Saxo Markets vs IC Markets 2025

Saxo Markets and IC Markets offer competitive features, platforms, and trust scores. However, our detailed research indicates that one broker stands out. Explore which one receives our recognition. Read further.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 16:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 7 most important trading factors you need to consider when choosing between Saxo Markets and IC Markets.

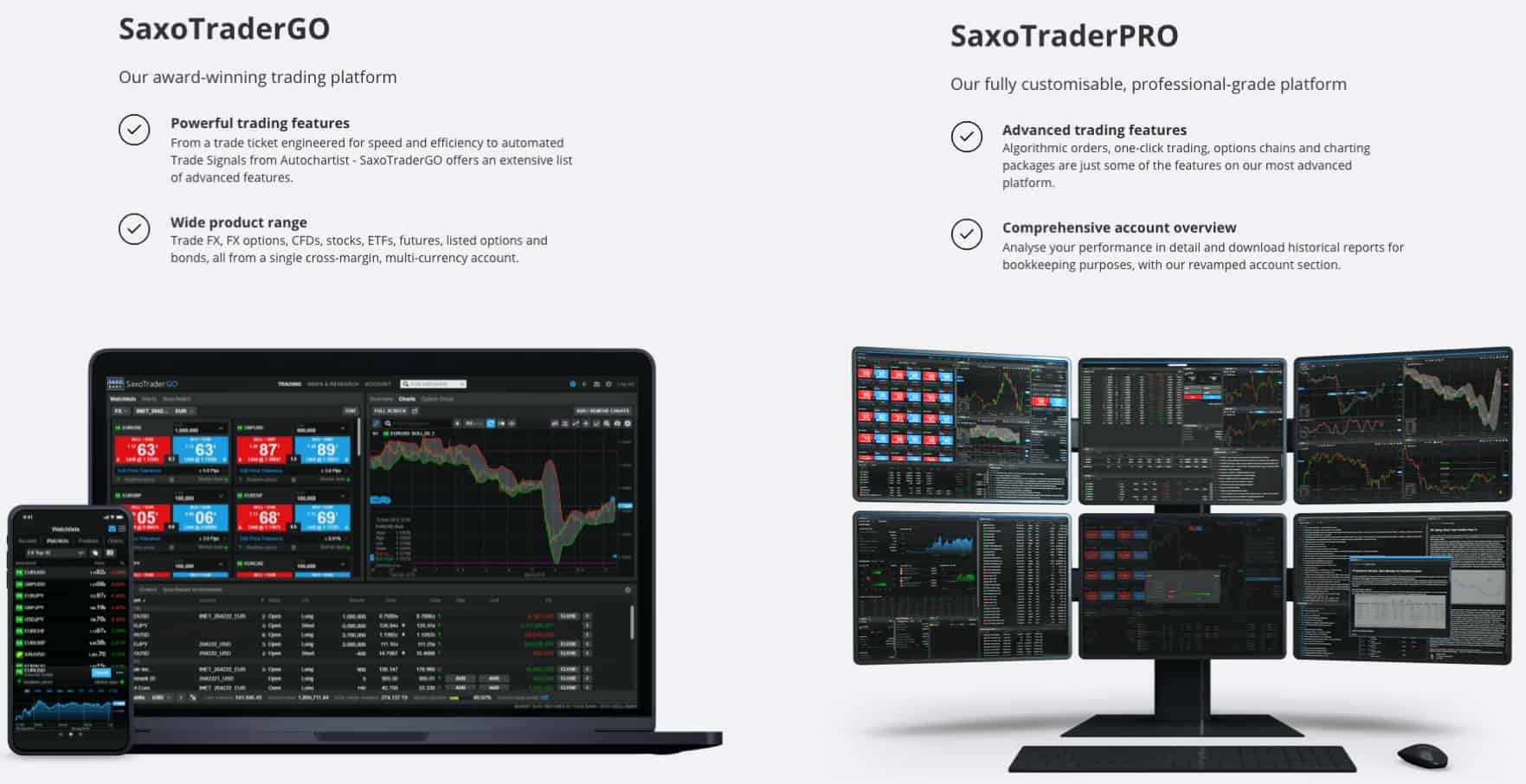

- Saxo Markets offers proprietary platforms SaxoTraderGO and SaxoTraderPRO.

- Saxo Markets’ SaxoTraderPRO is for experienced traders, enabling complex orders and advanced analysis.

- Saxo Markets offers platforms such as SaxoTraderGO.

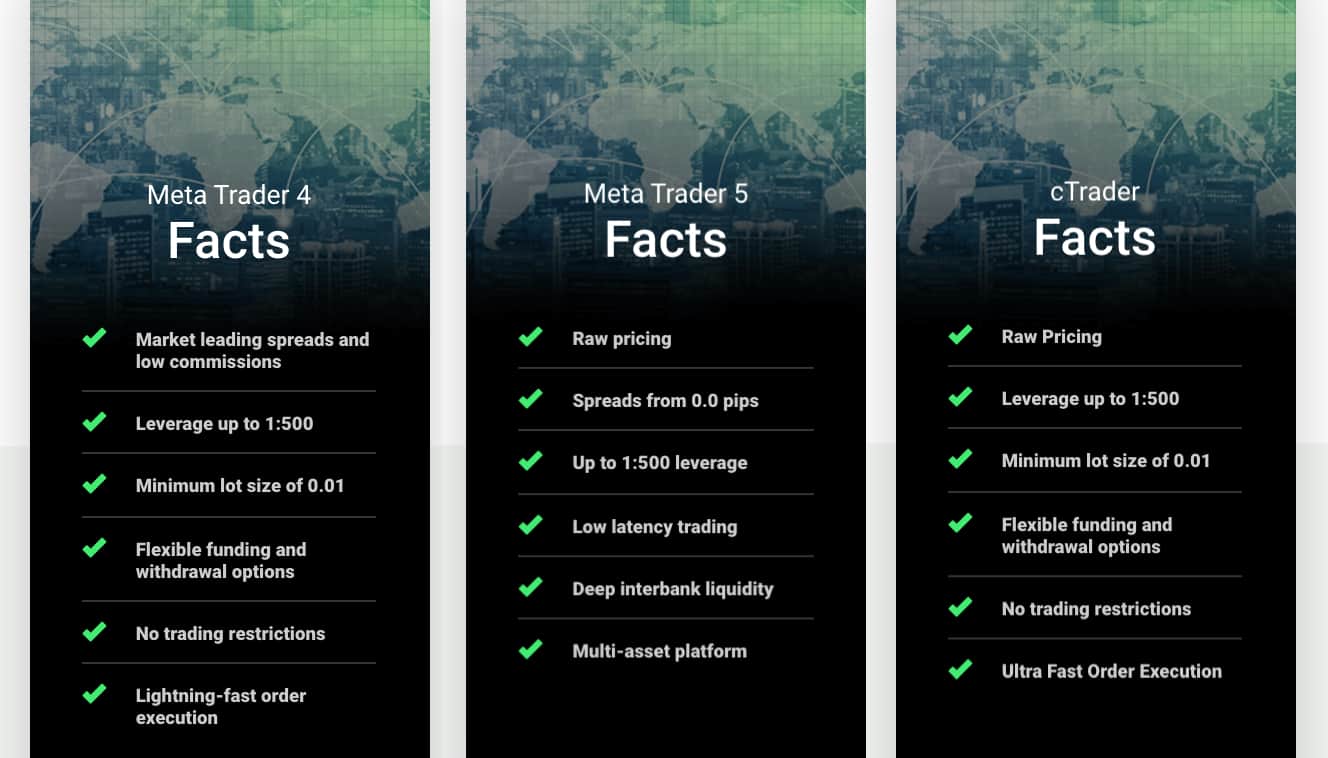

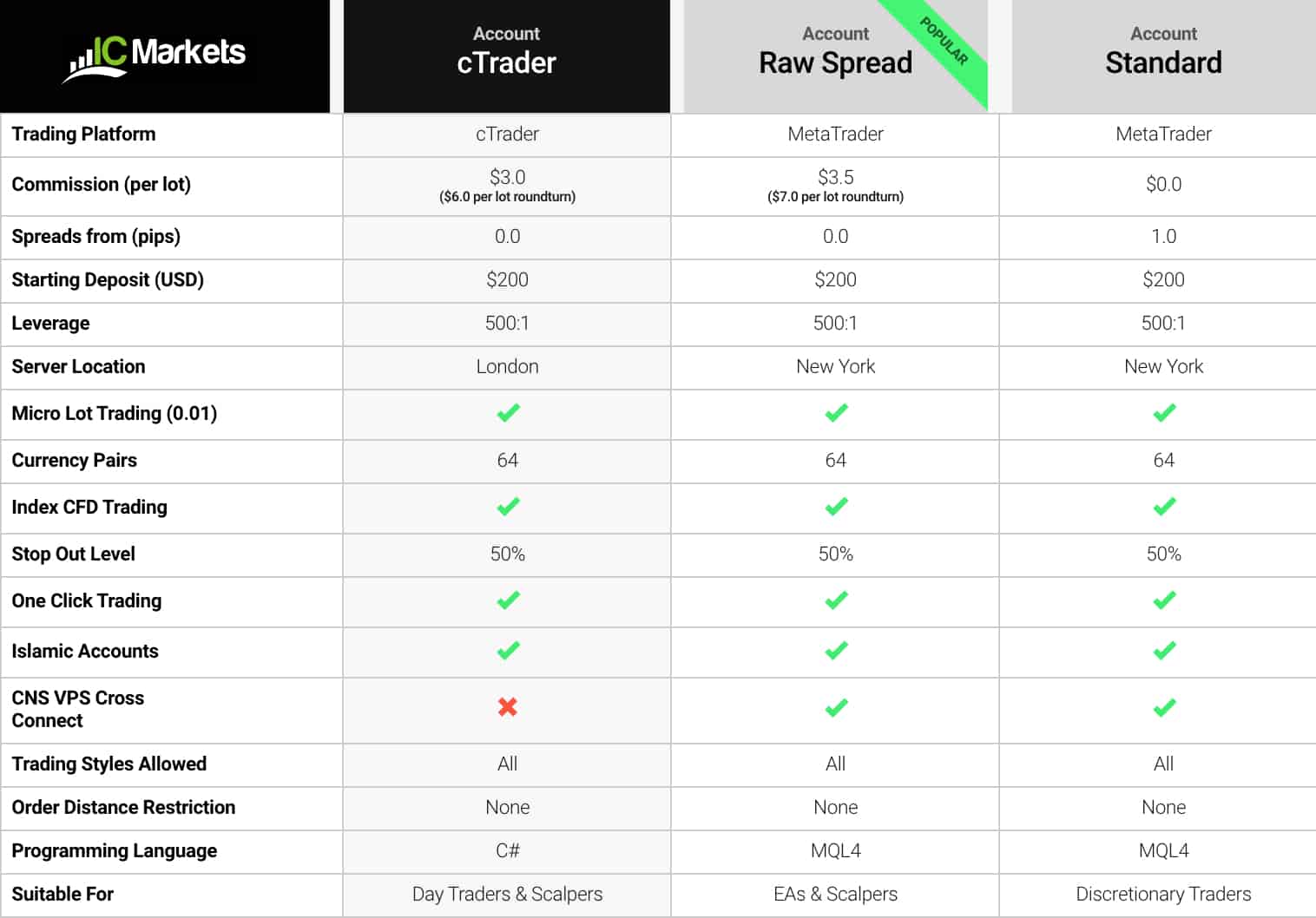

- IC Markets provides MetaTrader 4, MetaTrader 5, and cTrader.

- IC Markets has a more extensive range of trading platforms suitable for automated trading, including MT4, MT5, and cTrader.

- IC Markets offers mobile apps for MT4, MT5, and cTrader.

- IC Markets offers exclusive trading tools for MT4 users, including a Correlation Matrix, Sentiment Trader, and Tick Chart Trader.

1. Lowest Spreads And Fees – IC Markets

In forex trading, low costs are crucial for traders, particularly those who trade frequently. IC Markets and Saxo Markets provide cost-effective conditions, with tight spreads and transparent fees that attract traders. Lower transaction costs enhance profits and improve market activity, making trading smoother and more rewarding.

IC Markets and Saxo Markets are two forex brokers that provide various platforms and tools to accommodate different trading styles. IC Markets, established in 2007 and based in Australia, is noted for its low spreads and fast execution speeds. Saxo Markets, founded in 1992 and headquartered in Denmark, is recognized for its comprehensive trading platforms and a wide range of financial instruments. Both brokers offer access to numerous currency pairs, including EUR, USD, and AUD, which makes them commonly chosen options among traders.

Spreads

IC Markets stands out as a No Dealing Desk (NDD) broker, providing traders the option to choose between a standard fixed spread that includes a commission or an ECN-style raw spread accompanied by a flat-rate commission fee. Notably, IC Markets boasts a EUR/USD spread of just 0.82, significantly lower than Saxo Markets’ 1.1 and the average industry spread of 1.2. For AUD/USD, IC Markets offers a spread of 0.83, while Saxo Markets has a spread of 1.1, well above the industry average of 1.5. Overall, IC Markets achieves an impressive average spread of 1.09, considerably lower than Saxo Markets’ 1.70 and the industry average of 1.6. These exceptionally tight spreads position IC Markets as a highly appealing choice for traders looking for cost-effective trading conditions.

| Standard Account | Saxo Markets Spreads | IC Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.70 | 1.09 | 1.6 |

| EUR/USD | 1.1 | 0.82 | 1.2 |

| USD/JPY | 2.2 | 0.94 | 1.4 |

| GBP/USD | 1.8 | 1.03 | 1.6 |

| AUD/USD | 1.1 | 0.83 | 1.5 |

| USD/CAD | 1.9 | 1.05 | 1.8 |

| EUR/GBP | 1.6 | 1.27 | 1.5 |

| EUR/JPY | 2 | 1.3 | 1.9 |

| AUD/JPY | 1.9 | 1.5 | 2.1 |

Commission Levels

IC Markets stands out in the industry with a competitive commission fee of just $3.50 per lot. As for Saxo Markets, there are no current updates regarding their commission structure. When it comes to minimum deposits, Saxo Markets has a relatively high requirement of $2,000, whereas IC Markets is more accessible with a requirement of only $200. Both brokers boast no funding fees, ensuring they cater to a diverse array of traders. Furthermore, IC Markets suggests a recommended deposit of $200, while Saxo Markets has not provided any recent updates on this aspect.

Standard Account Fees

IC Markets provides a compelling cost advantage for traders with standard account fees, boasting a spread of just 0.62 for EUR/USD and 0.77 for AUD/USD. In contrast, Saxo Markets has higher spreads, at 1.20 for EUR/USD and 0.90 for AUD/USD. This significant discrepancy underscores IC Markets’ appeal for those who prioritize minimizing trading costs.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

0.82 | 0.83 | 1.27 | 1.03 | 0.94 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.00 | 1.11 | N/A | 1.32 | 1.09 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Both IC Markets and Saxo Markets are reputable brokers, each offering unique benefits. IC Markets is notable for its low spreads and competitive commission fees, making it a cost-effective option for traders. On the other hand, Saxo Markets excels with its comprehensive trading platforms and wide array of financial instruments, providing an exceptional trading experience for those in search of variety. As we look ahead to the evolving forex trading landscape in 2025, both brokers are strategically equipped to meet the diverse needs of traders, especially those focused on EUR, USD, and AUD currencies.

Our Lowest Spreads and Fees Verdict

Without any doubt, IC Markets excels in this niche due to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

The right platform is crucial for forex trading. IC Markets and Saxo Markets both provide advanced tools, real-time data, and fast execution. Their user-friendly, customizable interfaces support automated and social trading, offering flexibility. Security is prioritized, enhancing traders’ peace of mind. Access to diverse financial instruments improves the trading experience.

IC Markets and Saxo Markets are two forex brokers that offer various platforms and tools suitable for different trading styles. IC Markets, established in 2007, is based in Australia and is noted for its low spreads and efficient execution speeds. Saxo Markets, founded in 1992, is a global broker headquartered in Denmark, known for its comprehensive trading platforms and a wide range of financial instruments. Both brokers provide access to numerous currency pairs, including EUR, USD, and AUD, and are commonly selected by traders.

| Trading Platform | Saxo Markets | IC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | Yes |

| TradingView | Yes | Yes |

| Copy Trading | No | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

MetaTrader

IC Markets presents three of the most sought-after trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. MT4 is celebrated for its powerful algorithmic trading capabilities, empowering traders to create and implement strategies through Expert Advisors (EAs). Clients of IC Markets enjoy access to 20 exclusive trading tools on MT4, including innovative resources like the Correlation Matrix, Sentiment Trader, and Tick Chart Trader. For Raw Account holders, MT5 expands the possibilities with a broader range of products and advanced charting features, such as Level 2 Market Depth for enhanced pricing transparency. cTrader stands out by offering ECN-like pricing, lightning-fast execution speeds, and comprehensive charting tools, making it a premier choice for professional traders seeking an edge in the market.

MetaTrader4

Advanced Platforms

Saxo Markets offers two state-of-the-art proprietary trading platforms: SaxoTraderGO and SaxoTraderPRO. SaxoTraderGO prioritizes user-friendliness, making it ideal for traders at any experience level and providing access to Saxo’s vast array of products. On the other hand, SaxoTraderPRO is tailored for experienced professionals, delivering a multi-screen desktop environment that supports in-depth analysis and precise order execution. Both platforms are rich in technical analysis and trading tools, with SaxoTraderPRO featuring advanced functionalities specifically designed for the astute professional trader.

MetaTrader 5

Copy Trading

IC Markets facilitates copy trading via its MT4 platform, seamlessly integrating with popular social trading platforms such as ZuluTrade and Myfxbook. This feature empowers traders to mirror the strategies of seasoned professionals effortlessly. In contrast, Saxo Markets does not provide a specific copy trading function; however, its sophisticated trading platforms and extensive tools equip traders to devise and implement their own strategies with precision.

cTrader

In comparing the trading platforms offered to customers of Saxo Markets and IC Markets, IC Markets provides access to three widely-used platforms for automated trading: MT4, MT5 (EAs), and cTrader (cBots). In contrast, Saxo Markets features its proprietary platforms, SaxoTraderGO and SaxoTraderPRO, which support a solid trading experience for various traders. As forex trading trends progress in 2025, both brokers are equipped to address the varied needs of traders, especially those focused on EUR, USD, and AUD currencies.

Our Better Trading Platform Verdict

Clearly, we can see here that IC Markets come up on top owing to their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts and Features – IC Markets

Choosing the right trading account is crucial for your forex journey. IC Markets and Saxo Markets offer diverse, feature-rich accounts for various trading styles, including competitive spreads, low commissions, demo accounts, and swap-free options. Additional benefits like social trading and excellent customer support enhance the trading experience, making it smoother and more rewarding.

IC Markets and Saxo Markets stand out as two of the foremost forex brokers, each delivering a diverse array of features and platforms tailored to various trading preferences. Established in 2007, IC Markets is an Australian broker celebrated for its exceptionally low spreads and rapid execution speeds. Conversely, Saxo Markets, founded in 1992 and based in Denmark, is renowned for its sophisticated trading platforms and an extensive selection of financial instruments. Both brokers offer a broad spectrum of currency pairs, such as EUR, USD, and AUD, making them favored options among traders. As we look toward 2025, emerging trends in forex trading indicate a significant shift toward algorithmic trading, social trading, and a growing emphasis on mobile trading platforms.

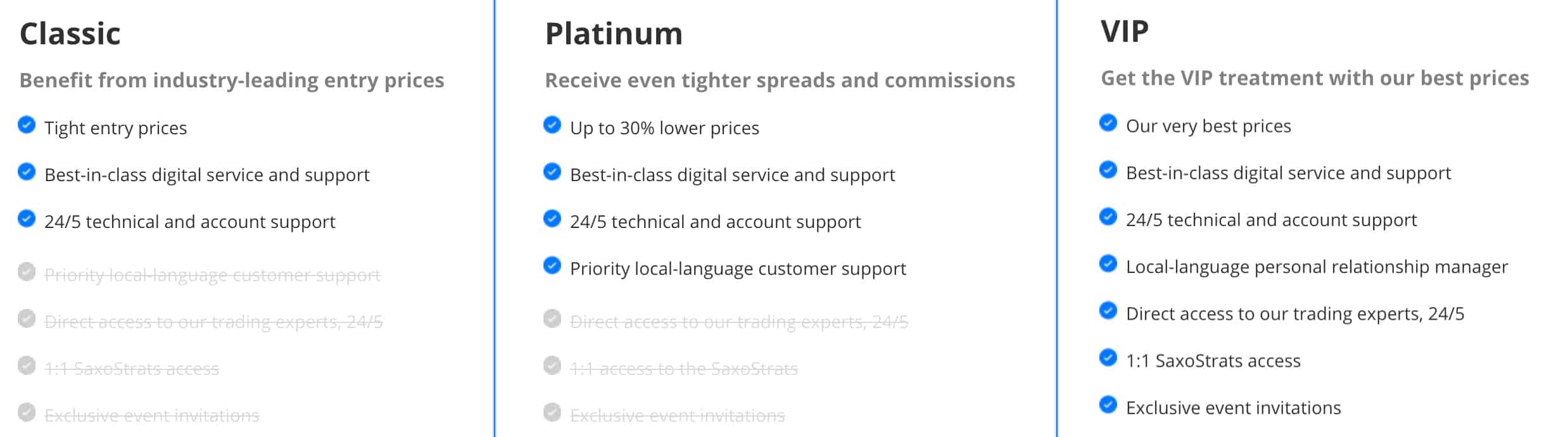

Saxo Markets operates as a Market Maker, offering three tiers of retail investor accounts, each with commission fees built into fixed spreads. The Classic account provides clients with entry-level pricing and standard customer support. In contrast, Platinum and VIP account holders enjoy tighter spreads, tailored customer support, and exclusive VIP benefits. On the other hand, IC Markets functions as a No Dealing Desk (NDD) broker, presenting three distinct account types designed to accommodate various pricing structures and platform preferences. Much like Saxo’s Classic account, the IC Markets Standard account incorporates commission charges within the spread, making it an ideal choice for those venturing into forex trading.

IC Markets and Saxo Markets have different account type structures. Saxo Markets provides no-commission fixed spreads and offers discounted prices for high-volume traders, while IC Markets allows clients to choose between raw, ECN-like pricing or a Standard commission-free account. CompareForexBrokers suggests an IC Markets Raw Spread account, as it offers narrow ECN-style spreads with low commission fees, which can help reduce trading costs. As forex trading trends develop in 2025, both brokers are positioned to cater to the varied needs of traders, especially for those trading EUR, USD, and AUD currencies.

| Saxo Capital Markets | IC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

IC Markets is on top of the world right now, this due to their superior accounts and features.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

IC Markets and Saxo Markets provide an efficient forex trading experience with top-tier platforms, fast execution speeds, and competitive spreads. Their user-friendly interfaces, advanced tools, and educational resources enhance accessibility. With strong customer support and features for all skill levels, they prioritize efficiency and profitability in trading.

IC Markets and Saxo Markets are two notable forex brokers that offer various features and platforms suitable for different trading styles. IC Markets, established in 2007, is an Australian-based broker recognized for its low spreads and efficient execution speeds. Saxo Markets, founded in 1992, operates globally with headquarters in Denmark and is known for its comprehensive trading platforms and diverse range of financial instruments. Both brokers provide access to numerous currency pairs, such as EUR, USD, and AUD, making them popular among traders. In 2025, forex trading trends suggest an emphasis on algorithmic trading, social trading, and the growing significance of mobile trading platforms.

In the industry of trading, IC Markets stands out with its diverse array of platforms, each equipped with distinctive features that enhance the trading experience. For example, the MT4 platform boasts 20 proprietary trading tools that elevate your trading strategies. IC Markets also provides Advanced Trader Tools exclusively available on MT4, while MT5 offers Level 2 Market Depth for greater pricing transparency. Furthermore, cTrader facilitates ultra-fast execution alongside comprehensive charting capabilities. Meanwhile, SaxoTraderPRO caters to seasoned traders with its robust technical analysis tools and multi-screen desktop interface. Saxo Markets is certainly a strong contender, as their SaxoTraderPRO platform serves as a sanctuary for experienced traders, packed with advanced analytical features.

IC Markets and Saxo Markets provide trading platforms and tools that accommodate different trading styles. IC Markets features the MT4, MT5, and cTrader platforms, offering various tools and functionalities. Saxo Markets presents its SaxoTraderPRO platform, which caters to advanced traders. As forex trading trends evolve in 2025, both brokers appear to be equipped to address the varied requirements of traders, especially those focused on EUR, USD, and AUD currencies.

Our Best Trading Experience and Ease Verdict

Evidently, IC Markets shines bright in this field of expertise by the reason of their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Saxo Markets

Trust and regulation are crucial when selecting a forex broker. IC Markets and Saxo Markets operate under strict regulations, ensuring a secure trading environment. Regulated brokers uphold high standards, protecting traders from fraud and fostering confidence for active investment. A strong regulatory reputation helps brokers attract and retain clients. This review will evaluate how IC Markets and Saxo Markets perform in terms of trust and security.

Saxo Markets Trust Score

IC Markets Trust Score

In this section, it is evident that Saxo Markets possesses a commendable trust score of 86, in contrast to IC Markets, which holds a trust score of 61. However, we must not rely solely on these trust scores; we must delve deeper to thoroughly evaluate the exceptional attributes, platforms, and overall user-friendliness of the brokers in question. Therefore, which broker emerges as the superior choice?

IC Markets and Saxo Markets are two forex brokers that offer various features and platforms for different trading styles. IC Markets, founded in 2007, is based in Australia and is noted for its low spreads and fast execution speeds. Saxo Markets, established in 1992, operates globally from Denmark and is known for its comprehensive trading platforms and wide range of financial instruments. Both brokers provide access to numerous currency pairs, including EUR, USD, and AUD, making them popular among traders. In 2025, trends in forex trading show an emphasis on algorithmic trading, social trading, and the growing significance of mobile trading platforms.

Saxo Markets and IC Markets each offer distinct advantages in terms of trust and regulation. Saxo Markets is regulated by multiple authorities, including the FCA and BaFin, which contributes to a diversified regulatory framework. In contrast, IC Markets is regulated by ASIC and CySEC, both of which are reputable but not as varied as Saxo’s regulations. Saxo Markets provides a broader regulatory scope, while IC Markets has a strong presence in the Asia-Pacific region due to its ASIC regulation. As forex trading trends in 2025 continue to develop, both brokers appear well-equipped to address the varying needs of traders, especially those involved with EUR, USD, and AUD currencies.

| Saxo Markets | IC Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) MAS (Singapore) FINMA (Switzerland) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | SFC | |

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) |

Our Stronger Trust and Regulation Verdict

Finally, Saxo Markets rides high in this field of expertise owing to their stronger trust and regulations.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than Saxo Markets. On average, IC Markets sees around 246,000 branded searches each month, while Saxo Markets gets about 165,000 — that’s 55% fewer.

| Country | IC Markets | Saxo Markets |

|---|---|---|

| United Kingdom | 33,100 | 4,400 |

| South Africa | 9,900 | 170 |

| India | 8,100 | 1,900 |

| Thailand | 8,100 | 320 |

| Vietnam | 8,100 | 170 |

| Spain | 6,600 | 6,600 |

| United States | 6,600 | 1,600 |

| Australia | 6,600 | 1,600 |

| Germany | 5,400 | 1,600 |

| Pakistan | 5,400 | 260 |

| France | 4,400 | 18,100 |

| Brazil | 4,400 | 1,600 |

| United Arab Emirates | 4,400 | 590 |

| Morocco | 4,400 | 320 |

| Italy | 3,600 | 3,600 |

| Singapore | 3,600 | 3,600 |

| Colombia | 3,600 | 1,000 |

| Malaysia | 3,600 | 880 |

| Indonesia | 3,600 | 720 |

| Nigeria | 3,600 | 110 |

| Poland | 2,900 | 1,900 |

| Sri Lanka | 2,900 | 50 |

| Netherlands | 2,400 | 14,800 |

| Mexico | 2,400 | 1,300 |

| Hong Kong | 2,400 | 1,300 |

| Algeria | 2,400 | 1,300 |

| Canada | 2,400 | 390 |

| Philippines | 2,400 | 140 |

| Kenya | 2,400 | 40 |

| Saudi Arabia | 1,900 | 260 |

| Bangladesh | 1,900 | 70 |

| Peru | 1,600 | 3,600 |

| Switzerland | 1,600 | 1,900 |

| Egypt | 1,600 | 110 |

| Turkey | 1,300 | 2,900 |

| Argentina | 1,300 | 2,900 |

| Japan | 1,300 | 880 |

| Sweden | 1,300 | 590 |

| Portugal | 1,000 | 1,300 |

| Ecuador | 1,000 | 480 |

| Taiwan | 1,000 | 390 |

| Dominican Republic | 1,000 | 140 |

| Uzbekistan | 1,000 | 70 |

| Ireland | 880 | 170 |

| Cyprus | 880 | 110 |

| Ghana | 880 | 20 |

| Greece | 720 | 1,900 |

| Chile | 720 | 1,000 |

| Venezuela | 720 | 260 |

| Austria | 720 | 210 |

| Ethiopia | 720 | 50 |

| Uganda | 720 | 20 |

| Mongolia | 720 | 10 |

| Jordan | 590 | 30 |

| Mauritius | 480 | 90 |

| Costa Rica | 390 | 50 |

| Tanzania | 320 | 10 |

| Bolivia | 260 | 260 |

| Panama | 260 | 40 |

| Botswana | 260 | 10 |

| New Zealand | 210 | 70 |

| Cambodia | 170 | 70 |

2024 Monthly Searches For Each Brand

IC Markets - UK

IC Markets - UK

|

33,100

1st

|

Saxo Markets - UK

Saxo Markets - UK

|

4,400

2nd

|

IC Markets - India

IC Markets - India

|

8,100

3rd

|

Saxo Markets - India

Saxo Markets - India

|

1,900

4th

|

IC Markets - US

IC Markets - US

|

6,600

5th

|

Saxo Markets - US

Saxo Markets - US

|

1,600

6th

|

IC Markets - Australia

IC Markets - Australia

|

6,600

7th

|

Saxo Markets - Australia

Saxo Markets - Australia

|

1,600

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 1,047,000 for Saxo Markets.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

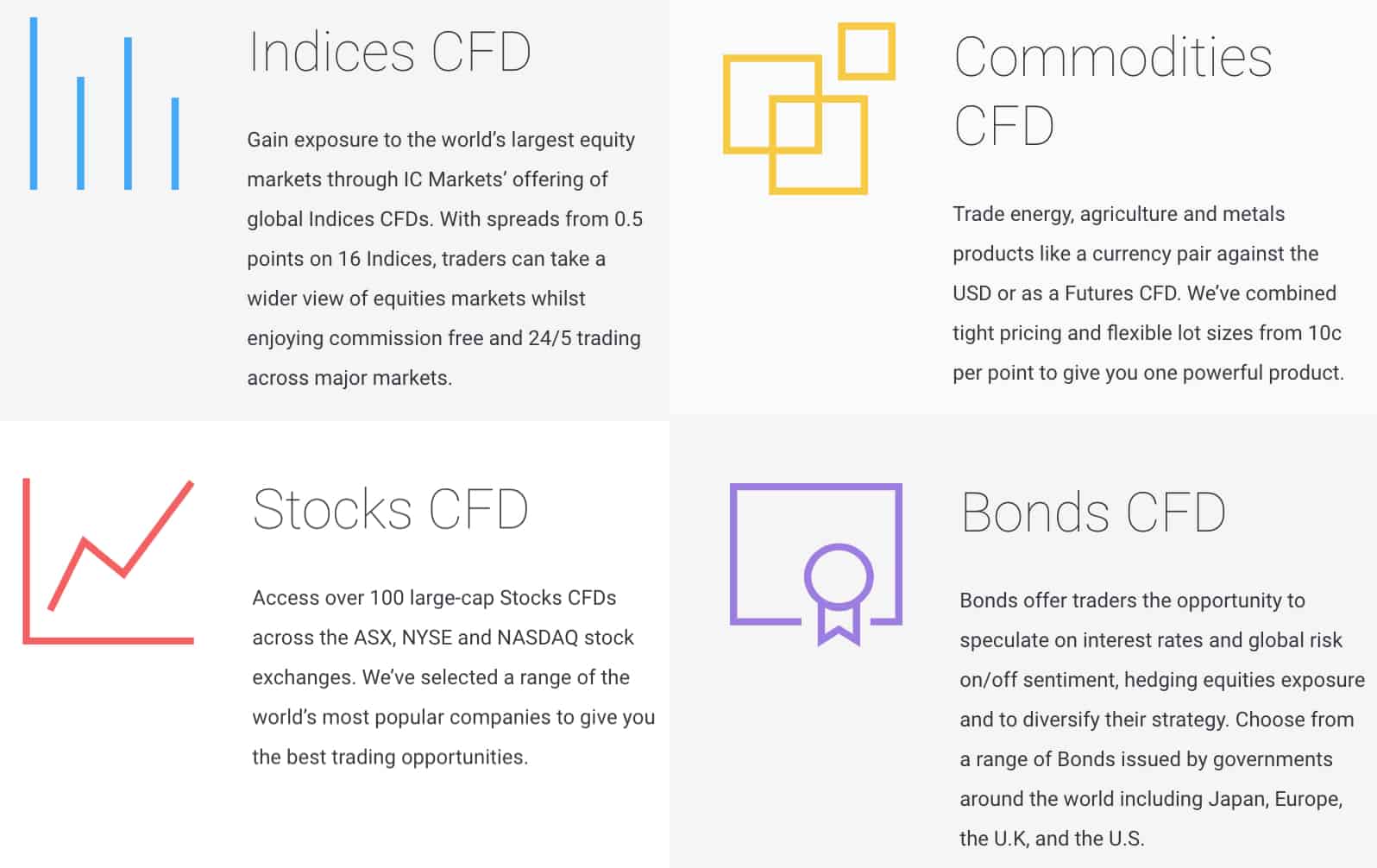

7. Top Product Range And CFD Markets – A Tie

Access to diverse financial instruments is crucial in trading. IC Markets and Saxo Markets provide extensive CFDs, including forex, commodities, indices, and cryptocurrencies, which enable traders to diversify portfolios and adapt to market conditions. This variety enhances trading experiences for both short-term and long-term strategies. Let’s explore each broker’s offerings!

IC Markets and Saxo Markets are forex brokers that offer a variety of features and platforms suitable for different trading styles. IC Markets, established in 2007, is an Australian-based broker known for low spreads and fast execution speeds. Saxo Markets, founded in 1992, is a global broker based in Denmark, recognized for its comprehensive trading platforms and wide selection of financial instruments. As of 2025, trends in forex trading highlight the rise of algorithmic trading, social trading, and the growing importance of mobile trading platforms, especially for major currencies such as AUD, USD, and GBP.

| CFDs | Saxo Markets | IC Markets |

|---|---|---|

| Forex Pairs | 7 CFDs, 190 Spot, 130 Forwards | 61 |

| Indices | 29 | 25 |

| Commodities | 5 Metals 7 Energies 8 Softs | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies |

| Cryptocurrencies | 9 | 23 |

| Share CFDs | 9000+ | 2100+ |

| ETFs | 1200 | No |

| Bonds | 8 | 9 |

| Futures | No | Yes |

| Treasuries | 8 | 9 |

| Investments | No | Yes |

Both Saxo Markets and IC Markets offer impressive market access that allows traders to develop diversified trading strategies.

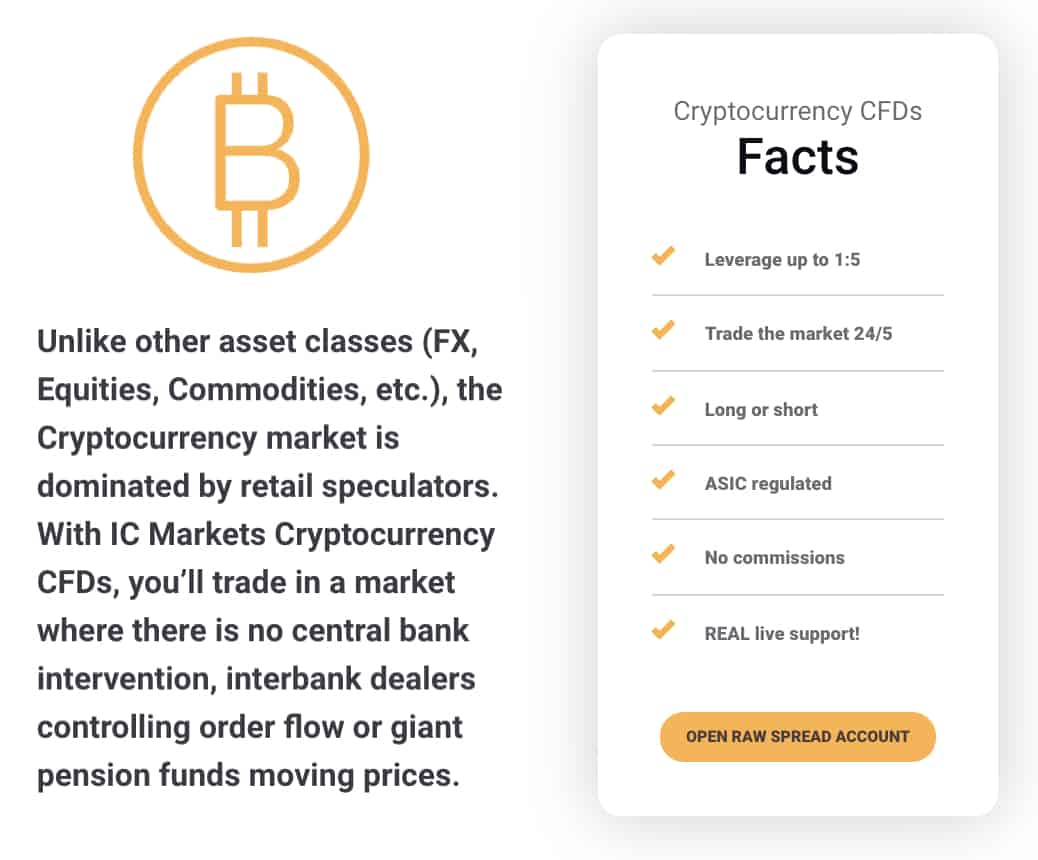

IC Markets stands out as one of the premier online brokers for traders eager to integrate Crypto CFD trading into their portfolios, offering a diverse selection of 10 cryptocurrencies with leverage up to 5:1 and zero commission fees. In contrast, Saxo Markets limits its offerings to just Bitcoin and Ethereum through ETNs, which do not allow for leveraged trading. Both brokers, however, provide extensive access to various asset classes beyond Forex and Cryptocurrency CFDs. IC Markets boasts over 17 indices, more than 19 agricultural, metals, and energy products, over 6 bonds, and upward of 120 shares. Meanwhile, Saxo Markets offers an impressive range with over 29 indices, 5 government bonds, 19 commodities, and access to over 19,000 stocks across 36 global exchanges. It’s important to note that Saxo Capital Markets UK Limited has halted cryptocurrency trading for retail clients in the UK due to FCA regulations, though clients from other regions can still engage in crypto trading through Saxo Markets’ subsidiaries.

IC Markets and Saxo Markets offer market access with a variety of asset classes and financial instruments suitable for diversified trading strategies. IC Markets provides a notable selection of cryptocurrency options, while Saxo Markets has a wider range of CFDs and investment products. As the forex trading environment changes in 2025, both brokers appear prepared to accommodate the diverse requirements of traders, particularly those using AUD, USD, and GBP currencies.

Our Top Product Range and CFD Markets Verdict

It’s neck to neck for both Saxo Markets and IC Markets due to their excellence in the field of top product range and CFD markets.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

Education is crucial in forex trading, and both IC Markets and Saxo Markets recognize this. Access to quality materials—webinars, articles, tutorials, and courses—helps traders make informed decisions and improve strategies. Continuous learning is essential for both beginners and experienced traders in the dynamic forex market. Strong educational support builds confidence and aids in adapting to market changes for long-term success. Let’s explore how these brokers compare in trader education and resources.

IC Markets and Saxo Markets are two notable forex brokers that offer various features and platforms to accommodate different trading styles. IC Markets, established in 2007, is an Australian-based broker recognized for its low spreads and quick execution speeds. Saxo Markets, founded in 1992, is a global broker based in Denmark, known for its comprehensive trading platforms and wide range of financial instruments. Both brokers provide access to numerous currency pairs, including EUR, USD, and AUD, appealing to many traders. In 2025, forex trading trends are expected to highlight algorithmic trading, social trading, and the growing significance of mobile trading platforms.

Our team can surmise that IC Markets offers a robust educational platform, providing traders with a wealth of resources, including webinars, eBooks, and video tutorials for beginners. Saxo Markets, on the other hand, provides in-depth research reports and trading strategy guides. Both brokers offer demo accounts for practice, with IC Markets providing a comprehensive FAQ section. As forex trading trends in 2025 continue to evolve, both brokers remain well-positioned to meet the diverse needs of traders, particularly those dealing with EUR, USD, and AUD currencies.

Our Superior Educational Resources Verdict

Based on our dedicated team’s in-depth investigation of both brokers’ features and platforms, IC Markets steals the crown in this section due to their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Superior Customer Service – IC Markets

Great customer support is crucial for traders, and both IC Markets and Saxo Markets excel in this area. With 24/7 live chat, phone, and email support in multiple languages, traders can receive help anytime. Fast response times and knowledgeable teams boost confidence, enabling traders to focus on strategies. In the fast-paced forex market, exceptional customer service builds trust and satisfaction.

IC Markets and Saxo Markets are forex brokers that offer various features and platforms suitable for different trading styles. IC Markets, established in 2007 in Australia, is known for its low spreads and fast execution speeds. Saxo Markets, founded in 1992 and headquartered in Denmark, is recognized for its comprehensive trading platforms and a wide range of financial instruments. Both brokers provide access to numerous currency pairs, such as EUR, USD, AUD, and GBP. In 2025, forex trading trends show an emphasis on algorithmic trading, social trading, and the growing significance of mobile trading platforms.

| Feature | Saxo Markets | IC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 9/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Customer Service

IC Markets stands out for its exceptional customer service, providing round-the-clock support via live chat, email, and phone. This commitment ensures that traders can access assistance whenever they need it, greatly enhancing their trading experience. In contrast, while Saxo Markets delivers quality support, it does not offer phone assistance or webinars. Nonetheless, Saxo Markets compensates with a thorough help center and responsive email and live chat support, allowing traders to obtain the help they require.

IC Markets and Saxo Markets both provide customer support, with IC Markets notable for its 24/7 availability and various support channels. Saxo Markets does not offer phone support or webinars but delivers assistance through its help center and live chat. As forex trading trends in 2025 develop, both brokers appear equipped to address the needs of traders, especially those trading EUR, USD, AUD, and GBP currencies.

Our Superior Customer Service Verdict

Our team can surmise that in this category IC Markets brings home the gold thanks to their superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – IC Markets

Flexible funding options are crucial in forex trading. IC Markets and Saxo Markets provide various deposit and withdrawal methods, including bank transfers, credit/debit cards, and digital wallets like PayPal, Skrill, and Neteller, with some supporting cryptocurrencies. Low or no transaction fees ensure efficient fund management. Fast funding leads to a seamless trading experience, allowing traders to concentrate on the markets without deposit and withdrawal worries.

IC Markets and Saxo Markets are two prominent forex brokers, each offering various features and platforms to accommodate different trading styles. IC Markets, established in 2007, is an Australian-based broker known for competitive spreads and efficient execution speeds. Saxo Markets, founded in 1992, is a global broker headquartered in Denmark, recognized for its extensive trading platforms and a wide range of financial instruments. Both brokers provide access to a variety of currency pairs, including EUR, USD, AUD, and GBP, making them well-regarded options among traders. In 2025, trends in forex trading are expected to focus on algorithmic trading, social trading, and the growing significance of mobile trading platforms.

Funding Options

Both IC Markets and Saxo Markets present a wide array of funding options designed to meet the diverse needs of traders. IC Markets stands out with over 15 flexible funding methods, including credit and debit cards, wire transfers, and popular e-wallets like PayPal, Neteller, and Skrill. Similarly, Saxo Markets provides various funding solutions, such as bank transfers, credit/debit cards, and electronic funds transfers. Nevertheless, IC Markets holds a slight advantage due to its larger selection of options, enabling traders to fund their accounts swiftly and efficiently.

| Funding Option | Saxo Markets | IC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | No | Yes |

| Neteller | No | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Both IC Markets and Saxo Markets provide a variety of funding options suited to different trading needs. IC Markets offers a broader range of funding methods, which may provide traders with more flexibility and convenience. Saxo Markets has quality funding options, though it may have fewer choices than IC Markets. As forex trading trends in 2025 develop, both brokers are positioned to address the diverse needs of traders, particularly those involved with EUR, USD, AUD, and GBP currencies.

Our Better Funding Options Verdict

IC Markets, undoubtedly, outperforms the other in this niche by the reason of their better funding options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – IC Markets

Forex trading is now more accessible with lower minimum deposits, especially for beginners. IC Markets and Saxo Markets offer flexible options that lower financial barriers, allowing more traders to gain experience and develop strategies without significant upfront costs. This inclusivity fosters long-term growth and confidence while managing financial risks.

IC Markets and Saxo Markets are two prominent forex brokers, each providing various features and platforms to accommodate different trading styles. IC Markets, established in 2007 and based in Australia, is noted for its low spreads and rapid execution speeds. Saxo Markets, founded in 1992 and headquartered in Denmark, is recognized for its comprehensive trading platforms and a wide range of financial instruments. Both brokers offer access to numerous currency pairs, including EUR, USD, AUD, and GBP, which makes them commonly selected by traders. In 2025, forex trading trends suggest an emphasis on algorithmic trading, social trading, and the growing significance of mobile trading platforms.

| Minimum Deposit | Recommended Deposit | |

| Saxo Markets | $0 | - |

| IC Markets | $200 | $200 |

Funding Requirements

IC Markets stands out as an ideal option for beginner traders or those looking to trade with limited funds. With a minimum deposit of only $200, it opens the door for a diverse group of investors. In contrast, Saxo Markets sets a steep minimum deposit of $10,000, which could be a barrier for many. This higher requirement aims to attract more seasoned traders and those who can invest larger amounts.

IC Markets and Saxo Markets provide trading platforms and tools that accommodate different trading styles. IC Markets has a lower minimum deposit requirement, which may appeal to beginner traders and those with limited capital. In contrast, Saxo Markets has a higher minimum deposit, making it more suitable for experienced traders with larger capital. As forex trading trends develop in 2025, both brokers are positioned to address the varied needs of traders, especially those trading EUR, USD, AUD, and GBP currencies.

Our Lower Minimum Deposit Verdict

Indisputably, IC Markets is having its moment in the spotlight on the account of their lower minimum deposit.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: IC Markets Or Saxo Markets?

IC Markets definitely takes home the crown in all of the category on account of it consistently outperforms Saxo Markets across multiple categories, including trading platforms, customer service, and educational resources. The table below summarises the key information leading to this verdict.

| Categories | Saxo Markets | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | No | Yes |

Saxo Markets: Best For Beginner Traders

Saxo Markets is the better choice for beginner traders due to their excellence in the field of top product range and CFD markets.

IC Markets: Best For Experienced Traders

For experienced traders, IC Markets best choice for experienced traders, offering advanced trading features, a wide range of CFD markets, and competitive spreads and fees.

FAQs Comparing Saxo Market vs IC Markets

Does IC Markets Or Saxo Markets Have Lower Costs?

IC Markets has lower costs. They offer some of the lowest spreads in the industry, often starting from 0.0 pips. For more details on low-cost trading, check out our Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

IC Markets is the clear winner for MetaTrader 4 users. They offer a range of exclusive tools and features for MT4. For more on this, you can visit our Best MT4 Brokers.

Which Broker Offers Social Trading?

Neither IC Markets nor Saxo Markets offer social or copy trading. However, there are other brokers that do. For more information, visit our best copy trading platforms page.

Does Either Broker Offer Spread Betting?

Neither IC Markets nor Saxo Markets offer spread betting. For alternatives, you can check out our best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is superior for Australian Forex traders. They are ASIC-regulated and founded in Australia. For more, visit our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK traders, I’d recommend Saxo Markets. They are FCA-regulated and offer advanced trading platforms. For more details, check out our Best Forex Brokers In UK page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert