Fusion Markets vs IC Markets: Which Broker is Better?

In this comparison guide, I’ll put Fusion Markets and IC Markets head-to-head to see which broker comes out on top.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Before I get into the full breakdown, here’s a quick overview of how Fusion Markets and IC Markets compare across the fundamentals:

- IC Markets offers raw spreads from 0.0 pips and fast order execution

- Fusion Markets has a zero minimum deposit requirement

- Fusion Markets allows leverage up to 500:1 while IC Markets allows up to 1:1000

1. Lowest Spreads And Fees – IC Markets

In forex, the tighter the spreads, the more room you’ve got to let trades run, especially if you’re in and out of the market often. That’s why traders gravitate toward brokers like IC Markets and Fusion Markets.

Standard Account

Both push a low-cost model with tight spreads and no commission on standard accounts, but the real question is: who’s actually giving you better value where it counts?

I ran the numbers using our standard account data at CompareForexBrokers and on paper, the two brokers are pretty competitive.

Fusion starts out reasonably with 0.89 pips on EUR/USD and 1.05 on USD/CAD. IC Markets comes in lower at 0.82 and 1.05 respectively. Dig a little deeper and IC Markets continues to pull ahead. On majors like USD/JPY and GBP/USD, Fusion widens to 1.2 and 1.11 pips. Meanwhile, IC holds tighter at 0.94 and 1.03.

That may not seem like much, but across dozens or hundreds of trades, it makes IC Markets a more cost-effective option.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall | |

|---|---|---|---|---|---|---|---|---|---|

| IC Markets | 0.82 | 0.94 | 1.03 | 0.83 | 1.05 | 1.27 | 1.3 | 1.5 | 1.09 |

| Fusion Markets | 0.89 | 1.2 | 1.11 | 0.95 | 1.05 | 1.06 | 1.43 | 1.49 | 1.15 |

Raw Account

Raw accounts work by giving you ultra-tright spreads straight from the market (often close to zero) and charging a flat commission instead. So instead of paying, say, a 1-pip spread like on standard accounts, you might get 0.02 pips plus a $3.50 commission per side.

Fusion Markets has built much of its reputation on being competitive on this account type, and to be fair, it holds up well. Spreads on majors like EUR/USD and USD/CAD come in at 0.09 and 0.23 respectively which I find well within industry averages.

IC Markets maintains lower raw spreads with better consistency e.g 0.02 on EUR/USD and AUD/USD at 0.03. Even cross pairs like EUR/JPY and AUD/JPY have noticeably tighter spreads than Fusion.

RAW Account Spreads | |||||

|---|---|---|---|---|---|

| 0.31 | 0.12 | 0.14 | 0.38 | 0.13 |

| 0.03 | 0.04 | 0.01 | 0.27 | 0.02 |

| 0.30 | 0.30 | 0.10 | 0.30 | 0.10 |

| 0.14 | 0.18 | 0.90 | 0.14 | 0.13 |

| 0.24 | 0.70 | 0.16 | 0.54 | 0.29 |

| 0.64 | 1.59 | 0.51 | 0.94 | 1.15 |

| 0.35 | 0.45 | 0.18 | 0.36 | 0.60 |

| 0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-03

Commission Rates

Fusion charges just $2.25 per side (that’s $4.50 round-turn) for USD and AUD accounts, one of the lowest rates in the industry. IC Markets, by comparison, charges $3.50 per side in USD and $4.50 in AUD, which is $7.00 or $9.00 round-trip respectively.

Fusion clearly wins on raw commission costs. Combine that with decent spreads, and I think it becomes a compelling choice for scalpers, high-frequency traders, and anyone running EAs.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Fusion Markets | $2.25 | $2.25 | N/A | N/A |

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

Verdict

When you factor in total trading cost (spread plus commission) IC Markets still comes out cheaper overall for most traders. While Fusion Markets wins on commission pricing, IC more than makes up for it with consistently tighter spreads across both standard and raw accounts.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platforms – IC Markets

Fusion Markets and IC Markets offer an impressive lineup of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and even TradingView.

Regardless of whether you prefer manual charting, social trading, or full-blown automation, you’ll find a suitable platform with both brokers. I’ve created a software questionnaire to help you find the platform that best suits your trading style.

Now, if you’re choosing IC Markets, I’d lean hard into MetaTrader 5. This isn’t just the newer version of MT4 but a major step up in performance and functionality.

You get advanced order types, improved charting, Level II market depth, a more powerful strategy tester for EAs. Besides, you get access to MetaQuotes Language 5 (MQL5) which opens the door to faster, more complex automation.

It’s particularly well-optimised for IC’s Raw Pricing infrastructure, which connects you to over 25 liquidity providers through servers located in Equinix NY4. This setup results in sub-millisecond execution speeds and no trading restrictions.

If you’re trading with Fusion Markets, MetaTrader 4 is the platform I’d recommend every time. It’s an industry veteran and many still find it fast, stable, and battle-tested across every kind of market condition.

With Fusion’s version of MT4, you’re getting flexible order types, 50+ built-in indicators, and one-click execution all powered by Fusion’s low-cost infrastructure. That means lightning-fast trade execution, raw pricing, and seamless integration with the Fusion Hub, where you can manage accounts, funding, and performance.

| Trading Platform | Fusion Markets | IC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | No | Yes |

In both cases, copy trading is fully supported, but the experience depends on the platform you’re using and how involved you want to be.

IC Markets nails the integration side with cTrader Copy built directly into the cTrader platform. Forget the hassle of having to log in to external accounts and switching between tools. And I like that it actually gives you proper filters e.g you can sort strategies by ROI, drawdown, win rate, trade frequency, and more.

Fusion Markets goes the third-party route, partnering with DupliTrade, which is a separate web-based platform. You get access to a smaller, curated pool of professional traders which I think is an advantage if you prefer vetted signals over the wild west of social trading.

The strategies tend to be more conservative, often from institutional-style managers, but it’s not as flexible or customizable as cTrader Copy.

Verdict

IC Markets edges out Fusion with not just a wider selection of platforms, but a deeper tech stack behind them.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

IC Markets gives you options, maybe too many if you’re just starting out, but perfect if you want flexibility. You can choose between a Raw Spread account or Standard, depending on whether you’d rather pay commissions or slightly higher spreads.

And if you’re using cTrader, there’s a dedicated Raw account just for that, with seamless TradingView integration for advanced charting and strategy sharing.

Leverage goes as high as 1:1000, and IC Markets puts no restrictions on trading strategies. You can scalp, hedge, automate with EAs, whatever fits your style. Micro lot trading is available on all accounts, and for those who need it, Islamic account options are on offer too.

With Fusion Markets you get two core account types: Zero and Classic accounts. The Zero (Raw) account has raw spreads and low commissions, and the Classic Account rolls everything into a slightly higher spread. You’ve also got swap-free and demo account options available.

| Fusion Markets | IC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Verdict

Whether you’re a scalper, algo trader, or discretionary trader, you’ll find that IC Markets delivers more depth, flexibility, and raw performance in their account structure.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience – Fusion Markets

For me, a great trading experience usually comes down to how smooth the platform runs day-to-day, and how quickly and cleanly my trades are executed. The faster your trades hit the market, the less exposure you have to slippage and missed entries.

Fusion Markets ranks #2 overall for execution speed and sits right near the top for both limit and market order performance. In fact, it ranks #1 for market order speed, clocking in at just 77 milliseconds, and #3 for limit orders at 79 ms.

IC Markets, despite its infrastructure, lands further down the list at #17 overall, with 153 ms on market orders and 134 ms for limit orders. Still fast by global standards, but clearly slower than Fusion.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 5 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| Octa | 4 | 81 | 4 | 91 | 6 |

| OANDA | 5 | 86 | 5 | 84 | 2 |

| Exness | 6 | 92 | 10 | 88 | 3 |

| Blueberry Markets | 7 | 88 | 6 | 94 | 7 |

| FOREX.com | 8 | 98 | 13 | 88 | 4 |

| Global Prime | 9 | 88 | 7 | 98 | 9 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

Fusion’s lightning fast execution partnered with stable, intuitive, and consistently responsive platforms provide the best trading experience. Whether you’re trading on MT4, MT5, or cTrader, the platform holds up well during peak hours without lags and freeze-ups.

Verdict

Both are top ECN brokers but in my view, Fusion Markets offers a smoother, faster trading experience.

5. Stronger Trust And Regulation – IC Markets

I use three key criteria to gauge a broker’s trust level: regulation, reputation and reviews. IC Markets got a trust score of 80/100 in my reviews while Fusion managed 63/100. I’ll quickly break down why I awarded them these scores.

IC Markets Trust Score

Fusion Markets Trust Score

1. Regulation

Both brokers are licensed by ASIC, a Tier 1 regulator known for its strict oversight. But IC Markets adds another layer of credibility with additional licenses from CySEC and several Tier 3 jurisdictions, including the FSA (Seychelles) and the SCB.

Fusion, by contrast, is regulated only by ASIC and the VFSC, which is widely considered a lighter regulatory environment.

| Fusion Markets | IC Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | VFSC FSA-S (Seychelles) | FSA-S (Seychelles) SCB (Bahamas) |

2. Reputation

IC Markets also benefits from deeper brand trust, built over nearly two decades. Launched in 2007, it’s one of the longest-running forex brokers in the retail space. Fusion, in comparison, only opened its doors in 2017 so they’re still relatively new players in the industry.

3. Reviews

Fusion Markets holds a Trustpilot score of 4.7 out of 5, based on around 3,700 reviews. IC Markets, on the other hand, scores 4.8 out of 5 from a much larger pool of over 46,000 reviews. While both brokers are highly rated, IC Markets has a more extensive and consistently positive review history, suggesting broader trust and reliability among traders

Verdict

IC Markets has been around longer, holds more licenses, and operates under stricter global oversight. That makes it the more secure choice in terms of trust and regulatory strength.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

Popularity doesn’t always mean quality but in forex and CFD trading, it usually reflects reach, reliability, and trader confidence at scale. On that front, IC Markets leaves Fusion Markets in the dust.

According to Similarweb data, IC Markets leads in global site visits and also sees significantly more branded searches on Google. That means more traders are actively looking for the broker by name, not just generic forex terms. If you ask me, that’s a clear sign of strong brand recognition and loyalty.

Across nearly every major trading region, from the UK and India to South Africa, Vietnam, and Brazil, IC Markets attracts significantly more users.

In the UK, for instance, IC sees 33,100 visits, compared to just 1,900 for Fusion. In South Africa, it’s 9,900 vs. 720. Even in Fusion’s home turf, Australia, IC Markets draws more attention with 6,600 visits to Fusion’s 1,900.

| Country | Fusion Markets | IC Markets |

|---|---|---|

| United Kingdom | 1,900 | 33,100 |

| South Africa | 720 | 9,900 |

| Thailand | 480 | 8,100 |

| India | 1,900 | 8,100 |

| Vietnam | 210 | 8,100 |

| Australia | 1,900 | 6,600 |

| United States | 2,900 | 6,600 |

| Spain | 480 | 6,600 |

| Germany | 880 | 5,400 |

| Pakistan | 480 | 5,400 |

| Brazil | 480 | 4,400 |

| France | 1,300 | 4,400 |

| United Arab Emirates | 320 | 4,400 |

| Morocco | 260 | 4,400 |

| Malaysia | 590 | 3,600 |

| Colombia | 110 | 3,600 |

| Italy | 1,000 | 3,600 |

| Indonesia | 320 | 3,600 |

| Singapore | 390 | 3,600 |

| Nigeria | 390 | 3,600 |

| Poland | 480 | 2,900 |

| Sri Lanka | 880 | 2,900 |

| Kenya | 390 | 2,400 |

| Mexico | 110 | 2,400 |

| Hong Kong | 170 | 2,400 |

| Netherlands | 590 | 2,400 |

| Philippines | 1,000 | 2,400 |

| Canada | 1,900 | 2,400 |

| Algeria | 170 | 2,400 |

| Bangladesh | 390 | 1,900 |

| Saudi Arabia | 140 | 1,900 |

| Peru | 30 | 1,600 |

| Egypt | 170 | 1,600 |

| Switzerland | 140 | 1,600 |

| Turkey | 390 | 1,300 |

| Argentina | 90 | 1,300 |

| Japan | 170 | 1,300 |

| Sweden | 140 | 1,300 |

| Ecuador | 50 | 1,000 |

| Taiwan | 50 | 1,000 |

| Dominican Republic | 140 | 1,000 |

| Portugal | 170 | 1,000 |

| Uzbekistan | 40 | 1,000 |

| Cyprus | 110 | 880 |

| Ghana | 90 | 880 |

| Ireland | 90 | 880 |

| Mongolia | 10 | 720 |

| Chile | 40 | 720 |

| Venezuela | 70 | 720 |

| Ethiopia | 90 | 720 |

| Uganda | 90 | 720 |

| Austria | 110 | 720 |

| Greece | 110 | 720 |

| Jordan | 50 | 590 |

| Mauritius | 40 | 480 |

| Costa Rica | 20 | 390 |

| Tanzania | 90 | 320 |

| Bolivia | 10 | 260 |

| Botswana | 90 | 260 |

| Panama | 20 | 260 |

| New Zealand | 50 | 210 |

| Cambodia | 70 | 170 |

1,900 1st | |

33,100 2nd | |

720 3rd | |

9,900 4th | |

1,900 5th | |

8,100 6th | |

1,900 7th | |

6,600 8th |

Verdict

IC Markets is not only among the most popular brokers but it’s also one of the most visible and trusted names globally.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – IC Markets

IC Markets has a far wider range of CFD products than Fusion Markets, especially if you’re looking to trade beyond just forex.

Fusion does well in currency pairs, offering 84 forex instruments compared to IC’s 61, including some minor and exotic pairs that give you a bit more flexibility.

Outside of FX, IC Market starts to shine with 26 indices, 18 cryptocurrencies, 12 bonds, and over 2,100 share CFDs. Fusion’s 100+ shares, 15 indices, and 14 crypto pairs don’t come close.

IC Markets also provides access to futures and other investment products, while Fusion has no offering in those categories.

Energies, and soft commodities are well covered by both, but IC goes further with gold and silver crosses against multiple currencies.

| CFDs | Fusion Markets | IC Markets |

|---|---|---|

| Forex Pairs | 84 | 61 |

| Indices | 15 | 23 Spot Indices 3 Index Futures |

| Commodities | 10 Metals (+ 3 Gold Crosses) (+2 Silver Crosses) 3 Energies 11 Softs | 4 Precious Metals (gold vs 6 flats) 3 Energies 3 Energy futures 14 Soft commodity futures |

| Cryptocurrencies | 14 | 18 |

| Share CFDs | 100+ | 2100+ |

| ETFs | No | 3 NASDAQ 33 NYSE |

| Bonds | No | 12 |

| Futures | No | Yes |

| Treasuries | No | Yes |

Verdict

If you’re just trading forex pairs, Fusion gives you everything you need. But if you want to diversify your portfolio across a wide range of markets, IC Markets gives you exactly that and much more.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

I found IC Market’s trader education section decent. They have video tutorials and brief lessons on the advantages of forex and CFD trading. On top of that, you’ve got access to webinars, a podcast, WebTV content, and timely market insights.

Fusion Markets, on the other hand, offers very little in the way of education. Beyond a basic FAQ page under their help section, there’s not much designed to actually guide you through the platform, market, or trading strategies.

Verdict

If you’re still learning the ropes and want educational resources, IC Markets gives you far more to work with. It’s a strong starting point, and easy to supplement with outside resources as you go.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

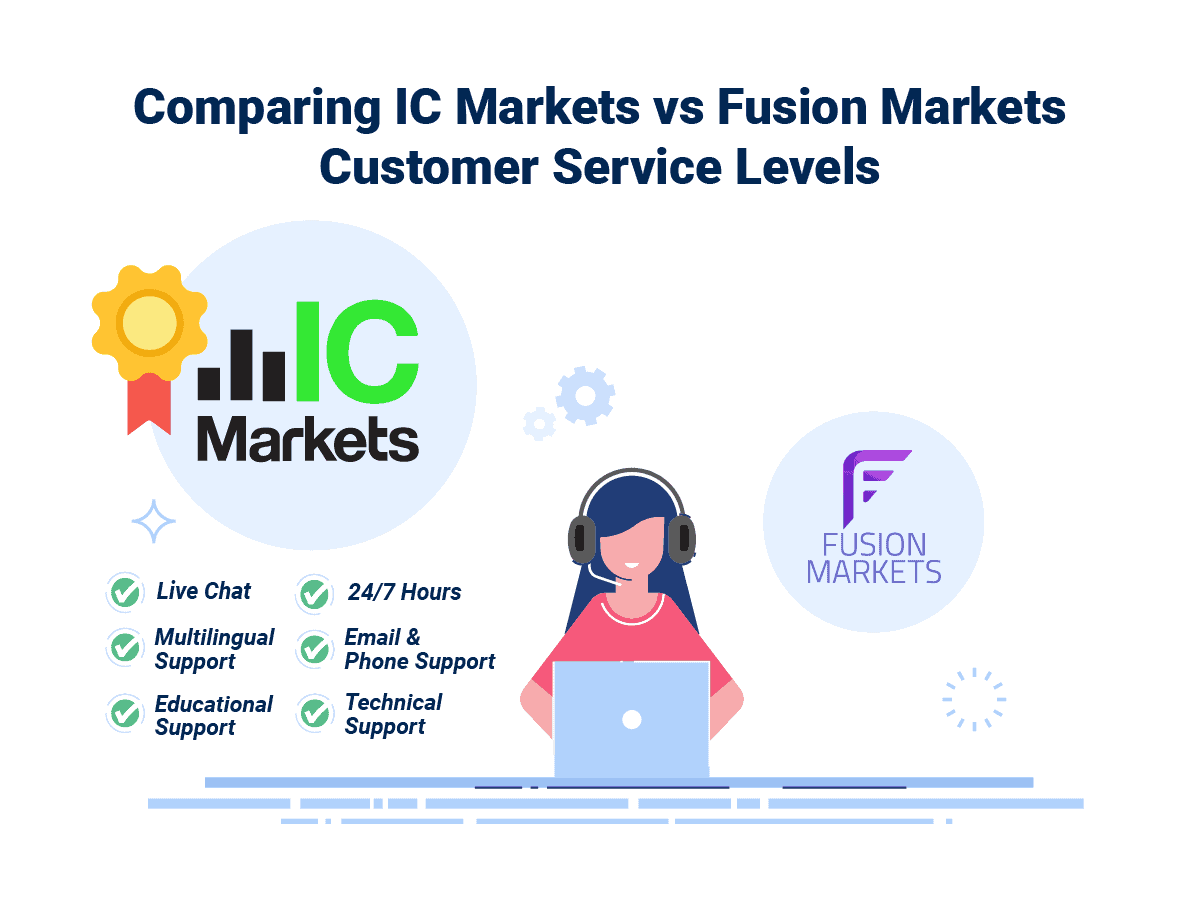

9. Better Customer Service – IC Markets

When you’re dealing with live markets, even a small delay in resolving a platform issue or funding question can cost you. That’s why responsive and knowledgeable support is an integral part of the broker you rely on to trade confidently.

Both brokers offer live chat, email, phone, and 24/7 access. You’ll also find multilingual support, so no matter where you’re trading from, you can get help when you need it.

Both brokers offer live chat, email, phone, and 24/7 access. You’ll also find multilingual support, so no matter where you’re trading from, you can get help when you need it.

IC Markets has the more refined support experience, though. Their response times were consistently faster in my tests, and I found the team better at handling complex queries despite whatever I threw at them.

| Feature | Fusion Markets | IC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | No | Yes |

Verdict

Customer support is part of what keeps your trading smooth and stress-free, and IC Markets comes out on top in this regard.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – IC Markets

I like that both Fusion Markets and IC Markets offer a wide range of funding options including bank cards, bank transfer, e-wallets, crypto, and more. Deposits are also free, fast, and typically processed within minutes.

IC Markets does offer more account base currencies, which can help reduce conversion fees if you’re trading in your local currency. But Fusion still supports all the major options, and for most traders, the experience is seamless either way.

| Funding Option | Fusion Markets | IC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Interac (Canada | Yes | No |

| Klarna | No | No |

Verdict

It’s a tie for me here as both brokers provide fast, flexible, and cost-effective funding options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Fusion Markets

Barriers to entry are low with either broker, but Fusion Markets makes it even easier to get started. There’s no minimum deposit at all, which means you can fund your account with whatever you’re comfortable with.

IC Markets has a minimum deposit requirement of $200. It’s not unreasonable and actually well within industry norms but it still isn’t a lower barrier to entry compared to Fusion.

Realistically, I’d recommend a $1,500 deposit with either broker. This will be enough to cover margin, manage risk properly, and avoid being over-leveraged.

| Minimum Deposit | Recommended Deposit | |

| Fusion Markets | $0 | $1,500 |

| IC Markets | $200 | $200 |

Verdict

Fusion Markets takes the win here. With no minimum deposit, you’ve got complete freedom whether you want to start small and build gradually or fund a full account from day one.

So Is IC Markets or Fusion Markets The Best Broker?

It depends on what matters most to you as a trader. If we’re going by overall performance, IC Markets is the stronger all-round broker. It dominates in critical areas like spreads, trading platforms, accounts and features, regulation, education, product range, and customer support.

If you’re just starting out or focused purely on raw pricing with minimal funding requirements, Fusion is a great low-cost entry point. But if you’re looking for a broker that delivers across the board, IC Markets is the better long-term choice.

| Categories | Fusion Markets | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | Yes | Yes |

| Lower Minimum Deposit | Yes | No |

Fusion Markets: Best For Beginner Traders

Fusion Markets offers a more approachable platform and a lower minimum deposit, making it a suitable choice for new traders.

IC Markets: Best For Experienced Traders

IC Markets is the best choice if you’re experienced and looking for a broker offering a wide range of markets and advanced features.

FAQs Comparing Fusion Markets Vs IC Markets

Does Fusion Markets or IC Markets Have Lower Costs?

IC Markets typically offers lower overall trading costs. While Fusion offers low raw account commissions on USD, IC makes up the difference with tighter spreads across both standard and raw accounts. On high-volume pairs like EUR/USD, IC’s spreads can drop as low as 0.1 pips. For a full breakdown of who’s offering the best rates, Check out this guide on the Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

IC Markets offers a more advanced MT4 experience. With its custom suite of 20+ trading tools, enhanced order management features, and deeper liquidity connections, IC’s MT4 setup is built for serious trading. If you’re relying on MT4 for scalping, EAs, or advanced charting, IC provides more power straight out of the box. For a closer look at the top MT4 setups in the market, check out this list of the best MT4 brokers.

What Broker is Superior For Australian Forex Traders?

If you’re trading from Australia, IC Markets is the clear pick. They’re ASIC-regulated, have deep local roots, and offer more firepower across platforms, tools, and liquidity. Add in their long-standing reputation and institutional-grade infrastructure and you’ve got a broker built for serious Aussie traders. Check out our Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, IC Markets is the safer, more established choice. They’re FCA-regulated which means strict oversight, strong client protections, and the credibility that comes with one of the world’s top-tier regulators. Fusion doesn’t hold an FCA license, and for traders who prioritise local compliance, that’s a deal-breaker. Here’s our full guide to the Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the COO & Co-Founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does Fusion Markets accept crypto?

Yes, Fusion Markets accepts crypto as a funding method.

Which broker is best for scalping?

Both Fusion Markets and IC Markets are among the very best brokers in the market for scalping. Both have low spreads, low commissions and good automation. Fusion is might be slightly better given they have lower commissions and faster execution speed.