Eightcap vs TMGM: Which One Is Best?

This Eightcap vs TMGM forex broker comparison found these no dealing desk brokers have over 40 currency pairs, good crypto options and offer MetaTrader 4 and 5 Trading Platforms. Find out how the brokers compare in this review.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors between Eightcap and TMGM.

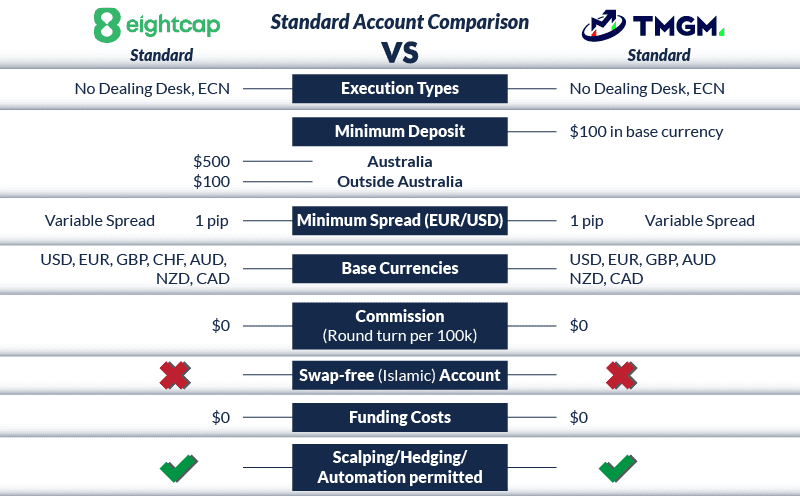

- Eightcap offers over 250 cryptocurrency options, while TMGM provides just 12.

- Both brokers offer MetaTrader 4 and 5 platforms, but Eightcap also provides Capitalise.ai and TradingView.

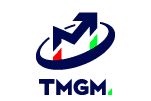

- Eightcap and TMGM both require a minimum deposit of $100.

1. Eightcap: Lowest Spreads And Fees

On a standard brokerage account, the main trading fee you face is the spread cost. This represents the difference between the price you can buy a CFD at and the price you can sell it at, meaning you want the lowest possible spreads.

TMGM’s spreads are competitive, although not the best in the industry. Eightcap’s spreads are consistently around the 1.0 mark across most forex pairs, with a slight increase for AUD/JPY at 1.2. TMGM, on the other hand, shows a bit more variability. Their spreads range from 1.0 for USD/JPY to 1.4 for AUD/JPY.

| Standard Account | Eightcap Spreads | TMGM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.16 | 1.20 | 1.7 |

| EUR/USD | 1 | 1.2 | 1.2 |

| USD/JPY | 1.2 | 1.4 | 1.5 |

| GBP/USD | 1.20 | 1.20 | 1.6 |

| AUD/USD | 1.2 | 1 | 1.6 |

| USD/CAD | 1.20 | 1.20 | 1.9 |

| EUR/GBP | 1.1 | 1.2 | 1.5 |

| EUR/JPY | 1.20 | 1.20 | 2.1 |

| AUD/JPY | 1.20 | 1.20 | 2.3 |

Standard Account Analysis Updated February 2026[1]February 2026 Published And Tested Data

Comparing these to the industry average, both brokers generally offer competitive spreads. But if I had to pick a winner, I’d lean towards Eightcap for their consistency across the board. That being said, TMGM’s slightly higher spreads are still within a competitive range, and they could be a good fit for traders who prioritize other features or services.

Remember, while spreads are a key factor in choosing a forex broker, they’re not the only thing to consider. Always look at the bigger picture when deciding which broker is the right fit for you.

We built a tool to show how smaller spreads affect fees. Enter your base currency, trade size, and the pair to calculate the cost.

Our Lowest Spreads and Fees Verdict

Trading fees on both accounts are very similar, and it is hard to differentiate on price. However, for forex, we give the win to Eightcap. On average, you will likely get lower spreads with Eightcap as opposed to TMGM.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

2. Eightcap: Better Trading Platform

The most popular forex trading platforms are MetaTrader 4 and MetaTrader 5, or MT4/MT5, respectively. Both MetaTrader options will be available for you to access on both Eightcap and TMGM.

| Trading Platform | Eightcap | TMGM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

The only other platform offered by TMGM is IRESS, a great stock trading platform aimed at retail traders.

The top tool offered by TMGM is Trading Central. This helps generate daily trading ideas and provides information like sentiment analysis or economic news. TMGM also has their own market sentiment tool available for you to use, with the sentiment based on news articles and social media.

Eightcap has a wider suite of extra CFD platforms compared to TMGM in the form of Capitalise.ai and TradingView. The Capitalise.ai platform allows you to easily program Algo-trading bots without any form of programming skills needed. Meanwhile, TradingView provides you with top-notch charting capability and all of the tools you would need to study chart trade at a high level.

Meanwhile, Eightcap’s trading tools, AmazingTrader and Cryptocrusher, are aimed at improving your trading experience. Beginner traders greatly benefit from both as AmazingTrader helps manage when trading, therefore increasing your profit, while Cryptocrusher helps generate crypto trading strategies.

Our Better Trading Platform Verdict

Overall, Eightcap provides you with both a wider range of trading platforms and a stronger set of trading tools that will help you trade better. As a result, we determined that Eightcap is our platform winner.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

3. Tie: Superior Accounts And Features

- Eightcap:

- Raw Account: This account type offers tighter spreads and charges a commission. The minimum deposit required to open a Raw account is $250.

- Standard Account: With a slightly higher minimum deposit of $500, the Standard account offers wider spreads but does not charge any commission on trades.

- TMGM:

- Standard Account: TMGM’s standard account offers competitive spreads without any commission. The minimum deposit for this account is notably lower at $100.

- Edge Account: This is TMGM’s equivalent to Eightcap’s Raw account. It offers tighter, ‘raw’ spreads but comes with a commission fee. The minimum deposit requirement is the same as their standard account, at $100.

Both brokers aim to cater to a range of traders, from beginners to professionals, with their account offerings. The choice of account type often depends on trading volume, strategy, and preference regarding spreads and commissions.

| Eightcap | TMGM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

While TMGM offers a more accessible entry point with a lower minimum deposit, Eightcap provides a clear distinction between its account types in terms of deposit requirements and trading costs. The best choice depends on individual trader preferences and trading capital.

4. Eightcap: Best Trading Experience And Ease

Having delved deep into both Eightcap and TMGM and after analysing our own testing data, it’s evident that the trading experience varies between the two. Eightcap, for instance, has been recognised for its TradingView platform, offering traders an intuitive and comprehensive charting experience.

Additionally, when it comes to cryptocurrency trading, Eightcap stands out with its vast range of over 250 options, providing traders with a diverse and expansive crypto trading environment.

- Trading Platforms: Eightcap’s integration with TradingView ensures a seamless trading experience with top-notch charting capabilities.

- Cryptocurrency Offerings: With over 250 cryptocurrency options, Eightcap offers one of the most extensive crypto portfolios in the industry.

- Automation: Both Eightcap and Pepperstone have integrated with Capitalise.ai, enhancing the trading experience with automated strategies.

- Spreads & Commission: Our testing data highlighted Eightcap’s competitive edge in offering low spreads, making it a cost-effective choice for many traders.

Our Best Trading Experience and Ease Verdict

While TMGM offers a commendable trading environment, Eightcap clearly takes the lead in providing the best overall trading experience, especially for those keen on crypto and advanced charting tools.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

5. Tie: Stronger Trust And Regulation

In forex trading, establishing a secure and transparent environment relies heavily on strong trust and regulation.

Eightcap Trust Score

TMGM Trust Score

Regulations

To determine how safe you will be when trading CFDs, we compare the regulatory licences held by Eightcap and TMGM.

| Eightcap | TMGM | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CYSEC (Cyprus) ASIC (Australia) | ASIC (Australia) FMA (New Zealand) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | SCB (Bahamas) | VFSC FSC-M (Mauritius) |

Eightcap has one top-tier and one second-tier regulatory licence. These are with the Australian Securities and Investments Commission (ASIC) in Australia and the Securities Commission of the Bahamas (SCB) with worldwide regulation, respectively.

Meanwhile, TMGM has two top-tier licences and one second-tier licence. Their two top-tier licences are with ASIC and the Financial Markets Authority (FMA) in New Zealand. TMGM’s second-tier regulatory agency is the Vanuatu Financial Services Commission (VFSC), which also gives them global regulatory coverage.

Reviews

Eightcap and TMGM both receive strong ratings on Trustpilot, reflecting generally positive customer experiences. Eightcap holds a score of around 4.2 out of 5, based on over 3,100 reviews, with users often highlighting its responsive support and reliable trading platform. TMGM, meanwhile, has a slightly higher score of approximately 4.4, though from fewer reviews of around 900.

Our Stronger Trust and Regulation Verdict

To stay safe when trading, you should always try to use a broker regulated in the country you are trading from.

The main difference in regulatory coverage between Eightcap and TMGM is that TMGM is regulated in New Zealand. Therefore, if you are trading in NZ, we recommend TMGM. Otherwise, both brokers are well-regulated.

6. Most Popular Broker – Eightcap

Eightcap gets searched on Google more than TMGM. On average, Eightcap sees around 40,500 branded searches each month, while TMGM gets about 18,100 — that’s 55% fewer.

| Country | Eightcap | TMGM |

|---|---|---|

| Thailand | 9,900 | 1,600 |

| Canada | 2,400 | 590 |

| Australia | 2,400 | 1,900 |

| United States | 1,900 | 880 |

| United Kingdom | 1,600 | 720 |

| India | 1,300 | 260 |

| Germany | 1,000 | 140 |

| Brazil | 1,000 | 70 |

| Malaysia | 880 | 2,400 |

| Spain | 720 | 110 |

| France | 720 | 210 |

| Colombia | 720 | 30 |

| Italy | 590 | 90 |

| Indonesia | 590 | 320 |

| Argentina | 590 | 20 |

| Netherlands | 480 | 170 |

| South Africa | 480 | 40 |

| Nigeria | 390 | 70 |

| Singapore | 390 | 590 |

| Sweden | 320 | 20 |

| Pakistan | 320 | 170 |

| Mexico | 320 | 30 |

| Dominican Republic | 320 | 70 |

| Poland | 260 | 50 |

| Philippines | 210 | 90 |

| United Arab Emirates | 210 | 90 |

| Portugal | 210 | 10 |

| Morocco | 210 | 40 |

| New Zealand | 210 | 110 |

| Switzerland | 170 | 20 |

| Vietnam | 170 | 1,600 |

| Hong Kong | 170 | 1,000 |

| Kenya | 170 | 20 |

| Austria | 140 | 10 |

| Japan | 140 | 260 |

| Taiwan | 140 | 2,400 |

| Chile | 140 | 20 |

| Bangladesh | 140 | 20 |

| Peru | 140 | 10 |

| Turkey | 110 | 90 |

| Ireland | 110 | 10 |

| Algeria | 110 | 10 |

| Venezuela | 110 | 10 |

| Ecuador | 110 | 10 |

| Greece | 90 | 20 |

| Egypt | 90 | 20 |

| Cyprus | 90 | 70 |

| Uzbekistan | 90 | 10 |

| Cambodia | 90 | 70 |

| Saudi Arabia | 70 | 20 |

| Ghana | 70 | 10 |

| Uganda | 70 | 10 |

| Mongolia | 70 | 10 |

| Sri Lanka | 50 | 10 |

| Jordan | 30 | 10 |

| Bolivia | 30 | 10 |

| Costa Rica | 30 | 10 |

| Tanzania | 30 | 10 |

| Ethiopia | 30 | 10 |

| Botswana | 30 | 10 |

| Panama | 20 | 10 |

| Mauritius | 20 | 50 |

9,900 1st | |

1,600 2nd | |

2,400 3rd | |

590 4th | |

2,400 5th | |

1,900 6th | |

1,600 7th | |

720 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Eightcap receiving 259,000 visits vs. 100,000 for TMGM.

Our Most Popular Broker Verdict

Eightcap is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

7. Eightcap: Top Product Range And CFD Markets

Regardless of which broker you trade with, you can be sure to have a wide range of CFDs (forex, indices, etc.), stocks and ETFs, and cryptos available for you to trade.

On Eightcap, you have access to 46 different currency pairs ranging from the EUR/USD to the GBP/AUD or even the NZD/CAD. What makes Eightcap stand out as a top broker is its crypto range. They have a staggering 250+ crypto options available, with many of the biggest cryptocurrencies like Bitcoin or Ethereum available against fiat currencies and even themselves.

TMGM offers 60 forex pairs, slightly more than Eightcap does. However, while TMGM does have a strong range of stocks, they have a much weaker cryptocurrency offering, with just 12 cryptos in their range.

Our Top Product Range and CFD Markets Verdict

If you are exclusively looking for forex, we recommend TMGM for its slightly wider range of currencies. However, our overall product winner is Eightcap, as they have carved out a niche for themselves in the crypto trading space.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

8. Eightcap: Superior Educational Resources

Eightcap:

- Offers a comprehensive library of educational videos.

- Provides detailed market analysis reports.

- Features webinars with industry experts.

- Includes beginner-friendly tutorials.

- Has advanced trading strategies for professionals.

- Supports a community forum for traders to discuss and learn.

TMGM:

- Boasts an extensive collection of e-books and articles.

- Delivers daily market insights and updates.

- Organizes live training sessions for traders.

- Contains step-by-step trading guides.

- Showcases expert interviews and panel discussions.

- Encourages a learning community through its blog.

Our Superior Educational Resources Verdict

Based on our team’s testing, Eightcap scores higher in educational resources, making it the superior choice for traders seeking comprehensive learning materials.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

9. Eightcap: Superior Customer Service

In the realm of forex trading, customer service plays a pivotal role. Traders often find themselves in situations where they need immediate assistance, be it for technical issues, account queries, or even market insights. We’ve delved deep into the customer service offerings of both Eightcap and TMGM to provide a comprehensive comparison.

Eightcap prides itself on its responsive customer support team, which is available 24/5. They offer multiple channels of communication, ensuring that traders can reach out via their preferred method. TMGM, on the other hand, also boasts a robust customer support system with a focus on providing timely and accurate responses.

| Feature | Eightcap | TMGM |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Based on our team’s testing and scores, Eightcap slightly edges out TMGM in terms of customer service, offering a more comprehensive and responsive support system for traders.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

10. Eightcap: Better Funding Options

Eightcap and TMGM allow you to deposit funds using typical payment methods that you might be used to.

TMGM funding can be done through bank transfers, Visa/Mastercard debit cards or credit cards, as well as POLi in Australia. Note that you can only withdraw via bank transfer. The minimum deposit requirement is $100 of your base currency.

Our Better Funding Options Verdict

Eightcap offers the above methods of payment as well, but also goes beyond that. If you are trading in Australia, you can also deposit with BPay. All forex traders can deposit with eWallets like PayPal, Neteller and Skrill. If you are trading from outside Australia, you can even fund your account with crypto like Bitcoin, something most brokers don’t allow.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

11. Tie: Lower Minimum Deposit

Eightcap and TMGM both have a $100 minimum deposit requirement. So far, the difference we have noticed between the two brokers is the funding methods they offer.

For instance, here are Eightcap’s top payment channels, along with some major currencies:

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | N/A | $100 | €100 | N/A |

| Neteller | N/A | $100 | €100 | N/A |

With TMGM, Skrill is only available for trading via USD, so we provided Wise instead below.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Bank Wire | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Wise | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

| Neteller | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $100 |

To conclude, here are the brokers’ required and recommended deposits:

| Minimum Deposit | Recommended Deposit | |

| Eightcap | $100 | $200 |

| TMGM | $100 | $500 |

Our Lower Minimum Deposit Verdict

Both brokers offer accessible entry points with their $100 minimum requirement and what we consider to be a reasonable amount for any trader to start a position.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

Is TMGM or Eightcap The Best Brokers?

Eightcap is the winner because it consistently outperforms TMGM in most of the key areas we’ve evaluated, offering traders a more comprehensive and competitive trading experience. The table below summarises the key information leading to this verdict:

| Criteria | Eightcap | TMGM |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ✅ |

Eightcap: Best For Beginner Traders

Eightcap offers a more user-friendly platform and resources, making it the ideal choice for beginner traders.

Eightcap: Best For Experienced Traders

While both brokers cater to experienced traders, Eightcap provides a more comprehensive range of tools and features that seasoned traders might find beneficial.

FAQs Comparing Eightcap Vs TMGM

Does TMGM or Eightcap Have Lower Costs?

Eightcap generally offers lower costs compared to TMGM. With competitive spreads starting from just 0.0 pips, traders can benefit from cost-effective trading. It’s essential to consider both spreads and commissions when evaluating total trading costs. For a more detailed comparison, you can explore the Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Eightcap and TMGM offer MetaTrader 4, a popular trading platform among forex traders. However, Eightcap provides additional integrations and features that enhance the MT4 trading experience. If you’re keen on exploring, here’s a list of the best MT4 brokers worldwide.

Which Broker Offers Social Trading?

Eightcap offers social trading features, allowing traders to copy strategies from experienced traders. Social or copy trading can be an excellent way for beginners to learn from seasoned professionals. For a deeper insight, check out the best social trading platforms for forex.

Does Either Broker Offer Spread Betting?

Neither Eightcap nor TMGM offer spread betting to their clients. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of market movements without owning the underlying asset. If you’re interested in exploring brokers that do offer this service, here’s a list of the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Eightcap holds a slight edge for Australian forex traders. Both brokers are ASIC regulated, ensuring a high level of trust and security for traders. However, Eightcap, being founded in Australia, has a deeper understanding of the local market dynamics. TMGM, while offering robust services, is based overseas. For a comprehensive look at the best options available, you might want to explore this list of Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally feel that TMGM offers a more tailored experience. While both brokers provide top-notch services, it’s crucial to note that neither of them is FCA-regulated or founded in the UK. This means that UK traders should exercise caution and ensure they’re comfortable with the regulatory environment of their chosen broker. For those keen on exploring UK-specific options, here’s a guide to the Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert