy.

Our Lowest Spreads and Fees Verdict

While Pepperstone’s no-commission, variable spreads are ultra-competitive, easyMarkets spreads are significantly wider.

easyMarkets pricing model means you are trading fixed spreads that start from 0.9 pips on MT4 and 1.2 pips on the easyMarkets platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Better Trading Platform – Tie

Both Pepperstone and easyMarkets offer MetaTrader 4. Pepperstone also offers MetaTrader 5 and cTrader, while easyMarkets also offers a proprietary platform.

| Trading Platform | Pepperstone | easyMarkets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

MetaTrader 4

MT4 offered by both forex brokers, has the largest market share of any forex trading platform. This means it’s easy to switch forex brokers as there is no need to learn a new platform when making the switch. The platform is easy to use and has an algorithmic trading feature known as Expert Advisors.

MetaTrader 4 offers the following tools

- 30 in-built technical indicators

- 23 analytical objects

- 31 graphical objects

- Fill or kill order filling

- 4 Pending orders

Known as Smart Trader Tools, Pepperstone has additional features to enhance MetaTrader 4. This includes trade notifications both online or via SMS through the alarm manager, an Excel widget known as Excel RTD and a trade simulator to test strategies based on historical market data. There is also a stealth order feature allowing traders to place pending order that is hidden from the market.

Other features of Smart Trader Tools include ‘connect’ which offers market information, trading guides and an economic calendar. There is also a correlation matrix and trader, both of which help find similarities between assets or markets as well as differences. There is a session map to show when different markets (e.g. UK) are open which impact forex liquidity. A market manager is also available providing in-depth insights into market prices, pending and open orders. This is ideal for making market reviews.

Pepperstone ReviewVisit Pepperstone

MetaTrader 5

With MetaTrader ceasing development of MT4, MetaTrader 5 (MT5) in time will inevitably become more popular than MT4. MT5 comes with significant improvements on MT4. MT5 can support more financial markets, has extra charting tools, new pending orders options, flexible order filling policies and an improved strategy tester.

- 38 technical indicators

- 44 graphical indicators

- 21 timeframes

- Unlimited supported symbols/instruments

- Shares CFD (not available with MetaTrader 4)

- Partial order filling

- New order filling feature – ‘Immediate or Cancel’ and ‘Return’

- 6 Pending Order

- Built-in economic calendar

- Upgraded strategy tester enabling multi-threaded backtesting

- Depth of Market

- Embedded MQL community chat

- Available 30 languages

MetaTrader is available via Webtrader for your browser, MetaTrader Mobile for Android, iOS and installs on a desktop for Windows and Mac.

Pepperstone ReviewVisit Pepperstone

cTrader

cTrader is only offered by Pepperstone and is designed for intermediate to advanced forex traders. The fx platform allows traders to access Pepperstone’s deep liquidity pools ideal for algorithmic trading systems. There are also extensive back-testing systems to test these algorithmic systems or to test your strategies.

cTrader also has an interface that can be customised for traders’ needs. It has detachable charts and pre-sets to suit different types of forex traders. Trades can be made from these charts to help make trades when volatility is high. The platform also has a mobile and web-based platform for traders that make trades when on the go. This can also be ideal for when a trader is at work or on a shared computer which restricts downloading the full interface onto the PC or Mac.

The easyMarkets Forex Trading Platforms

Exclusive to easyMarkets, this platform has enhanced features unique to easyMarkets. This includes dealCancellation discussed below in the risk management feature. There are also guaranteed stop losses and no slippage, which are also discussed in the late risk segment of this Pepperstone vs easyMarkets review.

The platform also has integrated charting and news when making technical analyses. Both forex trading and CFDs can be traded on this platform, but automation is not available. There are also easyMarkets apps available on Google Play or the App Store as well as their web platform, which requires no downloads for a computer.

Overall, the easyMarkets platform’s key strength is the ‘risk management’ features. Traders should be aware this platform is proprietary, meaning it may be difficult to switch to other trading platforms in future.

Our Better Trading Platform Verdict

Pepperstone has forex platforms for intermediate to expert traders with an enhanced MT4 platform and cTrader.

EasyMarkets platform is only recommended for those new to trading or with a low-risk appetite due to the enhanced risk management.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

Pepperstone Razor Trading Account

Pepperstone offers two main accounts types – Razor and Standard Accounts. The most popular Pepperstone forex trading account is the Razor account. This account offers market-based spreads from 0.0 pips and low commission fees.

View the full Pepperstone Razor vs Standard Accounts comparison.

If you are using MetaTrader 4 or 5, fees start from USD $3.50. cTrader users instead pay a percentage-based commission fee equal to 0.0035% of the base currency being traded. E.g., if you are trading 100,000 units of EUR/USD, you will pay €3.50 per side.

Other benefits of the Pepperstone Razor account are:

- Total of 92 Currency Pairs

- Trade lots Min / Max 0.01/100 lots

- Minimum deposit $200

- Leverage of 500:1 (traders outside Australia, Europe and the UK)

- ASIC, CySEC and FCA leverage of 30:1 for retail traders and 500:1 for professional clients

- Scalping and Hedging through expert advisors (called EAs)

Pepperstone also has a Standard account which is great for beginner traders, and an Islamic account which has no swap fees to meet Sharia law requirements. The Islamic account is available on request directly with Pepperstone, and you will require proof of your faith.

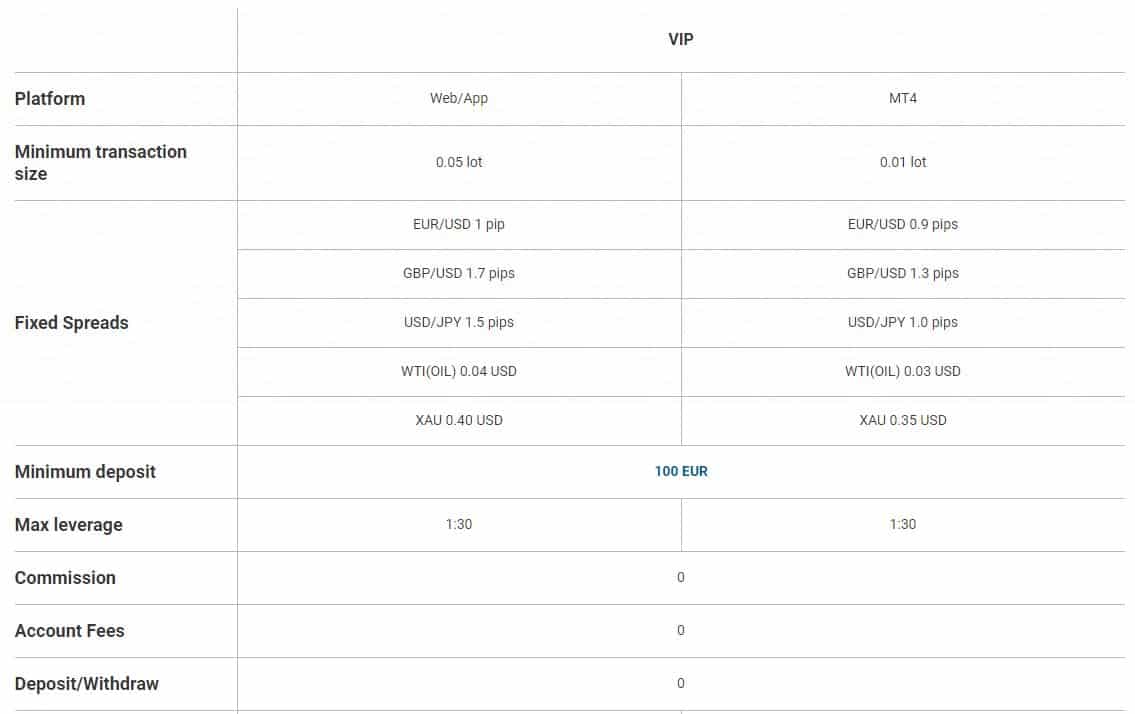

easyMarkets Account Types (VIP, Premium, Standard)

For Clients Outside Europe And The UK

There is no primary account for easyMarkets. Instead, three accounts are available, offering varying spreads based on the amount deposited. It should be noted that, unlike Pepperstone, the spreads are fixed, making the fees transparent to forex traders. Unlike Pepperstone Razor, there are no commissions charged on any easyMarkets trading account.

For Clients In Europe And The UK

Things are more simple for clients of easyMarkets coming from Europe and the UK. There is only one account available. This account needs only a minimum deposit of 100 Euros.

Each of the easyMarkets accounts also has the following features:

- 97 Currency Pairings

- 400:1 leverage outside Australia, Europe and the UK

- 30:1 leverage in Australia, the UK and Europe (CySEC) for major currency pairs, 20:1 for no-major pairs.

- No fees (except for DealCancellation/Guaranteed Stops)

- MT4 Expert Advisor (only available with the MT4 forex platform)

- Fixed Spreads

| Pepperstone | easyMarkets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | No |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | Yes |

The average spreads on Pepperstone are lower, and so are their fees overall. easyMarkets, on the other hand, offers more transparency over their fees with fixed spreads that don’t fluctuate over the day. Overall, the lower average spreads of the Razor account make Pepperstone the winner with lower trading brokerage than easyMarkets. View our Pepperstone Fees page for more details on the costs of brokerage.

Our Superior Accounts and Features Verdict

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

Having delved deep into the trading platforms of both Pepperstone and easyMarkets and after conducting our own extensive testing, we’ve come to some interesting conclusions. Pepperstone, with its ECN forex pricing and a range of platforms, including MT4, MT5, and cTrader, offers a seamless and intuitive trading experience. Their focus on fast execution speeds and reduced slippage is a testament to their commitment to providing traders with the best possible environment.

- Pepperstone has been recognised as the best MT4 broker.

- For those into automation, both Pepperstone and Eightcap stand out with their integration of Capitalise.ai.

- Our tests found that Pepperstone offers one of the best environments for automation.

- BlackBull Markets, although not the main focus of our comparison, deserves a mention for its impressive execution speeds.

On the other hand, easyMarkets, with its proprietary platform, places a strong emphasis on risk management tools, ensuring that traders, especially beginners, have a safety net to fall back on. Their fixed spreads and dealCancellation feature are particularly noteworthy. It’s clear that both brokers have their unique strengths, catering to different types of traders.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| easyMarkets | 155ms | 24/36 | 155ms | 24/36 |

Our Best Trading Experience and Ease Verdict

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Tie

Pepperstone Trust Score

easyMarkets Trust Score

Within Australia, The UK And Europe

easyMarkets operates in Australia under ASIC regulation and in Europe under CySEC. Pepperstone, on the other hand, operates under ASIC, CySEC and BaFin (Germany) plus FCA regulation in the UK.

Higher leverage means greater risks as a trader is taking on more debt; however, it can also mean greater gains. ASIC in Australia and the ESMA, which oversees financial regulation in Europe (CySEC, FCA and BaFin), aim to protect retail clients by enforcing leverage caps. If you are trading with these subsidiaries of easyMarkets or Pepperstone, you will be restricted to leverage of:

- 30:1 for major currency pairs;

- 20:1 for non-major currency pairs, gold and major indices;

- 10:1 for commodities other than gold and non-major indices;

- 5:1 for individual shares;

- 2:1 for cryptocurrencies.

Not only is leverage restricted, but your risk is managed as the brokers are required to offer Negative Balance Protection under ASIC and ESMA regulations.

If you are a high-volume trader, Pepperstone has a professional account with a leverage of 500:1. Joining this program means you will not have negative balance protection.

Outside Australia, Europe And The UK

Joining Pepperstone or easyMarkets outside Europe and the UK means higher leverage via the broker’s offshore entities. Pepperstone will offer you a leverage of 200:1 (under SCB regulation in the Bahamas) and easyMarkets 400:1 (under FSC regulation in the British Virgin Islands).

Pepperstone offers greater flexibility when it comes to leverage, and they are compliant with FCA, CySEC and ASIC, all tier-1 regulators.

It is important that you choose a broker that is regulated. Having a regulated broker means you can be sure your investments are secure. In the online world, you can be vulnerable to unscrupulous forex brokers who may take advantage of you.

Having a broker that is regulated can help in the following ways:

- Security of your funds. Regulators will require the broker to keep your funds in a segregated account

- Security of your data.

- Established trading terms and conditions. Regulators will require a product disclosure statement (PDS) so there is transparency when trading with your broker

- Grievance process – Regulators will require a process to lodge and hear complaints

- Funds management – brokers will be required to keep cash in reserve should financial troubles occur for the broker

Both Pepperstone and easyMarkets are regulated by the Australian Securities and Investments Commission or ASIC in Australia.

Pepperstone is also regulated by the Financial Conduct Authority or FCA in the UK. By BaFin in Germany and Austria and by the Cyprus Securities and Investment Commission or CySEC in the Rest of Europe. EasyMarkets is also regulated in Europe by CySEC and by the FCA in the UK.

If you are trading from Europe or the UK, then you will fall under FCA or Cysec regulation. Anywhere else in the world, and you will likely fall under ASIC regulation.

| Pepperstone | easyMarkets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSC-BVI FSA-S (Seychelles) |

Our Stronger Trust and Regulation Verdict

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than easyMarkets. On average, Pepperstone sees around 110,000 branded searches each month, while easyMarkets gets about 49,500 — that’s 55% fewer.

| Country | Pepperstone | easyMarkets |

|---|---|---|

| Australia | 8,100 | 2,400 |

| Brazil | 6,600 | 3,600 |

| United Kingdom | 5,400 | 390 |

| Thailand | 4,400 | 140 |

| United States | 4,400 | 1,900 |

| Malaysia | 4,400 | 880 |

| Kenya | 4,400 | 260 |

| Germany | 3,600 | 590 |

| Colombia | 3,600 | 320 |

| Mexico | 3,600 | 320 |

| Hong Kong | 3,600 | 170 |

| South Africa | 2,900 | 720 |

| India | 2,900 | 1,600 |

| Spain | 1,900 | 390 |

| Italy | 1,900 | 18,100 |

| Mongolia | 1,900 | 10 |

| Singapore | 1,600 | 210 |

| Indonesia | 1,600 | 480 |

| Peru | 1,600 | 140 |

| Turkey | 1,600 | 140 |

| Pakistan | 1,300 | 480 |

| Nigeria | 1,300 | 390 |

| Argentina | 1,300 | 170 |

| Bolivia | 1,300 | 20 |

| United Arab Emirates | 1,000 | 210 |

| France | 1,000 | 1,000 |

| Taiwan | 1,000 | 90 |

| Ecuador | 1,000 | 50 |

| Chile | 1,000 | 90 |

| Netherlands | 880 | 170 |

| Philippines | 880 | 480 |

| Dominican Republic | 880 | 70 |

| Vietnam | 720 | 590 |

| Morocco | 720 | 170 |

| Poland | 720 | 320 |

| Canada | 720 | 210 |

| Tanzania | 720 | 50 |

| Japan | 480 | 1,000 |

| Portugal | 480 | 70 |

| Cyprus | 480 | 590 |

| Costa Rica | 480 | 90 |

| Algeria | 390 | 210 |

| Bangladesh | 390 | 260 |

| Egypt | 390 | 590 |

| Sweden | 390 | 110 |

| Venezuela | 390 | 40 |

| Uganda | 390 | 40 |

| Ethiopia | 390 | 30 |

| Botswana | 390 | 50 |

| Sri Lanka | 320 | 90 |

| Switzerland | 320 | 110 |

| Austria | 320 | 110 |

| Panama | 320 | 70 |

| Cambodia | 320 | 140 |

| Saudi Arabia | 260 | 170 |

| Ireland | 260 | 50 |

| Ghana | 260 | 70 |

| Jordan | 260 | 50 |

| Greece | 210 | 390 |

| New Zealand | 170 | 140 |

| Uzbekistan | 140 | 390 |

| Mauritius | 110 | 10 |

2024 Monthly Searches For Each Brand

Pepperstone - Australia

Pepperstone - Australia

|

8,100

1st

|

easyMarkets - Australia

easyMarkets - Australia

|

2,400

2nd

|

Pepperstone - UK

Pepperstone - UK

|

5,400

3rd

|

easyMarkets - UK

easyMarkets - UK

|

390

4th

|

Pepperstone - Brazil

Pepperstone - Brazil

|

6,600

5th

|

easyMarkets - Brazil

easyMarkets - Brazil

|

3,600

6th

|

Pepperstone - Thailand

Pepperstone - Thailand

|

4,400

7th

|

easyMarkets - Thailand

easyMarkets - Thailand

|

140

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 296,000 for easyMarkets.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Tie

Overall, Pepperstone has a much larger selection of financial instruments, with 700+ CFDs available. Additionally, unlike easyMarkets, Pepperstone offers Shares CFD and Currency Index as options.

Indices trading –

- Pepperstone: 23 Indices

- easyMarkets- 14 Indices

Soft commodities –

- Pepperstone – 8 commodities

- easyMarkets – 7 Commodities

Major and precious metals –

- Pepperstone – 13 crosses for Gold, Silver, Platinum, Palladium, and Copper

- easyMarkets – Choice of 5 metals

Energies –

- Pepperstone – 3 Energies

- easyMarkets – 5 Energies

Cryptocurrencies* – inc. Bitcoin, Bitcoin Cash, Litecoin, Ethereum, Dash

- Pepperstone – 12 cryptocurrencies

- easyMarkets – 3 Cryptos

*NOTE: Under new FCA guidelines, UK retail traders are no longer able to trade cryptocurrencies.

Options –

- City Index – Vanilla Options

Shares CFD –

- Pepperstone – 700+ stocks from four exchanges

Currency Index –

- Pepperstone – Currency Index CFD – USDX basket

The biggest difference between the two brokers is that easyMarkets allows vanilla options when trading, which Pepperstone does not. This is when a buyer obtains the right (without the obligation) to buy or sell the CFD at an agreed price at a point in time in future.

Our Top Product Range and CFD Markets Verdict

Unless you have a specific need to trade with copper, orange juice or you wish to take advantage of vanilla trading options, then it is not likely to matter if you select Pepperstone or easyMarkets. You could compare the leverage available for the instrument you wish to trade with if you are looking for higher leverage; however, keep in mind higher leverage can come with extra risks.

8. Superior Educational Resources – Pepperstone

When it comes to educational resources, both Pepperstone and easyMarkets have invested significantly in ensuring their traders are well-equipped with knowledge. Our in-depth analysis and testing have revealed the following key points about the educational offerings of these two brokers:

- Pepperstone offers a comprehensive educational section, including webinars, tutorials, and market analysis.

- Their resources cater to both beginners and experienced traders, ensuring a holistic learning experience.

- easyMarkets, on the other hand, focuses on providing traders with real-time news updates and market insights.

- They also offer a range of e-books, videos, and articles to help traders understand the nuances of the market.

- Both brokers provide demo accounts, allowing traders to practice their strategies without risking real money.

- Additionally, easyMarkets offers a unique feature called “dealCancellation,” which can be a great learning tool for new traders.

Our Superior Educational Resources Verdict

Based on our testing, while both brokers offer valuable educational resources, Pepperstone edges out slightly due to its comprehensive and diverse range of learning materials.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

9. Superior Customer Service – Pepperstone

Users will find Pepperstone and easyMarkets have live online messaging, phone and email options when it comes to customer service. Customer support is available 24/5 from each provider.

| Feature | Pepperstone | easyMarkets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Pepperstone

For the past two consecutive years, ‘Investment Trends’ awarded Pepperstone the title of the most outstanding customer service in the industry. This speaks volumes about the high level of service clients can expect when dealing with their support teams. Their support team is made up of real traders who are, therefore excellent at assisting both beginner and experienced traders because they trade themselves.

Pepperstone offers a mix of phone, email and live chat in the following countries – Australia, China, USA, Thailand and the United Kingdom.

Customer Service With easyMarkets

Traders with a Standard account or Premium Account a limited to certain features from their customer service portfolio, as shown by the table.

Customers who use the Super VIP and VIP accounts have access to all customer services. This includes the ‘Personal Account Manager’, which provides information regarding market movements, relevant news that may impact trading decisions and investment tips.

One unique customer service feature offered by easyMarkets is supported via Viber and Facebook Messenger.

Our Superior Customer Service Verdict

The award-winning customer service offered by Pepperstone is why we are making Pepperstone our recommendation when it comes to customer support.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

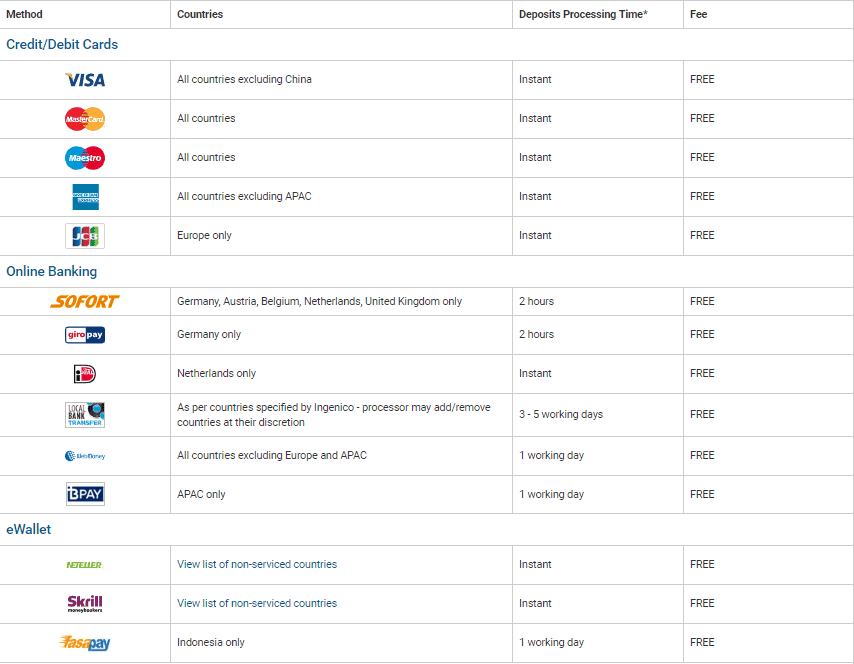

10. Better Funding Options – Tie

easyMarkets range of financial merchants for deposits and withdrawals is one of the largest on offer among all brokers. Many of these providers are not generally used in Australia, so may not apply to your funding account needs.

Pepperstone

When a withdrawal request is made before 7 am AEST then processing will be done on the same day. If made after this time, funds will be processed one day later. Withdrawals must be deposited into bank accounts that are linked with your registered Pepperstone account and must be in your name. Bank wire withdrawals take a few days longer, up to five business days.

While there is a $20 withdrawal fee for bank wire, Pepperstone does not charge any for deposits and withdrawals for all other funding methods. This means you can use Skrill, PayPal, POLi, BPay, Neteller, Union Pay, credit cards including Visa and MasterCard, debit cards and bank transfers without extra charges.

Pepperstone will accept a range of currencies, including USD, GBP, EUR, CHF, JPY, AUD, CAD, NZD, SGD and HKD.

easyMarkets

easyMarkets segregate all funds through ‘Bankwest. This helps protect your funds as easyMarkets have no access to the account.

When withdrawing funds from your bank account, you will be required to withdraw at least $50USD. eWallets and credit/debit cards do not have minimum withdrawal requirements. While easyMarkets have no deposit or withdrawal fees, some fees may be charged by the payment issuer.

The table below shows funding providers available and fees:

Our Better Funding Options Verdict

We suggest you research your preferred merchant and their fees when deciding on a broker, as their fees will vary and could add to your cost. If Pepperstone doesn’t offer your preferred merchant, then easyMarkets will.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

Pepperstone wins traders over with its $0 minimum deposit requirement, with easyMarkets requiring at least $25. However, Pepperstone does recommend starting with $200 to utilise the trading experience fully.

| | Minimum Deposit | Recommended Deposit |

| Pepperstone | $0 | $200 |

| easyMarkets | $200 | NA |

The minimum deposit can sometimes reflect the broker’s target audience, with some brokers aiming for more experienced traders who are willing to invest more initially.

Our Lower Minimum Deposit Verdict

Pepperstone offers a $0 minimum deposit, making it more accessible for new traders compared to easyMarkets’ $25 requirement.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

Is easyMarkets or Pepperstone The Best Broker?

Pepperstone is the winner because of its comprehensive range of offerings, from a $0 minimum deposit to superior educational resources and a diverse range of trading platforms.

The table below summarises the key information leading to this verdict:

| Criteria | Pepperstone | easyMarkets |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platforms | Yes | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| CFD Product Range And Financial Markets | Yes | Yes |

| Superior Educational Resources | Yes | No |

| Better Customer Service | Yes | No |

| More Funding Options | Yes | Yes |

| Lower Minimum Deposit | Yes | No |

easyMarkets: Best For Beginner Traders

easyMarkets is better suited for beginner traders due to its focus on risk management tools and fixed spreads, providing a safety net for those new to trading.

Pepperstone: Best For Experienced Traders

Pepperstone stands out for experienced traders because of its ECN forex pricing, diverse platform offerings, and ultra-competitive spreads.

FAQs Comparing Pepperstone Vs easyMarkets

Does easyMarkets or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs compared to easyMarkets. They are known for their ultra-competitive spreads, especially on major currency pairs. For instance, their EUR/USD spread can be as low as 0.13 pips. If you’re keen on diving deeper into spread data and broker comparisons, you might find this guide on the lowest spread forex brokers particularly useful.

Which Broker Is Better For MetaTrader 4?

Both Pepperstone and easyMarkets offer MetaTrader 4, but Pepperstone is often recognised for its enhanced MT4 experience. They provide advanced tools and faster execution speeds, smoothing the trading process. For traders who are specifically looking for the best MT4 experience, this comprehensive list of top MT4 brokers can be a great resource.

Which Broker Offers Social Trading?

Pepperstone offers social trading features, allowing traders to copy strategies from seasoned professionals. This feature is particularly beneficial for those who might not have the time or expertise to analyse the markets themselves. Social or copy trading bridges the gap between beginners and experts, creating a collaborative trading environment. For a broader perspective on social trading platforms, check out this detailed guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting for its UK clients, allowing them to take advantage of tax benefits associated with this form of trading. Spread betting is a unique way to speculate on price movements without owning the underlying asset. For those interested in exploring more about spread betting and finding the best brokers for it, this comprehensive guide on the best spread betting brokers in the UK can be a great starting point.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out as the superior choice for Australian forex traders. Founded in Melbourne, they are ASIC regulated, ensuring a high level of trust and security for their clients. Their deep roots in Australia and understanding of the local market nuances make them a preferred choice. Moreover, their commitment to offering competitive spreads and advanced trading platforms is commendable. For a broader perspective on the best brokers in Australia, you might find this Best Forex Brokers In Australia insightful.

What Broker is Superior For UK Forex Traders?

Personally, I believe Pepperstone is a strong contender for UK forex traders. They are FCA regulated, which adds an extra layer of trust for traders in the UK. While they were founded overseas, their commitment to understanding and catering to the UK market is evident. Their range of offerings, combined with top-tier regulation, makes them a solid choice. For those looking to delve deeper into the best brokers for the UK market, this detailed guide on the best UK forex brokers can be quite enlightening.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is it cheaper to have fixed or variable spreads?

Depends on what you call cheaper, generally you are more likely to pay more with fixed spreads. Brokers take on additionally risk since it is they who will pay if raw spread prices move against them so they protect themselves from this risk by widening the spread. This is why fixed spreads are usually wider than variable spreads. However, there are exceptions to this, when liquidity is low or conditions are volatile, variable spreads can widen and it is possible they will widen more than the spreads that are fixed which theoretically should not widen. For this reason variable can end up costing more if things go badly wrong in the market.

How do beginners learn how to start trading forex.

Can I trade on Pepperstone without verification?

Only if using a Demo Account.

easyMarkets legal in India?

easyMarkets will allow resident of India to open a trading account however if by legal you mean the broker is regulated by the financial regulatory body of India then, the answer they are not.