Pepperstone vs IC Markets: Which One is Best?

Our review found that Pepperstone offers a superior trading experience vs IC Markets across MetaTrader and cTrader. However, IC Markets offers lower spreads on the EUR/USD vs Pepperstone. Take a look at our detailed analysis to tease out the subtle differences and figure out which platform aligns best with your trading style.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors between Pepperstone and IC Markets.

- Pepperstone provides a superior trading experience across MetaTrader and cTrader platforms.

- IC Markets features lower spreads on the EUR/USD compared to Pepperstone.

- Pepperstone operates in more jurisdictions being regulated by top-tier authorities.

- IC Markets offers a broader range of CFDs, including bonds, futures, and stocks.

- Pepperstone has faster execution speeds, minimising slippage for traders.

1. Lower Trading Fees – Pepperstone

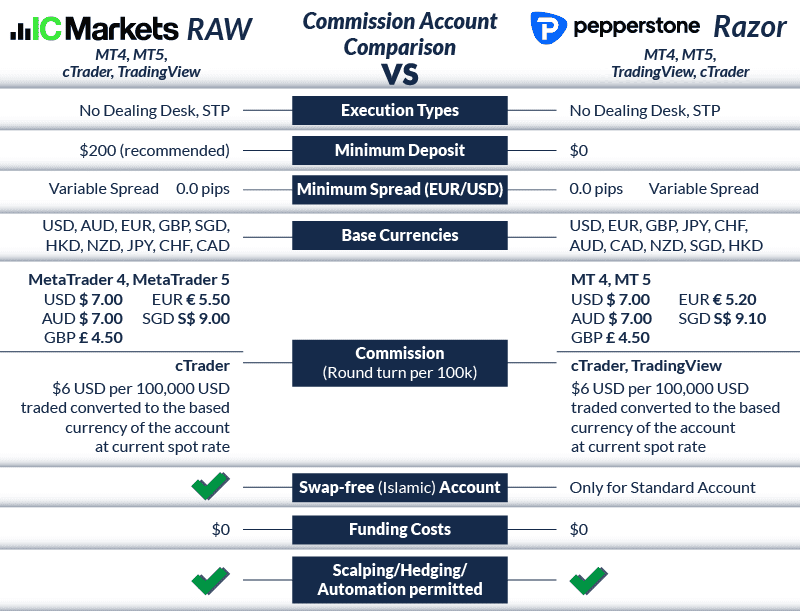

We compared both brokers’ ECN accounts (Spread + Commission) which for IC Markets is the RAW Account and for Pepperstone is the Razor Account. Our findings are that IC Markets has lower fees due to lower average spreads.

The exception is for European (EUR) and Australian (AUD) traders where Pepperstone has lower fees due to IC Markets’ higher commission rates. Our fee calculator explains the trading fees for different base currencies and currency pairs.

Pepperstone vs IC Markets Fee Calculator

Average Spreads

IC Markets average spread is 38% lower than Pepperstone based on the 9 most traded currency pairs. As shown below, Pepperstone only had a lower average spread on the EUR/GBP current pair.

| IC Markets Average Spread | Pepperstone Average Spread | Industry Average Spread | |

|---|---|---|---|

| All Currency Pairs | 0.29 | 0.47 | 0.72 |

| EUR/USD | 0.02 | 0.1 | 0.28 |

| USD/JPY | 0.14 | 0.3 | 0.44 |

| GBP/USD | 0.23 | 0.3 | 0.54 |

| AUD/USD | 0.03 | 0.2 | 0.45 |

| USD/CAD | 0.25 | 0.4 | 0.61 |

| EUR/GBP | 0.27 | 0.2 | 0.55 |

| EUR/JPY | 0.3 | 0.71 | 0.74 |

| AUD/JPY | 0.5 | 0.5 | 0.93 |

| USD/SGD | 0.85 | 1.5 | 1.97 |

It’s important to note that both raw account average spreads were far lower than the industry average (which we based on 38 brokers’ published spreads).

Commission Rates

Pepperstone has lower commission rates depending on the base currency chosen. In 2025 IC Markets increased their commission rates and now charge a higher commission compared to Pepperstone for the AUD, GBP, EUR, CAD and SGD base currency accounts.

| Account Base Currency | USD | AUD | GBP | EUR | CAD | SGD |

|---|---|---|---|---|---|---|

| IC Markets | $3.50 | $4.50 | £2.75 | €3.25 | $4.75 | $4.75 |

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 | $3.50 | $4.55 |

This is based on their MetaTrader 4 (MT4) rates and these can be slightly different if you choose their cTrader or TradingView platform option.

Our Final Verdict On Brokerage

While IC Markets does have the lowest spreads, Pepperstone has the lowest commission rates depending on the base currency leading to these findings:

- Pepperstone is the cheapest for Australian traders (AUD base currency)

- Pepperstone is the cheapest for European traders (EUR base currency)

- IC Markets is the cheapest for UK traders (GBP base currency)

- IC Markets is the cheapest for traders using the USD as their base currency

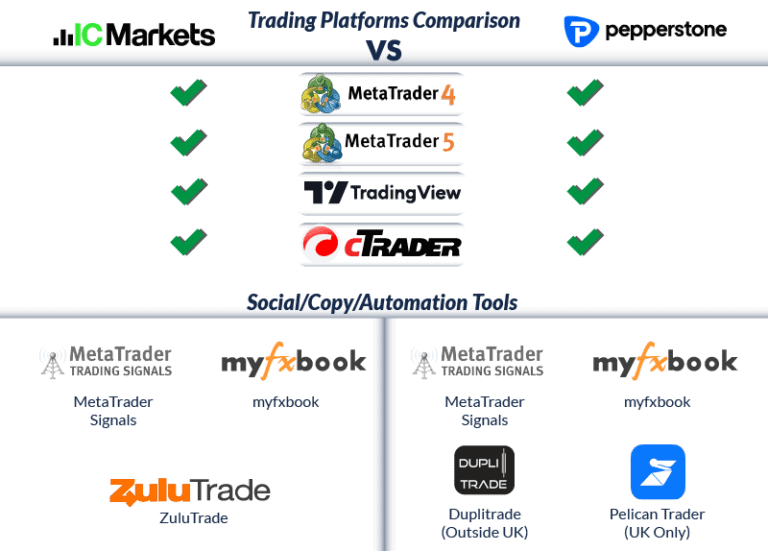

2. Better Trading Platform – Pepperstone

| Pepperstone | IC Markets | |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Both Pepperstone and IC Markets offer MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These solutions are suitable for Windows, Mac, iOS, and Android as desktop or web trader platforms as well as mobile apps.

MetaTrader 4 (MT4)

MetaTrader 4 (MT4)

MT4 is the most commonly used forex platform in the world. Since most brokers offer this platform, there are low barriers to switching brokers. MetaTrader 4 has an:

- Easy to use interface that is very easy to use with prompt order management functionality.

- Algorithmic trading and access to expert advisors for scalping traders.

Pepperstone MetaTrader 4 Features

Smart Trader Tools is a Pepperstone MT4 enhancement that has 10 main features such as:

- Alarm Manager for notifications and alerts.

- Connect, a central portal with an economic calendar and RSS feed for news and guides.

- Correlation Matrix that shows a relationship between different assets and markets.

- Correlation Trader to find similarities and differences between markets.

- Excel RTD offers real-time analysis, monitoring and reporting through Excel.

- Market Manager gives insights into open, pending orders and market prices.

- Sentiment Trader to understand live sentiment data to assist with trade decisions.

- Stealth Orders allow traders to hide their pending orders from the market.

- Trade Simulator offering profit and loss results based on tested strategies.

- Session Map showing what markets are open at different time periods.

Overall, Smart Trader Tools offers Pepperstone traders using MetaTrader 4 with decision assistance, sophisticated trade management, and execution. Market data is also transmitted to traders, while alarms help notify traders of key market events.

IC Markets MetaTrader 4 Features

Advanced Trading Tools was IC Markets’ answer to Smart Trader Tools with 20 features. Advanced Trading Tools contains all the features Smart Trader Tools offer but includes additional features:

- Trader Terminal which offers an all-in-one market watch, account summary and order list.

- Market Manager offers a watch list of all open positions and shows headline account information.

- Smart Lines uses items plotted on charts that become a stop-loss or take-profit position.

Overall, we found Pepperstone topped the list of the Best MT4 Brokers

MetaTrader 5

MetaTrader 5 is designed for CFD trading. Both Pepperstone and IC Markets offer Share CFD trading and, therefore, offer MT5. Below is a table comparing the differences:

| MetaTrader 4 | MetaTrader 5 | |

|---|---|---|

| General availability | Common | Growing |

| Number of Analytical tools | 33 | 68 |

| Number of indicators | 30 | 38 |

| Timeframes | 9 | 21 |

| Programming Language (for expert advisors) | MQL4 | MQL5 |

| Number of orders executable | 3 | 4 |

| Number of pending orders available | 4 | 6 |

| Partial Order Filling Policies | No | Yes |

| Order Fill Policy | Fill or Kill | Fill or Kill Immediate or Cancel Return |

| Hedging | Yes | Yes (since 2016) |

| Threading | 32bit / 2GB | 64 Bit / 4Gb |

| Speed / Stability | Fast / Stable | Faster / More Stable |

| CFD Trading | Decentralised | All (Decentralised and trading exchanges) |

| Strategy Tester | Single Thread | Multi-threaded + Multi-currency + Real ticks |

| Economic Calendar | with Add on | Yes |

| Depth of Market | No | Yes |

Our Best MT5 Brokers comparison found that IC Markets was the best broker for this CFD platform.

Other Platforms

MT WebTrader

Both brokers offer MT WebTrader, which is a MetaTrader platform for trading via web browsers. WebTrader offers many of the features available on MT4 but is designed to handle better the natural limitations mobiles will have due to size.

cTrader

cTrader is an alternative trading platform for MetaTrader. The platform is generally considered to have superior technical charting options than MetaTrader, along with offering faster execution. Key features of cTrader include:

- 26 Timeframes (MT5 only has 21)

- Ability to reverse position with one click

- Level II Depth of Market

- Mobile browser trading

- Ability to close all positions with one click

- Cloud-hosted profiles, passwords and templates

If you are looking to trade other derivatives than forex pairs, then cTrader might not be the best option. This is because cTrader is not designed for CFD and cryptocurrency trading. Its strength is in forex.

Social Trading And Copy Trading Platforms

Both brokers offer a range of social, copy and mirror trading platforms. Pepperstone offers Myfxbook, ZuluTrade, MirrorTrader, RoboX, MetaTrader Signals and DupliTrade. IC offers Myfxbook AutoTrade and ZuluTrade.

Verdict

Pepperstone is the winner for the forex platform category based on the unique software features offered, fast execution speeds and additional trading platform enhancements.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.3% of retail CFD accounts lose money’

3. Superior Trading Accounts – Pepperstone

Pepperstone and IC Markets offer two types of accounts: one that includes their fees through the bid-ask spread and one that keeps the spread at market price but charges a commission instead.

Both Pepperstone and IC Markets have no dealing desk and use straight-through processing (STP) to connect you with a large pool of liquidity providers. This allows both brokers to deliver their clients some of the most competitive spreads in the market.

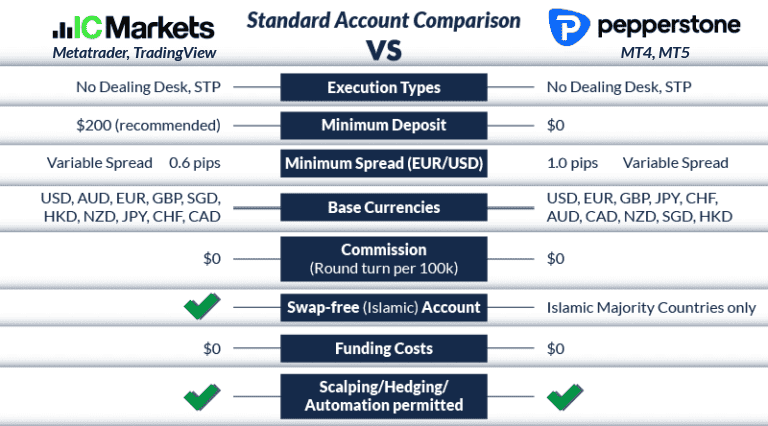

Standard Accounts

You won’t be charged a commission on trades when using standard accounts. Instead, brokers charge through the bid-ask spread, which is the difference between the buy and sell price of CFD products.

Each month, the team at CompareForexBrokers.com takes the average spreads published on brokers’ websites and compiles them in table format for you to compare.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

0.82 | 0.83 | 1.27 | 1.03 | 0.94 |

|

1.10 | 1.10 | 1.20 | 1.20 | 1.20 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

0.90 | 1.54 | 1.52 | 1.78 | 1.90 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.3% of retail CFD accounts lose money’

Looking at the table, the IC Markets standard accounts have tighter spreads compared to Pepperstone (and other competitors). Standard accounts are competitive with both brokers, but IC Markets might be the better choice since their minimum spread is lower, this being 0.6 pips for the EUR/USD.

One thing to note is that the cTrader and TradingView (in the case of Pepperstone) trading platforms are not available for this account.

Another feature to note is that swap-free trading is available to traders who follow Sharia law. Pepperstone, however, only offers this to clients in Muslim-majority countries such as the UAE, Indonesia, Morocco, etc.

Commission Accounts

Both IC Markets and Pepperstone also offer commission accounts that are structured differently from standard accounts. The fees are charged for each lot you trade rather than being included in the bid-ask spread. Despite commission fees, trading costs are slightly lower with this type of account.

As we did with the Standard account, we compiled the published spreads from a range of brokers for the commission account.

|

ECN Broker Spreads

|

|||||

|---|---|---|---|---|---|

|

0.14 | 0.25 | 0.02 | 0.27 | 0.03 |

|

0.20 | 0.40 | 0.10 | 0.20 | 0.10 |

|

0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

|

0.30 | 0.50 | 0.30 | 0.50 | 0.40 |

|

0.24 | 0.70 | 0.16 | 0.54 | 0.29 |

|

0.30 | 0.70 | 0.20 | 0.50 | 0.40 |

|

0.60 | 0.15 | 0.10 | 0.70 | 0.60 |

|

0.63 | 1.13 | 0.21 | 0.73 | 0.90 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

IC Markets ReviewVisit IC Markets

The table above shows that spread costs tend to average around 0.10 pips.

Broker Risk Management

Pepperstone and IC offer risk management features in the form of order types and investor protection policies. As both brokers operate multiple subsidiaries, the level of investor protection you will receive varies depending on where you reside and the branch you are trading with.

Investor Protection Policies

Regardless of the broker or subsidiary, your trading account balance will be held in a bank account that is segregated from the broker’s operational capital. Segregated client funds protect your money in case a broker becomes insolvent, and this is common practice throughout the world.

Those trading with IC Markets CySEC regulated branch, and Pepperstone’s CySEC, BaFin and FCA regulated branches will receive negative balance protection (NBP). NBP ensures your trading account balance cannot enter a negative balance if the market moves against you. This means you will never end up owing money to IC Markets or Pepperstone, as your open positions will automatically be closed before your balance hits zero.

While NBP is only required in European and UK financial jurisdictions, ASIC, a few years ago, introduced their own stricter CFD and forex trading rules, including NBP.

Order Types

Both Pepperstone and IC Markets lack premium pending order types. However, there are standard order types like limit and stop orders available on all trading platform options:

- Margin Stop Out: notifies you when a trader’s balance is heading below a minimum amount. The broker will automatically seek to exit the trader from the market before they dip below zero. This is a type of negative balance protection.

- Margin Stop Loss Order: this means traders can set the amount they are prepared to lose trading currency pairs. Brokers will try to get the trader out of a position before the set amount has been crossed. This is, however, not guaranteed.

It should be noted that CFDs are complex instruments involving high risk due to leverage. Retail investor accounts can lead traders to high losses even with risk management features such as stop-loss orders in certain trading conditions. It’s important to understand the risks before trading.

| Pepperstone | IC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | No |

Verdict

IC Markets appears to be slightly lower than Pepperstone, but both brokers are very competitive, making either broker a safe choice. Spreads with each broker are variable and can be as low as 0.0 pips for the EUR/USD pair. Should you trade at this price, you will not be paying any spread fees when trading.

4. Best Trading Experience – Pepperstone

When it comes to trading experience and ease, both Pepperstone and IC Markets stand out in the forex industry. Pepperstone, with its award-winning customer service, ensures that traders have a seamless experience complemented by top-notch educational resources. On the other hand, IC Markets offers 24/7 support, catering to traders across different time zones, and a comprehensive Help Centre for self-help.

- Pepperstone’s Smart Trader Tools enhance the MT4 experience with features like Alarm Manager and Sentiment Trader.

- IC Markets has Advanced Trading Tools with over 20 features, ensuring a comprehensive trading experience.

- Both brokers offer popular platforms like MT4, MT5, and cTrader, catering to various trader preferences.

- cTrader, known for its superior technical charting, is available with both brokers, offering features like Level II Depth of Market.

Upon further investigation, we discovered that both brokers prioritise providing a positive user experience. The platforms are designed in a user-friendly manner, making them easy to navigate even for beginners. Traders, whether novice or experienced, have access to a vast array of tools and features. Pepperstone and IC Markets have made significant efforts to ensure their users receive the best possible trading experience.

Here are some additional insights related to the trading experience and ease of Pepperstone and IC Markets:

- Pepperstone is recognised as the best for MT4 trading, highlighting its rich features and user experience.

- IC Markets stands out as the best for MT5 trading, offering advanced tools and a seamless trading environment.

- Both brokers are not the leading choice for cTrader, with Fusion Markets taking the top spot in this category.

- IC Markets has one of the best standard accounts, ensuring traders have a balanced and efficient trading experience.

Broker Execution Speeds

Both IC Markets and Pepperstone achieve the fastest execution speeds in the industry by using dedicated fibre optic cables. Faster execution speeds help prevent ‘slippage’ from occurring.

Pepperstone Edge Technology

Pepperstone Edge Technology, when it comes to faster and better trading, consists of the following:

- Speedier Execution with a designated fibre optic cable. This achieves the maximum possible speed of 240ms, which is a 12x improvement on previous Pepperstone technology.

- Low Latency with 10 optical fibre cables crossing directly to Equinox MetaTrader servers near the New York financial centre. Direct connection achieves a latency reduction of 10 times.

- One-Click Trading – As spreads are constantly changing, traders can efficiently execute trades with just one click. This is a MetaTrader 4 feature.

Overall, Pepperstone has very solid features when it comes to execution speeds. The use of dedicated cables and the best technology will give traders confidence transaction processing will not suffer delays or lags.

IC Markets Technology

IC Markets technology is very similar to Pepperstone’s. Both use very similar fibre optic technology and have the same one-click trading feature, but the low latency technology differs.

- Faster Execution with dedicated fibre optic cable. IC Markets advertise an average order execution under 40ms.

- Low Latency through a direct connection to Equinox servers in NY for MetaTrader 4 & London with cTrader.

- VPS Cross-Connect Low Latency. IC Markets have an arrangement with Commercial Network Services (CNS) which can achieve under 1-millisecond latency to their MetaTrader servers.

- One-Click Trading – Like Pepperstone, our IC Markets review found they offer one-click trading.

IC Markets provides advanced technology for fast order execution with low latency on major currency pairs. IC Markets guarantees a 100% execution rate, as stated on its website.

Verdict

After extensive testing, we have determined that Pepperstone and IC Markets are both leaders in the field of forex trading. Each platform excels in unique areas. Traders can rest assured knowing that both brokers provide a top-notch trading experience, regardless of platform or account type.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.3% of retail CFD accounts lose money’

5. Stronger Trust – Pepperstone

Pepperstone Trust Score

IC Markets Trust Score

Both brokers are considered safe and trustworthy as they are regulated by multiple top-tier financial authorities. Each financial regulator and jurisdiction enforces different rules for retail CFD and forex trading.

IC Markets cater to a global client base with subsidiaries in 3 major financial hubs:

- Australia – The Australian Securities and Investments Commission (ASIC)

- Europe – The Cyprus Securities and Exchange Commission (CySEC)

- Global – The Financial Services Authority of Seychelles

Pepperstone operates 7 different subsidiaries in the following jurisdictions:

- Australia: ASIC

- Europe: CySEC

- The UK: The Financial Conduct Authority (FCA)

- United Arab Emirates (UAE): The Dubai Financial Services Authority (DFSA)

- Kenya: Capital Markets Authority (CMA)

- Germany: Federal Financial Supervisory Authority of Germany (BaFin)

- Global: The Securities Commission of The Bahamas (SCB)

When selecting a CFD and forex broker, it is important to consider various features, including the broker’s financial jurisdiction. If you trade forex using high leverage, you may not have access to investor protection policies like negative balance protection.

| Regulations | Pepperstone | IC Markets |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSA-S (Seychelles) SCB (Bahamas) |

Verdict

While both online brokers are overseen by multiple top-tier financial regulators, Pepperstone is the clear winner with 7 subsidiaries compared to IC Market’s 3 branches. Both brokers have a strong presence in Europe and Australia with CySEC and ASIC financial services licenses, yet Pepperstone also operates in the UK under FCA regulation.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.3% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google about twice as often as Pepperstone. On average, IC Markets sees around 246,000 branded searches each month, while Pepperstone gets about 110,000 — that’s 55% fewer.

Looking at where these brokers are most popular, both are Australian brokers but Pepperstone has a stronger presence there. It’s also more commonly searched in Brazil, Kenya, and Malaysia. IC Markets, meanwhile, sees more interest from users in the UK, Thailand, Germany, and South Africa.

| Country | Pepperstone | IC Markets |

|---|---|---|

| Australia | 8,100 | 6,600 |

| Brazil | 6,600 | 4,400 |

| United Kingdom | 5,400 | 33,100 |

| Thailand | 4,400 | 8,100 |

| Kenya | 4,400 | 2,400 |

| United States | 4,400 | 6,600 |

| Malaysia | 4,400 | 3,600 |

| Colombia | 3,600 | 3,600 |

| Germany | 3,600 | 5,400 |

| Mexico | 3,600 | 2,400 |

| Hong Kong | 3,600 | 2,400 |

| South Africa | 2,900 | 9,900 |

| India | 2,900 | 8,100 |

| Italy | 1,900 | 3,600 |

| Mongolia | 1,900 | 720 |

| Spain | 1,900 | 6,600 |

| Indonesia | 1,600 | 3,600 |

| Singapore | 1,600 | 3,600 |

| Peru | 1,600 | 1,600 |

| Turkey | 1,600 | 1,300 |

| Nigeria | 1,300 | 3,600 |

| Bolivia | 1,300 | 260 |

| Pakistan | 1,300 | 5,400 |

| Argentina | 1,300 | 1,300 |

| United Arab Emirates | 1,000 | 4,400 |

| Chile | 1,000 | 720 |

| Taiwan | 1,000 | 1,000 |

| France | 1,000 | 4,400 |

| Ecuador | 1,000 | 1,000 |

| Netherlands | 880 | 2,400 |

| Philippines | 880 | 2,400 |

| Dominican Republic | 880 | 1,000 |

| Morocco | 720 | 4,400 |

| Canada | 720 | 2,400 |

| Vietnam | 720 | 8,100 |

| Poland | 720 | 2,900 |

| Tanzania | 720 | 320 |

| Costa Rica | 480 | 390 |

| Japan | 480 | 1,300 |

| Portugal | 480 | 1,000 |

| Cyprus | 480 | 880 |

| Ethiopia | 390 | 720 |

| Botswana | 390 | 260 |

| Sweden | 390 | 1,300 |

| Uganda | 390 | 720 |

| Algeria | 390 | 2,400 |

| Venezuela | 390 | 720 |

| Egypt | 390 | 1,600 |

| Bangladesh | 390 | 1,900 |

| Switzerland | 320 | 1,600 |

| Panama | 320 | 260 |

| Austria | 320 | 720 |

| Sri Lanka | 320 | 2,900 |

| Cambodia | 320 | 170 |

| Saudi Arabia | 260 | 1,900 |

| Ireland | 260 | 880 |

| Jordan | 260 | 590 |

| Ghana | 260 | 880 |

| Greece | 210 | 720 |

| New Zealand | 170 | 210 |

| Uzbekistan | 140 | 1,000 |

| Mauritius | 110 | 480 |

2024 Monthly Searches For Each Brand

Pepperstone - Australia

Pepperstone - Australia

|

8,100

1st

|

IC Markets - Australia

IC Markets - Australia

|

6,600

2nd

|

Pepperstone - UK

Pepperstone - UK

|

5,400

3rd

|

IC Markets - UK

IC Markets - UK

|

33,100

4th

|

Pepperstone - Brazil

Pepperstone - Brazil

|

6,600

5th

|

IC Markets - Brazil

IC Markets - Brazil

|

4,000

6th

|

Pepperstone - Thailand

Pepperstone - Thailand

|

4,400

7th

|

IC Markets - Thailand

IC Markets - Thailand

|

8,100

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 32,425,000 visits vs. 1,273,000 for Pepperstone.

Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

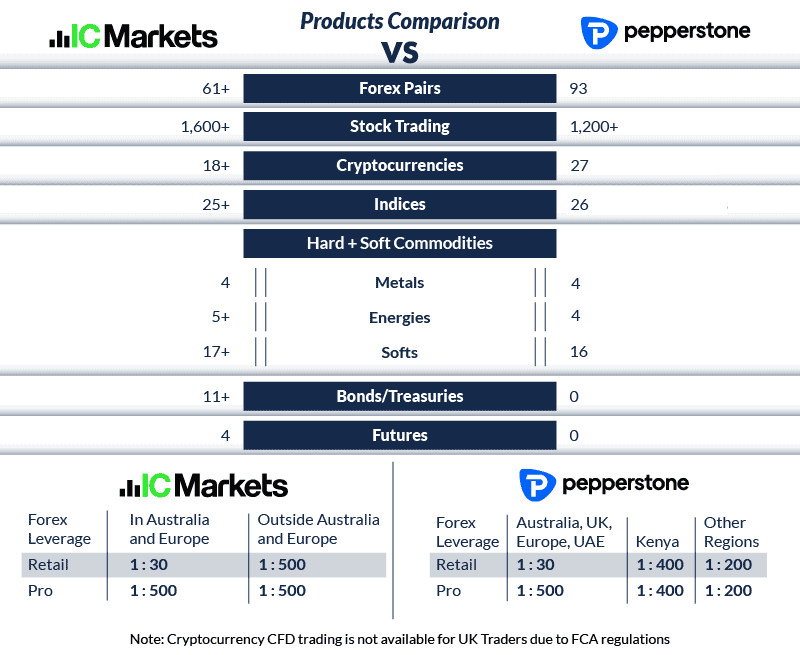

7. Greater Range of CFDs – IC Markets

Pepperstone and IC Markets offer a wide range of CFDs in addition to forex. This is not the same as share trading, which you can compare on the Pepperstone vs IG page. IC Markets’ range of CFDs is greater; however, Pepperstone is not an ‘all-in-one’ financial broker and, therefore, offers a more limited range when compared with IC Markets. Both ECN style providers offer:

- Indices

- Commodities such as metals and energy instruments, including crude oil

- Soft Commodities such as agricultural instruments

- Cryptocurrencies

Both Pepperstone and IC Markets offer these cryptocurrencies – Bitcoin, Bitcoin Cash, Ethereum, Dash, and Litecoin while IC Markets also offers Ripple. Both brokers offer leverage of 5:1. See our comparison with Plus500 for a broker with a large range of CFDs.

IC Markets, unlike Pepperstone, also offers the following:

- Bonds

- Futures

- Stocks

Commodities like crude oil can be traded quickly with low spreads.

Verdict

IC Markets is an all-in-one Broker. If having access to all types of CFDs is important, then IC Markets is likely our preferred broker when looking at CFDs in isolation.

Click the button below if you want to discover trading CFDs with a leading CFD provider.

8. Superior Educational Resources – Pepperstone

Each broker has something to offer.

Pepperstone

- Offers a comprehensive library of educational videos.

- Provides regular webinars hosted by industry experts.

- Features an interactive learning centre for beginners.

- Has a dedicated section for advanced trading strategies.

- Offers a free demo account for hands-on practice.

- Supports a community forum for traders to share insights.

IC Markets

- Features a beginner’s guide to forex trading.

- Provides access to e-books and trading manuals.

- Offers weekly market analysis webinars.

- Has a section dedicated to technical analysis tutorials.

- Provides a platform tutorial for new users.

- Supports a Q&A section for frequently asked trading questions.

Verdict

It’s a tie. Pepperstone and IC Markets offer exceptional educational resources, catering to beginners and experienced traders alike.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.3% of retail CFD accounts lose money’

9. Best Customer Service – Pepperstone

Both Pepperstone and IC Markets have live chat, phone and email customer support. Pepperstone’s customer service is award-winning, while IC Markets has a 24/7 server and a greater range of help desk tools.

Pepperstone

Pepperstone has developed a strong reputation for top customer service. “Investment Trends” have awarded Pepperstone as number #1 for customer services. Pepperstone customer service team in Australia consists of individuals who trade themselves. This means clients can trust that support understands the issues and concerns of all traders. This customer service level has helped Pepperstone achieve a 4.4 rating out of 5 on TrustPilot based on 595 reviews.

Pepperstone offers a range of trading education resources such as guides, webinars, courses, market news and more, in addition to their award-winning customer support.

IC Markets

IC Markets’ customer support team have 3 features that Pepperstone doesn’t have. These are:

- 24/7 support. Customer service is available weekdays and weekends. This may be important for ECN clients looking to trade when markets are closed, as ECN is available during outside market hours.

- Help Centre (keyword search) for self-help.

- Emails can be sent specifically to different IC Markets personnel such as Client Relations, Support, Accounts, Info, Marketing and IB/Partners.

- As of February 2023 on TrustPilot, the IC Markets reviews from customers were 4.4 based on 2,332 respondents.

Verdict:

Pepperstone has superior customer service based on our analysis and the number of third-party rewards (such as Investment Trends) over the past five years. While structurally, both brokers have similar contact points, the quality of the customer service team at Pepperstone makes them the best forex broker globally for the category.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.3% of retail CFD accounts lose money’

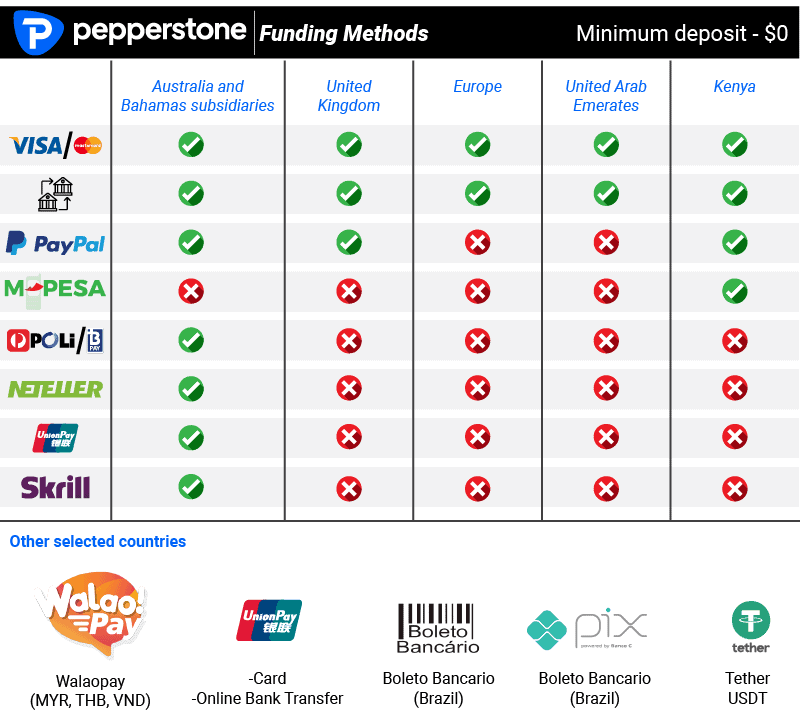

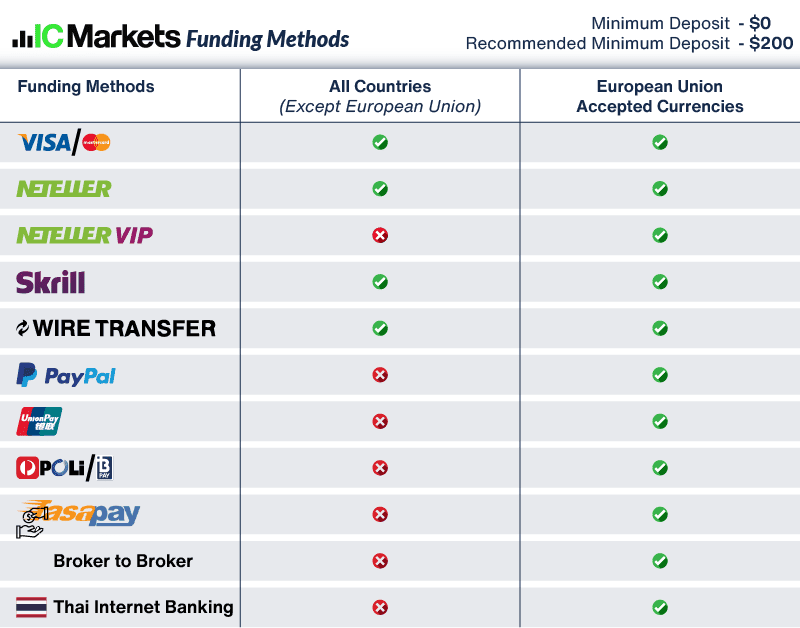

10. Better Funding Options – IC Markets

Our review found both forex brokers were the same in this category. Neither Pepperstone nor IC Markets charge fees for deposits or withdrawals, but international institutions may charge a fee. Both brokers have very similar funding policies. The primary difference is the cutoff time for same-day withdrawal payments.

Neither broker has a minimum deposit, but we do suggest starting with $200. Not only will you need some cash to trade, but you will need to use margin requirements to open a trade.

Pepperstone

The minimum deposit suggested is $200 for Pepperstone. This applies to their Standard, Razor and Islamic Accounts.

If a withdrawal request is received before 7:00 am AEST, then the withdrawal will be processed the same day otherwise. If a withdrawal request is received after 7:00 PM, it will be processed on the following day. Any bank account connected to a Pepperstone trading account will receive the funds (this needs to be first-party).

Credit cards can be used for withdrawals within the deposited amount. If the withdrawal exceeds the deposited amount, an alternative method is needed. Bank wire transfers take 3-5 business days to settle on average.

IC Markets

IC Markets minimum deposit is $200. This applies to their Standard, Raw and Islamic Accounts.

If you want to withdraw funds on the same day, make sure to submit your request before midday AEST. If a withdrawal request is submitted after this time, funding will be deposited on the next business day.

Verdict

Both IC Markets and Pepperstone accept similar payment methods. This includes Skrill, PayPal and NETELLER. Traders who select AUD-based currency (in Australia) can use BPAY for fast, free transfers. Both brokers offer UnionPay, but IC Markets only offers it when the RMB base currency is selected. IC Markets also offers RapidPay and Klarna for GBP-based currency accounts only.

Some base currencies, including NZD, JPY, CAD and CHF, have the most limited deposit and withdrawal options, so it’s worth viewing the broker site first before opening an account.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.3% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

Pepperstone has the lower deposit of $0 vs $200 for IC Markets. Both minimum deposits are relatively low and even Pepperstone (and IC Markets) recommend starting with a minimum of $200. The table below shows the recommended and minimum deposit amounts of both brokers.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| IC Markets | $200 | $200 |

Verdict

Pepperstone is the clear winner when it comes to which broker has a minimum deposit of $0 making them ideal for low stake traders. That said, for most traders a minimum deposit of $200 is more than reasonable which IC Markets requires.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.3% of retail CFD accounts lose money’

Is Pepperstone or IC Markets The Best Broker?

We conclude that Pepperstone is superior to IC Markets based on its faster execution speeds, enhanced trading platform stack and superior award-winning customer service. Our findings showed that Pepperstone had eight superior trading factors out of 10 compared to IC Markets as shown below.

| Criteria | IC Markets | Pepperstone |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ✅ | ✅ |

| Best Trading Experience And Ease | ✅ | ✅ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ✅ | ✅ |

IC Markets: Best For Beginner Traders

IC Markets is the preferred choice for beginner traders due to its user-friendly platform and comprehensive educational resources.

Pepperstone: Best For Experienced Traders

For seasoned traders, Pepperstone stands out with its advanced trading tools and faster execution speeds.

FAQs Comparing Pepperstone Vs IC Markets

Does IC Markets Or Pepperstone Have Lower Fees?

IC Markets typically offers lower costs when compared to Pepperstone. They have been known to offer spreads as low as 0.1 pips on major currency pairs. Pepperstone, while competitive, often has slightly higher spreads. For a detailed comparison of spreads, you can visit our page on the lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Pepperstone is generally considered superior for MetaTrader 4 compared to IC Markets. They offer enhanced MT4 features and faster execution speeds. For traders looking to dive deeper into MT4 features, our comprehensive guide on the best MT4 forex brokers in the UK provides valuable insights.

Which Broker Offers Social Trading?

Both IC Markets and Pepperstone offer social trading options for their users. This feature allows traders to mimic the strategies of successful traders, enhancing their trading experience. For those interested in exploring more about social trading, our comprehensive guide on the best copy trading platforms provides a wealth of information.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting, especially for UK clients. This tax-efficient way of trading is popular among UK traders. For those new to spread betting or seeking the best platforms, our guide on the best spread betting brokers in the UK is valuable.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone holds a slight edge for Australian Forex traders over IC Markets. Both brokers are ASIC-regulated, ensuring a high level of trust and security for traders. Pepperstone, founded in Australia, has a deep understanding of the local market dynamics. While IC Markets is also a strong contender and has a significant presence in Australia, there’s something reassuring about trading with a home-grown broker. For a broader perspective on Australian Forex brokers, you can check out our comprehensive guide on the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

In my view, Pepperstone is slightly ahead for UK Forex traders compared to IC Markets. Both brokers are FCA-regulated, which offers a significant layer of trust and protection for UK traders. While IC Markets has made a commendable mark in the UK market, Pepperstone’s commitment to understanding the nuances of UK trading gives it an edge. It’s worth noting that neither broker was originally founded in the UK, but their dedication to serving UK traders is evident. For more insights on the UK trading landscape, you might want to explore our detailed guide on the Best Forex Brokers In UK.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Ask an Expert

Is it better to copy trade on Pepperstone or on IC Markets?

Either broker is suitable. Both brokers allow trading with MetaTrader signals if you are using MT4 or MT5. IC Markets also offers ZuluTrade and Myfxbook while Pepperstone offers Myfxbook outside the UK and Europe and Pelican Trading for Uk and Europe traders. DupliTrader is also available for all Pepperstone clients for copy trading