BlackBull Markets vs easyMarkets

We compared BlackBull Markets to EasyMarkets and found that BlackBull had a superior offering with lower trading fees, more advanced trading platforms, and faster execution speeds. View our testing data below that led to this finding.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

$3,000 (Premium)

$10,000 (VIP)

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Of the 10 factors traders should compare brokers the 3 key differences between easyMarkets and Blackbull Markets were:

- Blackbull has lower fees with lower spreads on both their standard and ECN account.

- BlackBull offers a wider range of tradable instruments from forex, and indices to crypto.

- BlackBull Markets has a superior forex trading app ideal for advanced traders.

- easyMarkets has a slightly higher trust score.

- easyMarkets provides a seamless trading experience.

- Both brokers have a strong reputation.

1. Lowest Spreads And Fees – BlackBull Markets

Both BlackBull Markets and easyMarkets offer a Standard Account so we were able to directly compare their average spreads. As the table below shows BlackBull has lower spreads with an overall average spread of 1.50 vs 1.83 for easyMarkets.

| Standard Account | BlackBull Spreads | easyMarkets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.50 | 1.83 | 1.6 |

| EUR/USD | 1.1 | 0.8 | 1.2 |

| USD/JPY | 1.4 | 1.5 | 1.4 |

| GBP/USD | 1.4 | 1.3 | 1.6 |

| AUD/USD | 1.2 | 1.5 | 1.5 |

| USD/CAD | 1.4 | 2.3 | 1.8 |

| EUR/GBP | 1.7 | 2 | 1.5 |

| EUR/JPY | 1.8 | 2.2 | 1.9 |

| AUD/JPY | 2 | 3 | 2.1 |

To understand how these lower spreads affect trading costs, we developed a fee calculator below. You can choose your base currency, trading size, and currency pair to determine the resulting fee. Forex traders typically trade larger volumes than investors in shares, so it’s crucial to keep trading fees as low as possible.

ECN Account

Blackbull Markets also offers two additional account types:

- ECN Prime for traders with experience

- ECN Institutional for high-volume traders

Unlike a standard account, the two ECN accounts have a lower spread in addition to a commission. That said, the overall trading fees are lower than a standard account making Blackbull have a clear fee advantage over easyMarkets that don’t offer this account type.

Other Fees

Neither brokers charge a deposit or withdrawal fee. There are swap fees charged for longer-term positions held overnight (also called an overnight holding fee). Different account types have different minimum deposit requirements discussed later but overall, all accounts avoid hidden fees, unlike some other forex providers.

Our Lowest Spreads and Fees Verdict

With their considerably lower spreads and fees, BlackBull Markets is a smart choice in this category. We also recommend choosing the BlackBull Markets ECN prime account which is their most popular.

BlackBull Markets ReviewVisit BlackBull Markets

2. Superior Trading Platforms – BlackBull Markets

EasyMarkets and Blackbull offer the same trading platforms including MT4, MT5 and TradingView. There are two key differences with only Blackbull offering cTrader while both brokers have their own propriety trading platform.

| Trading Platform | BlackBull Markets | easyMarkets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

The biggest weakness of easyMarkets propriety trading platforms vs Blackbull (other than wider spreads) is that automation, social trading and copy trading are not available. easyMarkets do however have some great risk management features available including DealCancellation but this is more geared to beginner traders with a higher fee associated to the offering.

Our Better Trading Platform Verdict

While similar, BlackBull Markets offers more platforms and their own platform is more advanced making them a suitable option in this category.

3. Best Account Features – BlackBull Markets

As discussed earlier, only BlackBull Markets offer ECN accounts which have the lowest fees. By adding a commission rate based on trading volume they can offer the lowest spreads resulting in the lowest brokerage. Both have institutional account options for high volume traders leading to further discounts on fees. Neither brokers has FCA regulation and therefore can’t offer spread betting in the UK.

| Blackbull Markets | easyMarkets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | No |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

easyMarkets uses a market maker pricing model, meaning they are the counterparty to your trades. The good news, though, is that spreads are fixed and know exactly what the spread will be when opening a trading position. This is a great benefit if you are a scalper, meaning, your spreads are predictable. MetaTrader 5 is the exception to this rule which uses variable spreads.

| BlackBull Markets | easyMarkets | |

|---|---|---|

| Market Maker | No | Yes |

| Dealing Desk | No | Yes |

| Execution Type | STP | Market Maker |

| Demo Account | Yes | Yes |

| Standard Account | ECN Standard | MT4, MT5, easyMarkets (with Standard, Premium and VIP options) |

| Commission Account | ECN Prime | No |

| Fixed-spread Account | No | Yes (MT4 and easyMarkets accounts only) |

| Swap-free Account | On request | On request |

| # of Base Currencies | 9 | 19 |

| Maximum Forex Leverage | 1:500 | 1:30 or 1:500 |

Our Superior Accounts and Features Verdict

BlackBull Markets is an ideal choice resulting from its more solid range of account features including a superior execution speed.

4. Best Trading Experience – BlackBull Markets

We tested BlackBull Markets and found them to be the fastest broker for execution speed, with limit orders of 72ms and market orders speed of 90ms. EasyMarkets on the other hand were mid-range for both. This means that slippage is more likely to occur when trading with easyMarkets which is one of the biggest drawbacks of forex trading.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Blackbull Markets | 72ms | 1/36 | 90ms | 5/36 |

| easyMarkets | 155ms | 24/36 | 155ms | 24/36 |

Summarising a few key points with trading experience in addition to BlackBull Markets’ faster execution speed:

- easyMarkets provides a seamless trading experience ideal for beginner traders

- BlackBull Markets offers a higher leverage, giving traders more exposure.

- BlackBull Markets has a superior forex trading app ideal for advanced traders

Our Best Trading Experience and Ease Verdict

BlackBull Markets is a perfect choice in light of its rapid execution speeds, and the use of advanced charting capabilities, making it the best trading experience.

5. Most Trusted – easyMarkets

easyMarkets received a Trust Score of 58 as they are regulated by:

- ASIC (Australia),

- CySEC (Cyprus),

- FSA (Seychelles)

- FSC BVI

They also have strong reviews on TrustPilot of 4.5/5 based on 1,675 reviews. Founded in 2001 with extensive global marketing campaigns which gives them a strong reputation

easyMarkets Trust Score

Founded in 2014, BlackBull Markets has a lower Trust score of 50 and is only well-known by experienced traders or within New Zealand. The broker does have ‘tier 1’ regulation with the FMA (New Zealand) and a superior TrustPilot score of 4.7 based on 877 reviews

BlackBull Markets Trust Score

Our Stronger Trust and Regulation Verdict

easyMarkets has a better edge with more regulators and a greater brand recognition branding it the most trusted.

6. Most Popular Broker – easyMarkets

easyMarkets gets searched on Google more than BlackBull Markets. On average, easyMarkets sees around 49,500 branded searches each month, while BlackBull Markets gets about 18,100 — that’s 63% fewer.

| Country | BlackBull Markets | easyMarkets |

|---|---|---|

| Italy | 320 | 18,100 |

| Brazil | 110 | 3,600 |

| Australia | 1,900 | 2,400 |

| United States | 880 | 1,900 |

| India | 1,300 | 1,600 |

| France | 210 | 1,000 |

| Japan | 50 | 1,000 |

| Malaysia | 170 | 880 |

| South Africa | 720 | 720 |

| Germany | 1,600 | 590 |

| Vietnam | 70 | 590 |

| Egypt | 40 | 590 |

| Cyprus | 170 | 590 |

| Philippines | 50 | 480 |

| Pakistan | 210 | 480 |

| Indonesia | 140 | 480 |

| United Kingdom | 1,600 | 390 |

| Nigeria | 170 | 390 |

| Spain | 480 | 390 |

| Uzbekistan | 30 | 390 |

| Greece | 90 | 390 |

| Colombia | 170 | 320 |

| Poland | 170 | 320 |

| Mexico | 480 | 320 |

| Bangladesh | 70 | 260 |

| Kenya | 110 | 260 |

| Canada | 590 | 210 |

| Singapore | 110 | 210 |

| United Arab Emirates | 140 | 210 |

| Algeria | 50 | 210 |

| Netherlands | 320 | 170 |

| Morocco | 90 | 170 |

| Hong Kong | 30 | 170 |

| Argentina | 170 | 170 |

| Saudi Arabia | 40 | 170 |

| New Zealand | 1,900 | 140 |

| Turkey | 90 | 140 |

| Thailand | 210 | 140 |

| Peru | 50 | 140 |

| Cambodia | 10 | 140 |

| Austria | 210 | 110 |

| Switzerland | 140 | 110 |

| Sweden | 140 | 110 |

| Sri Lanka | 70 | 90 |

| Taiwan | 20 | 90 |

| Chile | 50 | 90 |

| Costa Rica | 10 | 90 |

| Portugal | 70 | 70 |

| Ghana | 50 | 70 |

| Dominican Republic | 40 | 70 |

| Panama | 10 | 70 |

| Ireland | 70 | 50 |

| Botswana | 30 | 50 |

| Tanzania | 30 | 50 |

| Ecuador | 70 | 50 |

| Jordan | 10 | 50 |

| Uganda | 50 | 40 |

| Venezuela | 50 | 40 |

| Ethiopia | 20 | 30 |

| Bolivia | 30 | 20 |

| Mauritius | 10 | 10 |

| Mongolia | 10 | 10 |

2024 Monthly Searches For Each Brand

BlackBull Markets -

BlackBull Markets -

|

1st

|

EasyMarkets -

EasyMarkets -

|

2nd

|

BlackBull Markets - Australia

BlackBull Markets - Australia

|

3rd

|

EasyMarkets - Australia

EasyMarkets - Australia

|

4th

|

BlackBull Markets - India

BlackBull Markets - India

|

5th

|

EasyMarkets - India

EasyMarkets - India

|

6th

|

BlackBull Markets - France

BlackBull Markets - France

|

7th

|

EasyMarkets - France

EasyMarkets - France

|

8th

|

Similarweb shows a different story when it comes to February 2024 website visits with easyMarkets receiving 296,000 visits vs. 415,000 for BlackBull Markets.

Our Most Popular Broker Verdict

easyMarkets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

7. Widest Product Range – BlackBull Markets

BlackBull Markets enables traders access to 72 currency pairs (EUR/USD), compared to easyMarkets’ 62 available pairs. easyMarkets does allow vanilla options with 24 of these currency pairs. In contrast, BlackBull Market’s range of markets to trade is more vast, including over 26,000 shares both as CFDs and as equities.

| BlackBull Markets | easyMarkets | |

|---|---|---|

| Forex trading | 72 | 62 CFD, 24 Vanilla options |

| Cryptocurrency trading | 9 | 3 |

| Share CFD trading | 26,000+ | 60 (US, EU, AU, JA, HK exchanges) |

| Commodities CFD trading | 9 Metals 5 Energies 8 Softs | 5 Metals 5 Energies 7 Softs |

| ETF CFD trading | 7 | 0 |

| Indices CFD trading | 10 | 14 |

| Bonds/Treasuries CFD trading | 0 | 0 |

| Real Stocks | Yes (selected countries) | 0 |

| Other Products | 0 | 0 |

There are more choices with BlackBull Markets with 9 cryptocurrencies to trade. Whereas, easyMarkets’ offer 3 cryptocurrencies.

Our Top Product Range and CFD Markets Verdict

We see that BlackBull Markets is a great pick with its widest product range as we give it a score of 7 out of 10 in contrast to easyMarkets’ 4 out of 10 score.

8. Superior Educational Resources – BlackBull Markets

Education is key in the field of forex trading. Investing in top-notch educational tools and resources to enhance the trading experiences for their clients is how both of these brokers truly demonstrate their understanding. Here’s a breakdown of what each broker offers in terms of educational content:

- BlackBull Markets provides comprehensive webinars and seminars for both beginners and advanced traders.

- easyMarkets offers a range of e-books and videos that cover various trading topics in depth.

- BlackBull Markets has an extensive FAQ section addressing common queries and concerns.

- easyMarkets boasts an interactive trading course guiding traders step-by-step.

- Both brokers offer daily market analysis, ensuring traders are up-to-date with the latest market trends.

- BlackBull Markets and easyMarkets both have dedicated sections for trading strategies, helping traders refine their approach.

Our Superior Educational Resources Verdict

BlackBull Markets takes the lead with its diverse range of learning materials, making it the preferred choice for traders keen on continuous learning.

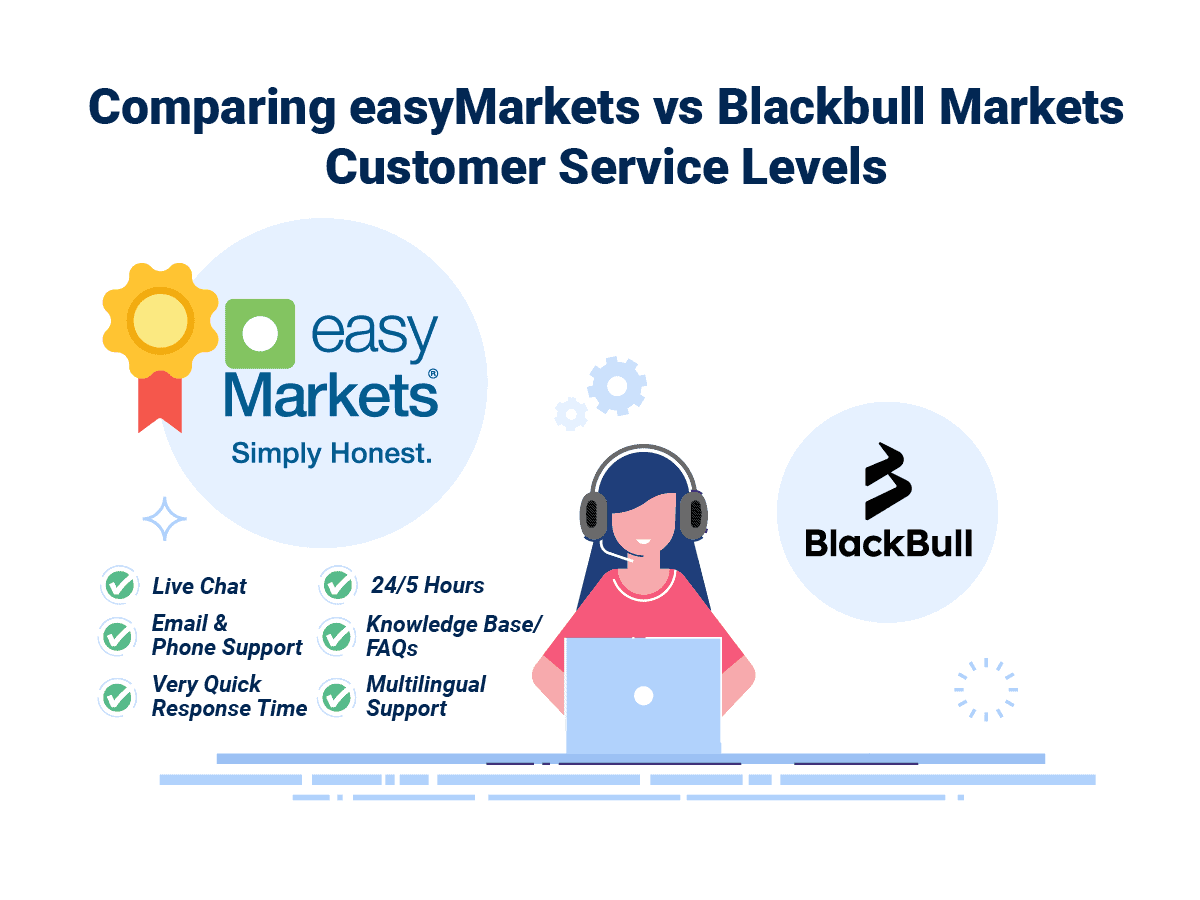

9. Top Customer Service – easyMarkets

In the business of forex trading, customer service can make or break a broker’s reputation. Both BlackBull Markets and easyMarkets have prioritised this aspect, ensuring that traders have a seamless experience from start to finish. It’s clear that both brokers have invested heavily in their customer support infrastructure.

BlackBull Markets offers a robust support system, with multiple channels of communication available for traders. While easyMarkets is known for its quick response times and knowledgeable support staff. Both brokers understand the importance of addressing client concerns promptly and efficiently.

| Customer Service Feature | BlackBull Markets | easyMarkets |

|---|---|---|

| Live Chat Support | Available | Available |

| Email Support | 24/7 | 24/5 |

| Phone Support | Multiple Lines | Direct Line |

| Knowledge Base/FAQs | Comprehensive | Detailed |

| Technical Support | Quick | Very Quick |

| Multilingual Support | Yes | Yes |

Verdict:

easyMarkets is a solid option for this portion with its top customer support making it the right choice for traders prioritising customer service.

10. Best Funding Options – easyMarkets

BlackBull Markets and easyMarkets provide a variety of choices to cater to the diverse needs of their clients in regard to funding options. From traditional bank transfers to modern e-wallet solutions, traders have the flexibility to choose the method that best suits their requirements.

It’s crucial for traders to have access to multiple funding options, as it allows for greater flexibility and can significantly impact the overall trading experience. The ease of deposits and withdrawals can be a determining factor for many when choosing a broker.

The availability of multiple funding options ensures that traders can seamlessly move funds in and out of their trading accounts without any hassles. This not only provides convenience, but also adds an extra layer of security, as traders can opt for methods they trust and are familiar with. Both understand the importance of this and have incorporated a range of options to ensure client satisfaction.

| Funding Methods | BlackBull Markets | easyMarkets |

|---|---|---|

| Bank Transfer | Yes | Yes |

| Credit Card | Yes | Yes |

| PayPal | No | No |

| Skrill | Yes | Yes |

| Neteller | Yes | No |

| Bitcoin | No | No |

| Ethereum | No | No |

| UnionPay | Yes | No |

| FasaPay | No | Yes |

| WebMoney | No | Yes |

Verdict:

easyMarkets offers a slightly broader range making it the preferable choice for traders looking for diverse deposit and withdrawal methods. BlackBull Market is a great choice if you are a Neteller or UnionPay user.

11. Lower Minimum Deposit – BlackBull Markets

Minimum deposit requirement is a crucial factor for many traders and beginners alike. It determines how accessible a broker is for different types of traders, from beginners to seasoned professionals.

A lower minimum deposit allows newer traders to start trading without committing a large sum, while higher tiers often come with additional benefits and features for more experienced traders.

BlackBull Markets and easyMarkets have structured their account types to cater to a wide range of traders. BlackBull Markets offers an ECN Standard account with no minimum deposit requirement, making it highly accessible for beginners.

On the other hand, their ECN Prime and ECN Institutional accounts cater to more professional traders with higher minimum deposit requirements. easyMarkets, in contrast, has a tiered approach with their account types, with the Standard and MT4/MT5 accounts being the most accessible.

| Broker | Account Type | Minimum Deposit |

|---|---|---|

| BlackBull Markets | ECN Standard | $0 |

| ECN Prime | $2,000 | |

| ECN Institutional | $25,000 | |

| easyMarkets | VIP | $10,000 |

| Premium | $3,000 | |

| Standard | $200 | |

| MT4/MT5 | $200 |

Verdict:

BlackBull Markets leads with the lowest minimum deposit, offering an ECN Standard account with no minimum requirement; an ideal option for traders looking to start with a smaller investment.

Is easyMarkets Or BlackBull Markets the Better Broker?

BlackBull Markets is superior to easyMarkets winning 7 of the 10 criteria important for choosing a broker. This includes the fact that the former has a wider range of trading platforms, lower trading fees, superior accounts and features, better trading experience, a larger CFD product range and lower minimum deposit requirements. The table below summarises the key information leading to this verdict:

| Criteria | BlackBull Markets | easyMarkets |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | Yes | No |

Best For Beginner Traders

For traders entering the trading world, easyMarkets provides a more user-friendly environment with exceptional educational resources and customer service.

Best For Experienced Traders

BlackBull Markets stands out as the top choice for seasoned professionals seeking advanced features, lower fees, faster execution speeds and a diverse product range.

FAQs

Does easyMarkets or BlackBull Markets Have Lower Costs?

Blackbull Markets has lower trading fees with lowered spreads. They also have some of the lowest commission rates as you can view on the Low Commission Broker page.

Which Broker Is Better For MetaTrader 4?

Blackbull Markets is better for MT4 versus easyMarkets based on the broker’s superior execution speeds and lower trading costs. With most MT4 traders using automation, these two elements are the most important as explained on our best MT4 brokers page.

Does Either Broker Offer Spread Betting?

Neither easyMarkets nor BlackBull Markets offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of market movements without owning the underlying asset. For those interested in spread betting, you can find a list of the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

Only easyMarkets has ASIC regulation and is therefore the recommended broker for most retain traders. BlackBull Markets is only regulated in the region by the FMA (in New Zealand) and only professional traders should consider an offshore broker with tier 1 regulation as explained in our best forex broker Australia guide.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How much is the commission on BlackBull?

Commission with the ECN Prime account is USD $6.00 per lot round-turn or USD $3.00 each way.