IC Markets vs FP Markets: Which One Is Best?

Our comprehensive comparison of IC Markets vs FP Markets dissects key areas like trading costs, Forex trading platforms, and regulations to help you choose the right Forex broker.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors between IC Markets and FP Markets. Here are five noticeable differences:

- IC Markets offers an average raw spread of 0.02 for EUR/USD, while FP Markets offers 0.10.

- For the GBP/USD average raw spread, IC Markets stands at 0.23 and FP Markets at 0.20.

- IC Markets provides 18+ cryptocurrency CFDs, whereas FP Markets offers only 4+.

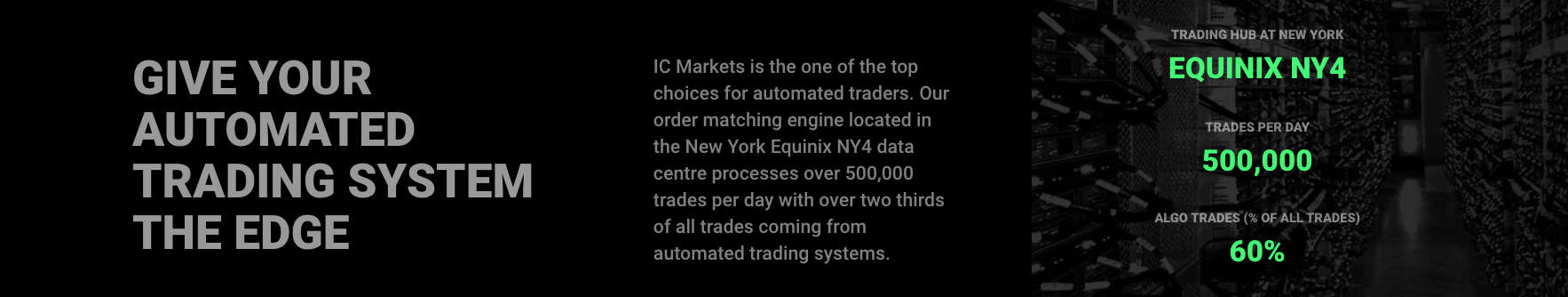

- Both brokers operate with STP trading execution, but IC Markets has servers in both New York and London, ensuring better execution.

- IC Markets generally offer more competitive spreads across all forex pairs compared to FP Markets.

1. IC Markets: Lowest Spreads And Fees

Both IC Markets and FP Markets mostly use Straight Through Processing (STP) trading execution to bring clients Electronic Communications Network (ECN) pricing. As ‘A book’ brokers using STP, orders are filled by external liquidity sources offering the best bid/ask prices with no dealing desk (NDD) involved in the trading process.

Both brokers source their prices and fill customers’ orders using a pool of top-tier liquidity providers as part of the STP trading execution, allowing for ultra-competitive spreads and institutional-grade trading conditions.

As FP Markets and IC Markets operate under similar business and pricing models, they also provide traders with comparable trade execution speeds. Both brokers promote low latency and minimal slippage as key features but IC Markets offers better execution as the broker is connected to two servers in London and New York (catering to a wider geographic region), while FP markets rely on one server in New York.

- IC Markets: Servers in New York and London, average execution speed less than 40ms.

- FP Markets: Equinix server in New York, average execution speed is 37ms.

Forex Spreads

With STP and NDD execution, the brokers are able to offer two main account types with different trading cost structures:

- Standard account types where no additional commission fees are charged on top of the spread. A great option for beginner forex traders wanting to avoid complex commission fee calculations.

- ECN-Style account types where traders pay flat rate commission fees but gain access to institutional-grade pricing. Both brokers refer to their ECN accounts as ‘Raw’ accounts.

Standard Spreads: IC Markets vs FP Markets

When IC Markets and FP Markets’ average commission-free spreads are compared, IC Markets offers the most competitive pricing for all currency pairs shown. If you want to focus your trading strategies around a major currency pair such as the EUR/USD, IC Markets offers lower average spreads of 1.10 pips (FP Markets averages 1.19 pips). Likewise, those wanting to trade the EUR/GBP gain access to spreads of 1.40 pips commission-free with IC Markets, while FP Markets customers are offered an average spread of 1.59 pips.

|

Commission Free, Standard Spread Comparison

|

|||||

|---|---|---|---|---|---|

|

0.82 | 1.50 | 0.83 | 1.27 | 1.30 |

|

1.20 | 1.90 | 1.40 | 1.40 | 1.90 |

|

1.32 | 3.19 | 1.95 | 1.37 | 1.87 |

|

2.10 | 3.60 | 2.10 | 2.70 | 2.50 |

|

1.40 | 4.90 | 2.50 | 2.50 | 2.60 |

|

1.20 | 2.80 | 1.80 | 1.90 | 2.30 |

|

1.20 | 1.20 | 1.30 | 1.20 | 1.20 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Standard Account Spreads

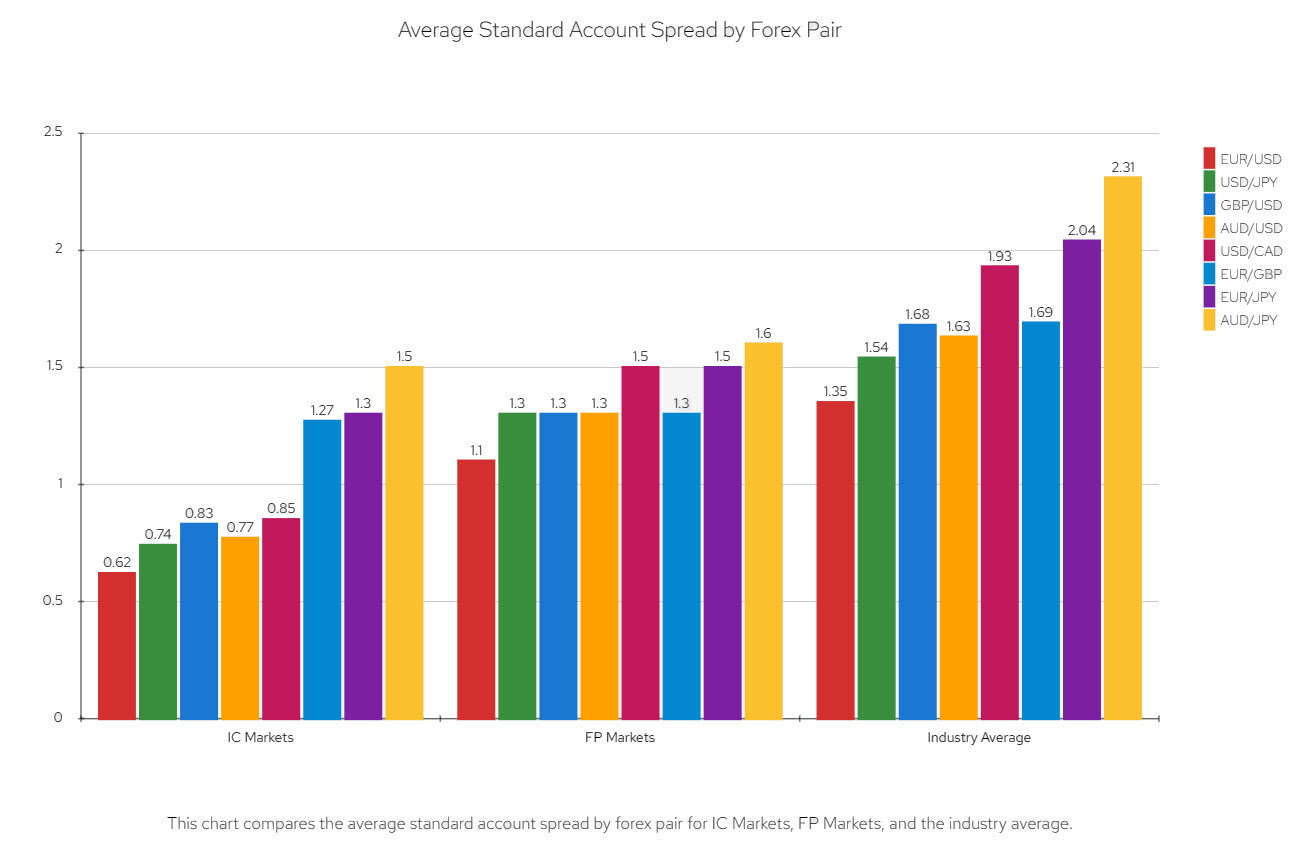

When we look at the average standard account spreads for IC Markets and FP Markets, we can see some noticeable differences. IC Markets consistently offers lower spreads across all forex pairs when compared to FP Markets. For example, the spread for EUR/USD is 0.62 for IC Markets, while it’s 1.1 for FP Markets. This pattern is consistent across all pairs, indicating that IC Markets generally offer more competitive spreads.

| Forex Pair | IC Markets | FP Markets | Industry Average |

|---|---|---|---|

| EUR/USD | 0.62 | 1.1 | 1.35 |

| USD/JPY | 0.74 | 1.3 | 1.54 |

| GBP/USD | 0.83 | 1.3 | 1.68 |

| AUD/USD | 0.77 | 1.3 | 1.63 |

| USD/CAD | 0.85 | 1.5 | 1.93 |

| EUR/GBP | 1.27 | 1.3 | 1.69 |

| EUR/JPY | 1.3 | 1.5 | 2.04 |

| AUD/JPY | 1.5 | 1.6 | 2.31 |

Standard Account Analysis Updated July 2025[1]July 2025 Published And Tested Data

However, it’s important to note that while IC Markets has lower spreads, this doesn’t necessarily mean it’s the cheaper option overall. Other factors, such as commission fees and account types, can also influence the total cost of trading.

When we compare these brokers to the industry average, both IC Markets and FP Markets offer competitive spreads. IC Markets, in particular, consistently beats the industry average, making it a cost-effective choice for traders who prioritise low spreads.

In conclusion, based on the spread data alone, I would argue that IC Markets appears to be the cheaper option. However, I would advise potential traders to consider all trading costs and not just spreads when choosing a forex broker.

Raw Spreads: FP Markets vs IC Markets

If you wish to execute day trading, scalping or Expert Advisor strategies or purely looking for the tightest spreads available to retail investor accounts, Raw accounts are appropriate as you pay a flat rate commission charge while gaining access to ultra-low ECN-style spreads.

IC Markets offers the lowest spreads for all currency pairs displayed below. While FP Markets offers competitive pricing compared to other top brokers, which also makes them a great choice of broker, IC Markets’ unbeatable spreads average 0.30 pips for the EUR/JPY, while FP Markets average 0.44 pips.

|

ECN-Style Commission Spreads

|

|||||

|---|---|---|---|---|---|

|

0.03 | 0.27 | 0.30 | 0.23 | 0.14 |

|

0.30 | 0.30 | 0.60 | 0.50 | 0.30 |

|

0.13 | 0.14 | 1.40 | 0.14 | 0.14 |

|

1.23 | 1.13 | 1.23 | 1.08 | 0.77 |

|

0.50 | 0.60 | 0.40 | 2.00 | 0.60 |

|

0.50 | 0.60 | 0.80 | 0.60 | 0.30 |

|

0.70 | 0.60 | 0.80 | 0.50 | 0.50 |

|

0.40 | 0.50 | 0.70 | 0.60 | 0.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Commission Fees: Raw Spread Accounts

Commission fees are paid per side (per 100,000 traded) and depend on the base currency of your IC Markets or FP Markets trading account. For base currencies such as AUD, CAD and EUR, FP Markets and IC Markets charge the same commission fees. Although FP Markets offers a narrower choice of base currencies, commission fees are less for currencies such as SGD, JPY and HKD.

| Raw Commission (Per Side, Per 100k) | IC Markets | FP Markets |

|---|---|---|

| AUD | 3.50 | 3.50 |

| CAD | 3.50 | 3.50 |

| USD | 3.50 | 3 |

| SGD | 4.50 | 3.50 |

| GBP | 2.50 | 2.25 |

| EUR | 2.75 | 2.75 |

| CHF | 3.30 | NA |

| HKD | 27.125 | 20 |

| JPY | 350 | 250 |

| NZD | 4.50 | NA |

Please note when trading via an IC Markets cTrader Raw account, fees are different from MetaTrader commission costs. Raw cTrader commission fees are USD 3 per side per 100,000 traded.

Verdict

FP Markets and IC Markets provide similar trading environments with tight spreads, commission or no commission account options, as well as fast trade execution with NDD interference. Yet, with the lowest spreads across all the fx pairs compared above, IC Markets offers the best trading conditions and lowest spreads overall. Although FP Markets charges lower commission fees for certain currencies, this can easily be avoided by selecting the AUD or CAD as your base currency when you sign up for an IC Markets Raw account.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. IC Markets: Better Trading Platform

| Trading Platform | IC Markets | FP Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

IC Markets and FP Markets each offer a choice of three trading platforms that are suited to different traders’ needs. Both brokers provide access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), with IC Markets also offering cTrader. FP Markets Iress Account holders can have the additional option of the broker’s proprietary platform, Iress.

| Trading Platforms | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | cTrader | Iress (FP Markets Proprietary Software) |

|---|---|---|---|---|

| Designed for: | Forex Trading | Multi-Asset Trading | Forex Trading | Multi-Asset Trading (Mainly Shares) |

| IC Markets | ✅ | ✅ | ✅ | ❌ |

| FP Markets | ✅ | ✅ | ✅ | ✅ |

MetaTrader 4 And MetaTrader 5 (FP And IC Markets)

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most popular trading platforms worldwide. With advanced technical analysis tools, automated trading features and an easy-to-use interface, the platforms are well-suited for beginner, intermediate or advanced traders.

Both FP Markets and IC Markets offer MetaTrader 4 and MetaTrader 5, although access may vary depending on the account type you are using.

Automating trading with Expert Advisors (EAs, aka trading robots) is becoming increasingly popular as EAs dramatically reduce the time spent conducting research and placing orders. As well as more efficient trading, Expert Advisors remove human emotion when developing strategies, allowing the predetermined algorithm to identify opportunities, maximise gains, and minimise losses. Traders can develop their own EAs or download existing EAs from the MetaTrader marketplace.

Automating trading with Expert Advisors (EAs, aka trading robots) is becoming increasingly popular as EAs dramatically reduce the time spent conducting research and placing orders. As well as more efficient trading, Expert Advisors remove human emotion when developing strategies, allowing the predetermined algorithm to identify opportunities, maximise gains, and minimise losses. Traders can develop their own EAs or download existing EAs from the MetaTrader marketplace.

Algorithmic trading with EAs is available on both MT4 and MT5, although there are key differences in features between platforms that are explained below.

MetaTrader 4: The Original Forex Platform

Although commodities, indices and precious metals can be traded on MT4, the platform was initially designed to facilitate forex trading for retail investor accounts. While popular asset classes such as share CFDs and ETFs cannot be accessed on MT4, it is still incredibly popular due to its Expert Advisor features and analysis tools.

MT4 features that FP Markets and IC Markets traders can utilise include:

- Pre-installed charting and technical analysis tools: 30 technical indicators, 31 graphical objects, and 9 timeframes

- Expert Advisors are written using the MQL4 programming language

- Single currency backtesting for Expert Advisors

- Alerts and notifications

- Hedging only

IC Markets Advanced Trading Tools For MT4

A unique feature that IC Markets offers is a package of 20 trading tools compatible with MetaTrader 4. The add-ons include risk management and execution tools such as a mini terminal, tick chart trader and market manager. As well as add-on tools, the package provides additional indicators such as High-Low, Pivot and Renko indicators.

MetaTrader 5: An Enhanced Multi-Asset Trading Platform

MT5 users gain access to an expanded collection of trading and analysis tools such as:

- A greater range of inbuilt charting and analysis tools: 38 technical indicators, 44 graphical objects and 21 timeframes

- Expert Advisors are developed with the more efficient MQL5 language

- Enhanced multi-currency backtesting for EAs

- Hedging and netting

Additional features that MT5 users gain that are not offered by its predecessor include:

- ETF and share trading are permitted

- Level 2 Depth of Market pricing

- A built-in economic calendar

The various improvements to MT5 are well-suited to those wanting to execute day trading or scalping strategies due to the platform offering 21 different timeframes plus a greater range of technical analysis tools.

Likewise, those using Expert Advisors may prefer MT5 over MT4, as the MQL5 programming language is comparable to the object-oriented C++ language. The more efficient MQL5 means it is easier for traders to learn the programming language, as well as write and edit EAs.

cTrader (IC Markets)

The forex trading platform is a good choice for beginner and advanced traders alike as it provides a user-friendly institutional-style trading environment.

Algorithmic Trading: Similarly to MetaTrader’s Expert Advisors, cTrader users can fully automate trading using cBots. cBots are developed using the software programming language C#.

Algorithmic Trading: Similarly to MetaTrader’s Expert Advisors, cTrader users can fully automate trading using cBots. cBots are developed using the software programming language C#.

cTrader also offers ultra-fast execution speeds. Yet, while MetaTrader servers are hosted by Equinix’s New York Data Centre, cTrader servers are based in Equinix’s Data Centre in London. This may be advantageous for those wanting to focus on forex trading based in the United Kingdom or Europe. Additional cTrader features and tools include:

- Level 2 depth of market pricing

- 50 technical indicators and 26 timeframes

- One-click trading

Iress (FP Markets)

Ideal for those wanting to trade a wide range of Share CFDs, FP Markets’ proprietary trading platform, Iress, offers market access to ETFs and over 10,000 stocks. While commodities, futures, forex and indices are available, market access is limited (only 34 currency pairs are available).

To access FP Markets Iress trading platform, customers must sign up to one of three Iress account types: Standard, Platinum or Premier. Other features of the trading Iress platform include:

- Analysis tools with 59 technical indicators and over 50 drawing tools

- Customisable charts that can be saved

- Alerts for news and price levels

Desktop, Webtrader And Mobile Trading

- MT4/MT5: Desktop, webtrader, iPhone, iPad, Android and Mac

- cTrader: Desktop, Web, iOS, Android

- Iress: Web-based platforms (ViewPoint, Trader and Investor) as well as mobile apps

Verdict

While asset classes, trading tools and automated trading features are similar across platforms, the combination of IC Markets and MetaTrader 5 (MT5) wins this round.

With all of MT4’s features, plus level 2 depth of market, MQL5 to write EAs, extended analysis features, as well as access to Share CFD markets, MT5 provides all the tools needed to develop diverse and effective trading strategies.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Tie: Superior Accounts And Features

As an IC Markets or FP Markets trader, you have the choice of a standard commission-free account, an ECN-type commission account, or a Swap-free account designed for Islamic traders who observe Sharia law.

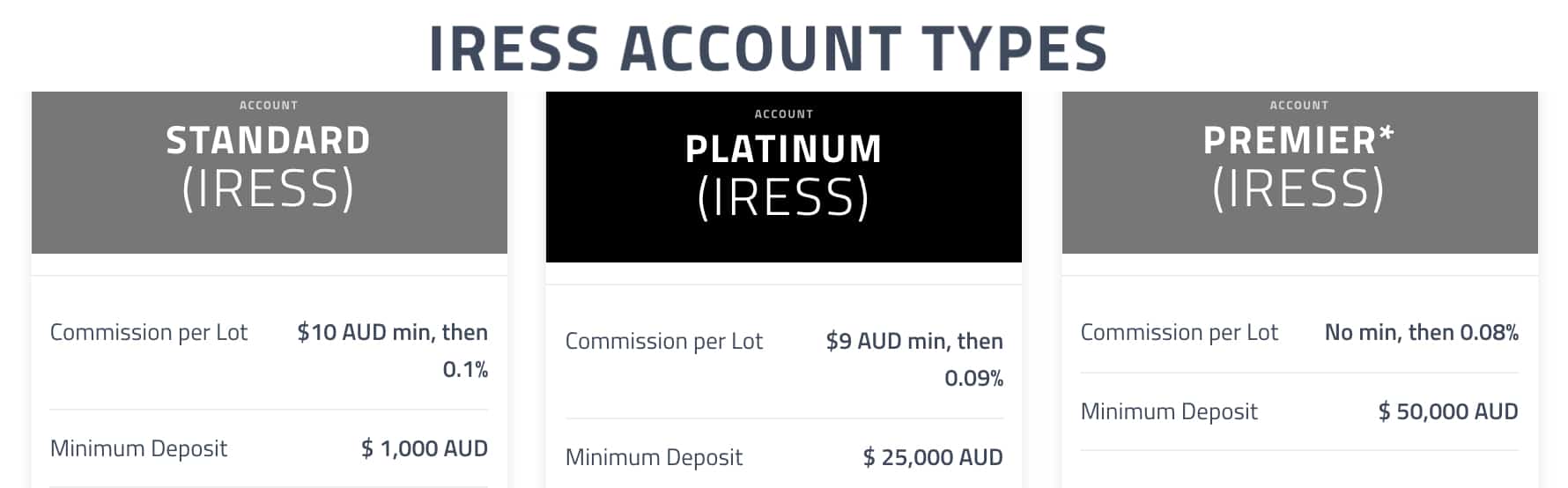

FP Markets customers wanting to focus on share trading via the broker’s proprietary trading platform, Iress, can sign up for a Standard, Platinum or Premier Iress Account, although commission costs are high and significant initial deposits are required. Traders wanting to trade Shares CFD may wish to consider this account as it offers Direct Markets Access (DMA) trading execution. If you only wish to trade Forex, the MetaTrader accounts a likely to be more suited.

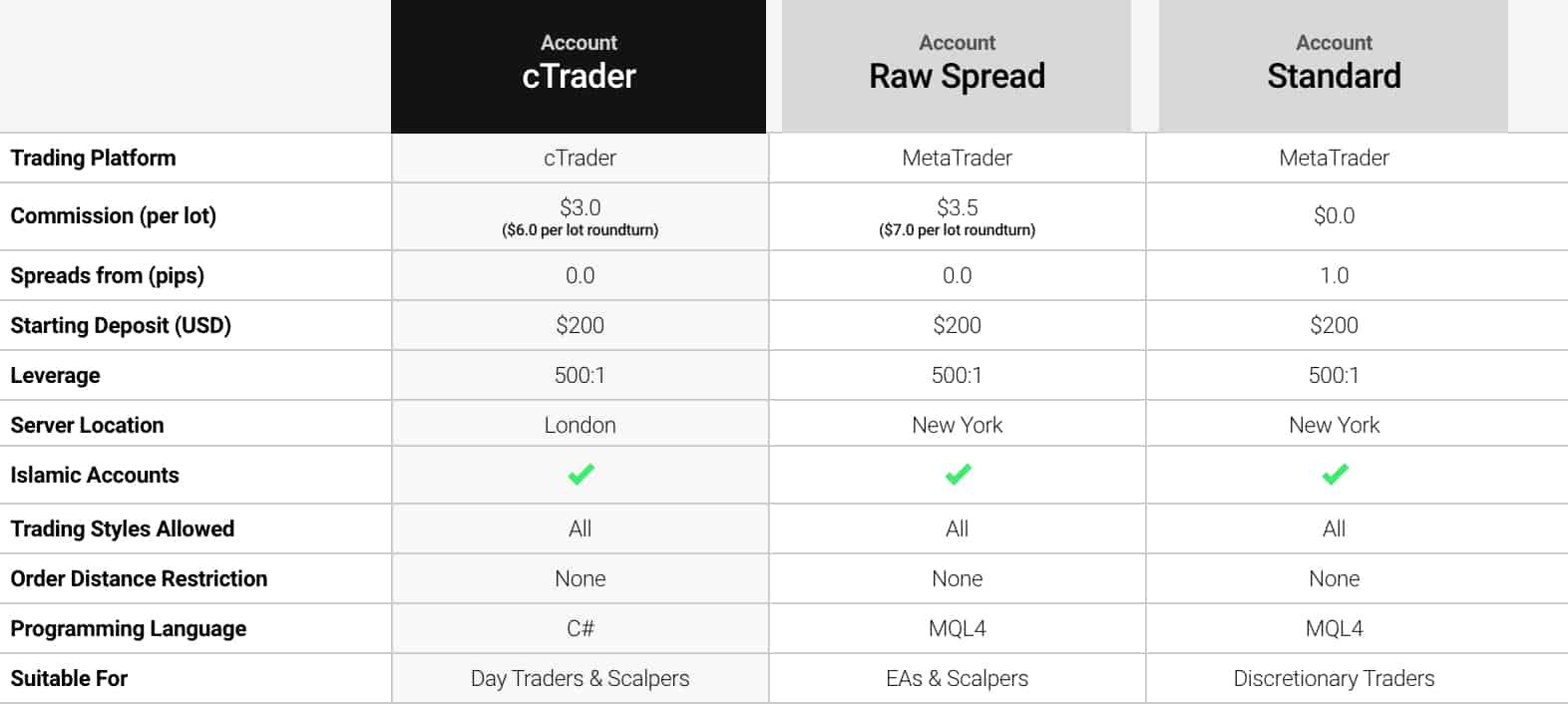

IC Markets Account Types

When signing up for an IC Markets account, you have the choice of standard spreads that are commission-free or raw spreads, where you pay a flat rate commission fee on each trade. Regardless of account type, an initial deposit of $200 is required. Depending on the commission fee structure and trading platform you prefer, the following account types are available:

- Standard Spread Account (MT4/MT5): Minimum spreads of 1.0 pip with no commission fees.

- Raw Spread Account (MT4/MT5): Lower spreads of 0.0 pips plus AUD $7 round turn commission fees.

- Raw Spread Account (cTrader): ECN-style spreads from 0.0 pips and AUD $6 round turn commission fees.

While spreads and commission fees are the key differences between IC Markets Raw and Standard account types, certain trading strategies are better suited to each account type.

If you trade infrequently or you are a beginner trader, the IC Markets Standard account offers a simple pricing structure avoiding the need to calculate commission costs for each trade executed.

If you are planning to implement day trading, scalping or Expert Advisor trading strategies, the broker’s Raw accounts on cTrader or MetaTrader is an ideal account type. Raw accounts with ultra-tight spreads provide traders with an institutional-style trading environment, offering some of the best prices currently available to retail investor accounts.

Swap Rates

Also known as rollover interest or overnight financing fees, a swap rate is an interest charged or received when a position is kept open for longer than one day. While swap rates differ between currency pairs (the rate is determined by the interest rate differential between the currencies involved in the trade), all positions held open on a Wednesday night are charged triple swap rates.

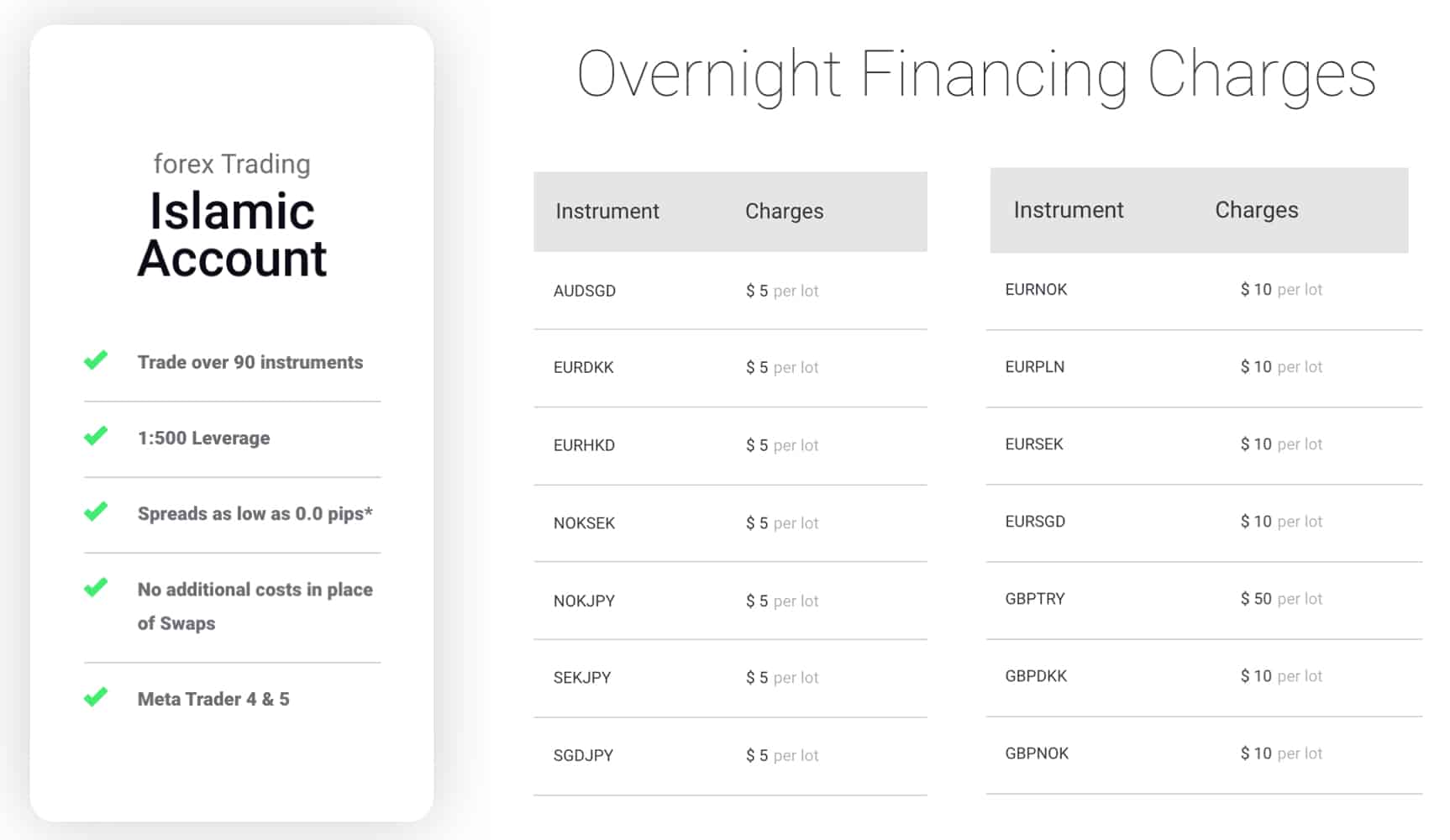

Islamic Account

Often referred to as a Swap-Free Account, IC Markets Islamic account is designed for those following Islamic finance practises where the interest cannot be received or paid. Rather than paying overnight financing fees, IC Markets charges a flat rate fee for positions held open longer than one day. Overnight financing charges vary between currency pairs, ranging from $5 per lot to $50 per lot, with triple charges applicable on Friday evenings.

Islamic accounts are available with Raw or Standard spreads and commission fees and can be accessed through cTrader, MetaTrader 4 or MetaTrader 5.

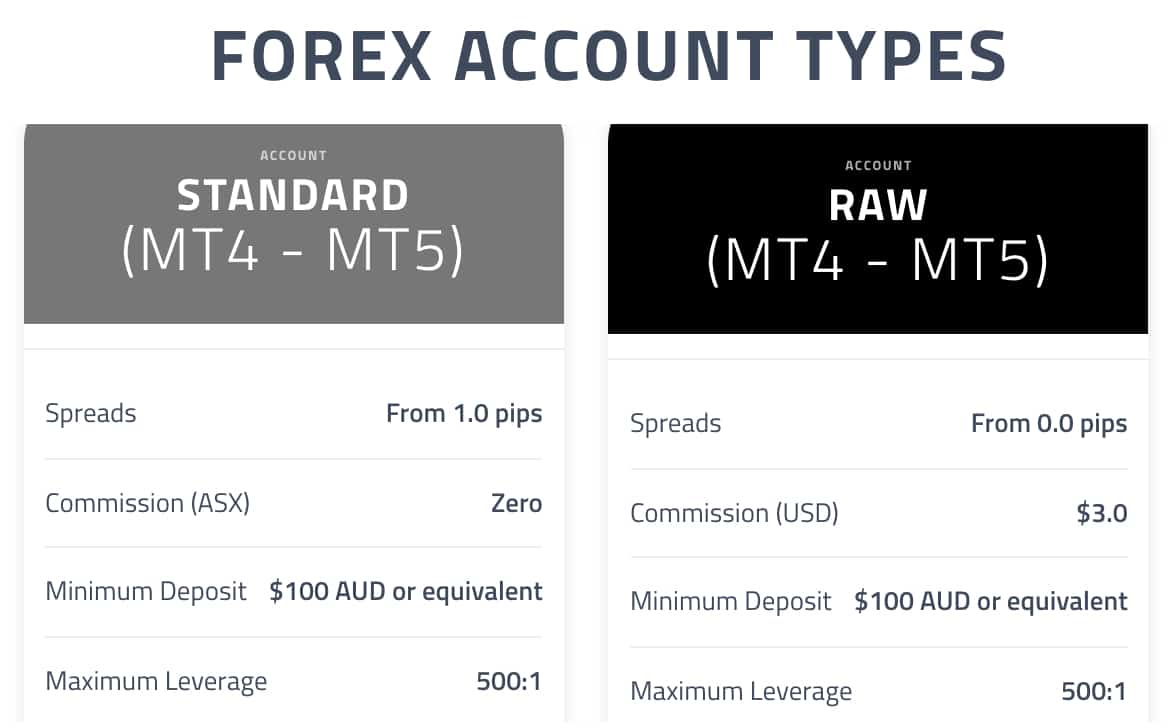

FP Markets Account Types

Similarly to IC Markets, two main pricing structures are offered by FP Markets. A low minimum deposit of $100 AUD is required to start trading, with commission fees and minimum spreads as follows:

- Standard Spread Account (MT4/MT5): Commission-free spreads starting from 1.0 pip.

- Raw Spread Account (MT4/MT5): Minimum spreads of 0.0 pips and USD $6 round turn commission fees.

Swap Rates

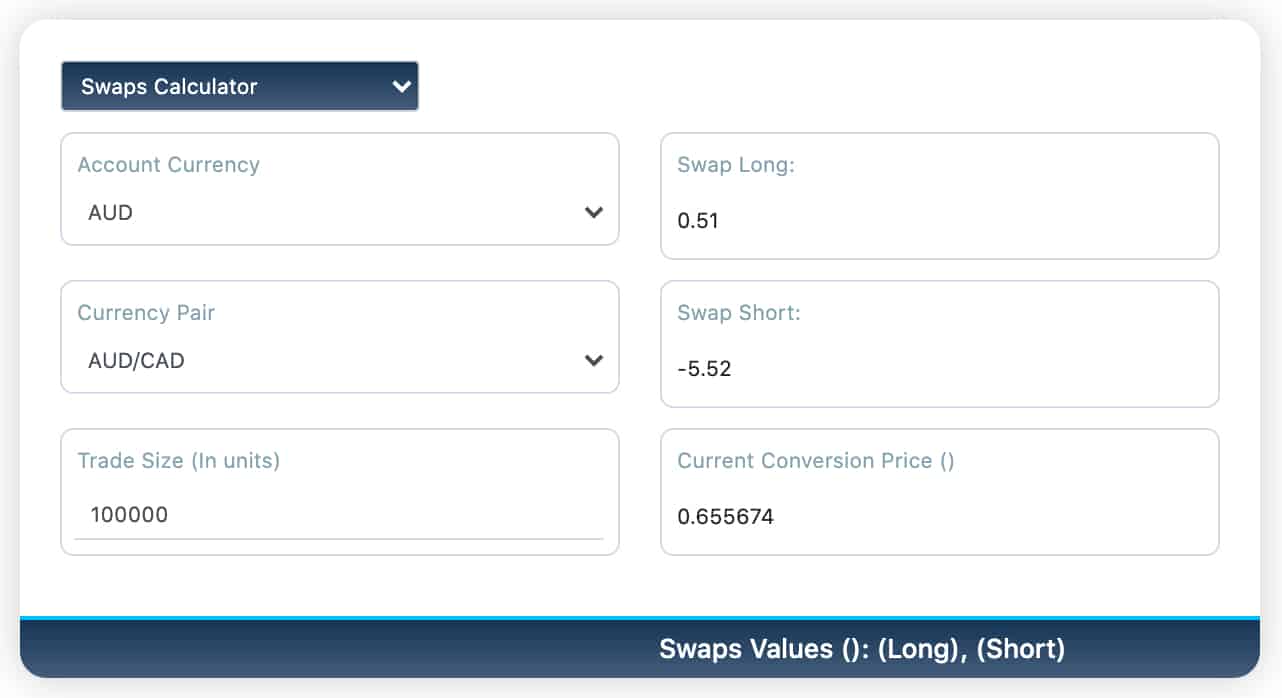

Whether you are using a Standard or Raw account, positions held open for longer than one day will incur swap charges. FP Markets offers a forex calculator online where you can estimate swap rates for overnight positions.

Islamic Accounts

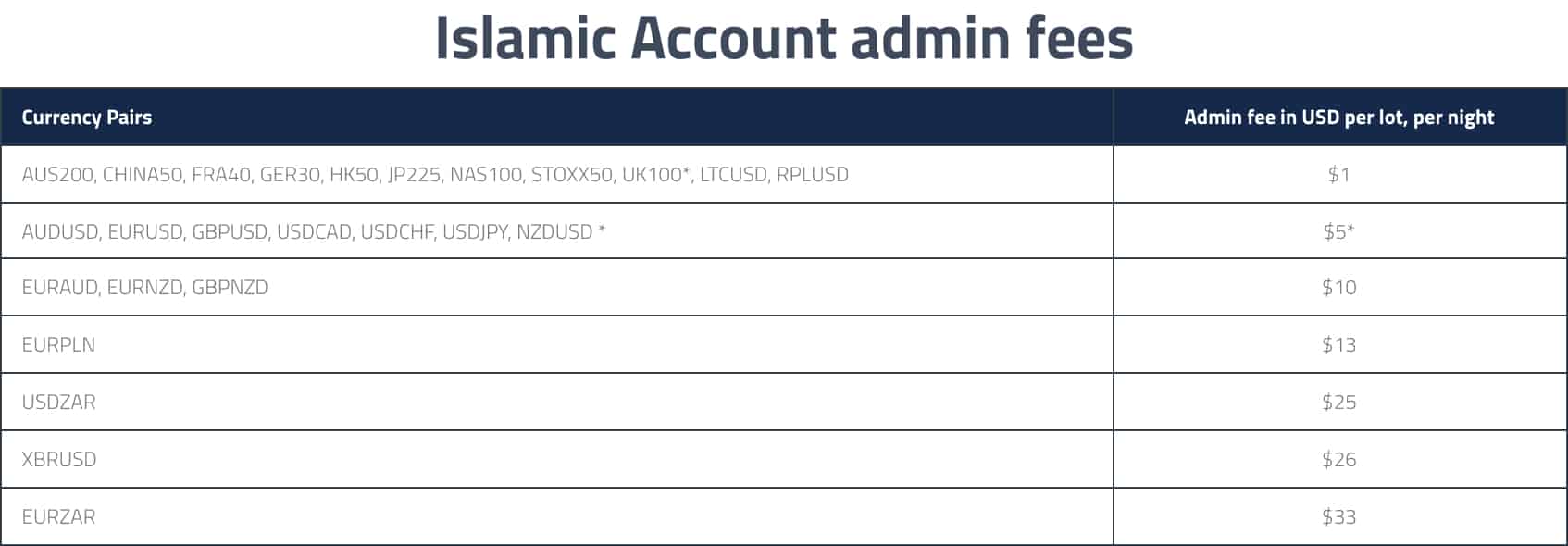

FP Markets Islamic account is available on MT4 or MT5. Following Islamic finance practises, traders do not pay or receive swap rates (aka rollover interest). Instead, for positions that are held open overnight, a flat rate admin fee is applicable. The admin fee traders pay varies with the financial instrument involved. For instance, popular stock indices such as the AUS200 or UK100 pay USD $1 per night per lot, while trades involving exotic currency pairs such as the EUR/ZAR pay a significant admin fee of USD $33 per night. For Major Forex Pairs such as the AUD/USD, EUR/USD, and GBP/USD, a $5 admin charge is incurred.

Iress Account

In addition to Raw, Standard and Islamic account types, FP Markets offer Iress accounts designed for trading shares among other CFDs. Initial minimum deposits are much higher than FP Markets Standard and Raw Accounts, with the three account tiers ranging from standard accounts with a $ 1,000 minimum deposit requirement, to a premier Iress account that requires an initial deposit of $50,000.

| IC Markets | FP Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Verdict

As IC Markets and FP Markets offer both Standard, ECN-style and Swap-Free account types, the brokers tie this round. Similar minimum deposits are required, with minimum spreads of 0.0 pips promoted by both brokers via their Raw Accounts. Regardless of whether you aim to execute scalping strategies regularly or a beginner trading infrequently, both brokers provide a suitable account type.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. IC Markets: Best Trading Experience And Ease

When it comes to the trading experience, both IC Markets and FP Markets have their unique strengths. Having spent considerable time on both platforms, we’ve noticed that IC Markets offers a more intuitive interface, especially for beginners. Their platform is streamlined, making it easier to navigate and execute trades.

On the other hand, FP Markets provides a robust set of tools that cater to more experienced traders, allowing for in-depth analysis and strategy formulation.

- IC Markets is recognised for offering the best MT5 experience.

- FP Markets stands out for its comprehensive CFD offerings.

- Both brokers provide competitive spreads, but IC Markets often edges out with slightly lower rates.

- In terms of standard accounts, IC Markets takes the lead with its user-friendly features and competitive pricing.

Verdict

Based on our analysis and hands-on experience, IC Markets offers a slightly better overall trading experience, especially for those who prioritise ease of use and intuitive design.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Tie: Stronger Trust And Regulation

IC Markets Trust Score

FP Markets Trust Score

To manage the high risk of trading forex and CFDs, trading platform features such as order types, and demo accounts can be used. Additionally, signing up with a broker that is regulated by top-tier financial authorities provides investors protection, although this varies between jurisdictions.

Trading Platform Risk Management

The order types available to manage risk vary between trading platforms. While market orders execute a trade at the current market price, pending orders can be used to buy and sell financial instruments at a predetermined price. You can use the following order types on MT4, MT5, cTrader and Iress to enter and exit markets at optimal times:

- Stop orders

- Limit orders

- Stop limit orders (MT5 only)

- Take profit

- Stop loss

- Trailing stop loss (MT5 only)

Managing Risk With Demo Accounts

Demo accounts are an additional risk management tool offered by both FP Markets and IC Markets. Demo accounts are useful for practising trading strategies against real-time market data, familiarising yourself with technical analysis as well and building confidence in placing different orders.

- IC Markets: Demo accounts are available for all platforms, with a virtual trading balance of $50,000 provided and access granted for 30 days.

- FP Markets: When signing up to a demo account, you are given a trading balance of $100,000 in virtual funds. Although the broker does not enforce time restrictions on demo accounts, demos will be closed if there has not been any activity for 30 days.

Financial Regulation

IC Markets and FP Markets are overseen by top-tier financial authorities that ensure subsidiaries provide the correct level of investor protection, depending on the jurisdiction.

IC Markets

Depending on where you reside, you can register with an IC Markets subsidiary that is regulated by one of the following financial authorities:

- Australia – The Australian Securities and Investments Commission (ASIC)

- Europe – Cyprus Securities and Exchange Commission (CySEC)

- International – Financial Services Authority FSA (Seychelles)

If you are a European or UK trader, IC Markets is required to provide Negative Balance Protection. Negative balance protection is a policy enforced by certain financial authorities such as CySEC and the FCA to ensure you cannot lose more funds than you initially deposited. If your trading balance falls below zero, IC Markets will close all open positions to protect your account from entering a negative balance. As negative balance protection is not a legal requirement for FSA or ASIC-regulated brokers, traders outside of the UK and Europe do not receive such protection.

FP Markets

With oversight from three major regulators, FP Markets is seen as a trusted broker. The broker’s policies aimed to protect investors differ between subsidiaries, with CySEC enforcing the strictest financial regulation overall.

- Australia: The Australian Securities and Investments Commission (ASIC)

- Europe: Cyprus Securities and Exchange Commission (CySEC)

- International: Financial Services Authority FSA (Seychelles) and Financial Services Commission in Mauritius (FSC-M)

- South Africa: Financial Sector Conduct Authority (FSCA)

If you are based in the UK or Europe, you can register with FP Markets CySEC regulated branch. As with IC Markets EU customers, FP Markets will provide negative balance protection. Those residing elsewhere have the option of the FSA or ASIC-regulated subsidiaries, where negative balance protection is not a requirement.

| IC Markets | FP Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | FSA-S (Seychelles) FSC-M (Mauritius) FSCA (South Africa) |

Verdict

FP Markets and IC Markets are seen as trusted, highly regulated brokers that provide similar risk management tools and investor protection. Both brokers are regulated by ASIC and CySEC, with European and UK traders receiving negative balance protection.

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than FP Markets. On average, IC Markets sees around 246,000 branded searches each month, while FP Markets gets about 49,500 — that’s 79% fewer.

| Country | IC Markets | FP Markets |

|---|---|---|

| United Kingdom | 33,100 | 2,400 |

| South Africa | 9,900 | 2,400 |

| Vietnam | 8,100 | 320 |

| Thailand | 8,100 | 720 |

| India | 8,100 | 2,900 |

| Spain | 6,600 | 1,600 |

| United States | 6,600 | 1,600 |

| Australia | 6,600 | 1,900 |

| Germany | 5,400 | 1,300 |

| Pakistan | 5,400 | 1,300 |

| France | 4,400 | 880 |

| Brazil | 4,400 | 590 |

| United Arab Emirates | 4,400 | 480 |

| Morocco | 4,400 | 590 |

| Italy | 3,600 | 12,100 |

| Colombia | 3,600 | 260 |

| Nigeria | 3,600 | 590 |

| Malaysia | 3,600 | 720 |

| Indonesia | 3,600 | 590 |

| Singapore | 3,600 | 590 |

| Poland | 2,900 | 720 |

| Sri Lanka | 2,900 | 140 |

| Mexico | 2,400 | 170 |

| Netherlands | 2,400 | 480 |

| Algeria | 2,400 | 210 |

| Canada | 2,400 | 1,600 |

| Philippines | 2,400 | 390 |

| Hong Kong | 2,400 | 170 |

| Kenya | 2,400 | 590 |

| Saudi Arabia | 1,900 | 210 |

| Bangladesh | 1,900 | 720 |

| Peru | 1,600 | 70 |

| Switzerland | 1,600 | 480 |

| Egypt | 1,600 | 210 |

| Argentina | 1,300 | 140 |

| Turkey | 1,300 | 720 |

| Sweden | 1,300 | 210 |

| Japan | 1,300 | 140 |

| Portugal | 1,000 | 210 |

| Ecuador | 1,000 | 70 |

| Dominican Republic | 1,000 | 70 |

| Taiwan | 1,000 | 210 |

| Uzbekistan | 1,000 | 70 |

| Ireland | 880 | 90 |

| Cyprus | 880 | 480 |

| Ghana | 880 | 70 |

| Chile | 720 | 70 |

| Austria | 720 | 170 |

| Venezuela | 720 | 110 |

| Greece | 720 | 1,900 |

| Uganda | 720 | 70 |

| Ethiopia | 720 | 110 |

| Mongolia | 720 | 10 |

| Jordan | 590 | 70 |

| Mauritius | 480 | 20 |

| Costa Rica | 390 | 20 |

| Tanzania | 320 | 110 |

| Bolivia | 260 | 30 |

| Panama | 260 | 20 |

| Botswana | 260 | 50 |

| New Zealand | 210 | 40 |

| Cambodia | 170 | 210 |

2024 Monthly Searches For Each Brand

IC Markets - UK

IC Markets - UK

|

33,100

1st

|

FP Markets - UK

FP Markets - UK

|

2,400

2nd

|

IC Markets - ZA

IC Markets - ZA

|

9,900

3rd

|

FP Markets - ZA

FP Markets - ZA

|

2,400

4th

|

IC Markets - Thailand

IC Markets - Thailand

|

8,100

5th

|

FP Markets - Thailand

FP Markets - Thailand

|

720

6th

|

IC Markets - Australia

IC Markets - Australia

|

6,600

7th

|

FP Markets - Australia

FP Markets - Australia

|

1,900

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 482,000 for FP Markets.

Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Tie: Top Product Range And CFD Markets

In addition to forex trading, IC Market and FP Market traders can create diversified investment strategies using CFD instruments such as indices, commodities and shares. As discussed in the next section, market access varies greatly between trading platforms, and customers should consider the asset classes they wish to trade before they choose an account type and trading platform.

IC Markets: Forex And CFD Trading

As well as forex trading, IC Markets clients can trade indices, commodities, metals, bonds, futures, shares and cryptocurrency CFDs.

- 60 currency pairs are available to trade as IC Markets customers, with variable forex spreads on major, minor and exotic fx pairs.

- 23 index CFDs derived from global equity markets.

- 19+ commodity CFDs, including softs, oil and gas.

- 7 metal CFDs with Gold, Silver, Palladium and Platinum valued against either the USD, EUR or AUD.

- 9 bond CFDs derived from securities issued by the UK, EU, Japan, Italy and the United States Governments.

- 4 futures CFDs (MT4 only), including dollar index, volatility index, and oil futures.

- 10 major cryptocurrency CFDs: Bitcoin, Bitcoin Cash, LiteCoin, Dash Coin, Ethereum, EOS, Ripple, Emercoin, PeerCoin and NameCoin.

- 120+ share CFDs (MT5 only) with popular companies listed on major stock exchanges such as the NYSE and ASX.

FP Markets: Fx Pairs And CFDs

As shown below, FP Markets’ product range tends to be less diverse than IC Markets, with no bonds and a significantly smaller number of commodities and crypto CFDs.

- 70+ forex pairs, depending on the trading platform you are using (MT4 gains greater market access than MT5 or Iress).

- 15 indices including the JP225, AUS200 and US500.

- 9 commodities CFDs crude oil products, Gold and Silver are available against either the USD, EUR or AUD

- 10+ crypto CFDs limited to Bitcoin, Ethereum, Ripple, Litecoin and Bitcoin Cash.

- 800+ share CFDs offered through MetaTrader 5.

- A range of ETFs and futures are accessible on the Iress trading platform.

Trading With Leverage

The maximum leverage you are offered by each broker is determined by the forex pair or CFD you are trading, as well as the subsidiary you are registered with. For instance, if you are trading major currency pairs with FP Markets or IC Markets ASIC-regulated Australian branch or FCA-regulated subsidiary in the UK, the maximum leverage offered is 30:1 for major currency pairs and 20:1 for minor and exotic pairs.

Maximum leverage on asset classes such as cryptocurrencies is much lower, with both brokers offering 2:1. Please note retail traders are no longer able to access crypto markets under FCA regulation.

Both brokers offer a professional account to Australian, European and UK traders if you match the criteria, and then you’ll be able to trade with increased leverage.

Verdict

Both brokers offer great market access with 60 currency pairs, yet each has its own strength – FP Markets in shares and IC Markets in crypto. Although FP Markets provides access to over 10,000 stocks, you are required to sign up to an Iress account type and use the broker’s proprietary trading platform. IC Markets, on the other hand, offers a great selection of asset classes and 10 different cryptocurrency CFDs to choose from.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. FP Markets: Superior Educational Resources

FP Markets:

- Webinars and Seminars: FP Markets offers regular webinars and seminars to educate their traders. This is beneficial for both beginners and experienced traders looking to sharpen their skills.

- E-books and Articles: A vast library of e-books and articles is available, covering everything from the basics of forex trading to advanced strategies.

- Video Tutorials: These are especially useful for visual learners, covering various topics in forex trading.

- Market Analysis: FP Markets provides daily market analysis, helping traders make informed decisions.

- Demo Account: A platform for beginners to practice their trading strategies without any risk.

- Customer Support: They offer 24/5 customer support, assisting traders with any queries related to trading.

IC Markets:

- Educational Webinars: IC Markets also hosts webinars, helping traders understand the nuances of the forex market.

- Trading Guides: Comprehensive guides are available, covering various aspects of trading.

- Video Library: A collection of videos explaining different trading strategies and market analysis.

- Market Commentary: Daily commentary on market movements and economic news.

- Demo Account: Like FP Markets, IC Markets also offers a demo account for practice.

- 24/7 Support: A slight edge over FP Markets, IC Markets offers 24/7 customer support.

Verdict

Based on our team’s testing, FP Markets offers superior educational resources with a score of 7.5, compared to IC Markets’ score of 6, providing traders with comprehensive tools and materials to enhance their trading knowledge.

9. IC Markets: Superior Customer Service

When choosing a broker, the level of support and educational resources you require may vary whether you are new to trading or an experienced investor. Two main areas of customer service to look at before choosing a broker are:

- Customer Support

- Education and Research

IC Markets: Excellent Customer Service

1. Customer Support

A major benefit to trading with IC markets is that customer support is available 24 hours a day, 7 days a week. To get in touch with IC Markets representatives, you can use phone, email and live chat contact methods, all of which provide quick and efficient responses.

- 24/7: Live chat, phone & email

2. Education and Research

Like the broker’s excellent customer support, IC Markets offers a wide range of educational materials and research tools to help expand your forex trading knowledge:

- Webinars and educational videos

- Trading platform tutorials

- Articles and Web TV that provide market analysis

- ‘Trading Ideas’ for MT4/MT5 users

- Newsfeeds showing significant market events

FP Markets Customer Service

1. Customer Support

Unlike IC Markets, FP Markets customer support is 24/7 Award-winning Customer Support. Phone, email and live chat contact methods are available, although the live chat function is known to be slow while providing irrelevant answers. Australian traders are provided with the additional option of visiting the broker’s head office, based in Sydney, Australia.

- 24/7: Phone, email & live chat

2. Education and Research

While FP Markets lacks the excellent webinars that IC Markets hosts, the broker still provides a good range of educational and research resources:

- Hosts webinars weekly in multiple languages

- Trading platform video tutorials

- Trading courses

- e-books freely available for download

- A Trading glossary

- Fundamental analysis provided by in-house analysts

- Economic calendar

Verdict

With 24/7 customer support via live chat, email and phone, IC Markets offers the best customer service overall. In addition to customer support being helpful and efficient, the broker offers a wide range of educational resources and research tools. The education and research tools help traders develop their trading knowledge while staying up to date with news and changes within financial markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. IC Markets: Better Funding Options

When funding your trading account, there are three key points to consider:

- What base currencies are available?

- What deposit and withdrawal methods are available? Are they fee-free?

- Does the broker charge account management fees, such as inactivity fees?

IC Markets Funding

1. Selecting a Base Currency

When setting up your IC Markets account, a base currency needs to be selected. The broker offers CAD, CHF, JPY, NZD, SGD, HKD, GBP, EUR and AUD as base currencies, regardless of whether you are signing up to a Raw or Standard account type.

2. Funding your Account

IC Markets offers 15 funding options, including traditional and e-wallet methods. The broker does not charge any deposit and withdrawal fees, yet third-party fees may apply for certain withdrawal methods. When making withdrawals, funds will be returned via the same payment method the funds were initially deposited with.

Deposit and withdrawal methods available include the following:

- Credit card/debit card: UnionPay, Visa and Mastercard

- e-Wallet: PayPal, Neteller, Neteller VIP, Skrill, BPay, FasaPay, POLi, Rapidpay, Klarna and Bitcoin Wallet

- Bank Transfer: Wire Transfer, Vietnamese Internet Baking, Thai Internet Banking, Broker to Broker

Please note that each deposit method accepts specific currencies, i.e, UnionPay only accepts the Chinese Yuan, and BPay only accepts the Australian Dollar.

3. Account Fees

IC Markets do not charge account fees such as inactivity fees, making it an excellent low-cost broker for infrequent traders.

FP Markets Account Funding

1. Base Currencies

FP Markets can set up their trading account with one of the following base currencies: USD, CAD, AUD, NZD, JPY, GBP, HKD, GBP, EUR, CHF and CAD.

2. Deposit and Withdrawal Methods and Fees

The broker provides credit card, banking and e-wallet payment options. As with IC Markets, each payment method accepts different base currencies and may not be suitable for all traders and locations.

- Credit/Debit Card: Visa and MasterCard

- Banking: Domestic transfer, international bank wire, local bank transfer (Paytrust88)

- e-Wallet: Neteller, Skrill, FasaPay, Ngan Luong, PayPal and Online Pay

Apart from international broker-to-broker transfers, where a $25 AUD fee applies, no deposit fees will be incurred if you use any of the above methods on MT4/MT5.

Withdrawal fees vary between payment methods; credit cards and domestic bank wires are fee-free, while certain e-wallet withdrawals can be charged up to USD $30.

3. Account Management Fees

FP Market customers incur no penalties for leaving their trading accounts dormant. Traders can stop placing orders for any length of time without incurring inactivity fees.

Verdict

While FP Markets offers a good range of funding methods, a major disadvantage when trading with the broker is that certain e-wallet withdrawals can be charged up to $30. IC Markets offers a wide range of base currencies, fee-free deposit and withdrawal options, plus no inactivity fees. Meaning when compared to FP Markets, IC Markets provide the best funding methods overall.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. FP Markets: Lower Minimum Deposit

FP Markets has a lower minimum deposit of $100 vs $200 by IC Markets. Whether your base currency is GPB, USD, EUR, or AUD, both brokers’ requirements remain the same. It also applies whether you use credit cards, debit cards, PayPal, bank transfers, or Skrill.

To sum up, here are IC Markets and FP Markets’ minimum deposit requirements:

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| FP Markets | $100 | $100 |

Verdict

When it comes to the lower minimum deposit, FP Markets wins with its $0 minimum deposit. However, depending on your trading style, the difference of $100 between the two brokers’ requirements may have little or no impact.

So Is FP Markets or IC Markets The Best Broker?

IC Markets is the winner because of its competitive spreads, advanced trading platforms, and robust regulatory framework. The table below summarises the key information leading to this verdict.

| Criteria | IC Markets | FP Markets |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Top Product Range And CFD Markets | ✅ | ✅ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ❌ | ✅ |

IC Markets: Best For Beginner Traders

For those just starting out in the trading world, IC Markets offers a more intuitive platform and user-friendly features, making it the better choice for beginner traders.

FP Markets: Best For Experienced Traders

For seasoned traders looking for a comprehensive range of tools and advanced trading options, FP Markets stands out as the preferred broker.

FAQs Comparing IC Markets Vs FP Markets

Does FP Markets or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to FP Markets. They are known for their competitive spreads, especially on major currency pairs. For instance, the EUR/USD spread can go as low as 0.1 pips. For a more detailed comparison on broker commissions, you can check out this comprehensive list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both FP Markets and IC Markets offer MetaTrader 4, but IC Markets is often preferred for its enhanced features and seamless integration. Their MT4 platform is equipped with advanced charting tools and automated trading capabilities. For traders specifically looking for the best MT4 experience, this list of top MT4 brokers might be helpful.

Which Broker Offers Social Trading?

When it comes to social trading, FP Markets stands out with its innovative copy trading features. This allows traders to mimic the strategies of successful traders, making it easier for beginners to get started. Social trading has gained immense popularity, and if you’re interested in exploring more, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither FP Markets nor IC Markets offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of market movements. If you’re interested in brokers that specialise in spread betting, you might want to check out this comprehensive list of the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian forex traders. Founded in Australia, IC Markets is ASIC regulated, ensuring a high level of trust and security for traders. FP Markets, while also ASIC regulated, caters to a broader international audience. Both brokers have a strong presence in the Australian market, but IC Markets’ local foundation gives it an edge. For a deeper dive into the best brokers in Australia, you can explore this guide on the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe FP Markets offers a more comprehensive trading experience. While both brokers cater to the UK market, it’s essential to note that neither is FCA regulated or founded in the UK. They operate overseas but have made significant inroads in the UK market. If you’re looking for brokers specifically tailored to the UK market, this list of the Best Forex Brokers In UK might be of interest.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Which broker offers the best beginner-friendly research and trading experience?

Both brokers offer great high-quality research to traders, and an excellent trading experience. The primary difference between them is that IC Markets hosts educational webinars, allowing you to learn more about the financial markets and how to improve your trading.